The Total Cost of Credit Post Rate Cap., & Cytonn Weekly #02/2018

By Cytonn Research Team, Jan 14, 2018

Executive Summary

Fixed Income

Treasury bills were oversubscribed this week, after 8-weeks of undersubscription, with the overall subscription rate coming in at 124.4%, compared to 85.3% recorded the previous week. The yields on the 182 and 364-day papers remained unchanged at 10.7% and 11.2%, respectively, while the yield on the 91-day paper dropped to 8.0% from 8.1% the previous week. The Energy Regulatory Commission (ERC) announced that it plans to eliminate a subsidy on the cost of electricity for the low-income households, from April 2018. Currently, low-income households pay Kshs 2.5 per unit, middle-income households pay Kshs 12.8 per unit, while the high-end pay Kshs 20.6 per unit, where one unit is equivalent to one kilowatt hour;

Equities

During the week, the equities market recorded mixed trends, with NASI and NSE 25 gaining 1.1% and 0.9%, respectively, while NSE 20 lost marginally by 0.1%, taking their YTD performance to 2.8%, 2.4% and (0.1%) for NASI, NSE 25 and NSE 20, respectively. From December 2016, NASI, NSE 25 and NSE 20 have gained 40.0%, 32.8% and 21.7%, respectively. According to the Central Bank of Kenya (CBK) Commercial Banks’ Credit Survey for Q3’2017, gross loans increased by 1.0% to Kshs 2.39 tn from Kshs 2.37 tn in June 2017, with the industry’s gross non-performing loans (NPL) ratio increasing to 10.4% from 9.9% in June, which can be attributed to a challenging business operating environment due to the prolonged electioneering period;

Private Equity

IHS Holding Limited, a provider of mobile telecommunications infrastructure in Africa with operations in Nigeria, Cameroon, Côte d’Ivoire, Zambia, and Rwanda, has received USD 231.0 mn (Kshs 23.8 bn) in 8-year debt funding from MTN Group, Africa’s biggest Global System for Mobile Communications (GSM) operator;

Real Estate

During the week, the Kenyan Government announced incentives worth Kshs 40.0 bn aimed at private developers in a bid to encourage Public-Private Partnerships (PPP’s) towards addressing the high housing deficit, setting a target of 4.3 mn house units by 2030. This equates to approximately 358,000 house units per year, a 617% increase from the current annual supply of approximately 50,000 units;

Focus of the Week

Following the recent headline on the Business Daily on the total cost of credit at 19% compared to the legislated cap at 14%, we seek to analyse the true cost of credit, initiatives put in place to make credit cheaper and more accessible, the impact on private sector credit growth, and what more can be done.

- As part of our regional expansion strategy, Cytonn Investments on Friday launched the Mt. Kenya Region Office, located in Nyeri Town, on the 3rd floor of Sohan Plaza. The office is aimed at helping to serve our clients from the region better and undertake real estate developments. The event was presided over by the Governor of Nyeri, H.E Mutahi Kahiga. See the event note here

- Our Investment Analyst, Dennis Kariuki, discussed the expected impact of Kenya Airways direct flights to USA. Watch Dennis on CNBC here

- We continue to showcase our real estate developments through weekly site visits. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. The site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0% and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our Private Wealth Management Training (largely covering financial planning and structured products). Due to increased demand, we have changed the trainings to weekly from the bi-weekly schedule. The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar, and if interested in the training for your employees or investment group please get in touch with us through clientservices@cytonn.comor book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- To invest in any of our current or upcoming real estate projects, please visit Cytonn Real Estate

- Cytonn Towers, where we are only selling residential units in the first phase of residential apartments, is currently about 20.0% sold. See Cytonn Towers

- The Alma, which is 55.0% sold. See The Alma

- Amara Ridge has currently 100.0% uptake. See Amara Ridge

- Situ Village is currently 22.0% sold. See Situ Village

- The Ridge (Phase 1) is currently 31.0% sold. See The Ridge

- Taraji Heights is currently 14.0% sold. See Taraji Heights

- RiverRun Estates (Phase 1) is currently 11.0% sold. See RiverRun Estates

- With over 10 investment ready projects worth over Kshs 82.0 billon of project value, we shall be very selective on new real estate projects going forward, only focusing on Joint Ventures and real estate opportunities with deep value. We are increasingly focused on private equity deals. Should you have any deals in banking, insurance, education, hospitality and technology sectors, kindly email a teaser to PE@cytonn.com.

During the week, T-bills were oversubscribed, after 8-weeks of undersubscription, with the overall subscription rate coming in at 124.4%, from 85.3% recorded the previous week. The oversubscription can be attributed to improved liquidity in the market, as can be seen by the sudden decrease in the average interbank rate to 5.6% from 7.1% recorded the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 125.8%, 141.8%, and 106.6% compared to 89.6%, 97.5%, and 71.4%, respectively, the previous week. The yields on the 182 and 364-day papers remained unchanged at 10.7% and 11.2%, respectively, while the yield on the 91-day paper dropped to 8.0% from 8.1% the previous week. The overall acceptance rate declined to 85.0%, compared to 88.9% the previous week, with the government accepting a total of Kshs 25.4 bn of the Kshs 29.9 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is still behind its domestic borrowing target for the current fiscal year, having borrowed Kshs 101.1 bn, against a target of Kshs 220.9 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 410.2 bn budgeted for the full financial year as per the Cabinet-approved 2017 Budget Review and Outlook Paper (BROP)). The usage of the Central Bank overdraft facility remains high as it stands at Kshs 41.5 bn compared to a nil overdraft at the beginning of this fiscal year.

The average interbank rate declined to 5.6% from 7.1% recorded the previous week, while the average volumes traded in the interbank market decreased by 15.4% to Kshs 18.1 bn from Kshs 21.4 bn the previous week.

