Kenya’s Private Sector Credit Growth, & Cytonn Weekly #45/2022

By Cytonn Research, Nov 13, 2022

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 204.5%, an increase from the 181.9% recorded the previous week. The oversubscription was partly attributable to investor’s preference for the shorter dated papers as they sought to avoid duration risk coupled with the ample liquidity in the money market with the average interbank rate easing to 4.2% from 4.6% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 26.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 662.8%, up from 463.8% recorded the previous week. The subscription rates for the 182-day paper also increased to 138.9% from 83.4%, while the subscription rate of the 364-day paper declined to 86.8% from 167.6%, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 7.7 bps, 1.5 bps and 3.4 bps to 10.2%, 9.7% and 9.2%, respectively. In the Primary Bond Market, the Central Bank of Kenya released the results for the newly issued infrastructure bond; IFB1/2022/14 highlighting that the bond recorded an oversubscription of 153.1%;

During the week, the International Monetary Fund (IMF) announced that it had reached a staff level agreement with Kenyan authorities on the fourth review of the 38-months Extended Fund Facility (EFF) and Extended Credit Facility (ECF) financing for Kenya which will allow Kenya to access financing of USD 433.0 bn (Kshs 52.7 bn) once the formal review is completed;

Equities

During the week, the equities market recorded mixed performance with NASI gaining by 0.4% while NSE 20 and NSE 25 declined by 0.5% and 0.2% respectively, taking YTD performance to losses of 23.3%, 12.9% and 17.8% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was mainly driven by gains recorded by banking stocks such as ABSA Bank and NCBA Group of 2.6% and 1.9%, respectively and Safaricom of 1.8%. The gains were however weighed down by losses recorded by large stocks such as EABL, Equity Group, Bamburi and KCB Group of 4.3%, 1.3%, 1.2%, and 1.1% respectively;

Also during the week, Safaricom Plc released its H1’2023 financial results for the period ending 30th September 2022, highlighting that the profit after tax declined by 18.6% to Kshs 30.2 bn, from 37.1 bn recorded in H1’2022;

Real Estate

During the week, Real Estate developer Hass Consult released it’s House Price Index Q3’2022 Report highlighting that y/y Nairobi residential house prices appreciated by 10.3% in Q3’2022. Additionally, Knight Frank, a Real Estate consulting firm released the Prime Global Cities Index Q3’2022 Report highlighting that the average selling prices of houses in sampled prime cities globally recorded a capital appreciation of 6.6% quarter on quarter (q/q) and 6.1% year on year (y/y),

In the residential sector, the County Government of Nakuru announced plans to complete the construction of 605 affordable housing units by December 2023. Additionally, student housing developer Acorn Holdings received Kshs 1.8 bn from the sale of Qwetu Aberdare Heights I hostel located in Ruaraka,

In the retail sector, Carrefour Supermarket, a French based retail chain opened a new store at Comet House along Monrovia Street. In the Mixed-Use Developments (MUD’s) sector, Mi Vida Homes announced plans to begin the construction of two projects at Garden City in April 2022; the 2nd phase of their mid-market apartments dubbed Amaiya, and, affordable housing units dubbed 237 Garden City,

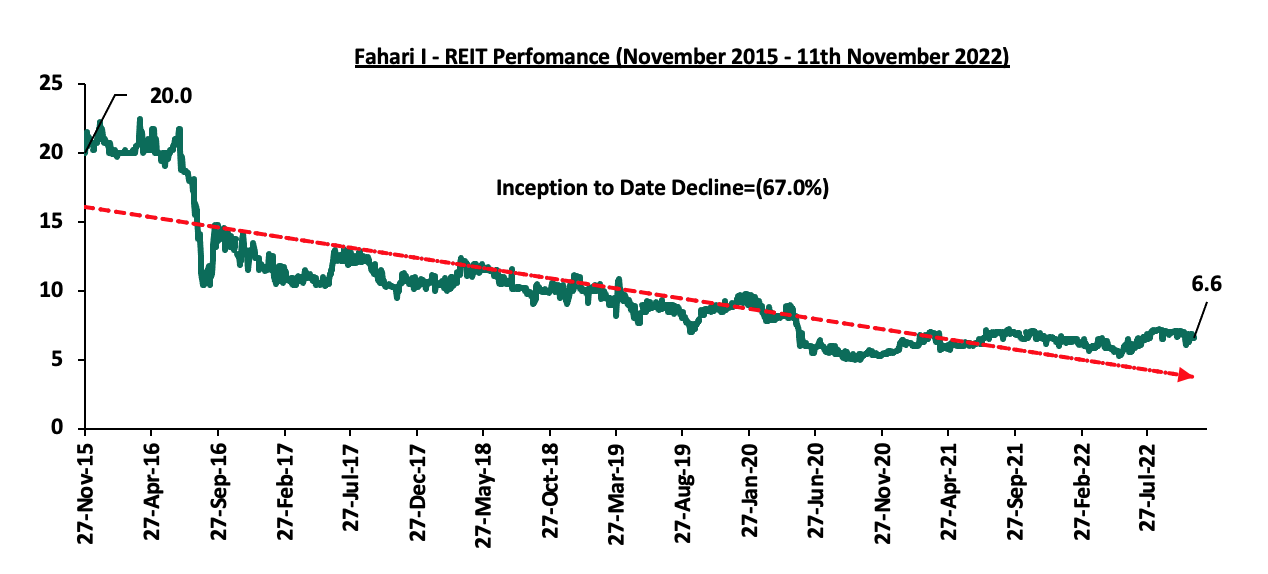

For Real Estate Investment Trusts (REITs), Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share on the Nairobi Stock Exchange, while Acorn D-REIT and I-REIT closed the week trading at Kshs 23.8 and Kshs 20.8 per unit, respectively, on the Unquoted Securities Platform as at 7th October 2022;

Focus of the Week

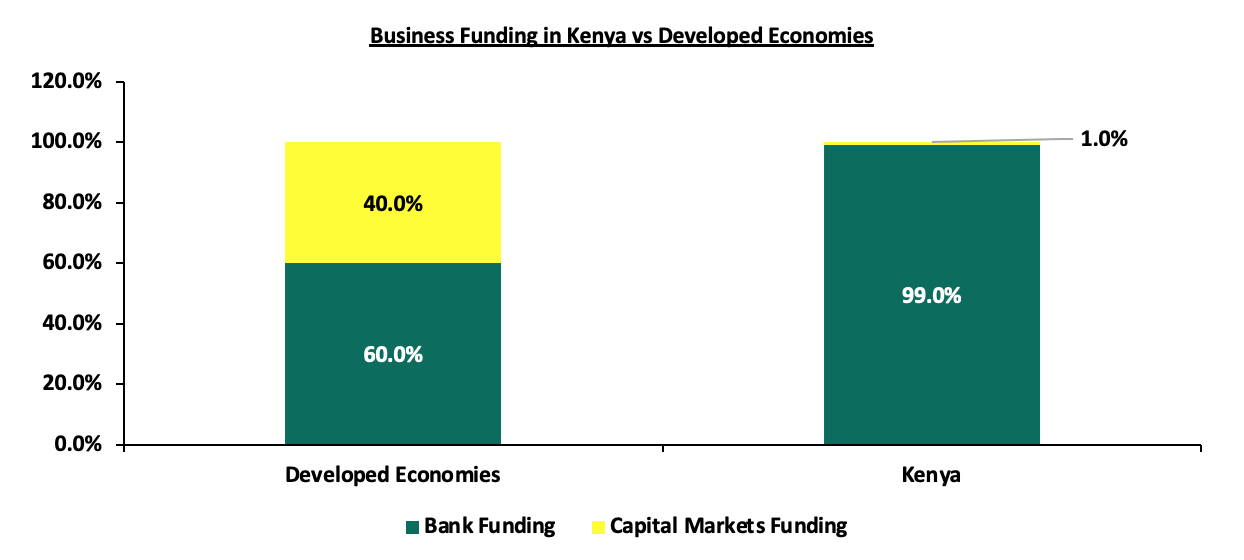

In Kenya, like every other country in the world, adequate credit to the private sector plays an important role in economic growth by ensuring that there is efficient allocation of resources for investment. Subsequently, for an economy to function well, there should exist alternative sources to provide private sector credit, and the government through its regulatory and legislative arms should provide an enabling environment for businesses to grow and providers of capital to compete. In Kenya, the main provider of capital to businesses is the Banking sector, estimated to provide 99.0%, while alternative sources provide a combined 1.0%. Private sector credit from the banking sector currently stands at Kshs 3.3 tn, equivalent to approximately 26.1% of the GDP. This continues to lag behind other advanced economies such as USA and Japan where the Private sector credit to GDP ratio stood at 216.0% and 192.8% respectively in 2020. Closer to home, in economies such as Mauritius, the Private sector credit as a percentage of GDP stood at 95.9% in 2020. From the above, it is clear that Kenya has some work to do to bridge the gap in Private sector credit. As such, we saw it fit to cover a topical on the private sector credit growth to shade light on the evolution, current state of lending to the private sector and give our recommendations on what can be done to improve credit access to the private sector;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.7%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 14.0% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com

During the week, T-bills remained oversubscribed, with the overall subscription rate coming in at 204.5%, an increase from the 181.9% recorded the previous week. The oversubscription was partly attributable to investor’s preference for the shorter dated papers as they sought to avoid duration risk coupled with the ample liquidity in the money market with the average interbank rate easing to 4.2% from 4.6% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 26.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 662.8%, up from 463.8% recorded the previous week. The subscription rates for the 182-day also increased to 138.9% from 83.4%, while the subscription rate of the 364-day paper declined to 86.8% from 167.6%, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing by 7.7 bps, 1.5 bps and 3.4 bps to 10.2%, 9.7% and 9.2%, respectively.

In the Primary Bond Market, the Central Bank of Kenya released the auction results for the newly issued infrastructure bond; IFB1/2022/14 with an effective tenor to maturity of 14 years. As per our expectations, the bond recorded an oversubscription of 153.1%, partly attributable to the ample liquidity in the market and the attractive tax-free nature of the infrastructure bond. The government issued the bond seeking to raise Kshs 60.0 bn for funding of infrastructure projects in the FY’2022/2023, received bids worth Kshs 91.8 bn and accepted bids worth Kshs 75.6 bn, translating to an 82.3% acceptance rate. The coupon rate and the weighted average yield for the bond both came in at 13.9%.

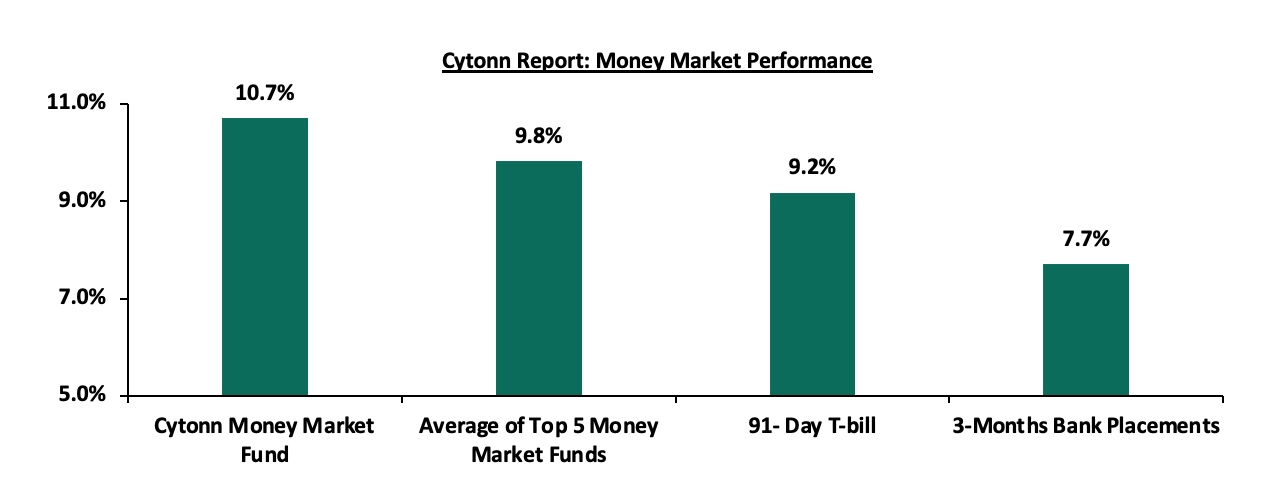

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 3.4 bps to 9.2%. The average yields of the Top 5 Money Market Funds and the Cytonn Money Market Fund remained unchanged at 9.8% and 10.7%, respectively.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 11th November 2022:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 11th November 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.7% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Sanlam Money Market Fund |

9.6% |

|

4 |

GenCap Hela Imara Money Market Fund |

9.5% |

|

5 |

Nabo Africa Money Market Fund |

9.4% |

|

6 |

NCBA Money Market Fund |

9.4% |

|

7 |

Madison Money Market Fund |

9.4% |

|

8 |

Dry Associates Money Market Fund |

9.3% |

|

9 |

Old Mutual Money Market Fund |

9.3% |

|

10 |

Apollo Money Market Fund |

9.2% |

|

11 |

Co-op Money Market Fund |

9.2% |

|

12 |

CIC Money Market Fund |

9.1% |

|

13 |

British-American Money Market Fund |

9.0% |

|

14 |

AA Kenya Shillings Fund |

8.8% |

|

15 |

ICEA Lion Money Market Fund |

8.6% |

|

16 |

Orient Kasha Money Market Fund |

8.5% |

|

17 |

Absa Shilling Money Market Fund |

7.7% |

|

18 |

Equity Money Market Fund |

5.4% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets eased, with the average interbank rate declining to 4.2% from 4.6% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded declined by 42.3% to Kshs 11.6 bn from Kshs 20.2 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, an indication of declining risk concerns over the economy. The yield on the 7-year Eurobond issued in 2019 declined the most by 3.1% points to 11.3% from 14.4% recorded in the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 10th November 2022;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

03-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

31-Oct-22 |

15.6% |

13.9% |

13.2% |

14.7% |

14.1% |

12.7% |

|

03-Nov-22 |

15.7% |

13.6% |

13.2% |

14.4% |

13.9% |

12.5% |

|

04-Nov-22 |

15.4% |

13.4% |

12.9% |

13.7% |

13.8% |

12.1% |

|

07-Nov-22 |

14.8% |

13.1% |

12.8% |

13.7% |

13.5% |

11.5% |

|

08-Nov-22 |

13.1% |

12.5% |

12.0% |

12.1% |

12.3% |

11.2% |

|

09-Nov-22 |

13.0% |

11.8% |

11.8% |

11.9% |

11.9% |

10.8% |

|

10-Nov-22 |

12.8% |

11.5% |

11.6% |

11.3% |

11.6% |

10.1% |

|

Weekly Change |

(2.9%) |

(2.1%) |

(1.6%) |

(3.1%) |

(2.3%) |

(2.4%) |

|

MTD Change |

(2.8%) |

(2.3%) |

(1.6%) |

(3.4%) |

(2.5%) |

(2.5%) |

|

YTD Change |

8.4% |

3.5% |

3.5% |

5.7% |

4.9% |

3.5% |

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.2% against the US dollar to close the week at Kshs 121.8, from Kshs 121.5 recorded the previous week, partly attributable to increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 7.6% against the dollar, higher than the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 5.3% of GDP in the 12 months to September 2022, same as what was recorded in a similar period in 2021,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 68.1% of Kenya’s External debt was US Dollar denominated as of July 2022, and,

- A continued hike in the United States of America Federal interest rates in 2022 to a range of 3.75%-4.00% in November 2022 has strengthened the dollar against other currencies and has caused capital outflows from the Kenyan market.

The shilling is however expected to be supported by:

- Improved diaspora remittances standing at a cumulative USD 4.0 bn as of September 2022, representing a 13.3% y/y increase from USD 3.5 bn recorded over the same period in 2021, and,

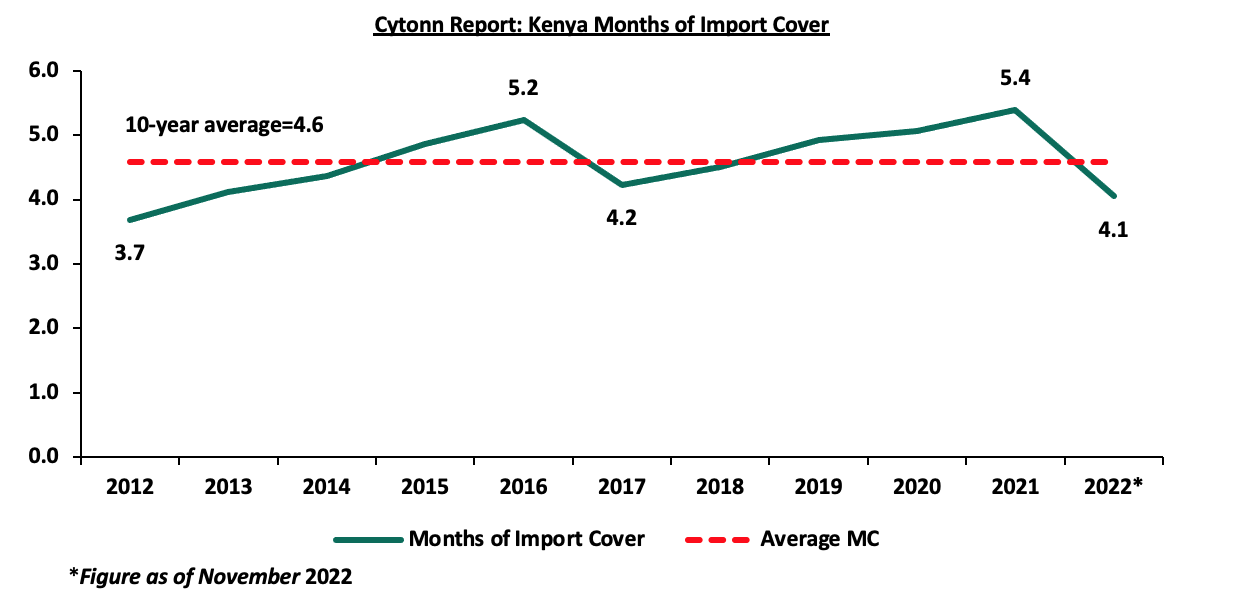

- Sufficient Forex reserves currently at USD 7.2 bn (equivalent to 4.1 months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, however it’s important to note that Forex reserves have dropped by 17.5% YTD from USD 8.8 bn. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years;

Weekly Highlight:

Kenya’s International Monetary Fund (IMF) Loan facility

During the week, the International Monetary Fund (IMF) announced that it had reached a staff level agreement with Kenyan authorities on the fourth review of the 38-months Extended Fund Facility (EFF) and Extended Credit Facility (ECF) financing for Kenya. Upon completion of the formal approval by IMF management, Kenya will access the fifth tranche of USD 433.0 mn (Kshs 52.7 bn) of the approved loan facility totaling to USD 2.3 bn (Kshs 284.8 bn) that was announced in April 2021, and this will bring the amount received from the facility to a total of USD 1.6 bn (Kshs 199.7 bn). Notably, this would be the biggest tranche Kenya has received so far from the loan facility, and is aimed to continue supporting the recovery of the economy, while also covering the financing needs arising from the impact of ravaging drought in the country, as well as the challenging conditions to access external debt. The IMF commended Kenya’s economic resilience despite the challenging economic environment supported by better debt management policies, strong tax revenue, which as a percentage of Gross Domestic Product (GDP) increased to 13.7% in the year ended June 2022 from 12.6% achieved in the previous year, and the measures taken by the new administration to reduce fiscal deficit such as removal of fuel and electricity subsidies. The table below shows the funding the government has received so far out of the original amount:

|

Cytonn Report: International Monetary Fund (IMF) EFF and ECF Financing Programme |

||

|

Date |

Amount Received (USD mn) |

Amount Received (Kshs bn, 1 USD= Kshs 121.7) |

|

Apr-21 |

307.5 |

37.4 |

|

Jun-21 |

407.0 |

49.5 |

|

Dec-21 |

258.1 |

31.4 |

|

Jul-22 |

235.6 |

28.7 |

|

Nov-22 |

*433.0 |

52.7 |

|

Total Amount Received |

1641.2 |

199.7 |

|

Amount Pending |

698.8 |

85.1 |

|

*Expected funds upon IMF management and executive board approval |

||

The financing support comes at a time when the country aims to optimize the use of concessional loans and reduce the use of the costly commercial loans through its Medium Term Debt Strategy, and the new administration’s plans to cut on public expenditure to reduce the fiscal deficit, which is projected to be 6.2% of the country’s Gross Domestic Product (GDP) in FY2022/2023, with a view of further reducing it to 4.3% of GDP in the FY 2023/2024. According to the National Treasury, the total public debt stood at Kshs 8.6 tn as of July 2022, with IMF’s total financing to Kenya coming in at Kshs 234.2 bn as of July 2022, representing 12.0% of the total multilateral debt. The receipt of the USD 433.0 bn funds is also expected to increase the country’s foreign exchange reserves which have dropped by 17.5% year to date to USD 7.2 bn from USD 8.8 bn recorded in the beginning of the year and consequently help support the Kenyan shilling from further depreciation, having depreciated by 7.6% year to date. Furthermore, the financing is also expected to boost the country’s import cover, which has declined to 4.1 months of import cover, currently slightly above the statutory requirements of 4 months, as of 11th November 2022 from 5.4 months in 2021. Going forward, IMF noted that there is need to continue with structural and governance reforms, which includes openness and transparency in government contracts, and reforms in the financially troubled enterprises such as the Kenya Airways and the Kenya Power and Lighting Company (KPLC), which have continued to accumulate high levels of debt, necessitating financial assistance from the government.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 14.6% ahead of its prorated borrowing target of Kshs 214.1 bn having borrowed Kshs 245.4 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 486.0 bn in the FY’2022/2023, equivalent to a 22.7% of its target of Kshs 2.1 tn. Despite the performance, we believe that the projected budget deficit of 6.2% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to finance some of the government projects and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance with NASI gaining by 0.4% while NSE 20 and NSE 25 declined by 0.5% and 0.2% respectively, taking YTD performance to losses of 23.3%, 12.9% and 17.8% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was mainly driven by gains recorded by stocks such as ABSA Bank, NCBA Group and Safaricom of 2.6%, 1.9% and 1.8%, respectively. The gains were however weighed down by losses recorded by large stocks such as EABL, Equity Group, Bamburi and KCB Group of 4.3%, 1.3%, 1.2%, and 1.1% respectively;

During the week, equities turnover increased by 6.1% to USD 9.7 mn from USD 9.2 mn recorded the previous week, taking the YTD turnover to USD 723.0 mn. Additionally, foreign investors remained net sellers, with a net selling position of USD 2.2 mn, from a net selling position of USD 0.8 mn recorded the previous week, taking the YTD net selling position to USD 186.2 mn.

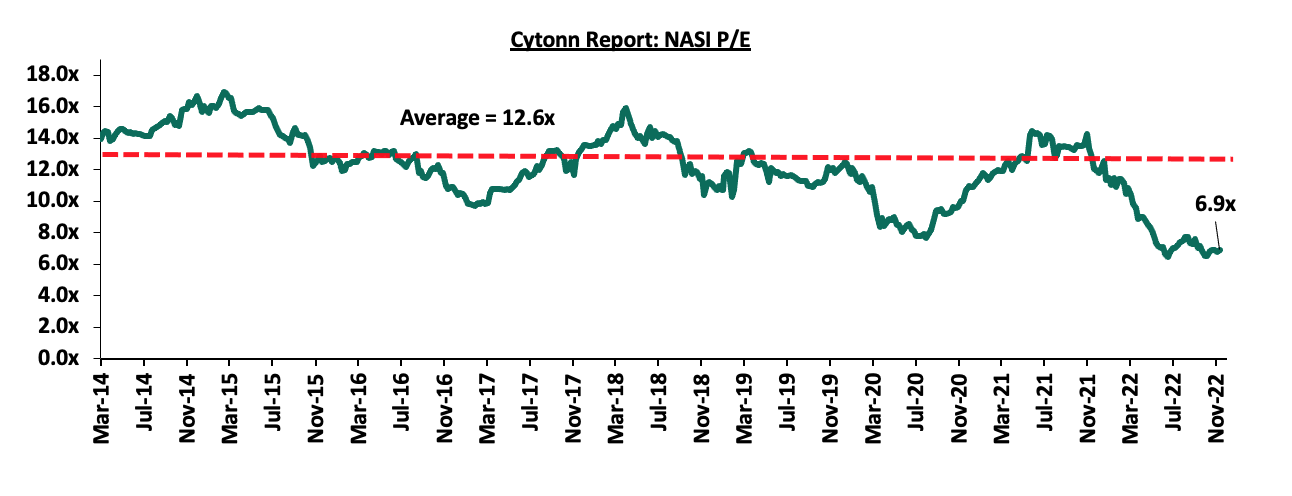

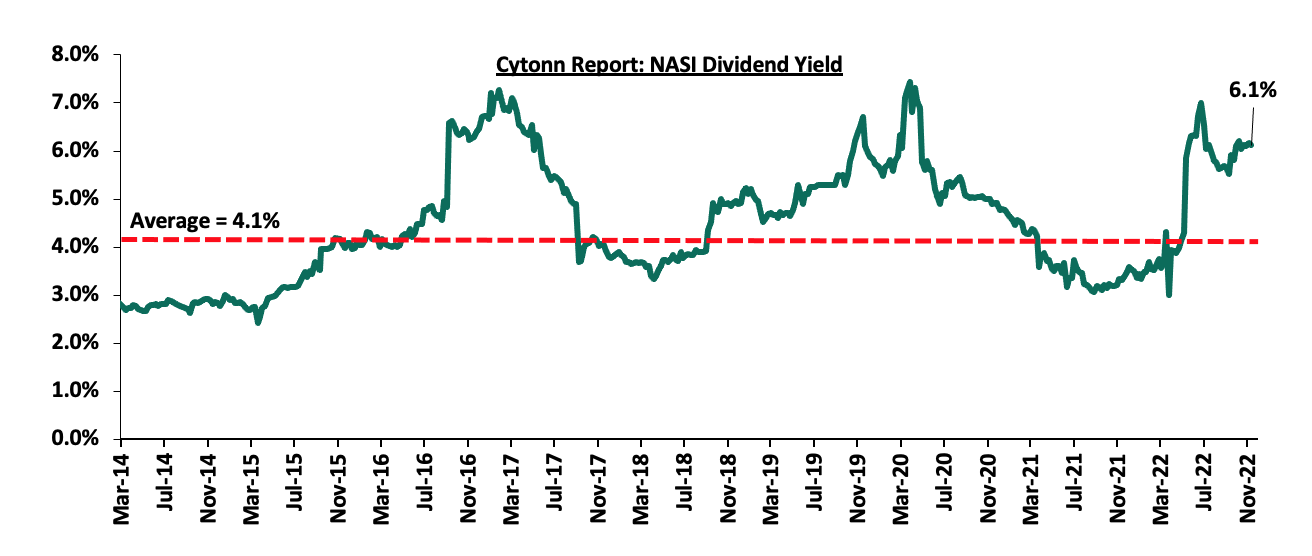

The market is currently trading at a price to earnings ratio (P/E) of 6.9x, 45.3% below the historical average of 12.6x, and a dividend yield of 6.1%, 2.0% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Weekly Highlight:

Safaricom H1’2023 Financial Performance

During the week, Safaricom Plc released its H1’2023 financial results for the period ending 30th September 2022, highlighting that the profit after tax declined by 18.6% to Kshs 30.2 bn, from 37.1 bn recorded in H1’2022, largely attributable to a 32.2% increase in operating expenses to Kshs 31.0 bn from Kshs 23.4 bn recorded in H1’2022 due to commencement of operations in Ethiopia. The tables below shows the breakdown of the group’s financial statements from the report;

|

Cytonn Report: Safaricom PLC H1’2023 Summarised Income statement |

|||

|

Income Statement |

H1'2022 |

H1'2023 |

Y/Y Change |

|

Kshs (bn) |

Kshs (bn) |

||

|

Total Revenue |

146.4 |

153.4 |

4.8% |

|

Operating Costs |

(69.0) |

(79.4) |

15.1% |

|

EBITDA |

77.4 |

74.0 |

(4.4%) |

|

Depreciation & Amortization |

(19.5) |

(22.8) |

16.9% |

|

Net Finance and other costs |

(3.2) |

(3.0) |

(6.3%) |

|

Profit before income tax |

54.7 |

48.2 |

(11.9%) |

|

Income tax expense |

(17.6) |

(18.0) |

2.3% |

|

Profit after Tax |

37.1 |

30.2 |

(18.6%) |

Source: Safaricom H1’FY22/23 financial report

|

Cytonn Report: Safaricom PLC H1’2023 Summarised Balance Sheet |

|||

|

Balance Sheet |

H1'2022 |

H1'2023 |

Y/Y Change |

|

Kshs (bn) |

Kshs (bn) |

||

|

Current Assets |

65.3 |

68.1 |

4.3% |

|

Non-Current Assets |

281.5 |

311.3 |

10.6% |

|

Total Assets |

346.8 |

379.4 |

9.4% |

|

Current liabilities |

98.2 |

112.2 |

14.3% |

|

Non-Current liabilities |

68.9 |

80.4 |

16.7% |

|

Total Liabilities |

167.1 |

192.6 |

15.3% |

|

Total Equity |

179.7 |

186.8 |

4.0% |

Source: Safaricom H1’FY22/23 financial report

Key take outs from the report include;

- Total revenue increased by 4.8% to Kshs 153.4 bn in H1’2023 from Kshs 146.4 bn recorded in H1’2022. The increase in revenue was majorly driven by 4.6% increase in service revenue to Kshs 144.8 bn from Kshs 138.4 bn recorded in H1’2022 with MPESA revenue and mobile data revenue increasing by 8.8% and 11.3% to Kshs 56.9 bn and Kshs 26.3 bn in H1’2023 from Kshs 52.3 bn and Kshs 23.6 bn recorded in H1’2022, respectively,

- Earnings Before interest, taxes, depreciation & amortization (EBITDA) declined by 4.4% to Kshs 74.0 bn from Kshs 77.4 bn recorded in H1’2022, largely attributable to a 32.2% increase in operating expenses to Kshs 30.9 bn from Kshs 23.4 bn recorded in H1’2022, and,

- Net finance and other cost recorded a y/y increase of 6.3% to Kshs 3.0 bn from Kshs 3.2 bn recorded in H1’2022.

Additionally, its Ethiopian subsidiary recorded a total revenue of Kshs 98.3 mn, with service revenue coming at Kshs 9.1 mn and operating cost at Kshs 6.0 bn leading to a loss after tax of Kshs 7.3 bn which weighed down on the group’s overall performance.

