COVID-19 Economic Containment Policies, & Cytonn Weekly #15/2020

By Cytonn Research, Apr 12, 2020

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the subscription rate coming in at 35.6%, down from 112.7% the previous week. The undersubscription is partly attributable to the IFB1/2020/9 bond sale in the primary market that closed during the week, coupled with tightening liquidity in the money market as evidenced by the interbank rate, which increased to 5.3% from 5.2% the previous week. The yields on the 91-day paper, 182-day, and 364-day paper all remained unchanged at 7.2%, 8.1%, and 9.0%, respectively. During the week, the National Treasury of Kenya released the Tax Amendment Bill 2020 necessitated by the Kenyan Presidential directive dated 25th March 2020, with regards to measures announced by the President to cushion the economy and Kenyans from the adverse effects of the Coronavirus pandemic. During the week, the World Bank released the Africa’s Pulse, April 2020. According to the report, Sub-Saharan Africa’s economic growth is projected to enter into the negative territory, with the World Bank projecting it at (2.1%) to (5.1%) from an estimated growth of 2.4% recorded in 2019, which will be the region’s first recession in 25-years;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 5.5%, 2.3% and 4.4%, respectively, taking their YTD performance to losses of 21.2%, 25.9% and 25.2%, for the NASI, NSE 20 and NSE 25, respectively. The YTD losses recorded by all the three indices breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. During the week, Safaricom PLC and Vodacom completed the acquisition of intellectual property rights of M-PESA from Vodafone through a newly formed Joint Venture. The deal is estimated to cost approximately USD 13.4 mn (Kshs 1.4 bn) and will see both Safaricom and Vodacom gain full control of the M-Pesa brand, product development and support services. During the week, the Central Bank of Kenya (‘CBK’) announced that banks have up to Friday 10thApril 2020 to submit details of all loans renegotiated as part of the measures to offer support to businesses and individuals and cushion the economy from the impact of the Coronavirus pandemic. This is in a bid to maintain the asset quality of banks with CBK anticipating Non-Performing Loans (NPL) to increase. As well during the week, CBK took regulatory action against ABSA Bank Kenya for failing to provide information about some specific foreign exchange trades conducted in March 2020;

Real Estate

During the week, The Tax Laws (Amendment) Bill 2020 was set to be tabled before parliament. However, this did not happen following the postponement of the legislature’s sitting to an undisclosed later date. In addition to other amendments, the Bill outlines a proposed amendment to the Income Tax Cap (Cap 470) through the deletion of section 22C, which provides for tax incentives to individuals saving towards purchasing of a house through a registered home ownership savings plan (HOSP). Fusion Capital, a local real estate developer, announced that it would offer a 3-month 30.0% rent relief to tenants in its Flamingo Towers development in Upperhill as a result of the Coronavirus pandemic, which continues to affect the sector. In the infrastructure sector, the Kenya Roads Board (KRB) disbursed Kshs 539.0 mn for maintenance of roads in the coastal region, as part of the Kshs 4.4 bn conditional grant, from the National Government for the maintenance of roads in all the 47 counties in this 2019/2020 financial year;

Focus of the Week

Over the past month, the situation surrounding COVID-19 (Coronavirus) pandemic has worsened as the number of positive cases increase globally. According to the World Health Organization (WHO), as of Friday, 10thApril 2020, the figures stood at 1,521,252 infections and 92,798 deaths. Closer home, Kenya’s numbers continue to grow with 184 confirmed cases and 7 deaths as at 10thApril 2020. The Coronavirus has had a devastating impact on the economic conditions of global economies. As a result, governments across the globe have rushed to put together economic stimulus packages for their countries in an effort to cushion the effects COVID – 19 has had on their respective economies and to prepare for the expected recession in the global economy. Consequently, this week we focus on what should be done to tame the economic impact of the pandemic.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.0% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.1% p.a. To subscribe, email us at sales@cytonn.com;

- Following the Kenyan Government's directive in containing the spread of COVID-19, we have adjusted our working hours to 8 am - 4 pm on weekdays and 8 am- 12 pm on Saturdays. For convenience, you can reach us online on clients.cytonn.com, WhatsApp at 0748 070 000, or email at clientservices@cytonn.com

- Wacu Mbugua, Real Estate Research Analyst at Cytonn Investments, was on NTV to discuss the extent the real estate market is expected to be hit from the adverse effects of COVID-19. Watch Wacu here;

- Wacu Mbugua, Real Estate Research Analyst at Cytonn Investments, was on Metropol TV to discuss the impact of the Coronavirus pandemic on the Kenyan real estate market. Watch Wacu here;

- Felix Otieno, Assistant Investment Analyst at Cytonn Investments, was on KBC Channel 1 to discuss short term and long-term investments during the Coronavirus pandemic. Watch Felix here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information, please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were undersubscribed, with the subscription rate coming in at 35.6%, down from 112.7% the previous week. The undersubscription is partly attributable to the IFB1/2020/9 bond sale in the primary market that closed during the week, coupled with tightening liquidity in the money market as evidenced by the interbank rate, which increased to 5.3% from 5.2% the previous week. The subscription rate of the 91-day, 182-day, and 364-day papers declined to 14.3%, 16.3%, and 63.4%, respectively, from 22.7%, 46.3%, and 215.1% the previous week, respectively. The yields on the 91-day, 182-day, and 364-day papers all remained unchanged at 7.2%, 8.1%, and 9.0%, respectively, similar to what was recorded in the previous week. The acceptance rate declined marginally to 99.3%, from 100.0% recorded the previous week, with the government accepting Kshs 8.46 bn of the Kshs 8.53 bn bids received.

During the week, the Central Bank of Kenya released the auction results for the newly issued infrastructure bond, IFB1/2020/9 with an effective tenor of 9.0-years and a coupon rate of 10.9%, in a bid to raise Kshs 60.0 bn for funding of infrastructure projects in the FY’2019/20 budget estimates. The bond was oversubscribed, with the government receiving bids worth Kshs 68.4 bn, higher than the quantum of Kshs 60.0 bn, translating to a subscription rate of 114.0%. The high subscription as per our expectation was mainly attributable to its short tenor as well as the tax-free incentive for infrastructure bonds, translating to a higher return. However, as per the proposals from the Tax Laws (Amendment) Bill, 2020, going forward, securities used to raise funds for infrastructure and other social services with tenors of at least 3-years will now be subject to 10.0% withholding tax, just like the other normal bonds. The introduction of the tax is set to remove the single most distinctive and attractive feature of these bonds, which will also mean that the State may be forced to pay higher interest on the papers to compensate for the tax levy. The yield on the tax-free bond came in at 12.3%, with the government accepting Kshs 39.0 bn out of the Kshs 68.4 bn worth of bids received, translating to an acceptance rate of 57.0%.

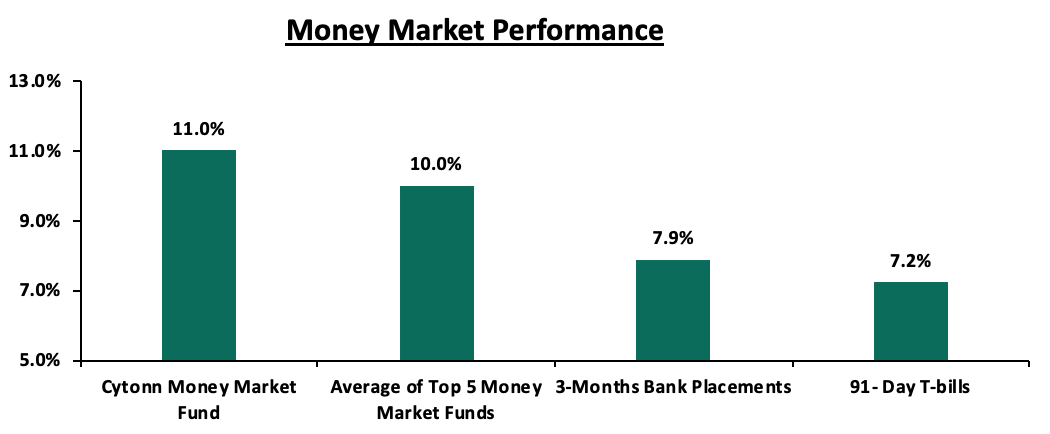

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.2%, unchanged from the previous week, while the average of Top 5 Money Market Funds declined by 0.1% point to 10.0%, from 10.1% the previous week. The yield on the Cytonn Money Market came in at 11.0%, unchanged from the previous week.

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing marginally to 5.3%, from 5.2% the previous week. The marginal rise was due to demand as banks raised funds for tax payments with Pay as You Earn (PAYE) due on Thursday 9th April. The average interbank volumes declined by 10.0% to Kshs 7.4 bn, from Kshs 8.2 bn recorded the previous week.

Kenya Eurobonds:

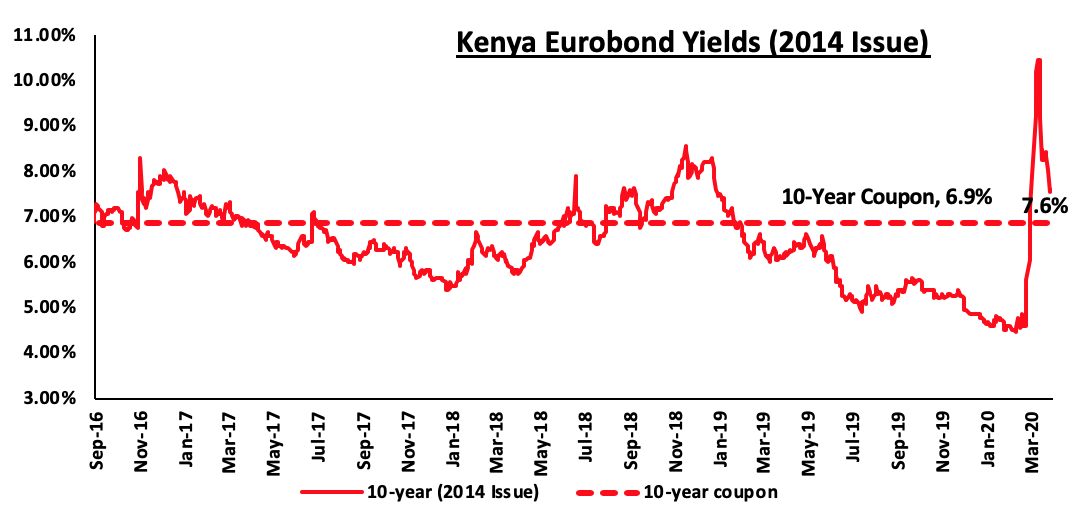

During the week, the yields on all the Eurobonds declined, as the market corrected from the sharp increase recorded during the last two weeks of March 2020, a trend, which was replicated in the performance of other Sub-Saharan African Eurobonds. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.7% point to 7.6%, from 8.3% recorded the previous week.

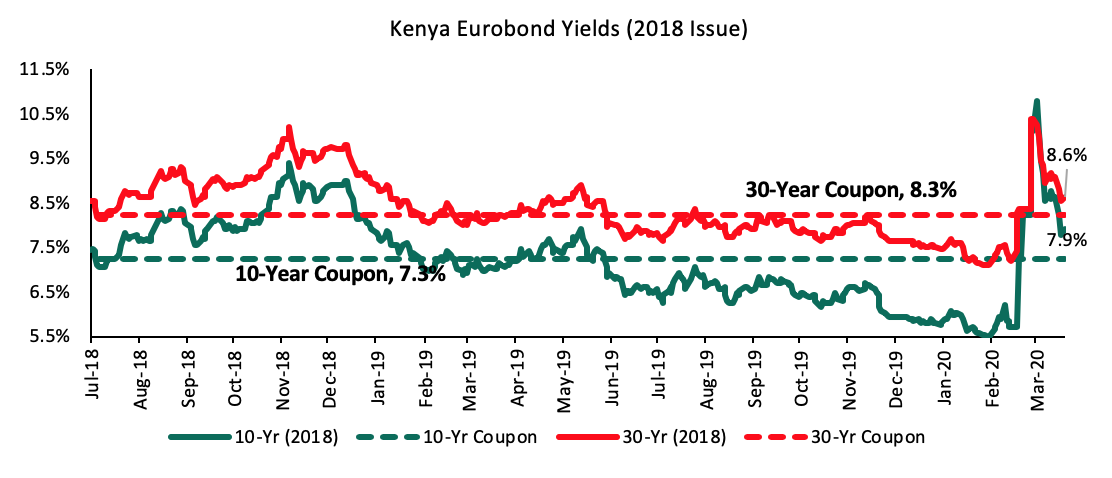

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018, declined by 0.7% points and 0.5% points to 7.9% and 8.6%, respectively, from 8.6% and 9.1% recorded previous week.

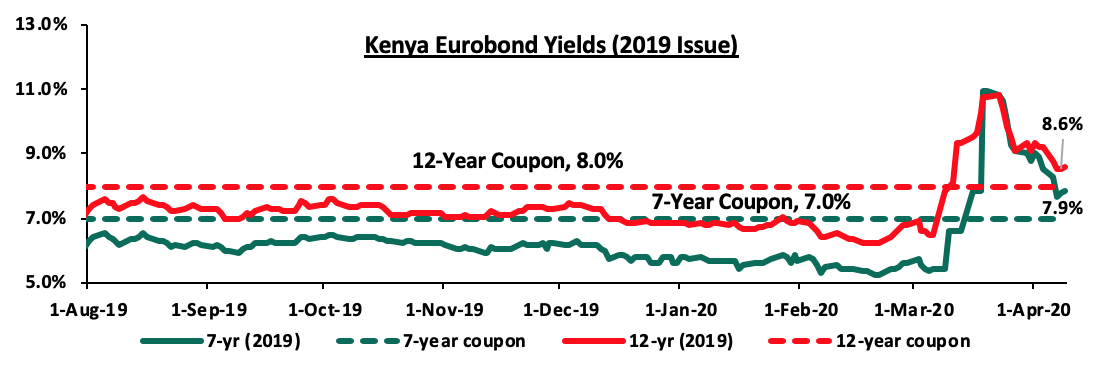

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 both declined by 0.6% points to 7.9% and 8.6%, respectively from 8.5% and 9.2%, respectively recorded the previous week.

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issues in Q1’2020 being Gabon and Ghana, Q1’2020 saw the Sub-Saharan Region raise USD 4.0 bn through Eurobond issues. The new instruments attracted a lot of interest as evidenced by the oversubscription in all the issues, with the Ghana issues recording the highest oversubscription of over 4.7x. This underlines the demand by premium investors to hold riskier assets, partly because, by comparison, African sovereign debt offers the highest yields to investors globally. Eurobond yields in Sub Saharan Africa increased in Q1’2020, attributable to the COVID-19 health crisis, with investors attaching a higher risk premium on the affected regions due to the anticipation of slower economic growth. The Eurobond window for Sub-Saharan Africa is effectively closed for now given the strong drop in commodity prices that has led to the region underperforming emerging market peers, and also because investors have a current preference for safe havens. For more information, please see our Q1’2020 Eurobond Performance Note.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.3% against the US Dollar to close at Kshs 106.0, from Kshs 105.7 recorded the previous week. The Kenya Shilling was under pressure due to dollar demand from commercial banks, merchandise, and energy sector importers beefing up their hard currency positions amid economic uncertainty caused by the Coronavirus outbreak amid little foreign exchange inflows to offer support. On an YTD basis, the shilling has depreciated by 4.6% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect depreciation of the shilling in 2020 as a result of:

- Rising uncertainties in the global market due to the Coronavirus outbreak, which has seen the disruption of global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to cause local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 8.0 mn (equivalent to 4.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- CBK’s supportive activities in the money markets, with the Central Bank of Kenya (CBK) having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March to bolster the forex reserves.

Weekly Highlight

During the week, the National Treasury of Kenya released the Tax Amendment Bill 2020 necessitated by the presidential directive dated 25thMarch 2020, with regards to measures announced by the President to cushion the economy and Kenyans from the adverse effects of the Coronavirus pandemic. Some of the major amendments include;

- A reduction of the turnover tax rate from the current 3.0% to 1.0% for all Micro, Small and Medium Enterprises (MSMEs), and a further proposal to increase the threshold of the MSMEs qualifying for turnover tax from Kshs 5.0 mn to Kshs 50.0 mn,

- Reduction of the corporate tax deductions available to corporate bodies, the removal of the recently introduced 30.0% additional tax deductions on electricity costs available to manufacturers and a reduction on the tax incentives available to companies listed on the Nairobi Securities Exchange,

- Reduction of income tax exemptions, including, overtime, bonuses, the capital gains exception on the disposal of a private residence, transfer of private land by an individual which is not more than Kshs 3.0 mn and agricultural property less than 50-acres, income from a registered home ownership savings plan, income from the National Social Security Firm, Monthly or lump sum pension granted to a person over 65 years of age, and investment income of a pooled fund which will reduce the benefits attributable to retirees. The amendment bill also proposed that Paragraph 51 of the First Schedule of Income Tax Act that exempts interest income accruing from all listed bonds, notes or other similar securities used to raise funds for infrastructure and other social services from taxation, be deleted. This will mean that interest earned from Infrastructure and green bonds, a fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects will now be subject to 10.0% withholding tax, just like the other normal bonds,

- On withholding tax, tax on dividends payable to non-residents increased to 15.0% from 10.0%,

- On employment taxes, the resident personal relief was increased from the current Kshs 1,408 per month to Kshs 2,400 per month effectively increasing the average take home to Kshs 992 per month. Tax bands have been expanded and the marginal tax rate reduced from 30.0% to 25.0%, and,

- On Value Added Tax, there is a proposal to change the VAT status of various services and goods from exempt or zero-rated to standard rated. To change the VAT status of others such as bread and milk from zero-rated to exempt. The bill also proposes to abolish the exclusion of excise duty, fees and other charges from the taxable value of petroleum products, a change that will increase the taxable value of petroleum products resulting into an increase in the final price charged to the consumer.

In our view;

- The reduction in the turnover rate and increasing the threshold for businesses that qualify is a welcome move, as it will reduce the tax burden on MSMEs, which constitute 98.0% of all businesses in the country, employing 14.9 mn Kenyans. The government is showing clear commitment towards shielding the MSMEs from economic shocks that will result from the Coronavirus pandemic,

- The reduction in corporate tax deductions indicates that the National Treasury intends to increase collection of tax revenues. The reduction of tax incentives for the companies listed in the Nairobi Securities exchange may reduce the allure of listing on the NSE as the costs incurred during a listing, such as legal fees, can be significant,

- On reduction of income tax exemptions, the state may have to pay higher interest on infrastructure and green bonds to compensate for the tax levy in order to attract investors, as the tax exemption was the single most distinctive and attractive feature of these bonds. Taxation of overtime, bonuses and retirement benefits will lead to a reduction of disposable income especially for the low-income earners and impacting their ability to save for retirement,

- The increase in withholding tax on dividends payable to non-residents may reduce Kenya’s attraction of Foreign Direct Investments (FDI) given the era of Africa Continental Free Trade, as foreigners will seek to set base in countries with more favorable Corporation tax regimes making Kenya less attractive for foreign investors,

- The change in employment taxes, once implemented will mean that persons earning under Kshs 24,000 will pay zero tax, those earning Kshs 35,000 will now pay a PAYE of Kshs 1,650 a Kshs 2,093 reduction from the previous Kshs 3,743 PAYE. This will go a long way in increasing their purchasing power, and,

- The change in VAT status may result in an increase in the cost of goods and services to the taxpayers. This includes the most basic such as milk and bread as the change in status from zero-rated to exempt will result in the inability of manufacturers to claim input VAT incurred in their operations with the potential of forcing them to pass the additional costs to consumers through price increases.

The above-proposed amendments will be law once passed by parliament and assented by the President. In our view, the new VAT and Capital gains taxes introduced by the bill are to offset the series of measures like the various tax cuts, VAT refunds and faster repayment of pending bills to suppliers that were put in place by the president as a measure to cushion the economy against the effects of the Coronavirus. According to Fitch, however, these measures would have led to a widening fiscal deficit approximated at 9.0% of the GDP in the financial year 2020. Based on some of the proposed amendments, our Pensions department has analyzed, here, the effect the Tax Amendment Bill, 2020 will have on the Retirement Benefits Sector.

During the week, the World Bank released the Africa’s Pulse, April 2020. Below are the key take-outs from the report:

- Economic Growth - Sub-Saharan Africa’s economic growth is projected to enter into the negative territory, with the World Bank projecting it at (2.1%) to (5.1%) from a growth of 2.4% recorded in 2019, which will be the region’s first recession in 25-years. Growth in resource-intensive countries is projected to fall by up to 7.0% points in oil-exporting countries and by more than 8.0% points in metal exporters. For non-resource intensive countries like Kenya, growth is expected to weaken substantially due to lower demand from its trading partners and disruptions of supply chains and domestic production. In Ethiopia, the locust invasion has also severely disrupted agricultural production, compounding the effects of COVID-19 on the economy,

- Public Debt - Public debt in the region has been on the rise over the past decade. Public debt profile in the region has become riskier due to lower concessional borrowing and rising obligations with private creditors and non–Paris Club governments, the Paris club being an informal group of creditor nations whose objective is to find workable solutions to payment problems faced by debtor nations. The shift is amidst heightened macroeconomic vulnerabilities, further raising debt sustainability challenges. According to the report, Kenya’s outstanding external debt is estimated at 30.6% of the GDP, with its debt service estimated at 20.1% of exports, the second highest among Sub-Saharan African countries, behind Ethiopia at 25.3% of exports. As highlighted in our Debt Sustainability Note, Kenya’s debt service-to-revenue ratio was estimated to have hit 33.4% as at the end of 2019, which is higher than the recommended threshold of 30.0%. As such, risks are abound due to the high rate of accumulation of new debt. With the recommended threshold already breached, the country faces risks of repayment in the event of shocks such as the ongoing COVID-19 pandemic which is expected to have a negative effect on revenue collection, and,

- Policy Response- Some Sub-Saharan Countries including Kenya have reacted quickly and decisively to curb the potential influx and spread of COVID-19. The World Bank, however, noted the need for the region to implement policies different from those adopted in advanced countries and (some) middle-income countries due to the structure of their economies as a high proportion of the population is in informal employment. Excluding Agriculture, informal employment accounts for 76.8% of total employment and small and medium-sized enterprises (SMEs), account for up to 90.0% of all businesses and represent 38.0% of the region’s GDP. The World Bank also noted that Monetary Policy stimulus by way of rate cuts may not be effective in the region mainly due to the prevalence of supply effects at the height of the containment measures, which has resulted in reduced labour supply and the closure of businesses, especially in contact-intensive sectors, coupled with the weak monetary transmission in many countries with underdeveloped domestic financial markets and as such there was need for a different type of Central Bank intervention that provides liquidity support through direct credit lines or guaranteed commercial loans to formal and informal businesses,

In conclusion, Sub-Saharan Africa needs a differentiated African policy response customized to specifically reflect the structural features of the economy and the particular constraints that policy-makers face including much less fiscal space and less operational capacity to respond. Given the large size of the informal sector, with 89.0% unemployment, the predominance of the micro, small and medium-sized enterprises in the business activity, at 90.0%, aggressive containment measures such as total lock-downs will be less effective and could result in a collapse in economic activity that will increase poverty and endanger lives and livelihoods. Going forward, protecting vulnerable groups with social grants and food distribution, wage subsidies to prevent massive layoffs, waivers for basic services such as electricity, water tariffs, and mobile money transaction fees, ramping up testing, and promoting the wearing of masks may be better options with more resources being directed towards protecting and equipping the health will be critical for success.

Cytonn Investments have also lowered the GDP growth estimates to 1.4%- 1.8% for the year 2020 depending on the severity of the outbreak and economic implications for Kenya. The table below shows GDP projections from 11 firms with the consensus GDP growth as per the 11 firms below expected to come in at 5.0%.

However, we expect this growth rate to be revised downwards as global research houses downgrade their GDP growth estimates for 2020 once they factor in the economic impact of Coronavirus.

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

Q1’2020* |

Q1’2020** |

|

1. |

Citigroup Global Markets |

6.2% |

6.2% |

|

2. |

International Monetary Fund |

6.0% |

6.0% |

|

3. |

African Development Bank |

6.0% |

6.0% |

|

4. |

World Bank |

6.0% |

6.0% |

|

5. |

National Treasury |

6.0% |

6.0% |

|

6. |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

7. |

Capital Economics |

5.9% |

5.9% |

|

8. |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

5.5% |

|

9. |

Central Bank of Kenya** |

6.2% |

3.4% |

|

10. |

Cytonn Investments Management PLC** |

5.7% |

1.6% |

|

11. |

McKinsey & Company *** |

5.2% |

1.9% |

|

|

Average |

5.9% |

5.0% |

|

*As at the beginning of the year **Revised GDP Growth |

|||

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 21.7% ahead of its domestic target having borrowed Kshs 295.2 bn against a prorated borrowing target of Kshs 242.6 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets, which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 5.5%, 2.3% and 4.4%, respectively, taking their YTD performance to losses of 21.2%, 25.9% and 25.2%, for the NASI, NSE 20 and NSE 25, respectively. The YTD losses recorded by all the three indices breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. The performance of the NASI was driven by losses recorded by all large-cap stocks with Safaricom, EABL and Bamburi recording losses of 8.3%, 6.6% and 5.6%, respectively, while both Equity Group and Co-operative Bank declined by 3.5%.

Equities turnover increased by 2.3% during the week to USD 26.0 mn, from USD 25.5 mn recorded the previous week, taking the YTD turnover to USD 479.7 mn. Foreign investors remained net sellers for the week, with the net selling position increasing by 117.1% to USD 8.4 mn, from a net selling position of USD 3.9 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing riskier assets in favor of safe havens.

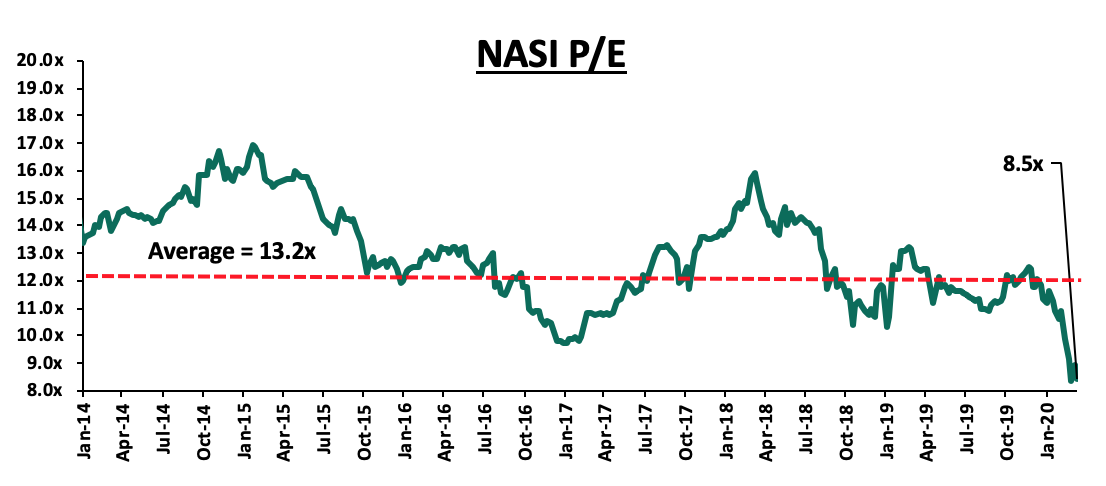

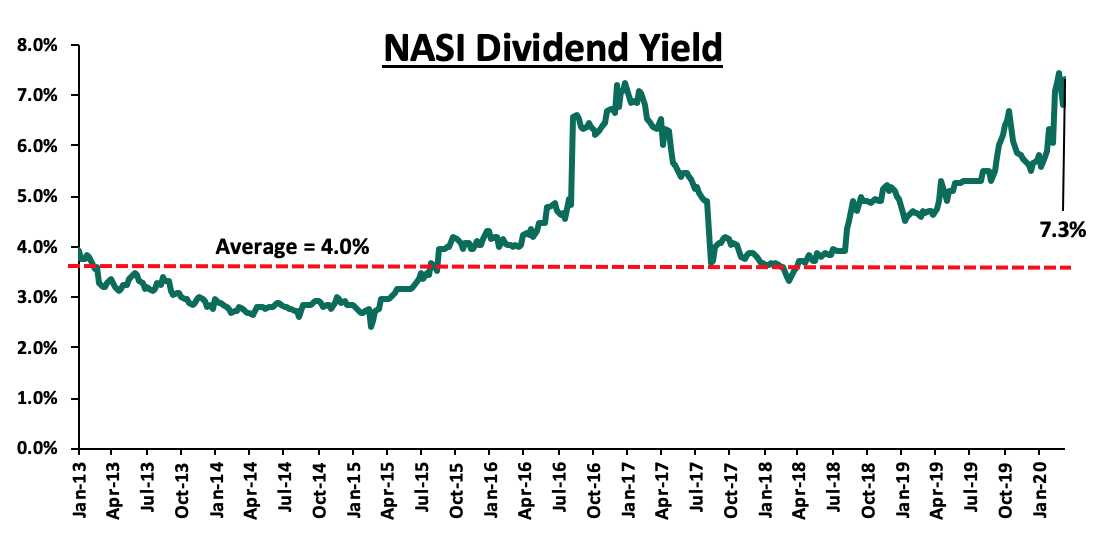

The market is currently trading at a price to earnings ratio (P/E) of 8.5x, 35.9% below the historical average of 13.2x, and a dividend yield of 7.3%, 3.3% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 8.5x is 12.9% below the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 1.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight:

During the week, Safaricom PLC and Vodacom completed the acquisition of intellectual property rights of M-PESA from Vodafone through a newly formed Joint Venture. The deal is estimated to cost approximately USD 13.4 mn (Kshs 1.4 bn) and will see both Safaricom and Vodacom gain full control of the M-Pesa brand, product development and support services. The purchase of M-Pesa’s Intellectual Rights is expected to give more headroom to Safaricom to grow the mobile money service into new African markets and yield significant savings from royalties paid to Vodafone. As at 1stNovember 2019, Safaricom’s M-Pesa revenues stood at Kshs 42.0 bn (approximately 32.3% of Safaricom’s total revenues) with Kshs 0.8 bn (accounting for approximately 2.0% of M-Pesa revenues) paid out to Vodafone as license fees for M-Pesa rights. M-Pesa is currently the largest mobile money platform with 23.6 mn users in Kenya. In our view, the acquisition will allow Safaricom to develop more local products such as Fuliza and will significantly contribute to the growth of Safaricom on the back of increasing mobile phone penetration and improving infrastructure. The deal will also lead to the expansion of mobile money services in Africa, diversification of the firm’s customer base as well as increase their revenue by tapping into the African Market. In our Cytonn Weekly #08/2020, we highlighted Safaricom’s intentions to bid for a telecommunications license in Ethiopia through a consortium of undisclosed investors. However, earlier in the month, the Ethiopian Government shut doors on foreign mobile money companies indicating that only local non-financial firms would be allowed to offer mobile money services in the country, in effect locking Safaricom’s mobile money platform M-Pesa out of the Ethiopian market momentarily. The fate of Safaricom’s bid is expected to be known by the end of 2021 when the mandate of the transaction adviser, the International Finance Corporation (IFC), ends on 31stDecember 2021. The Ethiopian Government disclosed that it plans to issue two new telecommunications licenses besides selling a stake in Ethiopian Telecommunications Corp.

During the week, the Central Bank of Kenya (‘CBK’) announced that banks have up to Friday 10thApril 2020 to submit details of all loans renegotiated as part of the measures to offer support to businesses and individuals and cushion the economy from the impact of the Coronavirus pandemic. This is in a bid to maintain the asset quality of banks with CBK anticipating Non-Performing Loans (NPL) to increase. According to data from the Central Bank Monthly Economic Indicators, December 2019, gross non-performing loans for the whole banking sector grew by 7.9% to Kshs 333.3 bn with an NPL ratio of 12.0% in December 2019, from Kshs 308.8 bn in December 2018 with the NPL ratio remaining unchanged. CBK indicated that banks are expected to meet all the costs of restructuring and must submit returns on the 10th of each succeeding month as part of its measures to track the loan moratoriums. The high NPLs remains a concern and has seen banks reduce lending to the riskier private sector and instead continue channeling funds to government securities.

During the week, CBK took regulatory action against ABSA Bank Kenya for failing to provide information about some specific foreign exchange trades conducted in March 2020. ABSA Bank Kenya failed to adhere to standard checks on anti-money laundering (AML), combating the financing of terrorism (CFT) and know-your-customer (KYC) requirements. The regulatory action will see ABSA lose profits from the dealings with the Central Bank directing ABSA Bank Kenya to reverse the market positions made from the trade. ABSA Bank Kenya is also required to undertake the following:

- By April 15th2020, put in place a robust framework that ensures all relevant documents for such foreign exchange transactions are available as required,

- Cease foreign exchange dealing in the Kenyan market for a period of 7 days from 9thApril 2020 to 15thApril 2020. However, all committed transactions as at 8thApril 2020 can be settled.

In our view, corporate governance is key to investor’s protection and is founded on the pillars that businesses have to practice accountability to stakeholders, fairness and have transparency in business activities. Increased regulation from regulatory bodies is essential for stability of the sector and the general market.

Universe of Coverage

|

Banks |

Price at 03/04/2020 |

Price at 09/04/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

87.8 |

85.5 |

(2.6%) |

(21.6%) |

109.0 |

189.0 |

3.2% |

124.2% |

0.4x |

Buy |

|

KCB Group*** |

34.6 |

34.5 |

(0.3%) |

(36.1%) |

54.0 |

64.2 |

10.1% |

96.2% |

0.9x |

Buy |

|

Kenya Reinsurance |

2.8 |

2.7 |

(4.3%) |

(12.2%) |

3.0 |

4.8 |

4.1% |

84.6% |

0.2x |

Buy |

|

Equity Group*** |

34.0 |

32.8 |

(3.5%) |

(38.7%) |

53.5 |

56.7 |

7.6% |

80.5% |

1.2x |

Buy |

|

Jubilee Holdings |

275.0 |

274.7 |

(0.1%) |

(21.7%) |

351.0 |

453.4 |

3.3% |

68.3% |

0.9x |

Buy |

|

Co-op Bank*** |

12.9 |

12.5 |

(3.5%) |

(23.9%) |

16.4 |

18.1 |

8.0% |

53.4% |

1.0x |

Buy |

|

I&M Holdings*** |

50.0 |

51.0 |

2.0% |

(5.6%) |

54.0 |

75.2 |

5.0% |

52.5% |

0.7x |

Buy |

|

Sanlam |

15.0 |

15.0 |

0.0% |

(12.8%) |

17.2 |

21.7 |

0.0% |

44.7% |

1.3x |

Buy |

|

ABSA Bank*** |

9.9 |

9.9 |

(0.4%) |

(26.1%) |

13.4 |

13.0 |

11.2% |

43.0% |

1.2x |

Buy |

|

NCBA |

28.3 |

28.0 |

(1.2%) |

(24.2%) |

36.9 |

37.0 |

6.3% |

38.6% |

0.7x |

Buy |

|

Standard Chartered |

185.0 |

182.3 |

(1.5%) |

(10.0%) |

202.5 |

211.6 |

11.0% |

27.1% |

1.4x |

Buy |

|

Liberty Holdings |

8.5 |

8.5 |

(0.2%) |

(18.3%) |

10.4 |

10.1 |

0.0% |

19.0% |

0.7x |

Buy |

|

Stanbic Holdings |

96.0 |

93.8 |

(2.3%) |

(14.2%) |

109.3 |

103.1 |

7.5% |

17.5% |

1.0x |

Buy |

|

CIC Group |

2.3 |

2.3 |

(1.3%) |

(15.7%) |

2.7 |

2.6 |

0.0% |

16.8% |

0.8x |

Buy |

|

Britam |

7.0 |

7.0 |

0.6% |

(22.2%) |

9.0 |

6.8 |

3.6% |

0.1% |

0.7x |

Lighten |

|

HF Group |

4.2 |

4.2 |

0.0% |

(35.0%) |

6.5 |

4.2 |

0.0% |

0.0% |

0.2x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Residential Sector

During the week, The Tax Laws (Amendment) Bill 2020 was set to be tabled before parliament. However, this did not happen following postponement of the legislature’s sitting to an undisclosed later date. Among other amendments, most of which are set to caution the economy in the wake of the COVID- 19 pandemic, the bill outlines a proposed amendment to the Income Tax Act (Cap 470) through the deletion of Section 22C, which provides for tax incentives to individuals saving towards purchasing of a house through a registered home ownership savings plan (HOSP). If the amendment is adopted and approved, this will mean that individuals making savings through all HOSP approved institutions, will cease to benefit from; (i) tax exemption on income to a maximum of Kshs 8,000 per month or Kshs 96,000 per annum, and (ii) tax exemption for any interest income earned by a depositor on a HOSP deposit of up to a maximum of Kshs 3.0 million. We expect this to negatively impact on homeownership levels in the country, by resulting in an increased tax burden especially among the low and middle-income earners who are the main beneficiaries of the HOSP platforms. The amendment also goes against the government’s affordable housing initiative, under the Big Four Agenda, which aims to enhance homeownership, by empowering both the demand and supply side of the housing sector, mainly for the low and middle-income market segments. Currently, Kenya has a cumulative housing deficit of 2.0 mn units growing by 200,000 units per year. Homeownership remains low with the key challenge being unaffordability and unavailability of financing, where a significant percentage of the population are not able to secure home loans provided by banks given their low-income levels with statistics showing that approximately 74.5% earn Kshs 50,000 per month and below. In addition, 83.4% of total employment is in the informal sector, which is characterised by small-scale activities, relatively unpredictable incomes and limited job security, and thus they are not able to afford to buy a house. Therefore, the HOSP platforms have been a move in the right direction as mortgage and cash buyers can save towards the purchase of a home, through a flexible and low- cost mechanism such as through Money Market Funds. In our view, there is, therefore, the need for Parliament to relook at the amendment, as it is likely to significantly impact on homeownership and an overall slowdown of the government’s Big Four Agenda.

- Commercial Sector

During the week, Fusion Capital, a local real estate developer, announced that it would offer a 3-month 30.0% rent relief to tenants in its Flamingo Towers development in Upper-Hill as a result of the Coronavirus pandemic, which continues to affect the sector. This in our view comes as a relief for tenants in light of business shutdowns owing to the Coronavirus lockdowns. The office sector like other real estate sub-sectors is experiencing a short- term disruption due to the Coronavirus pandemic and has presented some downside risk for the sector forcing property developers to employ creative strategies such as; (i) reduction of rental prices by a percentage to occupants, (ii) rent relief for some of the occupants, and (iii) extending of deadlines for rental payments for some occupants.

Globally, the pandemic has resulted in reduced demand for commercial properties as a result of the disruption of business operations and employers embracing remote work. In some countries, authorities have introduced legislative measures to support tenants whose purchasing power has been negatively affected by the pandemic. In the US for example, states such as New York and California have temporarily banned commercial evictions with landlords being encouraged to revise payment plans with tenants. Some of the flexible payment plans revisions by property managers to retain clients include:

- Reducing rent for a set period with no repayment or reducing rent for a set period, then amortizing for the remainder of the term,

- Reducing rent for a set period then including additional months on to the end of the term,

- Reducing the rent to a percentage of sales for retail tenants.

We expect landlords to continue to adopt various strategies to attract and retain tenants, which will cushion the performance of the sector in the wake of reduced demand for commercial spaces.

- Hospitality Sector

During the week, the Kenyan Government implemented a 21-day ban on movement in and out of the Nairobi Metropolitan Area effective Monday 6thApril 2020, with an exception of cargo to curb the spread of the Coronavirus to the rest of the country. In line with this, local airline carriers, Jambojet and Safarilink announced that they would temporarily suspend their local flights.

The hospitality sector, which is largely reliant on the travel industry, continues to grapple with the effects of the Coronavirus as travel restrictions and social distancing rules continue to reduce the number of tourists, cancellation of meetings, conferences and events and suspension of operations by hotels. Following the National Government’s ban on all international flights from 25thMarch 2020, several key players in the hospitality sector suspended their operations including major hotels such as the Tribe Hotel, Serena Hotels, and Ole Sereni.

In our view, the reduced number of tourist arrivals in Kenya coupled with the restricted movement of local tourists within will lower the demand for hospitality services, which is expected to impact the performance of the sector, evidenced by the suspension of operations in several hospitality facilities. However, the magnitude of the impact will depend on the duration of the outbreak and counteracting measures taken by both the government and the private sector. We expect the sector to cushioned by the ongoing domestic flights and the ministry’s post corona recovery strategy fund of Kshs 500.0 mn

- Infrastructure Sector

During the week, the Kenya Roads Board (KRB) disbursed Kshs 539.0 mn for maintenance of roads in the coastal region for counties such as Mombasa, Kilifi, Lamu and Taita Taveta. The fund is part of the Kshs 4.4 bn conditional grant for the maintenance of roads in all the 47 counties in this 2019/2020 financial year. Conditional grants, which is money transferred from the national government to the county governments for a specified purpose, have become the major source of development funds in counties as disbursements from equitable share mainly go into recurrent expenditure and consumption of fixed capital. We continue to see increased efforts by the government to diversify its sources of funds to finance infrastructure projects such as floating of bonds, and acquiring grants from foreign institutions and governments.

We expect continued efforts by the government in improving infrastructure in a bid to open up the coastal region. Notable infrastructural upgrades include the construction of the Dongo Kundu Bypass, which is in its phase II, and will integrate the Port of Mombasa, Moi International Airport, Standard Gauge Railway Mombasa Terminus, and the Nairobi-Mombasa Highway. We expect this to stimulate the tourism sector’s performance at the Coastal region, as inadequate infrastructure particularly between North and South Coast has been a key challenge, and ultimately lead to growth in property prices rise in the region. Overall, we expect the nationwide infrastructural development to support the real estate sector’s growth by opening up new opportunities for investors. According to KNBS Economic Survey of 2019, the infrastructure sector’s contribution to GDP increased by 0.4% points to 8.5% in 2018 from 8.1% in 2017, indicating steady growth in the sector which was fueled by; (i) presence of funds to facilitate development, (ii) establishment of the government’s public-private partnerships unit, and (iii) enhanced government incentives towards the development of the sector.

We retain a neutral outlook for the real estate sector as we continue to witness the effects of the COVID-19 pandemic. However, we expect the sector to pick once the pandemic ceases owing to continued investment in infrastructure, constant housing deficit and the government’s recovery strategy.

Introduction:

The effects of the COVID-19 pandemic continues to increase with the number of cases rising and the number of deaths escalating. According to the World Health Organization (WHO), as of Friday, 10thApril 2020, the figures stood at 1,521,252 infections and 92,798 deaths. Closer home, Kenya’s numbers continue to grow with 184 confirmed cases and 7 deaths as at 10thApril 2020. Below is a summary of what we have written so far on the COVID-19 pandemic:

- Impact of Corona Virus on the Kenyan Economy: We analyzed the resultant effect on the Kenyan economy given the negative impact that the pandemic is having on international trade, the financial and commodity markets, and the global macroeconomic environment; and,

- The Potential Effects of COVID – 19 on Money Market Funds: Here we highlighted the current macro-economic environment in the country, where we analyzed the effects in the fixed-income market and how things stand, having reported the first infection on 13thMarch 2020.

In this note, we focus on the options available to the Kenyan Government when it comes to managing the adverse economic effects brought about by the pandemic. Under this, we shall cover:

- Kenya’s Economic Policy Response to the COVID-19 Pandemic,

- Policies That Have Been Implemented in Other Economies to Limit Possible Economic Fallouts Arising from the Pandemic,

- Additional Policy Options to be considered by the Kenyan Government, and,

- Conclusion

Section I: Kenya’s Economic Policy Response to the COVID-19 Pandemic

COVID-19 is first and foremost a public health problem, with the economic aspect being a secondary but important factor; consequently, the focus should be policies that will enhance public health even before implementing fiscal and monetary policy to inject the requisite liquidity and support into the markets. The priority should first be to ensure that it is safe for people to go out to work and to spend. However, in this note we are focused on the economic aspect.

The pandemic has so far had a negative financial impact and is expected to worsen as highlighted below:

- Economic Growth Impact: Global growth is expected to decline with organizations such as the United Nations Department of Social and Economic Affairs (UN-DESA) forecasting a contraction of 0.9% in the global economy. In Kenya, GDP growth for 2020 is expected to decline significantly with the Central Bank of Kenya having already revised down their projections from an earlier estimate of 6.4% to 3.4%. Other firms such as McKinsey have also revised down their growth projections to 1.9%, from their earlier estimate of 5.2%. Having factored in the effects of the locust invasion, as well as the ongoing pandemic, we have also revised our growth projections downwards to a range of 1.4% - 1.8% for 2020, from our 5.7% projection as at the start of the year;

- Currency Volatility: The Kenyan Shilling has been depreciating due to the uncertainty created by Coronavirus with the YTD depreciation against the US Dollar currently at 4.6% as at 9thApril 2020, in comparison to the 0.5% appreciation in 2019;

- Inflation: Inflation has remained within the Central Bank’s targets of between 2.5% and 7.5%, with the March inflation coming in at 6.1% driven by increases in food prices. There are expectations of inflationary pressure emanating from the effects of the Coronavirus, driven by supply-side shortages owing to lockdowns across the globe which have disrupted supply chains, further heightening cost-push inflation;

- Interest Rates: There has been a recorded increase in yields towards the long-end of the yield curve in Q1’2020, mainly attributable to pent up demand for the short-term securities as investors maintained the duration play owing to the current uncertainties in the financial markets. Kenyan Eurobond yields have also recorded a rise, a trend replicated in other Sub-Saharan African Eurobonds. On average Kenyan Eurobonds recorded 2.6% points rise in Q1’2020. This is as a result of increased premium being demanded by investors for holding any government securities given the current economic growth uncertainty, and,

- Financial markets: The local financial market has also taken a hit from the uncertainty and industry disruptions brought about by the virus, a trend replicated in global financial markets. The Nairobi All Share Index during the first quarter of the year recorded a 20.7% decline as investors exit the market. Consequently, the market is now trading at historical lows, at a price to earnings ratio (P/E) of 8.5x, 35.9% below the historical average of 13.2x.

The government of Kenya and the Central Bank have respectively announced fiscal and monetary measures to support the citizens and the Kenyan economy at large. Below we highlight some of the measures put in place so far to prevent the spread as well as cushion the economic disruptions arising from the pandemic:

|

Action |

|

|

Fiscal Policy

(Total amount of Fiscal action is currently estimated at Kshs 145 bn / 1.5% of GDP) |

|

|

|

|

|

|

|

|

Monetary Policy |

|

|

|

|

In our view, the moves by the government are positive and quite pro-active but there is more to be done. In addition, the said policies would create some other challenges in terms of increasing the already constrained fiscal deficit. According to the FY’2019/20 Budget Policy Statement, the country’s fiscal deficit was estimated at 6.3%. This means that the government does not have the fiscal space to afford a borrow-and-spend fiscal stimulus. We are also pessimistic about the government’s ability to meet its revenue targets, putting into consideration the fact that the government raised its total revenue target by 14.2% to Kshs 2.1 tn for FY’2019/20, which it cannot meet in the current market conditions, and will thus exert pressure on the domestic borrowing front to plug in the deficit.

The National Treasury is working to establish a fund, COVID-19 Emergency Response Fund, whose purpose will be: (i) to fund the purchase of essential supplies to public hospitals and related institutions, health professionals and frontline workers as need arises, (ii) to fund programs and initiatives towards cushioning and provision of emergency relief to the most vulnerable, older and poor persons in urban informal settings, (iii) to support and stimulate MSMEs rendered vulnerable by the pandemic, (iv) to enhance the capacity of the relevant institutions in handling COVID-19 surveillance, and (v) to fund any emerging issue arising from the pandemic.

In the next section, we look at policies that have been implemented by other countries to see what we can borrow.

Section II: Policies That Have Been Implemented in Other Economies to Limit Possible Economic Fallouts Arising from the Pandemic

Some of the key measures implemented include (we have included in bold font the changes since our last update in our Topical here, and underlined what we think could have an impact if borrowed and adapted for Kenya:

|

Country |

Economic Measures Taken by the Government |

|

UK |

|

|

USA |

|

|

Italy |

|

|

Germany |

|

Section III: Additional Policy Options to be considered by the Kenyan Government

The government has the largest role to play in helping navigate the economy through this pandemic. This can be done by putting in place supportive rules and regulations that shall help protect and turn around the economy. We see five main additional actions that the government can explore:

- An Enhanced Economic Stimulus Package,

- A Lifeline Fund For Individuals/ Workers Most Affected,

- Credit Facilities to Keep Businesses Going,

- External and Partners Finance, and,

- Debt Relief to Go into Economic Containment.

We then analyze below, in detail the five additional actions that the government can explore:

- An Enhanced Economic Stimulus

Looking back at the Economic Stimulus Package (ESP) initiated by the government after the 2007/2008 post-election violence, which was put in place to pull the country out of an economic slump where the country’s GDP growth of 6.9% in 2007 had declined to 1.5% in 2008. The ESP was set up to “create demand” in the affected sectors through government spending. The package was split into two phases where the allocated budget for Phase I was Kshs 22.0 bn and Kshs 27.0 bn for Phase II, amounting to Kshs 49.0 bn, equivalent to 1.3% of GDP. This was directed towards the construction of schools, horticultural markets, juakali sheds and public health centers throughout the country.

A similar move will go a long way in helping the economy recover from the effects of the COVID-19 pandemic. Having looked at what other countries have done, as we stated in the previous section, we have seen stimulus packages equal to an average of 7.5% of GDP as highlighted below:

|

Country |

GDP 2019 |

Stimulus Package |

% of GDP |

|

UK |

2,743.6 |

412.5 |

15.0% |

|

USA |

21,439.5 |

2,000.0 |

9.3% |

|

Italy |

1,988.6 |

27.5 |

1.4% |

|

Germany |

3,863.3 |

171.4 |

4.4% |

|

Kenya |

98.6 |

1.4 |

1.4% |

|

Average |

|

|

7.5% |

Source: IMF, amounts in US Dollars (Billions)

To this effect, the government can:

- Re-allocate funds from government ministries, departments and agencies such that they absorb the full impact of the revenue collection shortfalls by cutting back on non-essential recurrent budget expenditures in areas such as travel, training and entertainment,

- Reallocate funds from its FY’2019/2020 budget directed towards various development projects. For example, the Cabinet Secretary for the National Treasury had proposed, allocating Kshs 180.9 bn for on-going roads construction projects as well as the rehabilitation and maintenance of roads,

- Allocate funds towards the containment of the pandemic in the FY’2020/21 Budget. For example, in the 2020 Budget Policy Statement, Kshs 388.9 bn had been allocated to the Energy, Infrastructure and ICT sector. Part of these funds can be directed towards the proposed ESP, and,

- The government can also consider giving economic stimulus through the central bank where attractive loan facilities can be set up to help mitigate the effects brought about by the pandemic. This can be done in conjunction with commercial banks in the country who will then provide cheap credit to businesses and individuals.

We believe that the focus should be to curb the immediate need, which is to contain the COVID-19 pandemic by setting up an ESP geared towards revamping the economy. As such, we recommend that the package amount to Kshs 100.6 bn, equivalent to 1% of GDP, given that the country currently cannot afford a large stimulus package similar to what we have seen other countries do.

- A Lifeline Fund for Individuals/ Workers Most Affected:

Low-income households, consisting of families living below the poverty line, are among the most affected groups in the country mainly due to the imposed curfews and decline in business activities. According to the Kenya National Bureau of Statistics, low-income households represents 27.4% of the country’s population. This also includes laid-off workers and self-employed persons in the informal sector (e.g. barbers and hairdressers), who due to their hand-to-mouth lifestyle, will be left at a disadvantage. This relates most to families in Nairobi’s crowded and informal settlements where social distancing and working from home is not practical.

The table below shows the countries that have set aside funds to go towards affected individuals and workers and their amounts as a percentage of GDP:

|

Country |

GDP 2019 |

Amount set aside |

% of GDP |

|

USA |

21,439.5 |

500.0 |

2.3% |

|

Italy |

1,988.6 |

11.0 |

0.6% |

|

Average |

1.4% |

Source IMF, amounts in US Dollars (Billions)

Based on the table above, we believe that the country can set aside approximately Kshs 55.6 bn (equivalent to 0.6% of Kenya’s GDP) towards a “Lifeline Fund”. We have assumed the 0.6%, which a conservative approach having considered the government’s fiscal constraints.

One of the ways this has been done e.g. in the United states, is through the distribution of funds to affected households through direct payouts to their households, through checks based on the number of people in a house hold and the level of income. This might be impractical in the Kenyan context but we believe households can be cushioned through other ways such as: (i) zero-rating tax on essential supplies such as foodstuffs, for example: maize flour, cooking fat and rice, and, medical supplies such as masks, gloves, and sanitizers, and, (ii) reducing the taxes and levies charged on utilities such as electricity and water which are considered necessities, which would help citizens, especially those who might not benefit from the proposed income tax reliefs due to the nature of their wage earnings.

- Credit Facilities to Keep Businesses Going:

In the current state of affairs, the government’s mitigation strategies with regards to the ongoing pandemic have led to reduced incomes. The directive to work from home, closure of restaurants and clubs, and the curfew, which has resulted, to reduced working hours has forced some businesses to lay off workers or require them to take unpaid leave for an unspecified period. This has adversely affected businesses and the economy at large. To curb this, credit facilities and payroll support can be given to the affected sectors and businesses in an effort to reduce the closure of businesses and loss of jobs during this period. Considering what the United Kingdome and the United States have done, highlighted in section ii, the Kenyan government can:

- Set up an Asset Backed Loan Facility for businesses in the affected sectors such as the tourism sector which is the most affected, putting into consideration the ongoing restrictions,

- Set up a Credit Facility for Large employers to go towards payroll support with the aim of reducing the expected job loses,

- Waive business rates for small firms and give discounts to larger ones for a period of 3 months to help cushion the effects of the virus.

The US set aside USD 500.0 bn towards these initiatives, equivalent to 2.3% of the country’s GDP. The Kenyan government can set aside about Kshs 100.6 bn, which is equivalent to 1.0% of Kenya’s GDP, having considered the current state of affairs with regards to government finances. Keeping these businesses alive will ultimately aid in a faster recovery once the situation is under control. As another option, the government can:

- Give Fiscal incentives such as waivers on levies charged to businesses in the adversely affected industries such as the catering levy (hospitality industry). For instance, as highlighted in the letter to CS Ministry of Treasury and Planning by Law Society of Kenya, under the Tourism Act, persons engaged in the provision of tourism services are required to charge a tourism levy at a rate of 2.0% of the gross sales. Further, hotels and restaurants are also required to charge a catering levy at a rate of 2.0% of the gross sales. Furthermore, Section 106 of the Tourism Act allows the CS for National Treasury to grant certain fiscal incentives to promote the development of sustainable tourism, including waivers and rebates to persons engaged in the provision of tourism services, hotels, and restaurants, and,

- Providing time extensions of up to 90-days to businesses with regards to the submission of returns and tax payments can help alleviate cash-flow challenges being faced in the economy. This is because April is the first quarter for most taxpayers and the due date for the first instalment of corporate tax and balances of corporate tax liabilities for the previous financial year.

- External & Partners Finance

Given the fact that the country has been running a fiscal deficit of about 7.0% over the past six years, the country needs to work with development partners to be able to get the much-needed cash to cushion against the pandemic. So far, we have seen the World Bank give the Kenyan Government USD 60.0 mn (Kshs 6.1 bn) to help mobilize response capacity, strengthen multi-sector platforms and help in monitoring and evaluate the prevention and preparedness against the Coronavirus. Some of the other options available include:

- UNICEF: Partnering with International organizations such as UNICEF to get additional funding to support the affected groups such as orphans and street children,

- IMF: Negotiations are underway with the IMF for a USD 350.0 mn financial rescue package to be directed towards budgetary support.

- Private Sector: Partnering with companies in the private sector to come up with initiatives to support the affected groups such as Commercial Banks. This can be done by encouraging banks to provide more affordable loans to households.

- Debt Relief to Go into Economic Containment

Initiating a conversation on a possible debt moratoria or even forgiveness with its foreign debtors both on the bilateral and multilateral debt servicing as well as on the foreign commercial debt servicing. Given the current market conditions, with the volatility of the Kenyan shilling also in play, debt repayments would be more expensive and as such elevating the risk of a higher fiscal deficit. The debt relief will allow the government redirect funds to go towards the containment of the pandemic. To put this into context, if the government manages to push this year’s loan repayments to China’s Exim bank, which includes the SGR loan, they will free up approximately Kshs 71.4 bn, for the current fiscal period. In the 2020 Budget Policy Statement, Kshs 630.1bn had been allocated towards debt repayment in the FY’2020/21 budget (both principal and interest). By initiating some of these talks with our debtors, we believe come funds can be reallocated and be directed towards containing the pandemic.

Protection of incomes for both corporates and individuals is key. Given that the country is not like the developed markets such as the US where people can access social security if they are unemployed, the challenge then becomes how to ensure that livelihoods are not compromised.

Section IV: Conclusion

The country should try balance between providing the most required relief to businesses and individuals and ensuring that they do not impact tax collections much as that would mean a huge fiscal deficit and then it opens other challenges. So far, the government has announced tax relief through the reduction of tax rates for both individual and corporate incomes. In line with some recommendations from the Parliamentary Budget Office released during the week in their Special Bulleting COVID-19, the government can balance taxation measures with expenditure reduction to reduce pressure on our already constrained budget.

In addition to the ongoing public health initiatives, the government can also explore the following additional 5 options:

- Initiating an enhanced Economic Stimulus Package to help spur the economy and hasten its recovery following the effects of the novel coronavirus. This will be directed to the affected sectors such as tourism and horticulture,

- Social transfers to vulnerable persons, laid-off workers and self-employed persons in the informal sector for 3 months. This can be done through a “Lifeline Fund” where these payouts will cushion the affected households and ultimately help enforce the set curfews and movement restrictions in an effort to curb the spread of the novel coronavirus,

- Setting up a credit facility to lend to businesses that have kept their staff on payroll to help reduce job losses attributable to the current economic situation,

- Reaching out to external partners to help mobilize response capacity putting into consideration the country’s current fiscal position. International organizations such as the IMF & World Bank can provide financial aid to be directed towards containing the spread and adverse effects of COVID-19, and,

- Initiate conversations with our foreign debtors regarding the existing repayment arrangements of the country’s debt and propose a debt relief, having considered the current market conditions. Restructuring the existing bilateral, multilateral and foreign commercial debt will help ensure the livelihoods of the citizenry is not compromised.

Finally, looking back at a period where the country was faced with sort of similar challenge, case in point: the 2007/08 Post-election Violence, the government put together an ESP that seemed to work. It is however important to note that during that period, according to data from the National Treasury, the Government’s fiscal deficit stood at 1.4% of GDP as at Q1’2007, compared to the 7.7% fiscal deficit for the FY’2018/19 financial year. This means that the government had more fiscal room to fund a stimulus package, coupled with readily available funding in both the local and financial markets, which is not the case today. It is to this effect we believe, the Government has proposed amendments to the Income Tax Act (ITA) 2020, where they have raised tax on some items with the aim of trying to balance the taxation measures hoping to maintain government revenue during this period of uncertainty.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.