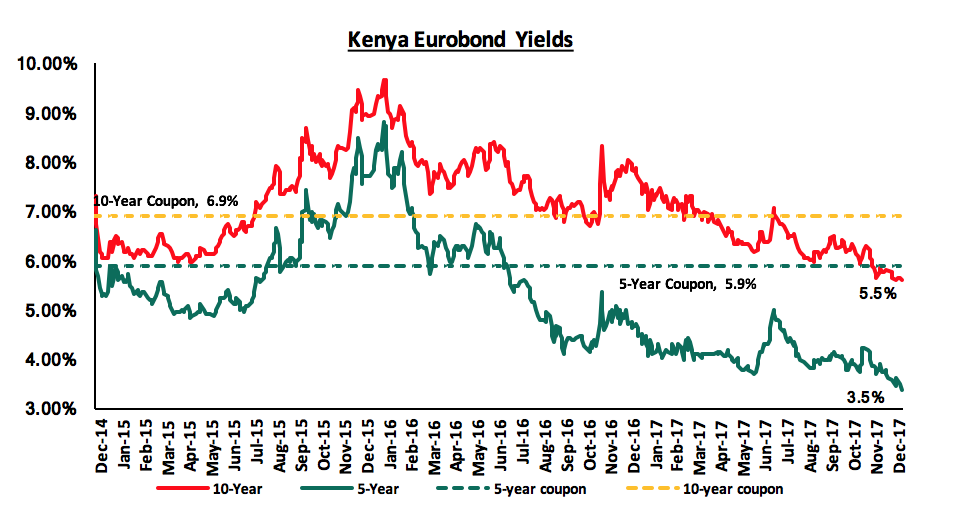

According to Bloomberg, yields on the 5-year and 10-year Eurobonds rose during the week by 30 bps and 20 bps, to close at 3.5% and 5.5%, from 3.2% and 5.3% the previous week, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 5.3% points and 4.2% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. The declining Eurobond yields and stable rating by Standard & Poor (S&P) are indications that Kenya’s macro-economic environment remains stable and hence an attractive investment destination. However, concerns from Moody’s and the International Monetary Fund (IMF) around Kenya’s rising debt to GDP levels may see Kenya receive a downgraded sovereign credit rating if the issue is not addressed.

The Kenya Shilling appreciated by 0.2% against the US Dollar during the week to close at Kshs 103.1 from Kshs 103.3 the previous week, due to improved dollar inflows from diaspora remittances and horticultural exports. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by (i) expected calm in the political front as the government settles into office, (ii) the weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and 0.7% YTD, and (iii) the CBK’s intervention activities, as they have sufficient forex reserves, currently at USD 7.0 bn (equivalent to 4.7 months of import cover). Of note is that Reserves have been on a slight declining trend.

This week, the Energy Regulatory Commission (ERC) announced that it plans to eliminate a subsidy on the cost of electricity for the low-income households, starting April 2018. Currently, low-income households (consuming 50 units of electricity or less) pay Kshs 2.5 per kilowatt hour, middle-income households (consuming 51 to 1,500 units of electricity) pay Kshs 12.8 per kilowatt hour, while the high-end consumers (consuming above 1,500 units of electricity) pay Kshs 20.6 per kilowatt hour, where one unit is equivalent to one kilowatt hour. The regulator implemented the policy in a bid to keep the costs down for low-income households, but has recently noted that the framework is unsustainable, with consumers unable to track their power consumption and charges with ease, due to the distinct range of costs on consumption. The new policy will likely see the Last Mile initiative by the government, which seeks to ensure increased access of electricity to Kenyans, through the extension of low voltage network, take a hit, as the cost of electricity for low-income households rises. Despite this, the new tariff should see the uniform implementation of charges for domestic consumers, while also reducing the energy costs of high-end consumers, who have been shouldering the weight of the low-income households, and could go a long way into ultimately keeping the cost of goods low, thus improving the cost of living for Kenyans, as large manufacturers are relieved of higher production costs, with the benefits of lower cost production expected to be passed on to the consumer, consequently impacting the economy positively.

Rates in the fixed income market have remained stable, and we expect this to continue in the short-term as the government rejects expensive bids despite being behind their borrowing target. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing in the domestic market to plug the deficit could lead to an upward pressure on interest rates. Consequently, our view is that investors should be biased towards short- term fixed income instruments to reduce duration risk.

During the week, the equities market recorded mixed trends, with NASI and NSE 25 gaining 1.1% and 0.9%, respectively, while NSE 20 lost marginally by 0.1%, taking their YTD performance to 2.8%, 2.4% and (0.1%) for NASI, NSE 25 and NSE 20, respectively. For the last twelve months, NASI, NSE 25 and NSE 20 have gained 40.0%, 32.8% and 21.7%, respectively. This week’s performance was driven by gains in large cap banking stocks such as KCB Group, Equity Group and Barclays Bank, which gained 3.5%, 3.1%, and 2.1%, respectively. Since the February 2015 peak, the market has lost 0.8% and 32.6% for NASI and NSE 20, respectively.

Equities turnover increased by 79.2% to USD 31.6 mn from USD 17.6 mn the previous week. Foreign investors remained net sellers with a net outflow of USD 1.8 mn compared to a net outflow of USD 1.7 mn recorded the previous week. We expect the market to remain supported by improved investor sentiment this year, as investors take advantage of the attractive stock valuations in some of the stocks.

