Cytonn Monthly - July 2020

By Research Team, Aug 2, 2020

Executive Summary

Fixed Income

During the month, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 243.1%, compared to 233.4% recorded in the month of June. The oversubscription is partly attributable to increased liquidity in the money market coupled with banks’ preference for government securities as opposed to lending to the private sector. The subscription rates for the 91-day paper rose to 574.7%, from 324.0% recorded in June. The y/y inflation for the month of July declined to 4.4%, from the 4.7% recorded in June 2020, mainly due to 0.8% decline in food prices despite a 4.0% increase in the transport cost. The Monetary Policy Committee (MPC) met on 29th July 2020 and retained the Central Bank Rate (CBR) at 7.0%, in-line with our expectations in the MPC July 2020 Note;

Equities

During the month of July, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 3.2%, 7.1% and 4.9%, respectively. Similarly, during the week, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 recording declines of 1.0%, 4.4% and 2.0%, respectively, taking their YTD performance to losses of 19.9%, 32.0%, and 25.4%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by declines recorded by large-cap stocks, with the highest declines being recorded in EABL, Co-operative bank and NCBA, which lost by 7.7%, 5.8% and 5.3%, respectively. During the week, the Monetary Policy Committee (MPC) disclosed that as at June 2020, Kshs 844.4 bn (29.1% of the total banking sector loan book) had been restructured by Kenyan banks in line with the emergency measures announced by the Central Bank to cushion the economy from the impact of COVID-19;

Real Estate

During the month, Knight Frank released the Kenya Markets Update H1’2020, according to which prices and rents in prime markets for all real estate sectors continued to decline in H1’2020. In the residential sector, Cytonn Investments, an investments management firm and real estate developer, announced that construction activities had resumed in phase II of their 600-unit comprehensive residential development in Ruaka, Kiambu County. In the retail sector, Naivas Supermarket, a local retailer, opened its 64th store along Mombasa Road opposite the Syokimau Railway station dubbed Naivas Airport view. In the hospitality sector, global hotel groups, Accor Hotels and Radisson Hotel Group announced that they would continue with their expansion plans in Kenya and the African region as a whole despite the slump in the sector due to the COVID-19 pandemic. In the industrial sector, Cold Solutions Kenya Limited, a leading temperature-controlled warehouse and logistics service provider, announced plans to invest Kshs 7.5 bn in constructing a grade ‘A’ temperature-controlled cold storage warehouses in Tatu City Development special economic zone. And in listed real estate, ILAM Fahari I-REIT (formerly Stanlib Fahari) released their H1’2020 earnings registering a 12.6% growth in earnings per unit to Kshs 0.48 in H1’2020 from Kshs 0.42 in H1’2019.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.69%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.01% p.a. To invest, email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on properties@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- Cytonn continues to inform the market on the importance of retirement planning and issues affecting the pensions industry. In this week's article, we focus on how occupational pension schemes work. Read the article here

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of July, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 243.1%, compared to 233.4% recorded in the month of June. The oversubscription is partly attributable to increased liquidity in the money market with the average interbank rate coming in at 2.2% for the month of July coupled with banks’ preference for government securities as opposed to lending with their holdings in government securities rising to 54.9% from 54.3% at the beginning of the year. The subscription rates for the 91-day paper rose to 574.7%, from 324.0% recorded in June. The subscription rates for the 182-day and 364-day papers, on the other hand, declined, coming in at 137.5% and 216.0%, lower than the 187.2% and 243.3% recorded in June, respectively. We note that the 91-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of 574.7% as investors preferred holding the shorter-dated paper due to the uncertainty in the market, coupled with the significant declines in yield for the 182-day and 364-day papers which has declined by 1.7% points and 2.4% points, respectively. The Central Bank remained disciplined in rejecting expensive bids in order to ensure the stability of interest rates as evidenced by the decline in yields on the 91-day, 182-day and 364-day paper to 6.2%, 6.6% and 7.5%, respectively, from 7.1%, 7.8% and 8.8% recorded in June. The T-bills acceptance rate came in at 66.9% during the month, compared to 30.9% recorded in June, with the government accepting a total of Kshs 195.0 bn of the Kshs 291.7 bn worth of bids received.

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 118.7%, down from 149.6% the previous week. The subscription rate for the 91-day and 182-day papers increased to 396.5% and 24.7%, respectively, from 270.4% and 13.9% recorded the previous week, respectively. The subscription rate for the 364-day paper, however, fell to 101.5%, from 236.9% recorded the previous week. The yields on the 91-day and 364-day papers remained unchanged at 6.1% and 7.4%, respectively, similar to what was recorded the previous week, while that of the 182-day paper increased marginally to close at 6.5%, from the 6.4% recorded the previous week. The acceptance rate declined to 82.8%, from 99.8% recorded the previous week, with the government accepting Kshs 23.6 bn of the Kshs 28.5 bn bids received.

For the month of July, the Kenyan government reopened 3 fixed coupon Treasury bonds, FXD1/2020/05, FXD2/2018/10 and FXD1/2019/15 with effective tenors of 5 years, 8 years and 14 years respectively, for budgetary support purposes. The issue was oversubscribed with the average subscription rate coming in at 303.0%, as the government received bids worth Kshs 181.8 bn, higher than the Kshs 60.0 bn offered, mainly attributable to the high liquidity in the money markets. Yields on the bonds came in at 10.6%, 11.7% and 12.4%, respectively, for the five, ten and fifteen-year papers, which was in-line with our expectations. The government rejected expensive bids only accepting Kshs 80.9 bn out of the Kshs 181.8 bn worth of bids received, translating to an acceptance rate of 44.5%.

