Using Pension for Housing Purchase, & Cytonn Weekly #19/2020

By Research Team, May 10, 2020

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 62.6%, down from 74.6% the previous week. The undersubscription is partly attributable to investors’ uncertainty in the market given the recent interest deferral discussions on Kenyan Government treasury papers, which is meant to avail cash flow for the government during the Coronavirus pandemic period. During the week, the Central Bank of Kenya released the auction results for the newly issued bond, FDX1/2020/5 with an effective tenor of 5.0-years and a coupon rate of 11.7%, in a bid to raise Kshs 50.0 bn for budgetary support. The bond was undersubscribed, with the government receiving bids worth Kshs 34.5 bn, lower than the quantum of Kshs 50.0 bn. During the week, rating agency Moody’s released its rating outlook where it changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable”, and also affirmed the B2 credit rating. The International Monetary Fund (IMF) Executive Board this week approved a USD 739.0 mn (Kshs 78.7 bn) disbursement to Kenya to be drawn under the Rapid Credit Facility (RCF) to help the country address the impact of COVID-19. Businesses in Kenya recorded another sharp decline in April according to Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI), with the seasonally adjusted PMI index coming in at 34.8. In response to the ongoing Coronavirus pandemic that has disrupted business operations in the country, the Actuarial Society of Kenya released the COVID-19: Proposals to the Government of Kenya urging the government to tap into Pensions and Insurance Industries to restructure the domestic debt portfolio. During the week, the Committee on Finance and Planning tabled their proposals in the National Assembly during the first reading of the Finance Bill, 2020;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 recording gains of 0.8%, 3.9% and 1.8%, respectively, taking their YTD performance to losses of 15.3%, 23.3% and 18.2%, for NASI, NSE 20 and NSE 25, respectively. During the week, the Central Bank of Kenya (CBK) in their presentation to the Senate Ad Hoc Committee on the COVID-19 situation, disclosed that Kenya’s seven largest banks had restructured loans amounting to Kshs 176.0 bn in April, equivalent to 6.4% of the industry’s total gross loan book of Kshs 2.8 tn as at January 2020, as the economic fallout from the pandemic continues to impact borrowers’ ability to repay and service their loans;

Real Estate

During the week, Hass consult released the Hass Property Index Q1’2020 Report and Land Indices Q1’2020 Report. According to the report, property prices registered a positive growth over the first quarter of the year with a 0.9% growth q/q, while land prices in the suburbs and satellite areas eased over the quarter by 0.9% and 0.2%, respectively. National Treasury Cabinet Secretary, Ukur Yatani, published the draft Retirement Benefits (Mortgage Loans) Regulations 2020 aimed at governing the new amendment to Section 38 of the Retirement Benefits Act, and in the hospitality sector, Sarova Hotels announced that it would stop managing Sarova Taita Hills Game Lodge and Sarova Salt Lick Game Lodge after 13-years of the management deal due to poor sales as a result of the COVID-19 pandemic;

Focus of the Week

On April 25th 2020, President Uhuru Kenyatta assented the amendments to the Tax Act 2020, one of which was to the Retirement Benefits Act allowing pensioners to use their savings to purchase a residential house. Following this amendment, the Retirement Benefits Authority drafted regulations aimed at governing the new provision. As such, this week, we seek to enlighten the market on the changes made in the Retirement Benefits Authority (RBA) Regulations, what the changes mean for retirement schemes and the pensions industry going forward and our take on the adequacy of the amendments. We focus on the tax rates upon withdrawal from a retirement scheme and the mortgage loans regulations.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.0% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.0% p.a. To subscribe, email us at sales@cytonn.com;

- Felix Otieno, Investments Analyst at Cytonn Investments, was on Metropol TV to talk about the need for the Treasury to seek debt relief from China. Watch Felix here;

- Rodney Omukhulu, Investments Analyst at Cytonn investments, was on CNBC Africa to talk about the current situation in the equities market and the issuance of a 5-year Kshs 50.0 bn bond for budgetary support by CBK. Watch Rodney here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 62.6%, down from 74.6% the previous week. The undersubscription is partly attributable to investors’ uncertainty in the market given the recent interest deferral discussions on Kenyan Government treasury papers; the supposed deferral is meant to avail cash flow for the government during the Coronavirus pandemic period. The subscription rate of the 91-day and 364-day papers declined to 61.1% and 87.8%, respectively, from 111.8% and 107.5% recorded the previous week, respectively. The subscription rate of the 182-day paper came in at 38.0%, up from 26.8% recorded the previous week. The yields on the 91-day, 182-day, and 364-day papers all rose by 0.1% points to 7.3%, 8.2% and 9.2%, respectively, from 7.2%, 8.1% and 9.1%, respectively. The acceptance rate increased to 98.5%, from 87.5% recorded the previous week, with the government accepting Kshs 14.8 bn of the Kshs 15.0 bn bids received.