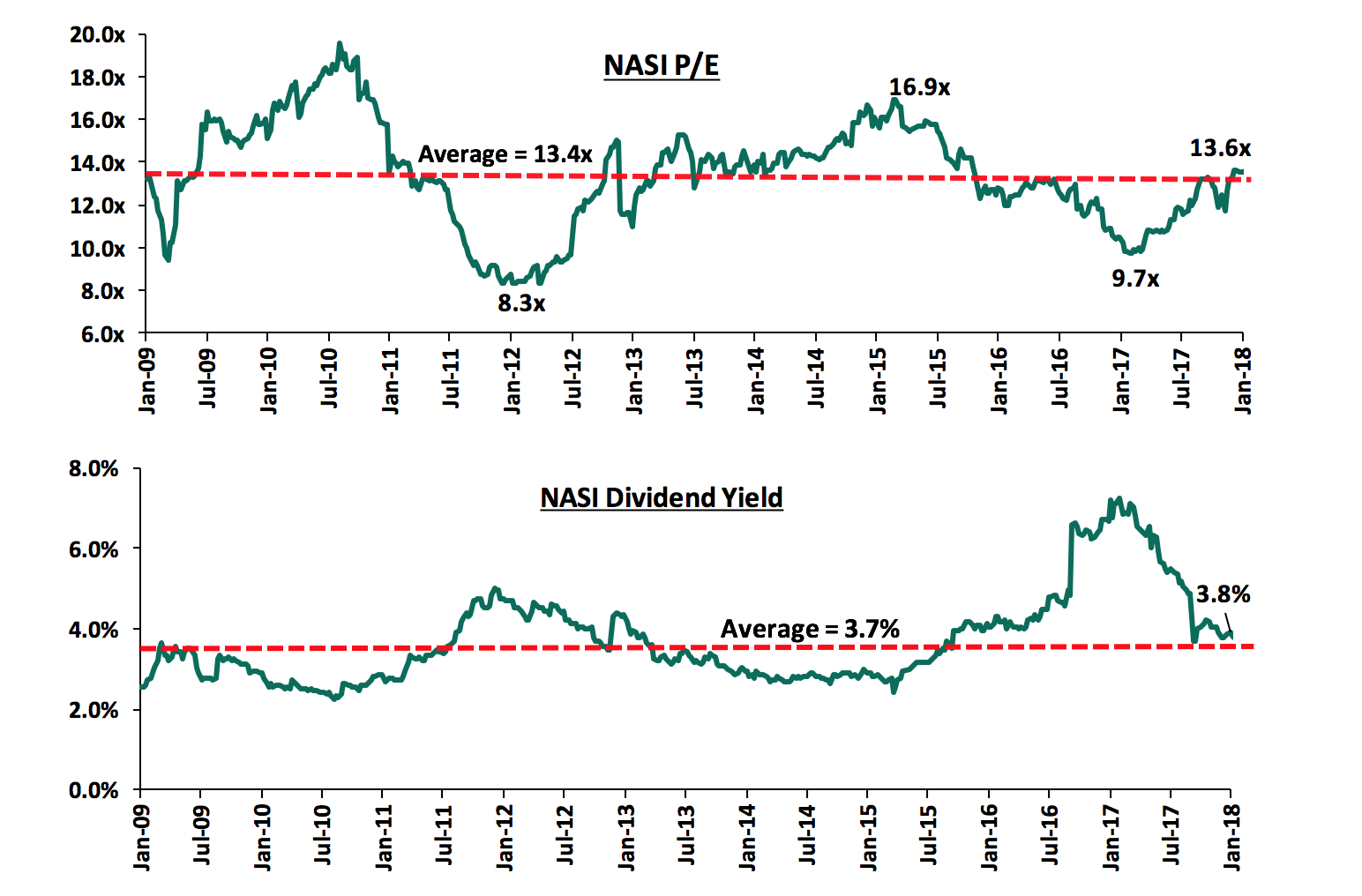

The market is currently trading at a price to earnings ratio (P/E) of 13.6x, which is 1.4% above the historical average of 13.4x, and a dividend yield of 3.8%, compared to a historical average of 3.7%. The current P/E valuation of 13.6x is 40.2% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 63.7% above the previous trough valuation of 8.3x experienced in December 2011. In our view, there still exist pockets of value in the market, with the current P/E valuation being 19.6% below the most recent peak of 16.9x in February 2015. The charts below indicate the historical P/E and dividend yields of the market.

According to the Central Bank of Kenya (CBK) Commercial Banks’ Credit Survey for Q3’2017, gross loans increased by 1.0% to Kshs 2.39 tn from Kshs 2.37 tn in June 2017 with the industry’s gross non-performing loans (NPL) ratio increasing to 10.4% from 9.9% in June, attributed to a challenging business operating environment, which was affected by political uncertainty following the long electioneering period. The perceived demand for credit remained unchanged in all sectors, except in the real estate sector, which recorded a decline due to slowdown in activities in the sector over the quarter. Most of the banks (55%) interviewed in the survey indicated that interest rate capping negatively affected their lending to SMEs as the caps compelled banks to tighten their credit standards, with 45% of the banks interviewed indicating that the caps did not affect their lending to SMEs negatively. Non-performing loans increased in 7 sectors: Building and Construction, Trade, Real Estate, Tourism, Transport and Communication, Manufacturing and Household sectors. To help mitigate against these losses, banks have intensified credit recovery efforts through;

- Timing collections for the Tourism sector for peak seasons due to seasonal fluctuations in cash flows,

- Collecting amounts due in the Agriculture sector during the rainy season, since defaults mainly arise due to low harvest and persistent drought, and,

- Enhance collections from contractor payments by the Government, and generally improve the quality of the asset portfolio.

Non-performing loans are expected to record an increase even in the last quarter of 2017, despite the recovery efforts above, attributed to a slowdown in economic activity due to the long election period. On implementation of IFRS 9, banks expect that it will have a negative impact on their profitability, in addition to other challenges including reduction of core capital as the increased provisioning will deplete loan reserves, review of business models, and cost implications of the relevant technology and personnel training. Under-capitalized banks and banks operating just above the regulatory minimum will be required to, (i) seek additional capital from shareholders to shore up capital buffers, and (ii) enhance prudence in loan disbursement, which will ultimately have an adverse effect on private sector credit growth, which slumped to 2.0% in October 2017, way below the government target of 18.3%, and will inevitably prove detrimental to the economy. We shall be releasing a note on “IFRS 9 Transition” during the week. The note will be published on our website, Facebook and Twitter.

