Nairobi Metropolitan Area Residential Report 2023, & Cytonn Weekly #18/2023

By Cytonn Research, May 7, 2023

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 110.7%, up from the 37.5%, recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 19.3 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 508.0%, significantly higher than the 167.2% recorded the previous week. The subscription rate for the 182-day and the 364-day papers increased to 53.4% and 9.2%, from 14.4% and 8.7%, respectively, recorded the previous week. The government accepted bids worth Kshs 25.5 bn out of the Kshs 26.6 bn total bids received, translating to an acceptance rate of 96.1%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 4.6 bps, 16.7 bps and 4.3 bps to 11.2%, 10.7% and 10.3%, respectively;

During the week, the Central Bank of Kenya announced the issuance and usage of the Kenya Quick Response Code Standard 2023 (KE-QR Code Standard 2023). The Standard will guide banks and payment service providers that are approved and regulated by the Central Bank in issuing of Quick Response Codes to consumers and businesses that accept digital payments;

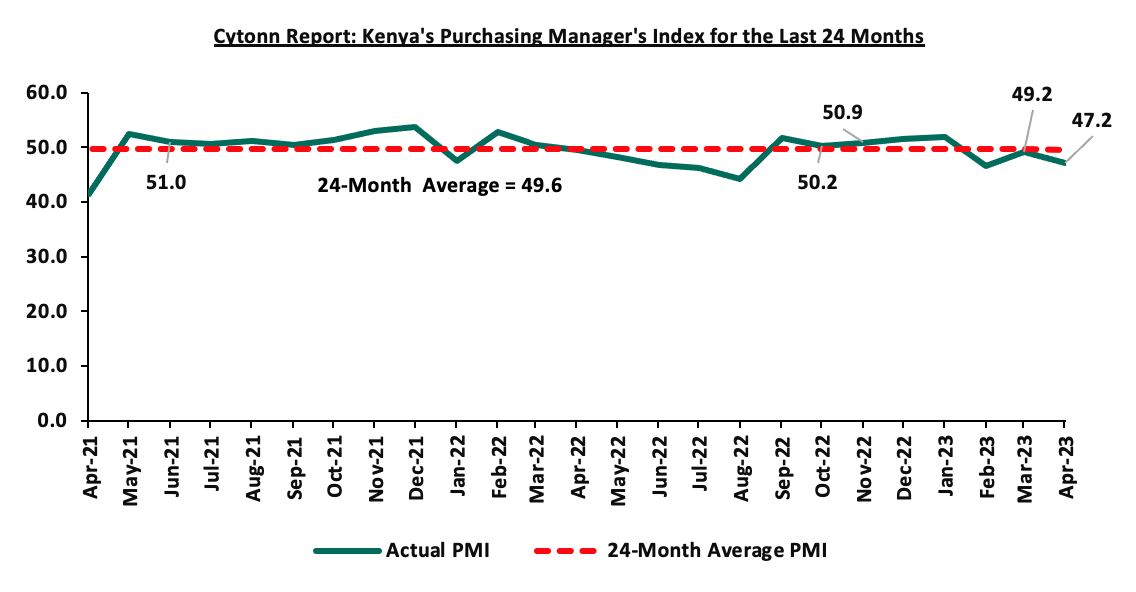

Additionally, during the week, Stanbic bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of April 2023 came in at 47.2, down from 49.2 in March 2023, pointing towards further deterioration in the business environment for the third consecutive month in 2023;

Also, during the week, the Cabinet Secretary for the National Treasury submitted the Finance Bill-2023 to the National Assembly for discussion and consideration for enactment into the Finance Act 2023;

Further, during the week, the Kenya National Bureau of Statistics released the Economic Review 2023, highlighting that the Kenyan economy recorded a 4.8% expansion in 2022, lower than the 7.6% growth recorded in 2021;

Equities

During the week, the equities market was on a downward trajectory with NASI, NSE 20 and NSE 25 declining by 4.3%, 2.8% and 4.7%, respectively, taking the YTD performance to losses of 19.1%, 8.4% and 13.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as ABSA Bank, NCBA Group, EABL and Safaricom of 16.9%, 15.3%, 6.1% and 4.5%, respectively. The losses were however mitigated by gains recorded by stock such as Stanbic Holdings of 1.1%;

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2023, highlighting a decline in growth of the Real Estate and Construction sectors. Additionally, Hass Consult, a consulting and Real Estate development firm based in Kenya, published its House Price Index Q1’2023 Report, highlighting that the average q/q selling prices for residential houses registered a 0.02% increase in Q1’2023, compared to a 2.2% decline recorded in Q4’2022, while on a y/y basis the average selling prices for residential houses appreciated by 2.0%, compared to a 6.8% increase that was recorded in Q1’2022. Additionally, Hass Consult released its Land Price Index Q1’2023 Report, highlighting that the average q/q and y/y selling prices for land in the Nairobi suburbs slightly increased by 0.3% and 1.4% respectively, compared to 0.1% and 1.1% recorded in Q1’2022. Consequently, q/q and y/y land prices in satellite towns of Nairobi increased by 1.3% and 8.1% respectively, compared to a 2.2% and 7.4%, respectively in Q1’2022. In the Commercial Office sector, the United Nations (UN) announced plans to relocate the United Nations Office for Project Services (UNOPS) Africa regional office to Nairobi, Kenya from Copenhagen, Denmark. In Regulated Real Estate Funds, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.10 per share in the Nairobi Securities Exchange. On the Unquoted Securities Platform as at 28 April 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.7%, remaining relatively unchanged from what was recorded the previous week.

Focus of the Week

This week we update our research on the Nairobi Metropolitan Area (NMA) Residential sector by showcasing the sector’s performance. We shall review the price performance, rental yields and space uptake, based on the coverage of 35 residential nodes;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.03%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.70% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

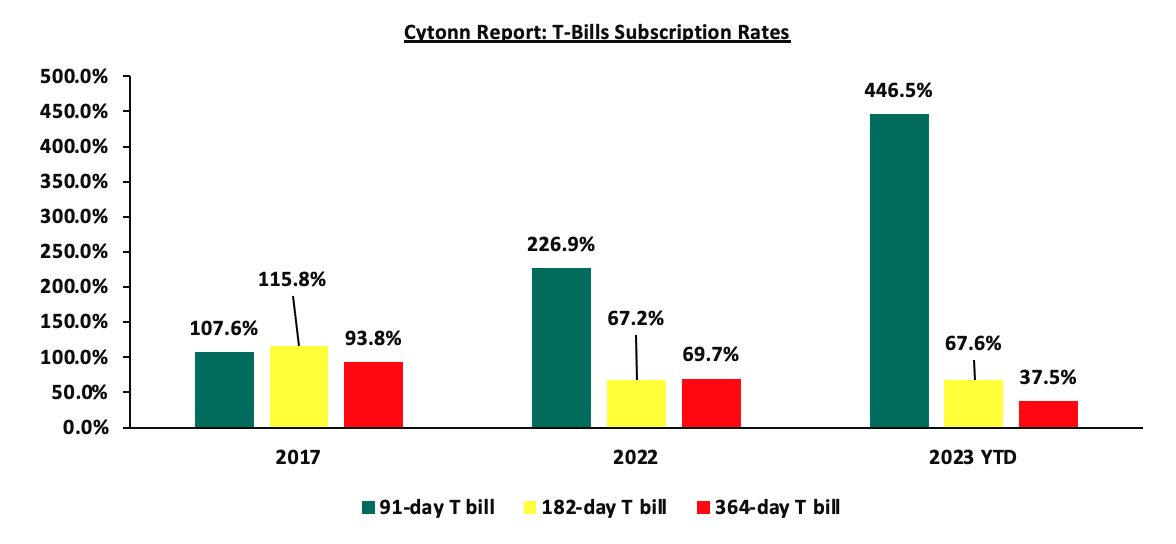

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 110.7%, up from the 37.5%, recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 19.3 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 508.0%, significantly higher than the 167.2% recorded the previous week. The subscription rate for the 182-day and the 364-day papers increased to 53.4% and 9.2%, from 14.4% and 8.7%, respectively, recorded the previous week. The government accepted bids worth Kshs 25.5 bn out of the Kshs 26.6 bn total bids received, translating to an acceptance rate of 96.1%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 4.6 bps, 16.7 bps and 4.3 bps to 11.2%, 10.7% and 10.3%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Money Market Performance:

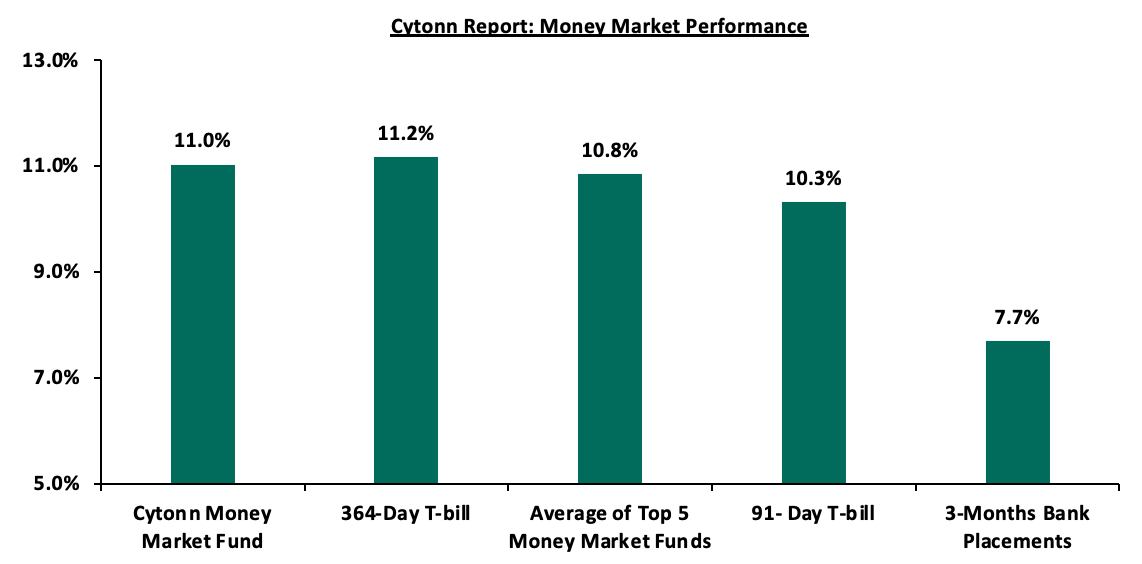

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yields on the 364-day and average yields on the Top 5 Money Market Funds increased by 4.6 bps and 11.6 bps to 11.2% and 10.8%, respectively. The yields on the 91-day paper increased by 4.3 bps to remain relatively unchanged at 10.3%, while the yield of Cytonn Money Market Fund decreased by 2.0 bps to remain relatively at 11.0%, similar to what was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 5 May 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 5 May 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

11.0% |

|

2 |

Etica Money Market Fund |

11.0% |

|

3 |

GenAfrica Money Market Fund |

10.9% |

|

4 |

Dry Associates Money Market Fund |

10.8% |

|

5 |

Apollo Money Market Fund |

10.6% |

|

6 |

Jubilee Money Market Fund |

10.5% |

|

7 |

Kuza Money Market fund |

10.2% |

|

8 |

Enwealth Money Market Fund |

10.1% |

|

9 |

Old Mutual Money Market Fund |

10.1% |

|

10 |

Madison Money Market Fund |

10.1% |

|

11 |

AA Kenya Shillings Fund |

10.1% |

|

12 |

NCBA Money Market Fund |

10.0% |

|

13 |

Zimele Money Market Fund |

9.9% |

|

14 |

Nabo Africa Money Market Fund |

9.8% |

|

15 |

Sanlam Money Market Fund |

9.8% |

|

16 |

Co-op Money Market Fund |

9.7% |

|

17 |

GenCap Hela Imara Money Market Fund |

9.6% |

|

18 |

KCB Money Market Fund |

9.6% |

|

19 |

CIC Money Market Fund |

9.5% |

|

20 |

British-American Money Market Fund |

9.4% |

|

21 |

Orient Kasha Money Market Fund |

9.3% |

|

22 |

ICEA Lion Money Market Fund |

9.3% |

|

23 |

Absa Shilling Money Market Fund |

8.4% |

|

24 |

Mali Money Market Fund |

8.3% |

|

25 |

Equity Money Market Fund |

7.2% |

Source: Business Daily

Liquidity:

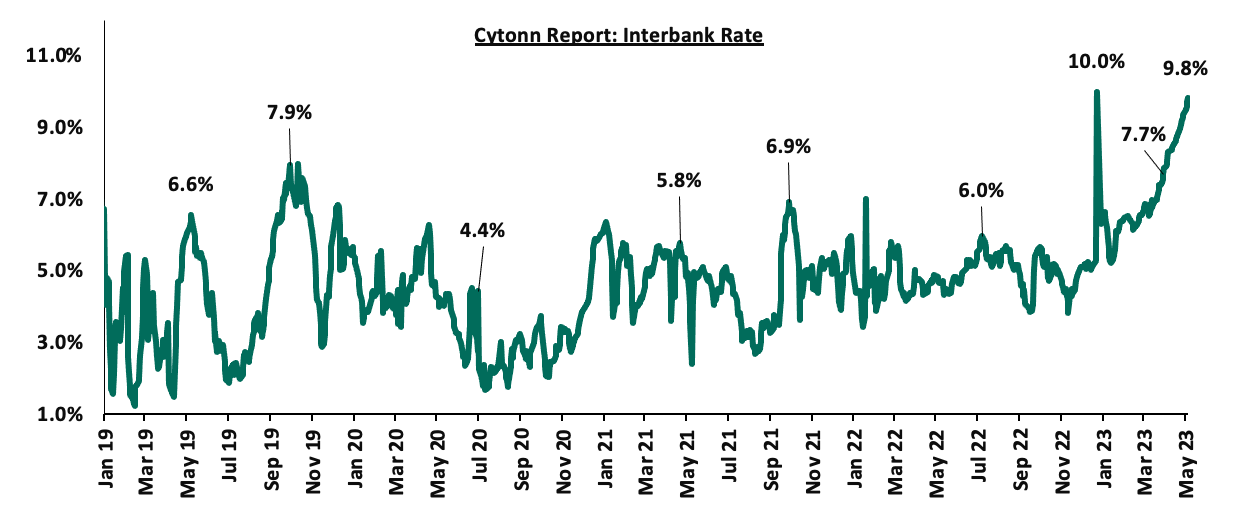

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 9.7%, from 9.2% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 11.3% to Kshs 19.0 bn, from Kshs 17.1 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Source: CBK

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performances with the yield on the 10-year Eurobond issued in 2018 recording the largest decline having declined by 0.4% points to 13.7%, from 14.1%, recorded the previous week, while the yield on the 7-year Eurobond issued in 2019 remained unchanged at 15.4%. The table below shows the summary of the performance of the Kenyan Eurobonds as of 4 May 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

1.2 |

4.8 |

24.9 |

4.1 |

9.1 |

11.2 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

31-Mar-23 |

14.2% |

12.3% |

11.6% |

13.4% |

11.7% |

11.3% |

|

27-Apr-23 |

20.0% |

14.1% |

12.7% |

15.4% |

13.2% |

12.4% |

|

28-Apr-23 |

20.6% |

14.1% |

12.7% |

15.5% |

13.2% |

12.4% |

|

1-May-23 |

20.6% |

14.1% |

12.7% |

15.5% |

13.2% |

12.4% |

|

2-May-23 |

20.9% |

14.2% |

12.8% |

15.7% |

13.2% |

12.4% |

|

3-May-23 |

20.4% |

14.1% |

12.7% |

15.6% |

13.2% |

12.4% |

|

4-May-23 |

19.7% |

13.7% |

12.6% |

15.4% |

13.0% |

12.3% |

|

Weekly Change |

(0.3%) |

(0.4%) |

(0.1%) |

0.0% |

(0.2%) |

(0.1%) |

|

MTD Change |

(0.8%) |

(0.4%) |

(0.1%) |

(0.0%) |

(0.1%) |

(0.1%) |

|

YTD Change |

6.8% |

3.2% |

1.7% |

4.5% |

2.3% |

2.5% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.4% against the US dollar to close the week at Kshs 136.4, from Kshs 135.9 recorded the previous week, partly attributable to the persistent dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 10.5% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 4.9% of GDP in twelve months to January 2023, from 5.6% recorded in a similar period last year,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 63.0% of Kenya’s External debt was US Dollar denominated as of December 2022, and,

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 1,015.5 mn in 2023 as of March 2023, albeit 0.8% lower than the USD 1,023.8 mn recorded over the same period in 2022, and,

- The tourism inflow receipts that came in at USD 268.1 bn in 2022, a significant 82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

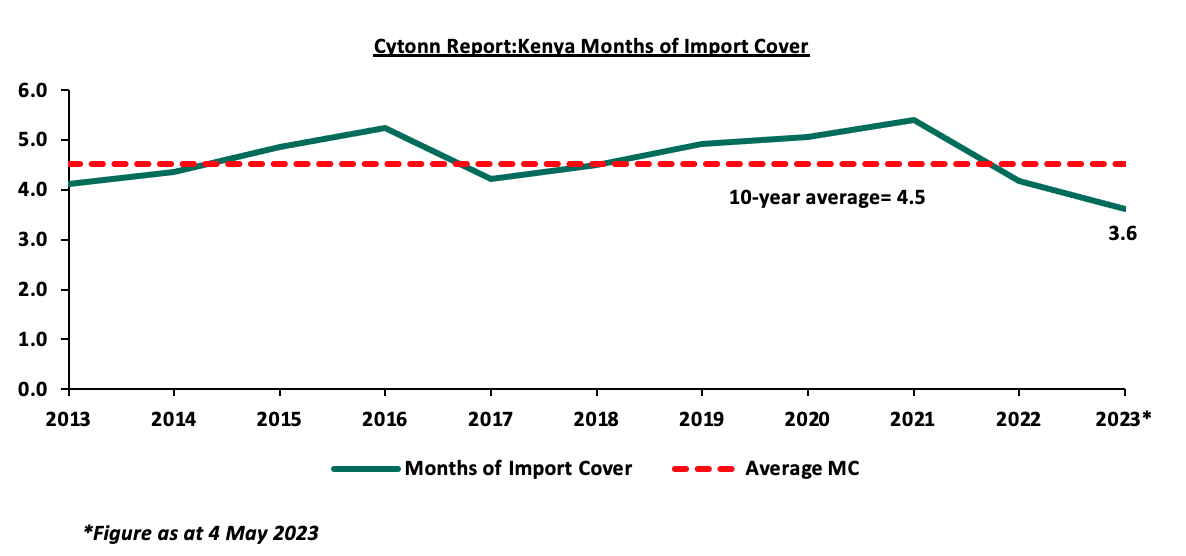

Key to note, Kenya’s forex reserves declined by 0.6% during the week to remain relatively unchanged at USD 6.5 bn as at 4 May 2023. As such, the country’s months of import cover also remained unchanged at 3.6 months, similar to what was recorded the previous week, and remained below the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years:

Weekly Highlights:

- Launch of the Kenya Quick Response Code Standard

During the week, the Central Bank of Kenya announced the issuance and usage of the Kenya Quick Response Code Standard 2023 (KE-QR Code Standard 2023). The Standard is aimed at guiding banks and payment service providers that are approved and regulated by the Central Bank in issuing of Quick Response Codes to consumers and businesses that accept digital payments. The launch of the QR code is in line with the Central Bank’s efforts to improve the efficiency and effectiveness of the National Payment System (NPS) for the period 2022-2025. The issuance of the Standard is a great step in facilitating payments with the following key take outs;

- Improve interoperability of the NPS through digital payments. Since digital payment system has made significant strides in Kenya with majority of institutions using payment channels such as M-PESA, the introduction of the QR Code will enhance interoperability by allowing the Central Bank of Kenya to develop, review and adopt common standard towards digital payments,

- Tackle the issue of friction and fragmentation among payment service providers and banking institutions to allow for uniform payments and financial inclusion, given that payment institutions have developed innovative products and services to meet the varied needs of Kenyan businesses,

- The adoption of the QR Code Standard will enable Kenya to join other countries that have implemented a standardized issuance of QR Codes for digital payment purposes. Some of the known countries include India, China, and Saudi Arabia, while closer home, South Africa is leading in the Sub-Sahara Africa, and,

- The QR Codes will be rolled out in two phases, with phase 1 to include formulation of the standardized QR codes for the retail payments industry, and phase 2 will enable the Central Bank of Kenya and Payment Service Providers to identify and resolve any payment fragmentation identified during the initial phase to enhance digital payment interoperability.

The adoption of the QR Code is a commendable move by the Central bank of Kenya in improving efficiency through fast tracking the implementation and adoption of cashless transactions. As such, we expect that common QR Code Standard will unify payment modules across the financial services industry, increase security of payment transactions as well as simplify the process of digital payment transactions. Additionally, the standardized QR codes will benefit the retail players especially supermarkets and other outlet stores by facilitating digital payments for customers at various points of sale.

- Stanbic Bank’s April 2023 Purchasing Manger’s Index (PMI)

During the week, Stanbic bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of April 2023 came in at 47.2, down from 49.2 in March 2023, pointing towards further deterioration in the business environment for the third consecutive month in 2023. The decline in the general business environment business was driven by subdued consumer spending on the back of elevated inflationary pressures despite the April inflation rate dropping by 1.3% points to 7.9% in April 2023, from 9.2% in March 2023. Further, the ongoing political protests, coupled with aggressive depreciation of the Kenyan shilling contributed significantly to the fall in aggregate consumer demand, and consequently production output by most businesses. The prices of both inputs and commodities continue to remain high amidst low cash flow circulation evidenced by the tightened liquidity in the money market with the average interbank rate coming in at 8.6% in April, up from an average interbank rate of 7.0%, recorded in March 2023.

On sectoral performances, activities declined in most sectors, with sectors such as manufacturing and services recording decline in sales volumes, while other sectors such as wholesale and retail, construction, and agriculture recorded expansion in sales volumes, albeit at lower rates. Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months:

We maintain a cautious outlook in the short-term owing to the elevated inflationary pressures, despite April inflation rate easing to 7.9% in April 2023. The cost of production continues to remain elevated increasing the prices of commodities, and as a result stifling consumer spending. As such, we expect that the general business environment to remain subdued in the short term as a result of the elevated inflationary pressures and continued depreciation of the shilling that have continued to weigh on consumer spending. Additionally, the elevated production costs occasioned by the high input costs on the back of the high fuel and electricity prices are expected to impede production levels in the private sector. However, the improvement in the general business environment in the country is largely pegged on the stability in the global economy.

- Finance Bill 2023

During the week, the Cabinet Secretary for the National Treasury submitted the Finance Bill 2023 to the National Assembly for discussion and consideration for enactment into the Finance Act 2023. Key to note, while the Finance Bill is yet to be published to the general public for review, the current draft proposes the following changes;

- Under the Income Tax Act;

- Increase in personal income tax brackets – The Finance Bill 2023 proposes to introduce a higher personal income tax rate of 35.0% on the income of individuals earning above Kshs 500,000.0 per month (an annual above Kshs 6.0 mn). Notably, the income tax bracket is currently subjected to an income tax rate of 30.0%,

- Housing Fund deductions on salaried workers – The treasury is proposing 3.0% deduction on an individual’s basic salary to be channelled to the National Housing Development Fund and matched by another 3.0% from the employer. Key to note, the Bill gives four exit routes that can be done voluntarily or one can exit the fund upon retirement, based on which happens first,

- Expansion of the scope of withholding tax – Additionally, the bill proposes withholding tax charges to the payments made to resident persons as follows;

-

- Payments made in relation to sales, promotion, marketing and advertising services at the rate of 5.0% of the gross amount the aggregate value of which is at least Kshs 24,000.0 in a month, and,

- In the 3rd Schedule of the income tax, payments made in relation to digital content monetization at the rate of 15.0%, with the aim of targeting content creators in various platforms such as YouTube, Instagram, Facebook and Tiktok, inclusive of all paid partnerships,

- Introduction of tax on digital assets – Digital Asset Tax is proposed at the rate of 3.0% applicable to income derived from the transfer or exchange of digital assets. The Bill defines digital assets to include anything of value that is not tangible and cryptocurrencies, token codes, numbers held in digital form and generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration that can be transferred, stored or exchanged electronically, as well as, a non-fungible token or any other token by whatever name called, and,

- Increase of turnover tax - The National Treasury is proposing that turnover tax rate to be increased upwards to 3.0%, from the current 1.0% while the tax bands eligible for turnover tax revised downwards to include a minimum band of Kshs 0.5 mn - 15.0 mn, from the current minimum band of Kshs 1.0 mn- 50.0 mn. This proposal is aimed at expanding the tax base to include the informal sector, targeting 2800 SMEs, in line with the Budget Policy Statement 2023.

- Under the Excise Duty Act;

- Removal of Kenya Revenue Authority’s power to implement inflation-adjusted exercise duty - The Finance Bill proposes to repeal section 10 of the Excise Duty Act which empowers KRA, with the approval of the Cabinet Secretary, to by notice in the Gazette adjust the specific rate of excise duty once every year to take into account the annual inflation adjustments depending on the economic circumstances in the relevant year. We expect that this proposal, if adopted, is a move to stabilize the cost of living, given that inflation has persistently remained above the government target range of 2.5% - 7.5%, despite easing to 7.9% in April 2023, from 9.2% recorded in March 2023,

- Introduction of exercise duty on items used in the beauty and cosmetics industry - The Finance Bill 2023 seeks to introduce excise duty on various goods such as wigs, false beards, eyebrows, eyelashes, artificial nails, and human hair at a rate of 5.0%, and,

- Payment of excise duty within 24 hours - The Finance Bill is proposing to introduce a requirement for excise duty on betting and gaming firms to remit exercise taxes to KRA by a bookmaker within 24 hours from midnight of the relevant day,

- Under the Value Added Tax Act;

- Exported services – The Finance Bill 2023, proposes re-introduction of exemption from VAT of exported services, a move that is commended by the public seeking to venture in job seeking opportunities abroad, and,

- Liquefied petroleum gas (LPG) - The Bill also proposes to delete the 8.0% VAT applicable to LPG and make LPG exempt from VAT. Notably, the rate of 8.0% VAT on LPG was revised downward in 2022, from the rate of 16.0%. In addition, the importation of LPG is proposed to be exempted from import declaration fees and railway development levy, in a bid to make LPG affordable, and consequently lower the cost of living.

- Other Key Proposals;

- Requirement to deposit 20.0% of the disputed amount before lodging a tax appeal at the High Court - The Bill proposes to introduce a requirement for taxpayers to deposit with the KRA 20.0% of the disputed tax or provide a security equivalent to 20.0% of the disputed tax before filing an appeal of a decision of the Tax Appeals Tribunal at the High Court. If the Court makes a decision in favour of the taxpayer, the KRA would be required to credit the amount or security within 30 days after the determination of the appeal.

The proposed tax measures in the Finance Bill 2023 are in line with the Budget Policy Statement 2023 in increasing the tax revenue by 15.3% to Kshs 2.9 tn in FY’2023/24, from the estimated Kshs 2.5 tn in FY’2022/2023. Notably, the proposals are consistence with the government’s focus on increasing tax revenue to above 17.8% of the GDP in FY’2023/2024, from the expected 17.4% expected in FY’2022/2023 by reducing the corporate tax gap to 30.0%, from the current 32.2%, as well as expand the tax base to include informal small and medium enterprises (SMEs). However, we maintain our view that the proposals are overly ambitious given the subdued general business environment, underpinned by depreciation of the Kenyan shilling, tightened liquidity in the money market, and elevated inflationary pressures that have suppressed both consumer spending and business production levels. Additionally, we note that the proposed increase in taxation, especially the turnover tax, may act as a disincentive to most SMEs, and further dampen the production levels in the country.

- Economic Survey 2023

During the week, the Kenya National Bureau of Statistics released the Economic Review 2023, highlighting that Kenyan economic recorded a 4.8% expansion in 2022, a 2.8% points decline from 7.6% recorded in 2021. The economic growth recorded in 2022 is an indication of resilience following multiple shocks such as supply chain constrains, soaring global fuel prices, elevated inflationary pressures and currency depreciation. Some of the key take outs of the macroeconomic performance include;

- GDP growth;

The Kenyan economic growth slowed down in 2022 as evidenced by an average GDP growth of 4.8%, a decline from 7.6% recorded in 2021, supported by strong performance in the services sector, which came in at 7.0%, albeit a lower growth compared to the 9.8% growth recorded in 2021. Notably, the key sub-sectors that supported growth were Financial and Insurance, Information and Communication, and Transportation and Storage with growths of 12.8%, 9.9%, and 5.6%, respectively. Despite the decline in the economic growth, the relatively high growth recorded in 2022 is an indication of resilience following multiple shocks such as supply chain constrains, soaring global fuel prices, elevated inflationary pressures and currency depreciation. Similarly, the global economy grew at a slower rate of 3.4% in 2022, from an expansion of 6.0% recorded in 2021. The slow down in global economic growth was mainly attributable to supply chain disruption worsened by geopolitical tensions between Russia and Ukraine, tightened monetary policies and elevated inflationary pressures. Additionally, in 2022, the Sub-Saharan and East African economies recorded growths of 3.9% and 4.9%, respectively,

- Inflation;

Kenya’s inflation rate averaged at 7.7% in 2022, up from an average of 6.1% recorded in 2021, mainly driven by high food and non-alcoholic beverage index, housing as well as fuel index. Similarly, the world inflation increased to 8.7% in 2022, from 4.7% in 2021, driven by high fuel prices and supply chain bottlenecks, while the inflation for the Sub-Saharan Africa rose to 14.5%, from 11.0% in 2021,

- Current account deficit;

The Kenyan current account deficit deteriorated by 7.9% to Kshs 679.7 bn in 2022, from a deficit of Kshs 629.8 bn recorded in 2021. The deterioration was attributable to a 17.6% widening of the trade balance deficit to Kshs 1.6 tn, from 1.4 tn recorded in 2021, on the back of a 17.5% increase in merchandise imports to Kshs 2.5 tn, relative to a 17.4% growth in export earnings to Kshs 0.9 tn,

- Monetary Policy;

In 2022, the Monetary Policy Committee raised the Central Bank Rate (CBR) by a cumulative 175.0 bps to 8.75% in December 2022, from 7.00% in December 2021, with the aim of anchoring inflation that averaged at 7.7% in 2022, 0.2% points above the government’s target range of 2.5%-7.5%, as well as support the Kenyan shilling that depreciated by 9.0% in 2022. Notably, the key interest hikes were witnessed in June, October and December to 7.50%, 8.25% and finally 8.75%, respectively. Consequently, lending interest rates for loans and advances increased to 12.7% as at the end of December 2022, from 12.2% in December 2021,

- Public Finance;

The total debt stock of the National Government increased by 9.5% to Kshs 8.8 tn in June 2022, from Kshs 8.1 tn in June 2021. Additionally, the total revenue including grants increased by 21.6% to Kshs 2.2 tn in FY’2021/2022, from Kshs 1.8 tn in FY’2020/2021, while total expenditure grew by 12.2% to Kshs 2.9 tn in FY’2021/2022, from Kshs 2.6 in FY’2020/2021. Despite the high growth of revenue, the total expenditure continues to outweigh revenue performance. Going forward, the total revenue including grants is expected to increase by 14.9% to Kshs 2.6 tn in FY’2022/2023, up from Kshs 2.2 tn recorded in FY’2021/2022. Similarly, total expenditure is also expected to increase, at a lower rate of 11.4% to Kshs 3.3 tn in FY’2022/2023, from Kshs 2.9 tn in FY’2021/2022,

Going forward, we expect the global economic growth to remain subdued in 2023, attributable to the tightening of monetary policies, high inflation rates, ongoing geopolitical tensions that has been worsened by the effects of Russia-Ukraine war, as well as, the lingering effects of COVID-19 pandemic. Despite the expected slowdown in global growth, we expect that Kenya’s economy will remain resilient in 2023, supported by a robust performance in the services sector and expected recovery in agriculture, following the ongoing rainfall in most parts of the country. However, on the downside, we expect the growth in the Kenya economy to be affected by high inflation pressures, tightened monetary policy and high production costs.

Rates in the Fixed Income market have been on an upward trend given the continued government’s demand for cash and the highly tightened liquidity in the money market. The government is 0.9% behind its prorated borrowing target of Kshs 363.2 bn having borrowed Kshs 359.8 bn of the revised domestic borrowing target of Kshs 425.1 bn for the FY’2022/2023. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at March 2023 coming in at Kshs 1.4 tn in the FY’2022/2023, equivalent to 65.9% of its revised target of Kshs 2.2 tn and 87.9% of the prorated target of Kshs 1.6 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on a downward trajectory with NASI, NSE 20 and NSE 25 declining by 4.3%, 2.8% and 4.7%, respectively, taking the YTD performance to losses of 19.1%, 8.4% and 13.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as ABSA Bank, NCBA Group, EABL and Safaricom of 16.9%, 15.3%, 6.1% and 4.5%, respectively. The losses were however mitigated by gains recorded by stock such as Stanbic Holdings of 1.1%.

During the week, equities turnover declined by 13.5% to USD 6.6 mn, from USD 7.6 mn recorded the previous week, taking the YTD turnover to USD 386.4 mn. Foreign investors remained net sellers for a third consecutive week, with a net selling position of USD 2.7 mn, from a net selling position of USD 1.3 mn recorded the previous week, taking the YTD net selling position to USD 45.9 mn.

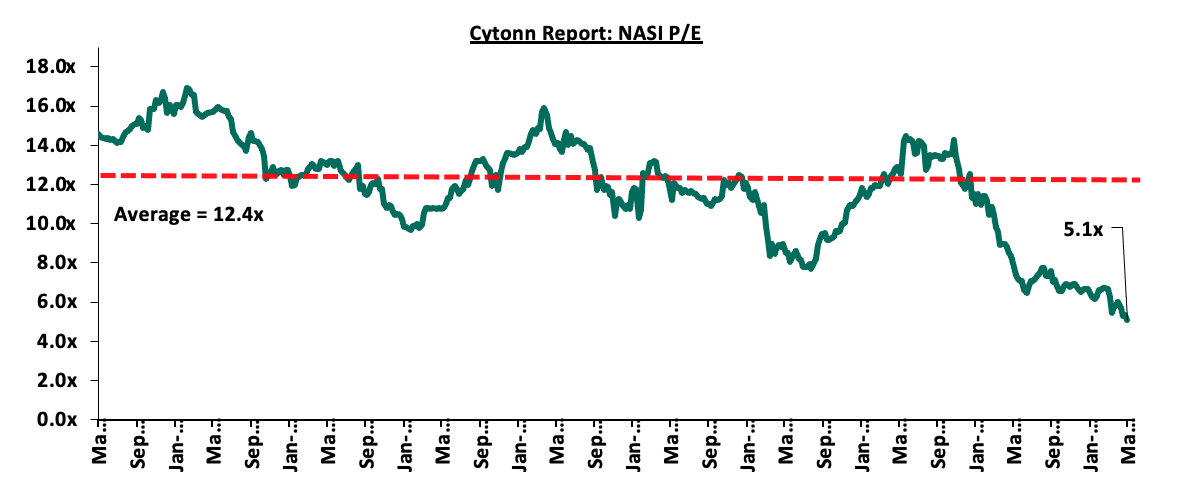

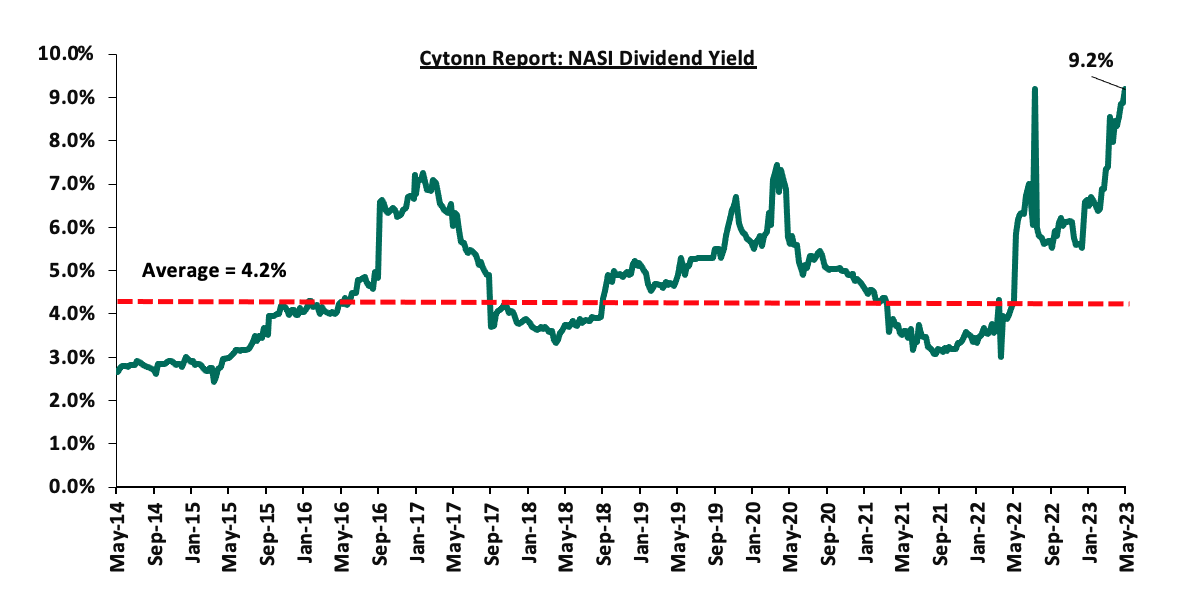

The market is currently trading at a price to earnings ratio (P/E) of 5.1x, 59.2% below the historical average of 12.4x. The dividend yield stands at 9.2%, 5.0% points above the historical average of 4.2%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 28/04/2023 |

Price as at 05/05/2023 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Britam |

4.3 |

4.2 |

(3.3%) |

(20.2%) |

5.2 |

7.1 |

0.0% |

71.6% |

0.7x |

Buy |

|

Jubilee Holdings |

180.0 |

185.8 |

3.2% |

(6.5%) |

198.8 |

305.9 |

6.5% |

71.2% |

0.3x |

Buy |

|

ABSA Bank*** |

12.2 |

10.1 |

(16.9%) |

(17.2%) |

12.2 |

15.1 |

13.4% |

63.3% |

0.8x |

Buy |

|

Liberty Holdings |

4.0 |

4.2 |

4.3% |

(17.7%) |

5.0 |

6.8 |

0.0% |

62.7% |

0.3x |

Buy |

|

I&M Group*** |

17.3 |

16.9 |

(2.6%) |

(1.2%) |

17.1 |

24.5 |

13.4% |

58.7% |

0.4x |

Buy |

|

NCBA*** |

39.5 |

33.5 |

(15.3%) |

(14.1%) |

39.0 |

48.7 |

12.7% |

58.4% |

0.6x |

Buy |

|

Standard Chartered*** |

149.0 |

142.8 |

(4.2%) |

(1.6%) |

145.0 |

195.4 |

15.4% |

52.3% |

0.9x |

Buy |

|

KCB Group*** |

32.9 |

31.6 |

(3.8%) |

(17.6%) |

38.4 |

45.5 |

6.3% |

50.3% |

0.5x |

Buy |

|

Kenya Reinsurance |

1.9 |

1.8 |

(4.2%) |

(3.2%) |

1.9 |

2.5 |

11.0% |

49.7% |

0.1x |

Buy |

|

Sanlam |

8.1 |

8.6 |

5.9% |

(10.2%) |

9.6 |

11.9 |

0.0% |

38.5% |

0.9x |

Buy |

|

Co-op Bank*** |

13.3 |

12.8 |

(3.8%) |

5.8% |

12.1 |

15.9 |

11.7% |

35.9% |

0.6x |

Buy |

|

Equity Group*** |

45.8 |

45.6 |

(0.5%) |

1.1% |

45.1 |

56.3 |

8.8% |

32.4% |

0.9x |

Buy |

|

CIC Group |

1.7 |

1.9 |

6.9% |

(3.1%) |

1.9 |

2.3 |

7.0% |

32.4% |

0.6x |

Buy |

|

Diamond Trust Bank*** |

54.8 |

53.8 |

(1.8%) |

7.8% |

49.9 |

64.6 |

9.3% |

29.5% |

0.3x |

Buy |

|

Stanbic Holdings |

116.0 |

117.3 |

1.1% |

15.0% |

102.0 |

131.8 |

10.7% |

23.1% |

0.8x |

Buy |

|

HF Group |

3.9 |

3.8 |

(2.8%) |

19.7% |

3.2 |

4.5 |

0.0% |

18.0% |

0.2x |

Accumulate |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Industry Reports

- Economic Survey 2023 Report

During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2023, and below are the key take outs related to the Real Estate sector:

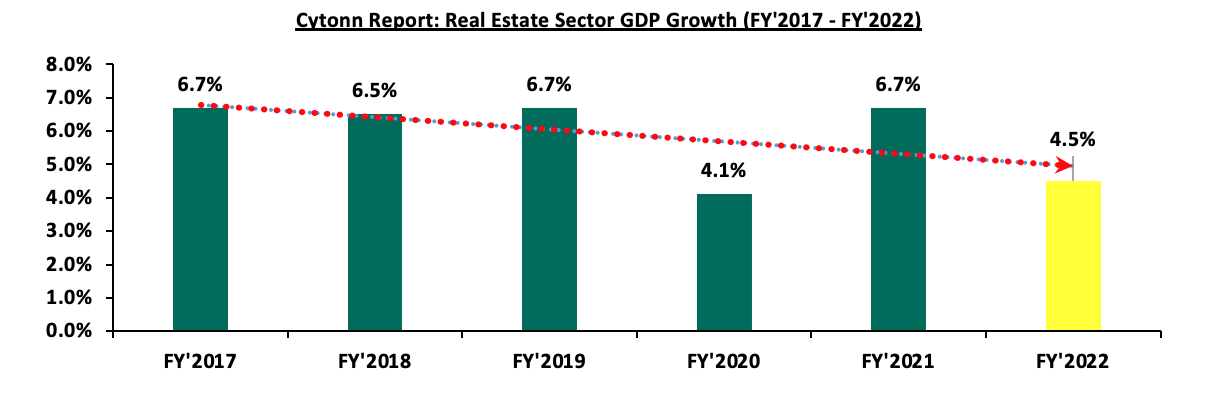

- Declined Growth in the Real Estate Sector – According to the report, the Real Estate Sector grew by 4.5% in FY’2022. This was however 2.2% points lower than the 6.7% growth recorded in FY’2021. The decline in performance was mainly attributed to increased cost of construction materials which hampered optimum investments, and reduced investor confidence as most investors, for the most part of the year adopted a ‘wait-and-see’ approach in anticipation of the August 2022 general elections. The graph below shows Real Estate sector growth rates from FY’2017 to FY’2022;

Source: Kenya National Bureau of Statistics (KNBS)

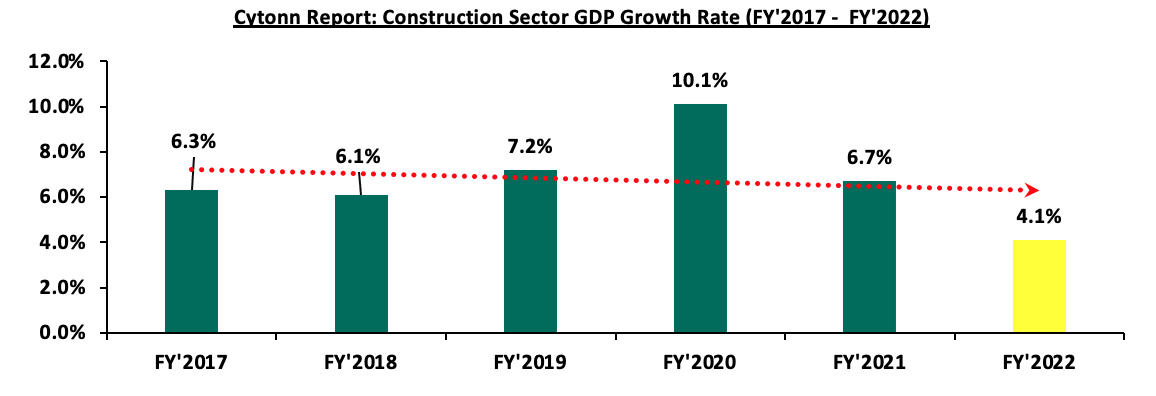

- Slower Growth in the Construction Sector - The construction sector grew by 4.1% in FY’2022, 2.6% point lower than the 6.7% growth recorded in FY’2021. The decline was driven by: i) rising cost of construction materials averaging at Kshs 5,210 per SQFT in 2022, a 5.0% increase from Kshs 4,960 per SQFT recorded in 2021, hence hindering several construction projects, ii) the completion of major development projects in the country such as the Nairobi Expressway, Eastern Bypass, and, iii) the government’s decision to cut back on infrastructure expenditure, subsequently reducing the FY’2022/23 budgetary allocation towards infrastructure projects, for the year ending June 2023, by Kshs 47.3 bn. This represented a 21.4% reduction in expected spending to Kshs 174.0 bn, from the Kshs 221.3 bn previously allocated, with an aim of prioritizing completion of stalled projects, and avoiding new capital intensive projects. The graph below shows the construction sector growth rate from FY’2017 to FY’2022;

Source: Kenya National Bureau of Statistics (KNBS)

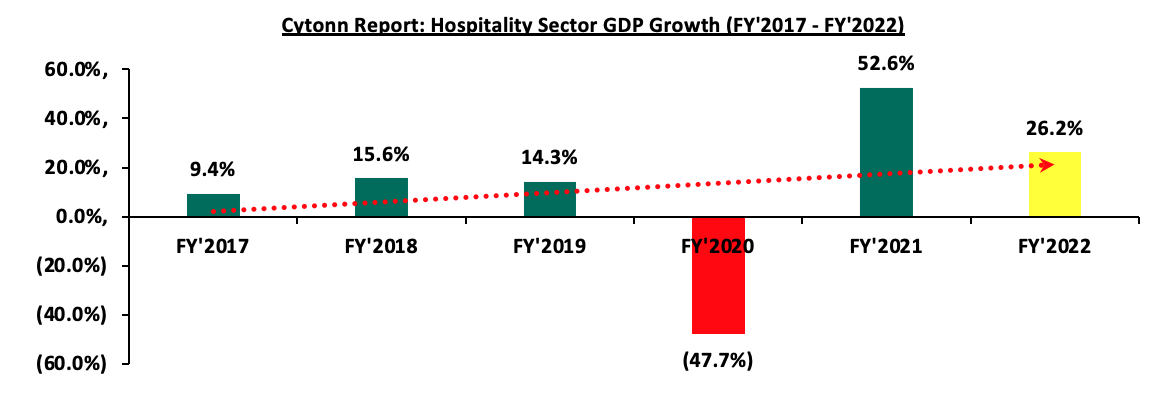

- Sustained Recovery in Accommodation and Food Service Sector - The Accommodation and Restaurant services grew by 26.2% in FY’2022, from the 52.6% growth recorded in FY’2021 demonstrating sustained recovery of the sector toward pre-COVID levels. However, the performance was 26.4% points decline from the 52.6% recorded in FY’2021, which was mainly attributed to the sector rebounding from a contraction occasioned by the COVID-19 pandemic, that saw countries impose lockdowns and travel restrictions. The sector’s growth in FY’2022 was slowed down by the elevated global and local inflationary pressures resulting from supply chain bottlenecks and persistent drought that negatively affected food production. Notably, the sector’s performance continues to be cushioned by the rising tourism activities with the number of visitors arriving into the country coming in at 1,145,133 visitors in FY’2022, from 692,938 visitors in FY’2021. The graph below shows the accommodation and restaurant sector growth rate from FY’2017 to FY’2022;

Source: Kenya National Bureau of Statistics (KNBS)

Kenya's Real Estate sector is expected to experience a surge in growth supported by; i) the peaceful post-election period, which bolstered investors' confidence, ii) the continuous recovery of the hospitality sector, aided by the Ministry of Tourism's vigorous marketing campaigns on platforms such as Magical Kenya, and iii) more development activities, particularly in the residential sector, with an emphasis on affordable housing. However, the impacts of the elevated inflationary pressures in the hospitality and construction sectors, coupled with a 4.4% reduction in government’s allocation for Infrastructure, Energy, and Information and Technology (ICT) for the FY’2023/24 to Kshs 398.2 bn, from Kshs 416.4 bn, are expected to weigh down on the optimum performance of the Real Estate sector.

- Hass House and Land Price Index Q1’2023 Report by Hass Consult

During the week, Hass Consult, a consulting and Real Estate development firm based in Kenya, published its House Price Index Q1’2023 Report. The report highlights the performance of the residential Real Estate sector in the Nairobi Metropolitan Area (NMA). The following are the main findings of the report:

- The average q/q selling prices for residential houses registered a 0.02% increase in Q1’2023, compared to a 2.2% decline in Q4’2022. The performance was mainly driven by 0.8% and 0.7% increase in apartment prices and detached houses prices respectively. However, the performance was weighed down by a 2.4% decline in the selling prices of semi-detached houses. On a y/y basis, the average selling prices for residential houses appreciated by 2.0%, compared to a 6.8% increase that was recorded in Q1’2022. The slow increase in property prices is attributable to inflationary pressures which have impended consumer demand, and saw developers be less aggressive in pricing their properties,

- In the Nairobi Suburbs detached and semi-detached houses, Lang’ata was the best performing node having recorded a y/y capital appreciation of 17.5% for its detached units, indicating increased demand for detached and townhouses in the area, fuelled by; i) its affordability compared to neighbouring nodes such as Karen, ii) good infrastructure network including the Southern-Bypass, and Lang’ata road enhancing accessibility and, iii) its close proximity to the Central Business District (CBD). Conversely, house prices in Runda recorded a significant y/y price decline of 6.5% primarily attributed to a decrease in demand for townhouses in the area due to house price affordability in neighbouring neighbourhoods such as Ridgeways and Nyari Estate that offer buyers the same lifestyle and quality of living as compared to Runda,

- In the Nairobi Suburbs apartments, Lang’ata remained to be the best performing region recording a y/y capital appreciation of 16.4% due to: i) its close proximity to the CBD and prime neighbourhoods such as Karen, ii) convenient access to social amenities such as shopping centres including Galleria, the Hub, Waterfront, and recreational facilities such as the Nairobi National Park, and iii) a well-established infrastructure network enhancing seamless accessibility through Lang'ata Road, Ngong Road, Mombasa Road, the Southern Bypass, and Wilson Airport for air travel. On the other hand, Upperhill realized the highest y/y price correction of 11.8% attributed to city residents opting for quieter neighbourhoods away from the noise pollution and traffic congestion prevalent in the area, and its transformation into a business district leading to a shift in demand from residential to commercial properties,

- In the satellite towns, houses in Ngong’ recorded the highest y/y price appreciation at 16.7% driven by increased demand resulting from; i) improved infrastructure development such as the Ngong’ Road thus enhancing accessibility, ii) growing middle income population in the area supporting demand, iii) proximity to social amenities and recreational facilities such as Milele Mall, Waterfront Karen, and The Hub, and iv) its affordability in terms of selling and rental prices compared to neighbouring areas such as Karen. Conversely, houses in Limuru realized the highest y/y price correction of 9.4% attributed to reduced demand owing to the region’s location which is far from Nairobi CBD and other major urban business nodes, and main transportation hubs like the Jomo Kenyatta International Airport (JKIA), Standard Gauge Railway (SGR), among others,

- In satellite towns’ apartments, Thika recorded the highest y/y price appreciation of 3.3% attributed to increased demand for apartments in the region facilitated by: i) the availability of affordable apartments in terms of selling and rental prices thus increasing demand ii) a growing student population from Mount Kenya University (MKU), Zetech University , Jomo Kenyatta University of Agriculture and Technology (JKUAT) and many more Technical And Vocational Institutes (TVETs) creating demand for affordable apartments in the area, and, iii) good infrastructural development mainly on the back of the Thika Superhighway which has reduced commute time from the CBD, thereby benefitting home buyers seeking to reside away from the city and the near-to-completion dualling of Kenol - Marua Road connecting the town centre to Murang’a and other counties in the Mt.Kenya region and the Northern Eastern frontier. On the other hand, Kitengela realized the highest y/y price correction of 11.1% attributed to stiff competition faced from neighbourhoods such as Athi River, Mlolongo, and Syokimau, which are strategically located along the Mombasa-Nairobi Highway enhancing accessibility and demand by buyers as well as its close proximity to amenities such as Crystal Rivers and Signature malls, and the Nairobi CBD,

- The overall asking rents of housing units in the NMA slightly declined by 0.5% q/q resulting to a 1.2% y/y decline, compared to a 1.5% q/q decline recorded in Q4’2022 and 0.3% y/y growth recorded in 2022, attributed to slow growth in the general demand for rental units post pandemic, and landlords still offering rent incentives to attract customers. Apartments recorded the highest y/y increase in asking rents of 3.2% with detached and semi-detached units realizing price corrections of 2.5% and 3.2% respectively, supported by the progressive expansion of the middle class preferring to renting apartments due to their affordability,

- In the Nairobi suburbs, houses in Loresho realized the highest y/y rent appreciation of 8.6%. This was attributed to; i) presence of sufficient amenities and infrastructure enhancing investments, ii) serene environment appealing to the upper-middle class hence creating demand, and iii) strategic and ambient location which is in part of Westlands. On the other hand, houses in Kileleshwa realized the highest y/y rental rates decline of 7.7% attributed to reduced demand for detached and semi-detached houses owing to new tenants shifting preference to renting apartments in areas that are more affordable,

- In the Nairobi Suburbs apartments, Lang’ata remained to be the best performing region recording a y/y rent appreciation of 12.8%, attributed to increased demand for the units in the region due to better amenities and the accessibility it offers. On the other hand, Parklands continued to realize the highest y/y rent correction of 11.3% attributable to reduced demand for residential properties by city dwellers and the region attracting more commercial office investments as compared to residential,

- In the satellite towns, houses in Ngong’ recorded the highest y/y rent appreciation at 17.4%, driven by increased demand resulting from; i) improved infrastructure development such as the Ngong’ Road thus enhancing accessibility, ii) growing middle income population in the area supporting demand, iii) proximity to social amenities and recreational facilities such as Milele Mall, Waterfront Karen and The Hub, and iv) its affordability in terms of selling and rental prices compared to neighbouring areas such as Karen. Conversely, houses in Juja realized the highest y/y rent correction of 3.1% attributed to reduced demand for detached and semi-detached houses owing to increased demand for apartments units facilitated by the student population from JKUAT and several colleges and TVETs in the region, and,

- For the satellite towns’ apartments, Rongai realized the highest y/y rental rate increase by 22.8% mainly due to better accessibility facilitated by improved infrastructure development and its affordability to the middle class that predominantly resides in the area. On the contrary, only apartments in Athi River recorded a y/y rental rates decline of 0.9% due to reduced demand on the back of competition from neighbouring nodes such as Mlolongo and Syokimau which are strategically located along Mombasa road are close to major transportation hubs such as Jomo Kenyatta International Airport (JKIA) and the Standard Gauge Railway (SGR) via the Nairobi Expressway which have significantly improved accessibility to the regions.

The findings of the report are in line with our Cytonn Q1’2023 Markets Review, highlighting that the residential market in NMA recorded a y/y improvement in performance with the average total returns to investors coming at 6.1%, 0.4% points increase from 5.7% recorded in Q1’2022. The improvement in performance was primarily fuelled by implementation of major infrastructural projects such as the Nairobi Expressway, Eastern, Northern and Western Bypasses, which have significantly improved accessibility to areas along the development, leading to increased demand of residential units, and the gradual recovery of the economy from the COVID-19 pandemic.

Hass Consult also released the Land Price Index Q1’2023 Report which highlights the performance of Real Estate land sector in the Nairobi Metropolitan Area (NMA). The following were the key take outs from the report:

- The average q/q selling prices for land in the Nairobi suburbs slightly increased by 0.3% compared to a 0.1% gain realized in Q1’2022. On a y/y basis, the performance represented a 1.4% increase, compared to a 1.1% growth recorded in Q4’2021. Consequently, q/q and y/y land prices in satellite towns of Nairobi increased 1.3% and 8.1% respectively, compared to a 2.2% and 7.4% respectively in Q1’2022. The sustained improvement in performance continues to demonstrate the sector’s resilience even during times of economic uncertainty characterised by inflationary pressures,

- Spring Valley was the best performing node in the Nairobi suburbs with a y/y price appreciation of 18.8%. This was attributed to increase in demand for land in the region owing to; i) adequate infrastructure, ii) adequate amenities such as Sarit Centre, and Westgate Shopping Malls, and, iii) proximity to the CBD and other prime and rising urban nodes such as Westlands. On the other hand, land in Kileleshwa recorded the highest y/y price correction of 2.9%. This was due to continuous decline in demand for development land attributed a general shift in trend by developers to satellite towns due to scarcity of affordable land for development in Nairobi, and,

- For satellite towns, Ngong was the best performing node with a y/y capital appreciation of 18.6%, followed by Athi River which recorded a y/y capital appreciation of 18.3%. The improvement in performance in Ngong was driven by i) infrastructural development, ii) increased demand for land due to its affordability, and, iii) its close proximity to the city centre and major urban nodes. On the other hand, land prices in Athi River continued to soar on the back of the Standard Gauge Railway (SGR) extension speculation. Conversely, Ongata Rongai was the worst performing node with a y/y price correction of 8.0% driven by low demand for land in the area, resulting from relatively farther distance from Nairobi CBD and other business nodes.

The findings of the report are also in line with our Cytonn Q1’2023 Markets Review, which highlighted that the overall average selling prices for land in the NMA appreciated by 5.7% to Kshs 130.4 mn per acre in Q1’2023, from Kshs 129.6 mn per acre recorded in Q1’2022. This was mainly attributed to; i) positive demographics driving demand for land facilitated by high population and urbanization growth rates significantly above the global averages, ii) improved development of infrastructure such as roads, railways, water and sewer lines which has improved and opened up areas for investment, ultimately increasing property prices, iii) increased construction activities particularly in the residential sector driven by the government’s affordable housing agenda thus boosting demand for land, iv) limited supply of land especially in urban areas which has contributed to rising land prices, and, v) a rising middle income class population with more disposable income to invest.

- Commercial Office Sector

During the week, the United Nations (UN) announced plans to relocate the United Nations Office for Project Services (UNOPS) Africa regional office to Nairobi, Kenya. Previously, the UNOPS Africa regional headquarters had its base in Denmark, while maintaining country offices in Liberia, Tunisia, Sudan, South Sudan, Kenya, the Democratic Republic of Congo (DRC), Nigeria, Ethiopia, Cote d'Ivoire, and Tunisia. The aim of the move was to bolster the agency's capability to aid its African member nations by improving its agility in addressing the continent's needs related to development, humanitarianism, peace, and security. Following the announcement, Kenya is set to host yet another United Nations agency including the United Nations Office at Nairobi (UNON), United Nations Environment Programme (UNEP), and, United Nations Human Settlements Programme (UN-Habitat) all of which are headquartered in Nairobi, alongside other country offices such as United Nations Development Programme (UNDP), and United Nations Children’s Fund (UNICEF) among others. The relocation is planned to be completed by the end of 2023.

Upon completion of the regional relocation by the agencies, we expect continued improvement in performance supported by; i) Kenya’s recognition as a peaceful, politically stable regional hub for businesses and diplomacy in the Eastern and Central Africa hence attracting more global organizations and agencies to the Kenyan commercial market, ii) increasing popularity of co-working spaces that cater to freelancers, small businesses, and clients with specific needs or shared interests, and, iii) full resumption of operations by most local firms and businesses resulting from the post-COVID-19 and peaceful post-electioneering periods thereby improve the economy. However, despite these positive developments, the sector's overall occupancy rates and yields may still be subdued due to the existing oversupply of office spaces, which is estimated at approximately 5.8 mn SQFT in the Nairobi Metropolitan Area (NMA) as at 2022.

- Regulated Real Estate Funds

- Real Estate Investment Trusts (REITs)

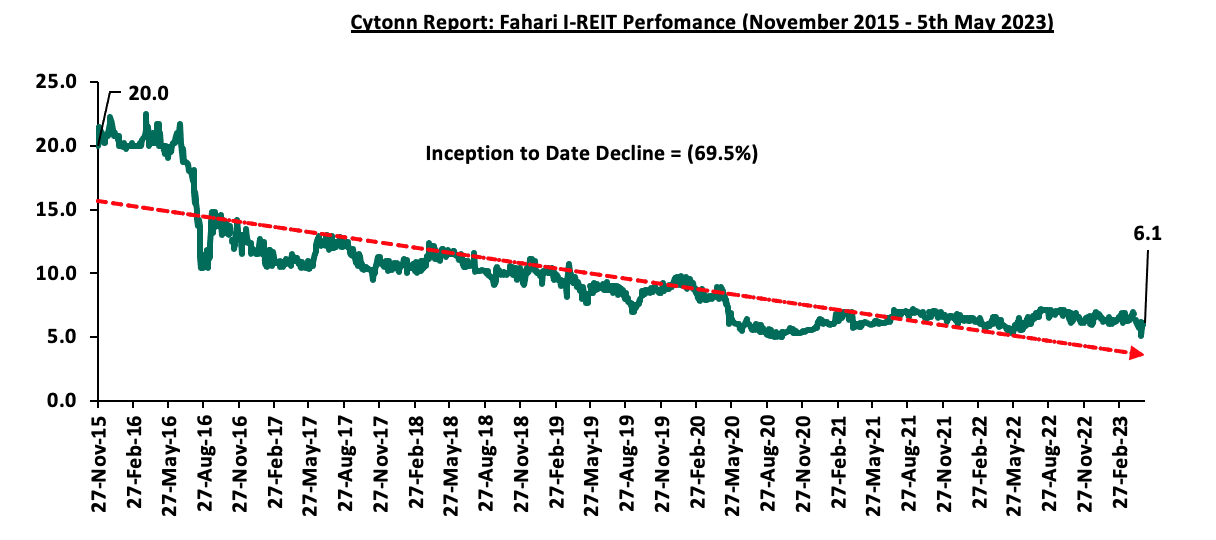

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.10 per share. The performance represented a 0.2% gain from Kshs 6.09 per share recorded the previous week, taking it to a 10.0% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3 January 2023. In addition, the performance represented a 69.5% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.7%. The graph below shows Fahari I-REIT’s performance from November 2015 to 5th May 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 28th April 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and IREIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.6 mn shares, respectively, with a turnover of Kshs 239.0 mn and Kshs 603.2 mn, respectively, since inception in February 2021.

REITs provide numerous advantages, including; access to more capital pools, consistent and prolonged profits, tax exemptions, diversified portfolios, transparency, liquidity and flexibility as an asset class. Despite these benefits, the performance of the Kenyan REITs market remains limited by several factors such as; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

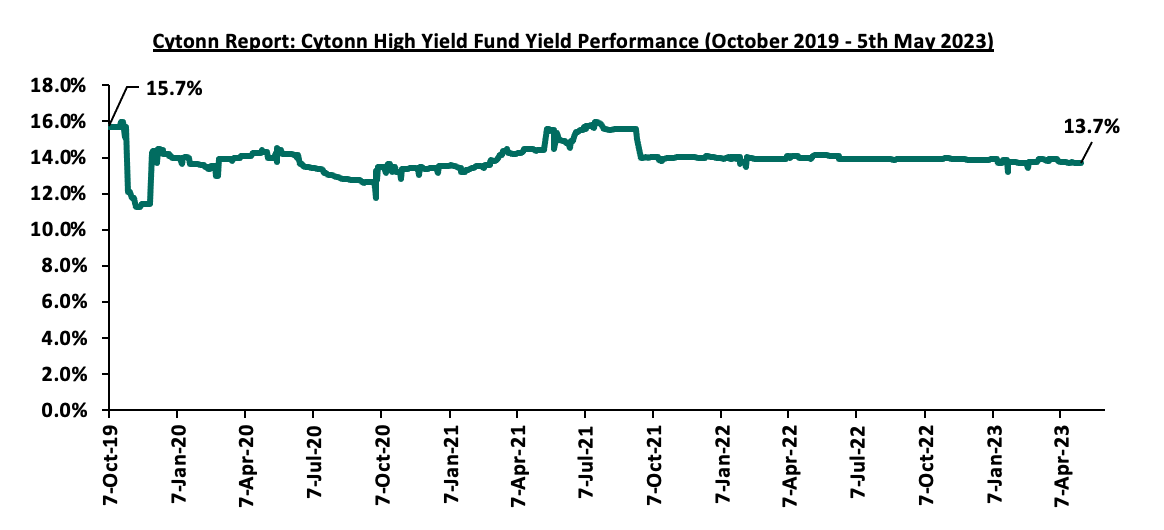

- Cytonn High Yield Fund (CHYF)

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.7% remaining relatively unchanged from what was recorded the previous week. The performance also represented a 0.2% points Year-to-Date (YTD) decline from 13.9% yield recorded on 1 January 2023, and 2.0% points Inception-to-Date (ITD) loss from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2015 to 5th May 2023;

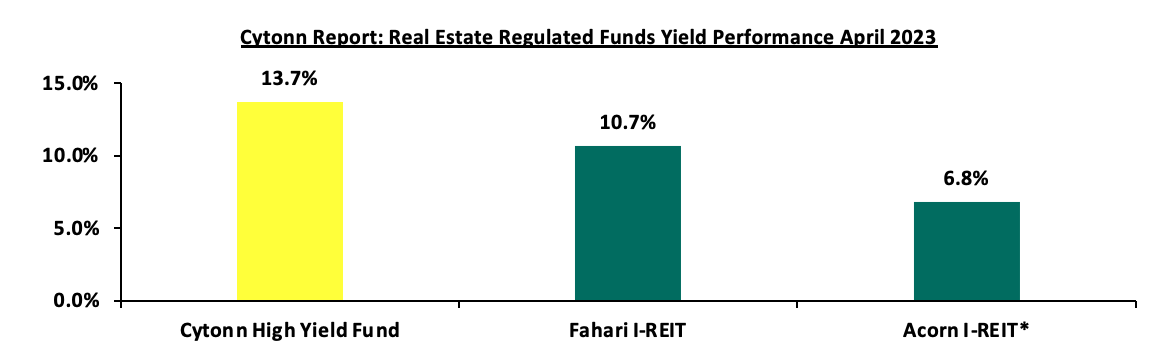

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 13.7%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.7%, and 6.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

*FY’2022

Source: Cytonn Research

We expect Kenya's Real Estate sector performance to continue on an upward trajectory propelled by various factors, including increased activities in the industrial sector, emphasis on affordable housing projects and the entry of international organizations into the commercial office sector that will assist curb the existing oversupply standing at 5.8 mn SQFT as at 2022. However, factors such as rising costs of construction due to inflationary pressures, a surplus of physical space in select sectors, and low investor appetite for REITs are expected to continue subduing the optimal performance of the general Real Estate.

Last year, we published our Nairobi Metropolitan Area (NMA) Residential Report 2022, titled ‘Improved Property Prices to Shape Market Recovery,’ in which we examined the performance of 35 residential nodes. This week, we update our analysis with the Nairobi Metropolitan Area (NMA) Residential Report 2023 titled ‘Resilient Market with Steady Growth Potential’ by highlighting the residential sector's performance in the region in terms of price appreciation, rental yields, and market uptake, based on the coverage of 35 regions within the Nairobi Metropolis. We also shall also discuss factors influencing residential supply and demand, current developments affecting the industry, and conclude with a look at investment options as well as the sector's general outlook for the coming fiscal year. As such, we shall discuss the following;

- Overview of the Residential Sector,

- Recent Developments in the Sector,

- Residential Market Performance, and,

- Conclusion, Residential Market Outlook and Investment Opportunity.

Section I: Overview of the Residential Sector

In FY’2022/23, the residential sector recorded increased activities mainly supported by the continued launch and implementation of various residential projects by the government, under the Affordable Housing Programme (AHP) which encouraged construction activities and property transactions. According to the Kenya National Bureau of Statistics (KNBS), Kenya’s Real Estate sector contribution to Gross Domestic Product (GDP) in 2022 came in at 10.5%, a 0.4% increase from the 10.1% recorded in 2021. The improvement in performance was attributed to improved investor confidence as a result of improvement in the country’s business environment post COVID-19 period, and, peaceful conclusion of the August 2022 General elections. The residential sector recorded improved performance evidenced by total returns to investors registering an uptick to come in at 6.2% in FY2022/23, a 0.4%-points increase from the 5.8% recorded in FY’2021/22. We expect the sector’s contribution to continue improving in 2023 supported by;

- Government and private sector aggressiveness in implementing housing initiative programs, with focus on affordable housing. As at 2022, the AHP had active pipeline of 376 projects looking to deliver 599,000 units across the country, with the construction of 13,529 units having already been completed and an additional 9,935 affordable housing units underway. Additionally, President William Ruto is set to further launch 35,980 units in Nairobi, Kiambu and Homa Bay counties,

- Increased partnerships between the Kenya Mortgage Refinance Company (KMRC) and commercial banks such as NCBA and Co-op Bank aimed at availing affordable mortgages and home loans to Kenyans,

- Concerted efforts by the government to provide affordable mortgages through the Kenya Mortgage Refinance Company (KMRC), in a bid to make home ownership more accessible to Kenyans by providing long-term, low-interest home loans to potential home buyers. In 2022, KMRC refinanced 1,948 mortgage loans valued at Kshs 6.8 bn, representing a 278.0% increase from 574 home loans valued at Kshs 1.3 bn disbursed in 2021, and,

- The growing trend towards use of alternative financing for Real Estate development particularly Public-Private Partnerships (PPPs) in delivering development projects.

Going forward, we anticipate that the following factors will influence the performance of the residential sector:

- Housing Deficit: According to KNBS, the Kenyan housing market still faces an acute housing shortage of more than 2.0 mn units. Additionally, the Center for Affordable Housing Finance Africa (CAHF) estimates the housing deficit in Kenya stood at 80.0%, as at the end of 2022, given that only about 50,000 new houses are delivered each year against a demand for 250,000. The government through the AHP has purposed to narrow this gap, and as such, affordable housing continues to attract more demand propelled by the increasing entry of private sector players through Public Private Partnerships (PPPs),

- Demographics: Kenya continues to witness positive demographics as evidenced by Kenya’s relatively high urbanization and population growth rates of 3.7% p.a and 1.9% p.a, respectively, against the global averages of 1.6% p.a and 0.9% p.a, respectively, as at 2021. As such, the demand for Real Estate development in the country continue to increase, and,

- Access to Credit: High mortgage interest rates currently at 11.3% and high transaction costs, have made it difficult for low- and middle-income earners to afford mortgages. However, we anticipate the increased collaborations between sector players and the KMRC, will aid remedy the situation. Notably, government’s efforts to make affordable home loans to Kenyans more accessible at lower interest rates of from 9.5%, will improve performance of mortgage lending by making home loans more accessible and consequently increase uptake rates in the country.

In terms of supply, the residential sector has been largely constrained by insufficient access to affordable funding by developers, and bureaucracies and delays in approval processes. In 2023, new supply is also expected to slow down owing to:

- Constrained Access to Financing: Lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector as evidenced by the 7.5% increase in gross Non-Performing Loans (NPLs) to Kshs 80.3 bn in Q4’2022, from Kshs 74.7 bn recorded during Q4’2021,

- Rising construction costs: Construction costs have remained high averaging at Kshs 5,210 per SQFT in 2022, a 5.0% increase from Kshs 4,960 per SQFT recorded in 2021, attributable to price increase of key construction materials such as cement, steel, paint, aluminium and PVC. The increase is mainly attributed to persisted inflationary pressures on the back of supply chain disruptions worsened by the ongoing Russia-Ukraine war. As such, we expect this will continue to impede development activities in the sector, and,

- Inadequate infrastructure: Inadequate and substandard infrastructure in many regions of the country will continue to impede development operations due to lack of accessibility, consequently limiting supply. Additionally, inadequate drainage and sewerage infrastructure in some places will continue to hinder developers, due to the anticipated additional development costs of projects. Moreover, the government’s decision to cut back on infrastructure expenditure until stalled projects are completed will slow down development of infrastructure across the country, thus further limiting supply.

Section II: Recent Developments in the Sector

In FY’2022/23, the government announced the following regulations, policies, measures, and proposals affecting the residential sector namely:

- Mortgage Plan: President William Ruto floated a mortgage plan that will allow tenants to own homes under the social housing tenant purchase scheme, and, affordable housing initiative, through monthly rental payments. The mortgage scheme plans to entail tenants paying their monthly rents as the mortgage repayments for a period of up to 20 years upon which, ownership of a unit is given to the tenant. For more information, see Cytonn Weekly #40/2022,

- Retirement and Benefits Act review: The Retirement Benefits Authority (RBA) announced plans to have pension managers publish data on the number of Kenyans who use their retirement savings to purchase homes by January 2023, after having reviewed the Retirement and Benefits Act. For more information, see Cytonn Weekly #41/2022,

- Stamp duty Act amendment: President William Ruto announced plans to exempt all first-time home buyers from paying stamp duty. This comes two years after the Stamp Duty Act was amended in 2020 to allow exemptions for first time home buyers of only approved affordable housing units by the government. For more information, see Cytonn Weekly #43/2022,

- Draft Valuation Roll 2019: Nairobi City Hall issued a notice on the increment of land rates to 0.115% of the current value of undeveloped land in Nairobi County based on the 2019 Draft Valuation roll, from 1st January 2023, in line with the Nairobi City Finance Act 2022. For more information, see Cytonn Weekly #47/2022,

- The Finance Act 2022: The Finance Act 2022 became effective as of 1 January 2023, with the Capital Gains Tax (CGT) chargeable on net gains upon transfer of property tripling to 15.0%, from the 5.0% previously chargeable. The bill was assented to law by President Uhuru Kenyatta in June 2022, stemming from the amendment of Section 34 (1) of the Income Tax Act. CGT is a final tax levied on the net gains which accrue to a company or an individual on or after 1 January 2015, whether or not the property was acquired before the aforementioned date, upon the transfer of property situated in Kenya. CGT was in existent until 1985 when it was suspended, and later re- introduced in 2015 through an amendment introduced to the Income Tax Act by the Finance Act 2014. For more information, see Cytonn Weekly #01/2023,

- The Finance Bill 2023: The Kenya National Treasury presented the Finance Bill 2023 to Parliament with an introduction of a new amendment in Section 31 of the Employment Act, The amendment recommends a 3.0% deduction on the basic salaries of both public and private sector employees who qualify for the low-cost housing scheme. This deduction will be matched with another 3.0% from their respective employers, and the total deduction will not exceed Kshs 5,000. The contribution will be directed to the National Housing Development Fund, President Ruto’s ambitious housing kitty which aims to finance the construction of 200,000 affordable houses annually across the country. However, high-income earners who are ineligible for the low-cost housing scheme will need to wait for seven years or until retirement to transfer the funds to a retirement benefits scheme or a pension scheme fund. Alternatively, they can opt to receiving their savings in cash as part of their income, which will be taxed at the prevailing rates. Previously, the government attempted to introduce a similar amendment in the Finance Act 2018, proposing a 1.5% deduction from employees' basic salaries, which was rejected by labor unions and employers in 2019. As a result, the National Treasury and the State Department of Housing were directed to revise the legal requirement by making the contribution voluntary to the Housing Fund Levy instead of being a compulsory deduction, and,

- FY’2022/23 Budget Statement: the 2023 Draft Budget Policy Statementindicated that the government's allocation for Infrastructure, Energy, and Information and Technology (ICT) for the fiscal year 2023/2024 is expected to be Kshs 398.2 bn, a 4.4% decline from the previous fiscal year's allocation of Kshs 416.4 bn. In addition, the FY'2022/2023 Supplementary Budget to the State Department of Infrastructure was slashed by Kshs 47.3 bn, representing a 21.4% reduction in expected spending to Kshs 174.0 bn, from the previous Kshs 221.3 bn allocated towards infrastructure projects for the year ending June 2023. This comes as the government is prioritizing the completion of previously stalled projects and avoiding initiation of new expensive projects amid the current regime’s promised cut on expenditure. As such, we expect the sourcing of funding for infrastructure projects in the country to further shift to alternative financing strategies such as; Public-Private Partnerships (PPPs), issuing of infrastructure bonds, joint ventures, and, grants and concessional loans from more foreign organizations, in order for the government to fast-track the infrastructural development that is critical in growing the Kenyan economy.

Notably, in November 2022, pension-backed mortgages received a setback after the court declared Retirement Benefits (Mortgage Loans) (Amendment) Regulations, 2020 unconstitutional as the process, through the parliament, did not involve public participation. The amendment, which was signed in 2020 by former Treasury Cabinet Secretary Ukur Yatani, was meant to support Kenya’s homeownership especially for the employed people in the formal sector who are unable to afford the monthly mortgage payments. The amendment was to allow workers access up to Kshs 7.0 mn or a maximum of 40.0% of their retirement savings from the pension schemes to buy their first residential house.

However, we continue to see increased focus on the Affordable Housing Programme (AHP) by the National and County governments and the private sector. These housing projects are undertaken through various strategies such as Public-Private Partnerships (PPPs) for the government involving private companies and Joint Ventures (JVs) for private companies executing their own projects. Currently, the AHP pipeline boasts about 25 affordable housing projects, with an estimated 47,787 housing units by the government and 50,225 housing units by the private sector under construction. This is as 200,000 housing units are targeted to be delivered per year. Some of the notable projects launched or ongoing during FY’2022/23 include:

- Centum Real Estate, a fully-owned subsidiary of Centum Investment Company kicked-off the phase one construction of its ‘Mzizi court’ housing project that will comprise 270 affordable residential units at the 102-acre Two Rivers Development. It is estimated that the construction of Mzizi Court apartments will take approximately 2.0 years and is anticipated to be complete by Q1’2024. For more information, see Cytonn Q1’2022 Markets Review,

- Heri Homes, a property developer in Kenya, in partnership with Finsco Africa, a Real Estate consultancy firm, announced plans to construct 384 affordable apartments in Ruiru Town, as part of its 200- acre mixed-use development project dubbed ‘Legacy Ridges’. For more information, see Cytonn Weekly #21/2022,

- The Nairobi Metropolitan Services (NMS) began the second phase of revamping housing estates in select parts of Nairobi County. This followed the completion of the first phase of the rehabilitation process in May 2022, which included 760 housing units in; Kariobangi South, Buruburu, Kariokor and Jamhuri estates. For more information, see Cytonn Weekly #23/2022,

- Property developer Mi Vida Homes announced plans to break ground 800 affordable housing units project by end of 2022. The more than Kshs 2.0 bn project dubbed, ‘Keza by Mi Vida’ will be located in Nairobi’s Riruta area. The project which will sit on a 4.5-acre piece of land 100m away from Kikuyu/Naivasha road junction. The project will consist of studios, one-bedroom, two-bedroom, and three-bedroom units, with prices ranging between Kshs 2.0 mn and Kshs 6.0 mn. Moreover, the project will be undertaken through a Joint Venture (JV) partnership strategy between Actis Limited, a private equity firm, Indian construction firm Shapoorji Pallonji Real Estate through Mi Vida Homes, and an undisclosed land owner. For more information, see Cytonn Weekly #27/2022,

- Pension funds administrator CPF announced plans to construct affordable housing units in Laikipia, Nakuru, Nairobi and Mombasa Counties. CPF which currently own assets worth Kshs 5.2 bn in its Individual Pension Plan (IPP)portfolio and Kshs 33.9 bn in its Local Authorities Pensions Trust (LAPTRUST) portfolio as at FY’2021, is looking to increase its investment portfolio into the Real Estate market, and is still in talks with the respective four county governments, in order to construct the housing units. For more information, see Cytonn Monthly, July 2022,

- National Housing Cooperation (NHC) announced that it is seeking to raise Kshs 7.0 bn through the International Finance Corporation (IFC) under the Public Private Partnership (PPP) model, to fund the construction of 3,500 housing units in Athi River, Machakos County. The housing units are part of the Kshs 20.0 bn ‘Stoni Athi Waterfront City’ project, consisting of 10,500 units to be developed on a 150 acres’ piece of land. For more information, see Cytonn Weekly #34/2022,

- Harambee Investment Cooperative Society (HICS), the investment subsidiary vehicle of Harambee Sacco Society Ltd, announced plans to develop housing projects in five counties namely; Nairobi, Nakuru, Kisumu, Laikipia, and Mombasa. The housing projects by HICs are aimed at providing investment opportunities for its 650 members which is expected to reach 1,000 by the end of the year. In addition to this, HICs also unveiled a mortgage facility dubbed ‘Harambee Home Loan’ by Harambee Sacco which is in partnership with the Kenya Mortgage Refinancing Company (KMRC), in order to provide a financing option to potential home buyers. Additionally, Safaricom Investment Cooperative (SIC) began the construction of an affordable housing project dubbed Miran Residence in Ruaka, Kiambu County. The Kshs 750.0 mn project has a completion date of June 2024 and will comprise of 200 units in its phase I, distributed into studio apartments, studio lofts, one bedrooms, and two bedrooms, with prices ranging between Kshs 3.2 mn and Kshs 6.5 mn. For more information, see Cytonn Q3’2022 Markets Review,

- President William Ruto announced plans to commission an affordable housing project consisting of 5,000 units in Homa Bay County with a start date on November 2022. The project was scheduled to be constructed in phases, with the first phase targeting 400 units; while the second phase comprising of 2,000 units and delivered by the end of 2023. For more information, see Cytonn Weekly #40/2022,

- Property developer Unity homes completed 10.0% of its Kshs 5.4 bn housing project dubbed ‘Unity East’, which sits on a 10.4-acre piece of land at Tatu City in Ruiru Sub - County. This constitutes 64 units of the total 640 houses whose construction began in November 2021 as the second phase of the project. For more information, see Cytonn Weekly #42/2022,

- The County Government of Nakuru announced plans to complete the construction of 605 affordable housing units by December 2023. Construction of the affordable housing scheme located at Bondeni was launched in May 2021, under Public-Private Partnership (PPP) agreement between the State Department of Housing and King Sapphire Developers. For more information, see Cytonn Weekly #45/2022,

- Property developer Mi Vida Homes announced plans to begin the construction of two projects at Garden City in April 2022; the 2nd phase of their mid-market apartments dubbed ‘Amaiya’, and affordable housing units dubbed ‘237 Garden City’. Sitting on a 47-acre piece of land at Garden City, Amaiya will comprise of one and two-bedroom duplexes, and three-bedroom flats, all totaling 200 units, with the prices starting at Kshs 9.5 mn, while 237 Garden City project worth Kshs 1.6 bn will comprise of a total of 600 units consisting of studio, one and two-bedroom apartments, with the prices starting from Kshs 2.8 mn. For more information, see Cytonn Weekly #45/2022,

- The National government, through the Permanent Secretary for State Department for Housing and Urban Development, Charles Hinga, commmenced the construction of 42,000 affordable housing units within November and December 2022. The projects were earmarked to be developed in; Makongeni, Starehe, and Shauri Moyo in Nairobi County, Ruiru in Kiambu County, and, Mavoko in Machakos County. For more information, see Cytonn Weekly #47/2022,

- The Kenyan National government in partnership with the United Nations Habitat, and, Epco Builders, a local private developer, broke ground for the construction of Mavoko Affordable Housing Project in Syokimau, Machakos County. For more information, see Cytonn Weekly #49/2022,