Cytonn Monthly - February 2021

By Research Team, Feb 28, 2021

Executive Summary

Fixed Income

During the month of February, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 103.4%, an increase from 67.3% recorded in the month of January. The highest subscription rate was in the 364-day paper, which came in at 146.4%, an increase from 115.9% recorded the previous month. The subscription for the 182-day and 91-day papers increased to 70.7% and 62.1%, from 33.1% and 45.5% respectively recorded in the month of January.

During the week, the T-bills subscription rate increased, with the overall subscription rate coming in at 132.0%, from 124.9% recorded the previous week. The highest subscription rate was in the 91-day paper at 157.0%, an increase from 116.9% recorded the previous week. The 364-day paper’s subscription rate increased to 151.6% from 139.0% recorded the previous week while the subscription for the 182-day paper declined to 102.3% from 114.0% recorded the previous week;

In the primary bond auction, the Central Bank of Kenya re-opened two bonds, FXD1/2013/15 and FXD1/2012/20, with effective tenors of 7.1 years and 11.8 years, with coupons of 11.3% and 12.0%, respectively. The issue recorded an overall subscription rate of 83.7%, with the government receiving bids worth Kshs 41.9 bn, lower than the Kshs 50.0 bn offered and accepted only Kshs 32.1 bn, translating to an acceptance rate of 76.7%. The weighted average rate of accepted bids was 11.9% and 12.7%, for the FXD1/2013/15 and FXD1/2012/20, respectively. Notably, given the undersubscription recorded, the Central Bank of Kenya re-opened the two bonds on tap sale during the month. The issues recorded low demand, with the overall subscription rate coming in at 62.4%, mainly attributable to the short bidding period and over-concentration of similar-tenure bonds in the market. The acceptance rate came in at 97.1%, with the weighted average rate of accepted bids being 11.8% and 12.6%, respectively;

In addition, the Kenya National Bureau of Statistics (KNBS) released inflation data, revealing the y/y inflation for February, 2021 increased to 5.8% from the 5.7% recorded in January;

Equities

During the month of February, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 6.3%, 1.8% and 5.5%, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as BAT and EABL which were up 20.5% and 10.9%, respectively, while Safaricom and KCB Group both recorded gains of 8.1%. The gains were however weighed down by losses recorded by some banking stocks such as Diamond Trust Bank (DTB-K) and Standard Chartered Bank which declined by 8.9%, and 2.7%, respectively. During the month, the Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended December 2020, highlighting that the banking sector’s loan book recorded a 7.1% y/y growth compared to 8.8% growth the prior year, with gross loans increasing to Kshs 3.0 tn in December 2020, from Kshs 2.8 tn recorded in December 2019. Additionally, Cooperative Bank of Kenya disclosed that it had secured a long-term financing facility of USD 75.0 mn (Kshs 8.2 bn) from the International Finance Corporation (IFC) for onward lending to the Micro and Small Medium Enterprises (MSMEs);

