Sub-Saharan Africa (SSA) Eurobonds, & Cytonn Weekly #03/2019

By Cytonn Research Team, Jan 20, 2019

Executive Summary

Fixed Income

T-bills were over-subscribed during the week, with the overall subscription rate coming in at 161.4%, a decline from 281.6% recorded the previous week. Yields on the 91-day paper declined to 7.1%, from 7.2% recorded the previous week, while yields on the 182-day and 364-day papers remained unchanged from the previous week at 8.9% and 10.0%, respectively. During the week, the Energy Regulatory Commission (ERC) released their monthly statement on the Maximum Retail Prices in Kenya indicating petrol prices declined by 8.2% to Kshs 104.2, from Kshs 113.5 per litre previously, while diesel and kerosene prices declined by 8.9% and 3.3% to Kshs 102.2 and 101.7 per litre, respectively, from Kshs 112.3 and 105.2 per litre, previously;

Equities

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 1.9%, 2.1% and 2.7%, respectively, taking their YTD performance to 3.4%, 0.6% and 4.0%, for NASI, NSE 20 and NSE 25, respectively. A proposal has been made by Mr. Moses Kuria, who is the Member of Parliament for Gatundu South, to allow borrowers to negotiate for interest rates chargeable on loans depending on their individual risk levels, with an upper limit of up to 6.0% above the existing interest rate cap levels, which is currently at 13.0%; meaning the proposal, if successful, would raise the highest limit to 19%. The 13.0% is 4.0% points above the Central Bank Rate (CBR) limit set under the Banking (Amendment) Act 2015;

Private Equity

In fundraising, Branch International, a mobile-based Microfinance Institution (MFI) operating in Kenya, Tanzania, Nigeria and California, raised a further Kshs 500.0 mn (USD 4.9 mn) in capital through an issuance of a third commercial paper that was arranged by Barium Capital, a capital-raising advisory firm owned by Centum Investments. The capital investment is expected to expand Branch’s business in Kenya. In education, (i) Dubai based GEMS Education, an international education company owned by a consortium of institutional investors, including Varkey Group and American private equity firm Blackstone Group, plans to put up five middle-range schools in Nairobi at a cost of USD 20 mn (Kshs 2.0 bn), and (ii) The Ministry of Education has announced plans to give loans at subsidised interest rates and education bonds to entrepreneurs to build schools and plug the capacity shortfalls coming from reduced State funding;

Real Estate

During the week, the Kenyan Government invited private developers to participate in the affordable housing initiative by filing bids for Lot 1A, Lot 1B and Lot 1C, which refer to flagship projects, social housing projects and county projects, respectively, by redeveloping government single dwelling estates to high-rise complexes. In the retail sector, Burger King, an American fast food franchise, announced plans to open a new store at Shell Fuel Station in Lavington, bringing its total number of outlets in Kenya to five. In addition, local retailer, Quickmart Supermarkets, announced plans to open its first 24-hour store at the Westfield Mall in Lavington;

Focus of the Week

Africa has increased its appetite for foreign debt over the recent past. In this week’s topical, we highlight fresh Eurobond issues in the year 2018 and reasons for issuance, Eurobond performance in Sub-Saharan Africa and the implications on debt sustainability, using a case study of Mozambique’s debt crisis. The note aims to paint a picture of investor sentiment towards African debt markets and underlying economic risks of unsustainable debt levels.

- Following the completion and handover of Amara Ridge in Karen, Cytonn Real Estate has launched Applewood, its Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. See the fly through video here;

- Our CEO, Edwin H. Dande, was a Speaker at Engage 22, a platform to Inform, Inspire and Influence, and the Theme was "All Said and Done". Edwin spoke about how success is less about the opportunities we get, and more about how we deal with the challenges that we come across. View the video here;

- On Saturday 19th January, Cytonn Asset Managers, the regulated fund management affiliate of Cytonn Group, held a panel discussion forum on the 2019 Economic Outlook. The discussion forum focused on the factors expected to drive growth of the economy in 2019. Read the event note here and you can view the full discussion forum here;

- Ian Kagiri, Investment Analyst, discussed the 2019 Business Outlook on KBC Channel 1. Watch Ian here.

- Caleb Mugendi, Senior Investments Analyst, discussed performance at the Nairobi Securities Exchange on CNBC. Watch Caleb here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects;

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers Section on our website to apply.

T-Bills & T-Bonds Primary Auction:

T-bills were over-subscribed during the week, with the overall subscription rate coming in at 161.4%, a decline from 281.6% recorded the previous week. The continued over-subscription has been attributed to favorable liquidity conditions in the interbank market, despite slight tightening towards the close of the week, due to the start of the new cash reserve requirement (CRR) cycle, as well as tax payments due on 20th of every month. There was a decline in subscription rates across the board for the 91-day, 182-day and the 364-day papers, with subscription rates falling to 180.8%, 138.8% and 176.2%, from 355.8%, 244.6% and 288.8% recorded the previous week, respectively. The yields on the 91-day paper declined to 7.1%, from 7.2% recorded the previous week, while yields on the 182-day and 364-day papers remained unchanged from the previous week at 8.9% and 10.0%, respectively. The acceptance rate rose to 73.6%, from 72.4% recorded the previous week, with the government accepting Kshs 28.5 bn of the Kshs 38.7 bn worth of bids received.

For the month of January, the Kenyan Government has issued two new bonds; issue no FXD 1/2019/2 and issue no FXD 1/2019/15, with 2.0-years and 15.0-years to maturity, and market determined coupon rates. The government will be seeking to raise Kshs 40.0 bn from the two bonds for budgetary support, whose issue will close on 22nd January 2019. The long-term bonds already issued in the FY’2018/2019 in a bid to lengthen the average time to maturity for the Kenyan Government’s debt portfolio and mitigate the potential rollover risks have continued to record a lackluster performance due to the saturation of long end offers. Due to this, we are of the view that the government is issuing the shorter-term 2-year bond in a bid to catch up with its borrowing schedule due to the pent-up in demand for the shorter-term papers, which has seen T-bills over-subscribed in all the 2019 auctions.

Treasury bonds with the same tenor (2.0-years and 15.0-years) are currently trading at a yield of 10.7% and 12.6% respectively. We expect bids to come in at between 10.7% - 10.9% and 12.6% - 12.8% for the 2-year and 15-year bonds, respectively.

Liquidity:

The average interbank rate declined to 2.5%, from 3.1% the previous week, while the average volumes traded in the interbank market rose by 32.0% to Kshs 14.4 bn, from Kshs 10.9 bn the previous week. The lower interbank rate points to improved liquidity conditions, experienced during the start of the week partly attributed to government payments. Liquidity however declined as at the end of the week, with the interbank rate rising to 3.3% as at 18th January 2018, from a low of 1.6% as at the start of the week, mainly attributed to tax payments due on 20th of every month.