During the week, Kenya Airways (KQ) announced that the airline will start direct flights to the US with the first flight slated for 28th October, 2018. According to the management, the direct flights are expected to boost KQ’s revenue by at least 10.0% due to a boost in tourism and trade. KQ reported revenue of Kshs 106.3 bn in FY’2017, which was an 8.5% decline from Kshs 116.2 bn recorded in FY’2016, attributed to reduction in both Available Seat Kilometres (ASKs) by 4.0% and in Yield per Revenue Passenger Kilometre by 7.4%, due to reduction in passenger capacity following phasing out of Boeing 777. We view this move by the airline to offer non-stop flights to the US as a boost to investor’s confidence on successful implementation of the ‘Operation Pride’ strategy, whose first phase of debt and equity restructuring was completed last year. With revamped senior management and governance, we expect KQ to continue improving on the business model, which will bring back the firm to profitability and providing value to shareholders.

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||

|

No. |

Company |

Price as at 05/01/18 |

Price as at 12/01/18 |

w/w Change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

|

1. |

NIC*** |

36.5 |

35.3 |

(3.4%) |

4.4% |

61.4 |

3.5% |

77.7% |

|

2. |

DTBK |

193.0 |

196.0 |

1.6% |

2.1% |

281.7 |

1.4% |

45.1% |

|

3. |

KCB Group |

42.8 |

44.3 |

3.5% |

3.5% |

59.7 |

6.8% |

41.7% |

|

4. |

Barclays |

9.6 |

9.8 |

2.1% |

1.6% |

12.8 |

10.2% |

41.5% |

|

5. |

I&M Holdings |

119.0 |

119.0 |

0.0% |

(6.3%) |

150.4 |

2.5% |

28.9% |

|

6. |

Kenya Re |

19.5 |

19.8 |

1.3% |

9.1% |

24.4 |

3.8% |

27.4% |

|

7. |

Liberty Holdings |

14.0 |

13.5 |

(3.2%) |

10.7% |

16.4 |

0.0% |

21.5% |

|

8. |

Britam |

13.7 |

13.0 |

(5.1%) |

(2.6%) |

15.2 |

1.8% |

18.7% |

|

9. |

Co-op Bank |

16.3 |

16.5 |

1.2% |

3.1% |

18.6 |

5.6% |

18.3% |

|

10. |

Jubilee Insurance |

500.0 |

499.0 |

(0.2%) |

0.0% |

575.4 |

1.7% |

17.1% |

|

11. |

HF Group*** |

10.0 |

10.2 |

1.5% |

(2.4%) |

11.7 |

0.9% |

16.4% |

|

12. |

Sanlam Kenya |

29.8 |

27.8 |

(6.7%) |

0.0% |

31.4 |

1.1% |

14.1% |

|

13. |

CIC Group |

5.7 |

5.6 |

(2.6%) |

(0.9%) |

6.2 |

1.8% |

13.5% |

|

14. |

Equity Group |

40.3 |

41.5 |

3.1% |

4.4% |

42.3 |

4.3% |

6.3% |

|

15. |

Standard Chartered |

206.0 |

207.0 |

0.5% |

(0.5%) |

201.1 |

4.3% |

1.4% |

|

16. |

Stanbic Holdings |

81.0 |

82.5 |

1.9% |

1.9% |

79.0 |

5.1% |

0.8% |

|

17. |

NBK |

9.3 |

9.3 |

0.0% |

(1.1%) |

5.6 |

0.0% |

(39.8%) |

|

*Target Price as per Cytonn Analyst estimates |

|

|

|

|

|

|||

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake |

||||||||

|

For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 9th largest shareholder |

||||||||

We remain neutral on equities for investors with short-term investment horizon, but are positive for investors with a long-term investment horizon since, despite the lower earnings growth prospects for 2017, the market has rallied and brought the market P/E closer to its historical average. Pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors.

During the week, we witnessed activity in the TMT (Technology, Media & Telecommunications) sector, which is one of the PE sectors we cover, including Real Estate, Financial Services, Hospitality, and Education.

IHS Holdings Limited, a provider of mobile telecommunications infrastructure in Africa with operations in Nigeria, Cameroon, Côte d’Ivoire, Zambia, and Rwanda, received USD 231.0 mn (Kshs 23.8 bn) in 8-year debt funding from MTN Group, Africa’s biggest GSM operator. MTN currently owns a 29.0% stake in IHS after it increased its stake in 2017 from 15.0% (valued at USD 920.1 mn), through a share swap of its 51% stake in Nigeria Tower INTERCO - a company which MTN co-owned with IHS, for the 14.0% extra stake in IHS. The financing will be beneficial to MTN as it will enable accelerate MTN’s network expansion in markets, such as Nigeria and will allow its Nigerian unit to continue investing in its network. The Telecommunication Sector in SSA continues to attract investments, both from foreign and local investors, driven by (i) increased capital looking for Telecommunications investments, driven by both the sector’s higher potential exit valuation compared to other sectors, such as the banking stocks, informed by their current higher trading multiples, with Telcos in SSA trading at a higher P/E of 19.2x compared to the SSA Banking Sector, which is trading at a P/E of 7.9x, and long term fundamental growth potential, with increased growth in mobile penetration in Africa, which is currently at 43.0%, and is expected to hit 51.2% by 2020, and (ii) increased technological advancement in the financial services sector, which is highly dependent on the telco industry.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest attributed to (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Sahara Africa’s private markets, (iii) the attractive valuations in Sub Sahara Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the week, the Principal Secretary (PS) for Ministry of Housing and Urban Development, Ms. Aidah Munano, announced Kshs 40.0 bn worth of incentives for the private sector to help developers meet a target of 4.3 mn housing units by 2030 to the market, equating to 358,000 units per year, a 617% increase from the current annual supply of 50,000 units. Of the planned affordable homes, 52.0% will target low-income households earning Kshs 25,000.0 and below, per month, who are unable to finance a home loan.