During the week, the Central Bank of Kenya released the auction results for the newly issued bond, FDX1/2020/5 with an effective tenor of 5.0-years and a coupon rate of 11.7%, in a bid to raise Kshs 50.0 bn for budgetary support. The bond was undersubscribed, with the government receiving bids worth Kshs 34.5 bn, lower than the quantum of Kshs 50.0 bn, translating to a subscription rate of 69.1%. The low subscription was unexpected given the scarcity of short tenor bonds in the market due to the government efforts of extending its maturity schedule through issuing longer-dated papers, which has seen the saturation on the long end of the yield curve. We believe the undersubscription is partly attributable to investor’s uncertainty in the market given the recent interest deferral discussions on government papers meant to avail cash flow for the government during the Coronavirus pandemic period. The yield on the 5-year bond came in at 11.8%, with the government accepting Kshs 20.8 bn out of the Kshs 34.5 bn worth of bids received, translating to an acceptance rate of 60.2%

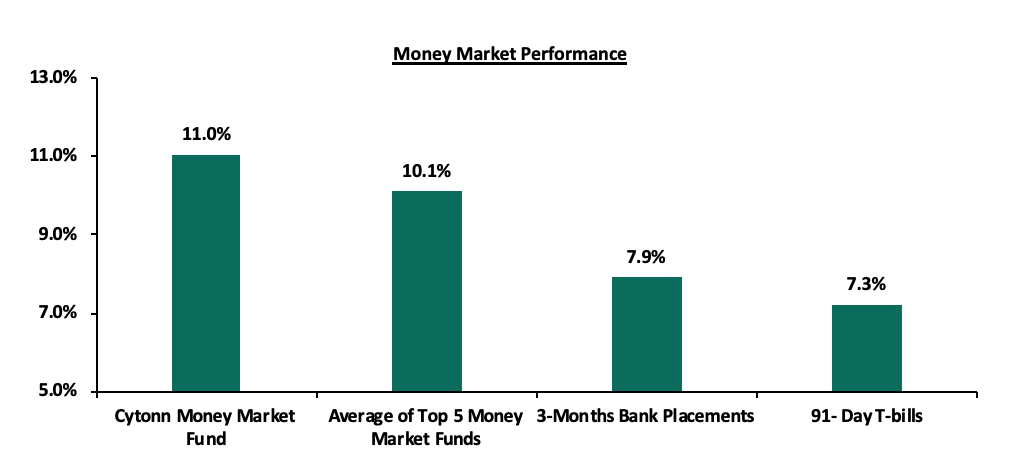

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill increased by 0.1% point to 7.3%, from 7.2% recorded the previous week. The average of Top 5 Money Market Funds remained unchanged at 10.1%, similar to what was recorded the previous week. The yield on the Cytonn Money Market also remained unchanged at 11.0%, similar to what was recorded the previous week.

Liquidity:

During the week, liquidity eased in the money market with the average interbank rate declining to 4.1%, from 4.5% recorded the previous week, supported by pending bill payments and tax refunds. The improved liquidity is also partly attributable reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up Kshs 35.2 bn to provide additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic. According to the Central Bank of Kenya, the reduction of the CRR in March 2020 had by the end of April 2020 freed Kshs 17.6 bn, which was granted to 11 commercial banks and 1 microfinance bank to be used for onward lending to distressed borrowers. Commercial banks’ excess reserves came in at Kshs 39.9 bn in relation to the 4.25% cash CRR. The average interbank volumes decreased by 43.0% to Kshs 7.8 bn, from Kshs 13.6 bn recorded the previous week.

Kenya Eurobonds:

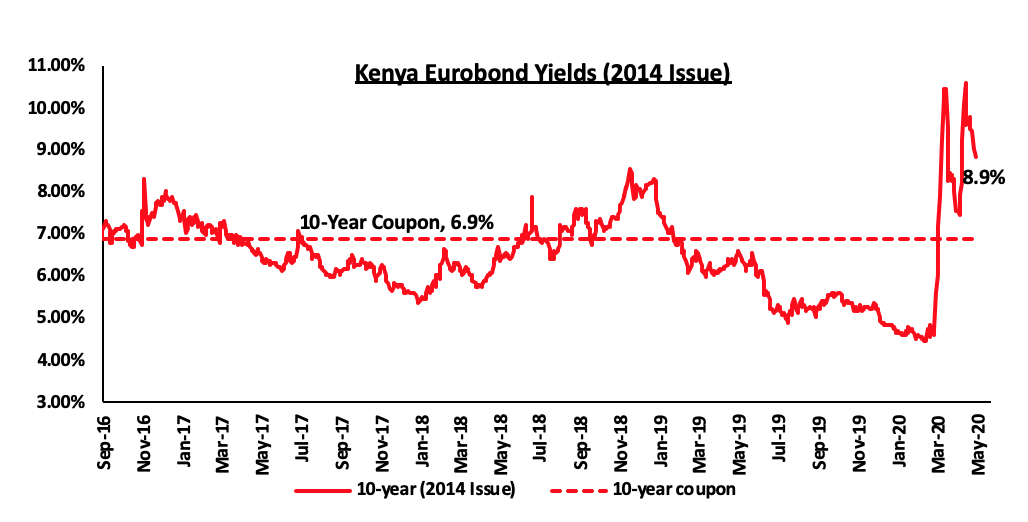

During the week, the yields on all the Eurobonds declined marginally. We, however, anticipate investors to continue attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the coronavirus pandemic as highlighted in our Q1’2020 Eurobond Performance Note as well as the recent downgrade by Moody’s where Kenya’s sovereign credit outlook was changed to negative from stable according to Reuters, the yield on the 10-year Eurobond issued in June 2014 decreased by 0.6% points to 8.9%, from 9.5% recorded the previous week.

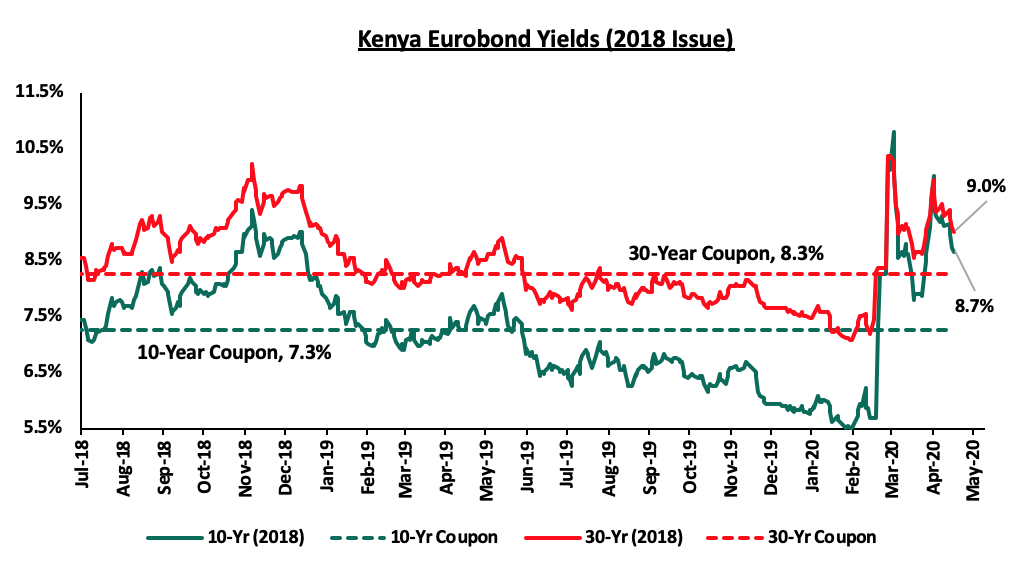

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 decreased by 0.4% points and 0.3% points to 8.7% and 9.0%, respectively, from 9.1% and 9.3% recorded previous week, respectively.