Kenya Eurobonds:

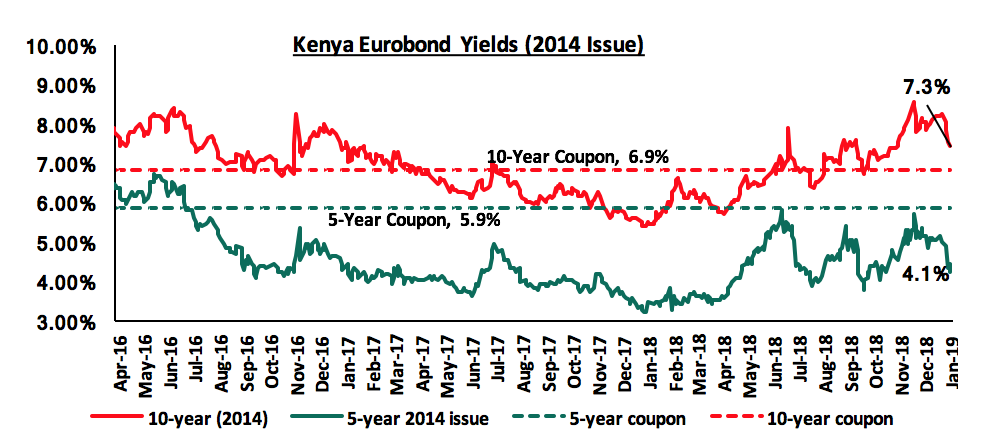

According to Bloomberg, the yields on the 5-year and 10-year Eurobonds issued in 2014 declined by 0.4% points and 0.1% points to 4.1% and 7.3% from 4.5% and 7.4%, respectively. Since the mid-January 2016 peak, yields on the Kenyan Eurobonds have declined by 2.3% points and 4.7% points for the 10-year and 5-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.4-years and 5.4-years to maturity for the 5-year and 10-year, respectively.

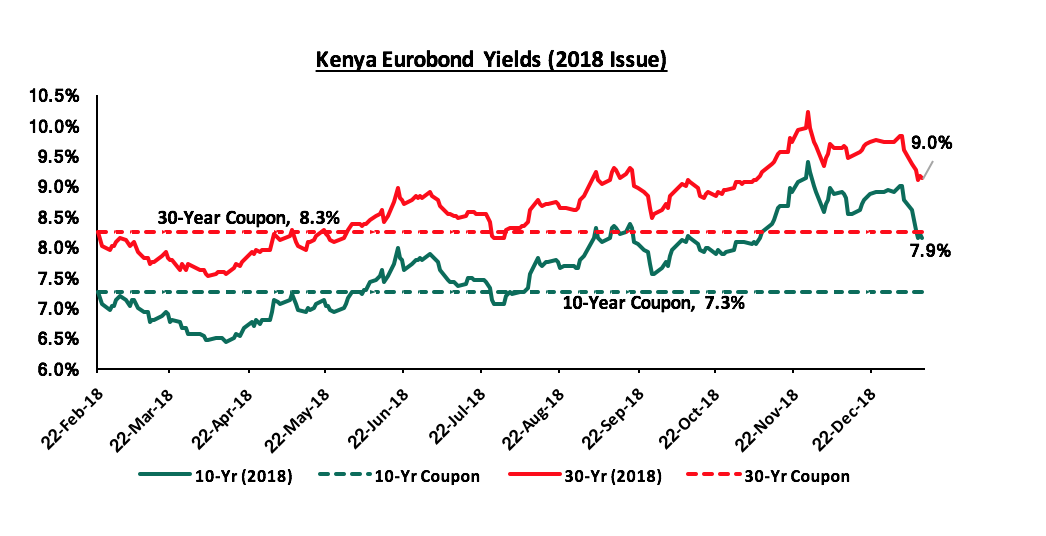

For the February 2018 Eurobond issue, during the week, the yields on both the 10-year and 30-year Eurobonds declined by 0.3% points and 0.1% points to 7.9% and 9.0% from 8.2% and 9.1% the previous week, respectively. Since the issue date, the yield on the 10-year Eurobond has increased by 0.4% points while that of the 30-year Eurobonds has increased by 0.7% points.

Kenya Shilling:

During the week, the Kenya Shilling remained relatively flat against the US Dollar, to close at Kshs 101.7, from Kshs 101.8 recorded the previous week, which was attributed to reduced merchant and oil importer demand supported by tight liquidity in the market and inflows from diaspora remittances. The Kenya Shilling has appreciated against the US Dollar by 0.1% year to date, and in our view the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.3% in the 12-months to September 2018, from 6.5% in September 2017, attributed to improved agriculture exports, increased diaspora remittances and strong receipts from tourism,

- Improving diaspora remittances, which increased by 6.9% m/m in the month of October 2018 to USD 219.2 mn, from USD 205.1 mn recorded in September. Cumulatively, total diaspora remittances rose by 39.5% in the 12-months to October 2018, to USD 2.6 bn, from USD 1.9 bn recorded in a similar period in 2017. This has been attributed to; (a) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (b) new partnerships between international money remittance providers and local commercial banks making the process more convenient. For more analysis on this see our October Diaspora Remittances Note,

- CBK’s activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.0 bn, equivalent to 5.2-months of import cover, compared to the one-year average of 5.1-months and above the EAC Region’s convergence criteria of 4.5-months of imports cover.

Highlight of the Week:

During the week, the Energy Regulatory Commission (ERC) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th January 2019 to 14th February 2019. Below are the key take-outs from the statement:

- Petrol prices have declined by 8.2% to Kshs 104.2 from Kshs 113.5 per litre previously, while diesel and kerosene prices have declined by 8.9% and 3.3% to Kshs 102.2 and 101.7 per litre, respectively, from Kshs 112.3 and 105.2 per litre, previously,

- The changes in prices has been attributed to the decline in average landing cost of imported super petrol by 14.9% to USD 590.9 per ton in December from USD 694.2 per ton in November. Landing costs for diesel and kerosene declined by 14.7% and 8.6% to USD 616.0 per ton and USD 620.1 per ton in December, respectively, from USD 722.2 per ton and USD 678.6 per ton in November, and,

- A 12.5%, decline in Free on Board (FOB) price of Murban crude oil lifted in December 2018 to USD 59.5 per barrel, from USD 68.0 per barrel in November 2018.

We expect a decline in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the decline in petrol and diesel prices. We will release our inflation projection for the month of January 2019 in next week’s report.

Rates in the fixed income market have remained stable as the government rejects expensive bids despite being 34.7% behind its domestic borrowing target for the current financial year, having borrowed Kshs 113.0 bn against a pro-rated target of Kshs 173.0 bn. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing in the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand on government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 1.9%, 2.1% and 2.7%, respectively, taking their YTD performance to 3.4%, 0.6% and 4.0%, for NASI, NSE 20 and NSE 25, respectively. The gain in NASI was mainly driven by gains in the banking sector stocks such as NIC Group, Equity Group Holdings, KCB Group and Barclays Bank of Kenya, which gained by 7.6%, 6.4%, 5.1% and 5.0%, respectively.