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), while the yield on the 91-day T-bill remained unchanged at 6.1%, similar to what was recorded the previous week. The average yield of Top 5 Money Market Funds increased to 10.2% from 9.9% recorded the previous week. The yield on the Cytonn Money Market remained unchanged at 10.7%, similar to what was recorded the previous week.

Secondary Bond Market:

The yields on government securities in the secondary market remained relatively stable during the month of July. The Central Bank of Kenya was keen to ensure that rates remained low and therefore continued to reject expensive bids given the investors' increased appetite for government papers, evidenced by the higher subscription rates in both T-bills and T-bonds. Consequently, this led to a decline in the yields on the yield curve, which saw the FTSE NSE bond index gain by 1.1% during the month of July bringing the YTD gain to 0.1%. The chart below is the yield curve movement during the period.

Liquidity:

Liquidity in the money markets eased in July with the average interbank rate declining to 2.3%, from 2.8% recorded in June. Liquidity was supported by government payments and maturing TADS of Kshs 162.2 mn. (TADs are used when the securities held by the CBK for Repo purposes are exhausted or when CBK considers it desirable to offer longer tenor options). During the week, the average interbank rate increased marginally to 2.3% from 2.2% recorded the previous week. The average interbank volumes rose by 316.8% to Kshs 23.2 bn, from Kshs 5.6 bn recorded the previous week.

Kenya Eurobonds:

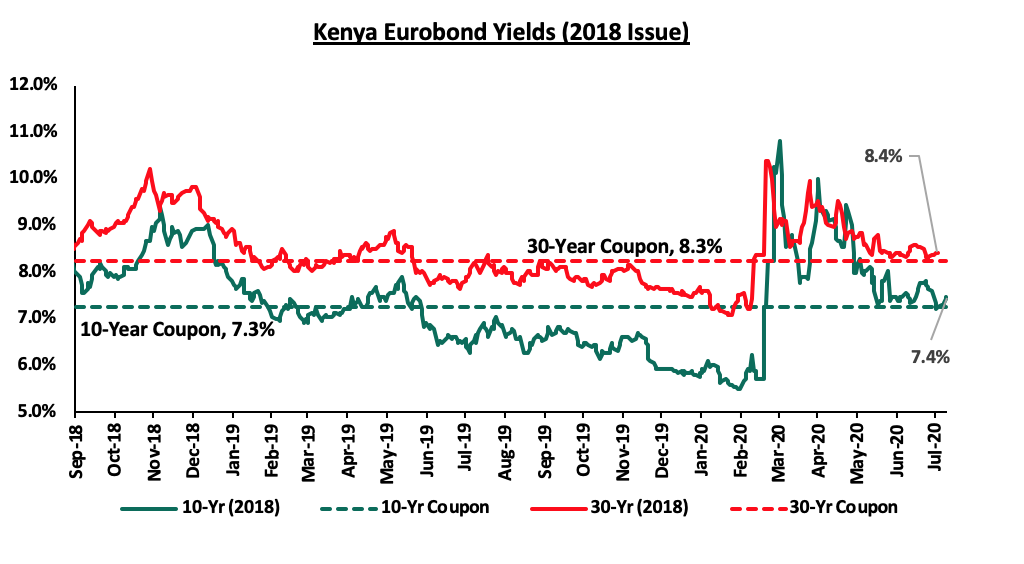

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 decreased marginally by 0.1% points to 6.4% in July, from 6.5% in June. During the week, the yield on the 10-year Eurobond remained unchanged at 6.4%, similar to what was recorded the previous week.

During the month, the yields on the 10 year Eurobonds issued in February 2018 decreased marginally by 0.1% points to close at 7.4% in July, from the 7.5% recorded in June. The 30 year Eurobond, on the other hand, remained unchanged at 8.4% in July, similar to what was recorded in June. During the week, the yield on the 10-year Eurobond increased by 0.2% points to close at 7.4% from 7.2% recorded the previous week. The 30-year Eurobond increased marginally by 0.1% point to 8.4%, from 8.3% recorded the previous week.

During the month, the yields on the newly issued dual-tranche Eurobond with 7-years increased marginally by 0.1% points to 7.4% in July, from 7.3% in June. The 12-year Eurobond remained unchanged at 8.2% similar to what was recorded in June. During the week, the yields on both the 7-year and 12-year Eurobonds increased by 0.2% points to 7.4% and 8.2%, respectively, from 7.2% and 8.0% recorded the previous week.