According to the PS, the move aims at fostering Public-Private Partnerships (PPP’s) towards addressing the housing shortage, which currently stands at a cumulative of 2.0 mn units growing annually by 200,000 units, according to the National Housing Corporation (NHC), through eliminating the challenges that investors cite as hindrances to the partnership model, such as:

- Difficulties in managing the multi-stakeholder nature of most of the PPP projects,

- Negative investor sentiment, especially with the lack of appropriate legal frameworks to enable transfer of public land into special purpose vehicles to be able to attract private capital and bank debt, and,

- A time-consuming, highly discretionary, and often corrupt approval and licensing system.

As per the PS, the annual demand is expected to grow to 343,232 units by 2030 from the current 200,000, a 12-year CAGR of 5.2%. According to Kenya National Bureau of Statistics, the Kenyan Government, through the State Department of Housing and NHC, delivered a total of 1,062 units countrywide in 2016. With private developers estimated to deliver 50,000 units annually, this translates to the government only providing 1.0% of the annual demand while private developers deliver at least 25.0%. For the initiative to be successful, the government will need to address the key challenges facing PPP’s and on the demand side, the government needs to enable home buyers by addressing the low mortgage uptake as the current active mortgages remain at a low of 24,085, having declined by 1.5% since 2015 following stringent credit standards by lending institutions with the introduction of the 2016 interest rates cap law.

Also during the week, Kiambu County Governor, H.E. Hon Ferdinand Waititu, announced plans to unveil a policy that will ensure single-dwelling house plans are approved within 5-days, a process that has been known to take up to 3-months, as a result of inefficiencies. The move is set to clear the backlog of these approvals from the previous regime and enhance the process of obtaining approvals for developers going forward. Additionally, all property brokers operating within the county will be required to register on an e-platform, though it is yet to be launched, with the aim of ridding the region of rogue agents infamous for swindling clients. In our view, the moves are the right step towards streamlining the process and improve the experience for all real estate stakeholders in Kiambu County. To come to full effect, there’s need for unwavering commitment by the new administration to address bureaucracies within the county offices.

The retail sector, this week, registered heightened activity as retailers opened shops across Nairobi, including;

- Naivas took over 22,000 SQFT of space, previously occupied by Nakumatt, along Moi Avenue in Nairobi, making it the 44th branch in the country and the 3rd within the Central Business District,

- Choppies, the Botswanan retailer, also announced plans to open its 12th outlet at Southfield Mall in Eastlands, later this month. According to the retailer, the Eastlands branch will be its biggest store in the country, with 44,000 SQFT of space, and,

- Chinese retailer, Miniso, a low-cost variety store chain that specializes in household and consumer goods including cosmetics, stationery, toys, and kitchenware, opened its first branch in Kenya at the Village Market, with plans to open another at the Thika Road Mall, in the space vacated by Woolworths. This will mark the retailer’s 3rd store in the continent, with two others in Lagos and Pretoria. Overall the retailer has a total of 2,600 branches worldwide.

The above trends show that the fundamentals that drive the retail sector, such as increased consumerism due to an expanding middle class and rapid urbanization rate, are still supportive of the sector’s vitality.

The hospitality sector remains attractive as can be seen by:

- A global travel firm, The Travel Corporation (TTC), listed Kenya as one of the top 10 transformative travel experiences in the world citing the 11-day East African Safari that heads off to the Maasai Mara as well as Tanzania’s Serengeti,

- The United States revised its travel advisory warning against Kenya urging US visitors to exercise caution when visiting, but retained its stance against travel to certain parts such as the Kenya-Somali border, Garissa and certain parts of Nairobi such as Eastleigh due to terrorism and insecurity. This comes after the launch of direct flights to the US from Kenya where Kenya Airways will be operating daily flights to and fro New York and Nairobi, and will see the trip time reduce by about eight hours, to 15 hours from the previous 23 hours. We expect this to lead to increased daily tourist arrivals, especially for leisure as the move promotes Kenya as a leading travel destination, and,

- Jambojet increased the frequency of its local flights per week to 39 up from 22, while Kisumu-Nairobi flights increased to 14 from the previous 8, attributed to increased demand.

The sector is thus expected to rebound further as a result of (i) aggressive marketing by the government and consistent media coverage aimed at making Kenya visible on the international stage, (ii) improved infrastructure such as the Mombasa ports and the SGR, and (iii) improved security measures in the country.

Other highlights during the week include:

- China Wu Yi announced plans to set up a construction firm to the tune of Kshs 9.5 bn to capitalize on the current real estate boom in the country,

- The Uasin Gishu County Governor, HE. Hon Jackson Mandago announced the commencing of the Eldoret Southern Bypass that is set to ease congestion in the region which is mainly served by the Nairobi-Uganda Highway. The project funded by African Development Bank will cost Kshs 6.0 bn and will see capital investment geared towards the county growth. Last Year, the county launched the Pearl River Special Economic Zone, a high end industrial park that will cost approximately Kshs 200.0 bn, indicating a positive growth and outlook for the county,

- The only listed REIT in Kenya risks delisting if it fails to meet the Capital Market Authority’s regulations to have the fund have 75% of its total asset value invested in real estate. Currently, the REIT has real estate assets valued at Kshs 2.4 bn, less Kshs 245.0 mn of the threshold and has until 31st March this year to meet this requirement. As of January 2018, the instrument has thus far shed 48% of its 2015 listing value, of Kshs 20.75.