Real Estate

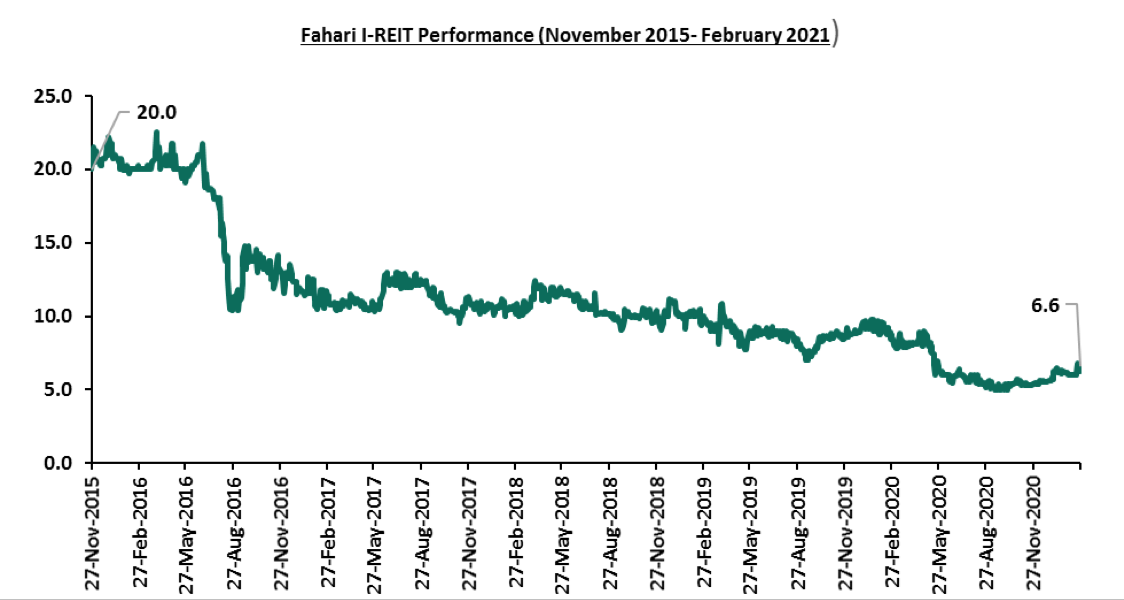

During the month, various industry reports were released namely, Hass Consult Q4’2020 House Price Index, Hass Consult Q4’2020 Land Price Index, Knight Frank Kenya Market Update H2’2020 Report, and, the Leading Economic Indicators December (LEI) 2020. In the residential sector, Infinity Development Limited, a design and building provider, announced plans to develop a 40-floor development dubbed West Riverside Tower to be located along Ring Road in Westlands. In the retail sector, French Retailer Carrefour opened a new outlet at Westgate Mall, Westlands, in an expansion drive that saw it take up approximately 15,000 SQFT of space previously occupied by Shoprite. The Fahari I-REIT closed the month trading at an average price of Kshs 6.6 per share, representing a 6.5% increase compared to the previous month’s closing price of Kshs 6.2 and bringing the YTD increase to 8.2%;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.77%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.61% p.a. To invest, email us at sales@cytonn.comand to withdraw the interest you just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tourand for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of February, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 103.4%, an increase from 67.3% recorded in the month of January. This is mainly attributable to the increased liquidity in the money markets as evidenced by the interbank rate declining to 4.5% from 5.2% over the period. Notably, the highest subscription rate was in the 364-day paper, which came in at 146.4%, an increase from 115.9% recorded the previous month. The increased appetite for the 364-day paper is mainly attributable to growing investor preference for medium-term papers (1-2 years) as they now believe the pandemic has been contained but are still worried about the possible effects of the current rising political temperatures preceding the elections in August 2022. The subscription for the 182-day and 91-day papers increased to 70.7% and 62.1%, respectively, from the 33.1% and 45.5% recorded in January. The yields on the 364-day, 182-day and 91-day papers rose by 39.1 bps, 14.4 bps and 3.4 bps to 9.0%, 7.7% and 6.9% respectively from 8.6%, 7.6% and 6.9%. The government continued to reject expensive bids with the acceptance rate declining by 6.3% points to 91.3% during the month, compared to 97.6% recorded the previous month, with the government accepting a total of Kshs 90.6 bn, out of the Kshs 99.3 bn worth of bids received.

During the week, the T-bills subscription rate increased, with the overall subscription rate coming in at 132.0%, from 124.9% recorded the previous week. The highest subscription rate was in the 91-day paper at 157.0%, an increase from 116.9% recorded the previous week. The 364-day paper’s subscription rate increased to 151.6% from 139.0% recorded the previous week, attributable to growing investor preference for medium-term papers, while the subscription for the 182-day paper declined to 102.3% from 114.0% recorded the previous week. The yields on 364-day, 182-day and 91-day papers rose by 8.3 bps, 3.8 bps and 2.0 bps respectively, to 9.0%, 7.7% and 6.9%. The government accepted 84.2% of the bids received, amounting to Kshs 26.7 bn, out of the Kshs 31.7 bn worth of bids received.

In the primary bond auction, the Central Bank of Kenya re-opened two bonds, FXD1/2013/15 and FXD1/2012/20, with effective tenors of 7.1 years and 11.8 years, and coupons of 11.3% and 12.0%, respectively. The issues recorded an overall subscription rate of 83.7%, mainly attributable to the short bidding period and tightened liquidity in the market during the week of the issue. The government received bids worth Kshs 41.9 bn, lower than the Kshs 50.0 bn offered and accepted only Kshs 32.1 bn, translating to an acceptance rate of 76.7%. The weighted average rate of accepted bids was 11.9% and 12.7%, for the FXD1/2013/15 and FXD1/2012/20, respectively.

During the month, the Central Bank of Kenya re-opened the two bonds on tap sale, FXD1/2013/15 and FXD1/2012/20, with effective tenors of 7.1 years and 11.8 years, and coupons of 11.3% and 12.0%, respectively, as the initial reopening had recorded an undersubscription. The bonds had an average rate of 11.8% for FXD1/2013/15 and 12.6% for FXD1/2012/20. The issues recorded low demand, with the overall subscription rate coming in at 62.4%, mainly attributable to the short bidding period and over-concentration of similar tenure bonds in the market. The government received bids worth Kshs 11.2 bn, lower than the Kshs 18.0 bn offered and accepted only Kshs 10.9 bn. The acceptance rate came in at 97.1%, with the weighted average rate of accepted bids being 11.8% and 12.6%, respectively.