Equities turnover gained by 58.7% during the week to USD 34.7 mn, from USD 21.9 mn the previous week, taking the YTD turnover to USD 63.9 mn. Foreign investors remained net sellers for the week, with a net selling position of USD 2.2 mn, which is a 12.1% increase from last week’s net selling position of USD 1.9 mn.

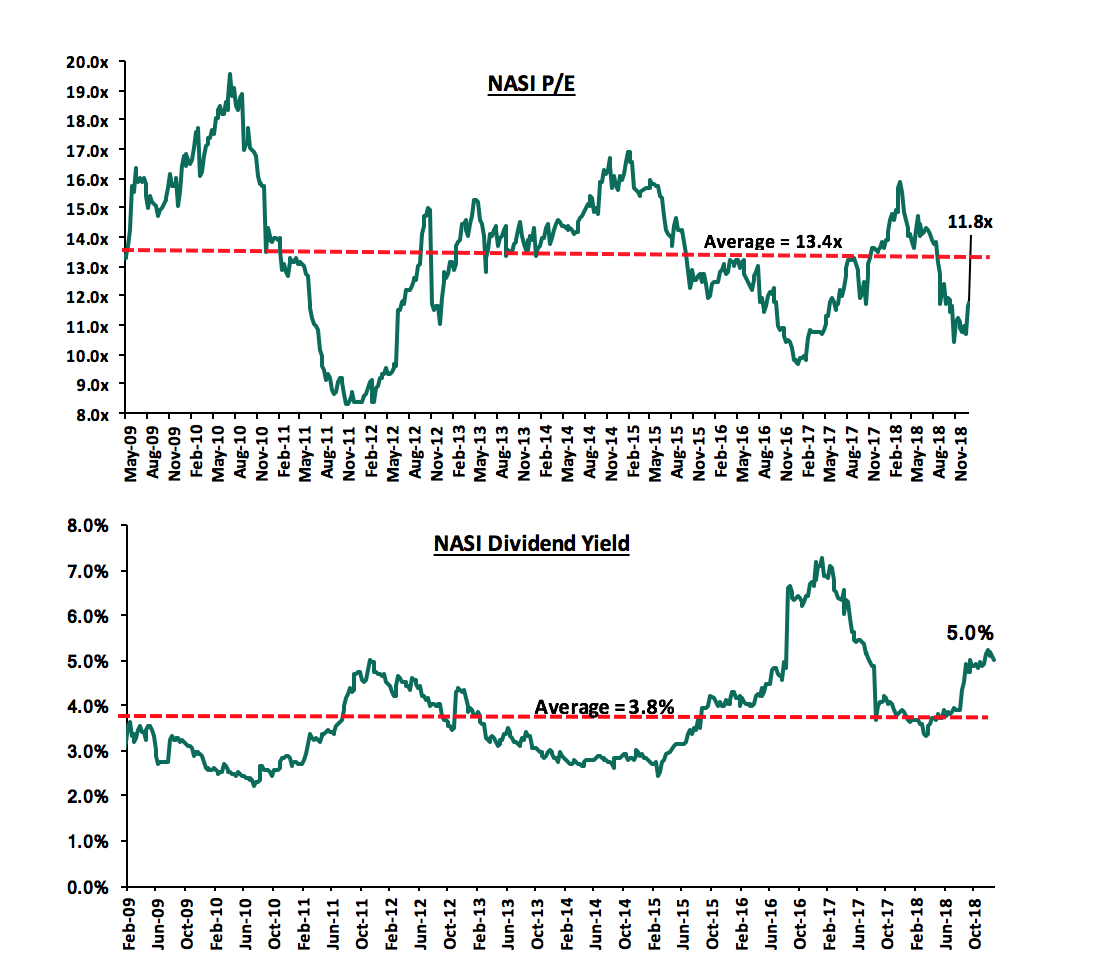

The market is currently trading at a price to earnings ratio (P/E) of 11.8x, 11.9% below the historical average of 13.4x, and a dividend yield of 5.0%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.8x is 21.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 42.2% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

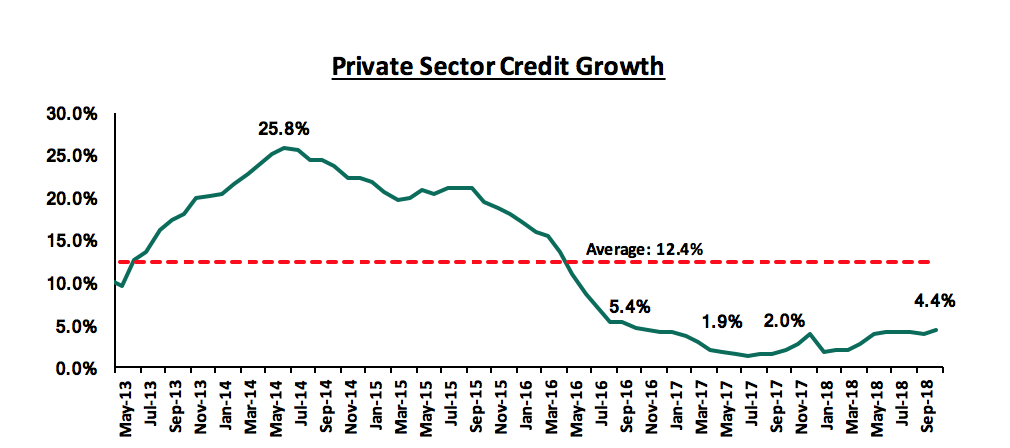

A proposal has been made by Mr. Moses Kuria, who is the Member of Parliament for Gatundu South, to amend the Banking (Amendment) Act 2015, to allow credit consumers negotiate for interest rates on loans, depending on their risk profile, with an upper limit of up to 6.0% above the existing interest rate cap levels, currently at 13.0%. This proposal, if passed, will see borrowers be able to access credit at rates of a maximum of 19.0% per annum. The move comes in a bid to try and improve credit extension to the private sector, comprised largely of the Micro, Small and Medium Enterprises (MSMEs). Credit extension to the private sector has remained below 5.0%, and below the 5-year average of 12.4%, as can be seen in the graph below:

The proposal aims to provide the room for banks to price risk within the new margins, with banks citing the inability to price risk within the 4.0% margin above the Central Bank Rate (CBR), as a key impediment to lending, owing to the lower risk adjusted returns when compared to investments in government securities. As such banks had continually increased allocations to government securities, shunning lending to MSMEs in the process. With the rate cap having failed to achieve its intended objective of improving credit access, we are of the view that the amendment presents an opportunity for risk-based lending to kick off, as cost of credit becomes pegged to the associated risks. If successfully tabled and passed in Parliament, it would go a long way towards significantly improving credit access, as banks begin to lossen the tighter credit standards adopted after the enactment of the Banking (Amendment) Act 2015, as they will likely have enough headroom to price risk.