We expect the real estate sector to remain vibrant driven by (i) sustained foreign investment, (ii) government incentives for real estate developers and investment in the tourism sector, and (iii) continued infrastructural development.

Following the recent headline on the Business Daily on the total cost of credit at 19% compared to the legislated cap at 14%, we:

- revisit the topic on interest rate caps by a general overview,

- have a look at initiatives put in place to make credit cheaper and more accessible,

- assess the impact on private sector credit growth, and,

- analyse the true cost of credit and what more can be done (see here for the Business Daily article).

Section I: Revisiting the Topic on Interest Rate Caps by a General Overview

We have already done four previous focus notes on the topic, namely,

- Interest Rate Cap is Kenya’s Brexit - Popular But Unwise, dated August 2016, less than a month before the signing into law, where we first expressed our view that the interest rate caps will have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, plus we noted the lack of compelling evidence that interest rate caps were successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing and alternative products and channels,

- Impact of the Interest Rate Cap, dated August 2016, just after the interest rate cap bill was signed into law, where we highlighted the immediate effects of the interest rate cap, with the President having signed the Bill into law, and banking stocks losing 15.6% in the span of 2-days. Here we re-iterated our stance on the negative effects of the interest rate caps, while identifying the winners and losers of the Banking (Amendment) Act 2015,

- The State of Interest Rate Caps, dated May 2017, 9-months after the Banking (Amendment) Act 2015 was signed into law, where we assessed the interest rate cap and its effect on private sector credit growth, the banking sector and the economy in general, following concerns raised by the International Monetary Fund (IMF). We called on policymakers to address the issue swiftly, noting that there existed, and continues to exist, opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow,

- Update on Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, where we analysed the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was higher than the 14.0%, as banks load excessive additional charges, while noting that the large banks, which control a substantial amount of the loan book, are the most expensive. We called for (i) repeal or modification of the interest rate caps, (ii) increased transparency, (iii) improved and more accommodating regulation, (iv) consumer education, and (v) diversification of funding sources into alternatives.

Section II: Initiatives Put in Place to Make Credit Cheaper and More Accessible

The government, in collaboration with Financial Services Regulators, has adopted various initiatives in the past, with the aim of keeping the total cost of credit low and enhancing credit growth. The major ones include:

- The Banking (Amendment) Act 2015, introduced in August 2016, which capped lending rates at 4.0% points above the Central Bank Rate (CBR), was introduced to protect consumers from banks enjoying high interest rate spreads at the expense of consumers, and make credit easier to access and more affordable,

- Making public the Cost of Credit website by The Kenya Bankers Association (KBA) and the Central Bank (CBK). This is a website in which commercial banks and micro-finance institutions are required to publish their true cost of credit, and,

- Setting out new regulations by the Central Bank of Kenya (CBK) that will see commercial banks incur heavy penalties, of up to a maximum of Kshs 20.0 mn, from Kshs 5.0 mn previously, for failure to disclose the true cost of credit to consumers.

Section III: Assess the Impact on Private Sector Credit Growth

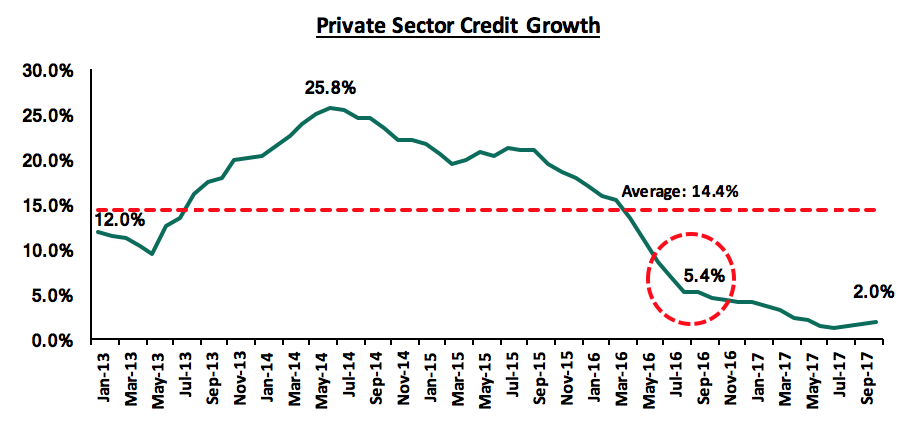

Despite the positive intention behind the Banking (Amendment) Act, private sector credit growth declined to an 8-year low of 1.4% in July 2017, attributable to the fact that banks preferred, and justifiably so, not to lend to consumers or businesses but invest in risk-free treasuries, which offer better returns on a risk adjusted basis. Following the capping of the interest rates, which excludes the extra charges, most commercial banks have taken advantage of the loophole allowing them to charge extra fees on the loans issued to increase the cost of credit well above the statutory ceiling of 14.0%, averaging 18.0%, which is 3.5% above the 14.0% cap. To a large extent, the negative impact of the introduction of interest rate caps has proved to outweigh its benefits, as credit growth has dipped compared to the pre-rate cap era, as illustrated in the graph below, which shows private sector credit growth over the last 4-years. As can be seen from the graph below, private sector credit growth touched a high of 25.8% in June 2014, and has averaged 14.4%, but has dropped to 2.0% levels after the capping of interest rates.

Section IV: Analyse the True Cost of Credit and What More Can Be Done

Further, in line with providing the market with information, and in an effort to promote transparency and control the total cost of credit, CBK and Kenya Bankers Association (KBA) made public a website called the ‘CostofCredit’ website, in which banks, both commercial and micro-finance institutions, are required to publish their Annual Percentage Rate (APR), loan repayment schedule and any additional details on their loans. Loans with a 1-year duration, both secured and unsecured, should attract the maximum chargeable interest of 14.0%, but banks have managed to increase the true cost of credit with bank charges varying depending on the bank.