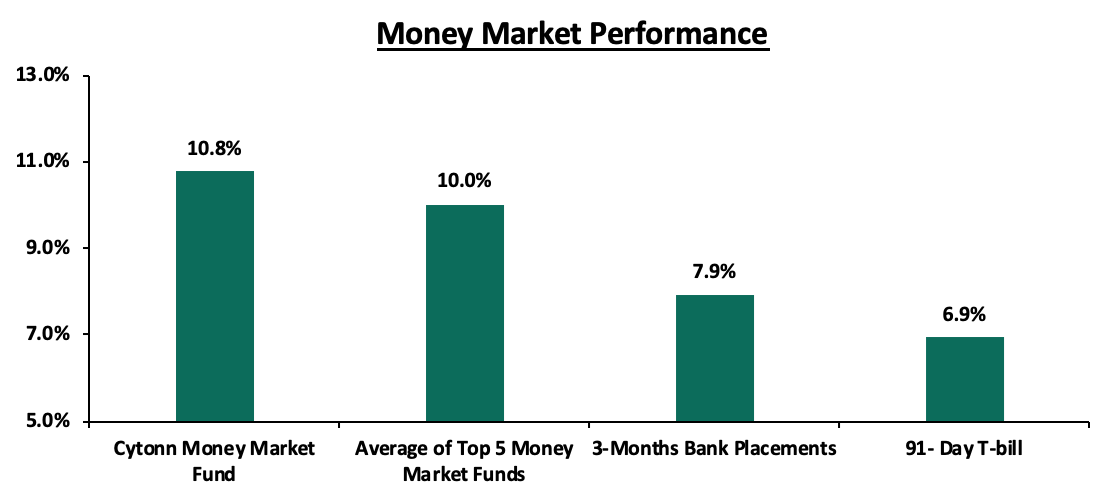

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 2.0 bps to 6.9%. The average yield of the Top 5 Money Market Funds remained unchanged at 10.0%. The yield on the Cytonn Money Market came in at 10.8%, unchanged from the previous week.

Secondary Bond Market:

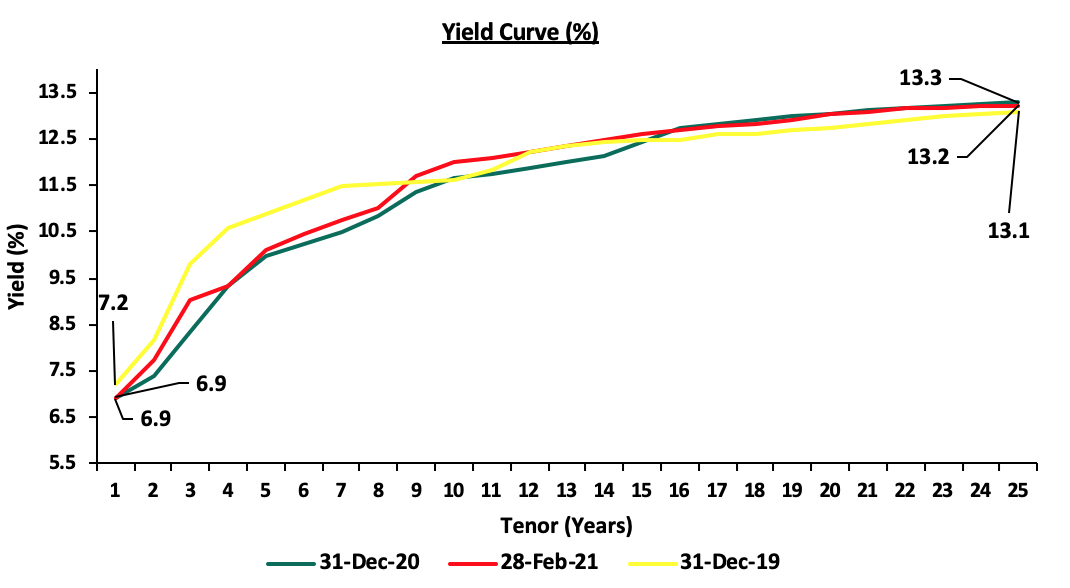

In the month of February, the yields on government securities in the secondary market remained relatively stable, while the bond turnover increased by 40.6% to Kshs 74.1 bn, from Kshs 52.7 bn recorded in January. The FTSE NSE bond index declined marginally by 0.4%, compared to the 0.0% recorded in January, to close the month at 97.6, from 98.0 recorded in January, bringing the YTD performance to a decline of 0.4%.

The chart below is the yield curve movement during the period;

Liquidity:

The liquidity in the money markets increased during the month of February mainly supported by government payments, with the average interbank rate declining to 4.5%, from 5.2% recorded in January. During the week, liquidity in the market tightened, with the average interbank rate increasing to 4.2% from the 3.9% recorded the previous week, as government payments were offset by tax remittances. The average interbank volumes increased by 32.1% to Kshs 15.3 bn, from Kshs 11.6 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, released on 26th February 2021, commercial banks’ excess reserves came in at Kshs 12.5 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the month, the yields on all Eurobonds recorded mixed performances. According to the Central Bank bulletin, the yield on the 10-year Eurobond issued in September 2014 declined by 0.3% points to 3.3% in February, from 3.6% in January. The yields on the 10 year and 30 year Eurobonds issued in 2018 remained unchanged to close at 5.3% and 7.2% respectively in February. The yields on the 2019 issued dual-tranche Eurobond with 7-years declined by 0.1% points to 4.7% in February, from 4.8% in January, while the 12-year Eurobond increased by 0.1% points to 6.2% in February, from 6.1% in January.

During the week, the yields on Eurobonds recorded mixed performance. The yields on the 10-year Eurobond issued in June 2014 declined by 0.1% points to 3.3% from 3.4%. The 10 year Eurobond issued in 2018 increased by 0.1% points to 5.3% from 5.2% recorded the previous week. On the other hand, the 30-year bond issued in 2018, the 7-year bond issued in 2019 and the 12-year bond issued in 2019 remained unchanged at 7.2%, 4.7%, and 6.2%, respectively.

