Affordable Housing in the Nairobi Metropolitan Area (NMA), & Cytonn Weekly #01/2022

By Research Team, Jan 9, 2022

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 96.6%, up from the 32.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 5.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 141.3%, an increase from the 14.3% recorded the previous week, partly attributable to the eased liquidity in the money market with the interbank rates decreasing to 4.5%, from 5.5% recorded the previous week. The subscription rates for the 364-day and 182-day papers increased as well to 112.0% and 63.3%, respectively, from 49.4% and 23.2% recorded the previous week. The yields on the government papers recorded mixed performance with the 91-day and 364-day papers increasing by 7.4 bps and 7.7 bps to 7.3% and 9.4%, respectively, while the yield on the 182-day paper declined by 5.4 bps to 8.0%. In the Primary Bond Market, the government released the auction results for the recently issued five-year treasury bond, FXD1/2020/005, which recorded an undersubscription of 94.6%;

During the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of December increased for the third straight month to 53.7 from 53.0 recorded in November 2021, pointing towards solid improvement in business activities and continued growth of new businesses. Additionally, the Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 9.9% growth in Q3’2021, up from the 2.1% contraction recorded in a similar period in 2020 pointing towards continued economic recovery. Also, The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2021 report highlighting that Kenya’s balance of payments improved in Q3’2021, coming in at a deficit of Kshs 34.4 bn, from a deficit of Kshs 103.9 bn in Q3’2020. The decline was mainly attributable to an 11.9% increase in the stock of gross official reserve to Kshs 1,064.2 bn from Kshs 951.0 bn in Q3’2020;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 3.2%, 0.9%, and 2.0%, respectively, taking their YTD performance to gains of 2.8%, 0.3% and 1.7% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large cap stocks such as Safaricom, NCBA, Standard Chartered Bank and KCB of 5.1%, 3.0%, 1.8% and 1.2%, respectively. The gains were however weighed down by losses recorded by Jubilee, ABSA and EABL of 2.1%, 0.4% and 0.2% respectively. The International Finance Corporation (IFC) disclosed that it would disburse USD 165.0 mn (Kshs 18.6 bn) to Equity Bank Kenya Limited in form of a 7-year Tier 2 subordinated loan. This amount is expected to be used to shore up the Bank’s Tier 2 capital and for onward lending to climate smart projects and Small and Medium Enterprises (SMEs) in Kenya;

Real Estate

The Kenya National Bureau of Statistics (KNBS) released the Q3'2021 GDP Report highlighting that the Real Estate Sector grew by 5.2%, 0.3% points higher than the 4.9% growth recorded in Q2’2021. In the residential sector, the National Environmental Management Authority (NEMA), gazetted the proposed development of three hostel buildings with a capacity to accommodate 4,842 students valued at Kshs 3.6 bn. The United States Embassy announced plans to lease a 90-unit gated estate comprising of both apartments and town houses dubbed ‘OBO Kenya Diplomatic Housing’ for its staff in Rosslyn. For the listed Real Estate, Fahari I-REIT increased by 1.9% to close at Kshs 6.4 per share, compared to Kshs 6.3 per share recorded the previous week;

Focus of the Week

According to the Center for Affordable Housing, Kenya has an accumulated housing deficit of 2.0 mn housing units, growing by 200,000 units annually. This emanates from the difference between the demand of 250,000 housing units and an estimated supply of 50,000 units every year. Out of this supply, low-cost affordable houses accounts for 2.0% representing 1,000 units, whereas units targeted for high and middle income earners account for 98.0% representing 49,000 units. This emphasizes the need for investment in affordable housing to bridge the housing deficit and increase home ownership.

Investment Updates:

- Weekly Rates:

-

- Cytonn Money Market Fund closed the week at a yield of 10.52%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.04% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- We continue to offer Wealth Management Training on Wednesdays from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert is welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s Real Estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent, please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Money Markets, T-Bills Primary Auction:

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 96.6%, up from the 32.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 5.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 141.3%, an increase from the 14.3% recorded the previous week, partly attributable to the eased liquidity in the money market with the interbank rates decreasing to 4.5%, from 5.5% recorded the previous week. The subscription rates for the 364-day and 182-day papers increased as well to 112.0% and 63.3% respectively, from 49.4% and 23.2% recorded the previous week. The yields on the government papers recorded mixed performance with the 91-day and 364-day papers increasing by 7.4 bps and 7.7 bps to 7.3% and 9.4%, respectively, while the yield on the 182-day paper declined by 5.4 bps to 8.0%. The government accepted Kshs 23.15 bn bids out of the Kshs 23.19 bn worth of bids received, translating to an acceptance rate of 99.9%.

In the Primary Bond Market, the government the government released the auction results for the recently issued five-year treasury bond, FXD1/2020/005, which recorded an undersubscription of 94.6%. The government sought to raise Kshs 30.0 bn for budgetary support, received bids worth Kshs 28.4 bn and accepted bids worth Kshs 27.4 bn, translating to a 96.6% acceptance rate. The bond had a coupon rate of 11.7% and a market weighted average rate of 11.3%. In December, the Government had re-opened two other bonds for the month of January, namely: FXD2/2018/10 and FXD1/2021/20, whose period of sale will end on 18th January 2022 and we expect investors to prefer these longer dated bonds since they offer higher yields of 12.5% and 13.4%, respectively, for the FXD2/2018/10 and FXD1/2021/20 respectively, compared to the 11.7% yield offered by the 5-year bond.

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 7.4 bps to 7.3%. The average yield of the Top 5 Money Market Funds marginally increased by 0.02% points to 9.78% from the 9.76% recorded the previous week while the yield on the Cytonn Money Market Fund remained relatively unchanged at 10.5%.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 7th January 2021:

|

|

Money Market Fund Yield for Fund Managers as published on 7th January 2022 |

|

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.5% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.7% |

|

4 |

Sanlam Money Market Fund |

9.5% |

|

5 |

CIC Money Market Fund |

9.3% |

|

6 |

Madison Money Market Fund |

9.2% |

|

7 |

Apollo Money Market Fund |

9.0% |

|

8 |

GenCapHela Imara Money Market Fund |

8.7% |

|

9 |

Dry Associates Money Market Fund |

8.7% |

|

10 |

British-American Money Market Fund |

8.5% |

|

11 |

Co-op Money Market Fund |

8.5% |

|

12 |

Orient Kasha Money Market Fund |

8.4% |

|

13 |

NCBA Money Market Fund |

8.4% |

|

14 |

ICEA Lion Money Market Fund |

8.3% |

|

15 |

AA Kenya Shillings Fund |

7.3% |

|

16 |

Old Mutual Money Market Fund |

7.3% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets eased, with the average interbank rate declining to 4.5% from the 5.5% recorded the previous week, partly attributable to government payments inclusive of maturities of government securities worth Kshs 20.5 bn, which offset tax remittances. The average interbank volumes traded declined by 2.3% to Kshs 13.9 bn, from Kshs 14.3 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with yields on the 10-year bond issued in 2014 remaining unchanged at 4.4% as was recorded the previous week. Yields on the 10-year and 30-year bonds issued in 2018, the 7-year and 12-year bonds issued in 2019 and the yield on the 12-year bond issued in 2021 all increased by 0.1% points to 5.9%, 8.2%, 5.7%, 6.8% and 6.7%, from the 5.8%, 8.1%, 5.6%, 6.7% and 6.6% respectively, recorded the previous week. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-21 |

4.4% |

5.8% |

8.1% |

5.6% |

6.7% |

6.6% |

|

3-Jan-22 |

4.5% |

5.7% |

8.1% |

5.6% |

6.7% |

6.6% |

|

4-Jan-22 |

4.4% |

5.7% |

8.1% |

5.6% |

6.7% |

6.5% |

|

5-Jan-22 |

4.3% |

5.7% |

8.1% |

5.6% |

6.7% |

6.5% |

|

6-Jan-22 |

4.4% |

5.9% |

8.2% |

5.7% |

6.8% |

6.7% |

|

Weekly Change |

0.0% |

0.1% |

0.1% |

0.1% |

0.1% |

0.1% |

|

M/M Change |

0.0% |

0.2% |

0.1% |

0.2% |

0.1% |

0.1% |

|

YTD Change |

(0.1%) |

0.2% |

0.1% |

0.1% |

0.1% |

0.1% |

Source: CBK

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.1% against the US dollar to close the week at Kshs 113.2, from Kshs 113.1 recorded the previous week, partly attributable to increased dollar demand from traders as they resume operating after the festive season. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a YTD basis, the shilling has depreciated by 0.1% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- Ever present current account deficit due to an imbalance between imports and exports with Kenya’s current account deficit having expanded by 27.4% in Q3’2021, to Kshs 184.6 bn, from Kshs 145.0 bn recorded in Q3’2020. This was attributed to a robust increase in merchandise imports by 39.6% to Kshs 321.8 bn in Q3’2021, from Kshs 230.5 bn in Q3’2020,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 17.7% to Kshs 7.8 tn in July 2021, from Kshs 1.5 tn in July 2011 thus putting pressure on forex reserves to repay some of the public debt, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound this global recovery following the emergence of the new COVID-19 Omicron variant. We are of the view that should the variant continue to spread; most nations will respond swiftly by adopting stringent containment measures to curb the spread.

