REITs H1'2025 performance report, & Cytonn Weekly #34/2025

By Investments Team, Aug 24, 2025

Executive Summary

Fixed Income

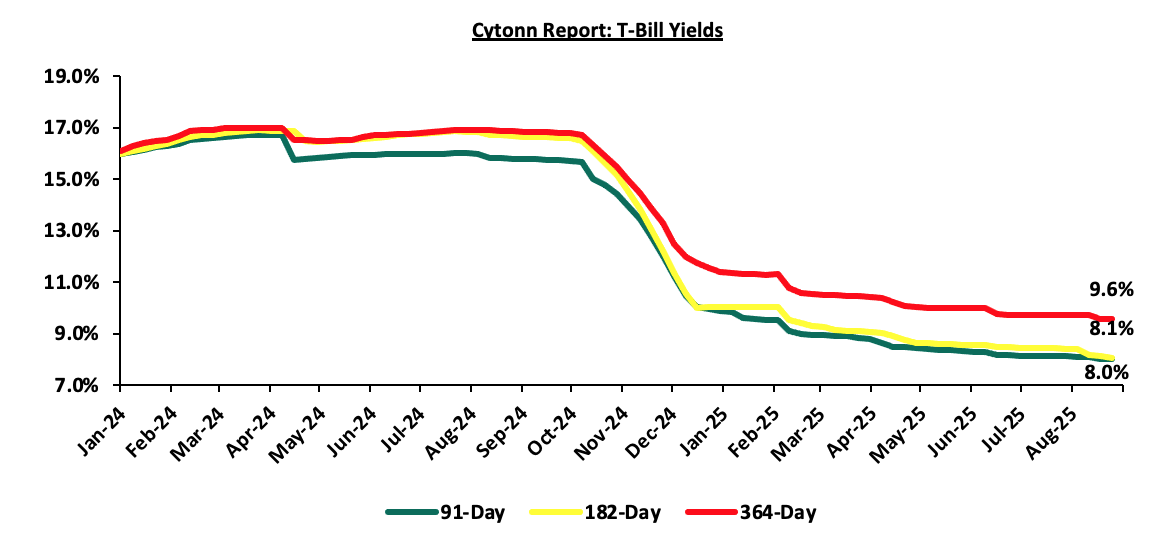

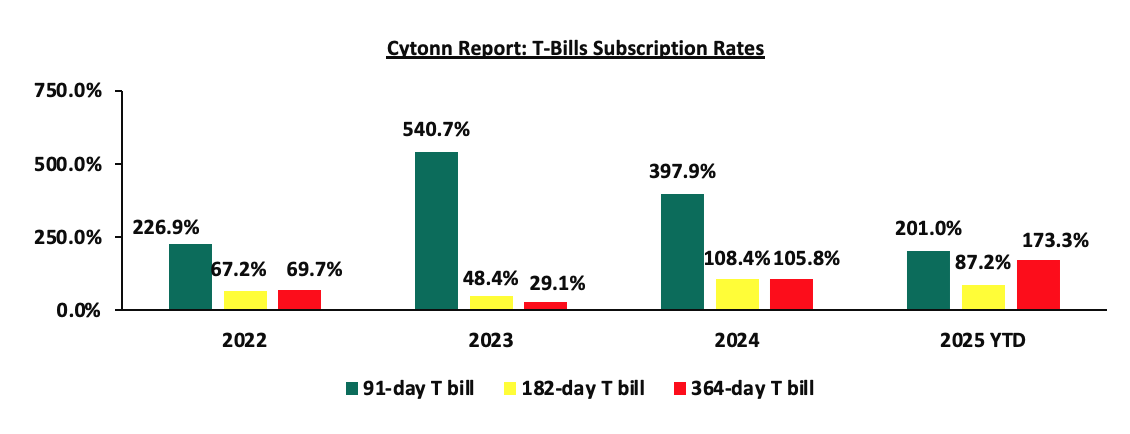

This week, T-bills were oversubscribed for the first time in four weeks, with the overall subscription rate coming in at 113.5%, higher than the subscription rate of 96.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 7.8 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 194.3%, higher than the subscription rate of 123.2%, recorded the previous week. The subscription rates for the 182-day paper increased to 120.8% from the 74.6 % recorded the previous week, while that of the 364-day paper decreased to 73.9% from the 108.0% recorded the previous week The government accepted a total of Kshs 24.3 bn worth of bids out of Kshs 27.2 bn bids received, translating to an acceptance rate of 89.1%. The yields on the government papers were on a downward trajectory with the yields on the 182-day paper decreasing the most by 4.9 bps to 8.07% from the 8.12% recorded the previous week. The yields on the 91-day paper and 364-day paper decreased by 1.2 bps and 0.9 bps to 8.00% and 9.57% respectively, from the 8.01% and 9.58% respectively recorded the previous week

The Central Bank of Kenya released the auction results for the IFB1/2018/015 and IFB1/2022/019 tap sale with tenors to maturities of 7.4 years and 15.4 years respectively and fixed coupon rates of 12.5% and 13.0% respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 414.9%, receiving bids worth Kshs 207.5 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 179.8 bn, translating to an acceptance rate of 86.7%. The allocated average yield for the accepted bids for the IFB1/2018/015 and IFB1/2022/019 was at 13.0% and 14.0% respectively. Given the bonds are tax free, compared to 10.0% withholding tax for other long-term bonds, the effective tax yield is 14.4% and 15.6% for the IFB1/2018/015 and IFB1/2022/019 respectively. With the Inflation rate at 4.1% as of July 2025, the real returns of the IFB1/2018/015 and IFB1/2022/019 are 8.9% and 9.9%;

We are projecting the y/y inflation rate for July 2025 to increase marginally to within the range of 3.9% - 4.4% mainly on the back of rising fuel prices in June and the decrease in the Central Bank Rate (CBR) by 25.0 bps to 9.50% from 9.75%.

During the week, the global ratings agency, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability;

Equities

During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 3.3%, while NASI, NSE 10 and NSE 25 gained by 2.6%, 2.5% and 1.9% respectively, taking the YTD performance to gains of 35.7%, 34.0%, 27.0% and 26.7% for NASI, NSE 20, NSE 10 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as DTB, EABL and Safaricom of 7.7%, 5.3% and 5.0% respectively. The performance was, however, weighed down by losses recorded by large cap stocks such as Standard Chartered, NCBA and BAT of 6.0%, 3.9% and 0.2% respectively.

Additionally, in the regional equities market, the East African Exchanges 20 (EAE 20) share index gained by 4.0 bps, attributable to gains recorded by large cap stocks such as NMB Bank, Tanzania Breweries Limited and Tanga Cement Limited of 5.9%, 3.8% and 3.6% respectively;

During the week, Standard Chartered released its H1’2025 financial results, with its Core Earnings per Share (EPS) decreasing by 21.4% to Kshs 21.4, from Kshs 27.2 in H1’2024;

During the week, Diamond Trust Bank, released its H1’ 2025 financial results with its Core earnings per share increasing to Kshs 19.2 from Kshs 15.5 in H1’ 2024;

I&M Group released their H1’ 2025 results with its core Earnings per share reducing by 37.9% to Kshs 4.5 from Kshs 3.3 in H1’ 2024;

During the week, Sanlam Kenya Holdings released their H1’2025 results, recording an 89.0% decrease in Profit After Tax to Kshs 0.03 bn, from the Kshs 0.3 bn recorded in H1’2024. The performance was mainly driven by a 51.3% increase Net expenses from reinsurance contracts held, to Kshs 0.4 bn from Kshs 0.3 bn in H1’2024, but supported by a 34.0% increase in insurance investment revenue to Kshs 3.1 bn in H1’2025, from Kshs 2.3 bn in H1’2024;

During the week, Liberty Kenya Holdings released their H1’ 2025 results, with Profit After Tax decreasing by 29.8% to Kshs 0.4 bn, from the Kshs 0.6 bn recorded in H1’2024. The performance was mainly driven by 61.0% decrease in net insurance service revenue to Kshs 0.2 bn in H1’2025, from Kshs 0.6 bn in H1’2024, coupled with 4.7% decrease in net investment revenue to Kshs 0.8 bn, from Kshs 0.9 bn in H1’2024;

Real Estate

During the week, the National Social Security Fund (NSSF) sought to secure a Kshs 1.6 bn loan from a local bank to kickstart the first phase of its ambitious Kisumu Lakeview Estate project—a major real estate venture designed to deliver over 1,300 homes and commercial amenities in Kisumu. This marks one of the fund’s largest investments outside Nairobi in more than ten years, reflecting its growing focus on regional development and real estate as a source of long-term returns for pensioners

During the week, state-backed mortgage lender, Kenya Mortgage Refinance Company (KMRC) released its H1 2025 financial results, which reported a 18.6% decrease in Profit After Tax (PAT) to Kshs 927.2 mn from Kshs 956.2 mn recorded in H1’2024 attributable to 24.5% increase in interest expense to Kshs 649.8 mn in H1’2025 from 521.7 mn in H1’2024.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 15th August 2025. The performance represented a 37.0% and 16.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 15th August 2025, representing a 45.0% loss from the Kshs 20.0 inception price.

Focus of the Week

Following the release of the H1’2025 results by all four authorized Real Estate Investment Trusts (REITs) in Kenya, Cytonn Real Estate Research Team undertook an analysis of the financial performance of the REITs and identified the key factors that shaped the performance of the sector, discussing the background and structure of REITs in Kenya, and assess the financial performance of the current REITs in the market during H1’2025 in terms of operational metrics, profitability metrics, leverage ratios, liquidity ratios and valuation metrics;

Money Markets, T-Bills and T-Bonds Primary Auction:

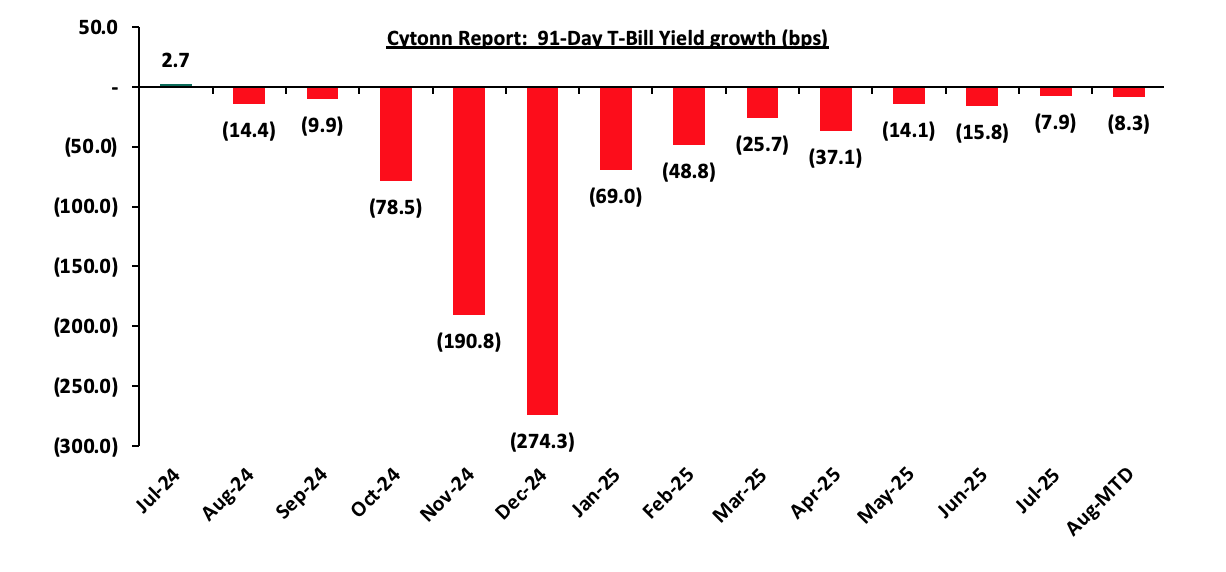

This week, T-bills were oversubscribed for the first time in four weeks, with the overall subscription rate coming in at 113.5%, higher than the subscription rate of 96.6% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 7.8 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 194.3%, higher than the subscription rate of 123.2%, recorded the previous week. The subscription rates for the 182-day paper increased to 120.8% from the 74.6 % recorded the previous week, while that of the 364-day paper decreased to 73.9% from the 108.0% recorded the previous week. The government accepted a total of Kshs 24.3 bn worth of bids out of Kshs 27.2 bn bids received, translating to an acceptance rate of 89.1%. The yields on the government papers were on a downward trajectory with the yields on the 182-day paper decreasing the most by 4.9 bps to 8.07% from the 8.12% recorded the previous week. The yields on the 91-day paper and 364-day paper decreased by 1.2 bps and 0.9 bps to 8.00% and 9.57% respectively, from the 8.01% and 9.58% respectively recorded the previous week;

The chart below shows the yield performance of the 91-day, 182-day and 364-day papers over the period;

The chart below shows the yield growth for the 91-day T-bill:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

During the week, the Central Bank of Kenya released the auction results for the IFB1/2018/015 and IFB1/2022/019 tap sale with tenors to maturities of 7.4 years and 15.4 years respectively and fixed coupon rates of 12.5% and 13.0% respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 414.9%, receiving bids worth Kshs 207.5 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 179.8 bn, translating to an acceptance rate of 86.7%. The allocated average yield for the accepted bids for the IFB1/2018/015 and IFB1/2022/019 was at 13.0% and 14.0% respectively. Given the bonds are tax free, compared to 10.0% withholding tax for other long-term bonds, the effective tax yield is 14.4% and 15.6% for the IFB1/2018/015 and IFB1/2022/019 respectively. With the Inflation rate at 4.1% as of July 2025, the real returns of the IFB1/2018/015 and IFB1/2022/019 are 8.9% and 9.9%;

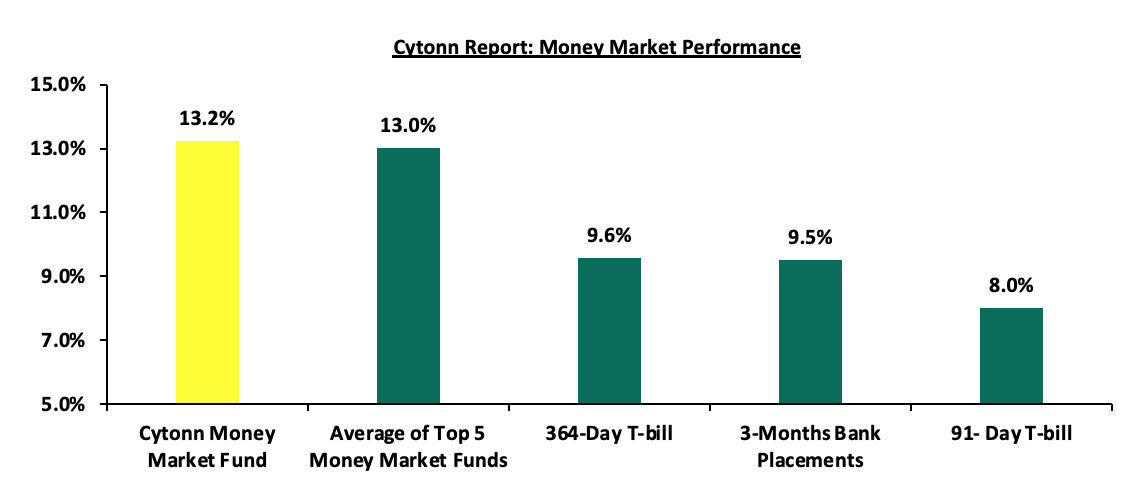

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 9.5% (based on what we have been offered by various banks) and the yields on the government papers were on a downward trajectory with the yields on 91-day papers and 364-day papers decreasing by 1.2 bps and 0.9 bps respectively to 8.00% and 9.57% from the 8.01% and 9.58% respectively recorded the previous week. The yield on the Cytonn Money Market Fund remained unchanged from the 13.2% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased marginally by 1.6 bps to remain relatively unchanged from the 13.0% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 22nd August 2025:

|

Money Market Fund Yield for Fund Managers as published on 22nd August 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download Cytonn App) |

13.2% |

|

2 |

Gulfcap Money Market Fund |

13.1% |

|

3 |

Ndovu Money Market Fund |

13.1% |

|

4 |

Nabo Africa Money Market Fund |

13.0% |

|

5 |

Lofty-Corban Money Market Fund |

12.6% |

|

6 |

Orient Kasha Money Market Fund |

12.3% |

|

7 |

Etica Money Market Fund |

12.1% |

|

8 |

Kuza Money Market fund |

12.0% |

|

9 |

Arvocap Money Market Fund |

11.9% |

|

10 |

Enwealth Money Market Fund |

11.1% |

|

11 |

GenAfrica Money Market Fund |

11.1% |

|

12 |

Old Mutual Money Market Fund |

11.0% |

|

13 |

Jubilee Money Market Fund |

10.8% |

|

14 |

British-American Money Market Fund |

10.7% |

|

15 |

Madison Money Market Fund |

10.4% |

|

16 |

Faulu Money Market Fund |

10.3% |

|

17 |

Dry Associates Money Market Fund |

10.2% |

|

18 |

Sanlam Money Market Fund |

10.1% |

|

19 |

Apollo Money Market Fund |

10.0% |

|

20 |

KCB Money Market Fund |

9.7% |

|

21 |

Mali Money Market Fund |

9.3% |

|

22 |

Co-op Money Market Fund |

9.3% |

|

23 |

ICEA Lion Money Market Fund |

9.3% |

|

24 |

Absa Shilling Money Market Fund |

9.1% |

|

25 |

Genghis Money Market Fund |

8.6% |

|

26 |

CIC Money Market Fund |

8.5% |

|

27 |

Mayfair Money Market Fund |

8.5% |

|

28 |

AA Kenya Shillings Fund |

7.7% |

|

29 |

CPF Money Market Fund |

7.6% |

|

30 |

Ziidi Money Market Fund |

6.8% |

|

31 |

Stanbic Money Market Fund |

6.6% |

|

32 |

Equity Money Market Fund |

5.1% |

Source: Business Daily

Liquidity:

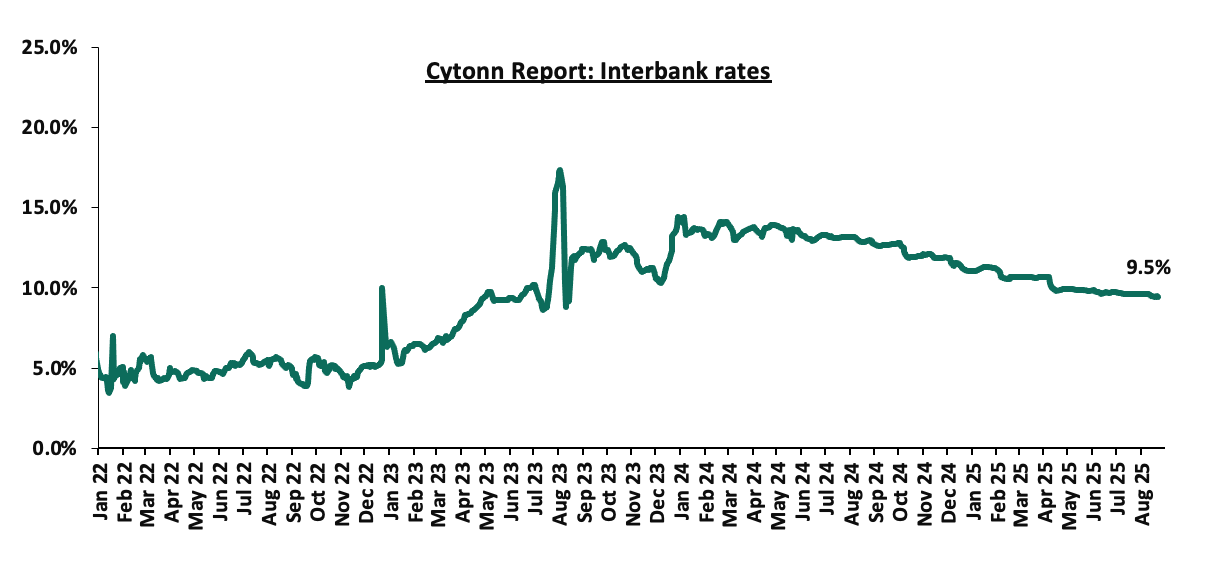

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 8.6 bps, to 9.4% from the 9.5% recorded the previous week, partly attributable to tax remittances that were offset by government payments. The average interbank volumes traded decreased by 36.7% to Kshs 6.2 bn from Kshs 9.8 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds were on an upward trajectory with the yield on the 13-year Eurobond issued in 2021 increasing the most by 13.4 bps to 9.5% from the 9.4% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 21st August 2025;

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.7 |

22.7 |

1.9 |

6.9 |

9.0 |

5.7 |

10.7 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

01-Aug-25 |

7.8% |

10.3% |

- |

9.3% |

9.8% |

9.2% |

|

|

14-Aug-25 |

7.4% |

10.0% |

- |

8.9% |

9.4% |

8.7% |

|

|

15-Aug-25 |

7.4% |

10.0% |

- |

8.9% |

9.4% |

8.8% |

|

|

18-Aug-25 |

7.4% |

10.1% |

- |

9.0% |

9.5% |

8.9% |

|

|

19-Aug-25 |

7.5% |

10.1% |

- |

9.1% |

9.5% |

8.9% |

|

|

20-Aug-25 |

7.6% |

10.2% |

- |

9.1% |

9.6% |

8.8% |

|

|

21-Aug-25 |

7.4% |

10.1% |

- |

9.0% |

9.5% |

8.8% |

|

|

Weekly Change |

0.0% |

0.1% |

- |

0.1% |

0.1% |

0.1% |

- |

|

MTD Change |

(0.4%) |

(0.2%) |

- |

(0.3%) |

(0.2%) |

(0.4%) |

- |

|

YTD Change |

(1.6%) |

(0.2%) |

- |

(1.0%) |

(0.5%) |

(1.3%) |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenyan Shilling appreciated marginally against the US Dollar by 0.1 bps, to remain relatively unchanged from the Kshs 129.2 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 5.2 bps against the dollar, compared to the 17.6% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,084.0 mn in the twelve months to June 2025, 12.1% higher than the USD 4,535.0 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the June 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.9% in the period,

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 8.0% to 2,303,028 in the 12 months to February 2025 from 2,133,612 in the 12 months to February 2024 and,

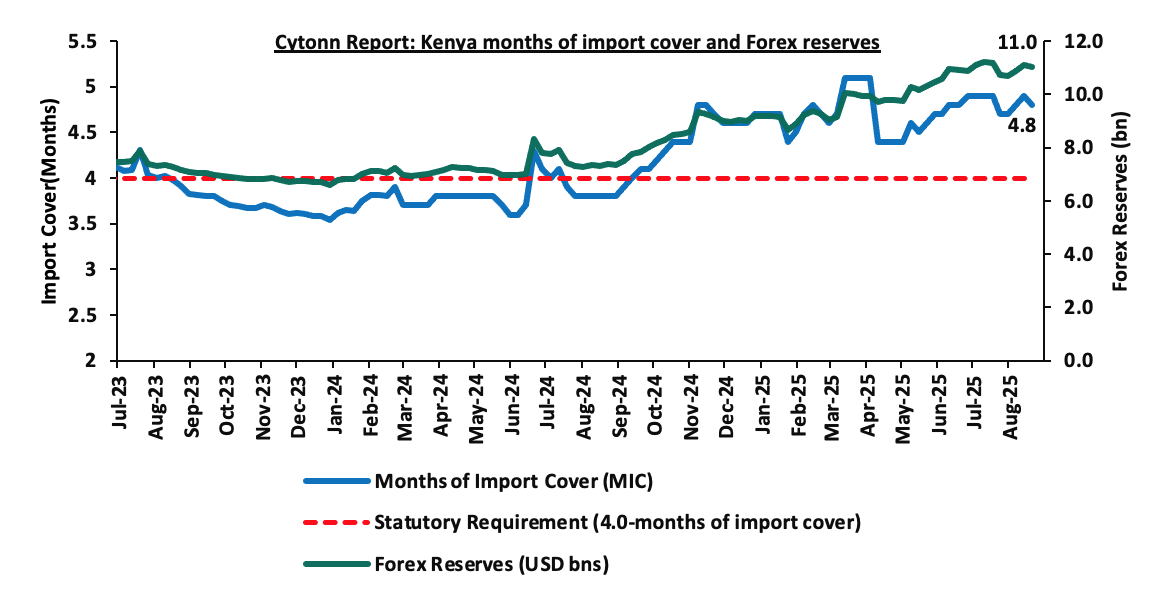

- Improved forex reserves currently at USD 11.0 bn (equivalent to 4.8-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 1.6% of GDP in the twelve months to June 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 62.0% of Kenya’s external debt is US Dollar-denominated as of December 2024.

Key to note, Kenya’s forex reserves decreased marginally by 0.7% during the week, to USD 11.0 bn from the USD 11.1 bn recorded in the previous week, (equivalent to 4.8 months of import cover), and above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly highlights

- August 2025 Inflation Projection Highlight

We are projecting the y/y inflation rate for August 2025 to remain stable within the range of 3.9% – 4.4%, mainly on the back of:

- The decrease in the Central Bank Rate (CBR) by 25.0 bps to 9.50% from 9.75% – In 2025, the CBK Monetary Policy Committee has continued adopting an accommodative monetary policy stance, reducing the Central Bank Rate (CBR) by a cumulative 175.0 bps from 11.25% at the beginning of the year. Notably, the MPC cut the Central Bank Rate (CBR) by 25.0 bps in August 2025, lowering it to 9.50% from 9.75% in June 2025. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR continue to gradually take hold in the broader economy.

- Depreciation of the Kenya Shilling against the US Dollar – The Kenya Shilling has recorded a slight 0.1 bps month-to-date depreciation as of 22nd August 2025 to Kshs 129.2 relatively unchanged from the beginning of the month. This depreciation in the exchange rate, albeit slight, could induce inflationary pressures making imported goods more expensive.

We, however, expect that inflation rate will, however, be supported by:

- Decreasing Fuel Prices in August 2025– In their last fuel prices release, EPRA announced that the maximum retail fuel prices in Kenya, effective from 15th August 2025 to 14th September 2025. The price for Super Petrol and Kerosene decreased by Kshs 1.0 each respectively, while the price for Diesel remained unchanged. Consequently, Super Petrol and Kerosene will now retail at Kshs 185.3 and Kshs 155.6 per litre respectively, from Kshs 186.3 and Kshs 156.6 per litre respectively while Diesel will now retail at Kshs 171.6 per litre. This notable decrease in fuel prices may alleviate upward pressure on inflation, given fuel's significant role in transportation and production costs across the economy.

- Reduced electricity prices – In August 2025, electricity prices decreased marginally on the back of a decrease in fuel cost charges and the forex adjustment charges. EPRA set the fuel cost charge and forex adjustment charge at Kshs 2.99 and Kshs 1.2 respectively, down from Kshs 3.02 and Kshs 1.7 respectively in July 2025. With electricity being one the major inputs of inflation, this decrease is expected to decrease production costs for businesses as well as decrease electricity costs for households and thus easing inflation.

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by reduced electricity prices. However, risks remain, particularly from the potential for increased demand-driven inflation due to accommodative monetary policy. The decision to lower the CBR to 9.50% during the latest MPC meeting will likely increase money supply, in turn increasing inflation, especially with further cuts expected in the coming meetings. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

- Kenya’s Credit Rating Upgrade by S&P Global Ratings

On 22nd August 2025, S&P Global Ratings raised Kenya’s long-term sovereign credit rating to ‘B’ from ‘B-’, with a stable outlook, while affirming the short-term sovereign credit rating at ‘B’. At the same time, the agency revised Kenya’s transfer and convertibility assessment upward to ‘B+’ from ‘B’, reflecting the country’s improved external liquidity buffers and relatively resilient economic fundamentals compared to peers. This development marks a notable turnaround in Kenya’s sovereign risk profile, coming only a year after the same agency downgraded the country in August 2024 in the wake of fiscal setbacks following the repeal of the Finance Bill 2024.

The upgrade was driven primarily by an easing of external liquidity risks, strong balance of payments support, and resilience in economic activity. Kenya’s current account deficit narrowed sharply to 1.3% of GDP in 2024, down from 2.5% in 2023, as well declining to 1.6% of GDP in the twelve months to June 2025 compared to 1.8% in a similar period in 2024. This improvement was anchored by strong performances in key foreign exchange-earning sectors, particularly coffee and horticulture exports, tourism receipts, and diaspora remittances. In addition, Kenya benefited from revisions to its external sector data, which incorporated oil re-exports and updated travel receipts, providing a more comprehensive picture of the country’s inflows. These developments saw foreign exchange reserves climb to a record-high USD 11.2 bn by July 2025, up significantly from USD 6.6 bn at the end of 2023, offering an important cushion against external financing pressures.

Debt management operations also played a critical role in boosting market confidence. In February 2025, the government successfully issued a USD 1.5 bn Eurobond and simultaneously conducted a buy-back operation on part of its outstanding 2027 Eurobond. This exercise lowered near-term Eurobond principal repayments to about USD 108.0 mn annually over 2025 - 2027, down from USD 300.0 mn previously. Although participation in the tender stood at 64.0%, below initial targets, the operation smoothed Kenya’s external maturity profile and helped lower refinancing risk over the medium term.

Domestic financial conditions have also improved on the back of a sustained monetary easing cycle. Since August 2024, the Central Bank of Kenya (CBK) has reduced its policy rate by a cumulative 350 basis points to 9.5% as of August 2025 from 13.0% in July 2024. The policy easing, underpinned by contained inflation, which stood at 4.1% in July 2025 and stable exchange rate dynamics, has contributed to a significant decline in borrowing costs. Yields on the 91-day Treasury bill fell to 8.0% on 21st August 2025 declining by 8.3 bps on a month to date basis, from a peak of 16.0% in July 2024. Although commercial bank lending rates have been slower to adjust, private sector credit growth has begun to recover with a modest 3.3% growth in July 2025, supported further by the government’s clearance of domestic arrears. This easing of financing conditions has provided the government with more favorable access to domestic funding, even as external concessional funding has slowed.

Despite these gains, fiscal and debt vulnerabilities remain a key constraint on Kenya’s sovereign creditworthiness. Interest payments are projected to remain extremely high, averaging around 33.0% of government revenue between 2025 and 2028, one of the highest levels among rated sovereigns globally. This reflects the government’s continued reliance on expensive domestic borrowing and non-concessional external financing. For instance, in May 2025, Kenya secured a USD 500.0 million multi-tranche loan from the United Arab Emirates priced at 8.25%, a costlier substitute for concessional financing that had been withheld by multilateral institutions. The International Monetary Fund (IMF), in March 2025, chose not to disburse the final tranche of its Extended Credit Facility/Extended Fund Facility, worth USD 850.0 mn, citing insufficient progress on fiscal and debt targets. This was compounded by delays in securing USD 750.0 mn in expected World Bank support, further tightening access to concessional credit. The table below shows the latest S&P long-term foreign-currency Sovereign Credit Ratings for selected African countries;

|

Cytonn Report: S&P Long-Term Foreign-Currency Sovereign Credit Ratings for Selected African Countries |

||||

|

Country |

IDR Credit Rating |

Outlook |

Last Rating Date |

Meaning |

|

Ivory Coast |

BB |

Stable |

Oct-24 |

Some risk; less vulnerable than lower ratings |

|

Benin |

B+ |

Positive |

Feb-25 |

Vulnerable; but capacity to repay exists |

|

Kenya |

B |

Stable |

Aug-25 |

High risk; meets obligations for now |

|

Senegal |

B- |

Negative |

Jul-25 |

Very high risk; may struggle in tough conditions |

|

Cameroon |

B- |

Stable |

Mar-25 |

Very high risk; still meeting obligations |

|

South Africa |

BB- |

Positive |

May-25 |

Moderate risk; signs of improvement |

|

Nigeria |

B- |

Stable |

May-25 |

Very high risk; vulnerable to shocks |

Source: S&P Ratings

At the same time, Kenya’s fiscal consolidation efforts remain slow, even though the budget deficit is expected to narrow to 4.7% of GDP in fiscal year 2026, from an estimated 5.1% in fiscal 2025. S&P projects the deficit will average 5.2% of GDP over the 2026–2028 period, constrained by persistent revenue underperformance, elevated spending pressures, and political resistance to new tax measures. While the government has shifted its focus to broadening the tax base, progress has been undermined by widespread public resistance. The repeal of the Finance Bill 2024, following youth-led protests, underscored the difficulty of implementing politically sensitive revenue measures. With elections approaching in 2027, the government faces limited political space for aggressive fiscal adjustments, suggesting that consolidation will remain gradual at best.

The upgrade by S&P is a significant development for Kenya, especially given the downgrades by all three major rating agencies in 2024. It underscores the government’s ability to manage near-term liquidity risks and reflects the broader resilience of Kenya’s economy. However, it also highlights the dual challenge Kenya faces; balancing short-term liquidity improvements with the longer-term need for fiscal consolidation. The table below provides a summary of Kenya’s latest sovereign credit rating actions by the three major global rating agencies

|

Cytonn Report: Kenya’s Credit Ratings |

||||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Meaning |

Date Released |

|

Moody's Rating |

Caa1 |

Negative |

Caa1 |

Positive |

Substantial credit risks |

24th January, 2025 |

|

Fitch Ratings |

B |

|

B- |

Stable |

Highly Speculative |

25th July 2025 |

|

S&P Global |

B- |

Stable |

B |

Stable |

Extremely high risk, very vulnerable to default |

22rd August 2025 |

Source: Fitch Ratings, S&P Global, Moody’s

Moving forward, Kenya’s credit trajectory will largely depend on the government’s ability to sustain macroeconomic stability while addressing its structural fiscal weaknesses. The build-up of foreign exchange reserves and successful debt management operations have bought the country valuable time, but without deeper fiscal consolidation, the risk of slipping back into liquidity pressures remains elevated. Strengthening revenue mobilization, enhancing expenditure efficiency, and reducing reliance on costly non-concessional borrowing will be critical in placing debt on a sustainable path. At the same time, maintaining political and social stability, especially ahead of the 2027 elections, will be essential in sustaining investor confidence and safeguarding the hard-won gains in creditworthiness.

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which has lowered the cost of borrowing. The government is 247.0% ahead of its prorated net domestic borrowing target of Kshs 95.9, having a net borrowing position of Kshs 332.8 bn (inclusive of T-bills). However, we expect a stabilization of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns

Market Performance

During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 3.3%, while NASI, NSE 10 and NSE 25 gained by 2.6%, 2.5% and 1.9% respectively, taking the YTD performance to gains of 35.7%, 34.0%, 27.0% and 26.7% for NASI, NSE 20, NSE 10 and NSE 25 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as DTB, EABL and Safaricom of 7.7%, 5.3% and 5.0% respectively. The performance was, however, weighed down by losses recorded by large cap stocks such as Standard Chartered, NCBA of 6.0%, 3.9% and 0.2% respectively.

Additionally, in the regional equities market, the East African Exchanges 20 (EAE 20) share index gained by 4.0 bps, attributable to gains recorded by large cap stocks such as NMB Bank, Tanzania Breweries Limited and Tanga Cement Limited of 5.9%, 3.8% and 3.6% respectively.

During the week, equities turnover increased by 24.6% to USD 22.8 mn, from USD 18.3 mn recorded the previous week, taking the YTD total turnover to USD 579.7 mn. Foreign investors remained net buyers for the fourth consecutive week, with a net buying position of USD 2.1 mn, from a net buying position of USD 2.5 mn recorded the previous week, taking the YTD foreign net selling position to USD 22.4 mn, compared to a net selling position of USD 16.9 mn in 2024.

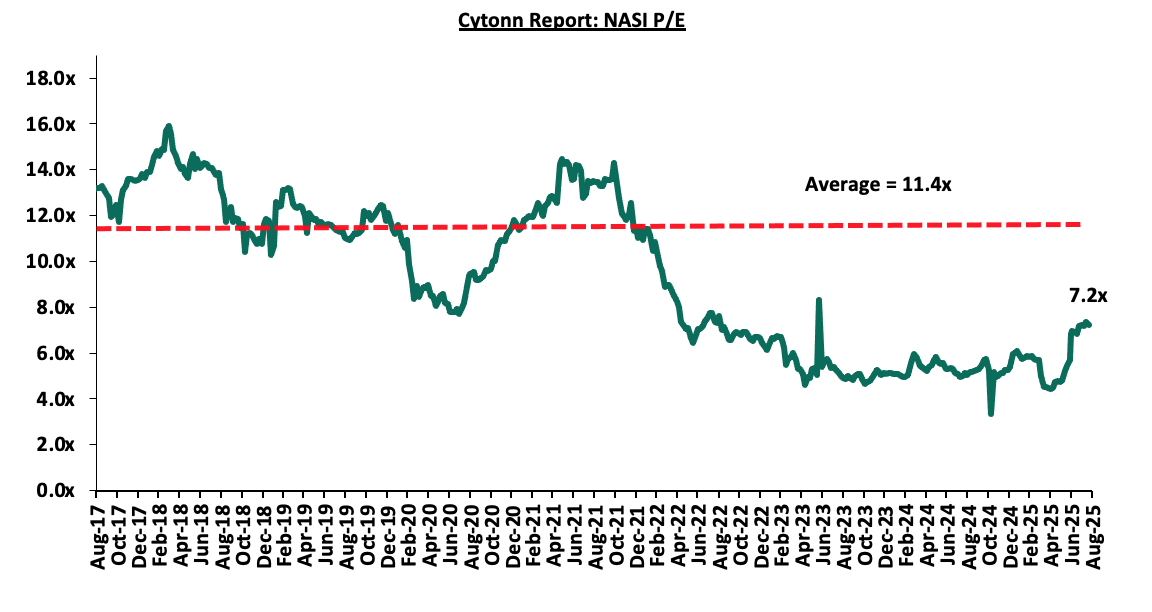

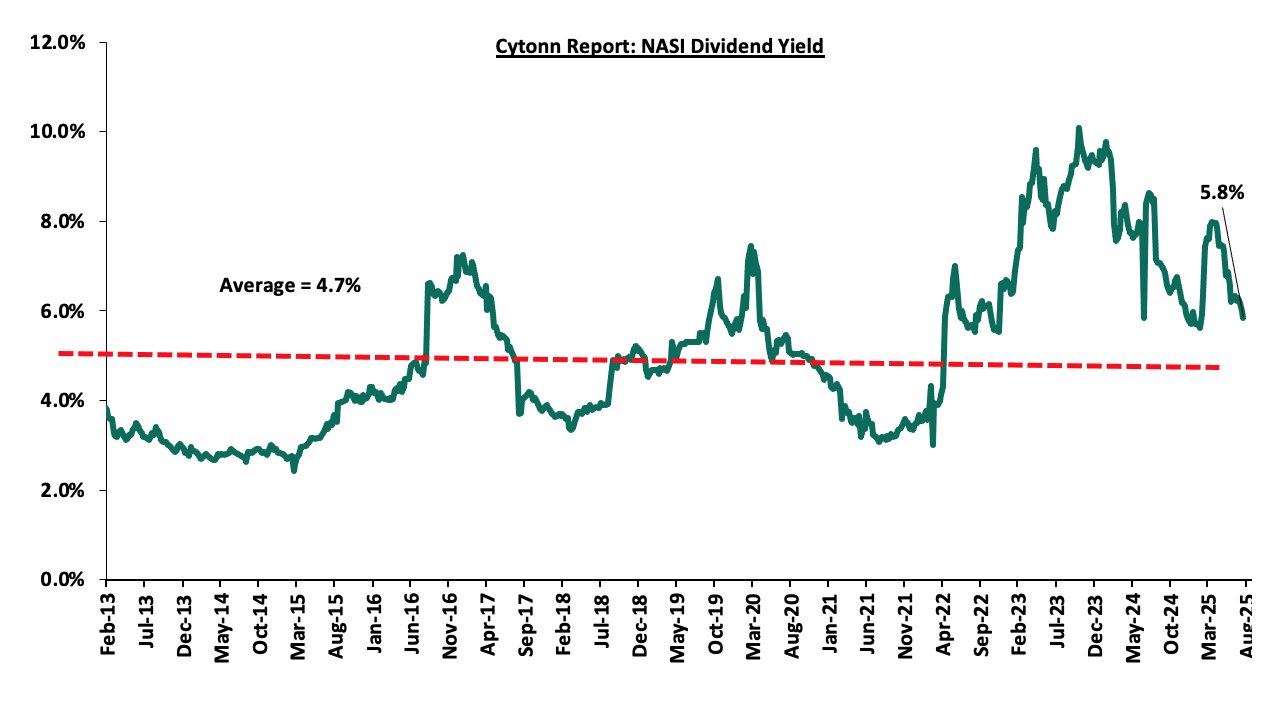

The market is currently trading at a price-to-earnings ratio (P/E) of 7.2x, 36.7% below the historical average of 11.4x. The dividend yield stands at 5.8%, 1.2% points above the historical average of 4.7%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||||

|

Company |

Price as at 15/08/2025 |

Price as at 22/08/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

|

Standard Chartered Bank |

335.3 |

315.3 |

(6.0%) |

10.5% |

285.3 |

393.4 |

14.3% |

39.1% |

1.8x |

Buy |

|

|

Co-op Bank |

17.4 |

17.4 |

0.0% |

(0.6%) |

17.5 |

21.6 |

8.6% |

33.0% |

0.6x |

Buy |

|

|

ABSA Bank |

20.0 |

20.0 |

0.0% |

5.8% |

18.9 |

23.5 |

8.8% |

26.6% |

1.3x |

Buy |

|

|

Equity Group |

54.5 |

55.0 |

0.9% |

14.6% |

48.0 |

61.7 |

7.7% |

19.9% |

0.9x |

Accumulate |

|

|

Stanbic Holdings |

184.3 |

183.8 |

(0.3%) |

31.5% |

139.8 |

193.4 |

11.3% |

16.5% |

1.1x |

Accumulate |

|

|

I&M Group |

37.6 |

38.2 |

1.7% |

6.1% |

36.0 |

41.2 |

7.9% |

15.7% |

0.7x |

Accumulate |

|

|

KCB Group |

54.0 |

54.0 |

0.0% |

27.4% |

42.4 |

56.1 |

5.6% |

9.4% |

0.7x |

Hold |

|

|

Britam |

8.3 |

8.8 |

5.8% |

50.9% |

5.8 |

9.5 |

0.0% |

8.4% |

0.8x |

Hold |

|

|

Diamond Trust Bank |

81.5 |

87.8 |

7.7% |

31.5% |

66.8 |

87.1 |

8.0% |

7.2% |

0.3x |

Hold |

|

|

NCBA |

64.8 |

62.3 |

(3.9%) |

22.1% |

51.0 |

60.2 |

8.8% |

5.5% |

1.0x |

Hold |

|

|

Jubilee Holdings |

286.3 |

288.8 |

0.9% |

65.2% |

174.8 |

260.4 |

4.7% |

(5.1%) |

0.4x |

Sell |

|

|

CIC Group |

4.0 |

4.7 |

17.9% |

118.7% |

2.1 |

4.0 |

2.8% |

(11.1%) |

1.3x |

Sell |

|

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2024 Dividends |

|||||||||||

Weekly Highlights

- Standard Chartered H1’ 2025 Financial Results

Below is a summary of Standard Chartered Bank Ltd H1’2025 performance:

|

Balance Sheet Items |

H1'2024 |

H1'2025 |

y/y change |

|

Net loans |

149.3 |

152.2 |

1.9% |

|

Government Securities |

71.6 |

108.2 |

51.1% |

|

Total Assets |

377.3 |

372.1 |

(1.4%) |

|

Customer Deposits |

276.4 |

290.6 |

5.1% |

|

Deposits per Branch |

7.7 |

9.1 |

18.3% |

|

Total Liabilities |

313.2 |

306.5 |

(2.1%) |

|

Shareholder's Funds |

64.1 |

65.6 |

2.3% |

|

Balance Sheet Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Loan to deposit ratio |

54.0% |

52.4% |

(1.6%) |

|

Government securities to deposit ratio |

25.9% |

37.2% |

11.3% |

|

Return on Average Equity |

28.4% |

27.5% |

(0.9%) |

|

Return on Average Assets |

4.7% |

4.8% |

0.1% |

|

Income Statement |

H1'2024 |

H1'2025 |

y/y change |

|

Net Interest Income |

16.5 |

15.3 |

(7.4%) |

|

Net non-Interest Income |

9.6 |

6.8 |

(29.1%) |

|

Total Operating income |

26.1 |

22.1 |

(15.3%) |

|

Loan Loss provision |

1.6 |

1.2 |

(24.6%) |

|

Total Operating expenses |

11.6 |

11.2 |

(3.4%) |

|

Profit before tax |

14.5 |

10.9 |

(24.8%) |

|

Profit after tax |

10.3 |

8.1 |

(21.4%) |

|

Core EPS |

27.2 |

21.4 |

(21.4%) |

|

Dividend per share |

8.0 |

8.0 |

0.0% |

|

Dividend Yield |

22.6% |

16.8% |

(25.6%) |

|

Dividend Payout Ratio |

29.4% |

37.4% |

27.2% |

|

Income Statement Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Yield from interest-earning assets |

10.8% |

10.8% |

0.1% |

|

Cost of funding |

1.5% |

1.7% |

0.2% |

|

Net Interest Spread |

9.3% |

9.2% |

(0.1%) |

|

Net Interest Margin |

9.5% |

9.4% |

(0.1%) |

|

Cost of Risk |

6.0% |

5.3% |

(0.7%) |

|

Net Interest Income as % of operating income |

63.3% |

69.3% |

5.9% |

|

Non-Funded Income as a % of operating income |

36.7% |

30.7% |

(5.9%) |

|

Cost to Income Ratio |

44.4% |

50.6% |

6.2% |

|

Cost to Income Ratio without LLP |

38.4% |

45.3% |

6.9% |

|

Capital Adequacy Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Core Capital/Total Liabilities |

19.7% |

19.4% |

(0.4%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

11.7% |

11.4% |

(0.4%) |

|

Core Capital/Total Risk Weighted Assets |

18.8% |

19.5% |

0.7% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

8.3% |

9.0% |

0.7% |

|

Total Capital/Total Risk Weighted Assets |

18.9% |

19.7% |

0.8% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

4.4% |

5.2% |

0.8% |

|

Liquidity Ratio |

63.2% |

64.5% |

1.3% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

43.2% |

44.5% |

1.3% |

Key takeouts

- Declined earnings growth - Core earnings per share decreased by 21.4% to Kshs 21.4 in H1’ 2025, from Kshs 27.2 in H1’2024, mainly driven by the 15.3% decrease in total operating income to Kshs 22.1 bn in H1’2025, from Kshs 26.1 bn in H1’2024. The performance was however supported by the 3.4% decrease in total operating expenses to Kshs 11.2 bn in H1’2025, from Kshs 11.6 bn in H1’2024

- Improved asset quality – The bank’s Asset Quality improved, with Gross NPL ratio decreasing to 6.0% in H1’2025, from 8.4% in H1’2024, attributable to the 29.4% decrease in gross non-performing loans to Kshs 9.6 bn, from Kshs 13.6 bn in H1’2024, relative to the slower 0.5% decrease in gross loans to Kshs 160.0 bn, from Kshs 160.9 bn recorded in H1’2024, and,

- Increased Lending – The bank’s loan book increased by 1.9% to Kshs 152.2 bn from Kshs 149.3 bn in H1’2024, and,

- Declaration of dividends- The board of directors declared and interin dividend of Kshs 8.0 per share for the period consistent with H1’2024. This translates to an annualized dividend yield of 16.8% and a dividend payout ratio of 37.4%

For more detailed analysis, please see Standard Chartered H1’ 2025 Earnings Note

- DTB H1’ 2025 Financial Results

Below is a summary of DTB-K Bank’s H1’2025 performance:

|

Balance Sheet Items |

H1'2024 |

H1'2025 |

y/y change |

|

Government Securities |

124.3 |

145.5 |

17.1% |

|

Net Loans and Advances |

267.9 |

288.5 |

7.7% |

|

Total Assets |

585.4 |

611.5 |

4.5% |

|

Customer Deposits |

431.9 |

483.2 |

11.9% |

|

Deposits/ Branch |

2.8 |

3.1 |

7.6% |

|

Total Liabilities |

501.1 |

510.7 |

1.9% |

|

Shareholders’ Funds |

74.6 |

90.3 |

21.0% |

|

Balance Sheet Ratios |

H1'2024 |

H1'2025 |

y/y change |

|

Loan to Deposit Ratio |

62.0% |

59.7% |

(2.3%) |

|

Government Securities to Deposit ratio |

28.8% |

30.1% |

1.3% |

|

Return on average equity |

11.3% |

11.3% |

0.0% |

|

Return on average assets |

1.4% |

1.6% |

0.1% |

|

Income Statement |

H1'2024 |

H1'2025 |

y/y change |

|

Net Interest Income |

14.2 |

15.9 |

11.7% |

|

Net non-Interest Income |

6.4 |

6.1 |

(5.0%) |

|

Total Operating income |

20.6 |

21.9 |

6.6% |

|

Loan Loss provision |

3.6 |

3.2 |

(10.4%) |

|

Other Operating expenses |

6.1 |

6.3 |

4.2% |

|

Total Operating expenses |

14.2 |

14.8 |

3.7% |

|

Profit before tax |

6.3 |

7.2 |

14.5% |

|

Profit after tax |

4.9 |

5.4 |

10.5% |

|

Core EPS |

15.5 |

19.2 |

23.6% |

|

Income Statement Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Yield from interest-earning assets |

8.8% |

11.8% |

3.0% |

|

Cost of funding |

4.3% |

6.1% |

1.8% |

|

Net Interest Spread |

4.5% |

5.7% |

1.2% |

|

Net Interest Income as % of operating income |

69.0% |

72.3% |

3.4% |

|

Non-Funded Income as a % of operating income |

31.0% |

27.7% |

(3.4%) |

|

Cost to Income Ratio (CIR) |

69.2% |

67.3% |

(1.9%) |

|

CIR without provisions |

51.6% |

52.5% |

0.92% |

|

Cost to Assets |

4.1% |

5.1% |

1.1% |

|

Net Interest Margin |

5.7% |

6.0% |

0.3% |

|

Capital Adequacy Ratios |

H1'2024 |

H1'2025 |

% Points Change |

|

Core Capital/Total Liabilities |

18.2% |

16.3% |

(1.9%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

10.2% |

8.3% |

(1.9%) |

|

Core Capital/Total Risk Weighted Assets |

17.6% |

15.8% |

(1.8%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

7.1% |

5.3% |

(1.8%) |

|

Total Capital/Total Risk Weighted Assets |

19.1% |

17.3% |

(1.8%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

4.6% |

2.8% |

(1.8%) |

|

Liquidity Ratio |

52.6% |

154.6% |

102.0% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

32.6% |

134.6% |

102.0% |

Key Takeouts

- Increased earnings - Core earnings per share (EPS) grew by 23.6% to Kshs 19.2, from Kshs 15.5 in H1’2024, driven by the 6.6% growth in total operating income to Kshs 21.9 bn, from Kshs 20.6 bn in H1’2024, which outpaced the 3.7% increase in total operating expenses to Kshs 14.8 bn, from Kshs 14.2 bn in H1’2024.

- Improved asset quality – The bank’s Asset Quality improved, with Gross NPL ratio decreasing to 12.9% in H1’2025, from 13.5% in H1’2024, as the 7.6% growth in gross loans to Kshs 306.7 bn, from Kshs 285.0 bn in H1’2024, outpaced the 2.7% increase in Gross Non-Performing Loans to Kshs 39.6 bn, from Kshs 38.6 bn in H1’2024.

- Expanded Balanced sheet - The balance sheet recorded an expansion as total assets increased by 4.5% to Kshs 611.5 bn, from Kshs 585.4 bn in H1’2024, driven by a 7.7% increase in net loans and advances to Kshs 288.5 bn, from Kshs 267.9 bn in H1’2024.

- Increased lending- Customer net loans and advances increased by 7.7% to Kshs 288.5 bn in H1’2025, from Kshs 267.9 bn in H1’2024, despite the elevated credit risk in the industry, with the lender preferring to expand customer lending.

For more detailed analysis, please see DTB H1’2025 Earnings Note

- I&M H1’2025 Financial Results

Below is a summary of I&M Group’s H1’2025 performance:

|

Balance Sheet Items |

H1'2024 |

H1'2025 |

y/y change |

|

Government Securities |

90.1 |

133.2 |

47.8% |

|

Net Loans and Advances |

284.2 |

290.3 |

2.1% |

|

Total Assets |

564.4 |

588.9 |

4.3% |

|

Customer Deposits |

419.4 |

429.4 |

2.4% |

|

Deposits/Branch |

4.3 |

3.9 |

(9.7%) |

|

Total Liabilities |

471.6 |

475.3 |

0.8% |

|

Shareholders’ Funds |

86.4 |

106.5 |

23.3% |

|

Balance Sheet Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Loan to Deposit Ratio |

67.8% |

67.6% |

(0.2%) |

|

Government Securities to Deposit Ratio |

21.5% |

31.0% |

9.5% |

|

Return on average equity |

14.3% |

19.6% |

5.3% |

|

Return on average assets |

2.4% |

3.3% |

0.9% |

|

Income Statement (Kshs Bn) |

H1'2024 |

H1'2025 |

y/y change |

|

Net Interest Income |

16.5 |

20.4 |

23.7% |

|

Net non-Interest Income |

6.2 |

7.0 |

12.9% |

|

Total Operating income |

22.7 |

27.4 |

20.8% |

|

Loan Loss provision |

(3.5) |

(4.1) |

17.4% |

|

Total Operating expenses |

(14.3) |

(16.1) |

12.6% |

|

Profit before tax |

8.7 |

11.7 |

34.1% |

|

Profit after tax |

6.1 |

8.3 |

36.3% |

|

Core EPS |

3.3 |

4.5 |

37.9% |

|

Income Statement Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Yield from interest-earning assets |

12.9% |

14.0% |

1.0% |

|

Cost of funding |

6.3% |

6.0% |

(0.3%) |

|

Net Interest Margin |

7.1% |

8.4% |

1.3% |

|

Net Interest Income as % of operating income |

72.8% |

74.6% |

1.8% |

|

Non-Funded Income as a % of operating income |

27.2% |

25.4% |

(1.8%) |

|

Cost to Income Ratio |

63.0% |

58.7% |

(4.3%) |

|

Cost to Income Ratio without LLP |

47.7% |

43.9% |

(3.8%) |

|

Cost to Assets |

1.9% |

2.0% |

0.1% |

|

Capital Adequacy Ratios |

H1'2024 |

H1'2025 |

% points change |

|

Core Capital/Total Liabilities |

17.7% |

21.4% |

3.7% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

9.7% |

13.4% |

3.7% |

|

Core Capital/Total Risk Weighted Assets |

14.8% |

17.2% |

2.4% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

4.3% |

6.7% |

2.4% |

|

Total Capital/Total Risk Weighted Assets |

18.1% |

19.8% |

1.6% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.6% |

5.3% |

1.6% |

|

Liquidity Ratio |

50.8% |

54.0% |

3.2% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

30.8% |

34.0% |

3.2% |

Key Take-Outs:

- Increased earnings - Core earnings per share (EPS) grew by 37.9% to Kshs 4.5, from Kshs 3.3 in H1’2024, driven by the 20.8% increase in total operating income to Kshs 27.4 bn, from Kshs 22.7 bn in H1’2024, which outpaced the 12.6% increase in total operating expenses to Kshs 16.1 bn from Kshs 14.3 bn in H1’2024,

- Improved asset quality –The bank’s Asset Quality improved, with Gross NPL decreasing to 11.0% in H1’2025, from 11.4% in H1’2024, attributable to a 1.4% decrease in Gross non-performing loans to Kshs 34.4 bn, from Kshs 34.8 bn in H1’2024, compared to the 2.8% increase in gross loans to Kshs 312.7 bn, from Kshs 304.3 bn recorded in H1’2024,

- Expanded Balanced sheet - The balance sheet recorded an expansion as total assets increased by 4.3% to Kshs 588.9 bn, from Kshs 564.4 bn in H1’2024, mainly driven by a 47.8% increase in governments securities holdings to Kshs 133.2 bn, from 90.1 bn in H1’2024, coupled with a 2.1% increase in net loans and advances to Kshs 290.3 bn, from Kshs 284.2 bn in H1’2024,

- Increased lending- Customer net loans and advances increased by 2.1% to to Kshs 290.3 bn, from Kshs 284.2 bn in H1’2024.

For more detailed analysis, please see I&M H1’ 2025 Earnings Note

Asset Quality

The table below shows the asset quality of listed banks that have released their H1’2025 results using several metrics:

|

|

H1'2025 NPL Ratio* |

H1'2024 NPL Ratio** |

% point change in NPL Ratio |

H1'2025 NPL Coverage* |

H1'2024 NPL Coverage** |

% point change in NPL Coverage |

|

Absa Bank Kenya |

13.2% |

11.5% |

1.7% |

66.6% |

62.3% |

4.3% |

|

Equity Group |

15.3% |

13.9% |

1.4% |

62.4% |

58.8% |

3.6% |

|

Stanbic Holdings |

9.5% |

8.9% |

0.6% |

82.7% |

75.0% |

7.7% |

|

Cooperative Bank |

17.3% |

16.7% |

0.6% |

65.8% |

67.7% |

(1.9%) |

|

KCB Group |

17.9% |

18.1% |

(0.2%) |

64.3% |

59.5% |

4.8% |

|

I&M Group |

11.0% |

11.4% |

(0.5%) |

65.4% |

57.9% |

7.5% |

|

Diamond Trust Bank |

12.9% |

13.5% |

(0.6%) |

45.9% |

44.4% |

1.5% |

|

Standard Chartered Bank |

6.0% |

8.4% |

(2.4%) |

81.4% |

85.1% |

(3.7%) |

|

Mkt Weighted Average* |

13.7% |

13.4% |

0.3% |

67.7% |

57.5% |

10.2% |

|

*Market Cap weighted as at 22/08/2025 |

||||||

|

**Market Cap weighted as at 13/06/2024 |

||||||

Key take-outs from the table include:

- Asset quality for the listed banks that have released results deteroriated during H1’2025, with market-weighted average NPL ratio increasing by 0.3% points to 13.7% from 13.4% in H1’2024 largely due to KCB Group’s numbers, and,

- Market-weighted average NPL Coverage for the listed banks increased by 10.2% points to 67.7% in H1’2025 from 57.5% recorded in H1’2024. The decrease was attributable to Stanbic Bank’s coverage ratio increasing by 7.7% points to 82.7% from 75.0% in H1’2024, coupled with I&M Group’s NPL coverage ratio increasing by 7.5% points to 65.4% from 57.9% in H1’2024.

Summary Performance

The table below shows the performance of listed banks that have released their H1’2025 results using several metrics:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

|

I&M Group |

37.9% |

3.1% |

(20.3%) |

23.7% |

8.4% |

12.9% |

25.4% |

14.8% |

2.4% |

47.8% |

67.6% |

2.1% |

19.6% |

|

|

Diamond Trust Bank |

23.6% |

0.1% |

(10.8%) |

11.7% |

6.0% |

(5.0%) |

27.7% |

8.9% |

11.9% |

17.1% |

59.7% |

7.7% |

11.3% |

|

|

Equity Group |

16.8% |

(0.6%) |

(18.0%) |

9.1% |

7.5% |

(4.4%) |

40.8% |

3.1% |

1.6% |

21.6% |

62.5% |

4.3% |

22.8% |

|

|

Absa Bank Kenya |

9.1% |

(8.3%) |

(21.3%) |

(2.9%) |

9.8% |

3.3% |

29.0% |

13.8% |

2.3% |

70.3% |

84.4% |

(3.6%) |

27.0% |

|

|

Co-operative Bank |

8.4% |

12.6% |

(3.3%) |

23.1% |

8.6% |

(8.2%) |

32.5% |

(3.4%) |

7.9% |

25.5% |

71.4% |

4.2% |

18.8% |

|

|

KCB Group |

8.0% |

3.2% |

(13.1%) |

12.7% |

8.4% |

(11.3%) |

29.9% |

1.8% |

(0.3%) |

(2.7%) |

73.7% |

6.1% |

23.4% |

|

|

Stanbic Group |

(9.3%) |

(10.5%) |

(35.3%) |

(5.8%) |

5.4% |

0.8% |

39.2% |

12.7% |

(2.5%) |

47.1% |

67.2% |

(2.2%) |

18.2% |

|

|

Standard Chartered Bank |

(21.4%) |

(10.5%) |

(29.4%) |

(7.4%) |

9.4% |

(29.1%) |

30.7% |

(2.0%) |

5.1% |

51.1% |

52.4% |

1.9% |

27.5% |

|

|

H1'2025 Mkt Weighted Average* |

7.4% |

(1.2%) |

(18.7%) |

7.6% |

8.2% |

(7.0%) |

33.2% |

4.5% |

2.5% |

31.2% |

67.8% |

2.7% |

22.7% |

|

|

H1’2024 Mkt Weighted Average** |

28.9% |

29.7% |

58.6% |

17.6% |

7.2% |

13.6% |

38.0% |

10.8% |

16.1% |

(9.3%) |

66.5% |

0.4% |

22.7% |

|

|

*Market cap weighted as at 22/08/2025 |

||||||||||||||

|

**Market cap weighted as at 13/06/2024 |

||||||||||||||

Key take-outs from the table include:

- The listed banks that have released their H1’2025 results recorded a 7.4% increase in core Earnings per Share (EPS) in H1’2025, compared to the weighted average growth of 28.9% in H1’2024, an indication of declined performance attributable to the declined operating environment experienced during H1’2025,

- Interest income recorded a weighted average decline of 1.2% in H1’2025, compared to 29.7% in H1’2024. Similarly, interest expenses recorded a market-weighted average decline of 18.7% in H1’2025 compared to a growth of 58.6% in H1’2024,

- The Banks’ net interest income recorded a weighted average growth of 7.6% in H1’2025, a decline from the 17.6% growth recorded over a similar period in 2024, while the non-funded income declined by 7.0% in H1’2025 compared to the 13.6% growth recorded in H1’2024 despite the revenue diversification strategies implemented by most banks, and,

- The Banks recorded a weighted average deposit growth of 2.5%, compared to the market-weighted average deposit growth of 16.1% in H1’2024.

- Sanlam H1’ 2025 Financial Results

Below is a summary of Sanlam’s H1’2025 Financial Results;

|

Cytonn Report: Sanlam Kenya Plc's Income Statement |

|||

|

Income Statement (Kshs bn) |

H1'2024 |

H1'2025 |

y/y change |

|

Insurance Revenue |

3.5 |

3.7 |

6.1% |

|

Insurance Service Expense |

(3.2) |

(3.3) |

5.3% |

|

Net Expense from reinsurance contracts held |

(0.3) |

(0.4) |

51.3% |

|

Insurance Service Result |

0.1 |

(0.01) |

(111.7%) |

|

Insurance Investment Revenue |

2.3 |

3.1 |

34.0% |

|

Net Insurance Finance expenses |

(0.4) |

(0.2) |

(38.3%) |

|

Profit before tax |

0.5 |

0.05 |

(89.9%) |

|

Income tax expense |

(0.2) |

(0.02) |

(91.1%) |

|

Profit after tax |

0.3 |

0.03 |

(89.0%) |

|

Core EPS |

1.9 |

0.1 |

(94.7%) |

|

Cytonn Report: Sanlam Kenya Plc's Balance Sheet |

|||

|

Balance Sheet items |

H1'2024 |

H1'2025 |

y/y change |

|

Financial Investments |

29.7 |

32.9 |

10.7% |

|

Insurance and Reinsurance contract assets |

1.3 |

0.4 |

(68.6%) |

|

Other assets |

6.4 |

8.1 |

27.2% |

|

Total assets |

37.3 |

41.3 |

10.8% |

|

Insurance contract liabilities |

29.4 |

30.2 |

2.7% |

|

Payables and Other liabilities |

6.7 |

7.2 |

6.1% |

|

Total liabilities |

36.2 |

37.4 |

3.4% |

|

Shareholder funds |

1.1 |

3.9 |

255.8% |

Key take outs from the results:

- Core Earnings Per share decreased by 94.7% to Kshs 0.1 from Kshs 1.9 per share in H1’2024, driven by a 3% increase Net expenses from reinsurance contracts held, to Kshs 0.4 bn from Kshs 0.3 bn in H1’2024, and outstanding share increase following rights issue.

- Net Investment revenue increased by 34.0% to Kshs 3.1 bn in H1’2025, from Kshs 2.3 bn in H1’2024. This was majorly attributable to a 68.2% increase in other investment revenue to Kshs. 1.5 bn from the Kshs 0.9 bn recorded in H1’2024 coupled with a 31.9% increase in other interest revenue to Kshs. 1.5 bn from the Kshs 1.1 bn recorded in H1’2024.

- Insurance revenue increased by 6.1% to Kshs 3.7 bn in H1’2025 from Kshs 3.5 bn in H1’2024, while insurance service expenses increased by 5.3% to Kshs 3.3 bn from Kshs 3.2 bn in H1’2024. In addition, there was a 51.3% increase in net expenses from reinsurance contracts held to Kshs 0.4 bn from Kshs 0.3 bn registered in H1’2024. This translated to a significant Net insurance service result decrease of 111.7% to Kshs 0.01 bn from Kshs 0.1 bn in H1’2024,

- The balance sheet recorded an expansion as total assets of 10.8% to Kshs 41.3 bn in H1’2025 from Kshs 37.3 bn in H1’2024 mainly driven by 10.7% increase in financial investments to Kshs 32.9 bn form Kshs 29.7 bn in H1’2024, coupled with a 27.2% increase in other assets to Kshs 8.1 bn from Kshs 6.4 bn in H1’2024.

- Total liabilities increased by 3.4% to Kshs 37.4 bn from Kshs 36.2 bn in H1’2024, majorly on the back of the 6.1% increase in payables and other liabilities to Kshs 7.2 bn from Kshs 6.7 bn in H1’2024.

Other highlights from the release include:

- Non-declaration of dividends – The directors of Sanlam Kenya Plc have not recommended a dividend payment for H1’2025.

Going forward, the factors that would drive the company’s growth would be:

- Capital preservation – The directors have implemented strategies to return to profitability through sustainable business growth, effective controls, product innovation and effective investment strategies. The Board of Directors has not proposed payment of dividends in the period ending 30th June 2024. This is to enable the business to preserve capital and continue to service its operational and finance costs. Consequently, the Group’s performance is expected to improve into the foreseeable future, with the Group maintaining profitability since 2024.

- Capital injection through rights issue – The rights issue by the Group in April 2025 successfully raised Kshs 2.0 bn, accepting 402.6 million shares with the remaining 92.3 million shares being subscribed by the underwriter. This capital-raising initiative aims at lowering the company’s outstanding long-term debt and to offer management operational and financial flexibility to support the company’s growth and return to profitability. This stronger capital position enhances the firm’s growth potential, investor confidence, and capacity to pursue expansion opportunities across key markets.

Valuation Summary:

- We are of the view that Sanlam Kenya Plc is an “Buy” with a target price of Kshs 9.5 representing an upside of 22.7%, from the current price of 7.7 as of 22nd August 2025.

- Liberty Kenya Holdings Plc’s H1’2025 Results

Below is a summary of Liberty Kenya H1’2025 financial results;

|

Cytonn Report: Liberty Kenya Holdings Income Statement |

|||

|

Item (All figures in Bns) |

H1’2024 |

H1’2025 |

y/y change |

|

Net Insurance Service Revenue |

0.6 |

0.2 |

(61.0%) |

|

Net Investment Revenue |

0.9 |

0.8 |

(4.7%) |

|

Total Insurance and Investment Result |

1.4 |

1.0 |

(27.3%) |

|

Other Operating Result |

(0.5) |

(0.4) |

(27.1%) |

|

Profit Before Tax |

1.0 |

0.7 |

(27.4%) |

|

Profit after tax |

0.6 |

0.4 |

(29.8%) |

|

Core EPS |

1.1 |

0.8 |

(29.8%) |

|

Cytonn Report: Liberty Kenya Holdings Balance Sheet |

|||

|

Item (All figures in Bns) |

H1’2024 |

H1’2025 |

y/y change |

|

Financial Investments |

26.7 |

29.7 |

11.2% |

|

Re-insurance contract assets |

1.3 |

1.5 |

19.3% |

|

Total Assets |

45.2 |

45.3 |

0.3% |

|

Insurance contract Liabilities |

17.6 |

20.7 |

17.4% |

|

Shareholders’ Funds |

9.8 |

9.9 |

0.5% |

|

Total Liabilities |

35.4 |

35.5 |

0.2% |

Key take outs from the results:

- Core Earnings Per share decreased by 29.8% to Kshs 0.8, from Kshs 1.1 in H1’2024, driven by the 0% decrease in net insurance service revenue to Kshs 0.2 bn in H1’2025, from Kshs 0.6 bn in H1’2024, coupled with 4.7% decrease in net investment revenue to Kshs 0.8 bn, from Kshs 0.9 bn in H1’2024,

- Net insurance revenue before reinsurance contracts held decreased by 37.4% to Kshs 0.9 bn in H1’2025 from of Kshs 1.4 bn in H1’2024, while net expense from reinsurance contracts held decreased by 20.0% to Kshs 0.6 bn from Kshs 0.8 bn in H1’2024, this translated to an insurance service result decrease of 61.0% to Kshs 0.2 bn from Kshs 0.6 bn in H1’2024,

- Net Investment Income decreased by 4.7% to Kshs 0.8 bn, from Kshs 0.9 bn in H1’2024.This was majorly attributable to 11.8% increase in net insurance finance expenses to Kshs 1.3 bn, from Kshs 1.1 bn in H1’2024, which outpaced 4.6% increase in investment income to Kshs. 2.1 bn from Kshs 2.0 bn in H1’2024,

- The balance sheet recorded an expansion as total assets increased by 0.3% to Kshs 45.3 bn in H1’2025, from Kshs 45.2 bn in H1’2024 mainly driven by 11.2% increase in financial investments to Kshs 29.7 bn, from Kshs 26.7 bn in H1’2024, coupled with 19.3% increase in reinsurance contract assets to Kshs 1.5 bn, from Kshs 1.3 bn in H1’2024,

- Total liabilities increased by 0.2% to Kshs 35.5 bn, from Kshs 35.4 bn in H1’2024, majorly on the back of the 17.4% increase in insurance contract liabilities to Kshs 20.7 bn, from Kshs 17.6 bn in H1’2024, coupled with 12.3% increase in financial liabilities under investment contracts to Kshs 11.5 bn, from Kshs 10.3 bn in H1’2024,

- The Board of Directors did not recommend interim dividend for the period, like in H1’2024.

Going forward, the factors that would drive the company’s growth would be:

- Technology Architecture – The company seeks to leverage technology to unify policy administration system for Liberty Life, enhance actuarial modelling, upgrade medical business systems, and API/digital

Valuation Summary:

- We are of the view that Liberty Kenya Holdings Plc is an “Buy” with a target price of Kshs 12.3 representing an upside of 3%, from the current price of 11.1 as of 22nd August 2025

- Liberty Kenya Holdings Plc is currently trading at a P/TBV of 0.7x and a P/E of 1x vs an industry average of 0.6x and 12.5x respectively.

Key to note, the Group completed the sale of Heritage Insurance Tanzania (HIT) on 4 April 2025, leading to its deconsolidation. At the date of sale, HIT’s IFRS Net Asset Value stood at Kshs 520.0 mn, while total proceeds after legal fees and capital gains tax amounted to Kshs 492.0 mn, resulting in a commercial deficit of Kshs 28.0 mn. The statement of comprehensive income also reflects a Kshs 217.0 mn accounting loss from discontinued operations, arising from cumulative translation differences in the Foreign Currency Translation Reserve (FCTR) that IFRS requires to be recycled upon deconsolidation. This accounting loss does not represent an additional cash outflow, as it had already been recognized in the Group’s net asset value. Comparative results for June 2024 have been restated to classify HIT’s performance under discontinued operations.

We are “Bullish” on the Equities markets in the short term due to current cheap valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to persistent foreign investor outflows. With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Residential Sector

- NSSF seeks 1.6 bn loan to kickstart the first phase of Kisumu project

During the week, The National Social Security Fund (NSSF) is sought to secure a Kshs1.6 bn loan from a local bank to kickstart the first phase of its ambitious Kisumu Lakeview Estate project—a major real estate venture designed to deliver over 1,300 homes and commercial amenities in Kisumu. This marks one of the fund’s largest investments outside Nairobi in more than ten years, reflecting its growing focus on regional development and real estate as a source of long-term returns for pensioners.

NSSF intends to use debt financing rather than tapping into its cash reserves, aiming to maintain liquidity to meet increasing pension payouts. The full development, estimated to cost around Kshs 8 bn, will be executed in phases, with the initial stage featuring 500 residential units—comprising apartments and townhouses—alongside schools, clinics, retail spaces, and recreational areas.

The fund’s management believes the project will support the government’s affordable housing agenda while generating solid returns for its contributors. This approach aligns with NSSF’s broader strategy of expanding its investment footprint through real estate, even amid concerns over delays and budget overruns in past developments.

Experts interpret this move as a signal of the fund’s increasing willingness to engage in leveraged property investments, buoyed by rising demand for housing in Kisumu. The city’s growing appeal is driven by enhanced infrastructure, the development of an inland port, and a rising expatriate community.

The Kisumu Lakeview Estate will be developed by NSSF’s investment arm, NSSF Investments Ltd, with construction expected to begin later this year, pending the finalization of the loan. If approved, this loan will add to the fund’s existing debt portfolio, which includes similar housing initiatives in Embakasi, Mavoko, and Nakuru.

We expect that this development will affect the residential sector by improving housing conditions.

- Kenya Mortgage Refinance Company (KMRC) financial performance H1 2025

During the week, state-backed mortgage lender, Kenya Mortgage Refinance Company (KMRC) released its H1’2025 financial results, which reported a 18.6% decrease in Profit After Tax (PAT) to Kshs 544.3 mn from Kshs 669.0 mn recorded in H1’ 2024 attributable to 24.5% increase in interest expense to Kshs 649.8 mn in H1’2025 from 521.7 mn in H1’2024.

The table below shows a summary of KMRC’s income statement for H1’2024 and H1’2025.

Figures in Kshs mn Unless Stated Otherwise

|

Cytonn Report: Summary of KMRC Statement of Comprehensive Income |

|||

|

|

H1'2024 |

H1'2025 |

y/y Change |

|

REVENUE |

|||

|

Interest Income |

1,477.9 |

1,576.9 |

6.7% |

|

Interest expense |

(521.7) |

(649.8) |

24.5% |

|

Net interest income |

956.2 |

927.2 |

(3.0%) |

|

EXPENSES |

|||

|

Operating and administration expenses |

(138.9) |

(148.9) |

7.1% |

|

Depreciation and amortisation expenses |

(16.7) |

(2.5) |

(85.1%) |

|

Total Expenses |

(155.6) |

(151.3) |

(2.7%) |

|

Net profit before income tax |

800.6 |

777.6 |

(2.9%) |

|

Income tax expense |

(131.6) |

(233.3) |

77.3% |

|

PROFIT AFTER TAX |

669.0 |

544.3 |

(18.6%) |

Source: KMRC

The table below shows a summary of KMRC’s balance sheet for H1’2024 and H1’2025.

Figures in Kshs mn Unless Stated Otherwise

|

Cytonn Report: Summary of KMRC Statement of Financial Position |

|||

|

|

H1'2024 |

H1'2025 |

y/y Change |

|

Assets |

|

|

|

|

Loan and Advances |

8,763.1 |

18,154.7 |

107.2% |

|

Cash and Cash equivalents |

14,365.6 |

16,154.7 |

12.5% |

|

Other Assets |

5,625.5 |

6,643.1 |

18.1% |

|

Total Assets |

28,754.2 |

40,952.6 |

42.4% |

|

Liabilities |

|

|

|

|

Borrowings |

22,941.9 |

33,960.3 |

48.0% |

|

Debt securities in issue |

1,185.4 |

938.7 |

(20.8%) |

|

Lease Liabilities |

24.2 |

14.7 |

(39.4% |

|

Other Liabilities |

414.2 |

422.9 |

2.1% |

|

Total Liabilities |

24,565.7 |

35,336.6 |

43.8% |

|

Capital Resources |

|

|

|

|

Share Capital |

1,808.4 |

1,808.4 |

0.0% |

|

Revenue reserves |

2,293.2 |

3,689.6 |

60.9% |

|

Other Revenues |

|

0.1 |

0.0% |

|

Statutory Reserve |

86.9 |

117.9 |

35.7% |

|

Total Capital |

4,188.5 |

5,616.0 |

34.1% |

|

Total Liabilities and Equity |

28,754.2 |

40,952.6 |

42.4% |

Source: KMRC

The key take-outs include:

- The profit after tax decreased by 18.6% to Kshs 544.3 mn in H1’2025, from Kshs 669.0 mn in H1’2024 majorly attributable to a 24.5% increase in interest expense to Kshs 649.8 mn in H1’2025 from 521.7 mn in H1’2024. This was driven by an increase in borrowing activities with borrowings reaching Kshs 34.0 bn in H1’2025 compared to Kshs 22.9 bn in H1’2024,

- The total expenses decreased by 2.7% to Kshs 151.3 mn in H1’2025 from Kshs 155.6 mn recorded in H1’2024 mainly attributable to an 85.1% decrease in depreciation and ammortisation expense to Kshs 2.5 mn in H1’2024 from Kshs 16.7 mn in H1’ 2024.

- Total assets increased by 42.4% to Kshs 41.0 bn in H1’ 2025 from Kshs 28.8 bn in H1’ 2024 mainly attributable to 107.2% increase in loans and advances to Kshs 18.2 bn in H1’ 2025 from Kshs 8.8 bn in H1’ 2024. Additionally, Cash and Cash equivalents increased by 12.5% to Kshs 16.2 bn in H1’ 2025 from Kshs 14.4 bn in H1’2024.

- The company borrowings increased by 48.0% to Kshs 34.0 bn in H1’2025 from Kshs 22.9 bn in H1’2024 as the lender aimed to improve its capacity to support higher lending, initially at Kshs 8.0mn to Ksh 10.5 mn a move that was effective February 2024 to boost mortgage uptake.

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 15th August 2025. The performance represented a 37.0% and 16.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.8 mn and Kshs 39.2 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 791.5 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 15th August 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1,235,285 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

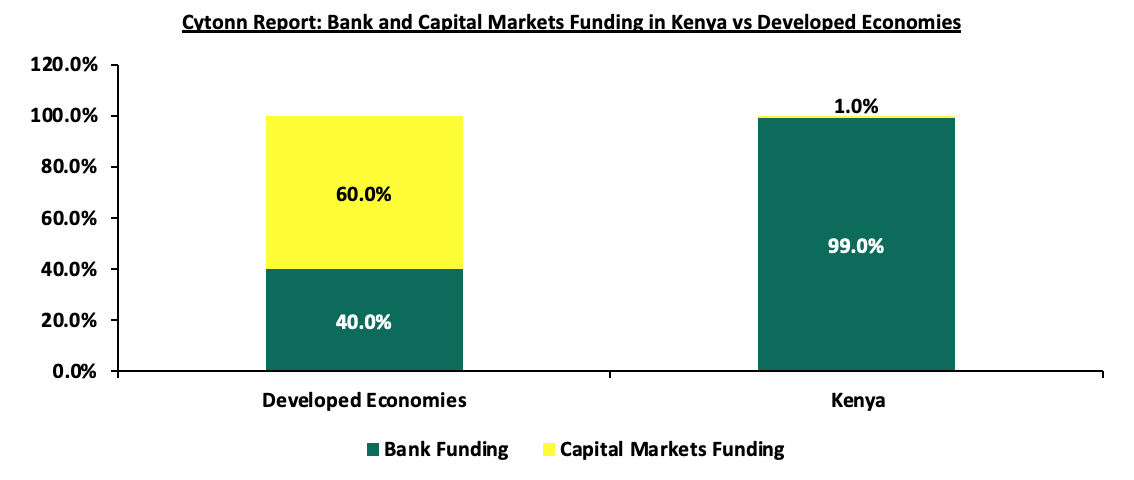

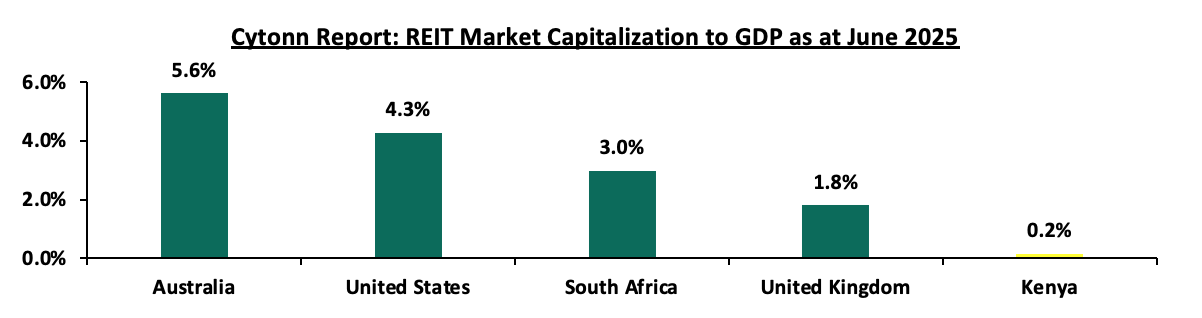

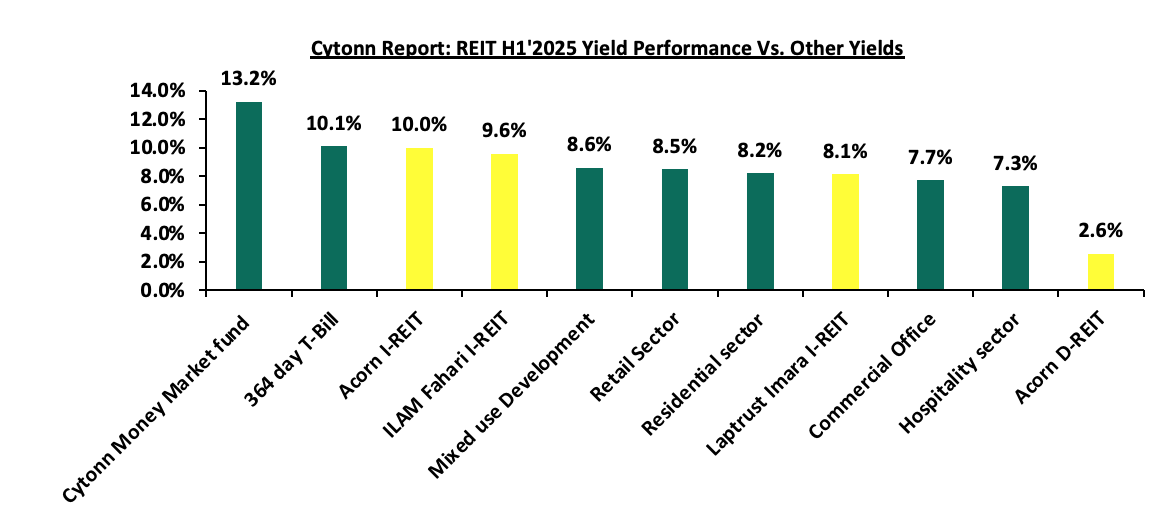

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies may be comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain resilient, supported by: i) improved housing conditions in the residential sector, as seen in NSSF’s plan to undertake a mega housing project in Kisumu, ii) increased funding from KMRC as seen in the 107.2% increase in loan and advances in H1 2025 compared to H1 2024, iii) continued public and private sector investment in housing and infrastructure under initiatives such as the Affordable Housing Programme, However, challenges including high capital requirements and regulatory constraints for REITs, rising construction costs, strain on infrastructure, and oversupply in select market segments will continue to limit optimal performance by constraining development pipelines and deterring some investor participation.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.

Following the release of the H1’2025 results by all four authorized Real Estate Investment Trusts (REITs) in Kenya, the Cytonn Real Estate Research Team undertook an analysis of the financial performance of the REITs and identified the key factors that shaped the performance of the sector. For the earnings notes of the various REITs, click the links below:

- ILAM Fahari I-REIT H1’2025 Earnings Note

- LapTrust Imara I-REIT H1’2025 Earnings Note

- Acorn I-REIT H1’2025 Earnings Note

- Acorn D-REIT H1’2025 Earnings Note

In the report we will assess the financial performance of the current REITs in the market during H1’2025 in terms of operational metrics, profitability metrics, leverage ratios, liquidity ratios, and valuation metrics. In addition, we highlight the outlook regarding our expectations for the REITs sector going forward. This we will cover as follows;

- Overview of the REITs Sector in Kenya,

- Themes that shaped the Real Estate Sector in H1’2025,

- Summary Performance of the REITS in H1’2025, and,

- Conclusion and Outlook for the REITs sector.

Section I: Overview of the REITs Sector in Kenya

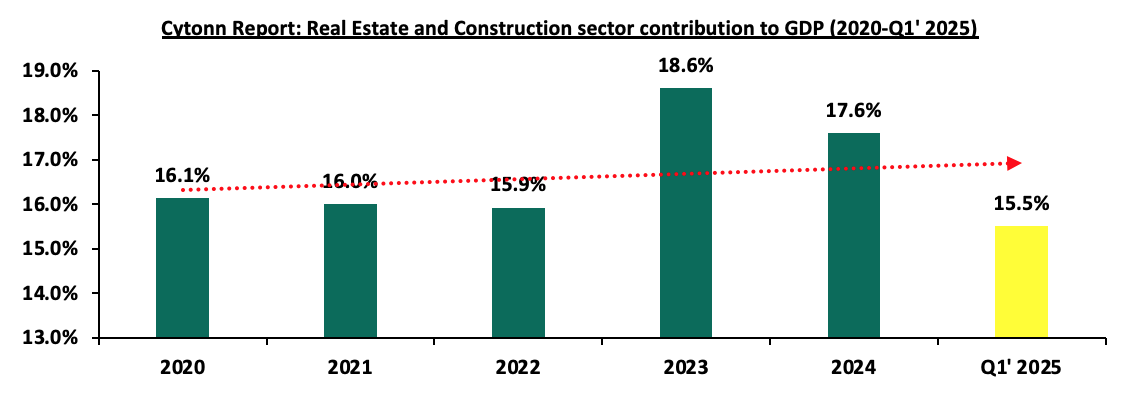

In H1’2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.3 % to Kshs 358.4 bn in Q1’2025, from Kshs 334.1 bn recorded during the same period in 2024. In addition, the sector contributed 8.1% to the country’s GDP, 0.1% points increase from 8.0% recorded in Q4’2024. Cumulatively, the Real Estate and construction sectors contributed 15.5% to GDP, 2.1% points decrease from 17.6% in Q4’2024, attributable to decline in construction contribution to GDP by 0.2% points, to 5.2% in Q1’2025, from 7.1% recorded in Q1’2024.

The graph below highlights the Real Estate and Construction sectors’ contribution to GDP from 2020 to Q1’2025;

Source: Kenya National Bureau of Statistics (KNBS)