There are various costs associated with a loan in addition to the interest rate component, which range from bank fees and charges to third party costs, such as insurance fees, legal fees and government levies. The total cost of credit is therefore defined as all costs related to the issue of credit, including interest and any fees tied to acquiring credit, usually expressed by the Annual Percentage Rate (APR), a metric that factors in additional costs and fees on the annual interest rate.

Moving to analyse the true cost of credit, below we have the ranking of the cheapest and most expensive banks, based on the APR, assuming an individual has taken up a personal secured loan, with the average APR in the sector under this category recorded at 16.7%, same as was recorded 6-months ago in July 2017. The two tables below show the Cheapest Banks having an average APR of 15.1% (same as in July 2017), with the Most Expensive Banks having an average APR of 18.7% (20 bps lower than 18.9% in July 2017).

|

Personal Secured Loans- Cheapest Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Guaranty Trust Bank |

14.0% |

0.0% |

0.0% |

14.0% |

14.0% |

|

2 |

CBA |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Victoria Commercial Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Paramount Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Oriental Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Middle East Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

I&M Bank |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

2 |

Habib Bank Zurich |

14.0% |

1.0% |

0.1% |

15.3% |

15.3% |

|

Average |

14.0% |

0.9% |

0.1% |

15.1% |

15.1% |

|

Source: www.costofcredit.co.ke

|

Personal Secured Loans- Most expensive Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Equity Bank |

14.0% |

5.0% |

0.5% |

20.6% |

20.6% |

|

2 |

Prime Bank |

14.0% |

4.0% |

0.4% |

19.2% |

19.2% |

|

3 |

Family Bank |

14.0% |

3.2% |

0.8% |

18.8% |

18.8% |

|

4 |

Barclays Bank |

14.0% |

3.0% |

0.8% |

18.5% |

19.9% |

|

5 |

Eco-bank Kenya |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

5 |

NIC Bank |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

5 |

Spire Bank |

14.0% |

3.0% |

0.3% |

17.9% |

17.9% |

|

Average |

14.0% |

3.5% |

0.5% |

18.7% |

18.9% |

|

Source: www.costofcredit.co.ke

When it comes to applying for a 3-year mortgage, the APR is elevated due to third party charges such as legal fees and other related costs, with bank charges remaining relatively unchanged. However, the average sector APR has is at 18.9% same as in July, 2017 under the mortgage category. The two tables below show the Cheapest Banks having an average APR of 18.2% (same as in July 2017), with the Most Expensive Banks having an average APR of 20.0% (same as in July 2017).

|

Mortgage - Cheapest Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Victoria Commercial Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Middle East Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

I&M Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Guaranty Trust Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

ABC Bank |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

1 |

Guardian Bank |

14.0% |

1.1% |

5.6% |

18.2% |

18.2% |

|

Average |

14.0% |

1.0% |

5.6% |

18.2% |

18.2% |

|

Source: www.costofcredit.co.ke

|

Mortgage - Most Expensive Banks |

||||||

|

No. |

Bank |

Annual Interest |

Bank Charges |

Other Charges |

APR (Jan-2018) |

APR (July-2017) |

|

1 |

Equity Bank |

14.0% |

5.0% |

6.0% |

21.3% |

21.3% |

|

2 |

Barclays Bank |

14.0% |

3.0% |

6.3% |

20.0% |

20.0% |

|

2 |

NIC Bank |

14.0% |

3.0% |

6.3% |

20.0% |

19.7% |

|

3 |

KCB Group |

14.0% |

2.6% |

6.3% |

19.8% |

19.7% |

|

4 |

Eco-bank Kenya |

14.0% |

3.0% |

5.8% |

19.7% |

19.8% |

|

5 |

Cooperative Bank |

14.0% |

2.5% |

5.8% |

19.3% |

19.3% |

|

5 |

Bank of Baroda |

14.0% |

0.0% |

8.3% |

19.3% |

19.3% |

|

Average |

14.0% |

3.2% |

6.1% |

20.0% |

20.0% |

|

Source: www.costofcredit.co.ke

From the tables above we can draw the following conclusions and insights on the total cost of credit as highlighted below;

- The total cost of credit is remains high, given the excessive fees being charged by large portions of the banking sector, with these additional costs accounting for 13.7% of the total cost of credit (Annual Percentage Rate) in the sector, meaning that 13.7% of the total lending rate is attributable to additional costs, hence the APR has remained consistently above the 14.0% cap, at 16.7%, over the last 6-months, and,

- The larger banks in the industry, which control a substantial amount of the loan book, are the costliest, and hence are able to sway the market, given the low customer bargaining power.

While interest rates have remained relatively stable at low levels, following the Banking (Amendment) Act 2015, private sector credit growth has continued to dip, slowing to an average of 2.4% for the first 10-months of the year 2017 compared to the 5-year average of 14.4%. This implies that while the interest rates might be relatively low, the government is the ultimate beneficiary, rather than the ordinary borrower the law was meant to serve. Banks have expressed the decline in the private sector credit growth is attributed to the inability to fit SMEs and other “high risk” borrowers within the 4.0% risk margin, with the yield on a 5-year government bond currently at 12.6%, just 1.4% points below the capped 14.0%. Despite the current low interest rates environment, the total cost of credit is quite high, with some banks charging close to 20.0%, which is 7.4% points premium over a government security, with spreads of up to 5.0% points, as a result of the excessive fees being charged by large portions of the banking sector, with these additional costs accounting for 13.7% of the total cost of credit in the sector.