The shilling is however expected to be supported by:

- High Forex reserves, currently at USD 8.8 bn (equivalent to 5.4-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July, 2021 coupled with the USD 972.6 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June 2021, and,

- Improving diaspora remittances evidenced by a 24.2% y/y increase to USD 320.1 mn in November 2021, from USD 257.7 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlights:

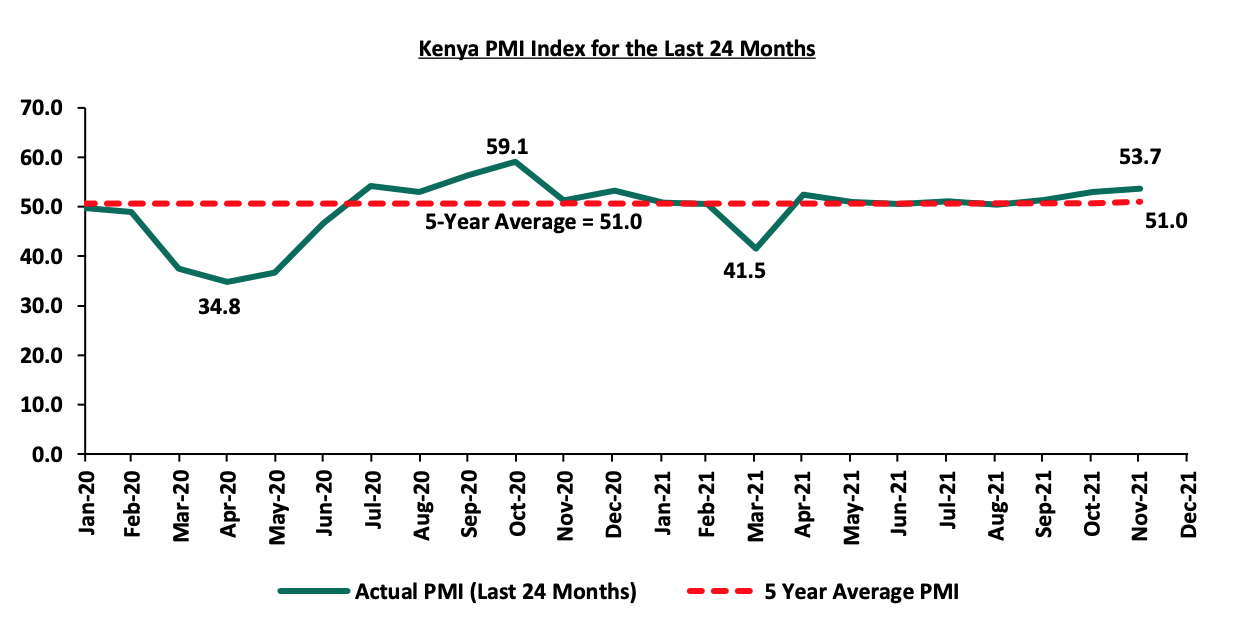

- Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of December increased for the third straight month to 53.7 from 53.0 recorded in November 2021, pointing towards solid improvement of business activities and continued growth of new business. Notably, this is the highest PMI recorded since October 2020 when the index was 59.1, and it is attributable to upturn in sales and growth in cash flow on the back of continued economic recovery. Key to note, overall cost pressures in the Kenyan private sector increased sharply in December 2021 due to high input purchasing prices driven by higher taxes and higher raw material prices during the month. The chart below summarizes the evolution of the PMI over the last 24 months:

*** Key to note, a reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration.

Despite the increase of the PMI index reading for the month of December 2021, we maintain a cautious outlook in the short-term owing to the increasing cost pressures, high cost of living, political pressures ahead of the August 2022 elections and concerns of an uptick in COVID-19 infections from the new Omicron variant. We expect the easing of COVID-19 containment measures coupled with the continued vaccine rollout across the country to support recovery of local businesses and consequently increase production and boost sales volumes. However, the existence and emergence of new COVID-19 variants, such as the Omicron variant, still pose economic uncertainty however it appears the variant is milder than the earlier Delta, hence we do not expect tighter restrictions, which could negatively affect the general business environment.

- Q3’2021 GDP Growth

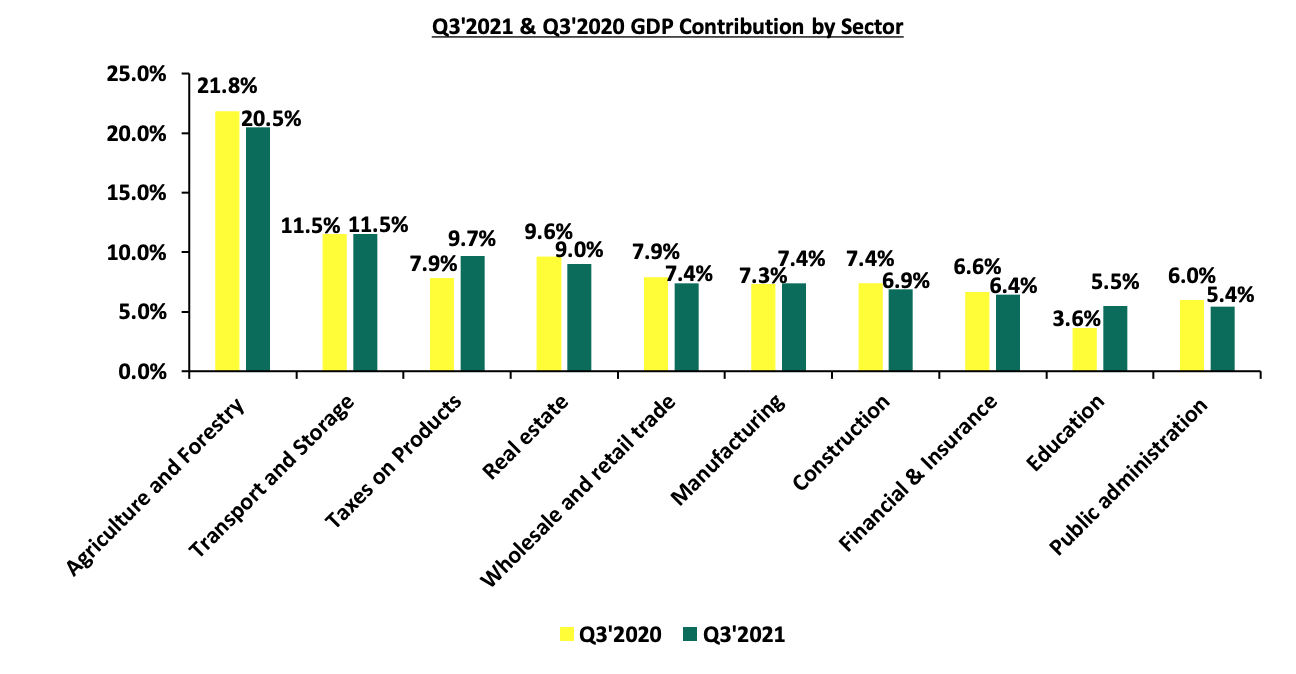

The Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 9.9% growth in Q3’2021, up from the 2.1% contraction recorded in a similar period in 2020, pointing towards continued economic recovery. Consequently, the average GDP growth rate for the 3 quarters in 2021 is a growth of 6.9%, an increase from the 0.8% contraction recorded during similar periods of review in 2020. The key take-outs from the report include;

- Sectoral Contribution to Growth - The biggest gainers in terms of sectoral contribution to GDP were Education and Taxes on Products, increasing by 1.8% points each to 5.5% and 9.7%, from 3.6% and 7.9% in Q3’ 2020, respectively. Agriculture was the biggest loser, declining by 1.3% points to 20.5% in Q3’2021, from 21.8% in Q3’2020, following the erratic weather conditions during the period. The Education sector recorded the highest growth rate in Q3’2021 growing by 64.7% compared to the 17.4% contraction recorded in Q3’2020. The performance is mainly attributable to the re-opening of schools following closure for the most of 2020 due to the pandemic. The chart below shows the top contributors to GDP by sector in Q3’2021:

Source: KNBS Q3’2021 and Q3’2020 GDP Report

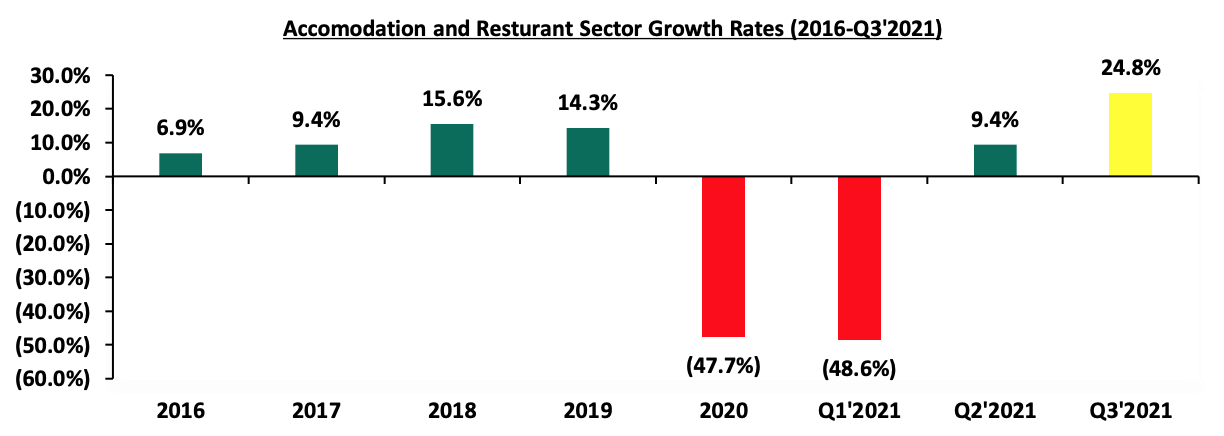

- Subdued Growth in the Agricultural Sector – Agriculture, Forestry and Fishing activities recorded a decline of 1.8% in Q3’2021 compared to a 4.2% growth in Q3’2020. The contraction during the quarters is mainly attributable to unfavorable weather conditions witnessed during the period. The sector’s performance was however supported by a notable increase in cut flower and vegetable exports as well as increase in milk intake by processors,

- Growth in the manufacturing sector - The manufacturing sector reported a growth of 9.5% in Q3’2021 compared to a 1.7% contraction in a similar period of review in 2020. The sectoral contribution also increased marginally by 0.1% points to 7.4%, from 7.3% in Q3’2020, and,

- Gradual rebound in the Accommodation and food services sector- The sector recorded 24.8% growth in Q3’2021 compared to a 63.4% contraction recorded in Q3’2020, attributable to the relaxation of COVID-19 containment restrictions on the back of a positive vaccine rollout. Additionally, the sectoral contribution increased to 0.4% from 0.3% as was recorded in Q3’2020. The chart below shows the different sectoral GDP growth rates for Q3’2021:

Source: KNBS Q3’2021 GDP Report

Going forward, we expect Kenya’s GDP to continue growing in tandem with the global economy and as most sectors of the economy continue to recover. The lifting of the dawn to dusk curfew on 20th October 2021, that was put in place since March 2020 is expected to boost economic recovery in sectors such as the accommodation and food services sector as well as the manufacturing sector. We however note that agriculture being the main driver of economic growth, is expected to decline further in the remaining quarter of 2021 and remain subdued in 2022 due to the erratic weather conditions. Additionally, concerns remain elevated on the existence and emergence of new COVID-19 variants such as the Omicron variant. For more details on the GDP Report, see our Kenya Q3’2021 GDP Note.

- Kenya Q3’2021 Balance of Payments

The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q3’2021 report highlighting that Kenya’s balance of payments improved in Q3’2021, coming in at a deficit of Kshs 34.4 bn, from a deficit of Kshs 103.9 bn in Q3’2020. The decline was mainly attributable to an 11.9% increase in the stock of gross official reserve to Kshs 1,064.2 bn from Kshs 951.0 bn in Q3’2020. The decline was however weighed down by a 27.4% expansion of current account balance to Kshs 184.6 bn, from Kshs 145.0 bn in Q3’2020. The table below shows the breakdown of the various balance of payments components, comparing Q3’2021 and Q3’2020:

|

Q3’2021 Balance of Payments |

|||

|

Item |

Q3’2020 |

Q3’2021 |

% Change |

|

Current Account Balance |

(145.0) |

(184.6) |

27.4% |

|

Capital Account Balance |

3.9 |

3.9 |

(0.7%) |

|

Financial Account Balance |

39.5 |

175.0 |

342.8% |

|

Net Errors and Omissions |

(2.4) |

(28.6) |

1,111.0% |

|

Balance of Payments |

(103.9) |

(34.4 ) |

(66.9%) |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) expanded by 27.4% to Kshs 184.6 bn, from Kshs 145.0 bn in Q3’2020, mainly attributable to widening of the Merchandise Trade Deficit by 39.6% to Kshs 321.8 bn, from Kshs 230.5 bn recorded in Q3’2020,

- The financial account balance (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by the foreign buyers) increased by 342.8% to a surplus of Kshs 175.0 bn, from a surplus of Kshs 39.5 bn in Q3’2021. Similarly, the stock of gross official reserves increased by 11.9% to stand at Kshs 1,064.2 bn, from 951.0 bn in Q3’2020, and,

- Consequently, the Balance of Payments (BoP) position improved to a deficit of Kshs 34.4 bn from a deficit of Kshs 103.9 bn in Q3’2020, mainly due to the 11.9% increase in the stock of gross official reserves.

During the period of review, the Kenya shilling remained under pressure, deteriorating by 1.1% y/y to close the quarter at Kshs 109.2, from Kshs 107.9 at the end of Q3’2020. However, the shilling was supported by the high forex reserves held by the Central Bank of Kenya which increased by 9.5% in the same period to close the quarter at USD 9.4 bn, from USD 8.5 bn recorded at the end of Q3’2020. We expect relative stability in the business environment in the 2022 given the easing of the lockdown measures by Kenya’s trading partners, positive COVID-19 vaccine rollout, and continued support from horticultural exports due to the normalised demand in Kenya’s export markets as well as earnings from the tourism sector. However, risks remain elevated on the back of increasing global fuel prices that has led to increase in fuel importation cost, supply shortages and logistical bottlenecks, emergence of new COVID-19 variants which could lead to further restriction measures and the upcoming 2022 August elections. For a more in-depth analysis, see our Q3’2021 BOP Note.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money market. The government is 9.0% ahead of its prorated borrowing target of Kshs 354.6 bn having borrowed Kshs 386.4 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by KRAs collection of Kshs 740.0 bn in revenues during the first five months of the current fiscal year, which is equivalent to 100.0% of the prorated revenue collection target. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash.

Markets Performance

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 3.2%, 0.9%, and 2.0%, respectively, taking their YTD performance to gains of 2.8%, 0.3% and 1.7% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large cap stocks such as Safaricom, NCBA, Standard Chartered Bank and KCB of 5.1%, 3.0%, 1.8% and 1.2%, respectively. The gains were however weighed down by losses recorded by Jubilee, ABSA and EABL of 2.1%, 0.4% and 0.2%, respectively.

During the week, equities turnover increased by 179.2% to USD 16.9 mn, from USD 6.1 mn recorded the previous week, taking the YTD turnover to USD 16.9 mn. Foreign investors turned net buyers, with a net buying position of USD 3.2 mn, from a net selling position of USD 1.5 mn recorded the previous week, taking the YTD net buying position to USD 3.2 mn.

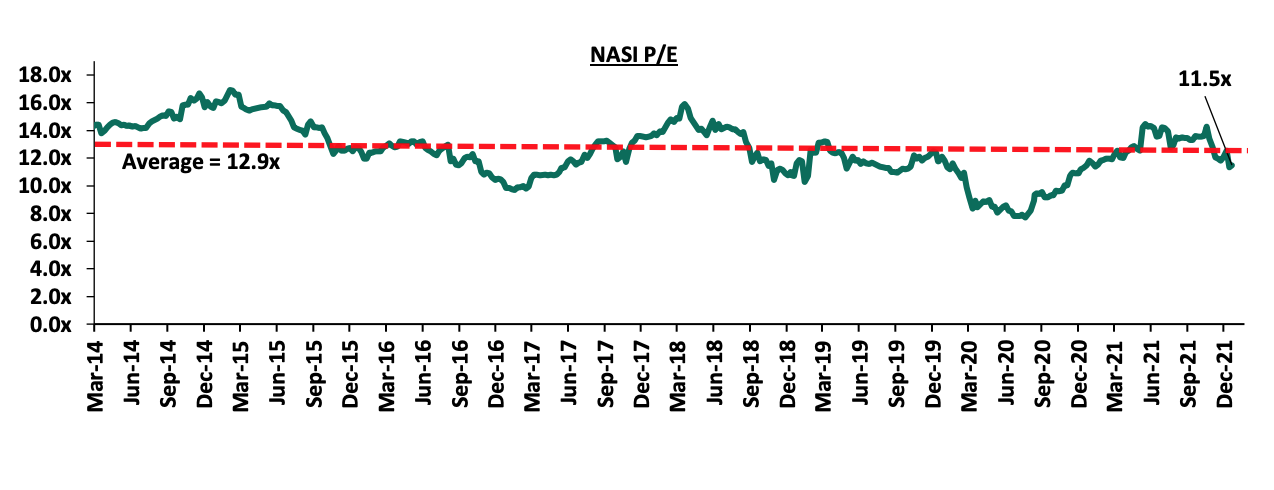

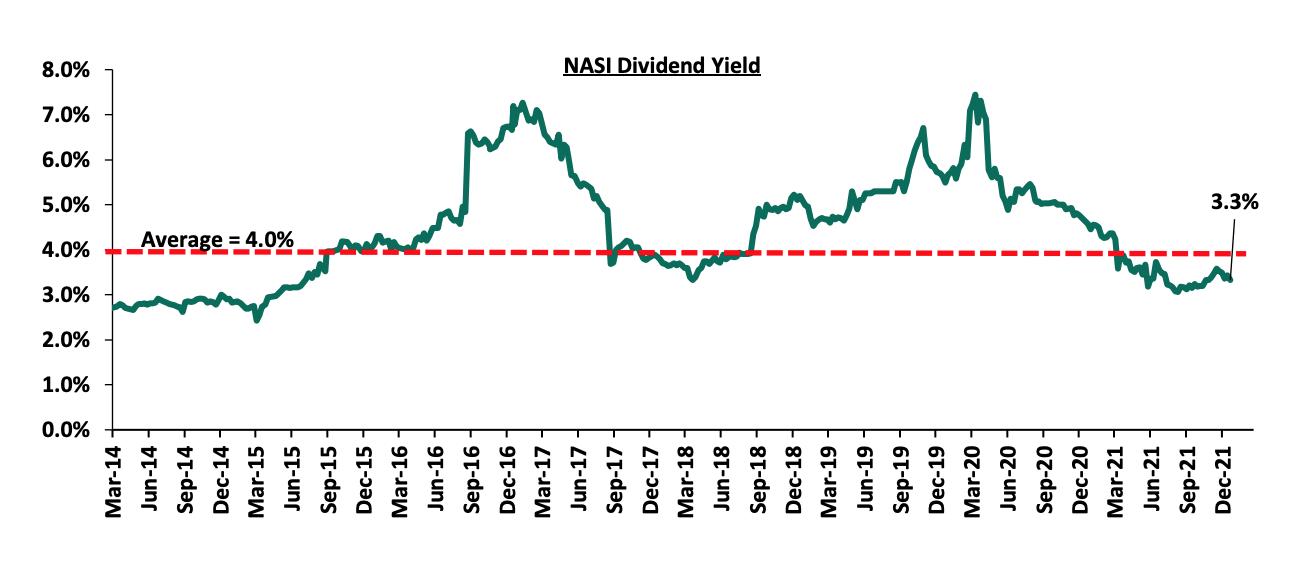

The market is currently trading at a price to earnings ratio (P/E) of 11.5x, 11.1% below the historical average of 12.9x, and a dividend yield of 3.3%, 0.7% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.3x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 11.5x is 49.2% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly highlight:

- International Finance Corporation to disburse USD 165.0 mn (Kshs 18.6 bn) loan facility to Equity Bank Kenya

During the week, the International Finance Corporation (IFC) disclosed that it would disburse USD 165.0 mn (Kshs 18.6 bn) to Equity Bank Kenya Limited in form of a 7-year Tier 2 subordinated loan. This amount is expected to be used to shore up the Bank’s Tier 2 capital and for onward lending to climate smart projects and Small and Medium Enterprises (SMEs) in Kenya. The investment in Equity Bank comes after the IFC and IFC Financial Institutions Growth Fund (IFC FIG Fund) entered into a share purchase and sale agreement with Britam Holdings to acquire a combined 6.7% of Equity Group shares, making the consortium the 2nd largest shareholder in Equity Group. For more information on the Britam’s share purchase and sale agreement, please see our Cytonn Weekly 52/2021.

The Kenyan Banking sector has been benefitting from facilities extended from Development Finance Institutions such as the IFC and the African Development Bank (ADB) which have been providing loan facilities for onward lending to support SME’s recovery from the pandemic. The table below highlights the disclosed loan facilities that banks secured for capital injection and lending to the MSMEs in 2021:

|

Bank |

Amount Borrowed For Onward Lending in 2021 (Kshs bn) |

Purpose |

|

Equity Bank |

86.5* |

MSME lending |

|

KCB Bank |

16.4 |

MSME lending |

|

Cooperative Bank |

17.3 |

MSME lending and Tier II Capital** |

|

I&M Bank |

5.4 |

MSME lending and Tier II Capital** |

|

Total |

125.6 |

|

|

*Includes a Kshs 2.6 bn grant offered by European Investment Bank (EIB) |

||

In addition to seeking funding to lend to the SMEs, we expect more capital raising activities by the Banking sector especially the smaller banks as they seek to maintain the minimum capital adequacy and liquidity levels as required by the CBK. Amounts extended from the CBK to banks as liquidity support increased significantly by 50.1% to Kshs 55.5 bn in June 2021 as compared to Kshs 36.9 bn in June 2020, highlighting the need for the smaller banks to raise capital and consolidate to achieve regulatory requirements.

Universe of coverage:

|

Company |

Price as at 31/12/2021 |

Price as at 07/01/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.3 |

0.0% |

0.4% |

2.3 |

3.3 |

8.7% |

52.9% |

0.2x |

Buy |

|

I&M Group*** |

21.1 |

21.4 |

1.4% |

0.0% |

21.4 |

24.4 |

10.5% |

24.4% |

0.6x |

Buy |

|

Jubilee Holdings |

316.8 |

310.0 |

(2.1%) |

(2.1%) |

316.8 |

371.5 |

2.9% |

22.7% |

0.6x |

Buy |

|

KCB Group*** |

45.5 |

46.0 |

1.2% |

1.0% |

45.6 |

51.4 |

2.2% |

13.8% |

0.9x |

Accumulate |

|

Standard Chartered*** |

128.3 |

130.5 |

1.8% |

0.4% |

130.0 |

137.7 |

8.0% |

13.6% |

1.0x |

Accumulate |

|

Stanbic Holdings |

87.3 |

87.0 |

(0.3%) |

0.0% |

87.0 |

94.7 |

4.4% |

13.3% |

0.8x |

Accumulate |

|

Britam |

7.5 |

7.5 |

0.3% |

(0.5%) |

7.6 |

8.3 |

0.0% |

10.9% |

1.2x |

Accumulate |

|

Liberty Holdings |

7.0 |

7.0 |

0.6% |

(0.3%) |

7.1 |

7.8 |

0.0% |

10.5% |

0.5x |

Accumulate |

|

Co-op Bank*** |

13.0 |

13.0 |

0.0% |

(0.4%) |

13.0 |

13.1 |

7.7% |

8.6% |

1.0x |

Hold |

|

NCBA*** |

25.2 |

26.0 |

3.0% |

2.0% |

25.5 |

26.4 |

5.8% |

7.5% |

0.6x |

Hold |

|

Equity Group*** |

52.8 |

53.0 |

0.5% |

0.5% |

52.8 |

56.6 |

0.0% |

6.8% |

1.4x |

Hold |

|

Sanlam |

11.6 |

11.6 |

0.0% |

0.0% |

11.6 |

12.1 |

0.0% |

4.8% |

1.2x |

Lighten |

|

Diamond Trust Bank*** |

59.5 |

60.0 |

0.8% |

0.8% |

59.5 |

61.8 |

0.0% |

3.0% |

0.3x |

Lighten |

|

ABSA Bank*** |

11.9 |

11.8 |

(0.4%) |

0.4% |

11.8 |

11.9 |

0.0% |

0.9% |

1.2x |

Lighten |

|

CIC Group |

2.2 |

2.1 |

(3.6%) |

(1.8%) |

2.2 |

2.0 |

0.0% |

(4.0%) |

0.7x |

Sell |

|

HF Group |

3.9 |

3.8 |

(2.3%) |

0.3% |

3.8 |

3.0 |

0.0% |

(22.5%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.3x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants coupled with slow vaccine rollout in developing economies to continue weighing down the economic outlook. On the upside, we believe that the recent relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

- Industry Reports

During the week, the Kenya National Bureau of Statistics (KNBS) released the Quarterly GDP Report for Q3’2021. The key take-outs related to the Real Estate sector are as outlined below:

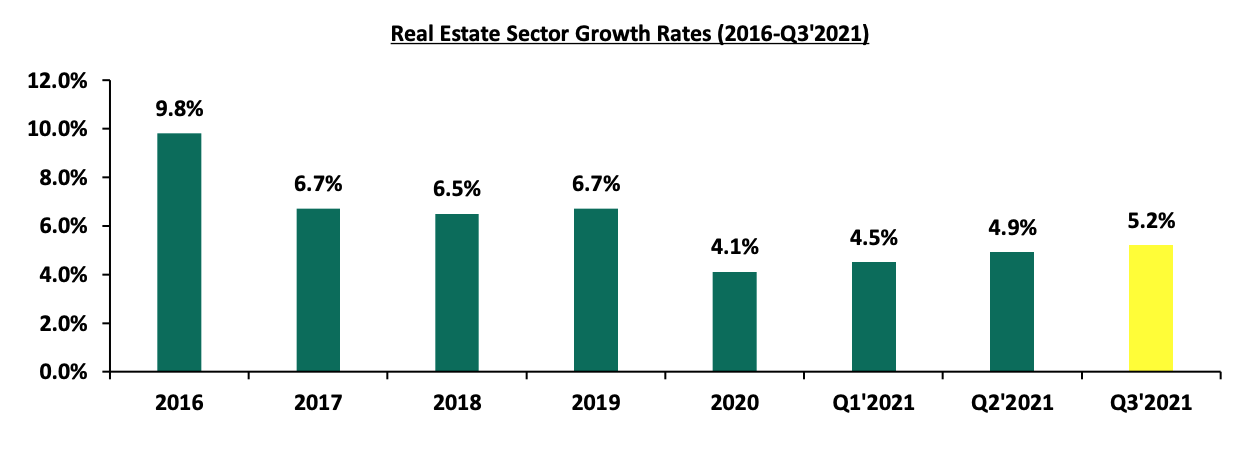

- The Real Estate Sector in Q3’2021 grew by 5.2%, 0.3% points higher than the 4.9% growth recorded in Q2’2021. This performance is attributed to the increased development activities as a result of a general improvement in Real Estate transactions and an improved business environment.

The graph below shows Real Estate sector growth rates from 2016-Q3’2021;

Source: Kenya National Bureau of Statistics

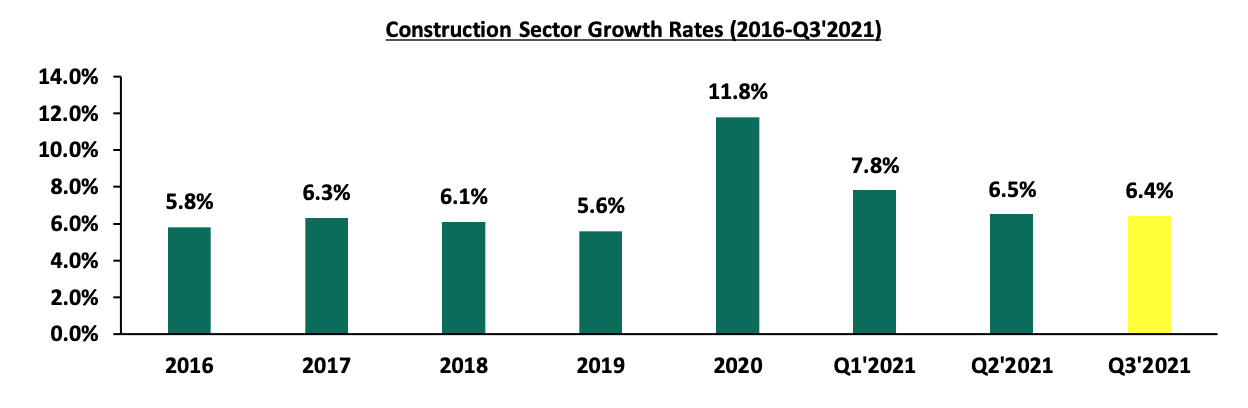

- The Construction sector recorded a growth of 6.4% in Q3’2021, 6.1% points lower than the 12.5% growth in Q3’2020. This performance represented a 0.1% points q/q drop from 6.5% growth recorded in Q2’2021. The decline is partly attributed to the current oversupply in select themes such as the commercial office and retail sectors at 7.3 mn and 3.0 mn SQFT, respectively, in the NMA as at 2021, causing investors to halt their development plans as they await absorption of the current supply. Cement consumption on the other hand increased by 27.5% to 2.5 bn metric tonnes in Q3’2021, from 2.0 bn metric tonnes in Q2’2021. This is mainly attributed to the increased infrastructural activities such as the ongoing construction of the Nairobi Expressway.

The graph below shows the Construction Sector growth rate from 2016-Q3’2021;

Source: Kenya National Bureau of Statistics

- The Accommodation and Restaurant sector grew by 24.8% in Q3’2021 from a contraction of 63.4% in Q3’2020. This performance represented a 15.4% points q/q increase from the 9.4% growth recorded in Q2’2021. The hospitality sector was one of the worst hit by the pandemic in 2020 following declines in the overall number of international tourist arrivals, and, scaling down or complete closure of hotels and other businesses operating in the hospitality industry. However, following the reopening of the economy in 2021, the sector has shown a tremendous improvement as operations of hotels and other hospitality facilities continue to stabilize.

The graph below shows the Accommodation and Restaurant Sector GDP growth rates from 2016- Q3’2021;

Source: Kenya National Bureau of Statistics

The Real Estate sector in general is expected to continue recording improvements supported by the reopening of the economy which continues to boost Real Estate transactions and development. We expect the path to recovery of the hospitality industry to continue gaining momentum as evidenced by the growth in the supporting sectors such as Accommodation and Restaurant services. Other key drivers of the hospitality industry are the continued improvements in the number of hotels in operations and bed occupancies, as a result of the increase in the number of tourist arrivals due to the return of international flights, the aggressive marketing of the hospitality sector in Kenya to key tourist markets, and, the mass COVID-19 vaccination.

- Residential

- Proposed Construction of Hostel Buildings by Acorn Holdings

The National Environmental Management Authority (NEMA), gazetted the proposed development of three hostel buildings with a capacity to accommodate 4,842 students valued at Kshs 3.6 bn. The project will be overseen by Acorn Holdings, a student housing developer, who incorporated three limited liability partnerships to develop the student accommodation facilities. The three projects are estimated to be completed by Q1’2024. Below is a summary of the proposed developments

|

Summary of the proposed hostel Buildings |

|||||

|

Limited Liability Partner |

Project Location |

Project Value (Kshs bn) |

Number of Units |

Number of Students to be Accommodated |

Brand |

|

Ebony Creek Properties LLP |

Hurlingham |

1.0 |

504 |

1,440 |

Qejani |

|

Magnolia Creek Properties LLP |

Northland City |

1.9 |

924 |

2,348 |

Qwetu and Qejani |

|

Willow Creek LLP |

Gachororo Rd, Juja |

0.7 |

378 |

1,054 |

Qejani |

|

Averages |

|

3.6 |

1, 374 |

4, 842 |

|

Source: Kenya Gazette and Acorn Holdings

The Acorn D-REIT (Development-Real Estate Investment Trust) is expected to finance the development of the hostels under the Qwetu and Qejani Brands. The Qwetu brand offers premium student housing facilities which are priced higher than the Qejani brand. The Qejani Brand on the other hand targets the mass markets under the affordable student housing programme. Moreover, Acorn also has the I-REIT (Income-Real Estate Investment Trusts) which is a Real Estate trust that primarily derives its revenues from rental properties. Acorn as a developer has continued to seek alternative ways of raising Real Estate funds besides traditional methods such as debt financing and equities. Alternative sources of funding include structured Real Estate notes such as project notes, Real Estate backed medium term notes, high yield loan notes, and, Real Estate Investments Trusts among others. Through the REITS, Acorn continues to gain access of funds from a pool of investors who wishes to take a specific Real Estate exposure. The Assets Under Management (AUM) as at H1'2021 for the D-REIT was Kshs 6.2 bn while the I-REIT had an AUM of Kshs 3.5 bn.

The move by Acorn to launch the three projects is in line with their target aim of 30,000 beds under management by 2030. Currently, Acorn has 5 developments under construction with more than 5,000 hostel-bed capacity. Acorn Holdings continues showing commitment towards bridging the gap between the increasing demand and the low supply of student’s hostels in the country, supported by:

- Rising demand of student housing evidenced by the increasing student population with Kenya National Bureau of Statistics (KNBS) data indicating that the university enrolment as at 2020 was 509,473, with exclusion of technical colleges, against a supply of 300,000 student housing facilities,

- The inability of individual learning institutions to host enrolled students into their premises, according to Cytonn Research, with the average higher learning institutions only being able to cater for approximately 22.6% of their student population,

- The need by students to have a secure but affordable housing near the learning institutions, and,

- The high returns, as the student housing thematic sector recorded a rental yield of 7.3% as at 2020 compared to other Real Estate classes such residential, serviced apartments, and, commercial which recorded rental yields of 4.8%, 5.5%, and, 7.1%, respectively as of FY’2021.

The graph below shows the performance of rental yields in student housing compared to the different Real Estate asset classes in FY’2021

Source: Cytonn Research

Investment in student housing is expected to continue gaining momentum supported by the high returns and demand evidenced by the growing student population against a limited supply. However, the increasing popularity of online learning is expected to weigh down the performance of student housing.

- OBO Kenya Diplomatic Housing Lease by the United Nations

During the week, the United States Embassy announced plans to lease a 90-unit gated estate in Rosslyn comprising of both apartments and town houses dubbed ‘OBO Kenya Diplomatic Housing’ for its staff. The US Embassy will lease the development for a period of eight years at a cost of Kshs 4.3 bn with the estimated first year’s rental income being Kshs 533.8 mn. OBO Kenya Diplomatic housing which is set to be completed by Q3’2022 has a total development cost of Kshs 5.5 bn and it is currently being constructed by Gateway Real Estate Africa Limited, a Mauritius-based real estate firm.

Rosslyn is an attractive residential development area supported by: i) the categorization of the area as a Blue Diplomatic Zone, ii) close proximity to social amenities such as the Rosslyn Riviera Mall, Two Rivers Mall, and Village Market, and, iii) ease of accessibility as the area is served by the Limuru Road and Kiambu Road. With regards to performance, according to the Cytonn Annual Markets Review-2021, Rosslyn was the best performing node in the high-end segment of detached units recording an average rental yield and capital appreciation of 4.7% and 2.0%, respectively, which is 0.8% and 1.0% points higher than the market average of 3.9% and 1.0%, respectively.

The table below shows the performance of the Nairobi Metropolitan Area (NMA) detached units in the high end areas.

All values in Kshs unless stated otherwise

|

Summary of Detached Units – FY’2021 |

||||||||

|

Area |

Average of Price per SQM FY'2021 |

Average of Rent per SQM FY'2021 |

Average of Occupancy FY'2021 |

Average of Uptake FY'2021 |

Average of Annual Uptake FY'2021 |

Average of Rental Yield FY'2021 |

Average of Price Appreciation FY'2021 |

Total Returns |

|

High-End |

||||||||

|

Rosslyn |

183,162 |

819 |

87.6% |

94.4% |

16.6% |

4.7% |

2.0% |

6.7% |

|

Lower Kabete |

148,394 |

386 |

92.4% |

80.1% |

15.0% |

2.9% |

2.5% |

5.4% |

|

Kitisuru |

245,741 |

736 |

91.4% |

90.3% |

15.5% |

3.6% |

1.3% |

4.9% |

|

Karen |

179,672 |

678 |

87.0% |

85.7% |

14.0% |

3.8% |

0.1% |

3.9% |

|

Runda |

211,606 |

789 |

91.0% |

90.0% |

10.2% |

4.4% |

(1.0%) |

3.4% |

|

Average |

193,715 |

682 |

89.9% |

88.1% |

14.3% |

3.9% |

1.0% |

4.9% |

Source: Cytonn Research

We expect the residential sector to record increased activities supported by the continued investor focus on student housing, and, the uptake of residential units sparking hopes to investors.

- Statutory

During the week, the senate announced that it is seeking the public’s opinion on the Landlord Tenant Bill-2021 which was tabled in the National Assembly in February 2021. The Landlord Tenant Bill is aimed at consolidating laws relating to renting of commercial and residential properties. It is also keen on creating a balance between the interests of landlords and tenants through ensuring that landlords earn reasonable income from their investments and tenants are protected from exploitation. It sets out a procedure for increasing or decreasing the rents, providing a notice of termination of tenancy, and, dispute resolution procedures among others. For more information, please see Cytonn Weekly #11/2021.

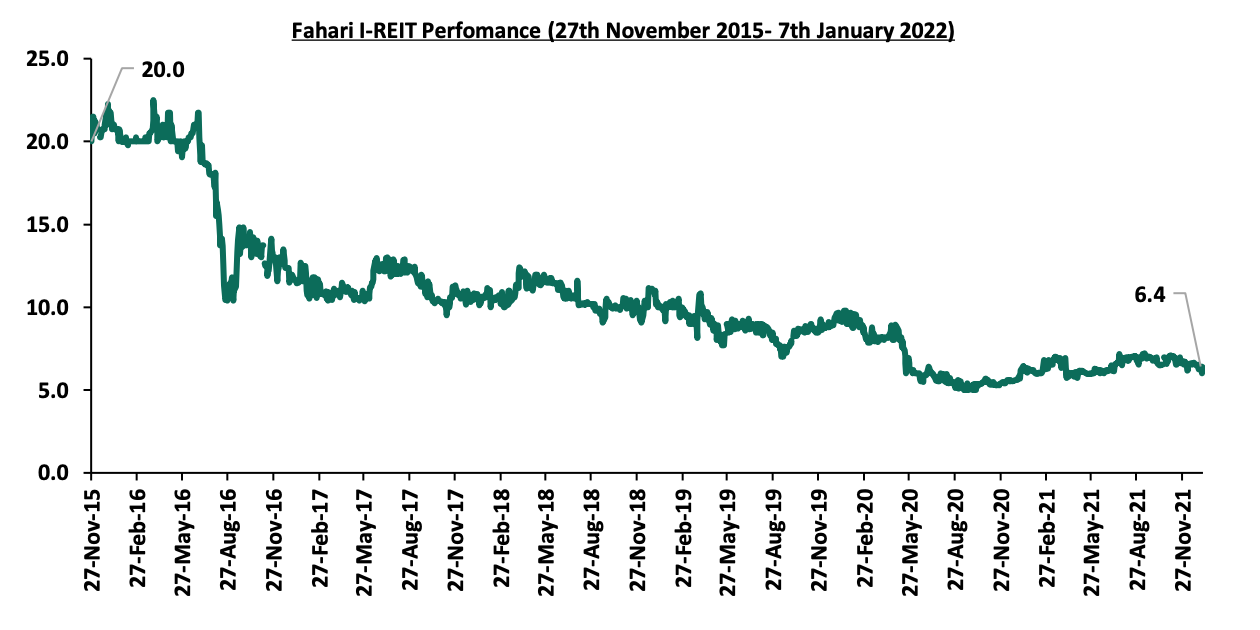

- Listed Real Estate

During the week, Fahari I-REIT closed the week trading at Kshs 6.4 per share, an increase of 1.9% compared to Kshs 6.3 per share recorded the previous week. On a YTD basis, the share price recorded a decline of 0.6% from Kshs 6.42 recorded at the beginning of the year. However, on an Inception to Date (ITD) basis, the share price declined by 68.1% from the listing price of Kshs 20.0 per share. The performance of the REITS market in Kenya continues to be subdued by factors such as inadequate investor knowledge on the instrument, lengthy approval process, high minimum capital requirements for a trustee at Kshs 100 mn and, high minimum investments amount.

The graph below shows the performance of the Fahari I-REIT from 27th November 2015-7th January 2022;

The Real Estate sector in 2022 is expected to be on an upward trajectory evidenced by the improving Real Estate and Hospitality sector performance, continued uptake of residential units giving hope to investors, focus on student accommodation, and, efforts by the government to create an appropriate regulatory environment for Real Estate investors. However, the low investor appetite for Real Estate Investments Trusts (REITS), continues to be a challenge affecting Real Estate investments.

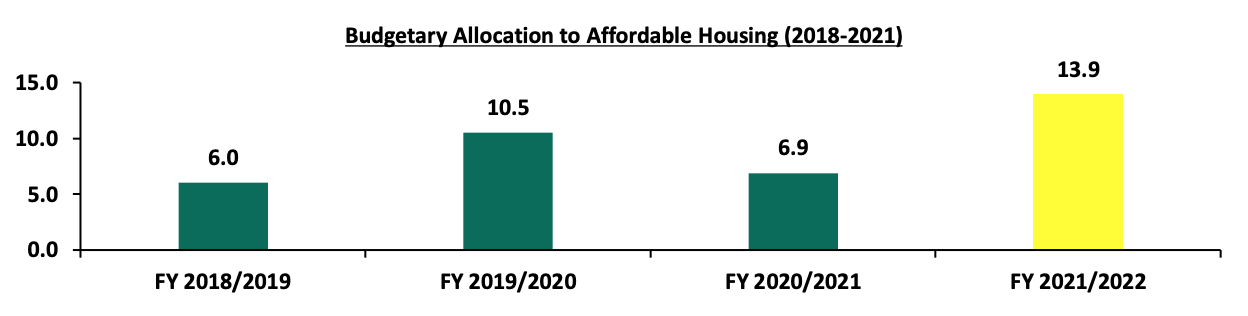

In 2017, the President, H.E Uhuru Kenyatta launched the Affordable Housing programme as one of the key pillars of the ‘Big Four Agenda’. The government had planned to deliver 500,000 by 2022 and with the president’s five-year term almost coming to a close, the government is already far out of reach since only about 1,000 units have been delivered through the Pangani and Park Road Ngara projects. Even before the onset of the COVID-19 pandemic, the government had no sustainable plan on how to fund the initiative despite increasing its budgetary allocation by 75.0% to Kshs 10.5 bn in FY’2019/20, from Kshs 6.0 bn in FY’2018/19.

We have previously tackled two topicals related to affordable housing:

- Affordable Housing in Kenya - in April 2018 we talked about whether the delivery of affordable housing can be a reality and concluded that the initial plan was very useful but some elements needed to be addressed to increase the likelihood of success, and,

- Accelerating Funding to Affordable Housing - in May 2020, we discussed ways of accelerating funding for affordable housing and concluded that there was need to mobilize alternative sources of funding, particularly the opening up of capital markets access to developers, to provide a low-cost capital raising mechanism.

This week, we look into the status of affordable housing in the Nairobi Metropolitan Area (NMA) and benchmark with more established case studies with the aim of giving recommendations on what can be done to enhance achievement of the initiative by covering:

- Introduction to Affordable Housing,

- Demand and Supply of housing in Kenya,

- Affordable Housing Programme in Kenya,

- Background, Status and Progress of the Affordable Housing Programme (AHP),

- Achievements of the Affordable Housing Programme (AHP), and,

- Challenges facing the Affordable Housing Programme (AHP).

- Lessons Kenya Can Learn from Other Countries,

- Recommendations, and conclusion.

Section I: Introduction to Affordable Housing

According to the Economic Times, affordable housing refers to housing units that are affordable by that section of society with the median household income or below. Based on this definition and with the statistics from Kenya National Bureau of Statistics (KNBS) on income distribution in the formal sector indicating that 74.4% of employees earn the median gross income of Kshs 50,000 or below per month, affordable housing in Kenya would therefore be units employees in median gross income bracket can afford; assuming a maximum of 30.0% of their gross income is spent on housing costs, these are individuals who can afford to pay rent of Kshs 15,000 per month and below. According to the government’s Blue Print, affordable houses range between at Kshs. 1.0 mn to Kshs. 3.0 mn per unit on average, and would therefore fit into the budget of two individuals earning at least Kshs. 50,000 each per month which is the Kenyan median income.

Assuming a 20-year mortgage at a 13.5% interest rate, and using the rule of the thumb of a maximum of 40.0% of their income being used to pay monthly instalments, then the median income household can afford a maximum of Kshs 3.4 mn for a house. As a result, in our view, at prevailing market conditions, an affordable house would be of Kshs 3.4 mn and below.

From our Cytonn Annual Markets Review-2021, the average price per SQM in the Nairobi Metropolitan Area residential market stood at Kshs 119,494. That would translate to a house price of Kshs 4.8 mn for the size of a 40.0-SQM 2 bedroom in affordable housing which is more than two times the price of such a unit under the government’s affordable housing initiative.

The table below gives a summary of what constitutes the average sizes and prices of affordable housing units in the Nairobi Metropolitan Area according to the government data;

|

Summary of Affordable Housing Units in the Nairobi Metropolitan Area |

|||

|

Typology |

Unit size (SQM) |

Unit Price (Kshs mn) |

Price per SQM(Kshs) |

|

1 |

30 |

1.0 |

33,333 |

|

2 |

40 |

2.0 |

50,000 |

|

3 |

60 |

3.0 |

50,000 |

|

Averages |

|

|

44,444 |

Source: Boma Yangu

The Affordable housing initiative comprises of three types of housing that target formal income earners as follows;

- Social Housing - Designated for individuals earning up to Kshs 14,999 monthly, accounting for 2.6% of the formal income earners (KNBS),

- Low-Cost Housing - Designated for individuals earning between Kshs 15,000 and Kshs 49,999 monthly, accounting for 71.8% of the formal income earners, and,

- Mortgage-Gap Housing - Designated for individuals earning between Kshs 50,000 and Kshs 100,000 monthly, accounting for 22.6% of the formal income earners.

With the above categorization indicating the initiative is targeting 97.0% of the formal income earners, it is quite worrying that only 3.0% of the formal income earners can comfortably afford to own homes hence it is necessary to address this problem to enhance home ownership in the country.

Section II: Demand and Supply of Housing in Kenya

According to the Center for Affordable Housing, Kenya has an accumulated housing deficit of 2.0 mn housing units, growing by 200,000 units annually. This is mainly due to the difference between the demand of 250,000 housing units and an estimated supply of 50,000 units every year. Notably, the Ministry of Housing indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. In summary, while 74.4% of Kenya’s working population requires affordable housing, only 17.0% of the housing supply goes into serving this low to lower-middle income segment. This supply issue has remained a challenge attributed to factors such as high construction costs, inadequate supply of development land, and, inadequate infrastructure.

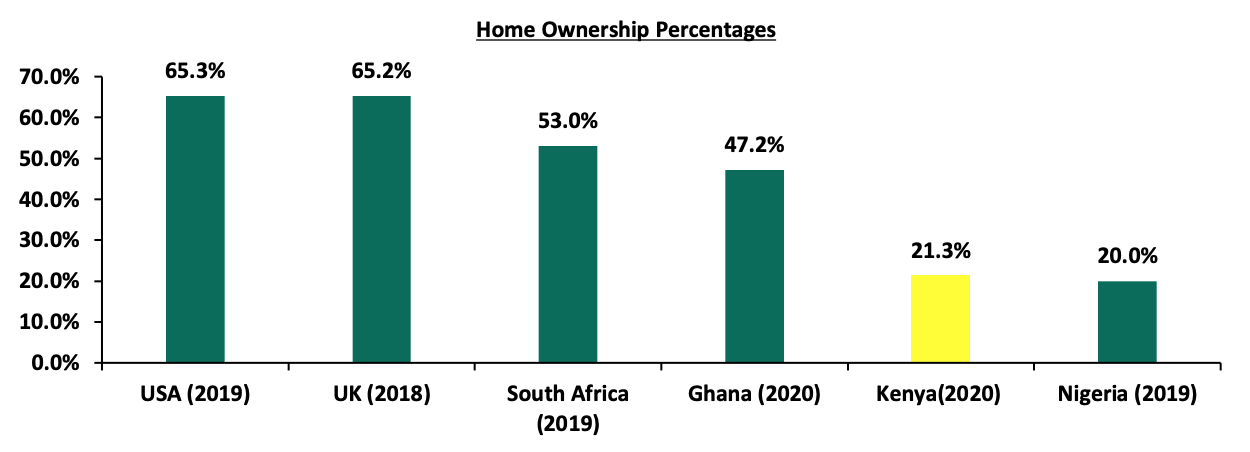

On the other hand, the growth in annual demand of housing has been fueled by the high urbanization and population growth rates at 4.0% and 2.3%, respectively, compared to global averages of 1.8% and 1.0%, respectively, as at 2020. Home ownership in Kenya also remains low compared to other African countries, at 21.3% in urban areas as at 2020, compared to other African countries such as South Africa and Ghana with a 53.0% and 47.2% urban home ownership rates, respectively. This signals the urgent need to emphasize the need for investment in affordable housing to bridge the housing deficit and increase home ownership in the country especially for the low income earners.

The graph below shows home ownership percentages for different countries compared to Kenya;

Centre for Affordable Housing Africa, Federal Reserve Bank

Section III: Affordable Housing Initiative in Kenya

- Background, Status and Progress of the Affordable Housing Initiative

The concept of affordable housing was not entirely new as of 2017. Kenya’s Vision 2030 first medium-term goal (2009-2012), had a target of increasing housing production from 35,000 units annually to 200,000 units annually for all income levels. However, the Kenyan Government delivered approximately 3,000 units only during that period, compared to a target of 800,000 houses, according to the World Bank Economic Update of 2017. With the fact that less than 1.0% of the target had been achieved, the Affordable Housing Program initiative became a pillar under the Big 4 Agenda in 2017, aimed at delivering the promise, of constructing 500,000 units by 2022. Under the agenda, the government also planned to; i) enhance affordability of homes by addressing the interest rate to be between 3.0%-7.0% and tenure of 25 years, ii) reduce cost of construction per SQM by 30.0%, iii) close the annual low-income housing gap by 60.0%, iv) create 350,000 jobs in the construction sector, and, v) Increase construction sector contribution to GDP. Additionally, the government established one platform and two entities to facilitate the affordable housing as listed below;

- Boma Yangu Online Platform – The platform facilitates the registration for housing allocations and has so far attracted about 325,000 applications as at January 2022. The platform supports three kinds of contributions namely; statutory contributions capped at Kshs 2,500 per month per employee, voluntary monthly contributions and joint contributions. Key to note, contributions to the Housing Fund can be accessed as soon as 15 years after a member’s first contribution or the attainment of retirement age.

- National Housing Corporation (NHC) – The corporation facilitates the implementation of the Government’s Housing Policies and Programs with a focus on promoting low-cost houses, stimulating the building industry and encouraging housing research. The NHC is also the government's main agency through which public funds for low cost housing are channeled to local authorities, and,

- Kenya Mortgage Refinance Company (KMRC) – The company plays a major role in the implementation of the government’s housing policies and programs by delivering affordable home ownership loans. KMRC provides the loans to Primary Mortgage Lenders (PMLs) to re-finance client mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) to individual borrowers whose monthly household income is not more than Kshs 150,000. The loans are issued at a fixed rate of 5.0% for onward lending at single digit rates.

Currently, the affordable housing initiative continues to take shape in the NMA and other counties. The table below indicates some of the notable ongoing affordable housing projects in the NMA;

|

Summary of Notable Ongoing Affordable Housing Projects in the Nairobi Metropolitan Area |

|||||

|

Name |

Developer |

Location |

Number of Units |

Pricing (Kshs) |

Status |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

1,562 |

1 bed: 1.0 mn 2 bed: 2.0 mn 3 bed: 3.0 mn

|

Ongoing |

|

River Estate Affordable Housing Program |

National Government and Edderman Property Limited |

Ngara |

2,720 |

||

|

Mavoko Affordable Housing Program |

NHC through Epco Builders Limited |

Machakos |

5,360 |

1.0 – 3.0 mn (Affordable Housing) and 2.0 mn – 8.0 mn (Middle Income) |

Initial Stages |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru, Enterprise Road |

15,000 |

- |

Ongoing |

Source: Online Research

Ongoing projects in other counties include Changamwe and Buxton Estates in Mombasa, Kakamega Affordable Housing Project in Kakamega and Nakuru Affordable Housing Program in Nakuru. For the Nairobi Metropolitan Area, other projects on the pipeline are Shauri Moyo, Makongeni and Starehe houses. The private sector has also played a major role in the roll out of affordable housing units to fast track their delivery and providing affordable housing financing to their clients below markets rates, with flexible repayment plans, and longer repayment periods. Some of the projects by the private sector include;

|

Private Affordable Housing Projects in the Nairobi Metropolitan Area |

||||

|

Project Name |

Developer |

Location |

Number of Units |

Status |

|

Kentek Ventures |

Kentek Venture Limited |

Ruiru |

53,716 |

Ongoing |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

30,000 |

Ongoing |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

8,888 |

Ongoing |

|

Tsavo Apartments |

Tsavo Real Estate |

Embakasi, Riruta,Thindigua, Roysambu and Rongai |

3,200 |

Ongoing |

|

Unity West |

Unity Homes |

Tatu City |

3,000 |

Ongoing |

|

Greatwall Gardens |

Edermann Property |

Mlolomgo |

2,200 |

Ongoing |

|

RiverView |

Karibu Homes |

Athi River |

561 |

Ongoing |

Source: Online Research

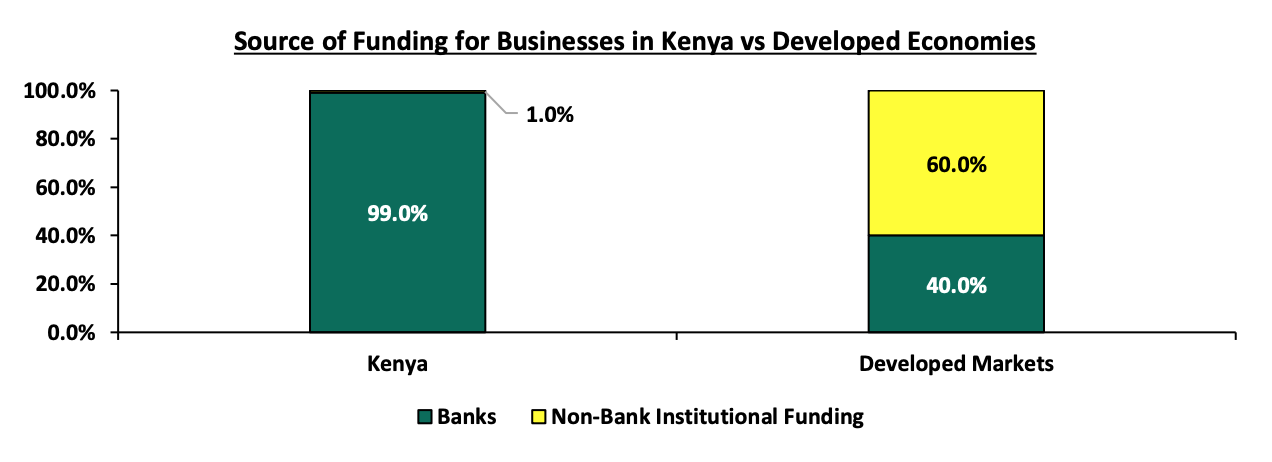

Despite the private sector’s efforts in complementing the government’s efforts in achieving affordable housing, we note that the roll out of Affordable Housing projects has remained a challenge due to the overreliance on traditional sources of funding projects such as bank debt as opposed to alternative sources of funding such as structured real estate project notes and Real Estate Investment Trusts (REITs). According to the Capital Markets Authority, Kenya’s businesses rely on banks for 95.0% of the funding with only 5.0% of the funds coming from the Capital Markets. Additionally, the bureaucracy and the slow approval processes in the construction industry has contributed to the delays in some of the projects breaking ground, especially during the lockdown period when operations were temporarily halted to adhere to COVID-19 measures.

- Achievements of the Affordable Housing Initiative

Despite the fact that the Affordable Housing Programme is set to fall short of its target, the initiative has made some achievements. Key among them being:

- Increased Budgetary Allocations and Diverse Sources of Funding: Since the Big Four Agenda was introduced in 2017, a total of Kshs 37.3 bn has so far been allocated collectively to fund the Affordable Housing Programme. This amount has been facilitating construction of new units, upgrading of existing units and has been offered to KMRC to support affordable mortgages. The only exception was in FY’2020/2021 where budgetary allocation was reduced as funds were diverted to help the government in containing the spread of the COVID-19 pandemic. Additionally, in December 2021, the Capital Markets Authority (CMA) approved the issuance of a Kshs 3.9 bn Medium Term Note (MTN) Program for Urban Housing Renewal Development Limited which will finance the construction of the ongoing Pangani Affordable Housing Project. The graph below indicates the budgetary allocation towards affordable housing from FY’2018/19 to FY’2021/2022;

Source: National Treasury

- Incentives to Home Owners and Developers - The government has made progress in improving the housing situation over the past three years by formulating incentive policies and fiscal reforms. These incentives are meant to motivate home buyers and developers into accelerating the development and progress of affordable housing;

For home owners, the government offers;

- Affordable housing relief of 15.0% of gross emoluments up to Kshs 108,000 per annum or Kshs 9,000 per month for Kenyans buying houses under the Affordable Housing Scheme,

- Tax exemption for interest on mortgage repayments up to Kshs 25,000 per month or Kshs 300,000 per annum provided that the taxpayer occupies the property,

- The National Housing Development Fund (NHDF) - The Fund aims to bridge the gap for affordable housing in Kenya by enabling end-buyer uptake through provision of affordable financing solutions such as the Tenant Purchase Scheme (TPS), and,

- A waiver on stamp duty for first- time home buyers under the affordable housing initiative, and,

- Pension scheme members the opportunity to utilize up to 40.0% of their accumulated pension benefits towards the direct purchase of a residential house in addition to the previous provisions allowing the utilization of up to 60.0% of pension benefits to secure a mortgage facility.

For Developers the government offers;

- Reduction in corporate tax by 50.0% from 30.0% to 15.0% for developers of over 100 affordable housing units annually,

- Exemption from Value Added Tax for supplies imported or purchased for direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones (SEZ), subject to a minimum of 5,000 units. Good case example is Tatu City, a mixed-use development of over 5,000 acres located in Ruiru, Kiambu County and the first operational SEZ in Kenya, and,

- The waiving of building approval fees for all affordable housing projects in Nairobi.

These incentives among others, have led to increased developments related to affordable housing and also boosted the development and uptake of affordable homes in the country.

- Launch and operationalization of the Kenya Mortgage Refinance Company (KMRC) - The Kenya Mortgage Refinance Company is a treasury backed lender which was established in August 2018 and licensed for operations in September 2020. The firm aims to provide long term funds to Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and SACCOs in order to increase the availability and affordability of home loans to Kenyans. The lending to PMLs in FY’2020/21 refinanced a portfolio of 1,427 mortgages valued at Kshs 2.1 bn. In FY’2021/22, KMRC tripled the lending allocation to Kshs 7.0 bn representing a 153.5% increase. The lending is done at 5.0% to PMLs for onward lending to affordable housing clients at single digit interest rates. KMRC re-finances mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) to individual borrowers whose monthly household income is not more than Kshs 150,000,

- Launch of Numerous Affordable Housing Projects: From the onset of the Big 4 Agenda, the government has launched a couple of projects focused on affordable housing. Key to note, Pangani and Park Road Estates have managed to deliver about 1,000 units with some already handed over for sale to potential buyers. In the Pangani Housing Project, 1,000 units are set to be handed over in May 2022. The housing project targets 1,562 units out of which 952 are in the affordable housing category. The private sector has also contributed to this initiative by initiating a couple of projects that cater to the low and middle income group, and,

- Establishment of the National Housing Development Fund (NHDF): The Fund aims to bridge the gap for affordable housing in Kenya by; i) enabling end-buyer uptake through provision of affordable financing solutions such as the anticipated nationwide Tenant Purchase Scheme (TPS), ii) allowing mortgage and cash buyers to save towards the purchase of an affordable home through the Home Ownership Savings Plan and, iii) extending mortgage loans to members at an interest rate of up to 7.0% p.a.

- Impediments towards the Achievement of National Housing Agenda in Kenya

The timely delivery of the Affordable Housing program has been impeded by several bottlenecks, with the Government only delivering less than 5,000 housing units which is a far cry from an ambitious target of 500,000 units at the end of 2022. Some of these bottlenecks include;

- Inadequate Funding: Inadequate funding has been a setback for both the government and the private sector players as discussed below;

-

- Government: Housing developments are capital intensive, particularly the mass production of affordable housing projects for which the government is the largest financier. Budgetary allocation to affordable housing has been low which has limited the supply of housing units. In the FY’2021/22 budget, the National treasury allocated Kshs 13.9 bn affordable housing which is only 7.6% of the total amount allocated to Infrastructure, Housing, Urban Development and Public Works Sector at Kshs 182.5 bn. On mortgage financing as a means, the government is also not clear on the sustenance of the Kenya Mortgage Refinance Company (KMRC) funding model in order to maintain lending at 5.0% to Primary mortgage lenders for onward lending at single digit rates.

- Private Sector and Developers: In Kenya, the main source of funding for real estate developers is banks which provide 99.0% of funding as compared to just 40.0% in developed countries. The capital markets structure in the country, which could be a source of alternative funds, is non-supportive and under-developed, hindering raising of funds for affordable housing developments for the private sector players. Funding to developers has also been affected by the uncertainty occasioned by the COVID-19 pandemic, with most investors opting for capital preservation.

The graph below shows sources of funding businesses in Kenya compared to developed countries;

- Unaffordable Mortgages: According to the Central Bank of Kenya’s Bank Supervision Annual Report 2020, the residential mortgage market recorded a 3.7% decline in the number of mortgage loans accounts, to 26,971 in December 2020, from 27,993 in December 2019. Mortgage access and penetration in the country still remains low mainly due to; i) low-income levels that cannot service the high mortgage initial deposits and subsequent installment payments, ii) high interest rates for mortgages ranging between 7.0-13.0%, iii) exclusion of employees in the informal sector due to inability to service mortgages, iv) lack of capital markets funding towards real estate purchases for end buyers, and, iv) lack of a secondary mortgage market that would improve ability and capacity of banks and other lenders to finance more mortgages. Notably, with the average mortgage loan size of Kshs 8.6 mn and interest rates at 10.9% and a maximum tenor of 20 years, one is required to make monthly repayments of approximately Kshs 88,000 per month, which is unaffordable assuming a median gross salary of Kshs 50,000,

- Inadequate Supply of Development Land: There is an inadequate supply of serviced land ready for development in most locations around the country. When available, this land is expensive especially in urban areas like Nairobi Metropolitan Area where land prices have grown at a 10-year CAGR of 8.3% according to Cytonn Research. Most of the land owners are also not willing to sell off land as they await long term price appreciation while others generally feel the need to maintain their ancestral land,

- High Construction Costs: Exorbitant land prices has led to increased development costs as land costs account for 25.0% - 40.0% of development costs in urban areas. The average cost of construction per square meter (SQM) stood at Kshs 44,754 in 2021. With the average plinth area of a 2-bedroom apartment under affordable housing at 40.0 SQM, the average cost of a complete unit stands at Kshs 1.7 mn which is unaffordable for most Kenyans when the seller has to realize a return after selling the unit, especially in the COVID-19 times when spending power remains weak,

- General Government Bureaucracy: According to the Centre for Affordable Housing Finance Africa, it takes 44 days to register a property in Kenya with the average cost to register the property standing at 5.9% of the property price. This when compared to some African countries like Ghana, where it takes 33 days, and the average cost is also less at 4.1%, illustrating the generally slow processes in Kenya. There also exist several agencies involved in the approval of licensing of housing development proposals ranging from respective county government approval to the National Construction Authority and the National Environmental Management Authority resulting to a lengthy, costly and complicated process before actual construction. This is not appealing to developers and potential investors thus slowing down provision of affordable housing,

- Ineffective Policy Actions: The Ministry of Housing and Urban Development established the Integrated Project Delivery Unit to act as a single point for regulatory approval for developments, infrastructure provision and developer incentives which is still awaiting operationalization to date. Incentives offered to developers such as reduction of income tax for developers developing more than 100 affordable units annually from 30.0% to 15.0% are neither clear nor accessible and fail to serve the desired purpose,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Affordable Housing Development: The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the intended objective as a result of:

- Regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security,

- Lack of clarity on returns and revenue-sharing,

- The extended time-frame of PPPs at 30 years, and,

- Bureaucracy and slow approval processes.

- Unsustainable Funding Model for the Kenya Mortgage Refinance Company (KMRC): The Kenya Mortgage Refinance Company is responsible for funding affordable mortgages in the country. In an aim to consolidate more funds for onward lending at 5.0%, however, the funding model for KMRC is not sustainable and it’s not clear on how the firm will borrow and maintain lending at such single digit rates. KMRC is likely to attract fewer investors as it seeks to both borrow and maintain lending at the low rates, and as a result, face competition from government instruments which are offering higher rates to investors. Some of the government bonds such as the 20-year bond are attracting a return of 13.5% and would seem more attractive to investors. It is therefore not clear how the firm will borrow and maintain lending at a 5.0% rate with the latest postponement of the green bond issue attributed to challenges surrounding rates, quantum and bond guarantee negotiations.

Section IV: Lessons Kenya Can Learn from Other Countries

In our previous topicals on Affordable Housing in Kenya and Accelerating Funding to Affordable Housing covered in April 2018 and May 2020, respectively, we highlighted Singapore and South Africa among the countries that have made strides in affordable housing. We now take a look at the lessons on initiatives that we can learn from these aforementioned countries, in addition to those from Canada and Japan.

|

Country |

Key Take-Outs |

|

Singapore |

|

|

Canada |

|

|

South Africa |

|

|

Japan |

|

Section V: Recommendations

From the above lessons, the following can be implemented to accelerate the affordable housing initiative in the Nairobi Metropolitan Area;

- Remove Obstacles in the Capital Markets: The private sector’s participation in the development of affordable housing in Kenya has been crippled by the unavailability of financing and the high dominance on banks as a source of funding. Learning from developed countries such as Singapore and the United Kingdom, capital markets play a key role in the mobilization of commercial financing. There is therefore need to deepen our capital markets and stimulate its growth and we believe that this can be achieved by;

- Allowing for sector funds: The current capital markets regulations require that funds must diversify. Consequently, one has to seek special dispensation in the form of sector funds such as a financial services fund, a technology fund or a real estate UTF fund. Regulations allowing unit holders to invest in sector funds would expand the scope of unit holders interested in investing in affordable housing,

- Reduce the minimum investments to reasonable amounts: Currently, the minimum investment for sector specific funds is Kshs 1.0 mn, while that for Development-Real Estate Investments Trusts (D-REIT) is currently at Kshs 5.0 mn. The high minimum initial and top up investments amounts are unreasonably high given that the national median income for employed individuals is estimated at around Kshs 50,000. This therefore locks out a lot of potential investors,

- Eliminate conflicts of interest in the governance of capital markets: The capital markets regulations should enable a governance structure that is more responsive to market participants and market growth, and,

- Improve fund transparency to provide investors with more information: Each Unit Trust Fund should be required to publish their portfolio holdings on a quarterly basis and make the information available to the public so as to enhance transparency for investors. Providing investors with more information will help both investors and prospects make better informed decisions and subsequently improve confidence and funding for such housing backed investment schemes.

- Focus on Enabling Environment Rather than Construction: The government should focus more on providing an enabling environment for developers and investors, as well as stimulating economic growth to ensure that even citizens can afford housing on their own. In the informal settlement areas, the government should look to prioritize repairs and upgrades, rather than the construction of new houses which is costlier and takes more time. In Canada, their National Housing Strategy is focused on repairing and upgrading units rather than doing new constructions. This strategy has so far borne fruit given the successful Community Programs Partnerships that have so far overseen repair of over 126,000 units by 2021,

- Focus on Urban Planning in the NMA: The government of Kenya can also adopt the technique of high-rise buildings with compact plinth areas in the Nairobi Metropolitan Area (NMA) to cater for the growing population. With a population of approximately 5.6 mn, Singapore is classified as one of the most densely populated cities in the world at 7,909 people per SQKM. Due to land scarcity, urban planners sought to maximize land use through construction of high rise and high-density buildings. The government then implemented a mandatory code in 2008 with requirements to ensure environmental sustainability of buildings leading to a higher quality of life for its residents, and

- Reduce Bureaucracy and Regulatory Hindrances in the Working of PPPs: The government needs to address regulatory gaps in PPP deals. Despite the Public Private Partnerships (PPP) Bill 2021 being signed into law, more can be done in addressing regulatory hindrances such as, lack of a revenue sharing mechanism and lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate easier access to private sector funds through the use of the land as security. In South Africa PPPs become SPVs, making lending funds to them easier such as Fleurhof Project, a USD 350.0 mn (Kshs 35.4 bn) residential development in Johannesburg, near Soweto. The project targeting low-income households started in 2009 was done through a partnership between International Housing Solutions (IHS), a private equity firm, and Calgro M3, the developer, and around 5,000 residents currently live at the Fleurhof Project.

In conclusion, the government has made some progress towards affordable housing by delivering units in the Nairobi Metropolitan Area and initializing several other projects in other counties. We believe that for affordable housing to properly take off and meet the existing demand in the NMA, the government has to implement comprehensive solutions with a main focus on increasing financing for affordable housing development. If the financing gap can be bridged, the government will be a step closer to achievement of the Big Four Agenda.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.