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

29-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.8% |

6.1% |

|

19-Feb-2021 |

3.4% |

5.2% |

7.2% |

4.7% |

6.2% |

|

22-Feb-2021 |

3.5% |

5.4% |

7.2% |

4.8% |

6.3% |

|

23-Feb-2021 |

3.4% |

5.3% |

7.3% |

4.7% |

6.3% |

|

24-Feb-2021 |

3.4% |

5.3% |

7.2% |

4.6% |

6.2% |

|

25-Feb-2021 |

3.3% |

5.3% |

7.2% |

4.7% |

6.2% |

|

Weekly Change |

(0.1%) |

0.1% |

0.0% |

0.0% |

0.0% |

|

Monthly Change |

(0.3%) |

0.0% |

0.0% |

(0.1%) |

0.1% |

|

YTD Change |

(0.6%) |

0.1% |

0.2% |

(0.2%) |

0.3% |

Source: CBK Bulletin

Kenya Shilling:

During the month, the Kenya Shilling appreciated marginally by 0.3% against the US Dollar to close the month at Kshs 109.8, from Kshs 110.1 recorded at the end of January 2021 mostly attributable to the decreased dollar demand from general importers due to the two-week long Lunar holiday in the Asian markets who are among the key trading partners. During the week, the Kenyan shilling depreciated marginally against the US dollar by 0.2% to Kshs 109.8 from Kshs 109.6 recorded the previous week. On an YTD basis, the shilling has depreciated by 0.6% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect continued pressure on the Kenyan shilling due to:

- Demand from merchandise traders as they beef up their hard currency positions as businesses reopen following the festive season,

- A slowdown in foreign dollar currency inflows due to reduced dollar inflows from sectors such as tourism and horticulture, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.6 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 19.7% y/y increase to USD 299.6 mn in December 2020, from USD 250.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation.

Weekly Highlight:

Inflation

The y/y inflation for the month of February increased to 5.8%, from the 5.7% recorded in January. The increase was due to:

- A 1.0% increase in the Food and Non-Alcoholic Drinks’ Index, mainly contributed by increases in prices of cabbages, spinach and cooking oil (salad) of 4.4%, 4.4% and 3.9% respectively, among other food items,

- A 0.4% increase in Housing, Water, Electricity, Gas and Other Fuels’ Index, mainly attributed to a 6.0% increase in the price of kerosene, and,

- A 2.3% increase in the Transport Index, mainly driven by a 5.7% and 7.6% increase in the prices of diesel and petrol, respectively.

|

Major Inflation Changes – February 2021 |

|||

|

Broad Commodity Group |

Price change m/m (February-21/January -21) |

Price change y/y (February-21/February-20) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.0% |

6.9% |

The m/m increase was mainly contributed by increases in prices of cabbages, spinach and cooking oil (salad) among other food items |

|

Housing, Water, Electricity, Gas and other Fuel |

0.4% |

3.4% |

The m/m increase was as a result of increase in the cost of kerosene

|

|

Transport Cost |

2.3% |

16.7% |

The m/m increase was mainly on account of an increase in pump prices of diesel and petrol |

|

Overall Inflation |

0.7% |

5.8% |

The m/m increase was due to a 1.0% increase in the food and non-alcoholic drinks’ index, mainly driven by the increase in prices of food items |

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5% despite the recent increases in the fuel prices. Food prices are likely to remain low due to favourable rainfall received.

Monthly Highlights

- Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for January 2021, which came in at 53.2, an increase from the 51.4 recorded in December 2020. The reading was the highest in three months and a seventh consecutive month of growth since the COVID-19 outbreak, pointing to a solid improvement in the private sector. The reopening of businesses and improved cash flow in the economy aided in driving higher customer spending, resulting in the quickest growth in output and new orders since October 2020. For more information, see our Cytonn Weekly #05/2021,

- The Kenya Revenue Authority (KRA) began the financial year 2021 on a high note, registering a 102.6% performance in revenue collections having collected Kshs 142.0 bn against a target of Kshs 138.0 bn. The collection was a 6.7% increase from last year’s collection during a similar period. The positive performance is mainly attributable to the economic resurgence following a 1.1% contraction in the third quarter of 2020, against a 5.5% contraction in the second quarter and partly due to the relaxation of the stiff COVID-19 control measures. For more information, see our, Cytonn Weekly #06/2021,

- The National Treasury released the Supplementary Budget Estimates I for the 2020/21 fiscal year on the back of a challenging first half of the fiscal year 2020/21, with the challenges including the adverse effects of the COVID-19 pandemic on the economy. The proposed budget was tabled to the National Assembly for debate and approval at a later date. The Treasury proposes an increase in the gross total supplementary budget by Kshs 120.8 bn to Kshs 3,036.5 bn from Kshs 2,915.7 bn previously. The proposed budget increment is attributable to COVID-19 related expenditure and efforts by the government to spur economic activity. For more information, see our Cytonn Weekly #06/2021, and,

- The Kenyan authorities and the International Monetary Fund (IMF) mission team reached an agreement on economic and structural policies that would reinforce a 38-month program under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF). Notably, the credit facility is approximately USD 2.4 bn (Kshs 262.9 bn) and is meant help Kenya respond to the unprecedented shock of the COVID-19 pandemic as well as reduce Kenya’s debt levels. The agreement is subject to approval from the IMF’s Management and Executive Board consideration, which is expected to happen in the coming weeks. For more information, see our Cytonn Weekly #07/2021.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 10.0% ahead of its prorated borrowing target of Kshs 363.4 bn having borrowed Kshs 327.2 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors shoul

Market Performance:

During the month of February, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 6.3%, 1.8% and 5.5%, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as BAT and EABL which gained by 20.5% and 10.9%, respectively, while Safaricom and KCB Group both recorded gains of 8.1%. The gains were however weighed down by losses recorded by some banking stocks such as Diamond Trust Bank (DTB-K) and Standard Chartered Bank which declined by 8.9%, and 2.7%, respectively.

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 1.4%, while NASI and NSE 25 shed by 0.1% and 0.4%, respectively, taking their YTD performance to gains of 8.8%, 6.3% and 2.3% for NASI, NSE 25 and NSE 20, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Cooperative Bank, and NCBA Group of 4.7%, 2.0% and 1.9%, respectively. The gains were however weighed down by losses recorded by stocks such as EABL, Diamond Trust Bank (DTB-K), KCB Group, and Equity Group which declined by 2.9%, 2.1%, 1.9%, and 1.4%, respectively.

Equities turnover increased by 21.9% during the month to USD 98.1 mn, from USD 80.5 mn recorded in January 2021. Foreign investors turned net sellers during the month, with a net selling position of USD 5.6 mn, down from January’s net buying position of USD 5.6 mn.

Equities turnover increased by 31.1% during the week to USD 29.0 mn, from USD 22.1 mn recorded the previous week, taking the YTD turnover to USD 178.6 mn. Foreign investors turned net buyers, with a net buying position of USD 0.1 mn, from a net selling position of USD 2.5 mn recorded the previous week, taking the YTD net selling position to USD 0.01 mn.

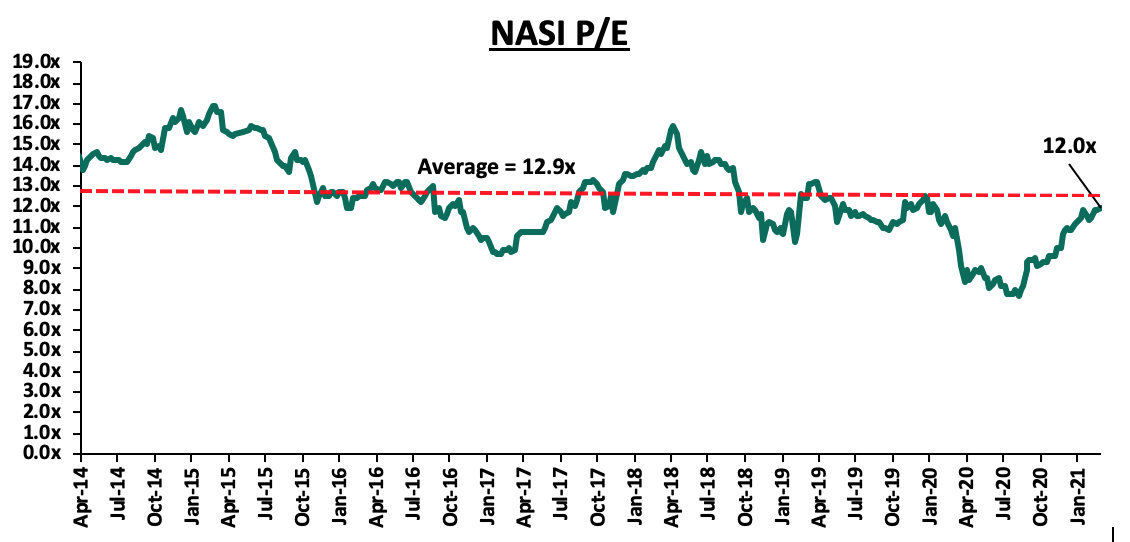

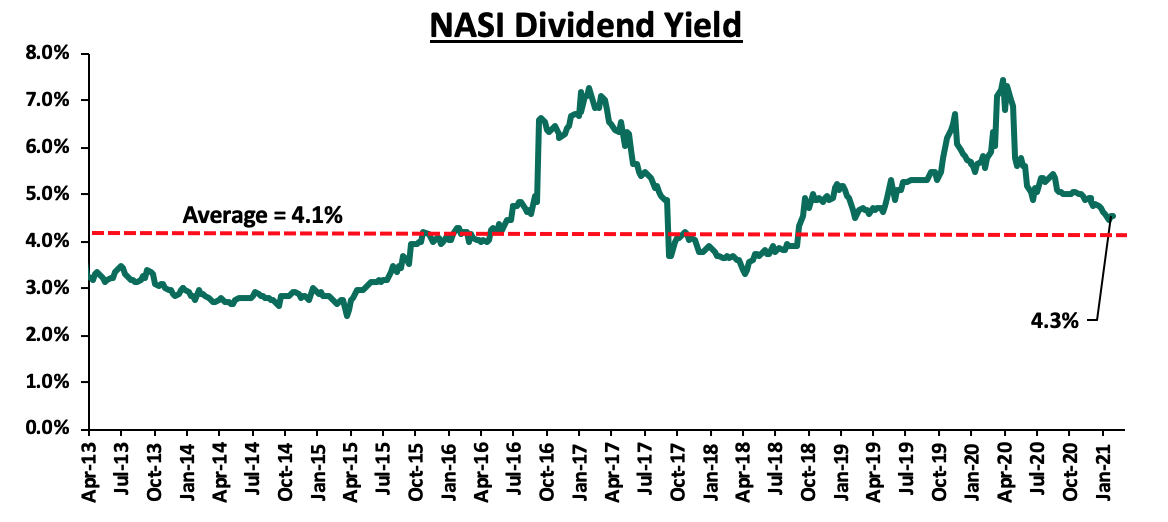

The market is currently trading at a price to earnings ratio (P/E) of 12.0x, 7.3% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.3%, unchanged from what was recorded the previous week, and 0.2% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe that there are pockets of value in the market for investors with higher risk tolerance. The current P/E valuation of 12.0x, the highest it has been since January 2020, is 55.5% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Monthly Highlight:

- The Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended December 2020. The quarterly Credit Officer Survey is undertaken by the CBK to identify the potential drivers of credit risk in the banking sector. According to the report, the banking sector’s loan book recorded a 7.1% y/y growth compared to 8.8% the prior year, with gross loans increasing to Kshs 3.0 tn in December 2020, from Kshs 2.8 tn recorded in December 2019 while the aggregate balance sheet recorded a 12.5% increase y/y to Kshs 5.4 tn in FY’2020, from Kshs 4.8 tn in FY’2019. For more information, please see Cytonn Weekly#05/2021

Weekly Highlight:

During the week, Co-operative Bank Kenya disclosed that it had secured USD 15.0 mn (Kshs 1.6 bn) long-term loan from SwedFund for onward lending to Micro and Small Medium Enterprises (MSMEs). This comes weeks after the lender secured a 7-year long-term financing facility of USD 75.0 mn (Kshs 8.2 bn) from the International Finance Corporation (IFC), for a similar purpose. The lender disclosed that the facility will support MSME’s which have been adversely affected by the pandemic. Following the disbursement of the intended loans to the MSMEs, the lender’s loan book exposure to SMEs which stood at Kshs 17.6 bn (5.9% of the loan book as of Q3’2020) is set to increase. The move by Co-operative Bank to support the struggling MSMEs during this period is commendable as the loan facility will not only lead to the recovery of the MSME’s but also lead to the lender’s diversification of the assets through increased long-term funding that will support their deposit funding. Recently, in a similar move, Diamond Trust Bank also disclosed that it would advance Kshs 1.6 bn worth of loans to support the recovery of MSMEs, following the tough operating environment brought about by the pandemic. The table highlights some of the disclosed loan facilities that banks have secured to lend to the MSMEs in the last year:

|

No. |

Bank |

Amount of Loan intended for MSMEs recovery (Kshs bn)* |

|

1 |

Equity Group |

113.4 |

|

2 |

KCB Group |

16.3 |

|

3 |

DTB Kenya |

7.0 |

|

4 |

ABSA Bank Kenya |

0.01 |

|

Total |

136.7 |

|

*Total amount of loans disclosed so far

Cumulatively, approximately Kshs 136.7 bn has been availed to Kenyan Banks to support the recovery of SMEs in Kenya. Key to note, the above banks are among the lenders selected by the National treasury to provide financing to MSMEs through the Credit Guarantee Scheme. We believe that the financing facilities the lender's avail to businesses will aid in the reduction of the non-performing loans in the Banking Sector, consequently leading to the gradual improvement of the Banking sector’s Asset Quality. However, given the elevated credit risk, we look forward to seeing whether these efforts by the lenders will be transmitted to the intended parties given that despite the Central Bank of Kenya’s efforts, private sector credit growth has been muted.

Universe of Coverage:

|

Company |

Price at 19/2/2021 |

Price at 26/2/2021 |

w/w change |

m/m change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

70.8 |

69.3 |

(2.1%) |

(8.9%) |

(9.8%) |

76.8 |

105.1 |

3.9% |

55.7% |

0.3x |

Buy |

|

Sanlam |

10.1 |

9.6 |

(5.1%) |

(26.3%) |

(26.3%) |

13.0 |

14.0 |

0.0% |

46.1% |

0.8x |

Buy |

|

I&M Holdings*** |

44.8 |

45.0 |

0.3% |

(4.4%) |

0.2% |

44.9 |

60.1 |

5.7% |

39.4% |

0.7x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.5 |

0.4% |

0.8% |

7.8% |

2.3 |

3.3 |

4.4% |

36.9% |

0.3x |

Buy |

|

KCB Group*** |

39.5 |

38.8 |

(1.9%) |

8.1% |

0.9% |

38.4 |

46.0 |

9.0% |

27.7% |

1.0x |

Buy |

|

Standard Chartered*** |

135.0 |

134.8 |

(0.2%) |

(2.7%) |

(6.7%) |

144.5 |

153.2 |

9.3% |

23.0% |

1.1x |

Buy |

|

Liberty Holdings |

7.5 |

8.0 |

7.8% |

7.2% |

4.4% |

7.7 |

9.8 |

0.0% |

21.9% |

0.6x |

Buy |

|

Britam |

7.0 |

7.3 |

4.0% |

(2.4%) |

4.0% |

7.0 |

8.6 |

3.4% |

21.6% |

0.8x |

Buy |

|

Jubilee Holdings |

265.3 |

266.0 |

0.3% |

(5.0%) |

(3.5%) |

275.8 |

313.8 |

3.4% |

21.3% |

0.6x |

Buy |

|

ABSA Bank*** |

9.6 |

9.7 |

1.0% |

4.3% |

2.1% |

9.5 |

10.5 |

11.3% |

19.3% |

1.2x |

Accumulate |

|

Co-op Bank*** |

12.8 |

13.1 |

2.0% |

3.6% |

4.0% |

12.6 |

14.5 |

7.7% |

18.8% |

1.0x |

Accumulate |

|

Equity Group*** |

38.5 |

37.9 |

(1.4%) |

3.8% |

4.6% |

36.3 |

43.0 |

5.3% |

18.7% |

1.1x |

Accumulate |

|

Stanbic Holdings |

84.0 |

83.0 |

(1.2%) |

3.8% |

(2.4%) |

85.0 |

84.9 |

8.5% |

10.8% |

0.8x |

Accumulate |

|

NCBA*** |

24.1 |

24.5 |

1.9% |

(1.0%) |

(7.9%) |

26.6 |

25.4 |

1.0% |

4.7% |

0.6x |

Lighten |

|

CIC Group |

2.1 |

2.3 |

8.5% |

11.1% |

9.0% |

2.1 |

2.1 |

0.0% |

(8.7%) |

0.8x |

Sell |

|

HF Group |

3.5 |

3.5 |

(0.6%) |

(9.6%) |

11.1% |

3.1 |

3.0 |

0.0% |

(14.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

|||||||||||

We are “Neutral” in the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities market in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

- Industry Reports

During the month, various industry reports were released and the key take-outs were as follows:

|

# |

Theme |

Report |

Key Take-out |

|

1 |

Residential |

|

|

|

2 |

Land |

|

|

|

3 |

General Real Estate |

|

|

|

Performance of the real estate sector is expected to pick in the long run following development activities gaining momentum, land performance remaining resilient as a good investment despite sluggish growth of land prices and improvement in the tourism industry boosting hospitality sector performance.

- Residential Sector

During the week, Infinity Development Limited, a design and building provider, announced plans to develop a 40-floor development dubbed West Riverside Tower to be located along Ring Road, Westlands. The lifestyle development will sit on a 0.5-acre piece of land and will comprise prime residential accommodation. The decision to put up the development in Westlands is supported by; i) Westlands’ positioning as a commercial hub, thus attracting a high number of clients, ii) improved infrastructure opening up areas for development with the construction of the Nairobi Expressway expected to cause an increase in property prices, iii) relaxation of zoning regulations enabling the construction of skyscrapers, and, iv) above-average returns of lifestyle apartments. Furthermore, the trend towards lifestyle developments continues to take shape supported by; i) the growing middle class with increased disposable income, ii) demographic growth presenting an ideal market for lifestyle communities, and, iii) benefits of the economies of scale as developers can offer amenities and services at a relatively lower unit cost.

According to the Cytonn Annual Markets Review- 2020, apartments performance in Westlands recorded total returns of 5.5%, 0.3% point higher compared to the upper mid-end market average of 5.2% with a price appreciation of 0.2% despite the tough economic environment, and a rental yield of 5.3%, 0.1% higher than the market average of 5.2% indicating sustained demand for rental units. This is an indication that the move by Infinity Developers is a step in the right direction towards achieving above-average returns through investing in lifestyle apartments,

The table below shows the performance of the residential apartments in the upper-mid end segment in 2020;

(All Values in Kshs unless stated otherwise)

|

Apartments Performance FY’2020 |

||||||||

|

Area |

Average Price Per SQM FY'2020 |

Average Rent per SQM FY'2020 |

Average Occupancy FY'2020 |

Average Uptake FY'2020 |

Average Annual Uptake FY'2020 |

Average Rental Yield FY'2020 |

Average Y/Y Price Appreciation FY'2020 |

Total Returns FY'2020 |

|

Upper Mid-End |

||||||||

|

Kilimani |

108,696 |

818 |

89.0% |

90.4% |

34.0% |

6.0% |

0.2% |

6.2% |

|

Kileleshwa |

124,057 |

637 |

84.3% |

83.4% |

20.4% |

5.2% |

0.6% |

5.8% |

|

Westlands |

145,479 |

783 |

78.5% |

83.0% |

26.4% |

5.3% |

0.2% |

5.5% |

|

Parklands |

115,793 |

677 |

83.4% |

84.1% |

16.7% |

5.5% |

(0.4%) |

5.1% |

|

Loresho |

117,016 |

560 |

89.7% |

89.0% |

11.4% |

5.2% |

(0.4%) |

4.8% |

|

Upperhill |

130,608 |

710 |

77.0% |

78.3% |

13.0% |

4.2% |

(0.1%) |

4.0% |

|

Average |

123,608 |

697 |

83.7% |

84.7% |

20.3% |

5.2% |

0.0% |

5.2% |

Cytonn Research 2020

Notable highlights during the month are;

- Shelter Afrique, a Pan-African housing lender and real estate developer, partnered with NCBA Bank to provide mortgage financing to 200 home buyers in Nairobi, Mombasa, Kisumu, Kiambu and Machakos counties, in targeted projects such as Tatu City in Kiambu, Eden Beach in Mombasa, and, Edenvale in Nairobi. For more information, see Cytonn Weekly #05/2021, and,

- Unity Homes, a Kenyan residential property developer, announced plans to develop a Kshs 4.0 bn, 576-unit apartment complex dubbed Universal One, in the Lekki Free Zone in Lagos City, Nigeria in an international expansion drive. For more information, see Cytonn Weekly #07/2021.

We expect performance of the residential sector to improve following increased development activities and provision of relatively affordable mortgage facilities to facilitate increase in homeownership.

- Retail Sector

During the week, French Retailer Carrefour opened a new outlet in Westgate Mall in Westlands, taking up approximately 15,000 SQFT of space previously occupied by Shoprite. This brings the retailers number of operational outlets to 12 having recently opened an outlet at Centre Point Mall in Diani and in Mombasa County at City Mall in Nyali.

In terms of the sub-markets analysis, Westlands was the best performing nodes recording average rental yields of 9.9%, compared to the overall market average of 7.5%. The performance is attributed to the presence of affluent residents who have a high consumer purchasing power with the areas hosting high-end income earners, the ease of access to the area served with good road connectivity, and, relatively high occupancy and rental rates of 81.5% and Kshs 209, respectively, against the market average of 75.2% and Kshs 169.

The table below shows Nairobi Metropolitan Area retail performance in FY’2020;

(All Values in Kshs Unless Stated Otherwise)

|

Nairobi Metropolitan Area Retail Market Performance FY’2020 |

|||

|

Area |

Rent Kshs /SQFT FY’2020 |

Occupancy% FY’2020 |

Rental Yield FY’2020 |

|

Westlands |

209 |

81.5% |

9.9% |

|

Karen |

217 |

81.0% |

9.8% |

|

Kilimani |

171 |

82.5% |

8.5% |

|

Ngong Road |

178 |

80.3% |

8.2% |

|

Kiambu road |

176 |

67.5% |

6.9% |

|

Thika Road |

158 |

70.5% |

6.3% |

|

Eastlands |

137 |

70.2% |

6.1% |

|

Mombasa road |

140 |

70.0% |

5.9% |

|

Satellite towns |

133 |

73.0% |

5.8% |

|

Average |

169 |

75.2% |

7.5% |

Source: Cytonn research 2020

The table below shows the number of stores of key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||

|

Name of Retailer |

Highest No. of Branches that ever Existed |

Number of Branches Opened in 2021 |

Closed Branches |

Current Number of Branches |

Branches Expected to be Opened/ Closed |

Projected Total Number of Branches 2021 |

|

Naivas Supermarket |

69 |

1 |

0 |

70 |

0 |

70 |

|

Tuskys |

64 |

0 |

59 |

5 |

0 |

5 |

|

QuickMart |

37 |

1 |

0 |

38 |

0 |

38 |

|

Chandarana Foodplus |

20 |

0 |

0 |

20 |

0 |

20 |

|

Carrefour |

9 |

3 |

0 |

12 |

0 |

12 |

|

Uchumi |

37 |

0 |

33 |

4 |

0 |

4 |

|

Game Stores |

3 |

0 |

0 |

3 |

0 |

3 |

|

Choppies |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

4 |

0 |

2 |

2 |

0 |

2 |

|

Nakumatt |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

323 |

5 |

172 |

156 |

0 |

156 |

Source: Online Research

Also during the month;

- French Retailer Carrefour opened two new outlets, at Nextgen Mall along Mombasa Road taking up approximately 18,000 SQFT of space previously occupied by Souk Bazar supermarket, and the other at Centre Point Mall in Diani, Kwale County taking up approximately 10,000 SQFT of space occupied by former retail giant Nakumatt. For more analysis, see Cytonn Weekly #05/2021, and, Cytonn Weekly #07/2021

We expect performance of retail sector in the Nairobi Metropolitan Area to continue being affected by the oversupply of approximately 2.0 mn SQFT, however, expansion by local and international retailers taking up space left by troubled retailers such as Nakumatt and Shoprite will boost performance of the sector.

- Infrastructure

A notable highlight during the month in the infrastructure sector;

- The Kenya Urban Roads Authority (KURA) announced the construction of a Kshs 907.2 mn 8-Kilometre road in Nairobi’s Umoja-Innercore aimed at improving access into the area. The project is expected to include a 7-meter wide two-lane carriageway, a footpath, bus bays, drainage facilities, road markings and street lighting. For more information, see Cytonn Weekly #06/2021.

- Listed Real Estate

During the month, the Fahari I-REIT closed the month trading at an average price of Kshs 6.6 per share, representing a 6.5% increase compared to the previous month’s closing price of Kshs 6.2 and bringing the YTD increase to 8.2% having opened the year at an average share price of Kshs 5.8;

The graph below shows performance of the Fahari I-REIT since inception;

A notable highlight during the month in the REIT market;

Student hostels developer, Acorn Holding’s listed their development REIT (D-REIT) and income REIT (I-REIT) at the Nairobi Stock Exchange at a cost of Kshs 7.5 bn, making it the first product to be traded on the Unquoted Securities Platform (USP) which was launched in December 2020. Acorn aims to tap into Kenya’s capital market to unlock growth opportunities as it seeks to grow its capacity in student hostels. Some of the key challenges that are still facing the REIT market include; i) insufficient institutional grade real estate assets, iii) lack of investor appetite in the instrument, and iv) negative investor sentiments.

We expect that quoting the REITs on the USP will allow the asset class to access a wider pool of investors, enhance the liquidity of their shares as well as support capital raising needs in the future, and therefore opening an investment path where local and foreign investors can inject funds.

The real estate sector is expected to continue recording activities supported by the gradual recovery of the tourism industry thus boosting performance of the hospitality sector, increased activities in the residential sector especially for lifestyle apartments, the expansion by international retailers and the continued launch of infrastructure projects by the government.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.