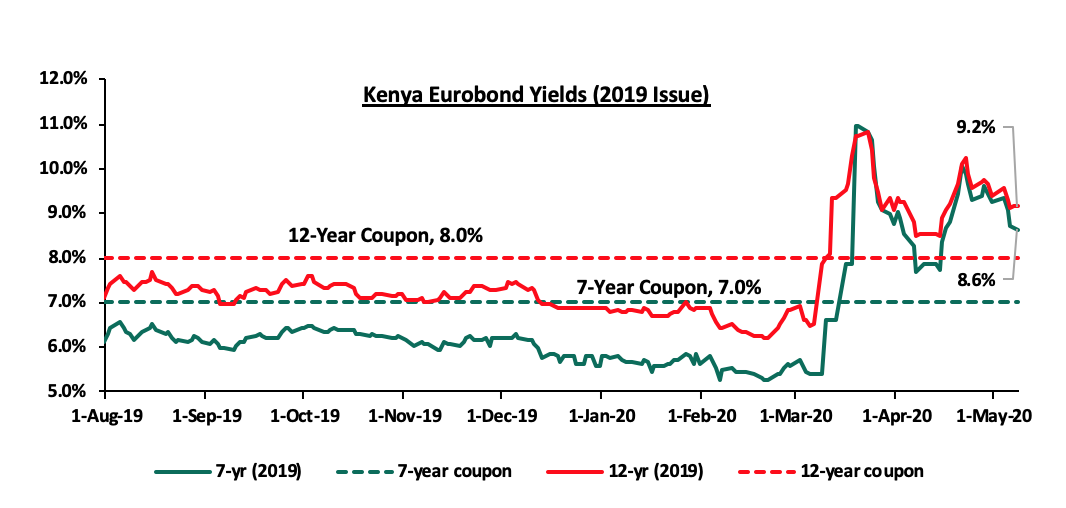

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 decreased by 0.7% points and 0.2% points, to 8.6% and 9.2%, respectively, from 9.3% and 9.4% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 1.2% against the US Dollar to close at Kshs 106.0, from Kshs 107.3 recorded the previous week, supported by reduced dollar demand from oil and merchandise importers as well as commercial banks selling off their excess dollars. On a YTD basis, the shilling has depreciated by 4.6% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling in with our sentiments being on the back of:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens as well as merchandise, and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows to meet the dollar demand, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 7.8 mn (equivalent to 4.7-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. The inflows from the IMF Rapid Credit Facility (RCF) approved during the week is expected to add Kshs 78.7 bn to the forex reserves, and,

- CBK’s supportive activities in the money markets, with the CBK having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March 2020 to bolster the forex reserves.

Weekly Highlight:

- Moody’s Rating

During the week, rating agency Moody’s released its rating outlook where it changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable”, and also affirmed the B2 credit rating. Moody’s has also downgraded the outlook of several countries that are part of the emerging markets including South Africa and India. The rating agency pointed out that the negative outlook was a result of rising financial risks brought about by the country’s large borrowing requirements especially during this time where the fiscal outlook is deteriorating given the erosion of the revenue base and the high debt and interest burden. The large borrowing needs and the negative fiscal outlook will and continues to expose Kenya to exchange and interest rate shocks thus threatening any fiscal consolidation measures that had been set aside by the government. The rationale behind changing the country’s outlook to negative from stable is as a result of;

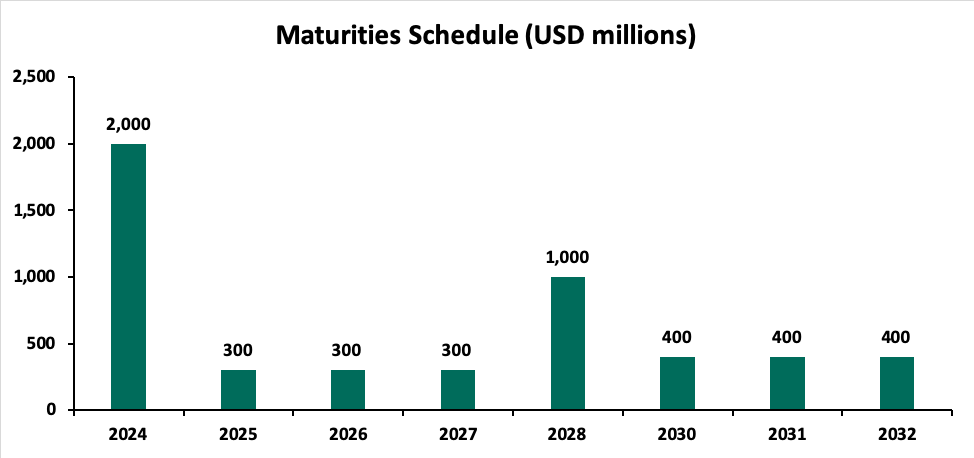

- The expectation of increased borrowing needs in the country amid the current high debt repayment schedules. The maturity profile of Kenya’s debt also raises concerns as its relatively short, which raises maturity concentration risk as the country will be in a continuous state of maturing obligations between 2024 and 2028 since:

- The 10-year Eurobond issued in 2014 will be maturing in 2024,

- There will be annual repayments of USD 300.0 mn for the 7-year Eurobond issued in 2019, which will be maturing in May 2027, and whose repayments are set to start in 2025, and,

- The 10-year Eurobond issued in 2018 will be maturing in 2028.