Despite a 10.0% decline in the firm’s core earnings to Kshs 0.84 in H1’2023, from Kshs 0.92 in H1’2022, Safaricom continues to remain a strong long-term proposition, owing to its 65.8% of market share in Kenya and over 97.0% market share in mobile money subscribers through M-Pesa, with M-Pesa recording an 8.6% year on year growth in one month active customers to 31.2 mn in H1’2023. Additionally, the Ethiopian subsidiary is expected to gain further traction after the firm officially launched its operation in October 2022 with the firm expecting to tap into Ethiopian market with a population of more than 117.9 mn people as of 2021. Further, we are of the view that the expected approval of a mobile money license coupled with resolution of Ethiopia’s internal conflict set the Ethiopian subsidiary in a good position to turn around its financials. However, the adverse macroeconomic situation is likely to weigh on the group’s overall performance during this period when it is aggressively expanding its network in Ethiopia. This is due to high import costs of gadgets and equipment as a results of global inflationary pressures that have caused commodity prices to soar

Universe of coverage:

|

Company |

Price as at 04/11/2022 |

Price as at 11/11/2022 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

37.2 |

36.8 |

(1.1%) |

(19.3%) |

53.5 |

8.2% |

53.7% |

0.6x |

Buy |

|

Jubilee Holdings |

215.0 |

210.0 |

(2.3%) |

(33.7%) |

305.9 |

0.5% |

46.2% |

0.4x |

Buy |

|

Co-op Bank*** |

11.8 |

11.9 |

0.9% |

(8.8%) |

15.6 |

8.4% |

40.1% |

0.7x |

Buy |

|

Kenya Reinsurance |

1.9 |

1.9 |

(0.5%) |

(18.3%) |

2.5 |

5.3% |

39.6% |

0.2x |

Buy |

|

Equity Group*** |

45.7 |

45.1 |

(1.3%) |

(14.5%) |

59.7 |

6.7% |

38.9% |

1.1x |

Buy |

|

ABSA Bank*** |

11.4 |

11.7 |

2.6% |

(0.4%) |

14.9 |

1.7% |

29.1% |

1.0x |

Buy |

|

Liberty Holdings |

5.2 |

5.0 |

(4.2%) |

(29.5%) |

6.8 |

0.0% |

35.5% |

0.4x |

Buy |

|

I&M Group*** |

17.0 |

17.2 |

0.9% |

(19.9%) |

20.5 |

8.7% |

28.5% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

48.3 |

48.5 |

0.4% |

(18.5%) |

59.5 |

6.2% |

28.9% |

0.2x |

Buy |

|

Sanlam |

9.3 |

8.7 |

(6.6%) |

(24.5%) |

11.9 |

0.0% |

36.6% |

0.9x |

Buy |

|

Britam |

5.8 |

5.7 |

(0.7%) |

(24.3%) |

7.1 |

0.0% |

24.5% |

0.9x |

Buy |

|

Standard Chartered*** |

136.8 |

137.0 |

0.2% |

5.4% |

155.0 |

10.2% |

23.4% |

0.9x |

Buy |

|

NCBA*** |

31.1 |

31.7 |

1.9% |

24.6% |

35.2 |

6.3% |

17.2% |

0.7x |

Accumulate |

|

CIC Group |

2.0 |

2.0 |

(2.0%) |

(10.1%) |

2.3 |

0.0% |

19.0% |

0.7x |

Accumulate |

|

HF Group |

3.3 |

3.1 |

(5.5%) |

(19.2%) |

3.5 |

0.0% |

14.0% |

0.2x |

Accumulate |

|

Stanbic Holdings |

100.0 |

100.0 |

0.0% |

14.9% |

99.9 |

9.0% |

8.9% |

0.8x |

Hold |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Industry Reports

- Hass Index Q3’2022 Report by Hass Consult

During the week, Hass Consult, a Real Estate Development and Consulting firm, released its House Price Index Q3’2022 Report, which reports the performance of Nairobi Metropolitan Area’s (NMA) Real Estate residential sector. The following were the key take outs:

- The average q/q selling prices for houses increased by 0.8% in Q3’2022 compared to a 0.2% increase in Q2’2022, while on a y/y basis, the average selling prices appreciated by 10.3% compared to a (1.1%) price correction that was recorded in Q3’2021. The increase in performance was mainly driven by an increase in the selling prices for detached units by 1.5% q/q and 16.6% y/y,

- In the Nairobi Suburbs, Lang’ata was the best performing node having recorded a y/y capital appreciation of 14.0% for its detached units, signaling increased demand for townhouses and villas in the region. On the other hand, apartments in Kileleshwa recorded the highest y/y price correction of 6.6%, attributed to reduced uptake with clients preferring to rent rather than buying the units,

- In the satellite towns, houses in Ngong’ recorded the highest y/y price appreciation at 18.3% driven by increased demand resulting from; i) proximity to prime locations such as Karen, ii) growing middle income population in the area enhancing demand, and, iii) improved infrastructure development such as the Ngong’ Road thus enhancing accessibility. Conversely, apartments in Rongai realized the highest y/y price correction of 6.9% attributed to reduced demand owing to the region’s unfavorable location far from Nairobi CBD and transportation hubs like the Jomo Kenyatta International Airport (JKIA) among others, and, the preference of tenants on renting of the units rather than buying,

- The overall asking rents of housing units in the NMA slightly decreased by 0.2% q/q and increased by 2.1% y/y, compared to a 0.1% q/q increase and 3.5% y/y growth recorded in Q3’2021, attributed to slow growth in the general demand for rental units. Apartments recorded the highest y/y increase in asking rents of 5.6% compared to detached units at 0.9%, signaling the increased preference of tenants on renting apartments due to their affordability,

- In the Nairobi suburbs, houses in Loresho realized the highest y/y rent appreciations of 6.4%. This was attributed to the presence of adequate infrastructure and amenities enhancing investments, serene environment, as well as its strategic and lavish location which is in part of Westlands. On the other hand, houses in Gigiri realized the highest y/y rental rates decline of 4.9% attributed to reduced demand for units to rents in the region, and,

- For the satellite towns, apartments in Ngong realized the highest y/y rental rate increase by 20.5% mainly due to better accessibility facilitated by improved infrastructure development like the expansion of the Ngong road and the Southern Bypass. On the contrary, apartments in Kiambu town recorded the highest y/y rental rates declines of 6.2% due to reduced demand especially by the young generation attributed to competition from neighboring nodes like Juja and Ruiru that offer affordable rates, better amenities and improved accessibility.

The findings of the report are in line with our Cytonn Q3’2022 Markets Review, which highlighted that the average y/y price appreciation and rental yield for houses in the NMA increased by 0.1% and 0.3% points, to 0.8% and 5.1% in Q3’2022, respectively. The improvement in performance was attributed to i) increased infrastructural developments like the Nairobi Expressway improving accessibility of areas along the development hence higher demand, ii) a gradual economic recovery which saw landlords collect higher rents, and, iii) an increase in property transaction volumes.

Hass Consult also released the Land Price Index Q3’2022 Report which highlights the performance of Real Estate land sector in the Nairobi Metropolitan Area (NMA). The following were the key take outs from the report:

- The average q/q and y/y selling prices for land in the Nairobi suburbs depreciated by 0.8% and 0.1% respectively attributable scarcity land within Nairobi which has forced developers to source for development land in the satellite towns of Nairobi. Consequently, the average q/q and y/y selling prices for land in the satellite towns of Nairobi increased by 1.6% and 9.5%, respectively, fueled by their affordability,

- Spring Valley was the best performing node in the Nairobi suburbs with a q/q and y/y price appreciation of 6.4% and 18.4%, respectively. This was attributed to increase in demand for land in the region owing to; adequate infrastructure, ample security, serene environment as it is also surrounded by areas such as Westlands and Kitisuru, and, adequate amenities such as Sarit Centre and Westgate Shopping Malls. On the other hand, Upperhill recording the highest y/y price correction of 3.5%. This was due to declined demand for development land resulting from the existing high oversupply of commercial spaces hence developers halting their construction plans, coupled with land in the area being the most expensive in the NMA thus hindering uptake, and,

- For satellite towns, Syokimau was the best performing node with a q/q and y/y capital appreciation of 6.9% and 20.1%, respectively, attributed to rising demand for development land due to increased improved infrastructure and accessibility following the completion and launch of the Nairobi Expressway in May 2022. On the other hand, Limuru was the worst performing node with a y/y price correction of 9.1% driven by low demand for land in the area, resulting from relatively farther distance from Nairobi CBD and other business nodes.

The findings of the report are also in line with our Cytonn Q3’2022 Markets Review, which highlighted that the overall average selling prices for land in the NMA appreciated by 1.6% to Kshs 130.42 mn per acre in Q3’2022 from Kshs 130.41 mn per acre recorded in Q3’2021. This was mainly attributed to; i) positive demographics evidenced thus driving demand for land for development, ii) improved development of infrastructure such as roads, railways, water and sewer lines, iii) proximity to amenities such as shopping malls, organizations and learning institutions, and, iv) increased construction activities particularly in the residential and infrastructural sector hence fueling demand for land.

- Prime Global Cities Index Q3’2022 Report by Knight Frank

During the week, Knight Frank, an international Real Estate consultancy and management firm, released the Prime Global Cities Index Q3’2022 Report, which highlights the performance of prime residential prices across sampled 45 cities worldwide. The following were the key take outs from the report:

- The average selling prices for houses in the sampled prime cities globally recorded a capital appreciation of 6.6% q/q and 6.1% y/y. This was attributed to factors such as; i) the high construction costs on the back of global inflationary pressures, ii) the high demand for decent houses across the globe, ii) growing urbanization rates driving demand for property, iv) improving infrastructure developments focused in the urban areas, and, v) adequate world-class amenities which are also mostly concentrated in urban cities thus improving investments,

- Dubai recorded the highest annual price change of 88.8% attributable to; i) its world class infrastructure developments and amenities enhancing both local and foreign investments such as Burj Khalifa, Dubai Highway, Dubai Museum of the Future, Dubai Mall, and Dubai Water Canal, among many others, ii) conducive tax conditions which attract rapid investments, iii) adequate security features, iv) improved digitization of businesses and transactions boosting investments, and, v) its recognition as best trade and financial destination hub hence attracting high end investments,

- On the other hand, Wellington city ranked last from the sampled prime cities with a y/y and q/q price correction of 18.0% and 8.2% respectively, attributed to a decline in property demand and transactions in the area resulting from credit access constraints, and,

- Nairobi being the only ranked African city came in at position 29, 4 positions higher from Q2’2022 where it was ranked position 33 out of the 45 countries, with a 2.9% y/y change, and a 0.5% q/q change in residential prices. This is attributed to i) increased infrastructure developments enhanced investments such as the Nairobi Expressway and the expansion of the Eastern and Norther Bypasses, ii) a growing middle income class, iii) annual recognition of Nairobi as a regional hub hence increasing foreign investments, and, iv) a high urbanization growth rate in Kenya which is currently at 4.0% compared to the world’s 1.8% according to the World Bank.

The table below shows the house selling price performance for various prime cities in the world as at Q3’2022;

|

Cytonn Report: Knight Frank Capital Appreciations For Prime Cities in the World Q3’2022 |

|||||||||||

|

# |

City |

Q/Q Change (Q2’2022-Q3’2022) |

YoY Change (Q3’2021-Q3’2022) |

# |

City |

Q/Q Change (Q2’2022-Q3’2022) |

YoY Change (Q3’2021-Q3’2022) |

# |

City |

Q/Q Change (Q2’2022-Q3’2022) |

YoY Change (Q3’2021-Q3’2022) |

|

1 |

Dubai |

29.3% |

88.8% |

16 |

Madrid |

1.6% |

5.6% |

31 |

London |

0.5% |

2.7% |

|

2 |

Miami |

3.1% |

30.8% |

17 |

San Francisco |

(10.0%) |

5.5% |

32 |

Vienna |

0.1% |

1.9% |

|

3 |

Tokyo |

10.6% |

17.0% |

18 |

Sydney |

(1.9%) |

5.4% |

33 |

Bangkok |

1.8% |

1.9% |

|

4 |

Los Angeles |

(4.1%) |

13.6% |

19 |

New York |

0.0% |

5.2% |

34 |

Shanghai |

1.0% |

1.4% |

|

5 |

Gold Coast |

(1.6%) |

11.3% |

20 |

Brisbane |

(2.4%) |

5.2% |

35 |

Manila |

0.9% |

1.2% |

|

6 |

Zurich |

2.85 |

10.7% |

21 |

Auckland |

8.3% |

4.9% |

36 |

Delhi |

0.0% |

1.2% |

|

7 |

Edinburgh |

0.9% |

9.9% |

22 |

Mumbai |

2.1% |

4.8% |

37 |

Hong Kong |

(0.4%) |

0.2% |

|

8 |

Berlin |

(0.9%) |

9.4% |

23 |

Shenzhen |

(4.8%) |

4.5% |

38 |

Monaco |

(2.0%) |

0.1% |

|

9 |

Seoul |

(4.1%) |

8.9% |

24 |

Toronto |

(9.0%) |

4.1% |

39 |

Kuala Lumpur |

0.0% |

(0.5%) |

|

10 |

Taipei |

8.6% |

1.7% |

25 |

Beijing |

0.9% |

3.9% |

40 |

Vancouver |

(6.7%) |

(1.7%) |

|

11 |

Dublin |

1.7% |

8.6% |

26 |

Perth |

(0.4%) |

3.4% |

41 |

Jakarta |

(0.2%) |

(2.2%) |

|

12 |

Paris |

1.2% |

7.6% |

27 |

Bengaluru |

1.5% |

3.3% |

42 |

Guangzhou |

(0.5%) |

(2.5%) |

|

13 |

Melbourne |

0.7% |

6.7% |

28 |

Geneva |

0.8% |

3.2% |

43 |

Stockholm |

(8.1%) |

(5.2%) |

|

14 |

Lisbon |

1.0% |

6.1% |

29 |

Nairobi |

0.5% |

2.9% |

44 |

Frankfurt |

(3.5%) |

(9.4%) |

|

15 |

Singapore |

2.3% |

6.0% |

30 |

Bucharest |

0.4% |

2.8% |

45 |

Wellington |

(8.2%) |

(18.0%) |

|

Average Change |

6.6% |

6.1% |

|||||||||

Source: Knight Frank Research 2022

The findings of the report are in line with our Cytonn Q3’2022 Markets Review, which highlighted that the average y/y price appreciation for houses in prime locations in Nairobi came in at 1.3% in Q3’2022 and also correlates with Hass Consult’s House Price Index Q3’2022 Report, which highlighted that the average y/y price appreciation for houses in prime locations in Nairobi was 1.5% in Q3’2022.

Overall, we expect the performance of Kenya’s property market to continue being driven by; i) increased housing construction activities, ii) continuous recognition of Nairobi as a regional hub hence attracting investments, iii) affordable housing initiative shaping the residential market, and, iv) improving infrastructural developments boosting property investments and prices. However, challenges such as inadequate mortgage financing for homeowners, financial constraints further driven by the tough economic conditions and rising cost of land and construction, and, the weakening of the Kenyan shilling which in turn fuel property prices of some developments, are expected to weigh down the optimum performance of the sector.

- Residential Sector

- Nakuru County Government to Complete 605 Affordable Housing Units by December 2023

During the week, the County Government of Nakuru announced plans to complete the construction of 605 affordable housing units by December 2023. Construction of the affordable housing scheme located at Bondeni was launched in May 2021, under Public-Private Partnership (PPP) agreement between the State Department of Housing and King Sapphire Developers, a subsidiary group of Royal Group Industries. In the project agreement, the private developer provided Kshs 2.0 bn funding while the government provided a 7.5 acre piece of land formerly occupied by municipal houses to make the new units affordable. with more than a third of the units having already been sold to registered homeowners. Upon completion, the project is expected to; i) improve the living standards of the residents through the provision descent housing, ii) boost housing supply in Nakuru County, iii) help reduce the existing housing deficit which stands at 2.0 mn units, and, iv) boost home ownership rates in the country which have remained significantly low at 21.3% in urban areas as at 2020. The table below shows breakdown of the housing units and their prices;

|

Cytonn Report: Bondeni Affordable Housing Project Nakuru County |

||

|

House Typology |

Number of Houses |

Price of Each Unit in Kshs |

|

1-bedroom |

45 |

1.6 mn |

|

2-bedrooms |

180 |

3.2 mn |

|

3-bedrooms |

380 |

4.3 mn |

Source: Cytonn Research

The aforementioned project comes at a time when the government has intensively focused on affordable housing initiative with an aim of constructing 5,000 housing units in every county in Kenya in the next five years. Other projects in the pipeline within the Nairobi Metropolitan Area include;

|

Cytonn Report: Summary of Notable Ongoing Affordable Housing Projects in the Nairobi Metropolitan Area |

|||

|

Name |

Developer |

Location |

Number of Units |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

1,562 |

|

River Estate Affordable Housing Program |

National Government and Edderman Property Limited |

Ngara |

2,720 |

|

Park Road Affordable Housing Program |

National Housing Corporation |

Ngara |

1,370 |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru, Enterprise Road |

15,000 |

|

Kibera Soweto East Zone B |

National Government |

Kibera |

4,400 |

Source: Boma Yangu Portal

The government aims to mitigate the national housing deficit by constructing and delivering approximately 200,000 units annually the next five years through partnership with county governments and the private sector. However, achievement of the target continues to be weighed down by various factors outlined in our Affordable Housing topical.

- Student housing developer Acorn Holdings sale of Qwetu Aberdare Heights I hostel

During the week, student housing developer Acorn Holdings received Kshs 1.8 bn from the sale of Qwetu Aberdare Heights I hostel located in Ruaraka. In our Cytonn Weekly 43/2022, the developer had in October 2022 announced plans to repay part of its outstanding Kshs 5.7 bn green bond through the sale of the aforementioned property with a 697 bed capacity, through an early redemption option. With the funds from the sale, Acorn settled part of the debt worth Kshs 800.2 mn to investors, thereby bringing the value of its outstanding bonds down to Kshs 2.6 bn. Moreover, the early bond repayment has significantly lowered the developer's financing costs owing to reduced amounts payable for interest accrued, which was capped at a fixed rate of 12.3% p.a. The impressive performance of the Acorn bonds backed by attractive investment returns and the early loan redemption continues to set good precedence for corporate bonds as a way of funding Real Estate projects in the country while building investor confidence in the product.

- Retail Sector

During the week, Carrefour Supermarket, a French based retail chain opened a new store at Comet House along Monrovia Street. This brings the retailers number of operating outlets to 19, and the first ever store to be opened by the retailer at Nairobi’s Central Business District, as it has significantly been focusing on strategically setting up its stores in shopping malls. The decision to open up the branch is driven by, i) the increased necessity to improve customer shopping experience and convenience, ii) the strategic location of the branch to broaden its customer base, iii) the increased demand for goods and services which has been propelled by the onset of the festive season, iv) the availability of new market opportunities, and, v) step up on the stiff competition offered by retailers such as Naivas and Quickmart. The table below highlights the number of stores operated by key local retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||

|

Name of retailer |

Category |

Branches as at FY’ 2018 |

Branches as at FY’ 2019 |

Branches as at FY’ 2020 |

Branches as at FY’ 2021 |

Branches opened in 2022 |

Closed branches |

Current branches |

Branches expected to be opened |

Projected branches FY’2022 |

|

|

Naivas |

Local |

46 |

61 |

69 |

79 |

8 |

0 |

88 |

3 |

90 |

|

|

QuickMart |

Local |

10 |

29 |

37 |

48 |

3 |

0 |

51 |

0 |

51 |

|

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

2 |

1 |

24 |

4 |

28 |

|

|

Carrefour |

International |

6 |

7 |

9 |

16 |

3 |

0 |

19 |

0 |

19 |

|

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

|

Total |

|

257 |

313 |

334 |

186 |

16 |

179 |

202 |

7 |

208 |

|

Source; Cytonn Research

We expect Kenya’s retail sector to be supported by i) rapid urbanization and population growth driving increased demand for goods and services, ii) the continued expansion by retailers in the market, iii) improved infrastructure resulting in better accessibility, iv) Nairobi’s recognition as a regional hub hence attracting foreign investments, and, v) enhanced ease of doing business. However, the sector is expected to continue experiencing declining occupancies owing to some business moving away from physical locations to online platforms, coupled with the existing oversupply of retail spaces in Kenya at 2.2 mn SQFT.

- Mixed Use Developments (MUDs)

During the week, property developer Mi Vida Homes announced plans to begin the construction of two projects at Garden City in April 2022; the 2nd phase of their mid-market apartments dubbed Amaiya, and, affordable housing units dubbed 237 Garden City. Sitting on a 47-acre piece of land at Garden City, Amaiya will comprise of one and two-bedroom duplexes, and three-bedroom flats, all totaling 200 units, with the prices starting at Kshs 9.5 mn, while 237 Garden City project worth Kshs 1.6 bn will comprise of a total of 600 units consisting of studio, one and two-bedroom apartments, with the prices starting at Kshs 2.8 mn. This therefore brings the number of projects by the developer at Garden City to three, having recently completed the first phase of mid-market apartments dubbed Mi Vida Homes in August 2021. The other project by the developer include Keza affordable housing apartments whose construction will also begin in April 2023 at Riruta, and consisting of studio, one, two and three-bedroom units on a six-acre piece of land off Ngong Road, with prices ranging between Kshs 2.0 mn and Kshs 6.0 mn according to our Cytonn Weekly #22/2022.

The decision to establish the aforementioned projects at Garden City is on the back of affordable housing shaping the residential market, impressive performance of Mi Vida phase 1 project, and the preference of investors and buyers for the live-work-play lifestyle offered by mixed-use developments. Upon completion of the developments, they will provide the different tenants with quality homes, as well as increasing the investor confidence in the Kenyan Residential sector.

In terms of performance, according to our Nairobi Metropolitan Area Mixed-Use Developments (MUDs) Report 2022, MUDs recorded average rental yields of 7.4% in 2022, 0.6% points higher than the respective single-use retail, commercial office and residential themes with an average yield of 6.8%. This was mainly attributed to their attractiveness to the high and middle income earning population, thus preferred by many investors. The table below shows the thematic comparison of rental yield performance between single-use themes and Mixed-Use Developments;

|

Cytonn Report: Performance of MUDs Vs. Single-Use Themes in 2022 |

||

|

MUD Themes Average |

Market Average |

|

|

Theme |

Rental Yield 2022 |

Rental Yield 2022 |

|

Retail |

8.8% |

7.8% |

|

Offices |

7.3% |

7.0% |

|

Residential |

5.2% |

5.5% |

|

Average |

7.4% |

6.8% |

Source: Cytonn Research

We expect the performance of MUDs to continue being driven by factors such as their strategic locations in prime areas with the capability to attract prospective clients, improving infrastructure developments given the fact they require massive infrastructure to set up, and, their increasing preference by target clients due to their convenience for work-life balance needs, hence improved demand and returns to investors.

- Real Estate Investment Trusts (REITs)

In the Nairobi Stock Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share. The performance represented a 4.1% decline from the Kshs 6.9 per share recorded last week, taking it to a 5.4% Year-to-Date (YTD) gain. However, the performance also represented a 67.0% Inception-to-Date (ITD) decline from Kshs 20.0. The graph below shows Fahari I-REIT’s performance from November 2015 to 11th November 2022:

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT closed the week at Kshs 23.8 and Kshs 20.8 per unit, respectively, as at 7th October 2022. The performance represented a 19.0% and 4.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 5.5 mn and 14.5 mn shares, respectively, with a turnover of Kshs 116.9 mn and Kshs 300.3 mn, respectively, since its Inception in February 2021.

We expect Kenya’s Real Estate sector performance to be on an upward trajectory supported by; i) initiation and completion of various housing projects, ii) rapid expansion drive in the retail sector, and, iii) continued popularity and growth of MUDs owing to their impressive performance and increased appetite for them by investors. However, the performance of the sector is expected to continue being weighed down by the inadequate investor appetite in REITs and oversupply in select Real Estate sectors.

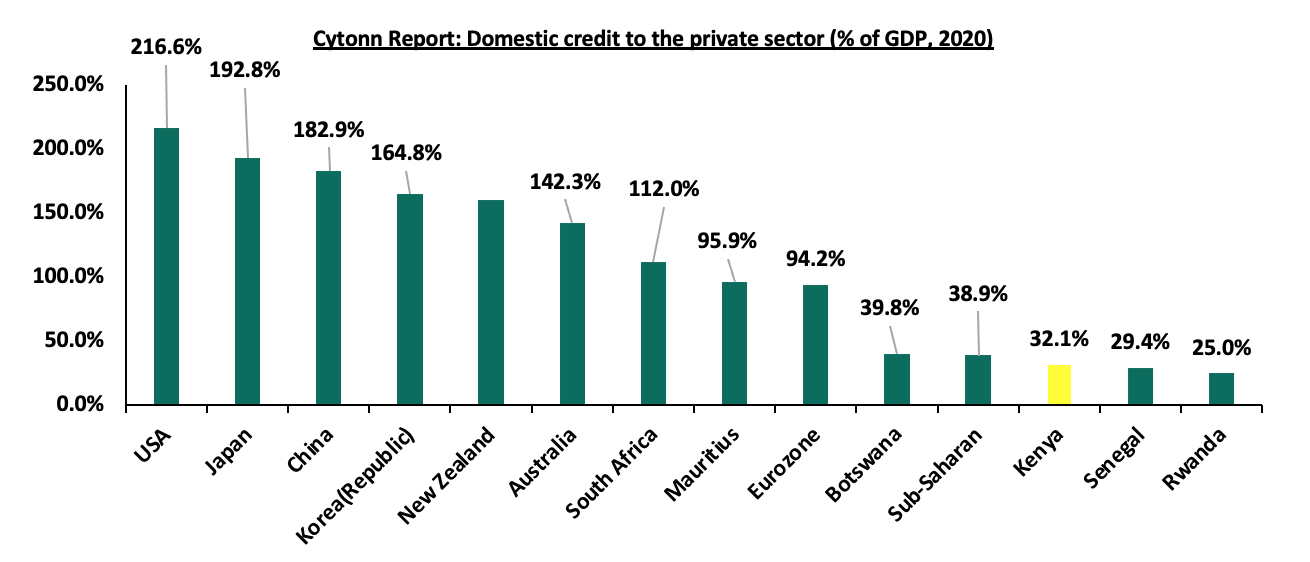

In Kenya, like every other country in the world, adequate credit to the private sector plays an important role in economic growth by ensuring that there is efficient allocation of resources for investment. Subsequently, for an economy to function well, there should exist alternative sources to provide private sector credit, and the government through its regulatory and legislative arms should provide an enabling environment for businesses to grow and providers of capital to compete. In Kenya, the main provider of capital to businesses is the Banking sector, estimated to provide 99.0%, while alternative sources provide a combined 1.0%. Private sector credit from the banking sector currently stands at Kshs 3.3 tn, equivalent to approximately 26.1% of the GDP. This continues to lag behind other advanced economies such as USA and Japan where the Private sector credit to GDP ratio stood at 216.0% and 192.8% respectively in 2020. Closer to home, in economies such as Mauritius, the Private sector credit as a percentage of GDP stood at 95.9% in 2020. From the above, it is clear that Kenya has some work to do to bridge the gap in Private sector credit. As such, we saw it fit to cover a topical on the private sector credit growth to shade light on the evolution, current state of lending to the private sector and give our recommendations on what can be done to improve credit access to the private sector. We shall do this by looking into the following:

- Introduction,

- Kenya’s Private sector credit performance,

- Factors influencing Private Sector credit growth,

- Initiatives placed to promote Private sector credit growth,

- Comparison against other countries, and,

- Conclusion and key consideration to improving private sector credit performance in Kenya

Section I: Introduction

Private sector is a section of the economy that is not state-owned comprising of private organizations and individual investors and is largely profit oriented. Private sector credit refers to the financial resources provided to the private sector by financial corporations for the development of the economy. In Kenya, the major constituents of the private sector lending include commercial banks, capital markets, Saccos, microfinance institutions, finance and leasing companies, pension funds, as well as insurance corporations. Despite the Kenya financial sector being dominated by banking institutions which contribute 99.0% of the total lending, private sector credit growth has remained relatively low, averaging at 10.6% for the nine years under review. As such, in comparison to developed economies, capital markets funding in Kenya at 1.0% is underdeveloped whereas the developed economies have bank and capital markets funding at 60.0% and 40.0% respectively. The table below shows the comparison of business funding in Kenya against developed economies;

Source: Cytonn Research

In Kenya, the private sector is a significant contributor to economic growth as well as employment creation. The sector comprises of private corporates and small and medium enterprises (SMEs) with the latter accounting for 90.0% of private sector enterprises and employs approximately nine out of ten workers in the country. Accessibility of credit has been a challenge especially to the SMEs, largely attributable to high risk perception by banks, and the high cost of credit charged on the current available credit options.

Section II: Kenya’s Private sector credit performance

- Evolution of Private sector credit

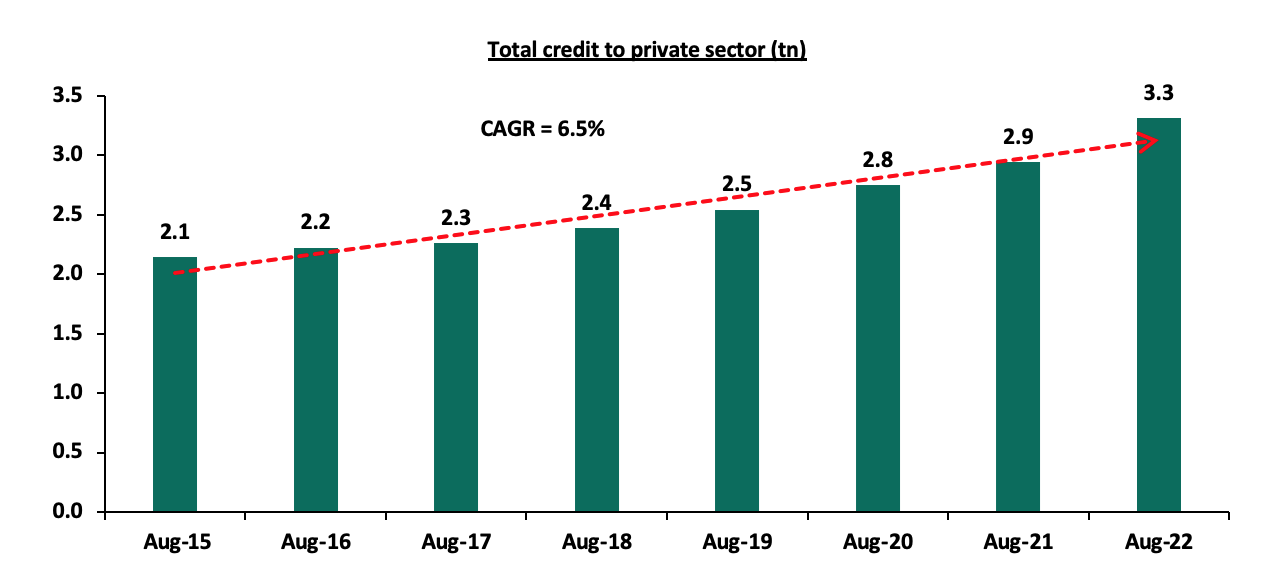

There has been a significant rise in banks’ lending to the private sector over the years, with the total domestic credit extended to the private sector credit increasing at a 7-year CAGR of 6.5% to Kshs 3.1 tn in August 2022, from Kshs 2.1 tn in August 2015, in line with the relative economic growth averaging at 4.8% for the last 7 years. Credit extended to the private sector as at August 2022 stands at Kshs 3.3 tn, with the sector with the highest allocation being credit to the trade sector at Kshs 504.4 bn, equivalent to 15.2% of the total credit. In terms of YTD growth, the mining and quarrying, as well as agriculture grew at 45.6% and 16.8% to Kshs 21.4 bn and Kshs 110.1 bn respectively, from Kshs 10.9 bn and Kshs 92.4 bn respectively in January 2022. The positive credit uptake shows resilience of the two segments despite increased credit risk due to the deteriorated business environment following elevated inflationary pressures. The graph below shows the cumulate private credit over the period under review;

Source: Central Bank of Kenya

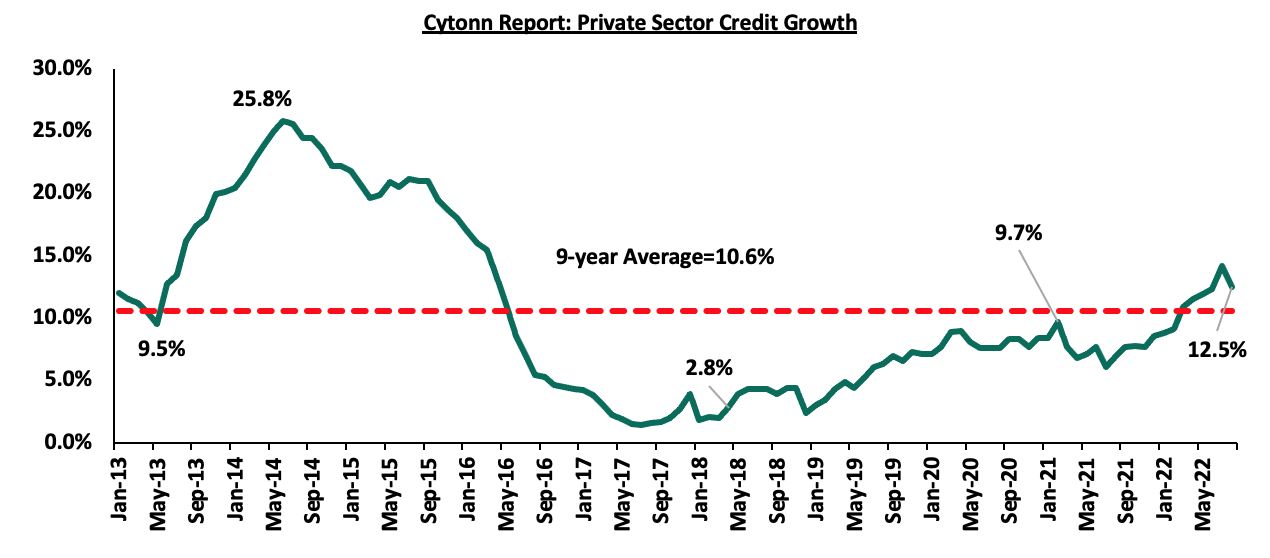

Private sector credit growth has been on an upward trajectory in 2022, reaching 12.5% in the 12-months to August 2022 compared to 7.0% in August 2021, attributable to increased credit demand despite elevated credit risk brought about by the electioneering period. Credit growth was mainly driven by sectors such as Agriculture, Business Services and Manufacturing at 19.2%, 16.1%, and 15.2%. Key to note, Finance and Insurance sector as well as the Real Estate Sector had the lowest y/y credit growth rates at 1.2% and 1.0% respectively. According to the Central Bank of Kenya, Real Estate credit uptake was low with gross loans advanced to the Real Estate sector increasing by 4.2% to Kshs 466.8 bn in H1’2022, from Kshs 448.0 bn realized in H1’2021. The slow growth was mainly attributed to the increased credit risk on the sector partly due to slowdown in activity in the build up to the 2022 general elections, coupled with subdued demand for property amid rising construction costs and a 16.4% increase in Non-Performing Loans (NPLs) in the Real Estate sector to Kshs 79.4 bn in H1’2022, from Kshs 68.2 bn in H1’2021. Key to note, the increase in NPLs was driven by tough economic environment as a results of ripple effects of Covid-19, and further fueled The table below shows the sectoral credit uptake on y/y and year to date basis:

|

Cytonn Report: Sectoral Credit Uptake (Kshs bn) |

|||||

|

|

Aug-21 |

Jan-22 |

Aug-22 |

Last 12 Months Change (%) |

YTD change (%) |

|

Mining and quarrying |

10.9 |

14.7 |

21.4 |

96.3% |

45.6% |

|

Other activities |

74.8 |

91.5 |

120.2 |

60.7% |

31.4% |

|

Agriculture |

92.4 |

94.3 |

110.1 |

19.2% |

16.8% |

|

Business services |

163.5 |

174.7 |

189.8 |

16.1% |

8.6% |

|

Manufacturing |

437.8 |

459.9 |

504.4 |

15.2% |

9.7% |

|

Consumer durables |

318.2 |

339.2 |

363 |

14.1% |

7.0% |

|

Transport & communication |

237.9 |

258.8 |

270.1 |

13.5% |

4.4% |

|

Trade |

504.2 |

532.4 |

571.5 |

13.3% |

7.3% |

|

Building and construction |

121 |

125.2 |

134.9 |

11.5% |

7.7% |

|

Private households |

462.7 |

477.7 |

498.8 |

7.8% |

4.4% |

|

Finance & insurance |

109 |

112.2 |

110.3 |

1.2% |

(1.7%) |

|

Real estate |

410.6 |

409.9 |

414.8 |

1.0% |

1.2% |

|

Total credit advanced |

2,943.0 |

3,090.5 |

3,310.1 |

12.5% |

7.1% |

Source: Central Bank of Kenya

The Kenyan private sector credit growth is subdued even after the removal of interest rates cap in November 2019 with average growth rate coming in at 8.7% since the removal compared to the growth rate of 10.6% for the 9-year period. While the capping of interest rates was implemented to control lending rates to the sector, the consequence as highlighted on our note on the impact of capping interest rates on the economy, was a contraction on the supply side of credit as banks had lower profit margins attributable to tougher lending environment. The positive private sector credit uptake in 2021 and 2022 was largely driven by economic recovery following gradual easing of COVID-19 restrictions evidenced by 7.5% GDP expansion in 2021 as well as a 7.3% and 4.4 % year to date expansion in trade and private household consumption, respectively. Despite the expansion in private sector credit uptake, the current growth rate of 12.5% in August 2022 is still below the historical credit growth levels. The chart below shows the movement of the private sector credit growth:

Source: Central Bank of Kenya

Section III: Factors influencing private sector credit growth

Private sector credit uptake is influenced by a number of factors which include;

- Interest rates – Interest rates affect both the demand and supply side of the credit market. For instance, the capping of interest rates in August 2016 led to low credit growth averaging at 3.7% for the capping period (August 2016-November 2019) with banks minimizing credit access due to the small profit margins. Key to note, the credit uptake has been relatively high during the pre- and post-capping periods with the private sector credit growth averaging at 18.3% and 8.7% respectively for the two periods respectively. However, high interest rates stifle the demand side of the credit market by increasing the cost of borrowing. The average lending rate as at June 2022 stood at 12.7%, a 0.5% points increase from 12.2% in May 2022. Key to note, the increase of the Central bank rates by 0.75 bps to 8.25% in September 2022 tightened liquidity within the economy forcing commercial banks to adjust their lending rates upwards to 14.0%, 13.2%, and 12.5% for corporates, personal and small business loans respectively. With the MPC expected to continue increasing interest rates, we expect the lending rates to increase even further,

- Government domestic borrowing - In Kenya, the government uses various debt instruments such as government securities (treasury bills and bonds), advances from commercial banks and overdrafts from the Central Bank of Kenya to borrow from the domestic market. Commercial banks have continued to hold the highest proportion of Government domestic debt, coming at 47.5% as at October 2022. This is mainly attributable to banks preference to lend to the government, which is considered a risk-free investment, effectively crowding out the private sector, which is considered riskier. Though the holding of domestic debt by commercial banks has declined from a high of 55.4% in the last 10 years, this continues to inhibit credit sector credit growth. The table below shows the holders of domestic public debt for the last 10 years;

Cytonn Report: Domestic Public Debt by Holder (Percent)

Nov-13

Nov-14

Nov-15

Nov-16

Nov-17

Nov-18

Nov-19

Nov-20

Nov-21

Nov-22

Banking Institutions

48.6%

52.9%

55.4%

53.4%

55.2%

54.9%

54.2%

54.3%

50.3%

47.1%

Insurance companies

10.3%

10.1%

8.7%

7.2%

6.2%

6.1%

6.5%

6.3%

6.7%

7.4%

Parastatals

3.6%

2.9%

4.6%

5.7%

6.5%

7.4%

6.8%

5.6%

5.4%

6.2%

Pension funds

25.9%

24.8%

25.3%

27.3%

27.7%

27.1%

28.1%

28.8%

31.5%

33.0%

Other investors

11.5%

9.3%

6.0%

6.4%

4.4%

4.5%

4.4%

54.2%

6.1%

6.4%

Source:(CBK)

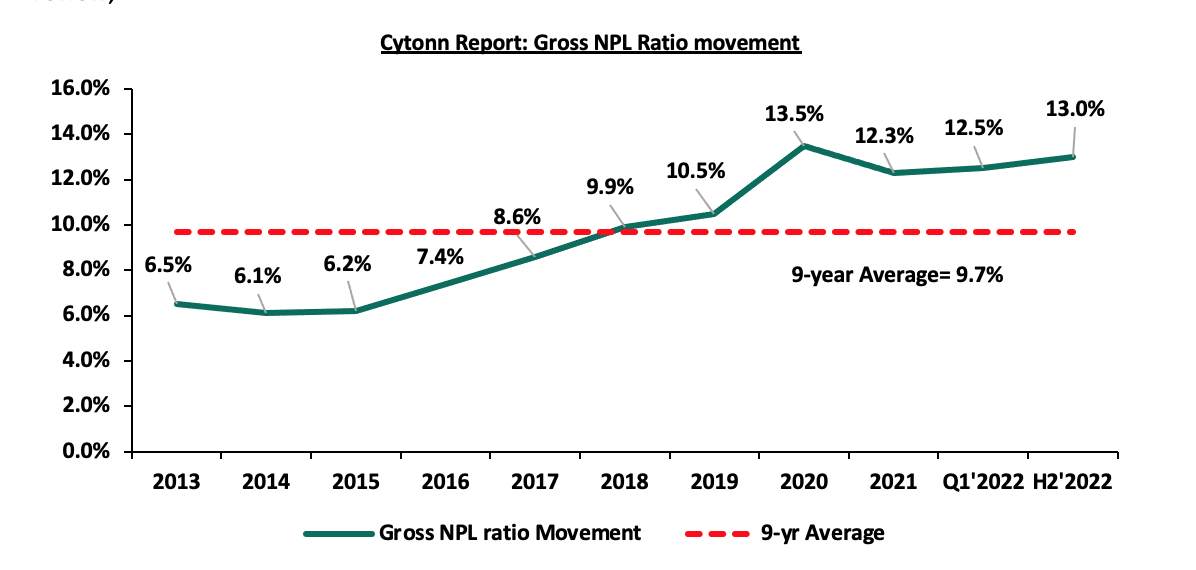

- High risk perception by lenders which contribute to high risk premiums – Commercial banks charge higher interest premiums on the loans borrowed to cater for future uncertainty risks. Additionally, according to the Central Bank of Kenya (CBK), the tightened macroeconomic environment in 2022 has resulted in increased credit risks as banks record deteriorating asset quality, driven by increase in non-performing loans (NPLs) to gross loans ratio to 14.7% in Q2’2022, up from 14.0% recorded in Q1’2022. The graph below shows the movement for the years under review;

- High cost of credit – There are other associated overhead costs incurred during borrowing such as bank fees, legal fees and government levies, valuation fees and insurance that are borne by the borrower, in addition to the interest charged on loans. The overhead costs increase the cost of credit, hence limits demand for credit by the private sector,

- Elevated Inflation rate – High inflation levels act as disincentive in both consumption and investment rates due to increased prices of both food and factor inputs. As a result, both private consumers and companies cut on spending and production levels respectively when inflation rates hike. For instance, the rise in inflation rate to 9.6% in October 2022, driven by high food and fuel prices in the country has lowered the household consumption resulting in decline in sales volumes. This is evidenced by the decline in Purchasing Managers Index(PMI) to 50.2% in October 2022 from 51.7% in September 2022 depicting deterioration of the business environment. Business deterioration due to low sales volumes leads to reduced credit demand by the private sector,

- Lack of financial knowledge – Majority of private sector businesses such as small and medium enterprises (SMEs) require financial information to determine the optimal measures of minimizing their debts, in terms of acquiring loans with lower interest rates and flexible repayment options. Additionally, financial knowledge help private businesses make adequate comparisons on lending options to choose from,

- Over-reliance on the banking sector - The Kenyan private sector is over dependent on lending from commercial banks due to under development of alternative sources of funding such as leasing, venture capital funds, development finance institutions and bonds and equity markets. Key to note, according to the Capital Markets Authority, there has been no recent IPO listing in the Equities market with the last IPO issued by Stanlib Fahari IREIT in October 2015 having an undersubscription rate of 29.0%. Similarly, there are only four issued corporate bonds with a low bond turnover at Kshs 0.1 bn in Q3’2022 as compared to government bonds at Kshs 197.0 bn in the same period. The low issuance and turnover rates show the overreliance of credit demand on the banking sector,

- Political Risk – The private sector growth in Kenya is susceptible to political tensions attributable to uncertainties surrounding the business environment and deterioration of the business environment as witnesses in the August 2022 electioneering period where credit demand by the private sector declined by 1.6% to Kshs 79.6 bn in Q2’2022 from Kshs 124.1 bn recorded in Q1’2022.

Section IV: Initiatives placed to promote private sector credit growth

Based on the importance on private sector contribution to GDP, the Central Bank of Kenya (CBK), in collaboration with other stakeholders, has implemented various measures ranging from licensing of new products, technological innovations and public education to promote credit growth in Kenya. Some of the initiatives include;

- Implementation of the Credit Guarantee Scheme (CGS) Regulation 2020 to enhance credit access to MSMEs – Since its inception, the scheme has facilitated 2,609 business access loans to MSMEs totalling to Kshs 4.1 bn as at 31st August 2022 surpassing its seed capital of Kshs 3.0 bn. Key to note, 60.0% of the beneficiaries were small enterprises, while micro and medium enterprises accounted for 25.0% and 15.0% respectively,

- Alternative sources of borrowing - The Kenyan Government through the Central Bank of Kenya pursued alternative funding sources such as external borrowing. However, the government should focus more on the concessional borrowing such as soft loans that are cheaper as compared to commercial loans such as the Eurobonds. By implementing alternative borrowing, the government domestic credit from commercial banks will reduce, and as a result, increased the ease of credit access to the private sector. Additionally, the government has implemented Public-Private Partnerships (PPP) initiatives in different thematic Real Estate Sector sectors such as infrastructure and housing projects to reduce its borrowing costs and promote fiscal consolidation efforts. The move helps in minimizing the crowding out of the private sector,

- Lowering the cash reserve requirement ratio – The CBK reviewed the cash reserve ratio in March 2022 to 4.25% from the preceding 5.25% releasing Kshs 35.2 bn additional liquidity to commercial banks. The increased liquidity improved credit access within the economy, and consequently to the private sector,

- Adoption of the cost of credit website for commercial banks in enhancing loan comparison – The introduction of the credit cost website by the Kenya Bankers Association (KBA) in collaboration with the Central Bank of Kenya (CBK) has enabled commercial banks and microfinance institutions to publish their costs of credit. The initiative has promoted disclosure of bank charges and fees and ease comparison of loan rates to facilitate informed borrowing decisions by the private sector,

- Approval of banks risk-pricing models – The Central bank of Kenya has approved risk-pricing models for 22 out of the 38 commercial banks in a bid to increase credit accessibility based on a lenders borrowing history the customers while helping banks and other lenders to manage their risk exposure. The initiative will increase credit accessibility to the private sector based on an individual financial profile in terms of borrowing and repayment history,

- Capital Markets Authority (CMA) regulations on crowd funding - Recently, the Cabinet Secretary for the National Treasury and Planning, through the Capital Markets Authority (CMA) gazetted the amended Capital Markets (Investments-Based Crowdfunding) Regulations 2022, seeking to increase the access to funding for the Micro, Small and Medium Enterprises (MSMEs), start-ups and businesses while protecting investor’s interest by reducing the platform operator’s annual regulatory fee by 50.0% to Kshs 100,000.0 from Kshs 200,000.0.

- Credit facilities to target groups such as Youth and Women – The government under the Public Finance Management Regulations has rolled out various loans targeting women, youths and persons living with disabilities (PWDs) such as the Youth Development Fund, Uwezo Fund and Women Enterprise Fund in increasing credit to special groups people. Uwezo Fund has proven the most successful loan rollout fund due to its decentralized criterion of disbursements. The fund has extended cumulative loans amounting to Kshs 7.2 bn to 79,164 groups comprising of 70.0% female groups and 30.0% male groups since inception,

Additionally, the banking system has put in place measures to aid private sector credit growth such as;

- Deepening financial inclusion through digital integration – Banks are increasing their presence and accessibility to the private sector through digital avenues such as apps and USSD in promoting credit uptake. Banks such as KCB and NCBA partnered with Safaricom to offer the overdraft credit facility of Fuliza in increasing credit lending to SMEs. Additionally, KCB has the VOOMA app specifically targeting lending to small and medium enterprises,

- Restructuring of loans – Commercial banks collectively restructured loans amounting to KSh 1.7 tn involving 300,000 loan accounts between March 2020 and February 2021 in an effort to improve flexibility of credit repayment to the private sector and accelerate post COVID-19 businesses recovery,

- Adoption of risk-based pricing - 22 out of the 38 commercial banks have adopted risk-based pricing as a measure of tailoring loans to a customer’s financial profile while helping banks and other lenders to manage their risk exposure. The initiative will increase credit accessibility to the private sector based on an individual financial profile in terms of borrowing and repayment history,

Section V: Comparison against other countries

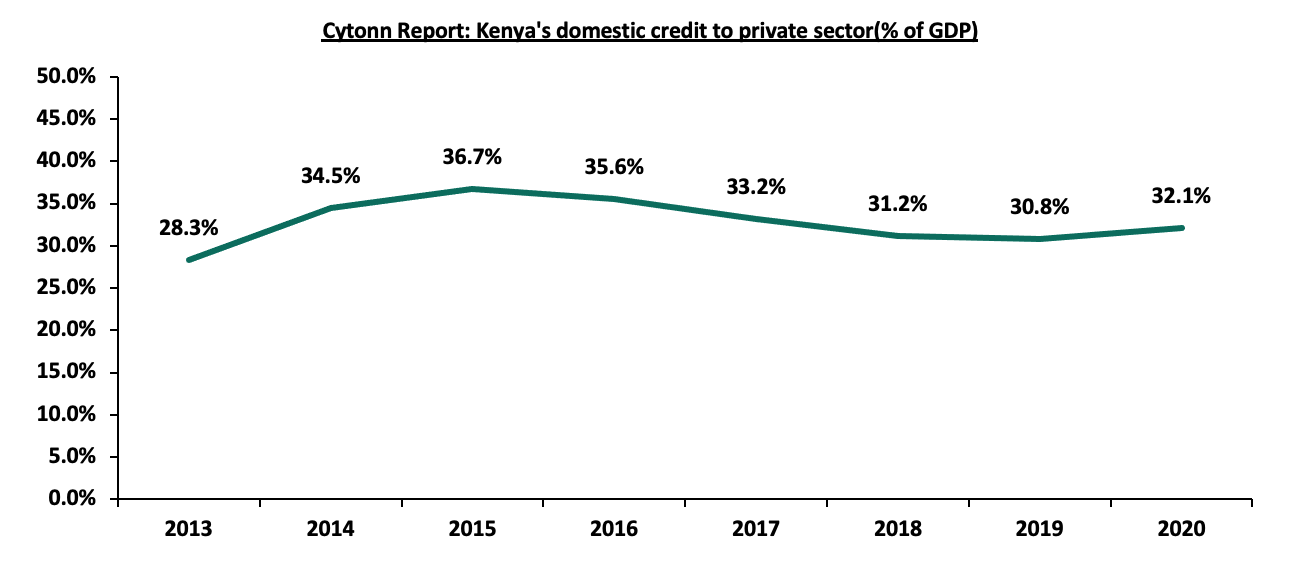

According to the World Bank, Kenya’s domestic credit extended to the private sector outperformed majority of the Sub-Saharan countries. The Kenya’s domestic credit extended to private sectors as a percentage of the GDP came in at 32.1%, 6.8% points lower than the average Sub-Saharan domestic credit to private sectors lending which stood at 38.9% in the same period. Although Kenya outperformed majority of Sub-Saharan countries in credit extended to the private sector, the country still underperformed against developed economies. The graph below shows domestic credit extended to the private sector over the years and a comparison of Kenya’s performance against selected economies;

Source: World Bank

Source: World Bank

Different developed countries have adopted different measures in enhancing private sector credit growth. Some of the successful measures include:

- Project Finance Structuring – a financing option structured around a projects own operating cash flow and assets alleviating investments risks and raise finance at a low cost. China used the measure in 1997 to launch a local contract undertaken by Plantation Timber Products (Hubei) Ltd amounting to USD 57.0 mn greenfield project in installing modern medium-density fibreboard plants in interior China. Due to the limited-recourse financing nature of the project, IFC sourced for USD 26.0 mn in syndicated loans, at a time when foreign commercial banks remained cautious about project financing in China's interior provinces.

- Universal supervisory body to monitor fund disbursements – The UK has a universal monitoring organization, the British Business Bank (BBB), in charge of monitoring all fund operations of government fund initiatives such as Enterprise Finance Guarantee Scheme (EFGS), the British Growth Fund (BGF), the Funding for Lending Scheme (FLS) and the Start Up Loans Scheme (SLS). The measure helps in promoting accountability and transparency of funds disbursements.

Section VI: Conclusion and Recommendation