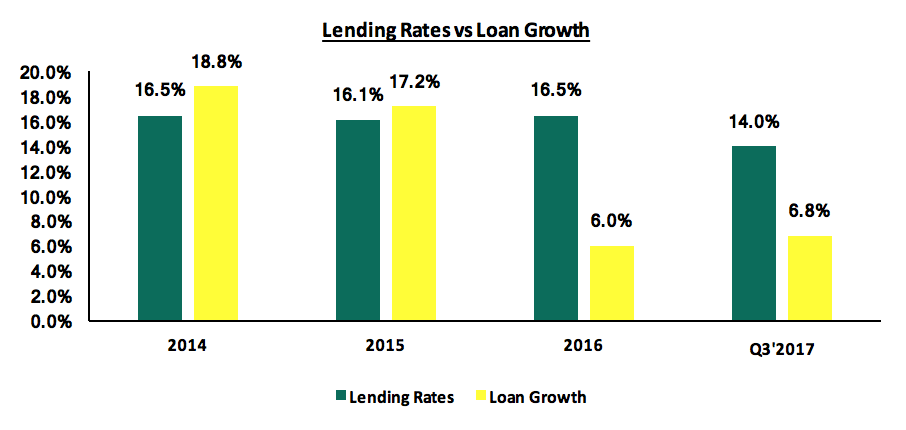

However, given the total cost of credit has remained relatively high, it is quite ironic that banks are still not lending to the private sector, as they would still be able to make attractive margins at the current levels. The reduced lending can be evidenced by the paltry loan growth recorded by the commercial banks. For instance, as shown in the chart below, the average rates for commercial banks’ loans and advances have been 16.5% in 2014, 16.1% in 2015 and 16.5% in 2016, while the rate over the year 2017 has been fixed at 14.0%. When this is compared to loan growth, as shown in the chart below, it is noticeable that loan growth was highest during a time of no interest rate caps, dipping to 6.0% in 2016 when the interest rate caps were introduced, and this dragged on with loan growth averaging at 6.8% for the first three quarters of 2017. As such, free pricing of loans with no government interference has led to the highest rates of credit growth, when compared to the fixed rate regime the economy is currently under.

Given the current state of low lending in the economy, and that we are under a fixed-rate regime on interest rates, below are the initiatives that need to be taken to spur credit growth once again in the economy:

- Repeal or at least significantly review the Banking (Amendment) Act 2015, given the current regulatory framework has proved to be a hindrance to credit growth, evidenced by the continued decline of private sector credit growth, which is at 2.0% as at October 2017, below the government set target of 18.3%, and compared to 5.4% when the amendment was introduced in August 2016,

- The implementation of a strong consumer protection agency and framework, to include robust disclosures on cost of credit, free and accessible consumer education, enforcement of disclosures on borrowings and interest rates, while also handling issues of contention and concerns from consumers. Following the financial crisis in 2008, the US government set up the Consumer Financial Protection Bureau, responsible for consumer protection in the financial sector, with enforcement actions proving effective in enhancing credit growth, as the agency has realized more than USD 11.7 bn in relief, passing the benefits on to more than 27.0 mn consumers,

- Diversify funding sources, which will enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly, which can be done through the promotion of initiatives for competing and alternative products and channels, in order to make the banking sector more competitive. In a normal developed economy, 40% of business comes from the banking sector, with 60% coming from non-bank institutional funding. In Kenya, it is at 95% of all funding that comes from bank funding, and only 5% from non-bank institutional funding, showing that the economy is over reliant on bank lending and should have more alternative and capital markets products funding businesses. Alternative Investment managers and the Capital Markets Authority need to look at how to enhance non-bank funding, such as high yield investment vehicles, some of which include High Yield Notes and Cash Management Solution, CMS, products. The products offer investors with cash to invest a rate of about 18% to 19%, equivalent to what the fund takers, such as real estate developers, would have to pay to get funds from the banks. Instead of a saver taking money to the bank and getting negligible returns, they can just invest in a funding vehicle where the business would pay them the same 18% to 19% that they would pay to get the same money from the bank. For the saver, it helps improve their rate from low rates, at best 7%, to as high as 18%, and for the business seeking funding, it helps them access funding much faster to grow their business,

- Level the playing field by making tax incentives available to banks to be also available to non-bank funding entities. For example, providing alternative and capital markets funding organizations with the same withholding tax incentives that banking deposits enjoy, of a 15% final withholding tax,

- Consumer education, where borrowers are educated on how to be able to access credit, the use of collateral, and establishing a strong credit history. However, this will also require the adoption of risk based lending by banks where cost of credit varies based on your credit history,

- Increased transparency, in a bid to spur competitiveness in the banking sector and bring a halt to excessive fees and costs, with recent initiatives by the CBK and KBA, such as the stringent new laws and cost of credit website being commendable initiatives,

- Improved and more accommodative regulation, such as the Movable Property Security Rights Bill 2017, which seeks to facilitate use of movable assets as collateral for credit facilities, allowing borrowers to use a single asset to access credit from different lenders, and,

- Have advocacy groups such as the East African Association of Structured Products engage policy makers on the need for alternative and structured products as viable options to bank funding, hence reducing overreliance on banks and increasing competition.

Despite the capping of interest rates on loans, both secured and unsecured, to a maximum chargeable interest of 14.0%, commercial banks have managed to increase the true cost of credit way above the ceiling. This coupled with the fact that the government has crowded out the private sector of credit and locked out “high risk” borrowers, following the rigid loan pricing framework, has resulted to the slowing of the private sector credit growth to an average of 2.4% for the first ten months of the year 2017. This could end up impacting negatively on the economy as evidenced by the deterioration of GDP to 4.4% in Q3’2017, which was partly attributed to a slowdown in the growth of the financial intermediation sector, which expanded by 2.4%, down from 7.1% recorded in Q3’2016.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor