Cytonn Q1’2023 Markets Review

By Cytonn Research, Apr 2, 2023

Executive Summary

Global Market Review

According to the January 2023 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 2.9% in 2023, 0.5% points slower than the growth of 3.4% recorded in 2022. The latest projection is 0.2% points higher than the IMF’s earlier projection of 2.7% growth, with the upward revision being on the back of full reopening of China coupled with expected easing of global inflation as the Central Banks around the world continue to tighten their monetary policies. Notably, advanced economies are expected to record a 1.2% growth in 2023, which is a significant decline from the 2.7% expansion recorded in 2022. However, the emerging markets and developing economies are projected to expand by 4.0% in 2023, marginally upwards from an estimated growth of 3.9% in 2022;

Sub-Saharan Africa Region Review

According to the International Monetary Fund (IMF), the Sub Saharan economy is projected to grow at a moderate rate of 3.8% in 2023, unchanged from 3.8% in 2022. Notably, the projection is an upward revision from both the World Bank’s Global Economic Prospects - 2023 and the initial IMF Regional outlook projection of 3.6%. The upward revision of the regional growth by the IMF is mainly as a result of expected easing of inflationary pressures in line with the ongoing reduction of global inflation as the central banks around the world continue to tighten the monetary policies aimed at bringing down the inflation rate to the target ranges. However, the growth is expected to be significantly weighed down by sustained supply constraints worsened by the geopolitical tensions arising from the Russia-Ukraine invasion given that most countries in the Sub-Saharan African are net importers, adverse weather conditions that have undermined agricultural productivity, and elevated risk of debt distress in the region;

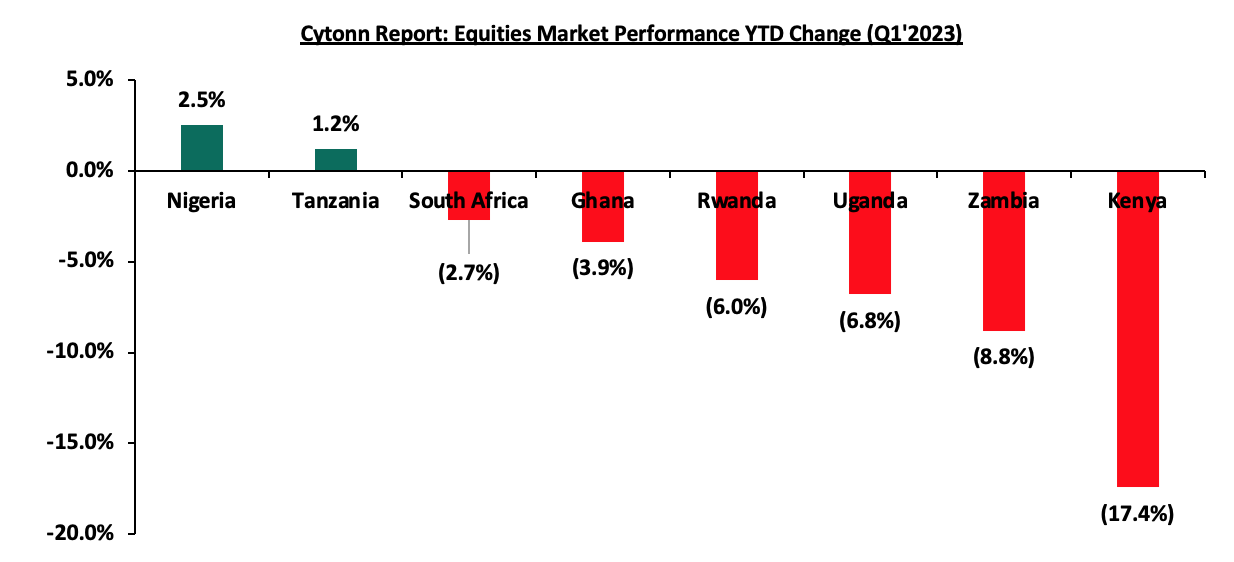

In Q1’2023, all of the selected Sub-Saharan currencies depreciated against the US Dollar, similar to the trend witnessed in FY’2022. The currency depreciation trend is attributable to the elevated inflationary pressures in region, high debt servicing costs that continue to dwindle foreign exchange reserves and monetary policy tightening by advanced economies. Additionally, Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2023, with Nigeria’s stock market (NGSEASI) being the best performing market gaining by 2.5% YTD due to rallying of global fuel prices with the country being a net fuel exporter;

Kenya Macro Economic Review

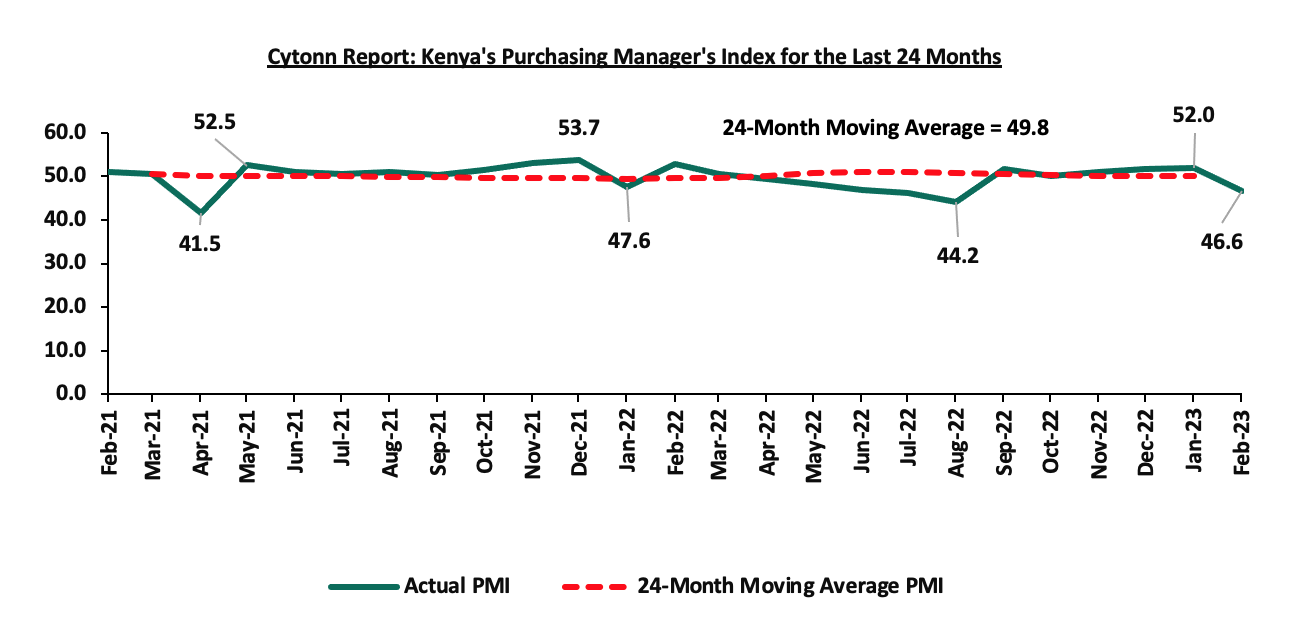

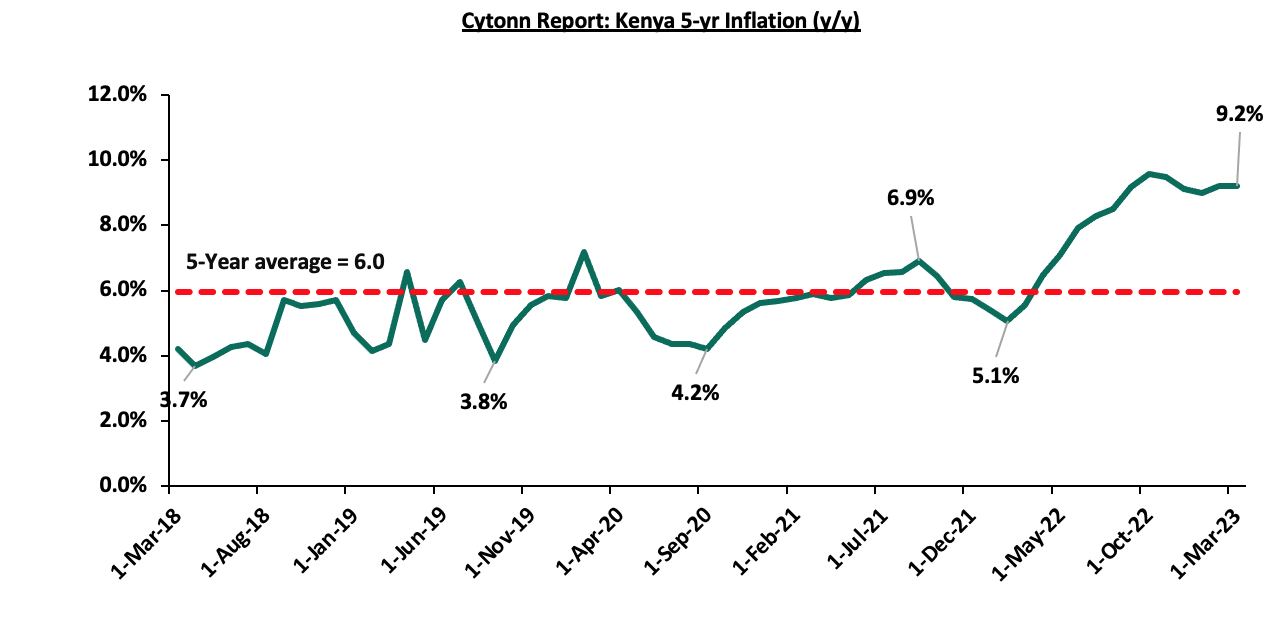

The Kenyan is economy projected to grow at an average of 5.3% in 2023, 0.3% points lower than the 5.6% growth recorded in 2022, attributable to the sustained inflationary pressures, elevated global risks and erratic weather conditions. The average inflation rate increased to 9.1% in Q1’2023, compared to 5.3% in Q1’2022, attributable to increase in food and fuel prices during the period under review. The sustained inflationary pressures reflected in deterioration of general business environment in Q1’2023, with the average Purchasing Manager’s Index for the first two months of the quarter coming at 49.3, compared to 51.7 recorded in a similar period in 2022, mainly on the back of elevated commodity prices, which have resulted in reduced consumer spending. Additionally, in a bid to contain the elevated inflation rate which came at 9.2% in March 2023 similar to what was recorded in February 2023, and 1.7% points above the CBK upper ceiling of 7.5%, the Monetary Policy Committee (MPC) decided to raise the Central Bank Rate (CBR) by 75.0 bps to 9.50% in their March 2023 sitting from 8.75% in January 2023. The action to tighten the monetary policy was in line, although higher than our expectation of a 25.0 bps increase;

Fixed Income

During Q1’2023, T-bills were oversubscribed, with the overall subscription rate coming in at 135.8%, up from 108.5% in Q4’2022. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 217.8 bn against the offered Kshs 48.0 bn, translating to an oversubscription rate of 453.5%, higher than 364.9% recorded the previous quarter. Overall subscriptions for the 182-day and 364-day papers increased to 95.1% and 49.5% from 65.9% and 48.5% in Q4’2022, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day and the 91-day papers increasing by 48.3 bps, 34.2 bps and 41.8 bps to 10.6%, 10.1% and 9.6%, from 10.1%, 9.7% and 9.2%, respectively, recorded in Q4’2022. The government also issued one new Treasury bond and one infrastructure bond, re-opened three bonds and offered five of them on tap sale, seeking to raise Kshs 190.0 bn. The bonds were generally undersubscribed, receiving bids worth Kshs 164.1 bn against the offered Kshs 190.0 bn, translating to a subscription rate of 86.4%;

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 34.4%, a continued decline from the 49.2% recorded the previous week, attributable to persistent tightened liquidity in the money market evidenced with the average interbank rate increasing to 7.6% from 7.2% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 2.9 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 72.6%, significantly lower than the 179.4% recorded the previous week. Notably, the 182-day and 364-day papers recorded undersubscriptions of 35.5% and 18.1% from an undersubscription rate of 87.7% and 43.7%, respectively, recorded the previous week. The government accepted bids worth Kshs 8.0 bn and rejected Kshs 0.3 bn out of the total Kshs 8.3 bn bids received, translating to an acceptance rate of 97.2%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.3 bps, 5.5 bps and 7.8 bps to 10.8%, 10.4% and 9.9%, respectively;

Equities

During Q1’2023, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 11.5%, 3.2% and 5.4%, respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as Safaricom, Bamburi, KCB Group, and NCBA Group of 25.1%, 11.0%, 6.8% and 6.7%, respectively. The losses were however mitigated by gains recorded by banking stocks such as Standard Chartered Bank (SCBK), Co-operative Bank, ABSA Bank and NCBA Group of 19.1%, 6.9%, 4.1% and 2.5%, respectively;

During the first quarter of 2023, listed banks in Kenya released their FY’2022 results, recording an increase in their earnings growth, with their average core Earnings per share (EPS) recording a weighted average growth of 26.5%, compared to a weighted average growth of 83.2% in FY’2021. The performance is however largely skewed by the strong EPS growth from HF Group, Diamond Trust Bank of Kenya and NCBA Group of 138.9%, 53.9% and 34.8%, respectively;

Real Estate

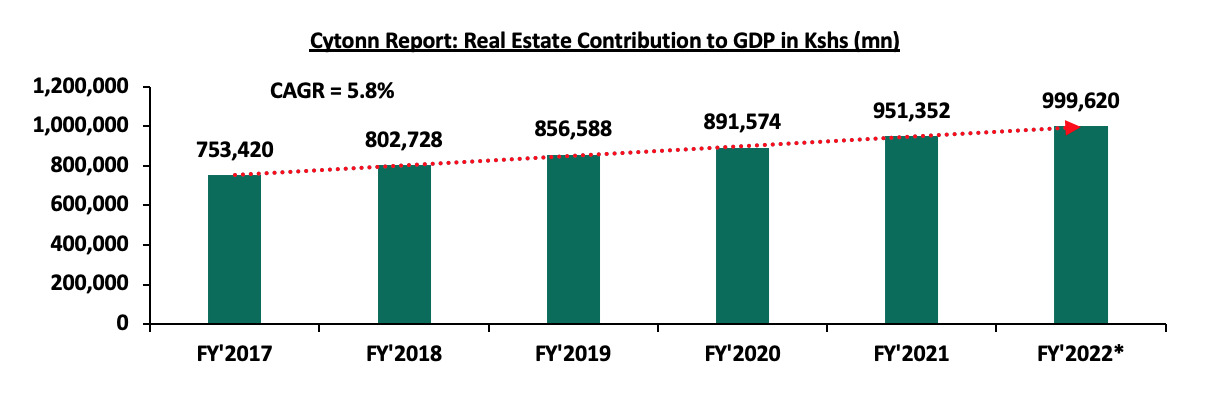

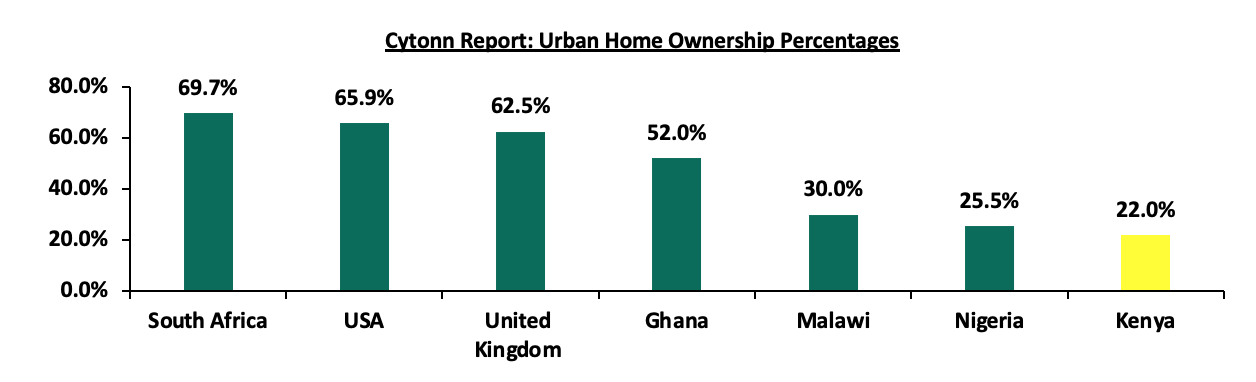

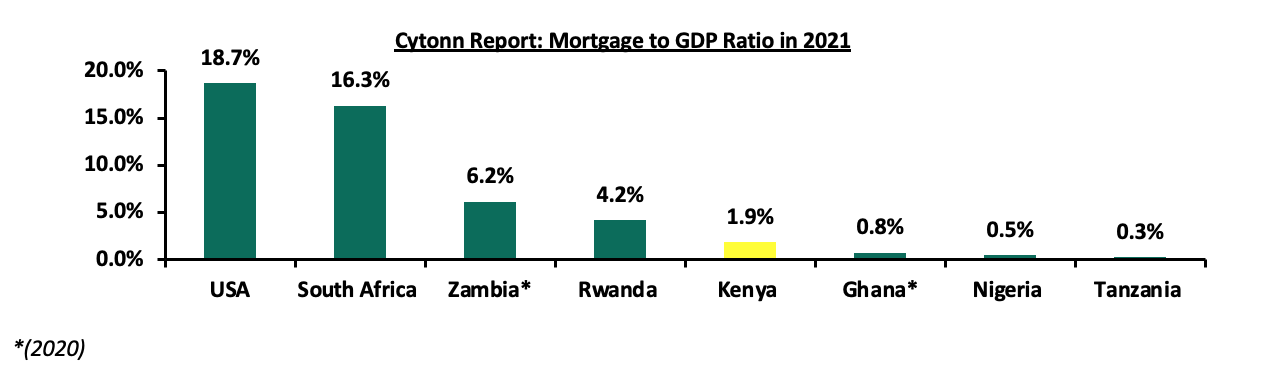

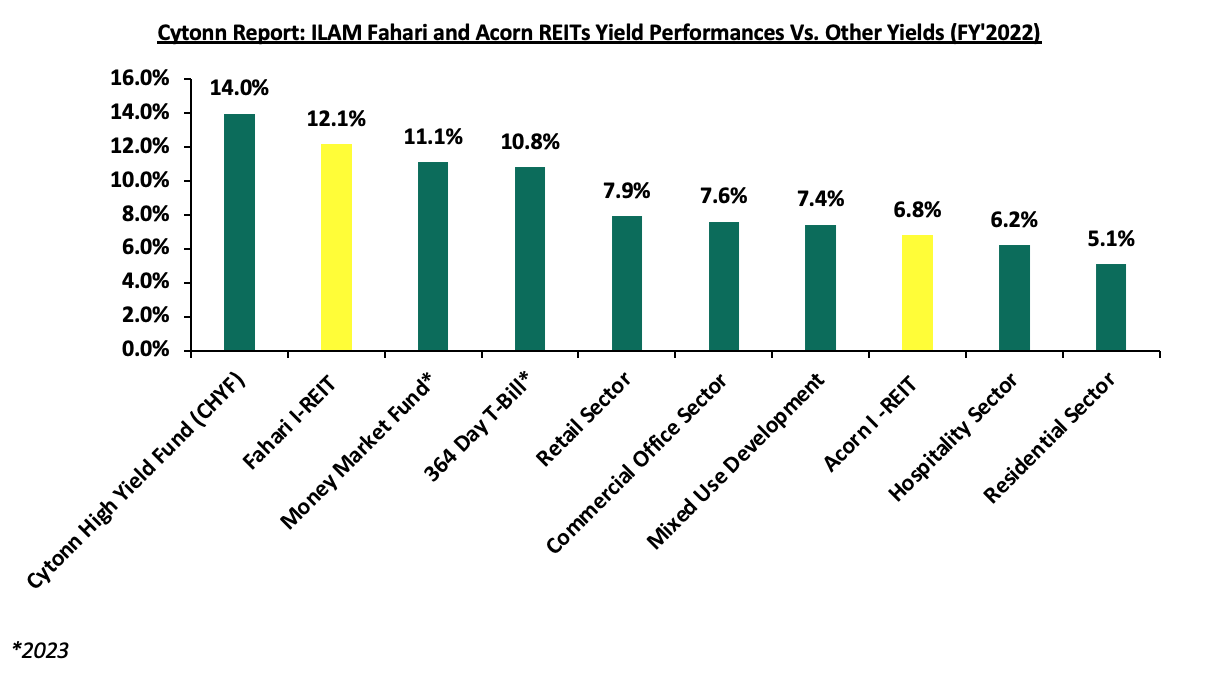

In Q1’2023, Kenya’s Real Estate sector recorded notable growth in terms of activity compared to the similar period in 2022, attributable to continued growth of the Kenyan economy enabling increased Real Estate property transactions. In the Nairobi Metropolitan Area (NMA), the residential sector recorded improved performance with a 0.4% points y/y increase in average total returns to 6.1% from the 5.7% recorded in Q1’2022. The commercial office sector recorded average rental yields of 7.6% in Q1’2023, representing a 0.3% points y/y increase from 7.3% recorded in Q1’2022. The retail sector recorded average rental yields of 8.0% in Q1’2023, representing a 0.1% points y/y increase from 7.9% recorded in Q1’2022. The land sector recorded an average annualized capital appreciation of 5.7% in Q1’2023, with un-serviced land prices in satellite towns realizing the highest capital appreciation at 14.2% y/y;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.10%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.92% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the January 2023 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 2.9% in 2023, 0.5% points slower than the growth of 3.4% recorded in 2022. The latest projection is 0.2% points higher than the IMF’s earlier projection of 2.7% growth, with the upward revision being on the back of full reopening of China coupled with expected easing of global inflation as the Central Banks around the world continue to tighten their monetary policies. Notably, advanced economies are expected to record a 1.2% growth in 2023, which is a significant decline from the 2.7% expansion recorded in 2022. However, the emerging markets and developing economies are projected to expand by 4.0% in 2023, marginally upwards from an estimated growth of 3.9% in 2022.

The expected slowed down in global economic growth in 2023 as compared to 2022 is majorly attributable to;

- The elevated global inflationary pressures which have necessitated hiking of interest rates by central banks around the world with the aim of anchoring inflation. As such, the global inflation is forecasted to ease slightly to 6.6% in 2023, from 8.8% in 2022,

- Persistent supply chain constraints worsened by the ongoing Russia-Ukraine conflict which have led to increase in global fuel and energy prices. Consequently, the high energy prices have increased inflationary pressures as well as contributed to currency depreciation as dollar demand increases in majority of the world economies, and,

- Tight global financial conditions occasioned by high cost of borrowing which have increased risks of debt distress in emerging economies as most advanced economies continue to tighten their monetary policies.

The global economy is expected to remain subdued in the short term mainly as a result of persistent inflationary pressures as well as tightening of monetary policies which are expected to curtail economic growth.

Global Commodities Market Performance:

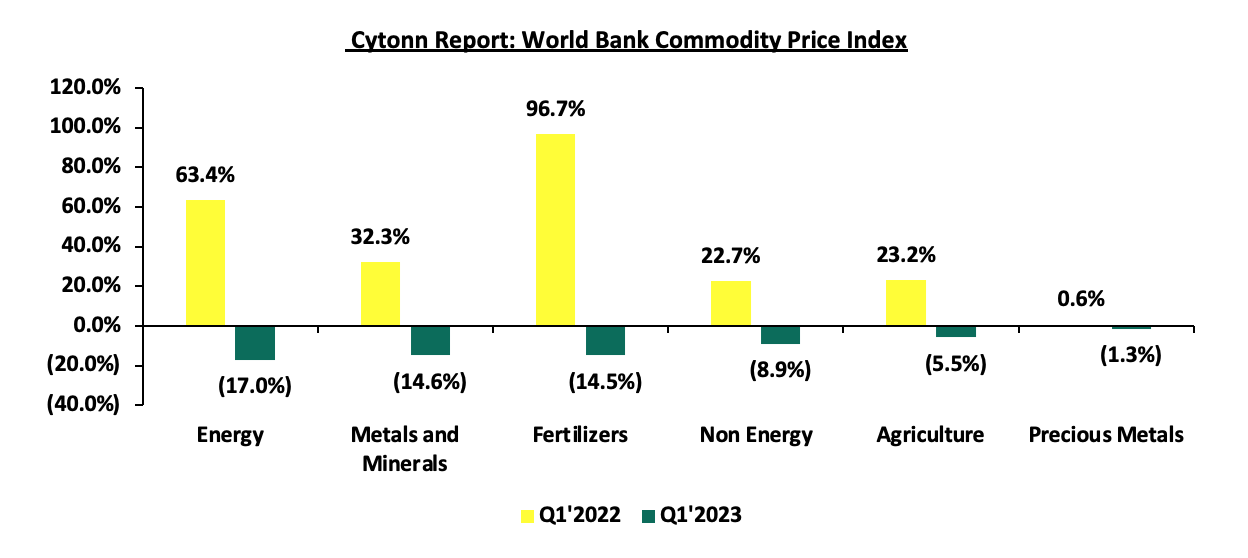

Global commodity prices were on a downward trajectory in Q1’2023, with prices of energy declining the most, by 17.0% compared to the 63.4% increase recorded in Q1’2022, mainly as a result of weaker global demand. Similarly, prices of metals and minerals, fertilizers, Non-energy, Agriculture and Precious metals declined by 14.6%, 14.5%, 8.9%, 5.5% and 1.3%, respectively, on the back of reduced global demand coupled with easing supply chain constraints. Below is a summary performance of various commodities;

Source: World Bank

Global Equities market performance:

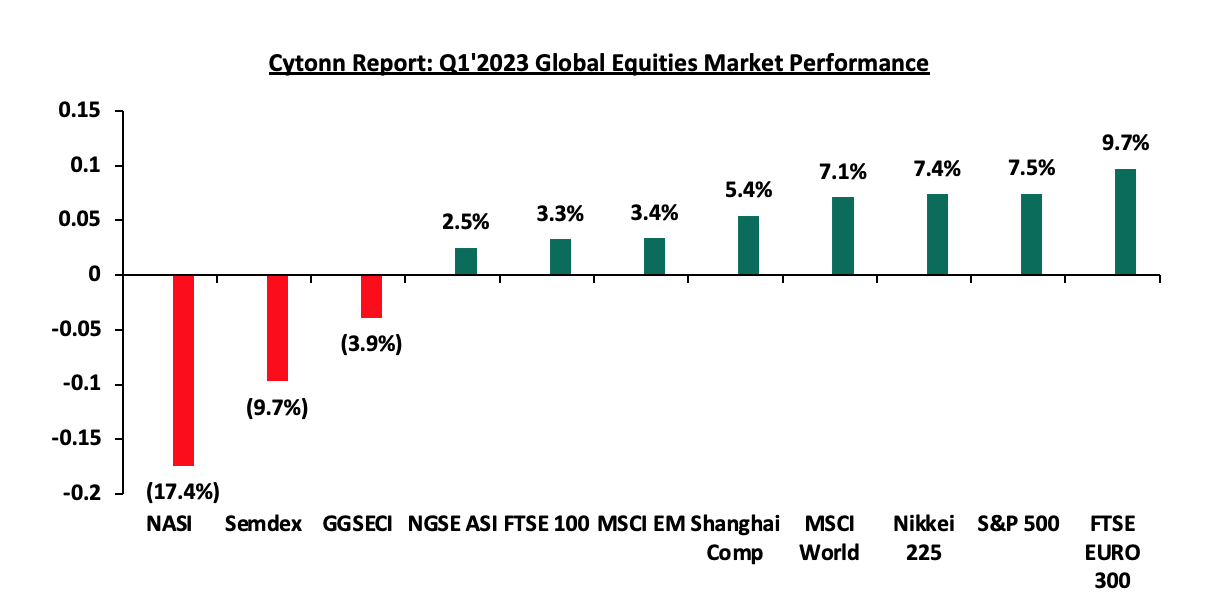

Global stock market recorded mixed performance in Q1’2023, with most indices in developing economies declining attributable to capital flights following interest rate hikes in advanced economies aimed at curbing the inflationary pressures. Consequently, investors have resorted to place their investments in less risky markets such as government papers and other investments alternatives. On the other hand, most indices in the developed countries recorded gains during the quarter largely attributable to increased investor sentiments as a results of continued economic recovery following full reopening of the economies coupled with investor preference of the stock markets in the developed countries. Notably, FTSE Euro 300 recorded the largest gain at 9.7% in Q1’2023 driven by gains recorded by blue- chip financial companies as the European Central Bank continue to hike the central bank rates which has increased investor sentiments on financial stocks. NASI was the largest decliner recording losses of 17.4%, mainly due to capital flight as investors foreign investors sold off their investments in the Kenyan equities market. Additionally, investors have continued to attached a higher risk premium to the country as a result of deteriorated business environment as evidenced by average Purchasing Managers Index (PMI) of 49.0 in the first two months of 2023, with February’s PMI coming in at 46.6, mainly attributable to the high inflation at 9.2% as of March 2022 and continued weakening of the Kenyan Shilling which has depreciated by 7.2% on year to date basis in 2023. Below is a summary of the performance of key indices:

*Dollarized performance

According to the International Monetary Fund (IMF), the Sub Saharan economy is projected to grow at a moderate rate of 3.8% in 2023, unchanged from the estimated economic growth of 3.8% in 2022. Notably, the projection is an upward revision from both the World Bank’s Global Economic Prospects - 2023 and the initial IMF Regional outlook projection of 3.6%. The upward revision of the regional growth by the IMF is mainly as a result of expected easing of inflationary pressures in line with the ongoing reduction of global inflation as the central banks around the world continue to tighten the monetary policies aimed at bringing down the inflation rate to the target ranges. However, the growth is expected to be significantly weighed down by sustained supply constraints worsened by the geopolitical tensions arising from the Russia-Ukraine invasion given that most countries in the Sub-Saharan African are net importers, adverse weather conditions that have undermined agricultural productivity, and elevated risk of debt distress in the region;

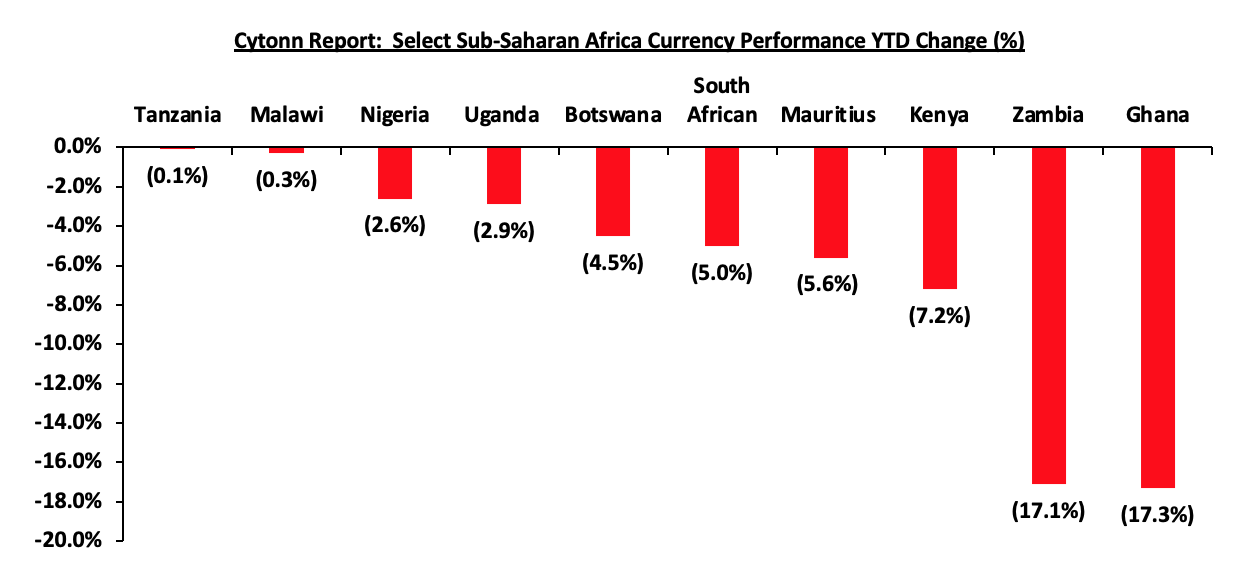

Currency Performance

In Q1’2023, all of the select Sub-Saharan currencies depreciated against the US Dollar, similar to the trend witnessed in FY’2022. The depreciation trend is attributable to the elevated inflationary pressures in region, high debt servicing costs that continue to dwindle foreign exchange reserves and monetary policy tightening by advanced economies such as the United States Federal reserve and the European Central Bank. For instance, in March 2023, the USA increased its interest rate by 25.0 bps to the rage of 4.75%-5.00% from 4.50% -4.75%. Similarly, in March 2023, the European Central Bank increased its benchmark rate by 50.0 bps to 3.50%, from 3.00%. The high interest rates in developed countries has led to massive capital outflows as investors both institutional and individual seek to take advantage of the higher returns offered in developed economies. Further, the elevated inflationary pressures in most economies in the region puts pressure on the value of local currencies due to expensive importation. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Mar-22 |

Jan-23 |

Mar-23 |

Last 12 Months change (%) |

YTD change (%) |

|

Tanzanian Shilling |

2320.0 |

2,332.0 |

2,334.0 |

(0.6%) |

(0.1%) |

|

Malawian Kwacha |

802.0 |

1,009.0 |

1,012.1 |

(26.2%) |

(0.3%) |

|

Nigerian Naira |

415.3 |

447.6 |

459.0 |

(10.5%) |

(2.6%) |

|

Ugandan Shilling |

3553.5 |

3,678.1 |

3,785.1 |

(6.5%) |

(2.9%) |

|

Botswana Pula |

11.3 |

12.6 |

13.2 |

(16.8%) |

(4.5%) |

|

South African Rand |

14.5 |

16.9 |

17.7 |

(22.5%) |

(5.0%) |

|

Mauritius Rupee |

43.4 |

43.0 |

45.4 |

(4.6%) |

(5.6%) |

|

Kenyan Shilling |

115.0 |

123.4 |

132.3 |

(15.1%) |

(7.2%) |

|

Zambian Kwacha |

19.9 |

18.1 |

21.2 |

(6.1%) |

(17.1%) |

|

Ghanaian Cedi |

7.3 |

9.8 |

11.5 |

(57.5%) |

(17.3%) |

Source: Yahoo Finance

Key take outs from the table include:

- The Ghanaian Cedi was the worst performing currency in Q1’2023 and the largest decliner over the last twelve months, depreciating by 17.3% and 57.5%, respectively, mainly as result a deteriorated macro-economic environment driven by the high debt unsustainability concerns, with the total public debt to GDP as of March 2023 coming in at 93.5%, similar to what was recorded in November 2022. Additionally, the country’s currency performance has been weighed down by the elevated inflationary pressures with February 2023 inflation coming in at 52.8%, way above the Ghana Central Bank target rate of 8.0% - 10.0%, and,

- The Kenya Shilling depreciated by 7.2% in Q1’2023 to close at Kshs 132.3 against the US Dollar, compared to Kshs 123.4 recorded at the beginning of the year, driven by increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. Additionally, the declining foreign reserves has continued to weigh down on the value of the shilling, with foreign exchange reserves currently standing at USD 6.4 as at 31 March 2023, equivalent to 3.6 months of import cover and below the statutory requirement of maintaining at least 4.0 months of import.

The chart below shows the year to date performance of different sub-Saharan African countries in Q1’2023;

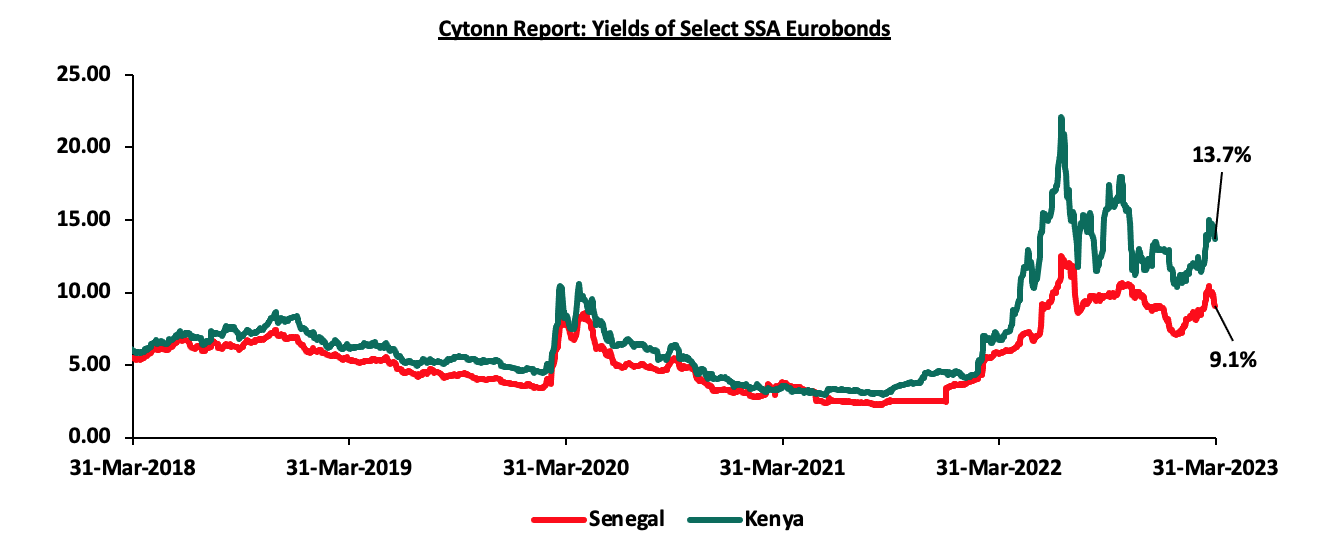

African Eurobonds

Africa’s appetite for foreign-denominated debt has continued to decline in recent times with no issuer during Q1’2023, with most countries shying away from the Eurobonds market due to sustained high yields and tough macroeconomic conditions. The significant increase in yields was partly attributable to investors attaching higher risk premium on Sub-Saharan Countries, driven by the region’s elevated inflationary pressures, public debt distress and continued depreciation of local currencies. Yields on the Kenyan and Senegal Eurobonds increased by 0.8% points and 1.1% points in Q1’2023 to 13.7% and 9.1%, from 12.9% and 8.9%, respectively, recorded at the end of December 2022. Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2023, with Nigeria’s stock market (NGSEASI) being the best performing market gaining by 2.5% YTD driven by the high global fuel prices with the country being a net fuel exporter. Kenya’s NASI was the worst performing stock market, declining by 17.4% at the end of Q1’2023, mainly attributable increased capital flight with investors chasing higher returns from advanced economies following hiking of interest rates as well as deterioration in investor confidence in country on the back of macroeconomic uncertainties occasioned by the high inflation at 9.2% as of March 2022 and continued weakening of the Kenyan Shilling which has depreciated by 7.2% on year to date basis in 2023. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance Q1’2023 (Dollarized*) |

||||||

|

Country |

Index |

Mar-22 |

Jan-23 |

Mar-23 |

Last 12 Months change (%) |

YTD change (%) |

|

Nigerian |

NGSEASI |

113.00 |

115.3 |

118.2 |

4.6% |

2.5% |

|

Tanzanian |

DARSDEI |

1.5 |

1.7 |

1.8 |

17.9% |

1.2% |

|

South Africa |

JALSH |

5160.0 |

4,408.4 |

4,289.8 |

(16.9%) |

(2.7%) |

|

Ghana |

GGSECI |

375.6 |

245.2 |

238.7 |

(36.4%) |

(3.9%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

29.2% |

(6.0%) |

|

Uganda |

USEASI |

0.4 |

0.33 |

0.3 |

(24.0%) |

(6.8%) |

|

Zambia |

LASILZ |

377.2 |

406.2 |

370.6 |

(1.8%) |

(8.8%) |

|

Kenya |

NASI |

1.5 |

1.03 |

0.9 |

(41.2%) |

(17.4%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

GDP growth in Sub-Saharan Africa region is expected to record moderate growth, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

The Kenyan is economy projected to grow at an average of 5.3% in 2023, 0.3% points lower than the 5.6% growth recorded in 2022, attributable to the sustained inflationary pressures, elevated global risks and erratic weather conditions. The table below shows the projections according to various organizations:

|

Cytonn Report: Kenya 2023 growth Projections |

||

|

No. |

Organization |

2023 GDP Projections |

|

1 |

International Monetary Fund |

5.1% |

|

2 |

National Treasury |

6.1% |

|

3 |

World Bank |

5.0% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.0% |

|

Average |

5.3% |

|

Source: Cytonn Research

Key to note, Kenya’s general business environment deteriorated in Q1’2023, with the average Purchasing Manager’s Index for the first two months of the quarter coming at 49.3, compared to 51.7 recorded in a similar period in 2022, mainly on the back of elevated commodity prices, which have seen consumers cut back on spending. Additionally, during the quarter, S&P Global Ratings downgraded Kenya’s outlook to negative from stable, signaling increased risks of defaults in debt repayments amid weakening liquidity position aggravated by dwindling foreign exchange reserves as well as high debt servicing obligations in the next fiscal year. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signal an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Inflation:

The average inflation rate increased to 9.1% in Q1’2023, significantly higher than the 5.3% in Q1’2022, mainly attributable to the elevated food and fuel prices in the period under review. Notably, the prices of super petrol increased by Kshs 2.0 in March 2023, to Kshs 179.3 per litre representing a 1.1% year-to-date increase, while diesel and kerosene remained unchanged at Kshs 162.0 and Kshs 149.5 per litres from what was recorded at the beginning of the year. Below is the chart showing the inflation trend for the last five years:

March 2023 Inflation

The year on year inflation rate in the month of March 2023 remained constant at 9.2%, from what was recorded in the month of February 2023, while the monthly inflation rate for March 2023 was 0.8%. It was against our expectation of an ease within a range of 8.6%-9.0%. The headline inflation was largely driven by increase in prices of commodities in the following categories, food and non-alcoholic beverages; housing, water, electricity, gas and other fuels; and transport. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – March 2023 |

|||

|

Broad Commodity Group |

Price change m/m (February-2023/March-2023) |

Price change y/y (Mach-2022/March-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

1.6% |

13.4% |

The m/m increase was mainly driven by increase in price commodities such as cabbages, carrots, potatoes, kales, and fortified maize flour. The increase was, however, mitigated by drop in prices of commodities such onions, cooking oil and tomatoes |

|

Housing, Water, Electricity, Gas and Other Fuel |

0.6% |

7.5% |

The m/m change was mainly due to increase in prices of electricity, cooking gas and monthly house rent |

|

Transport cost |

0.3% |

12.6% |

The m/m change was mainly due to increase in prices of super petrol |

|

Overall Inflation |

0.8% |

9.2% |

The m/m was mainly driven by 1.6% increase in prices of food and non-alcoholic Beverages |

Inflationary pressures in the country remain worryingly above the Central Bank of Kenya target range of 2.5%-7.5% for a tenth consecutive month to March 2023, with commodities under food and non-alcoholic beverages being the largest contributors of inflation. The sustained inflationary pressures continue despite the monetary policy committee intervening with subsequent hikes in the Central Bank Rate, raising the CBR rate by a cumulative of 200.0 bps since July 2022 to 9.50% in March 2023. Notably, in move to combat food inflation the government through the Kenya Revenue Authority issued an exemption on duty to Kenya National Trading Corporation for importation of cooking oil, rice, beans and sugar. The state agency will sell the commodities directly to shops, reducing the long value chain that consequentially make commodities expensive. The importation of duty free commodities is also expected to increase competition among other local manufacturers and producers, forcing them to lower prices of commodities.

Going forward, we expect inflationary pressures in the country to persist in the short term due to high fuel and electricity prices following the scaling down of fuel subsidies as well as higher electricity tariffs. However, we expect food inflationary pressures to ease in the medium term following the expected long rains in the coming months. Furthermore, we are of the view that the eventual slowdown in inflationary pressures is largely pegged on how quickly the elevated global inflationary pressure ease.

The Kenyan Shilling:

The Kenyan Shilling depreciated against the US Dollar by 7.3% in Q1’2023, to close at Kshs 132.3, from Kshs 123.4 at the end of 2022, partly attributable to increased dollar demand in the energy, oil and manufacturing sectors. Key to note, this is the lowest the Kenyan shilling has traded against the dollar. During the week, the Kenya Shilling depreciated against the US Dollar by 0.8% to close at 132.3 from 131.3 the previous week. We expect the shilling to remain under pressure in 2023 because of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand. The high crude oil prices have inflated Kenya’s import bill and as a result, petroleum products imports have continued to weigh heavily on the country’s import bill, and accounted for 27.6% of the total import bill in Q3’2022, up from 25.6% in Q2’2022 and much higher than 15.2% recorded in Q3’2021,

- An ever-present current account deficit projected at 5.4% of GDP in 2023 from the estimate of 4.9% of GDP in 2022,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

- A continued interest rate hikes in the USA and the Euro Area with the Fed and European Central Bank increasing their benchmark rates to 4.75%-5.00% and 3.50% respectively in March 2023, which has strengthened the dollar and sterling pound against other currencies following capital outflows from other global emerging markets.

However, the shilling is expected to be supported by:

- Diaspora remittances standing at a cumulative USD 658.6 mn in 2023 as of February 2023, albeit 0.3% lower than the USD 660.3 mn recorded over the same period in 2022, and,

- The tourism inflow receipts that came in at USD 268.1 bn in 2022, a significant 82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

Monetary Policy:

The Monetary Policy Committee (MPC) met on March 29th, 2023 to review the outcome of its previous policy decisions and recent economic developments, and to decide the direction of the Central Bank Rates (CBR). Notably, the MPC decided to raise the Central Bank Rate (CBR) by 75.0 bps to 9.50% from 8.75% in their January2023 sitting, in a bid to contain the elevated inflation rate, which came at 9.2% in March 2023, similar to what was recorded in February 2023, and 1.7% points above the CBK ceiling of 7.5%. The action to tighten the monetary policy was in line, although higher than our expectation of a 25.0 bps increase. Below are some of the key highlights from the meeting:

- Overall Inflation increased to 9.2% in February 2023 from 9.0% in January 2023 on the back of high food prices in the country. Food inflation rose to 13.3 percent in February from 12.8 percent in January, mainly due to increases in the prices of vegetables, attributed to erratic weather conditions witnessed in the period. Additionally, fuel inflation remained elevated at 13.8% in February 2023 attributable to scaling down of the fuel subsidy and high electricity prices due to higher tariffs. The MPC projected the inflation to remain elevated in the near term partly attributed to increases in electricity prices. However, the anticipated long rains are expected to moderate food inflation in the medium to long term,

- The MPC noted that leading economic indicators pointed to a strong performance of the Kenyan economy in the Q1’2023, reflecting robust activity in services sector particularly wholesale and retail trade, accommodation and food services among others. The economy is expected to remain resilient in 2023 supported by continued strong performance of the services sector and expected recovery in agriculture sector,

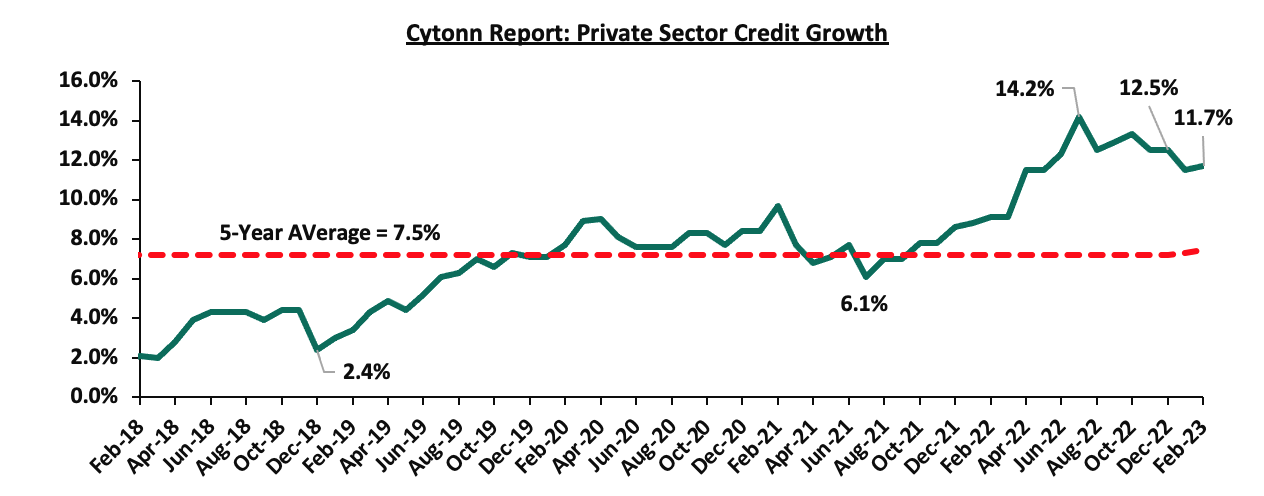

- Private sector credit growth stood at 11.7% in February 2023 compared to 12.7% in December 2022. Key sectors that recorded strong credit growth were transport and communication, manufacturing, consumer durables, and trade of 16.5%, 15.2%, 12.4%, and 11.8%. Consequentially, the number of loan application and approval declined reflecting, reduced demand. The chart below shows the movement of the private sector credit growth of the last five years.

Source: Central Bank of Kenya

- Goods exports remained strong having grown by 11.0% in the 12 months to February 2023 compared to 12.1% recorded in a similar period in 2022. Notably, receipts from tea and manufacturing goods exports increased by 13.4% and 27.2%, respectively during the period. The increase in receipts from tea exports is attributed to improved prices due to increased demand from traditional markets. In addition, imports grew by 2.1% in the 12 months to February 2023 compared to 27.3% growth recorded in a similar period in 2022, on the back of lower imports of infrastructure related equipment due to completion of major projects. Remittances stood at USD 4.0 bn in 12 months to February 2023, 4.9% higher than USD 3.8 bn recorded in a similar period in 2022. The current account deficit is projected at 5.4% of GDP in 2023 from the estimate of 4.9% of GDP in 2022, and,

- The banking sector remains resilient, stable, with strong liquidity, and capital adequacy ratios, despite the deterioration in asset quality. The gross non-performing loans to gross loans ratio increased to 14.0% in February 2023, compared to 13.3% in December 2022. The increase in non-performing loans was noted in sectors such as trade, personal and household, manufacturing and building and construction. However, banks have continued to make adequate provisioning for the NPLs.

The MPC concluded that following the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy, there was a need for further tightening of the monetary policy in order to anchor inflation within its target range of 2.5% to 7.5%. Going forward, we expect the inflationary pressures to endure in the short term mainly on the back of elevated fuel prices following the scaling down of fuel subsidies coupled with high electricity prices due to higher tariffs. Additionally, we expect inflationary pressures to persistent as a result of sustained depreciation of the Kenya shilling against the US dollar which continues to inflate the cost of importation and production, forcing manufacturers to transfer the cost to consumers through hike in prices. The Committee will meet again in May 2023, but will closely monitor the impact of the policy measures and remains ready to re-convene earlier if necessary.

Q1’2023 Highlights:

- Stanbic Bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of December picked up to a three-month high of 51.6, from 50.9 in November 2022, pointing towards a sustained improvement in the business environment for a fourth consecutive month. The rebound in business activity in the country was linked to factors such as increase in demand, favourable weather conditions and softer price pressures as firms saw input costs increase at the slowest rate in 12 months. For more information, please see our Cytonn Weekly #01/2023,

- The National Treasury gazetted the revenue and net expenditures for the first half of FY’2022/2023, ending 30th December 2022, highlighting that the total revenue collected as at the end of December 2022 amounted to Kshs 987.9 bn, equivalent to 92.3% of the prorated estimates of Kshs 1070.8 bn. For more information, please see our Cytonn Weekly #02/2023,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th January 2023 to 14th February 2023. Notably, fuel prices remained unchanged for the second consecutive month at Kshs 177.3, Kshs 162.0 and Kshs 145.9 per litres of Super Petrol, Diesel and Kerosene, respectively. For more information, please see our Cytonn Weekly #02/2023,

- The Kenya Revenue Authority released the draft regulations for the Excise Duty (Excisable Goods Management Systems)(Amendment) Regulations, 2023 having reviewed the previous Excise Duty (Excisable Goods Management Systems)(Amendment) Regulations, 2017, under the Excise Duty Act No. 23 of 2015, seeking to increase the stamp duty fees on various commodities. For more information, please see our Cytonn Weekly #03/2023, and,

- The National Treasury released the Draft 2023 Budget Policy Statement, projecting a 59.2% increase in tax revenue in the medium term to Kshs 4.0 tn by the end of FY’2026/27 from the Kshs 2.5 tn original FY’2022/23 budget estimates. For more information, please see our Cytonn Weekly #03/2023,

- The y/y inflation in January 2023 came at 9.0%, marginally easing from the 9.1% recorded in December 2022. This was against our expectations of an increase within a range of 9.2%-9.6%, driven by an expected increase in the Housing, water Electricity, Gas and other fuel index following the increase in electricity prices. For more information, please see our January 2023 Cytonn Monthly,

- The Monetary Policy Committee (MPC) met on January 30th, 2023 to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). The MPC retained the CBR rate at 8.75%, which was against our expectation of a 25.0 bps increase to 9.0%. For more information, please see our January 2023 Cytonn Monthly,

- Stanbic bank released its monthly Purchasing Managers Index (PMI), highlighting that the index for the month of January 2023 came in at 52.0, up from 51.6 recorded in December 2022, pointing towards a sustained improvement in the business environment for a fifth consecutive month. The improvement was largely attributable to rising demand levels, as well as improved operating conditions which boosted business confidence. For more information, please see our January 2023 Cytonn Monthly,

- The National Treasury presented the Supplementary Budget for FY’2022/23 to the National Assembly, seeking to slightly increase the gross total budget by 0.4% to Kshs 3,373.3 bn, from the previous estimates of Kshs 3,358.6 bn. Mainly due to an increase in the recurrent expenditure by 6.6% to Kshs 1,496.9 bn in the Supplementary estimates from Kshs 1,403.9 bn in the Original estimates. On the other hand, Development expenditure was set to reduce by 14.9% to Kshs 609.1 bn in the supplementary estimates from Kshs 715.4 bn in the original estimates. For more information, please see our Cytonn weekly #06/2023,

- The National Treasury gazetted the revenue and net expenditures for the seven months of FY’2022/2023, ending 31th January 2023. In addition, the National Treasury released the Final 2023 Budget Policy Statement, which was the first to be prepared under the new administration. This follows the release of the Draft of the 2023 Budget Policy Statement in January 2023. The policy statement stipulates the administration priority programs, policies and reforms to be implemented in the Medium-Term Expenditure Framework (MTEF). For more information, please see our Cytonn weekly #07/2023, and,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th February 2023 to 14th March 2023. Notably, fuel prices remained unchanged for the third consecutive month at Kshs 177.3, Kshs 162.0 and Kshs 145.9 per litres of Super Petrol, Diesel and Kerosene, respectively. For more information, please see our Cytonn weekly #07/2023,

- S&P Global Ratings downgraded Kenya’s outlook to negative from stable, signaling increased risks of defaults in debt repayments amid weakening liquidity position aggravated by sustained decline in foreign exchange reserves as well as high debt servicing obligations in the next fiscal year. Furthermore, the recent undersubscription of domestic bond issuances, as well as constrained access to international capital markets, have heightened Kenya’s medium term fiscal and external refinancing risks. For more information, please see our February 2023 Cytonn Monthly,

- The Kenya National Bureau of Statistics (KNBS) released the y/y inflation for February 2023, which came in at 9.2%, up from the 9.0% recorded in January 2023. This was in contrast to our expectations of an ease within a range of 8.6%-9.0%. For more information, please see our February 2023 Cytonn Monthly,

- Stanbic Bank Kenya released its monthly Purchasing Managers Index (PMI), highlighting that the index for the month of February 2023 came at 46.6, down from an 11-month high of 52.0 recorded in January 2023. This is the first time in six months that the index has registered below the 50.0 no change threshold, pointing towards a solid deterioration in operating conditions. For more information, please see our February 2023 Cytonn Monthly,

- The National Treasury gazetted the revenue and net expenditures for the eight months of FY’2022/2023, ending 28th February 2023. For more information, please see our Cytonn weekly #11/2023,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th March 2023 to 14th April 2023. Notably, prices of Super Petrol increased by Kshs 2.0 per litre to Kshs 179.3, while prices of Diesel and Kerosene remained unchanged for the fourth consecutive month at Kshs 162.0 and Kshs 145.9 per litres, respectively. For more information, please see our Cytonn weekly #11/2023, and,

- The Central Bank of Kenya announced the issuance of the Foreign Exchange Code (the FX Code) on 22nd March 2023 to commercial banks, in a move to regulate wholesale transactions of the foreign exchange market in Kenya.

During Q1’2023, T-bills were oversubscribed, with the overall subscription rate coming in at 135.8%, up from 108.5% in Q4’2022. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 217.8 bn against the offered of Kshs 48.0 bn, translating to an oversubscription rate of 453.5%, higher than 364.9% recorded the previous quarter. Overall subscriptions for the 182-day and 364-day papers increased to 95.1% and 49.5% from 65.9% and 48.5% in Q4’2022, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day and the 91-day papers increasing by 48.3 bps, 34.2 bps and 41.8 bps to 10.6%, 10.1% and 9.6%, from 10.1%, 9.7% and 9.2%, respectively, recorded in Q4’2022. The upward trajectory in the yields is mainly on the back of investors attaching higher risks with high inflation, currency depreciation and tight liquidity position hence the need to demand higher returns to cushion against the possible loss. The acceptance rate for the quarter increased to 91.8% from 81.3% in Q4’2022, with the government accepting a total of Kshs 351.9 bn of the Kshs 391.2 bn worth of bids received during the quarter.

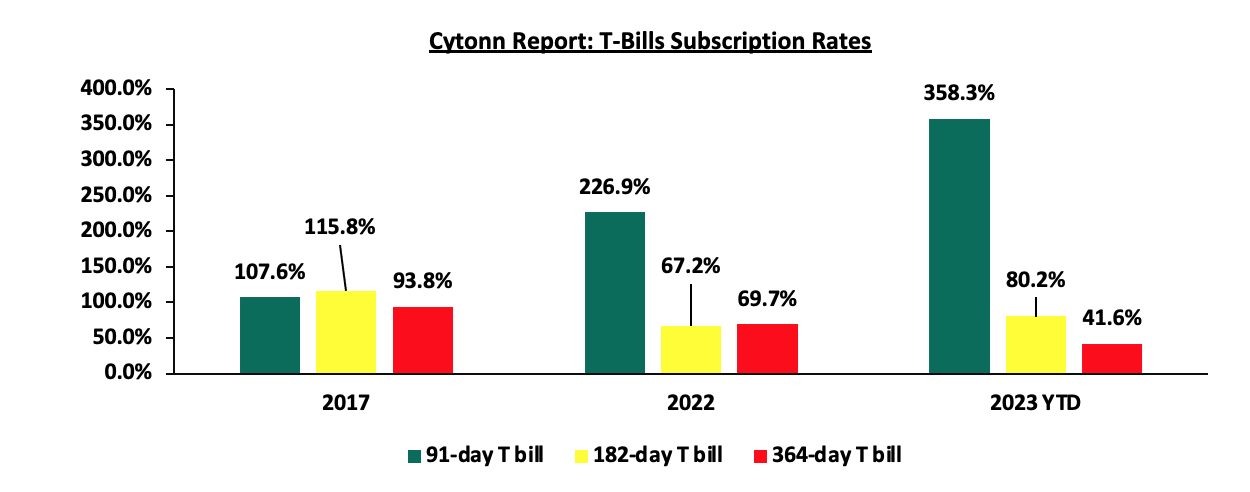

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 34.4%, a continued decline from the 49.2% recorded the previous week, attributable to persistent tightened liquidity in the money market evidenced by the average interbank rate increasing to 7.6% from 7.2% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 2.9 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 72.6%, significantly lower than the 179.4% recorded the previous week. Notably, the 182-day and 364-day papers recorded undersubscriptions of 35.5% and 18.1% from an undersubscription rate of 87.7% and 43.7%, respectively, recorded the previous week. The government accepted bids worth Kshs 8.0 bn and rejected Kshs 0.3 bn out of the total Kshs 8.3 bn bids received, translating to an acceptance rate of 97.2%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.3 bps, 5.5 bps and 7.8 bps to 10.8%, 10.4% and 9.9%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Primary T-bond auctions in Q1’2023:

In Q1’2023, the government issued one new Treasury bond and one infrastructure bond, re-opened three and offered five of them on tap sale, seeking to raise Kshs 190.0 bn. The bonds were generally undersubscribed, receiving bids worth Kshs 164.1 bn against the offered Kshs 190.0 bn, translating to a subscription rate of 86.4%. The government was keen on rejecting expensive bids and thus accepted only Kshs 141.7 bn of the Kshs 164.1 bn worth of bids received, translating to an acceptance rate of 86.4%. The table below provides more details on the bonds issued during the quarter:

|

Cytonn Report: Q1’2023 T-bonds auction results |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

16/01/2023 |

FXD1/2020/005 (re-opened) |

2.4 |

11.7% |

50.0 |

31.5 |

41.6 |

12.9% |

83.3% |

75.7% |

|

FXD1/2022/015 (re-opened) |

14.3 |

13.9% |

14.3% |

||||||

|

20/01/2023 |

FXD1/2020/005 - Tapsale |

2.4 |

11.7% |

10.0 |

17.6 |

18.0 |

13.9% |

180.2% |

97.8% |

|

FXD1/2022/015 - Tapsale |

14.3 |

13.9% |

14.2% |

||||||

|

13/02/2023 |

FXD1/2017/10 (re-opened) |

4.4 |

13.0% |

50.0 |

16.7 |

19.5 |

13.9% |

38.9% |

86.1% |

|

FXD1/2023/10 |

10.0 |

14.2% |

14.2% |

||||||

|

20/02/2023 |

FXD1/2020/005 - Tapsale |

4.4 |

13.0% |

10.0 |

12.2 |

12.5 |

13.9% |

124.6% |

97.9% |

|

FXD1/2022/015 - Tapsale |

10.0 |

14.2% |

14.2% |

||||||

|

8/3/2023 |

IFB1/2023/017 |

17.0 |

14.4% |

50.0 |

50.9 |

59.8 |

14.4% |

119.5% |

85.1% |

|

IFB1/2023/017-Tapsale |

17.0 |

14.4% |

20.0 |

12.7 |

12.7 |

14.4% |

63.6% |

100.0% |

|

|

Q1'2023 Total |

|

|

190.0 |

141.7 |

164.1 |

|

|

|

|

|

Q1'2023 Average |

9.6 |

13.4% |

31.7 |

23.6 |

27.3 |

14.0% |

101.7% |

90.4% |

|

|

Q4'2022 Average |

12.9 |

13.6% |

37.8 |

26.9 |

31.2 |

13.8% |

110.8% |

87.3% |

|

Source: CBK

Secondary Bond Market Activity:

- Bond Turnover

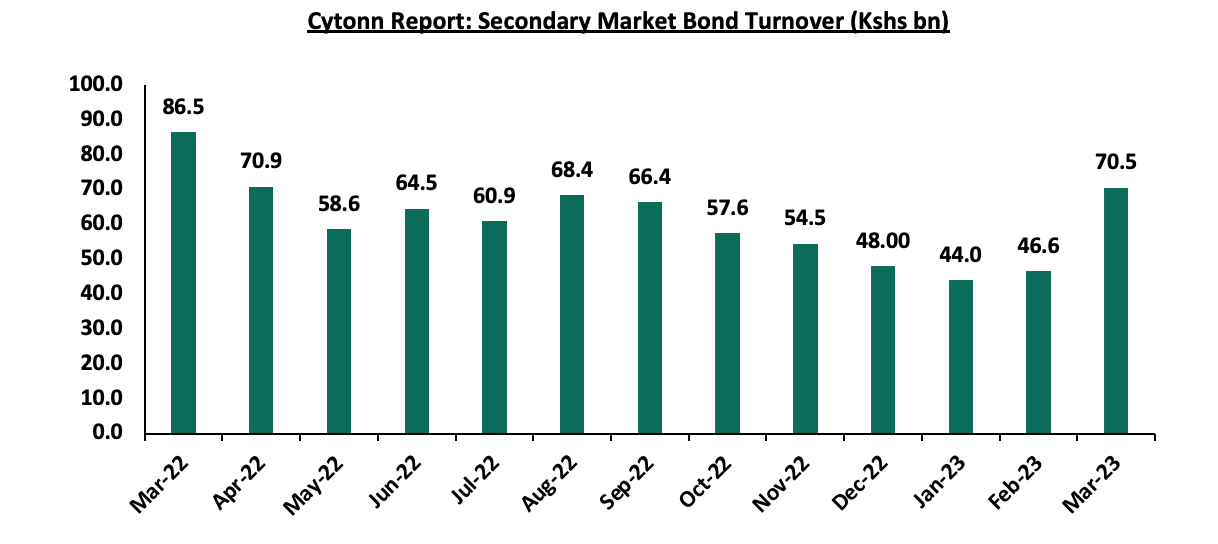

In the secondary bond market, activity increased slightly, with the turnover increasing by 0.7% to Kshs 161.1 bn, from Kshs 160.1 bn in Q4’2022, partially attributable to the increased allocation to treasury bonds by local institutional investors as they sought for higher yield in the market. The chart below shows the bond turnover over the last one year:

- Yield Curve

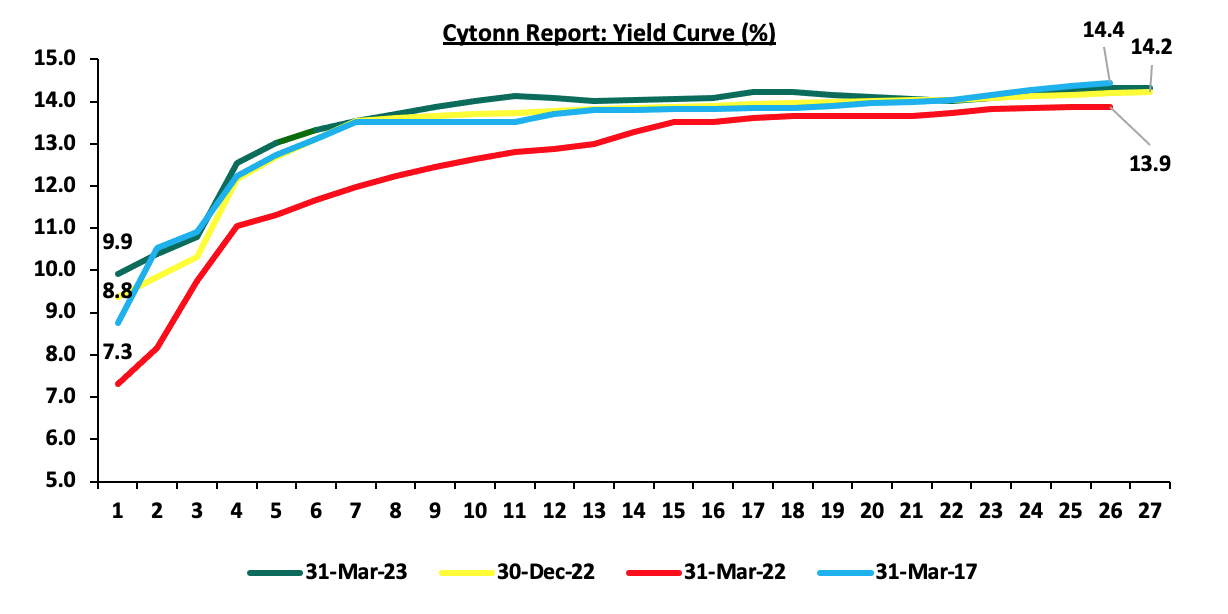

The yield curve was on an upward trajectory in Q1’2023 with a notable increase in the yields on all bonds, however the shorter end of the yield curve increased more than the longer end, signaling a flatter curve, hence reflecting short-term risk sentiments. The chart below shows the yield curve movement during the quarter;

Money Market Performance

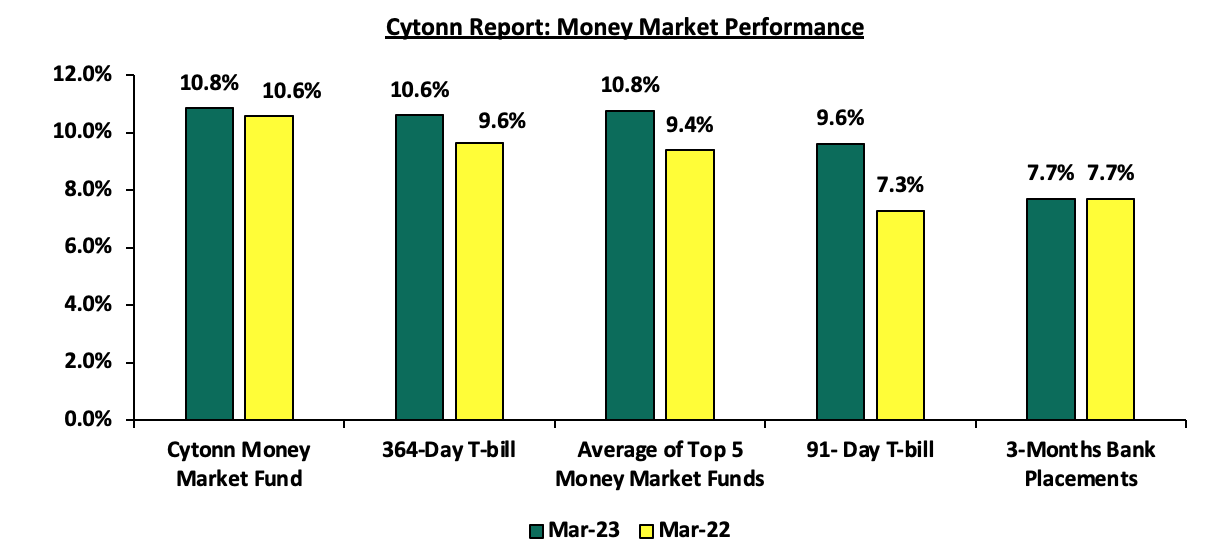

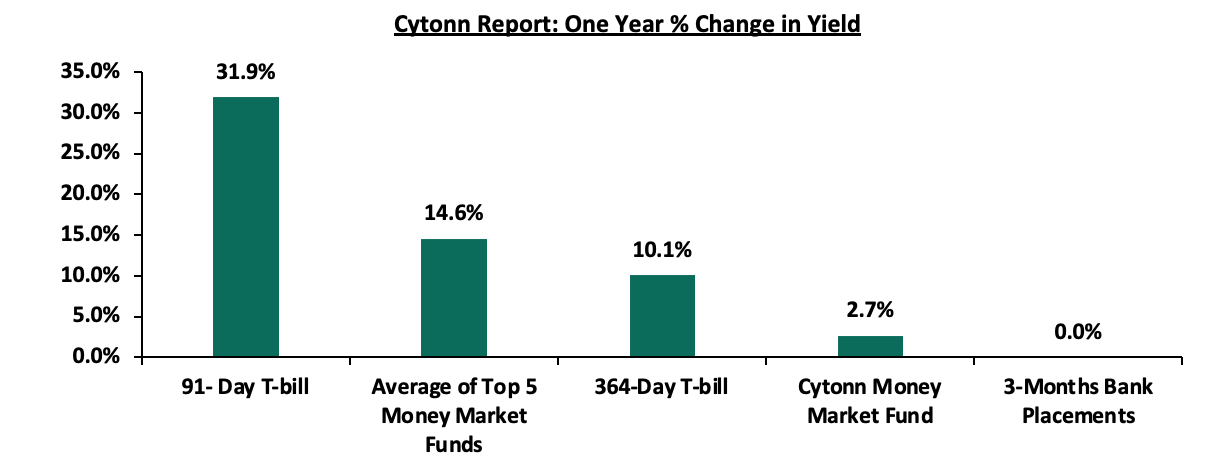

The 3-month bank placements recorded 7.7% as at the end of Q1’2023, similar to what was recorded at the end of Q1’2022 (based on what we have been offered by various banks). The average yield on the 91-day T-bill and the average Top 5 Money Market Funds increased by 2.3% points and 1.4% points to 9.6% and 10.8% in Q1’2023 from 7.3% and 9.4% in Q1’2022, respectively. The average yield on the Cytonn Money Market (CMMF) increased by 0.2% points to 10.8% in Q1’2023 from 10.6% in Q1’2022.

Notably, in the past one year, the yield on 91-day T-bill increased the most, recording an increase of 31.9% followed by average of Top 5 Money Market Funds which recorded a 14.6% change. However, the 3-months bank placement remained constant recording no percentage change during the period. The chart below shows the one year percentage change in yields of various asset classes:

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 31st March 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 31st March 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

11.10% |

|

2 |

Madison Money Market Fund |

10.84% |

|

3 |

Jubilee Money Market Fund |

10.73% |

|

4 |

Apollo Money Market Fund |

10.59% |

|

5 |

Dry Associates Money Market Fund |

10.52% |

|

6 |

Old Mutual Money Market Fund |

10.18% |

|

7 |

NCBA Money Market Fund |

10.16% |

|

8 |

Nabo Africa Money Market Fund |

10.11% |

|

9 |

Kuza Money Market fund |

10.10% |

|

10 |

Zimele Money Market Fund |

9.91% |

|

11 |

AA Kenya Shillings Fund |

9.88% |

|

12 |

Sanlam Money Market Fund |

9.80% |

|

13 |

KCB Money Market Fund |

9.79% |

|

14 |

Co-op Money Market Fund |

9.78% |

|

15 |

GenCap Hela Imara Money Market Fund |

9.65% |

|

16 |

GenAfrica Money Market Fund |

9.44% |

|

17 |

CIC Money Market Fund |

9.33% |

|

18 |

British-American Money Market Fund |

9.18% |

|

19 |

ICEA Lion Money Market Fund |

8.93% |

|

20 |

Orient Kasha Money Market Fund |

8.93% |

|

21 |

Mali Money Market Fund |

8.67% |

|

22 |

Absa Shilling Money Market Fund |

8.64% |

|

23 |

Equity Money Market Fund |

6.73% |

Liquidity:

In Q1’2023, liquidity in the money market tightened, evidenced by the 1.4% points increase in the average interbank rate to 6.5%, from 5.1% the previous quarter, partly attributable to tax remittances that outweighed government payments, consequently leading to reduced liquidity in the money market as more money were paid to the government compared to maturities payments. As such, the interbank rate rose due to high demand with low liquidity in the market. The tightened liquidity is also attributable to the tightened monetary policy, with the MPC rate being hiked by 75.0 bps to 9.50 in March 2023 from 8.75% in January 2023. The average volumes traded in the interbank market increased by 6.3% to Kshs 226.7 bn, from Kshs 213.2 bn recorded in Q4’2022.

During the week, liquidity in the money markets continued to tighten, with the average interbank rate increasing to 7.6% from 7.2% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 12.6% to Kshs 22.0 bn from Kshs 25.1 bn recorded the previous week.

Kenya Eurobonds:

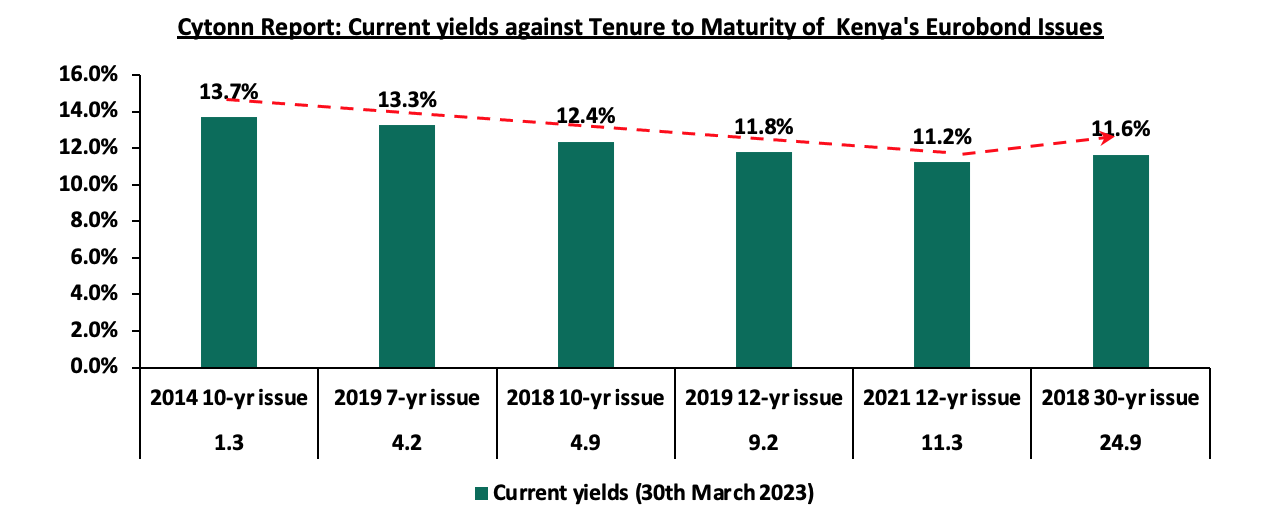

During Q1’2023, the yields on Eurobonds were on an upward trajectory, with the 7-year Eurobond issued in 2019 increasing the most, having increased by 2.4% points to 13.3% from 10.9% recorded in Q4’2022. The increase in yields is partly attributable to increased perceived risks in the economy amid the country’s dwindling forex reserves raising concerns on the country’s ability to meet its debt obligations. The continued currency depreciation and the elevated inflationary pressures are affecting investors’ sentiments hence the need to cushion against possible losses.

During the week, the yields on Eurobonds were on a downward trajectory with the yields on the 10-year Eurobond issued in 2018, 12-year Eurobond issued in 2019 and 12-year Eurobond issued in 2021 declining the most, having declined by 0.5% points each to 13.7%, 11.8% and 11.2% from 14.2%, 12.3% and 11.7% recorded the previous week. The decline followed an announcement by the Permanent Secretary to the National Treasury that the government is keen on prioritizing the payment of debt obligations and had settled all debt due in March 2023 amounting to Kshs 150.0 bn. The table below shows the summary of the performance of the Kenyan Eurobonds as of 30th March 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

2014 |

2018 |

2019 |

2021 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

0.9 |

1.2 |

1.0 |

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

30-Dec-22 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.8% |

|

23-Mar-23 |

14.2% |

12.8% |

12.0% |

13.7% |

12.3% |

11.7% |

|

24-Mar-23 |

14.7% |

13.1% |

12.1% |

14.1% |

12.6% |

11.8% |

|

27-Mar-23 |

14.4% |

13.1% |

12.1% |

14.0% |

12.6% |

11.7% |

|

28-Mar-23 |

14.5% |

13.2% |

12.2% |

14.4% |

12.6% |

11.8% |

|

29-Mar-23 |

14.3% |

12.9% |

12.1% |

14.3% |

12.5% |

11.6% |

|

30-Mar-23 |

13.7% |

12.4% |

11.6% |

13.3% |

11.8% |

11.2% |

|

Weekly Change |

(0.5%) |

(0.4%) |

(0.4%) |

(0.4%) |

(0.5%) |

(0.5%) |

|

Q/Q Change |

0.8% |

1.9% |

0.7% |

2.4% |

1.0% |

1.4% |

|

YTD Change |

0.8% |

1.9% |

0.8% |

2.3% |

1.0% |

1.4% |

Source: Central Bank of Kenya (CBK) and National Treasury

The chart below compares the current yields to the tenure to maturity of the various Eurobond issuances by Kenya, highlighting that the shorter-tenure issuances have higher yields as compared to the long-tenure Eurobonds, attributable to servicing concerns;

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 17.3% ahead of its prorated borrowing target of Kshs 322.3 bn having borrowed Kshs 378.2 bn of the new domestic borrowing target of Kshs 425.1 bn as per the February 2023 revised domestic borrowing target for FY’2022/23. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at February 2023 coming in at Kshs 1.3 tn in the FY’2022/2023, equivalent to 59.8% of its target of Kshs 2.1 tn and 89.7% of the prorated target of Kshs 1.4 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During Q1’2023, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 11.5%, 3.2% and 5.4%, respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as Safaricom, Bamburi, KCB Group, and NCBA Group of 25.1%, 11.0%, 6.8% and 6.7%, respectively. The losses were however mitigated by gains recorded by banking stocks such as Standard Chartered Bank (SCBK), Co-operative Bank, ABSA Bank and NCBA Group of 19.1%, 6.9%, 4.1% and 2.5%, respectively.

Equities turnover increased by 151.6% during the quarter to USD 348.4 mn, from USD 138.4 mn in Q4’2022. Foreign investors remained net sellers during the quarter, with a net selling position of USD 41.0 mn, from a net selling position of USD 40.1 mn recorded in Q4’2022.

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 1.2%, 3.7% and 4.8%, respectively, taking the YTD performance to losses of 11.4%, 3.2%, and 5.5% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as Equity Group, NCBA, BAT Group and ABSA Bank of 17.7%, 12.1%, 9.1% and 7.6%, respectively. The gains were however weighed down by losses recorded by other large stocks such as Safaricom and EABL of 4.2% and 0.4% respectively.

During the week, equities turnover declined by 93.3% to USD 13.3 mn from USD 197.0 mn recorded the previous week taking the YTD turnover to USD 348.4 mn. Foreign investors remained net sellers, recording a net selling position of USD 3.4 mn, from a net selling position of USD 1.6 mn recorded the previous week, taking the YTD net selling position to USD 41.0 mn.

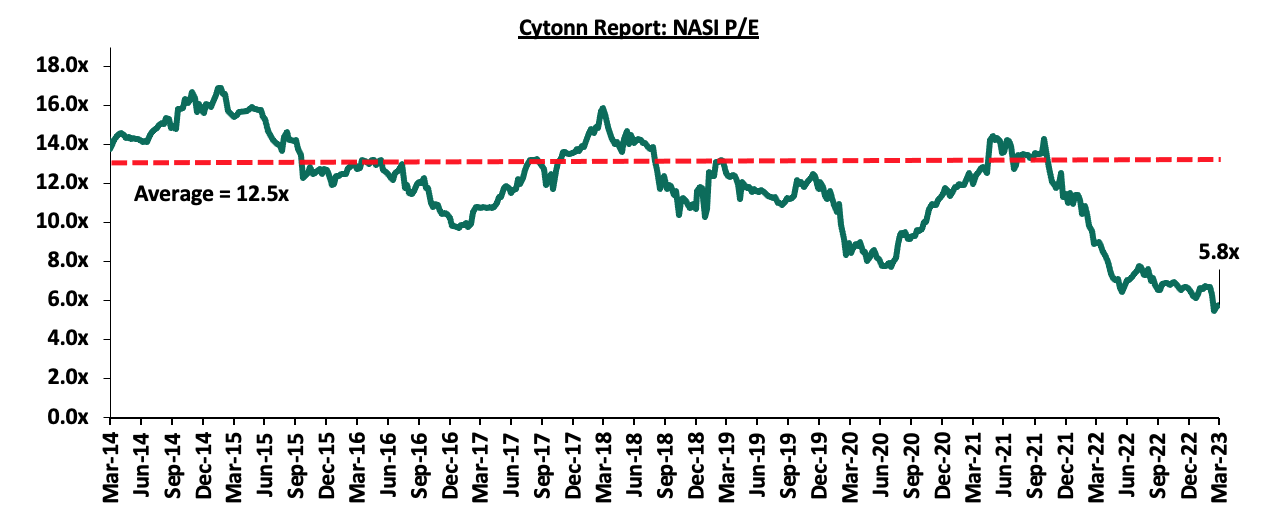

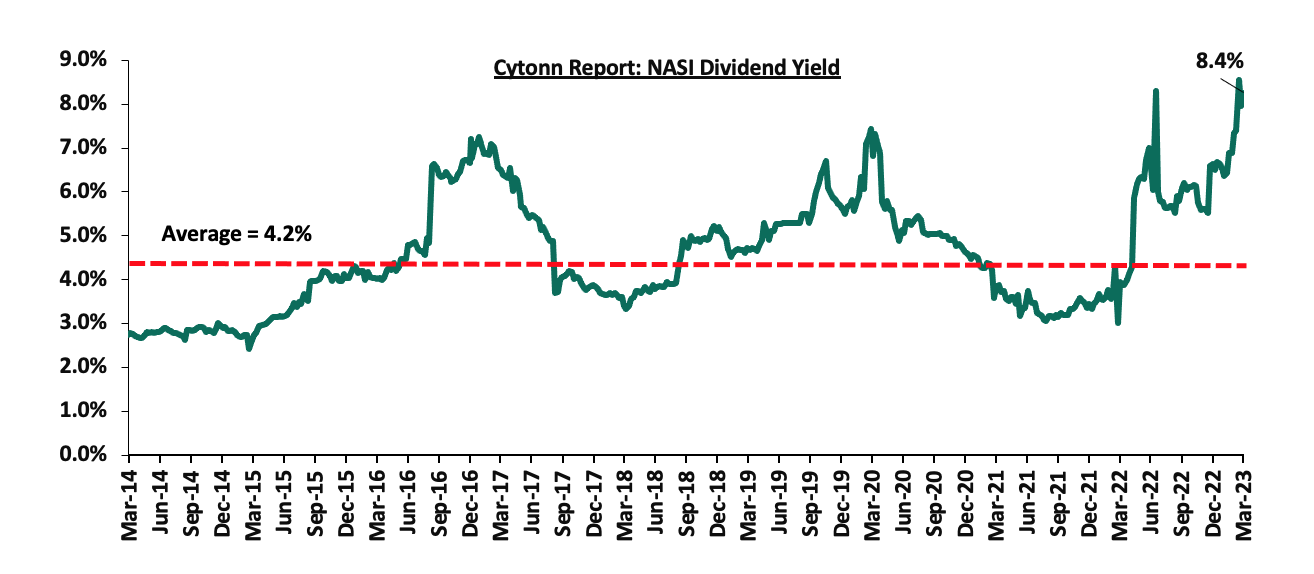

The market is currently trading at a price to earnings ratio (P/E) of 5.8x, 53.6% below the historical average of 12.5x. The dividend yield stands at 8.4%, 4.2% points above the historical average of 4.2%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Earnings Releases

During the first quarter of 2023, listed banks in Kenya released their FY’2022 results, recording an increase in their earnings growth, with their average core Earnings per share (EPS) recording a weighted average growth of 26.5%, compared to a weighted average growth of 83.2% in FY’2021. The performance is however largely skewed by the strong EPS growth from HF Group, Diamond Trust Bank of Kenya and NCBA Group of 138.9%, 53.9% and 34.8%, respectively.

- Equity Group Holdings Plc FY’2022 performance

During the week, Equity Group Holdings Plc released their FY’2022 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

FY’2021 (Kshs bn) |

FY’2022 (Kshs bn) |

y/y change |

|

Government Securities |

228.5 |

219.2 |

(4.1%) |

|

Net Loans and Advances |

587.8 |

706.6 |

20.2% |

|

Total Assets |

1,304.9 |

1,447.0 |

10.9% |

|

Customer Deposits |

959.0 |

1,052.2 |

9.7% |

|

Deposits per Branch |

2.8 |

3.0 |

4.4% |

|

Total Liabilities |

1,128.7 |

1,264.8 |

12.1% |

|

Shareholders’ Funds |

169.2 |

176.2 |

4.2% |

|

Balance Sheet Ratios |

FY’2021 |

FY’2022 |

% points y/y change |

|

Loan to Deposit Ratio |

61.3% |

67.2% |

5.9% |

|

Gov’t Securities to Deposit Ratio |

23.8% |

20.8% |

(3.0%) |

|

Return on average equity |

26.6% |

26.7% |

0.1% |

|

Return on average assets |

3.5% |

3.4% |

(0.1%) |

|

Income Statement |

FY’2021 (Kshs bn) |

FY’2022 (Kshs bn) |

y/y change |

|

Net Interest Income |

68.8 |

86.0 |

25.0% |

|

Net non-Interest Income |

44.6 |

59.9 |

34.5% |

|

Total Operating income |

113.4 |

145.9 |

28.7% |

|

Loan Loss provision |

(5.8) |

(15.4) |

163.7% |

|

Total Operating expenses |

(61.5) |

(86.1) |

40.0% |

|

Profit before tax |

51.9 |

59.8 |

15.3% |

|

Profit after tax |

40.1 |

46.1 |

15.1% |

|

Core EPS |

10.6 |

12.2 |

15.1% |

|

Income Statement Ratios |

FY’2021 |

FY’2022 |

% points y/y change |

|

Yield from interest-earning assets |

9.3% |

10.0% |

0.7% |

|

Cost of funding |

2.7% |

2.9% |

0.2% |

|

Cost of risk |

5.2% |

10.6% |

5.4% |

|

Net Interest Margin |

6.8% |

7.2% |

0.4% |

|

Net Interest Income as % of operating income |

60.7% |

58.9% |

(1.8%) |

|

Non-Funded Income as a % of operating income |

39.3% |

41.1% |

1.8% |

|

Cost to Income Ratio |

54.2% |

59.0% |

4.8% |

|

Cost to Income Ratio without LLP |

49.1% |

48.4% |

(0.7%) |

|

Cost to Assets |

4.8% |

5.1% |

0.3% |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% Points Change |

|

Core Capital/Total Liabilities |

14.2% |

16.9% |

2.7% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

- |

|

Excess |

6.2% |

8.9% |

2.7% |

|

Core Capital/Total Risk Weighted Assets |

12.9% |

15.6% |

2.7% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

- |

|

Excess |

2.4% |

5.1% |

2.7% |

|

Total Capital/Total Risk Weighted Assets |

17.7% |

20.2% |

2.5% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

- |

|

Excess |

3.2% |

5.7% |

2.5% |

|

Liquidity Ratio |

63.4% |

52.1% |

(11.3%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

- |

|

Excess |

43.4% |

32.1% |

(11.3%) |

|

Adjusted core capital/ total deposit liabilities |

14.2% |

16.9% |

2.7% |

|

Adjusted core capital/ total risk weighted assets |

12.9% |

15.6% |

2.7% |

|

Adjusted total capital/ total risk weighted assets |

17.7% |

20.2% |

2.5% |

Key Take-Outs:

Earnings Growth- Core earnings per share increased by 15.1% to Kshs 12.2 in FY’2022, from Kshs 10.6 recorded in FY’2021, higher than our projections of a 10.1% increase to Kshs 11.7. The performance was driven by a 28.7% growth in total operating income to Kshs 145.9 bn, from Kshs 113.4 bn in FY’2021 higher than our projections of 25.1%. However, the performance was weighed down by the 40.0% growth in total operating expenses to Kshs 86.1 bn, from Kshs 61.5 bn in FY’2021,

Equity Group’s directors recommended a final dividend per share of Kshs 4.0 in FY’2022, representing a dividend yield of 8.8% as at 31st March 2023. The dividends recommended represent a 33.3% increase from dividend per share of Kshs 3.0 paid in FY’2021. Additionally, the dividend payout ratio increased to 33.6% in FY’2022, from 28.9% in FY’2021,

Increased profitability as a result of Group’s Geographical diversification- The Group’s geographical diversification strategy has continued to emerge as a net positive, with the bank’s various subsidiaries in Uganda, DRC, Rwanda, Tanzania, and South Sudan cumulatively contributing 30.0% to the bank’s total profitability and 44.0% to the group’s total asset base. Cumulatively, the group’s subsidiaries, excluding Equity Bank Kenya Ltd, recorded an 61.1% growth in their Profit after Tax (PAT) to Kshs 12.7 bn, from Kshs 7.9 bn in FY’2021, with the Equity Bank South Sudan recording the highest year on year growth of 1381.0% in PAT to Kshs 2.3 bn from a loss of Kshs 0.2 bn in FY’2021, mainly driven by favorable operating business environment following reduction in political instability in the country. However, concerns remain high on the high NPL levels in the group’s Tanzanian subsidiary of 18.9% and we expect the group to improve its credit assessment in the country to bring down the high NPL ratio,

Increased Provisioning – The Group increased its Loans Loss Provision (LLPs) by 163.7% to Kshs 15.4 bn in FY’2022, from Kshs 5.8 bn recorded in FY’2021 aimed at mitigating increased credit risk on the back of the elevated inflationary pressures. Additionally, the NPL coverage increased to 70.5%, from 68.7% in FY’2021 as a result of the 13.9% increase in general provisions, coupled with a 39.2% increase in interest in suspense which outpaced the 17.2% growth in Gross non-performing loans. We expect the high provisioning to cushion the Group against high credit risk on the tough operating business environment which has curtailed recovery in some sectors locally and the high NPL ratios in some of the group’s subsidiaries,

Improved Lending – FY’2022 was characterized by a 20.2% growth in loans with investments in government securities declining by 4.1%, highlighting the Group’s strategy to increase lending despite the tough operating business environment. Notably, the Group diversified risk by extending credit to various sectors in the economy with high lending recorded in sectors such as trade, personal household, and real estate at 23.0%, 22.0% and 14.0%, respectively.

For a comprehensive analysis, please see our Equity Group Holding Plc’s FY’2022 Earnings Note

- NCBA Group FY’2022 performance

During the week, NCBA Group released their FY’2022 financial results. Below is a summary of NCBA Group FY’2022 performance:

|

Balance Sheet Items (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Net Loans and Advances |

244.0 |

278.9 |

14.3% |

|

Government Securities |

196.1 |

205.4 |

4.8% |

|

Total Assets |

591.1 |

619.7 |

4.8% |

|

Customer Deposits |

469.9 |

502.7 |

7.0% |

|

Deposits per Branch |

4.5 |

5.8 |

29.4% |

|

Total Liabilities |

513.1 |

537.2 |

4.7% |

|

Shareholders’ Funds |

77.9 |

82.4 |

5.9% |

|

Balance Sheet Ratios |

FY’2021 |

FY’2022 |

y/y change |

|

Loan to Deposit Ratio |

51.9% |

55.5% |

3.6% |

|

Gov’t Securities to Deposit Ratio |

41.7% |

40.9% |

(0.8%) |

|

Return on average equity |

13.6% |

17.2% |

3.6% |

|

Return on average assets |

1.8% |

2.3% |

0.4% |

|

Income Statement (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Net Interest Income |

27.0 |

30.7 |

13.5% |

|

Net non-Interest Income |

22.1 |

30.3 |

36.8% |

|

Total Operating income |

49.2 |

60.9 |

24.0% |

|

Loan Loss provision |

12.7 |

13.1 |

2.7% |

|

Total Operating expenses |

33.4 |

37.9 |

13.4% |

|

Profit before tax |

15.0 |

22.5 |

49.6% |

|

Profit after tax |

10.2 |

13.8 |

34.8% |

|

Core EPS |

6.2 |

8.4 |

34.8% |

|

Dividend Per Share |

3.0 |

4.3 |

41.7% |

|

Dividend payout ratio |

48.3% |

50.8% |

2.5% |

|

Income Statement Ratios |

FY’2021 |

FY’2022 |

Y/Y Change |

|

Yield from interest-earning assets |

9.8% |

10.1% |

0.3% |

|

Cost of funding |

4.2% |

4.3% |

0.1% |

|

Net Interest Spread |

5.6% |

5.7% |

0.1% |

|

Net Interest Margin |

5.7% |

5.9% |

0.2% |

|

Cost of Risk |

25.9% |

21.4% |

(4.5%) |

|

Net Interest Income as % of operating income |

55.0% |

50.3% |

(4.7%) |

|

Non-Funded Income as a % of operating income |

45.0% |

49.7% |

4.7% |

|

Cost to Income Ratio |

68.1% |

62.2% |

(5.9%) |

|

Cost to Income Ratio without LLP |

42.2% |

40.8% |

(1.4%) |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% points change |

|

Core Capital/Total Liabilities |

16.8% |

16.3% |

(0.5%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

- |

|

Excess |

8.8% |

8.3% |

(0.5%) |

|

Core Capital/Total Risk Weighted Assets |

19.0% |

18.4% |

(0.6%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

- |

|

Excess |

8.5% |

7.9% |

(0.6%) |

|

Total Capital/Total Risk Weighted Assets |

19.1% |

18.4% |

(0.7%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

- |

|

Excess |

4.6% |

3.9% |

(0.7%) |

|

Liquidity Ratio |

61.7% |

53.2% |

(8.5%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

41.7% |

33.2% |

(8.5%) |

|

Adjusted core capital/ total deposit liabilities |

17.5% |

16.6% |

(0.9%) |

|

Adjusted core capital/ total risk weighted assets |

19.8% |

18.8% |

(1.1%) |

|

Adjusted total capital/ total risk weighted assets |

19.9% |

18.8% |

(1.1%) |

Key Take-Outs:

Earnings Growth- Core earnings per share rose by 34.8% to Kshs 8.4 from Kshs 6.2 in FY’2021, slightly higher than our expectations of a 31.8% increase to Kshs 8.2, with the variance stemming from the 24.0% increase in total operating income which was higher than our projection of a 13.5% increase. The performance was driven by a 24.0% increase in total operating income to Kshs 60.9 bn, from Kshs 49.2 bn in FY’2021, which outpaced the 13.4% increase in the total operating expenses to Kshs 37.9 bn in FY’2022, from Kshs 33.4 bn in FY’2021,

NCBA Group board recommended the payment of a final dividend for the year of Kshs 2.25 per share which added to the interim dividend of Kshs 2.00 per share paid on 30th September 2022, bringing the total dividend for the year 2022 to Kshs 4.25 per share, and a dividend yield of 11.8% as at 31st March 2023. The total dividends for FY’2022 represent a 41.7% increase from the total dividend of Kshs 3.00 per share paid in 2021. Additionally, the dividend payout ratio increased to 50.8%, from 48.3% in FY’2021,

Growth in non-funded income – The total non-funded income grew by 36.8% to Kshs 30.3 bn in FY’2022 from Kshs 22.1 bn in FY’2021, which was higher than the 13.5% increase in net interest income. The growth was mainly driven by a 147.1% increase in foreign exchange income to Kshs 12.5 bn from Kshs 5.1 bn in FY’2021 attributed to increased demand for the dollar amid widening margins. As such, the revenue mix for funded to non-funded income shifted to 50:50 from 55:45, and,

Improvement in Asset Quality – The group’s asset quality improved, with the NPL ratio improving by 3.0% points to 13.0% from 16.0% in FY’2021, owing to the 11.7% decline in gross non-performing loans to Kshs 39.1 bn in FY’2022 from Kshs 44.3 bn in FY’2021, while gross loans increased by 9.1% to Kshs 301.8 bn in FY’2022 from 276.7 bn in FY’2021. However, the NPL ratio increase on a q/q from 12.6% recorded in Q3’2022. The y/y decline in gross non-performing loans is an indication of reducing credit risk in the bank loan portfolio.

For a comprehensive analysis, please see our NCBA Group’s FY’2022 Earnings Note

- Diamond Trust Bank Kenya’s FY’2022 performance

During the week, Diamond Trust Bank Kenya released their FY’2022 financial results. Below is a summary of the performance:

|

Balance Sheet Items (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Government Securities |

124.3 |

131.5 |

5.8% |

|

Net Loans and Advances |

220.4 |

253.7 |

15.1% |

|

Total Assets |

456.8 |

527.0 |

15.4% |

|

Customer Deposits |

331.5 |

387.6 |

16.9% |

|

Deposits per Branch |

2.6 |

3.0 |

16.0% |

|

Total Liabilities |

382.3 |

449.3 |

17.5% |

|

Shareholders’ Funds |

67.3 |

69.0 |

2.5% |

|

Balance Sheet Ratios |

FY’2021 |

FY’2022 |

y/y change |

|

Loan to Deposit Ratio |

66.5% |

65.5% |

(1.0%) |

|

Gov’t Securities to Deposit Ratio |

37.5% |

33.9% |

(3.6%) |

|

Return on average equity |

6.8% |

10.0% |

3.2% |

|

Return on average assets |

1.0% |

1.4% |

0.4% |

|

Income Statement (Kshs bn) |

FY’2021 |

FY’2022 |

y/y change |

|

Net Interest Income |

20.0 |

22.9 |

14.5% |

|

Non-Interest Income |

6.3 |

9.1 |

43.5% |

|

Total Operating income |

26.3 |

31.9 |

21.4% |

|

Loan Loss provision |

7.6 |

7.1 |

(5.5%) |

|

Total Operating expenses |

19.9 |

22.1 |

11.1% |

|

Profit before tax |

6.6 |

9.5 |

43.8% |

|

Profit after tax |

4.4 |

6.8 |

53.9% |

|

Earnings per share (Kshs) |

15.8 |

24.3 |

53.9% |

|

Income Statement Ratios |

FY’2021 |

FY’2022 |

Y/Y Change |

|

Yield from interest-earning assets |

8.7% |

9.2% |

0.5% |

|

Cost of funding |

3.9% |

4.3% |

0.4% |

|

Net Interest Spread |

4.8% |

5.0% |

0.2% |

|

Net Interest Income as % of Total Income |

76.0% |

71.7% |

(4.3%) |

|

Non-Funded Income as a % of Total Income |

24.0% |

28.3% |

4.3% |

|

Cost to Income |

75.6% |

69.1% |

(6.5%) |

|

Cost to Income Ratio without provisions |

46.9% |

46.8% |

(0.1%) |

|

Cost to Assets |

4.5% |

4.5% |

- |

|

Net Interest Margin |

5.1% |

5.3% |

0.2% |

|

Capital Adequacy Ratios |

FY’2021 |

FY’2022 |

% points change |

|

Core Capital/Total deposit Liabilities |

22.0% |

21.1% |

(0.9%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

- |

|

Excess |

14.0% |

13.1% |

(0.9%) |

|

Core Capital/Total Risk Weighted Assets |

19.9% |

19.8% |

(0.1%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

- |

|

Excess |

9.4% |

9.3% |

(0.1%) |

|

Total Capital/Total Risk Weighted Assets |

21.2% |

20.7% |

(0.5%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

- |

|

Excess |

6.7% |

6.2% |

(0.5%) |

|

Liquidity Ratio |

61.6% |

58.2% |

(3.4%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

- |

|

Excess |

41.6% |

38.2% |

(3.4%) |

|

Adjusted Core Capital/Total Deposit Liabilities |

22.1% |

21.1% |

(1.0%) |

|

Adjusted Core Capital/Total Risk Weighted Assets |

20.0% |

19.8% |

(0.2%) |

|

Adjusted Total Capital/Total Risk Weighted Assets |

21.3% |

20.7% |

(0.6%) |

Key Take-Outs:

Earnings Growth - Core earnings per share increased by 53.9% to Kshs 24.3 in FY’2022, from Kshs 15.8 in FY’2021, higher than our projections of 51.3% increase to Kshs 23.9 per share. The performance was driven by a 21.4% increase in total operating income to Kshs 31.9 bn in FY’2022, from Kshs 26.3 bn in FY’2021. However, the growth was weighed down by the 11.1% increase in the total operating expenses to Kshs 22.1 bn in FY’2022, from Kshs 19.9 bn in FY’2021,

DTB-K’s directors recommended a first and final dividend per share of Kshs 5.0 in FY’2022, representing a dividend yield of 10.8% as at 31st March 2023. The dividends recommended represents a 66.7% increase from dividend per share of Kshs 3.0 paid in FY’2021. Additionally, the dividend payout ratio increased to 20.6% in FY’2022, from 19.0% in FY’2021, and,

Improved Asset Quality – The group’s asset quality improved, with the NPL ratio improving to 12.0% in FY’2022, from 12.9% in FY’2021, owing to the faster 15.3% growth in gross loans, which outpaced the 7.2% increase in gross non-performing loans to Kshs 32.2 bn, from Kshs 30.1 bn in FY’2021. The improvement in asset quality is attributable to proactive credit management strategies leading to increased loan repayment and the declining credit risk in the Kenya’s banking sector, with sector’s gross NPLs to gross loans ratio improving to 13.3% in Q4’2022 from 13.7% in Q3’2022, and,

For a comprehensive analysis, please see our Diamond Trust Bank Kenya’s FY’2022 Earnings Note

- I&M Group FY’2022 performance