Barclays Bank of Kenya’s (BBK) mobile app dubbed “Timiza” has seen its loan applications rise to 10,000 applications per day, from 5,000 per day, which the bank was processing before the launch of Timiza in March 2018. The mobile application with 3.0 mn subscribers has seen the bank venture into a target market that doesn’t have the requisite documentation and is in need of faster processing of loans. Commercial banks have increasingly been focusing on the adoption and promotion of mobile applications in a bid to leverage on the alternative channel, to boost lending activities with the high number of low-value loans, and consequently increase transactional income. Examples of applications by banks include Commercial Bank of Africa’s Mshwari and Loop, Equity Group’s Equity EazzyApp, Equity EazzyBiz and Equitel, KCB’s KCB Mpesa, Co-operative Bank’s MCo-op cash, and HF Group’s HF Whizz. We maintain our view that continued focus, and increased adoption of these alternative channels will continue to see banks increase their Non-Funded Income (NFI), which contributed 34.5% of total operating income as at Q3’2018, an increase from the 33.3% in Q3’2017 for listed banks, while at the same time aiding banks in improving their operational efficiency, with the Cost to Income Ratio (CIR) of listed banks declining to 56.3% as at Q3’2018 from 59.4% in Q3’2017, owing to the relatively lower cost demands of these channels compared to the brick and mortar model of operation. Revenue expansion and cost containment will aid banks in achieving sustainable growth going forward.

The Board of Directors of Nairobi Securities Exchange (NSE) listed oil marketer Kenol Kobil has endorsed the proposed takeover by France-based Rubis Energie. Following this approval, Kenol Kobil shareholders have been granted until 18th February 2019 to accept the buyout offer of Kshs 23.0 per share. Rubis, already with a 25.0% stake in Kenol Kobil seeks to expand its presence in East and Central Africa, and is effectively valuing the company at Kshs 35.7 bn if the transaction is successful. Since the announcement on 23rd October 2018, the share has gained by 39.2% to Kshs 21.3 per share as at 18th January 2018, from Kshs 15.3 per share. The offer by Rubis was at a premium, being 50.3% above the prevailing Kshs 15.3 price per share. The buyout is set to take place, with the only impediment being the refusal of the offer by any shareholders, or possibly the filing of an injunction in court by a shareholder to stop the process.

Universe of Coverage

|

Universe of Coverage |

||||||||

|

Banks |

Price as at 11/1/2019 |

Price as at 18/1/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Diamond Trust Bank |

152.0 |

150.0 |

(1.3%) |

(4.2%) |

283.7 |

1.7% |

90.9% |

0.9x |

|

Ghana Commercial Bank*** |

4.6 |

4.5 |

(2.0%) |

(2.2%) |

7.7 |

8.4% |

80.0% |

1.1x |

|

Access Bank |

5.7 |

5.6 |

(0.9%) |

(17.6%) |

9.5 |

7.1% |

76.8% |

0.4x |

|

NIC Bank |

27.6 |

29.7 |

7.6% |

6.7% |

48.8 |

3.4% |

68.0% |

0.8x |

|

Zenith Bank*** |

21.9 |

21.5 |

(1.6%) |

(6.7%) |

33.3 |

12.6% |

67.5% |

1.0x |

|

KCB Group |

36.9 |

38.8 |

5.1% |

3.6% |

61.3 |

7.7% |

65.7% |

1.2x |

|

UBA Bank |

7.4 |

7.3 |

(0.7%) |

(5.2%) |

10.7 |

11.6% |

58.2% |

0.5x |

|

I&M Holdings |

91.0 |

94.3 |

3.6% |

10.9% |

138.6 |

3.7% |

50.8% |

1.0x |

|

Co-operative Bank |

13.9 |

14.0 |

0.7% |

(2.4%) |

19.9 |

5.7% |

48.4% |

1.2x |

|

CRDB |

140.0 |

140.0 |

0.0% |

(6.7%) |

207.7 |

0.0% |

48.4% |

0.5x |

|

Equity Group |

37.0 |

39.3 |

6.4% |

12.8% |

56.2 |

5.1% |

48.1% |

1.9x |

|

Ecobank |

7.5 |

7.5 |

(0.4%) |

(0.4%) |

10.7 |

0.0% |

43.6% |

1.6x |

|

CAL Bank |

1.0 |

1.0 |

(1.0%) |

1.0% |

1.4 |

0.0% |

41.4% |

0.8x |

|

Stanbic Bank Uganda |

30.0 |

30.0 |

0.0% |

(3.2%) |

36.3 |

3.9% |

24.8% |

2.1x |

|

Guaranty Trust Bank |

33.5 |

32.0 |

(4.6%) |

(7.3%) |

37.1 |

7.5% |

23.6% |

2.0x |

|

Union Bank Plc |

6.0 |

6.8 |

12.5% |

20.5% |

8.2 |

0.0% |

20.7% |

0.7x |

|

HF Group |

5.4 |

5.8 |

7.4% |

4.7% |

6.6 |

6.0% |

19.8% |

0.2x |

|

Barclays |

11.1 |

11.7 |

5.0% |

6.4% |

12.5 |

8.6% |

15.9% |

1.6x |

|

SBM Holdings |

6.0 |

6.1 |

1.3% |

2.3% |

6.6 |

4.9% |

12.5% |

0.9x |

|

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

299.9 |

4.8% |

8.2% |

1.6x |

|

Standard Chartered |

194.5 |

195.8 |

0.6% |

0.6% |

196.3 |

6.4% |

6.7% |

1.6x |

|

Stanbic Holdings |

90.0 |

95.0 |

5.6% |

4.7% |

92.6 |

2.4% |

(0.2%) |

0.9x |

|

Bank of Baroda |

135.0 |

135.0 |

0.0% |

(3.6%) |

130.6 |

1.9% |

(1.4%) |

1.2x |

|

FBN Holdings |

7.4 |

7.3 |

(1.4%) |

(8.2%) |

6.6 |

3.4% |

(5.8%) |

0.4x |

|

Standard Chartered |

21.4 |

21.1 |

(1.7%) |

0.4% |

19.5 |

0.0% |

(7.7%) |

2.6x |

|

National Bank |

5.2 |

5.5 |

5.8% |

2.6% |

4.9 |

0.0% |

(10.3%) |

0.4x |

|

Stanbic IBTC Holdings |

47.0 |

46.2 |

(1.8%) |

(3.8%) |

37.0 |

1.3% |

(18.5%) |

2.4x |

|

Ecobank Transnational |

14.0 |

13.5 |

(3.6%) |

(20.6%) |

9.3 |

0.0% |

(31.3%) |

0.5x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in ****Stock prices indicated in respective country currencies

|

||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

Branch International, a mobile-based microfinance institution headquartered in California with operations in Kenya, Tanzania and Nigeria, raised a further Kshs 500.0 mn (USD 4.9 mn) in capital investment based on its third issued commercial paper in the Kenyan market. The Silicon Valley start-up, founded in 2015, processes loans ranging from Kshs 250 to Kshs 70,000 daily and applies machine learning to create an algorithmic approach to determine credit worthiness via customers' smartphones.

The commercial paper was arranged by Barium Capital, a capital–raising advisory firm owned by Centum Investments. The investment is expected to expand Branch’s business in Kenya. Branch International has so far disbursed more than Kshs 25.0 bn (USD 245.8.0 mn) and distributed more than 10.0 mn loans. This is the third time Branch International has issued a commercial paper. In July 2018, Branch international raised Kshs 350.0 mn (USD 3.5 mn), arranged by Barium Capital through the issuance of its second commercial paper as highlighted on Cytonn Weekly #27/2018 and in 2017, Branch International raised Kshs 200.0 mn (USD 2.0 mn) through the issuance of its first commercial paper.

The table below highlights the fundraising activities by various FinTech companies with operations in Kenya:

|

Fundraising Activities by FinTech Companies |

|||||

|

No. |

Funded Entity |

Investor |

Form of Funding |

Investment Amount (Kshs bns) |

Date |

|

1. |

Tala |

Revolution Growth |

Equity and Debt |

6.5 |

Apr-18 |

|

2. |

Branch International |

Trinity Ventures, CreditEase Fintech Investment Fund, Victory Park, IFC, and Andreessen Horowitz |

Equity and Debt |

7.0 |

Apr-18 |

|

3. |

Africa’s Talking |

Orange Digital Ventures, Social Capital and International Finance Corporation (IFC) |

Equity |

0.9 |

Apr-18 |

|

4. |

Cellulant |

Texas Pacific Group (TPG) and Satya Capital |

Equity |

4.8 |

May-18 |

|

5. |

Bitpesa |

Sompo Holdings |

Equity |

0.5 |

Jun-18 |

|

6. |

Bismart Insurance |

GreenTec Capital Partners |

Equity |

Undisclosed |

Jul-18 |

|

7. |

Branch International |

Commercial Paper |

Debt |

0.4 |

Jul-18 |

|

8. |

Lendable |

Netherlands Development Finance Company |

Convertible Debt |

0.05 |

Aug-18 |

|

9. |

Jumo |

Odey Asset Management, Goldman Sachs, Proparco, Finnfund, Vostok Emerging Finance, Gemcorp Capital and LeapFrog Investments |

Equity |

6.6 |

Sep-18 |

|

10. |

Tala |

Paypal |

Equity |

Undisclosed |

Oct-18 |

|

11 |

Branch International |

Commercial Paper |

Debt |

0.5 |

Jan-19 |

Source: Cytonn Research

FinTech lending and Microfinance Institutions in general have been a major attraction for investors in Kenya and Sub-Saharan Africa. Lack of access to finance is a major issue for entrepreneurs and MSMEs across Africa. According to the IMF, there are 44.2 mn MSMEs in Sub-Saharan Africa with a potential demand for USD 404.0 bn in financing. The current volume of financing in Sub-Saharan Africa is estimated at USD 70.0 bn signifying a huge financing gap of USD 331.0 bn. Microfinance Institutions and FinTech companies aim to bridge this gap by offering convenient access to credit.

In the education sector, Dubai based GEMS Education, an international education company owned by a consortium of institutional investors, including Varkey Group and American private equity firm Blackstone Group, plans to put up five middle-range schools in Nairobi at a cost of USD 20 mn (Kshs 2.0 bn). The investment will continue the Dubai based company’s initiative to expand in the Kenyan market. Additionally, they plan to set up low cost Kenyan curriculum schools charging between Kshs 20,000 to Kshs 40,000 per year from 2020. The group is also planning to open Regis Runda School, which is built on 26-acres with a capacity of 2,000 students, in January 2020. This investment comes a week after GEMS acquired a 100% stake of Hillcrest International Schools from its current owners, Fanisi Capital and businessman Anthony Wahome, for Kshs 2.6 bn as highlighted in our Cytonn 2019 Markets Outlook.

The Ministry of Education has announced plans to give loans at subsidized interest rates and education bonds to entrepreneurs to build schools and plug the capacity shortfalls coming from reduced State funding. The Ministry is also proposing to float sovereign bonds to support the funding of the education sector. These are some of the proposals that were tabled in the National Assembly in December 2018 on Reforming Education and Training for Sustainable Development by the Ministry of Education. Kenya currently invests 6.4% of GDP annually on education and this heavy investment is borne largely by the government. The bulk of the investment goes to the payment of teachers’ salaries leaving little for building classrooms, laboratories and dormitories. In the 2018/2019 Budget, the government allocated Kshs 200.5 bn to the education sector in order to enhance quality and relevant education and enhance the expansion of Technical and Vocational Education and Training institutes. The proposal tabled in the National Assembly will enhance access to quality education and provide investment opportunities to investors through the access of loans at a subsidized rate. We are of the view that the government should encourage Public-Private Partnership (PPP) to help reduce levels of government financing and enable the government to obtain greater value for their investments in the education sector.

Despite the recent slowdown in growth, we maintain a “Positive” outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

- Residential Sector

During the week, the Kenyan Government invited private developers to participate in the affordable housing initiative, by redeveloping government single dwelling estates to high-rise complexes. Developers are required to file for bids for Lot 1A, Lot 1B and Lot 1C, which refer to flagship projects, social housing projects and county projects, respectively, by 21st January 2019. Lot 1A, 1B and 1C are expected to consist of 167,640 units, which is 33.5% of the 500,000 units expected to be developed for the low and middle-income households in the next three-years. A total of 7,000-acres of public land has been reserved for the project, which will consist of studio, 1-bed, 2-bed and 3-bed apartments. Over the last year, the government has provided incentives and policy reviews all in support of the affordable housing initiative, expecting to push developers towards provision of more housing for the lower-middle and low-income section of the population. Some of the initiatives include: (i) establishment of the Kenya Mortgage Refinancing Company (KMRC) facilitating provision of mortgages to buyers at affordable rates, (ii) a 15.0% tax relief for first-time buyers up to a maximum of Kshs 108,000 p.a., and (iii) exemption of first time homebuyers from stamp duty tax. The affordable initiative structure involves the government partnership with private sector through Public-Private Partnerships (PPP’s), where the government provides development land and the private sector offers financing and development capabilities. However, realizing this PPP structure has been difficult due to several challenges, which the government is addressing, among them being:

- Regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security,

- Lack of clarity on returns and revenue-sharing,

- The extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and,

- Bureaucracy and slow approval processes.

In our view, to achieve the affordable housing initiative, the government, in addition to addressing the PPP structure to be favourable for the private sector, needs to establish other financing methods such as tapping into capital markets, and provide incentives for the mortgage market to support both the developers and off-takers.

- Retail Sector

During the week, Burger King, an American fast food restaurant chain, opened a new store at Shell Fuel Station on James Gichuru Road in Lavington, bringing its total number of outlets in Kenya to five. In addition, local retailer, Quickmart Supermarkets also announced plans to open a 10,000 SQFT 24-hour store at Westfield Mall in Lavington, fronting Gitanga Road, bringing its total retail stores to 10. The Lavington area has attracted various retailers over the last 2-years such as Java House and KFC, mainly due to the area serving as an affluent neighborhood hosting middle to high-end income earners with high consumer purchasing power and thus investors are willing to pay higher rents for retail space in the area.

The increased retailers has thus improved the retail space performance in Lavington, making it the third best performing submarkets in Nairobi, with an average yield of 10.7% compared to a market average of 9.0% and average occupancy rates of 97.0% compared to a market average of 79.8% in 2018.

The table below shows the performance of the submarkets within Nairobi:

|

Summary of Nairobi’s Retail Market Performance 2018 |

|||

|

Location |

Rent Kshs/SQFT 2018 |

Occupancy Rate 2018 |

Rental Yield 2018 |

|

Westlands |

219.2 |

88.2% |

12.2% |

|

Karen |

224.9 |

88.8% |

11.0% |

|

Kilimani/Lavington* |

167.1 |

97.0% |

10.7% |

|

Ngong Road |

175.4 |

88.8% |

9.7% |

|

Thika Road |

177.3 |

75.5% |

8.3% |

|

Kiambu Road |

182.8 |

69.5% |

8.1% |

|

Mombasa Road |

161.5 |

72.4% |

7.9% |

|

Eastland’s |

153.3 |

64.8% |

6.8% |

|

Satellite Towns |

142.1 |

73.7% |

6.7% |

|

Average |

178.2 |

79.8% |

9.0% |

|

*Kilimani includes Lavington and Kileleshwa |

|||

Source: Cytonn Research

We expect the continued entry of international retailers and expansion of local retailers within Lavington and the general Kilimani submarket supported by (i) increased disposable income due to an expanding middle class, and (ii) provision of higher quality amenities. We also expect increased activity from private developers attributed to attractive rental yields and occupancy rates at 9.9% and 84.5%, respectively.

- Hospitality Sector

During the week, Kenya Airways and local airline Silverstone, announced plans to introduce daily direct flights from Nairobi to Seychelles, and from Nairobi to Lodwar, respectively. The move is in light of the increased air transport recorded in 2018, with several airlines recording increased frequencies in and out of the country, some of which include Ethiopian Airlines, which increased their weekly frequencies from Addis Ababa to Mombasa from 7 to 14 per week. In our view, the improving air transport, political stability and continued marketing of Kenya as an experience destination, will result in increased tourist arrivals, which according to Kenya National Bureau of Statistics (KNBS), recorded a 39.8% increase from 1.4 mn 2017 to 2.0 mn in 2018, and we expect the numbers to grow by 30.0% y/y to 2.6 mn in 2019. As a result, we expect continued demand for hospitality services, with serviced apartments expected to record relatively high occupancies of above 80.0% in 2019, according to our Cytonn 2019 Markets Outlook.

We expect increased activities in the real estate sector mainly residential, retail and hospitality themes, supported by (i) increased government push towards the affordable housing agenda (ii) entry of international retailers and expansion of the already existing brands, and (iii) continued marketing of Kenya as an experience destination enhancing confidence in Kenya as a travel destination.

Focus of the Week : Sub-Saharan Africa (SSA) Eurobonds: 2018 Performance and Effects on Debt Sustainability

Africa has increased its appetite for foreign debt in recent times with the latest issues being by the Republic of Nigeria, which issued three debt instruments in November 2018. The increased affinity for foreign currency-denominated debt by African nations is driven by:

- Reduced financial aid to African countries by Western donor nations,

- The need to finance heavy infrastructure projects,

- Covering for budget deficits, and

- Financing of maturing debt obligations.

This note analyses SSA’s Eurobond performance in the year 2018 with the aim of painting a picture of the investor confidence and risk tolerance, and an outlook on yield performance for the year 2019. The analysis will be broken down as follows:

- Background of Eurobonds in Sub Saharan Africa,

- Eurobond Performance in Sub-Saharan Africa,

- Debt Sustainability in Africa: Case Study of Mozambique Debt Crisis,

- Outlook on SSA Eurobonds.

Section I. Background of Eurobonds in Sub Saharan Africa

Collectively, the year 2018 saw the Sub-Saharan Region (excluding South Africa) raise USD 13.7 bn through various Eurobond issues. The new instruments attracted a lot of interest as evidenced by the oversubscription in all the issues, with the Kenyan issues recording the highest oversubscription of 7.0x, underlining the sustained investor confidence in the African debt market. This may partly arise because, by comparison, African sovereign debt offers the highest yields to investors globally. Data from Bloomberg indicates that Africa offers an average dollar-bond yield of 6.0%, higher than the Emerging Market average of 5.5%, as well as the North American average of 4.5%; and the Asia Pacific average of 4.0%. African Eurobond issuers possess different risk characteristics depending on the issuer and the tenor of the bonds. Such risks include political, economic and therefore credit risks as highlighted in our focus on Sub-Saharan African (SSA) as an Attractive Investment Destination.

Section II. Eurobond Performance in Sub-Saharan Africa

Analysis of New 2018 Issues

Four countries issued new Eurobonds in Sub Saharan Africa in 2018, with the issuers being:

- Kenya, with a USD 1.0 bn, 10-year tenor bond and another 30-year tenor bond of a similar amount; earmarked for infrastructural development and active debt management. The issue raised USD 14.0 bn from investors, thus an oversubscription by 7.0x,

- Senegal, with two bonds of USD 1.0 bn each, which were 4.7x oversubscribed with USD 9.3 bn in bids received. The stated plan was for new infrastructure development as well as refinancing some USD 150.0 mn of foreign debt, due in 2021,

- Ghana, with a dual-tranche Eurobond in May 2018, raising a total of USD 2.0 bn in 10-year and 30-year instruments of USD 1.0 bn each. The funds, which were for budgetary purposes and liability management, were 4.0x oversubscribed with USD 8.0 bn in bids received,

- Nigeria’s triple-tranche debt note of USD 1.2 bn with a 7-year tenor, USD 1.0 bn with a 12-year tenor and USD 0.8 bn with a 30-year tenor in November 2018, with total bids received amounting to USD 9.5 bn translating to a 3.2x oversubscription. 97.0% (USD 2.8 bn) of the funds generated were to be used in part to finance the 2018 budget, while the remaining 3.0% (USD 82.5 mn) was used to refinance the balance of the USD 0.5 bn bond that matured in July 2018. Nigeria had also issued two Eurobonds in February 2018.

Key to note is that most Eurobond issues in 2018 have been motivated by refinancing needs as part of debt-management strategies mooted by the various governments, with part of the bond proceeds being used to meet existing debt obligations of the respective issuers. The table below summarizes the recent Eurobonds issued in 2018:

|

Yield Changes for SSA Eurobonds Issued in 2018 |

||||||||

|

Country |

Issue Tenor (yrs) |

Issue Date |

Maturity Date |

Coupon |

Yield at Issue Date |

Oversubscription |

Yield as at December 2018(% points) |

Issue to Dec 31 Yield Change(% points) |

|

Nigeria |

12 |

23/02/2018 |

23/02/2030 |

7.1% |

6.8% |

4.6x |

8.7% |

1.9% |

|

Kenya |

10 |

28/02/2018 |

28/02/2028 |

7.3% |

7.0% |

7.0x |

8.9% |

1.9% |

|

Kenya |

30 |

28/02/2018 |

28/02/2048 |

8.3% |

8.0% |

7.0x |

9.7% |

1.7% |

|

Nigeria |

20 |

23/02/2018 |

23/02/2038 |

7.7% |

7.3% |

4.6x |

9.0% |

1.7% |

|

Ghana |

11 |

16/05/2018 |

16/05/2029 |

7.6% |

7.6% |

4.0x |

9.1% |

1.5% |

|

Senegal |

30 |

13/03/2018 |

13/03/2048 |

6.8% |

6.9% |

4.7x |

8.3% |

1.4% |

|

Ghana |

31 |

16/05/2018 |

16/06/2049 |

8.6% |

8.7% |

4.0x |

9.8% |

1.1% |

|

Senegal |

10 |

13/03/2018 |

13/03/2028 |

4.8% |

4.8% |

4.7x |

5.9% |

1.1% |

|

Nigeria |

30 |

21/11/2018 |

21/01/2049 |

9.2% |

9.2% |

3.2x |

9.6% |

0.4% |

|

Nigeria |

7 |

21/11/2018 |

21/11/2025 |

7.6% |

7.9% |

3.2x |

8.2% |

0.4% |

|

Nigeria |

12 |

21/11/2018 |

21/01/2031 |

8.7% |

9.0% |

3.2x |

9.1% |

0.1% |

Key to note from the table above is that there was no drop in yields for any African Eurobond issuance that happened in 2018. The yields on the new issues rose during the year 2018, mainly attributable to two key reasons:

- The turbulence witnessed in global financial markets due to the trade tensions between U.S and China, which began around mid-April, dampening investor sentiment in emerging markets and causing volatility in commodity prices hence adversely affecting commodity-dependent African economies, and,

- The increment in the Federal Funds Rate four times in 2018, (currently at 2.25% - 2.5%), also led to a general increase in Eurobond yields in most emerging markets due to the higher yields on US Treasuries that caused capital flows into their fixed income markets and out of emerging markets, coupled with the increased risk perception for emerging market debt.

Coming into 2019, we expect yields on Ghanaian Eurobonds to decline due to prospects of relative economic and political stability, whereas Kenyan, Nigerian and Senegal Eurobond yields might rise due to potential political risks arising from the looming elections later in the year in Nigeria and Senegal, coupled with volatility in global commodity prices, especially for oil-producing Nigeria. The downgrading of Kenya’s debt distress rating from low to moderate by the IMF would mean investors will expect higher yields on any new debt issued.

Analysis of Existing Issues

This section analyses some of the Eurobonds issued in Sub Saharan Africa before 2018.

|

Yield Changes in SSA Eurobonds Issued Before 2018 |

|||||||||

|

Country |

Issue Tenor (yrs) |

Issue Date |

Maturity Date |

Coupon |

Yield at Issue Date |

Yield as at Year Open |

Yield as at December 2018 |

Year-on-year Change (% Points) |

Issue Date to Dec 2018 Yield Change(% points) |

|

Zambia |

10 |

20/09/2012 |

20/09/2022 |

5.4% |

5.2% |

5.9% |

15.4% |

9.5% |

10.2% |

|

Zambia |

10 |

14/04/2014 |

14/04/2024 |

8.5% |

8.4% |

6.4% |

15.6% |

9.2% |

7.2% |

|

Zambia |

12 |

30/07/2015 |

30/07/2027 |

9.0% |

9.3% |

7.1% |

14.0% |

6.9% |

4.7% |

|

Nigeria |

30 |

28/11/2017 |

28/11/2047 |

7.6% |

7.3% |

7.0% |

9.1% |

2.1% |

1.8% |

|

Senegal |

16 |

23/05/2017 |

23/05/2033 |

6.3% |

6.1% |

5.7% |

7.9% |

2.2% |

1.8% |

|

Kenya |

10 |

24/06/2014 |

24/06/2024 |

6.9% |

6.4% |

5.6% |

8.2% |

2.6% |

1.7% |

|

Ghana |

11 |

18/09/2014 |

18/01/2026 |

8.1% |

7.9% |

6.2% |

8.9% |

2.7% |

1.0% |

|

Senegal |

10 |

30/07/2014 |

30/07/2024 |

6.3% |

6.1% |

4.7% |

6.8% |

2.1% |

0.7% |

|

Ghana |

10 |

08/07/2013 |

08/07/2023 |

7.9% |

7.9% |

5.7% |

8.3% |

2.6% |

0.4% |

|

Ghana |

6 |

15/09/2016 |

15/09/2022 |

9.3% |

5.9% |

6.2% |

6.1% |

(0.1%) |

0.2% |

|

Kenya |

5 |

24/06/2014 |

24/06/2019 |

5.9% |

4.8% |

5.3% |

5.0% |

(0.3%) |

0.2% |

|

Ghana |

15 |

14/10/2015 |

14/10/2030 |

10.8% |

10.3% |

6.3% |

8.9% |

2.6% |

(1.4%) |

|

Senegal |

10 |

13/05/2011 |

13/05/2021 |

8.8% |

8.0% |

3.8% |

5.8% |

2.0% |

(2.2%) |

From the table above,

- Zambia recorded the highest increases in Eurobond yields, with the 10-year instruments for both the 2012 and 2014 issues increasing by 9.5% and 9.2% points respectively, while the yield on the 12-year bond issued in 2015 increased by 6.9% points. This makes Zambian Eurobonds the worst performing in Sub Saharan Africa, due to concerns of a widening fiscal deficit and deteriorating credit worthiness on the back of high debt levels. According to Zambia’s budget, the country’s fiscal deficit stands at 7.4% of GDP, with debt levels expected to rise to 69.0% of GDP by the end of the financial year 2018. Zambia’s increasing debt levels, coupled with the 19.0% depreciation of the Kwacha in 2018, present the risk of rising debt-service costs for the economy, hence necessitating demands for higher premium on sovereign debt issued by the country.

- With the exception of Ghana’s 6-year instrument issued in 2016 and Kenya’s 5-year paper issued in 2014, all other sovereign bond yields in SSA have increased moderately - within a band of 2.1-2.6 percentage points.

- The Nigerian Government had earlier issued two Eurobonds for USD 2.5 bn across two maturities: 12-years and 20-years, in order to finance repayment of government securities denominated in the local currency. The increase in Nigerian bond yields has partly been attributable to inherent weaknesses in fiscal policies, as well as the looming elections, while Ghana bond yield increases have largely been attributed to weakening investor sentiment because of the emerging banking sector risk that led to a government bailout for failing banks, which increased the stock of public debt.

- The rising yield on Kenyan Eurobonds signals higher country risk perception by investors, partly attributed to International Monetary Fund (IMF) raising the risk of Kenya’s debt distress from low to moderate in October 2018, resulting in investors demanding a higher return for the risk.

The declining yields have further been weighed down by the declining commodity prices, coupled with the depreciation of most of the local currencies of the respective nations. Below is a summary of the performance of the different resident currencies for the year 2018:

|

Select SSA Currency Performance vs USD |

|||

|

Currency |

Dec-18 |

Dec-17 |

Y-O-Y Change |

|

Kenya Shilling |

101.2 |

103.2 |

1.4% |

|

Nigerian Naira |

362.6 |

360.0 |

(0.7%) |

|

CFA Franc (Senegal) |

577.5 |

564.2 |

(2.3%) |

|

Ghana Cedi |

4.9 |

4.5 |

(8.6%) |

|

Zambian Kwacha |

11.9 |

10.0 |

(19.0%) |

The depreciation of local currencies has the effect of making dollar denominated debt more expensive. This would pose the danger of rising debt-service costs, especially taking into account the diminishing revenues because of commodity price declines.

Section III: Debt Sustainability in Africa: Case Study of Mozambique Debt Crisis

Debt distress is a situation where an entity fails to meet its periodic obligations because a large portion of revenue is used in paying down debt, to a point where periodic debt payments become unsustainable. In this section, we shall give an example of the Mozambican debt crisis as a pointer to the possible economic implications of unsustainable debt levels that could be brought about by issuing Eurobonds.

Mozambique fell into debt distress in 2016 after it defaulted on a USD 0.7 bn, 10-year tenor Eurobond that was due in January 2020. The Eurobond was issued in January 2013 to refinance what it termed as ‘tuna bonds’. Ematum, a state-owned fishing company, borrowed the tuna bonds, taken out in 2013 to finance a new tuna fishing fleet. The loans, a USD 500.0 mn and a USD 350.0 mn notes, were borrowed from Credit Suisse Bank and Russian-based VTB Bank, respectively. The loans were securitized with the help of the two banks and a French bank, PNB Paribas, after which they were divided into smaller chunks and issued as unlisted securities. These securities came to be the now infamous tuna bonds. The Mozambican government guaranteed the debt, meaning it would have to pay up in case Ematum was unable to. As fate would have it, Ematum was unable to meet its obligations, amounting to USD 260.0 mn per annum, due to a shortfall in annual tuna catch below the 200,000 tonnes needed to make its business model viable. At the time, the government’s fiscal position was worsening due to plummeting commodity prices and an underperforming agricultural sector. High budget deficits meant extensive borrowing to plug the shortfalls, necessitating budget cuts in order to lower the deficit. Nevertheless, it struggled in financing the debt, announcing a restructuring of the Eurobond in April 2016. Bondholders agreed to swap the tuna bonds maturing in 2020 for new, interest-only Eurobonds maturing in 2023. This was on the premise that income from Mozambique’s newly discovered offshore natural gas fields would be used in financing the debt.

After the restructuring, Mozambique admitted to undeclared borrowing of a further USD 1.4 bn in commercial and bilateral debt. Following the disclosure, 14 donor countries (including the IMF) froze financial aid to the country, further deteriorating the already dire fiscal position. The International Monetary Fund (IMF) estimated the proportion of public debt to the country’s GDP at 128.3% in 2016, with external debt arrears amounting to USD 709.6 mn by the end of 2017. The government announced that it could not pay any of its debt obligations until 2021, the year it expected to start receiving revenues from the sale of natural gas. Instead, it offered to restructure the debt, now amounting to USD 2.1 bn including the tuna bonds, which would need restructuring yet again. Real GDP growth slumped to 3.8% in 2016 after registering growth rates of 7.4% and 6.6% in 2014 and 2015, respectively. Fiscal deficits were notably high, peaking at 10.7% in 2014 and easing off to 7.2% in 2015, before closing the year 2016 at 7.6% of GDP. The IMF forecasts the debt crisis to continue over the medium term to reach 126.0% of GDP by the end of the year 2022.

The path to recovery for Mozambique lies in the commercialization of liquid natural gas (LNG) reserves, expected to begin generating income in 2023. However, the economic outlook remains bleak in the medium term, with the IMF expecting GDP growth to slow down to 2.2% by the year 2022, after which it is estimated to grow by 9.9% once natural gas sales commence in the year 2023. Even then, growth is hinged on timely completion of the LNG processing facilities, which will require heavy foreign direct investment as well as private debt financing. The total costs of development of the facilities are estimated at USD 25.0 bn, of which 60.0% (USD 15.0 bn) will be financed by debt. In the meantime, GDP growth will ride on expansion in coal mining and infrastructure investments. In addition, fiscal consolidation is required in order to improve the country’s external position, while austerity measures are needed to reduce public spending. Prudence should be exercised in contracting of new debt, to avoid non-concessional arrangements and focus borrowing efforts on immediate, high-impact projects. The country also needs to improve management of state-owned enterprises (SOEs), with a possible privatization wave looming.

From the case study above, key take-outs for African countries include:

- The need to diversify economies away from commodity exports, which are prone to fluctuating revenues due to volatility in global prices. This will serve to alleviate pertinent budget deficits hence reducing reliance on debt for budget financing,

- Debt should only be taken out for the sole purpose of financing high value infrastructural projects that have an immediate high impact on the economy, and;

- Fiscal consolidation is paramount in order to minimise fiscal deficits for countries aiming to improve their external position with regard to foreign funding. Austerity measures should be adopted to reduce government spending, thereby freeing up capital for development expenditure.

Section IV: Outlook on SSA Eurobonds

From the analysis, it is evident that Eurobond yields in Sub Saharan Africa rose in 2018, partly due to the aggressive tightening monetary policy regime adopted by the U.S Federal Reserve, coupled with the China-U.S trade tensions, which dampened investor sentiment in emerging markets. The volatility of commodity prices adversely affected export revenues for resource-endowed countries like Nigeria and Zambia. Internal country risks also exacerbated the rise in yields, such as the developing banking sector risks in Ghana. As a result, most foreign investors began pulling out their capital in the wake of rising US treasury yields and a strong dollar, thereby increasing the risk profile of most emerging market economies. However, with the truce arrived at between US and China after the G20 Summit, we expect yields to stabilise going forward as investors respond positively to the agreement between the two economic powers not to extend tariffs on trade commodities. We thus expect SSA countries to continue accessing foreign debt through the issue of Eurobonds this year, with plans underway in Ghana to raise USD 3 bn, and Ivory Coast that targets to raise USD 1 bn from Eurobond sales.

While external debt might be a cheaper and more easily accessible financing option for African governments, it also poses the sustainability question due to rising debt levels as well as volatility in commodity prices and exchange rates. Unsustainable debt levels may cause distress and increase probability of default, and the possible effects of the heavy debt burden will be felt most by the taxpaying citizens. Countries seeking to increase revenue may opt to increase the tax base, eliminate trade barriers and boost local industries as opposed to increased borrowing that is not sustainable.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.