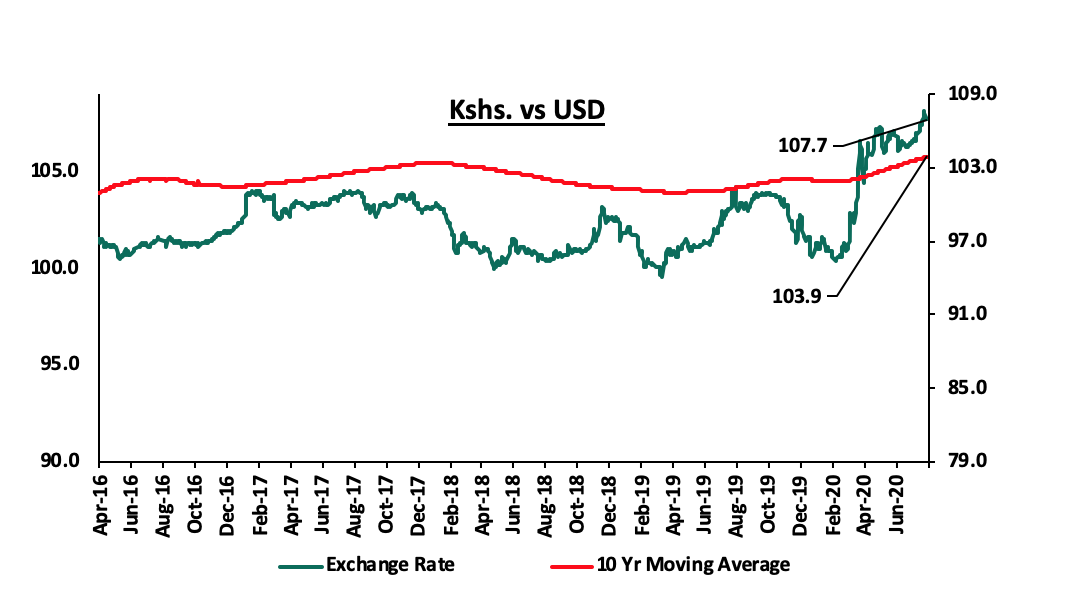

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 1.1% against the US Dollar to close at Kshs 107.7, from Kshs 106.5 recorded at the end of June, due to increased dollar demand by both banks and merchandise importers. During the week, the Kenya Shilling appreciated marginally by 0.3% against the US Dollar to close at Kshs 107.7, from Kshs 108.0 recorded the previous week, attributable to subdued dollar demand from merchandise importers and players in the energy sector. On a YTD basis, the shilling has depreciated by 6.3% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions,

- A deteriorating current account position, with the current account deficit deteriorating by 10.2% during Q1’2020, to Kshs 110.9 bn, from Kshs 100.6 bn recorded in Q1’2019 attributable to;

- 0% decline in the secondary income (transfers recorded in the balance of payments whenever an economy provides or receives goods, services, income or financial items) balance, to Kshs 124.1 bn, from Kshs 128.0 bn in Q1’2019, and,

- A 67.0% decline in the services trade balance (the difference between the imports and exports of services) to Kshs 20.4 bn, from Kshs 61.9 bn.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.4 mn (equivalent to 5.7-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- Improving diaspora remittances evidenced by the 24.0% increase to USD 258.2 mn in May 2020, from USD 208.2 seen the previous month. In terms of y/y performance, diaspora remittances increased by 6.2% to USD 258.2 mn in May 2020, from USD 243.2 mn recorded in May 2019.

Weekly Highlight:

Inflation

The y/y inflation for the month of July declined to 4.4%, from the 4.7% recorded in June 2020. Month-on-month inflation came in at 0.9%, which was attributable to:

- A 0.8% decline in the food and non-alcoholic drinks’ index, due to a decline in prices of significant food items such as tomatoes, Irish potatoes, spinach, onions and kales which declined by 5.5%, 4.1%, 3.2%, 3.1% and 2.6%, respectively,

- A 0.4% decline in the housing, water, electricity, gas and other fuels index, as a result of the lower cost of water vendor services, house maintenance and some house rents. Despite the above, the effects were muted due to,

- A 4.0% increase in the transport index on account of an increase in the pump prices of diesel and petrol by 22.3% and 12.2%, respectively.

|

Major Inflation Changes – July 2020 |

|||

|

Broad Commodity Group |

Price change m/m (July-20/June-20) |

Price change y/y (July-20/July-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

(0.8%) |

6.6% |

The m/m decline was due to a decline in prices of some food items such as tomatoes, Irish potatoes, spinach, onions and kales |

|

Transport Cost |

4.0% |

11.1 % |

The m/m increase was mainly on account of increases in the pump prices |

|

Housing, Water, Electricity, Gas and other Fuels |

(0.4%) |

1.1% |

The m/m marginal decline was as a result of the lower cost of water vendor services, house maintenance and some rents |

|

Overall Inflation |

0.1% |

4.4% |

The m/m increase was due to a 4.0% increase in the transport cost, mainly driven by the increase in fuel prices which was mitigated by the decline of 0.8% in the Food and non-alcoholic foods index |

Going forward, we expect the inflation rate to remain within the government set range of 2.5% - 7.5%. We expect inflation to remain stable despite supply-side disruption due to COVID-19 as low demand for commodities compensates for the cost-push inflation, coupled with the low oil prices in the international markets.

Monetary Policy

The Monetary Policy Committee (MPC) met on 29th July 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the CBR at 7.00%, which was in line with our expectations; MPC July 2020 Note. The MPC indicated that the previous cuts in the CBR rate in March and April 2020 to the current 7.0%, was having the intended outcome. The key highlights from the meeting:

- The economy remained resilient during the first quarter of 2020 where real GDP grew by 4.9% compared to Q1’2019, mainly supported by agricultural production. Leading economic indicators for the second quarter point towards continued strong performance in agriculture due to favourable weather conditions and the lifting of restrictions in key export markets. However, against a backdrop of major disruptions due to COVID-19 containment measures, the services sector remained subdued, particularly hotels, restaurants and the education sector,

- Inflation is expected to remain within the government’s 2.5% - 7.5% target range, largely supported by lower food prices, the impact of the reduction of VAT and muted demand pressures,

- The banking sector remained resilient with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans to gross loans stood at 13.1% in June compared to 13.0% in May. Increased in NPLs were noted in the manufacturing, trade and personal sectors due to the subdued business environment,

- Total loans amounting to Kshs 844.4 bn (29.0%of the total banking sector loan book) has been restructured by the end of June, of which personal/ household loans amounted to Kshs 240.0 bn 30%, while the other sectors amounted to Kshs 604.4 bn; Trade (22.9%), Real Estate (19.5%), Transport and communication (16.3%) and Manufacturing (14.0%),

- The imminent operationalization of the Credit Guarantee Scheme for the vulnerable MSMEs which is expected to reduce the risk banks will take on by lending, and ultimately boost credit growth,

- Private sector credit growth came in at 7.6% in the 12-months to June 2020, below the 5-Year historical average, of 8.2%. Strong credit growth was observed in the Manufacturing sector (12.3%), trade (8.4%), transport and communication (14.9%) and consumer durables (15.2%), and

- Export of goods rebounded, growing at 1.7% during the first half of the year, compared to a similar period in 2019. Receipts from tea exports increased by 18.4% while horticulture exports declined by 14.2% as a result of the contraction of flower exports in April 2020.

The committee noted that the policy measures put in since March were having the intended effect on the economy and would be augmented by the implementation of the measures in the FY2020/21 budget. The MPC concluded that the current accommodative policy stance remains appropriate and they will continue to closely monitor the policy measure implemented so far, as well as developments in the global and domestic economy. The committee will meet again in September 2020, but remains ready to re-convene earlier if necessary.

Monthly Highlights

- The Kenya National Bureau of Statistics (KNBS) in conjunction with the Ministry of Treasury and National Planning released wave 2 of the Survey on Socio-Economic Impact of COVID-19 on Household Report. The Government of Kenya established a National Coordination Committee on the Response to the Corona Virus Pandemic (NCCRCP) to respond to the crisis and help cushion Kenyans against the adverse effects of the Coronavirus pandemic. For more information, see our, Cytonn Weekly #28/2020.

- S&P Global lowered Kenya’s Credit rating outlook from stable to negative and affirmed the B+ long term and B short-term credit rating. Key to note, Moody’s credit rating agency changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable” and affirmed the B2 credit rating. The agency pointed out that the negative outlook was as a result of rising financial risks brought about by the country’s high debt and interest burden. Below is a summary of the credit rating and outlook revisions on Kenya so far;

|

Rating Agency |

Rating as at January 2020 |

Outlook as at January 2020 |

Current Rating |

Current Outlook |

|

Moody’s |

B2 |

Stable |

B2 |

Negative |

|

S&P Global |

B+ ‘short term’, B ‘Long Term’ |

Stable |

B+ ‘short term’, B ‘Long Term’ |

Negative |

|

Fitch Ratings |

B+ |

Stable |

B+ |

Negative |

For more information, see our, Cytonn Weekly #29/2020.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. As a result of depressed revenue collection with the revenue target for FY’2020/2021 at Kshs 1.9 tn, we expect a higher budget deficit, which the Treasury estimates at 7.5% of GDP, creating uncertainty in the interest rate environment as additional borrowing from the domestic market will be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk

Markets Performance

During the month of July, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 3.2%, 7.1% and 4.9%, respectively. The equities market performance during the month was driven by large declines recorded by Co-operative bank, ABSA and SCBK of 13.6%, 9.8% and 9.4%, respectively. Similarly, during the week, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 recording declines of 1.0%, 4.4% and 2.0%, respectively, taking their YTD performance to losses of 19.9%, 32.0%, and 25.4%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by declines recorded by large-cap stocks, with the highest declines being recorded in EABL, Co-operative bank and NCBA, which lost by 7.7%, 5.8% and 5.3%, respectively. However, the decline was slowed down by gains recorded by other large-cap stocks, with the highest gains being recorded by Safaricom and Equity which both gained by 0.2% and KCB which gained by 0.1%.

Equities turnover increased by 9.0% during the month to USD 125.5 mn, from USD 115.1 mn in June 2020. Foreign investors remained net sellers with a net selling position of USD 49.8 mn, compared to June’s net selling position of USD 15.9 mn. During the week, equities turnover declined by 53.8% during the week to USD 14.2 mn, from USD 30.7 mn recorded the previous week, taking the YTD turnover to USD 934.3 mn, with foreign investors turning into net buyers, with a net buying position of USD 0.5 mn, from a net selling position of USD 12.7 mn recorded the previous week, taking the YTD net selling position to USD 265.6 mn.

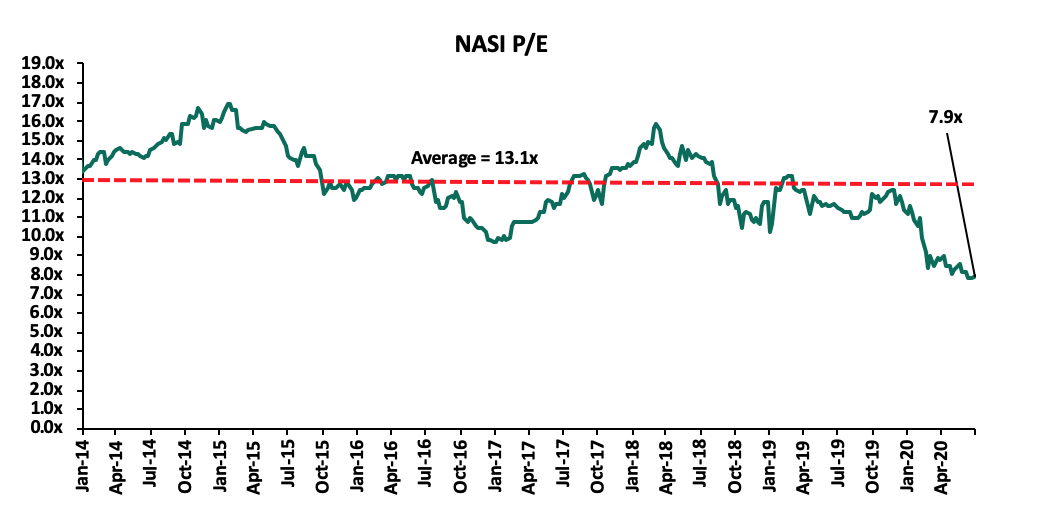

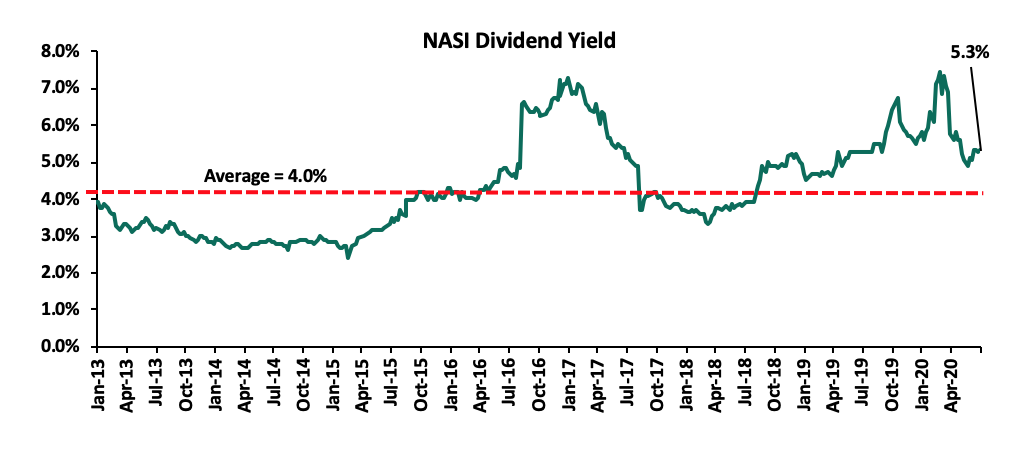

The market is currently trading at a price to earnings ratio (P/E) of 7.9x, 39.4% below the historical average of 13.1x. The average dividend yield is currently at 5.3%, unchanged from the previous week, and 1.3% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 7.9x is 1.5% above the most recent valuation trough of 7.8x experienced in the second week of July 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

- I&M Holdings PLC issued a cautionary statement to its shareholders on its intention to acquire 90.0% share capital of Orient Bank Limited Uganda (OBL). The transaction will see I&M spend more than Kshs 2.0 bn in the acquisition of the Ugandan Bank, whose book value stood at Ushs 114.1 bn (Kshs 3.3 bn) in FY’2019 For more information, please see Cytonn Weekly #30/2020,

- Equity Group disclosed it was seeking to raise up to Kshs 50.0 bn in long-term debt from international financiers in the next three years as it seeks to boost its liquidity and capital positions. This is reflective of the trend by local banks, which are increasingly seeking loans from global financiers such as the International Finance Corporation (IFC) and European Investment Bank. For more information, please see Cytonn Weekly #29/2020, and,

- Mortgage financier HF Group announced it was seeking to raise Kshs 1.0 bn additional tier II capital (a supplementary component of a bank’s capital) as part of its measures to inject liquidity into the bank, in a bid to remain compliant with the Central Bank’s Capital Adequacy requirements. For more information, please see Cytonn Weekly #28/2020.

Weekly Highlight

During the week, the Monetary Policy Committee (MPC) disclosed that as at June 2020, Kshs 844.4 bn (29.1% of the total banking sector loan book) had been restructured by Kenyan banks in line with the emergency measures announced by the Central Bank to cushion the economy from the impact of COVID-19. Other key highlights from the release include;

- Of the loans restructured, Kshs 240.0 bn are personal/ household loans were restructured as income for individuals continue to be strained as a result of depressed revenues to Small and Medium Enterprises (SMEs) and reduced employment income from pay cuts and job losses, occasioned by the pandemic,

- Kshs 31.4 bn (89.2% of Kshs 35.2 bn) made available by the lowering of the Cash Reserve Ratio (CRR) had been used to support lending especially to the tourism, transport and communication, real estate, trade and manufacturing sectors, and,

- Private sector credit growth remained subdued recording a growth of 7.6% compared to 8.1% in May 2020. However, the imminent operationalization of the Credit Guarantee Scheme, a program to enable the provision of affordable credit to SMEs in an efficient and structured manner, will de-risk lending by commercial banks and increase credit to the sector currently facing a challenge of accessing credit.

The table below shows the listed banks that have disclosed their restructured loans so far:

|

Loans Restructured By Listed Banks |

||||

|

# |

Bank |

Amount Restructured (Kshs Bn) |

% of Restructured Loans to Total Loans |

y/y change in Loan Loss Provisions |

|

1 |

Kenya Commercial Bank |

120.2 |

21.7% |

149.1% |

|

2 |

Equity Group |

100.0 |

26.4% |

660.4% |

|

3 |

ABSA Bank Kenya |

54.0 |

26.6% |

75.2% |

|

4 |

NCBA Group |

47.3 |

19.2% |

3.1% |

|

5 |

Diamond Trust Bank |

40.7 |

18.3% |

52.0% |

|

6 |

Standard Chartered Bank of Kenya |

22.0 |

17.5% |

3.1% |

|

7 |

Co-operative Bank of Kenya |

15.3 |

5.5% |

79.5% |

|

Average |

57.1 |

19.3% |

146.1% |

|

|

Total |

399.5 |

|||

With banks restructuring loans on account of the strained cash flows for businesses as well as disposable income to individuals due to the pandemic, we expect to see a rise in the Non-Performing Loans (NPL) ratio, higher than in Q1’2020, where the Gross NPL ratio stood at 11.3%, from 10.4% recorded in Q1’2019, and much higher than the 5-year average of 8.3%. Loan loss provisions are also set to remain high despite the softer guidance by the Central Bank in provisioning guidelines. The deteriorating asset quality remains a concern as most businesses struggle to keep afloat due to subdued revenues, we believe that they may not be able to meet their repayment requirements further elevating credit risks. As such, we expect bottom-line revenues to be subdued as a result of increased loan loss provisioning coupled with declining yields in Government securities, which the sector has heavily relied on in the past.

Universe of Coverage:

We are currently reviewing our target prices for the Banking and Insurance sector coverage.

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Industry Reports

During the week, Knight Frank released the Kenya Markets Update Report H1'2020, which tracks the status and trends in various economic sectors in Kenya including prime real estate. The key highlights from the report are:

- In the retail sector, monthly rents for prime stores reduced by 8.5% to Kshs 450 per SQFT from Kshs 492. The decline is attributable to oversupply in select nodes as well as reduced consumer spending due to declines in disposable incomes amidst the current economic environment. However, occupancy rates remained relatively high averaging 80% with established retail developments recording up to 90%. Footfall is expected to continue to rise as the economy gradually reopens although rental rates are expected to continue on a downward trend due to an unfavourable business climate,

- In the commercial office sector, monthly rents in prime nodes remained unchanged in H1’2020 at Kshs 139 per SQFT. The stagnation is attributed to the continued office glut in key commercial nodes as well as the economic slowdown that has seen businesses continue to reduce office space in a bid to reduce operational expenses. Occupancy rates averaged 73% as at the end of H1’2020 with nodes such as Westlands continuing to outperform the market, and

- In the residential sector, prices in prime markets reduced by 2.9% in H1’2020 compared to 1.8% in H1’2019 while rents also declined by 6.6% compared to a decline of 1.7% in H1’2019. The decline is attributable to oversupply in the prime residential markets, unfavourable economic environment, low liquidity, continued relocation of expatriates and reduced transactions due to the prolonged closure of land registries. Residential prices are expected to continue declining in the near term although at a slower rate as the economy gradually reopens and land registries resume operations.

The report findings are in line with our views in the Cytonn H1’2020 Markets Review according to which, average rental yields softened across all sectors coming in at 7.4%, 7.3% and 5.0%, for retail, office and residential sectors, respectively from 7.7%, 7.8% and 5.2% in Q1’2020 attributable to the negative impact of COVID-19 pandemic. Overall, we expect the real estate sector's performance to improve as economic activity regains momentum.

- Residential sector

During the month, the residential sector recorded various activities:

- Cytonn Investments, an investments management firm and real estate developer, announced that construction activities had resumed in phase 2 of their 500-unit comprehensive residential development in Ruaka, Kiambu County. For more information, see Cytonn Weekly #30/2020,

- Shelter Afrique, a pan-African housing development financier, announced plans to issue a bond in the Nairobi Stock Exchange (NSE) aimed at raising funds to develop new real estate projects. For more information, see Cytonn Weekly #29/2020,

- Stima Sacco, a local deposit-taking SACCO, announced that it had retracted its plans to raise Kshs 5 bn through a corporate bond to finance its mortgage business. Instead, the SACCO will partner with Kenya Mortgage Refinancing Company (KMRC), a State-backed home loans financier, in its goal of acquiring long term financing for onward lending. For more information, see Cytonn Weekly #29/2020, and,

- The Principal Secretary of the State Department of Housing and Urban Development, Mr Charles Hinga, issued a decree that all affordable housing development projects under the nation’s Big 4 Agenda will be required to meet the International Finance Corporation’s (IFC) Excellence in Design for Greater Efficiencies (EDGE) green buildings standard. For more information, see Cytonn Weekly #28/2020.

We expect to continue seeing momentum in the lower mid-end residential markets. In light of the current tough economic environment, we expect to see developers seek alternative sources of funding especially for projects geared towards the supply of low-cost housing.

- Retail Sector

During the week, L.C Waikiki, a Turkish fashion retailer, opened a new store in Nairobi Mega Mall along Uhuru Highway, Nairobi, marking the retailer’s 7th branch locally since opening its first store in 2017, with some of the other outlets being located at; The Hub in Karen, City Mall in Nyali, Mombasa, Two Rivers Mall in Ruaka, Thika Road Mall (TRM) along Thika Road, Sarit Centre mall in Westlands, and, The Junction Mall along Ngong Road. The retailer’s latest store seeks to leverage on increased consumer traffic at the premises that has been brought about by the recent opening of Carrefour Mega in June this year. The increased expansion by the international retailer is supported by; (i) growing demand for international brands from an expanding middle class thus creating demand for differentiated retail products, and, (ii) the availability of high-quality retail spaces in line with international standards. We expect the expansion of multinational retailers such as L.C Waikiki to help cushion the retail sector amidst increasing vacancy rates due to the tough economic climate attributed to the ongoing COVID-19 pandemic that has seen occupancies decline by 1.8% to 74.0% in H1’2020 from 75.9% in FY’2019, according to the Cytonn H1’2020 Markets Review. The table below shows the Nairobi Metropolitan Area (NMA) retail performance over time:

|

Summary of Retail Sector Performance Over Time |

|||||||

|

Item |

Q1' 2019 |

H1' 2019 |

Q3' 2019 |

FY' 2019 |

H1' 2020 |

∆ Y/Y |

∆ H1’2020 |

|

Average Asking Rents (Kshs/SQFT) |

174.3 |

170 |

167 |

175.6 |

170.3 |

(0.2%) |

(3.1%) |

|

Average Occupancy (%) |

76.8% |

75.6% |

74.5% |

75.9% |

74.0% |

(1.6%) points |

(1.8%) points |

|

Average Rental Yields |

8.5% |

8.2% |

8.0% |

7.8% |

7.4% |

(0.8%) points |

(0.4%) points |

Source: Cytonn Research

Also during the month:

- Naivas Supermarket, a local retailer, opened its 64thstore along Mombasa Road opposite the Syokimau Railway station dubbed Naivas Airport view. The store sits on 21,000 SQFT of retail space and is the retailer’s second store in Syokimau with the first one located at Gateway Mall, it is also the fourth branch that Naivas has opened in 2020. The retailer aims to open an additional branch in Kisumu at the Mega City Mall soon as it seeks to grow its footprint across the country in the fight for market share in an increasingly competitive market after it recently sold 30% of its stake to the French private equity firm, Amethis Finance. The new store targets the; (i) the growing population in such satellite towns especially with the increased relocation of Nairobi’s middle class from the suburbs, and, (ii) commuters using the CBD-Syokimau commuter train service that was introduced by the Kenya Railways Corporation in November last year, in a move aimed at helping ease congestion along Mombasa Road. In our view, the continued focus on satellite towns by the retailer is attributed to; (i) the relatively low rents of approximately Kshs 127.5 per SQFT, 33.6% lower than the market average of Kshs 170.3 per SQFT according to our Cytonn H1’2020 Markets Review, and, (ii) the low formal retail space penetration of approximately 35.0% in Kenya especially in satellite areas, compared to 60.0% in developed countries such as South Africa according to a Nielsen Report,

- Tuskys Supermarket, a local retailer, announced that it was seeking a strategic investor to inject Kshs 2 bn in a deal that would see the prospective investor gain majority stake. The announcement comes amidst soaring debt by the retailer that has seen it owe suppliers about Kshs 1.2 bn. In April, the retailer was forced to shut down 3 of its branches attributed to declining revenues and poor corporate governance. We expect the retailer's efforts of relinquishing majority stake coupled with the expected injection of new capital to help keep the retailer afloat and safe from suffering a similar fate to Nakumatt and Uchumi, and

- Artcaffe restaurant opened its third store in Nairobi’s Central Business District (CBD), located in Chester House, along Kimathi Street. For more information, see Cytonn Weekly #29/2020.

The recent easing of movement restrictions coupled with the expansion of various local and international retailers is expected to sustain the sector as it grapples with reduced occupancy rates attributed to the ongoing pandemic and the existing oversupply of formal retail space.

- Hospitality Sector

Activity in the hospitality sector in July remained muted. The key highlights were:

- The Ministry of Tourism and Wildlife Cabinet Secretary, Najib Balala, announced that the National Government had set aside Kshs 10 bn aimed at offering cheap loans to hotels and firms operating in the tourism sector through a state-backed credit scheme. For more information, see Cytonn Weekly #30/2020, and

- Global hotel groups, Accor Hotels and Radisson Hotel Group announced that they would continue with their expansion plans in Kenya and the African region as a whole despite the slump in the sector due to the COVID-19 pandemic. For more information, see Cytonn Weekly #28/2020.

We expect the sector to embark on a recovery path as domestic tourism slowly picks up due to the easing of movement restrictions and the expected resumption of international passenger flights on August 1st 2020.

- Industrial Sector

During the week, Purple Dot International Limited, a local real estate developer, kicked off construction of phase 4 of their Graylands Industrial Park in Athi River which is expected to comprise of 36 warehouses each set on 7,750 SQFT and selling for Kshs 19.5 mn each which translates to Kshs 2,516 per SQFT. In total, the development is expected to comprise of 8 phases totalling to about 296 warehouses. Phase 4 follows the completion of phase 3 in March 2020 that commenced in November 2018 and has seen investors receiving at least Kshs 180,000 in monthly rental income, which translates to Kshs 23 per SQFT with a similar plinth area and thus, a gross rental yield of 9.4% assuming average occupancy rate of 85.0% as per the Broll Report Q4’2018. This is the 5th industrial project by the developer, the others include;

|

Other industrial Developments by Purple Dot International Limited |

|||

|

Development |

Location |

No. of Units |

Plinth Area (SQFT) |

|

Swastik investment Park |

along Mombasa Rd. |

12 |

8,000 |

|

Ashapura Business Park |

Athi River |

23 |

6,600 – 7,200 |

|

Ridhi Business Park |

Athi River |

20 |

8,000 |

|

proposed Kongoni Business Park |

Wuyi Rd., Athi River |

64 |

7,750 |

Online sources

We continue to see an increase in warehouse developments attributed to the continued (i) growth of SMEs which is expected to increase the rate of manufacturing, and (ii) increased online shopping and near sourcing of inputs by local industries and retailers which is expected to accelerate owing to the current disruption in global supply chains. Athi River as an industrial sector node is boosted; (i) availability of development land in bulk and at relatively affordable prices with serviced land in the area going for Kshs 12 mn per acre according to our Nairobi Metropolitan Area (NMA) Land Report 2020, (ii) proximity to key logistics hubs, namely JKIA, Standard Gauge Railway and the Inland Container Depot, as well as (iii) improved infrastructure such as the ongoing expansion of Mombasa Rd, and thus, we expect to continue seeing demand for warehouse space in the area.

Also during the month, Cold Solutions Kenya Limited, a leading temperature-controlled warehouse and logistics service provider, announced that it will invest Kshs 7.5 bn in constructing, grade ‘A’ temperature-controlled cold storage warehouses in Tatu City Development special economic zone. For more information, see Cytonn Weekly #29/2020.

We expect to see continued demand for warehouse space especially in satellite towns due to; (i) availability of development land in bulk and at relatively affordable prices, (ii) improved infrastructure, and, (iii) increased online shopping and near sourcing of inputs by local industries and retailers due to the current disruption in global supply chains.

- Listed Real Estate

ILAM Fahari I-REIT (formerly Stanlib Fahari) released their H1’2020 earnings registering a 14.3% growth in earnings per unit to Kshs 0.48 in H1’2020 from Kshs 0.42 in H1’2019. This was due to an increase in net profits by 12.6% to Kshs 86.0 mn in the period under review from Kshs 76.4 mn in H1’2019, attributable to increase in fair value of investment property to Kshs 7.8 mn in H1’2020, from a loss of Kshs 10.3 mn in H1’2019, as well as reduced operating expenses by the manager in a bid to cushion the REIT from the adverse impact of the ongoing pandemic. Rental income grew by 2.4% to Kshs 174.7 mn from Kshs 170.7 mn in H1’2019. However, the growth was slower compared to the 26.3% increase recorded in H1’2019, attributable to the COVID-19 impact on the retail and commercial office sectors which has led to rent rebates for struggling tenants thus, suppressing rental income growth. The REIT did not recommend an interim distribution of dividends for the period ended 30th June 2020. It was noted that a full distribution will be declared in line with the requirements of the REITs Regulations to distribute a minimum of 80% of distributable earnings within four months after the end of the financial year, which ends on 31st December 2020.

We project a FY’2020 dividend yield of 12.7% assuming the dividend pay-out ratio remains similar to the 4-year average of 96.0% (2016-2019). This is in comparison to the average commercial real estate sector yields of 7.4% as at H1’2020 (Office – 7.3% and retail – 7.4%). However, the expected high dividend yield is largely attributable to the low trading price of the I-REIT, at Kshs 5.9 per unit as at 30th June 2020 compared to Kshs 9.2 as at 29th June 2019. Additionally, dividends are likely to remain weak due to COVID-19 and the resultant unfavourable economic environment.

For a more comprehensive analysis on the REIT’s H1’2020 performance, see our ILAM Fahari I-REIT Earnings Note - H1'2020.

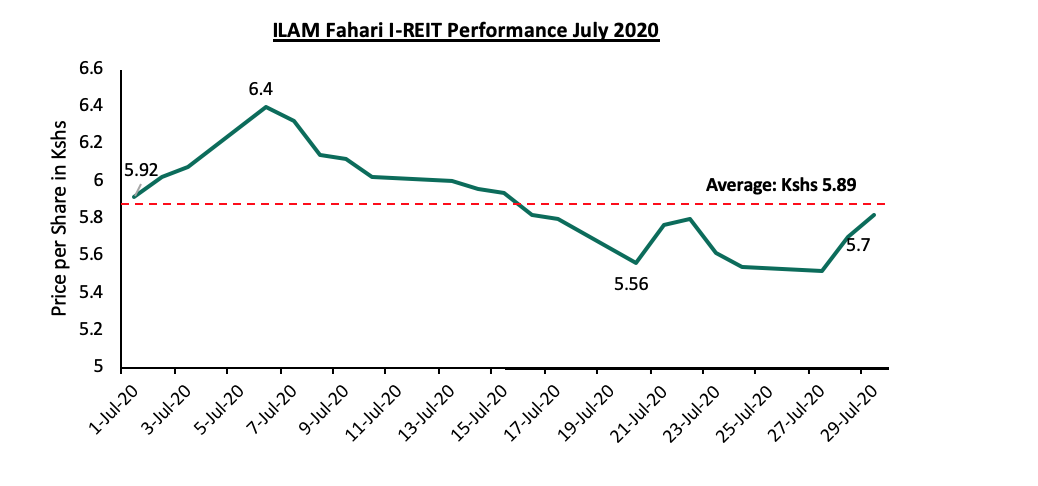

On the bourse, the REIT continued to perform poorly, trading at an average of Kshs 5.89 per share during the month of July and closing at Kshs 5.82, representing a 39.5% loss in value YTD and 70.9% lower than its initial listing price of Kshs 20.0. This indicates the continued lack of investor appetite for the instrument. Going forward, we expect the REIT’s revenue to continue declining in the near term due to COVID-19’s impact on commercial office and retail sectors, thereby suppressing rental income growth for the REIT.

Our outlook for listed real estate is neutral with a bias to negative, attributed to continued lack of investor interest for the instruments and the continued subdued performance of the real estate sector as it continues to grapple with the effects of the COVID-19 pandemic.

We expect the real estate sector to continue recording minimal activities as investors hold on to the wait-and-see attitude amidst the ongoing tough economic climate. However, the sector is expected to recover in the near term supported by (i) investor confidence in the hospitality sector’s resilience, (ii) the continued expansion of retailers, and, (iii) the ongoing demand for high-quality warehousing.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.