Below is a chart showing the maturities schedule:

- An eroding fiscal base, which has been worsened by the Coronavirus pandemic and is expected to increase the fiscal deficit. The lower expected growth alongside the tax measures announced to cushion the economy against the Coronavirus pandemic will likely widen the fiscal deficit to 8.5% for FY’2019/2020, from 7.7% in FY’2018/2019, and,

- The country is also likely to suffer from a high debt burden with Moody’s predicting that the debt to GDP ratio might rise to around 70.0% by the end of the next fiscal year 2020/2021, from 62.0% in FY’2018/2019. In the short term, the interest to revenue ratio is likely to increase thus making it harder for the country to cover its expenditure using government revenue. With half of the country’s debt in foreign currency, the Kenyan Shilling is likely to come under pressure during repayment periods. On the other hand, domestic borrowing could increase the interest to revenue ratio given that a majority of domestic debt is issued in the form of short term treasury bills.

As such, Moody’s expects the country’s GDP growth for 2020 to come in at 1.0% from 5.4% recorded in 2019. Below is a table showing Kenya’s GDP growth estimates for 2020 from various organizations, having factored in the effects of the Coronavirus and the locust invasion experienced in the country:

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

2020 Projections |

Revised Projections |

|

1 |

International Monetary Fund* |

6.0% |

1.0% |

|

2 |

Moody’s Investor Services * |

- |

1.0% |

|

3 |

World Bank** |

6.0% |

1.5% |

|

4 |

Cytonn Investments Management PLC* |

5.7% |

1.6% |

|

5 |

McKinsey & Company * |

5.2% |

1.9% |

|

6 |

Central Bank of Kenya* |

6.2% |

2.3% |

|

7 |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

5.5% |

|

8 |

Capital Economics |

5.9% |

5.9% |

|

9 |

African Development Bank |

6.0% |

6.0% |

|

10 |

National Treasury |

6.0% |

6.0% |

|

11 |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

12 |

Citigroup Global Markets |

6.2% |

6.2% |

|

|

Average |

5.9% |

3.9% |

|

*Organizations that have revised their projections for 2020 |

|||

|

**Figure is based on the best-case scenario according to the World Bank |

|||

We hold similar sentiments as Moody’s given that the public debt in the country remains a point of concern with both the debt to GDP ratio as well as the debt service to revenue ratio having exceeded the recommended threshold. The trend is worrisome as the economy is likely to face fiscal challenges arising from the global pandemic. For more on this, see our topical on Debt Relief Amidst the COVID-19 Pandemic.

- IMF-Rapid Credit Facility (RCF);

During the week, the International Monetary Fund (IMF) Executive Board approved a USD 739.0 mn (Kshs 78.7 bn) disbursement to Kenya to be drawn under the Rapid Credit Facility (RCF) to help the country address the impact of COVID-19. In the press release, the IMF highlighted that the Coronavirus pandemic is slowly but surely taking a toll on the Kenyan economy by significantly reducing its growth prospects as well as widening the fiscal and financial needs of the country. COVID-19 has significantly affected Kenya’s major sectors such as the tourism sector, manufacturing, transport, and trade sectors. Key to note is that Kenya has never accessed the Rapid Credit Facility (RCF) but has benefitted from Standby Credit Facility (provides financing to low-income countries that are facing short-term Balance of Payments needs), Extended Credit Facility (used to address the balance of payments resulting from structural problems a country may be facing that may require a long time to correct), as well as Standby Arrangements (the main lending arrangement advanced to emerging markets). Kenya has in the past been able to access various forms of financing from the IMF dating back to 7th July 1975, with the latest ones being approved on 14th March 2016, where the IMF advanced a new arrangement totaling to USD 1.5 bn through a standby arrangement (SBA) and a standby credit facility (SCF) of USD 989.8 mn and USD 494.9 mn, respectively. Below is a table showing various forms of financing Kenya has been able to access in the past;

Amounts in USD, converted from SDR at current exchange rate 1 SDR=USD 1.36 (as at 08 May 2020)

|

Table Showing Various Forms of Financing Kenya has Previously Received from the IMF |

|||||

|

Facility |

Date of Arrangement |

Expiration Date |

Amount Agreed |

Amount Drawn |

Amount Outstanding |

|

Standby Arrangement |

14-Mar-16 |

13-Mar-18 |

964,592.2 |

0.0 |

0.0 |

|

Standby Credit Facility |

14-Mar-16 |

13-Mar-18 |

482,295.4 |

0.0 |

0.0 |

|

Standby Credit Facility |

2-Feb-15 |

14-Mar-16 |

184,552.0 |

0.0 |

0.0 |

|

Standby Arrangement |

2-Feb-15 |

14-Mar-16 |

479,835.2 |

0.0 |

0.0 |

|

Extended Credit Facility |

31-Jan-11 |

19-Dec-13 |

664,387.2 |

664,387.2 |

628,215.2 |

|

Extended Credit Facility |

21-Nov-03 |

20-Nov-07 |

204,000.0 |

204,000.0 |

5,100.0 |

|

Extended Credit Facility |

4-Aug-00 |

3-Aug-03 |

258,400.0 |

45,696.0 |

0.0 |

|

Extended Credit Facility |

26-Apr-96 |

25-Apr-99 |

203,388.0 |

33,898.0 |

0.0 |

|

Extended Credit Facility |

22-Dec-93 |

21-Dec-94 |

61,512.8 |

61,512.8 |

0.0 |

|

Extended Credit Facility |

15-May-89 |

31-Mar-93 |

355,504.0 |

293,987.1 |

0.0 |

|

Structural Adjustment Facility Commitment |

1-Feb-88 |

15-May-89 |

135,184.0 |

38,624.0 |

0.0 |

|

Standby Arrangement |

1-Feb-88 |

15-May-89 |

115,600.0 |

85,136.0 |

0.0 |

|

Standby Arrangement |

8-Feb-85 |

7-Feb-86 |

115,872.0 |

115,872.0 |

0.0 |

|

Standby Arrangement |

21-Mar-83 |

20-Sep-84 |

239,292.0 |

239,292.0 |

0.0 |

|

Standby Arrangement |

8-Jan-82 |

7-Jan-83 |

206,040.0 |

122,400.0 |

0.0 |

|

Standby Arrangement |

15-Oct-80 |

7-Jan-82 |

328,440.0 |

122,400.0 |

0.0 |

|

Standby Arrangement |

20-Aug-79 |

14-Oct-80 |

166,566.0 |

0.0 |

0.0 |

|

Standby Arrangement |

13-Nov-78 |

19-Aug-79 |

23,460.0 |

23,460.0 |

0.0 |

|

Extended Fund Facility |

7-Jul-75 |

6-Jul-78 |

91,392.0 |

10,472.0 |

0.0 |

|

Total |

5,280,312.9 |

2,061,137.1 |

633,315.2 |

||

|

*SDR (Special Drawing Rights) - Artificial currency instrument used by the IMF, and is built from a basket of important national currencies. The IMF uses SDRs for internal accounting purposes 1 SDR=USD 1.36 (as at 08 May 2020) Source: International Monetary Fund |

|||||

IMF commended the Kenyan authorities for taking a hands-on approach when dealing with the pandemic, especially the health policies put in place to combat the spread of the virus as well as the economic measures the government has been taking to try and cushion the economy against the effects of the Coronavirus pandemic. Before the pandemic, the government was taking necessary steps in fiscal consolidation to reduce macroeconomic vulnerabilities on the economy. With the Coronavirus pandemic significantly affecting Kenya’s economy, the fiscal consolidation journey will have to be put on pause as the government tries to support the economy. The IMF highlighted that the government must continue its fiscal consolidation journey after the pandemic to reduce debt vulnerability. The RCF funds will be used to provide budget financing needs and allow the government to maintain an adequate level of foreign reserves to support the economy as well as cover the balance of payment gap for the year. The IMF also stated that it plans to conduct an independent post-crisis audit and post the results to ensure the funds provided under RCF were used for COVID-19 related expenses.

In our opinion, the move by the IMF to provide RCF funds will help bridge the financing gap that exists in the country with the fiscal deficit as a percentage of GDP being projected to hit 70.0% by the end of FY’2020/2021, as well as help to finance the Balance of Payment deficits for the year due to the expectations of a decline in the value of exports following reduced global demand. The funds will also go a long way in increasing foreign exchange reserves in the country, which will be used to support the shilling especially during the Coronavirus pandemic where the shilling has been on a depreciating trend YTD against the US Dollar.

- Kenya Purchasing Managers’ Index:

According to Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI), released earlier in the week, businesses in Kenya recorded another sharp decline, the fourth since the start of the year amid the Coronavirus pandemic. The seasonally adjusted PMI index came in at 34.8, a 30-month low and down from the 37.5 seen in March 2020, pointing towards a severe decline in business conditions since a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Overall activity levels contracted as output levels declined due to a decline in demand as well as shortages of inputs due to lockdown restrictions across the globe. A majority of businesses reported lowering wages for their employees as some opted to terminate some staff to keep costs low amid subdued revenues. Most firms reported difficulties in obtaining locally sourced inputs mainly due to the curfew policies in Nairobi. Sentiments on business expectations for the next 12-months fell sharply due to the uncertainty brought about by the coronavirus. The backlog of new orders eased for the second month consecutively due to a slowdown in new orders while selling prices reduced with most business people hoping that this would encourage consumer spending. We expect the subdued demand to prolong given the current lockdowns across the globe and the slowdown of business activities worldwide. Locally, most businesses are struggling to meet their expenses amid the subdued revenues. The pandemic has affected key industries in the country such as tourism and the hospitality industry leading to near closure of the sectors thus causing massive layoffs, decreasing people’s purchasing power, and decreasing local demand. Businesses may also find it hard to access credit facilities from financial institutions given the high risk of loan default. On the supply front, lockdowns have caused shortages of inputs, negatively affecting local production.

- TASK-COVID-19 Proposal to Government of Kenya

In response to the ongoing Coronavirus pandemic that has disrupted business operations in the country, The Actuarial Society of Kenya, “TASK” released the COVID-19: Proposals to the Government of Kenya urging the government to tap into Pensions and Insurance Industries to restructure the domestic debt portfolio. The portfolio faces a refinancing risk as approximately 35.0% of the issued government securities will have matured by December 2020. Below are the key proposals from the report;

- Suspension of statutory deductions: In light of the tough operating environment that has led to most businesses scaling down their operations leading to massive job losses and reduced income, TASK proposes a 6-month suspension of statutory deductions such as NHIF and NSSF made by both the employers and employees. This may come as a relief to some employers and help to mitigate retrenchment,

- Retirement Benefits Act: TASK proposes that the act should be revised to enable members to qualify for a soft loan of up to 25.0% of the pension funds with a maximum limit of Kshs 500,000. This will, in turn, ease the financial pressure of the consumers of pension products,

- National Social Security Fund: TASK proposes that the NSSF should offer the government a Kshs 25.0 bn soft loan given that it has over Kshs 200.0 bn in assets. The loan would be repayable over an agreed period and would provide the government with more funds to cushion the economy against the negative effects of the Coronavirus pandemic,

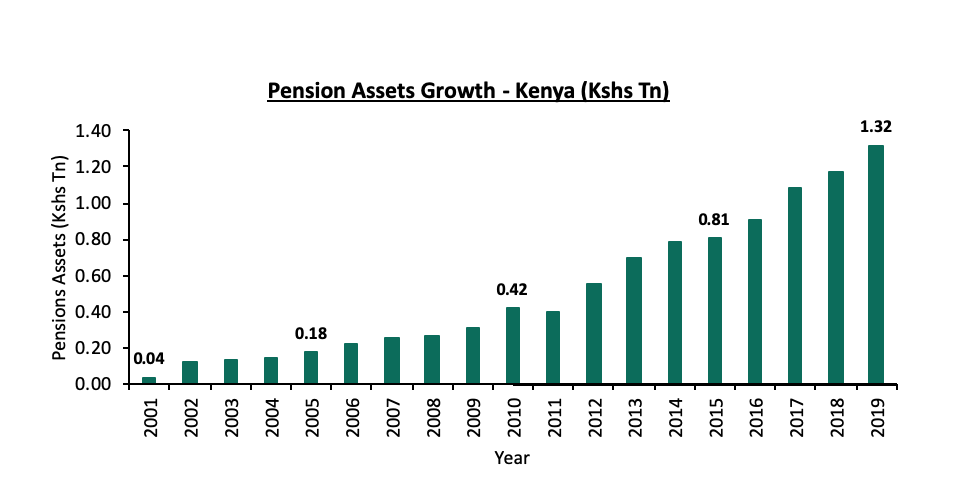

- Interest Payments on Pension Assets: According to the Economic Survey 2020 released by the Kenya National Bureau of Statics, pension funds’ assets grew by 13.6% to Kshs 1.3 tn in 2019 from Kshs 1.2 tn recorded in 2018 mainly attributable to the growth of government securities. TASK notes that 40.0% of these assets are held as government securities with the annual interest payments by the government being approximately Kshs 60.0 bn. TASK proposes that the government should consider freezing the interest payments for 1-2 years enabling the government to save approximately Kshs 60.0 bn in interest payments annually. Consequently, this will enable the government to channel the funds towards the fight against the Coronavirus pandemic, and,

- Insurance: With COVID-19 being declared a pandemic by the World Health Organization (WHO), TASK urges the Insurers to revise any clause that deems COVID-19 related deaths as void and consider processing claim payments for any COVID-19 related death. Given that Insurance companies will record low premium income in 2020 due to the tough operating environment, TASK proposes that the Insurance Regulatory Authority (IRA) should consider reducing the prescribed capital requirements temporarily for an insurer to 100.0% of the minimum capital from 200.0%.

In our view, the proposal to defer the interest payments for a maximum of 2-years will greatly affect the liquidity of the pension schemes since schemes might fail to meet their obligations to their members. Pension schemes primarily use interest payments as a source of liquidity to meet any payout needs since assets such as property are fairly illiquid and the current equities market is very volatile. The proposal for the government to defer on interest payment will also dampen investors' confidence given that government bonds should be risk-free. The discussion on deferred payments is already affecting the domestic borrowing market as indicated by the undersubscription of both the Treasury Bills and Treasury Bonds that were on offer during this week. The tough operating environment brought about by the Coronavirus pandemic has seen most firms slow down their operations leading to massive job losses and reduced income. The reduction in income will put a strain on pension contributions as most firms may halt their remittances to pension schemes. The proposal to issue soft loans to fund members of up to 25.0% will increase the liquidity of the members thereby cushioning them against the impact of the Coronavirus hence we support this particular initiative. The suspension of statutory deductions will be a welcome move as this will increase the disposable income available to employees as well as increase their purchasing power and we also support this particular initiative.

- Finance Bill 2020:

During the week, the Committee on Finance and Planning tabled their proposals in the National Assembly during the first reading of the Finance Bill, 2020. The amendment was necessitated by the need to legalize the measures announced by the president in March to help cushion the economy against the Coronavirus pandemic. Some of the key points, including our take on each, include;

- A proposal to cut the turnover tax from 3.0% to 1.0% of gross revenue. The bill also proposes to increase the threshold of the MSMEs qualifying for turnover tax from Kshs 5.0 mn to Kshs 50.0 mn. The reduction in the turnover rate and increasing the threshold for businesses that qualify is a welcome move, as it will reduce the tax burden on MSMEs, which constitute 98.0% of all businesses in the country, employing 14.9 mn Kenyans. The government is showing clear commitment towards shielding the MSMEs from economic shocks that will result from the Coronavirus pandemic,

- The bill also proposes to increase the withholding tax from 10% to 15% for dividends paid to non-residents. This may reduce Kenya’s ability to attract Foreign Direct Investments (FDI) given the era of Africa Continental Free Trade, as foreigners will seek to set base in countries with more favorable tax regimes making Kenya less attractive for foreign investors,

- A reduction in income eligible for tax exceptions, including income from a registered home ownership savings plan (HOSP), income from the National Social Security Firm (NSSF), overtime, bonuses, monthly or lump sum pension granted to a person over 65 years of age, and other non- deductible expenses such as membership subscriptions, capital expenditure incurred in the construction of social infrastructure, as well as any other incident capital expenditure relating to the authorization and issue of shares. Key to note is that all the above-mentioned exceptions were rejected by the National Assembly when the proposal was presented in the Tax Laws (Amendment) Bill, 2020 in April 2020. Taxation of overtime, bonuses, and retirement benefits will lead to a reduction of disposable income especially for low-income earners thus impacting their ability to save for retirement. The proposal to tax income from HOSP will mean that individuals making savings through all HOSP approved institutions, will cease to benefit from; (i) tax exemption on income to a maximum of Kshs 8,000 per month or Kshs 96,000 per annum, and (ii) tax exemption for any interest income earned by a depositor on a HOSP deposit of up to a maximum of Kshs 3.0 million. This amendment also goes against the government’s affordable housing initiative, under the Big Four Agenda, which aims to enhance homeownership, by empowering both the demand and supply side of the housing sector, mainly for the low and middle-income market segments. Taxing income earned through NSSF will reduce the funds available to retirees which is against the general provision for exemption of the income of registered retirement schemes,

- The Finance Bill 2020 is proposing to introduce a 1.5% digital tax payable on income earned or accrued in Kenya through any digital platform. It will, however, be difficult to implement the infrastructure needed to ensure this advance tax is remitted to the government given the complicated nature of digital transactions,

- The Bill seeks to remove payment of unclaimed dividends as a role performed by the Investor Compensation Fund under the Capital Markets Act. If approved, unclaimed dividends will now be paid to the Unclaimed Asset Authority charged with the responsibility of tracing beneficiaries of unclaimed assets,

- The Bill proposes to empower the Capital Markets Authority (CMA) to issue licenses, regulate, and approve private equity and venture capital firms with access to public funds. This means that CMA will now also act as a regulator to such firms, which have access to public funds,

- On Value Added Tax (VAT), the bill seeks to amend the VAT status of ambulance services and maize corn seed from vatable to exempt. The bill also proposes to change the VAT status of liquefied petroleum gas from zero-rated to vatable at a rate of 14.0%. This goes against the government’s efforts to discourage consumers from using wood and other fuels such as kerosene. If passed, the cost of LPG will increase given that the proposition is to tax it even higher than other petroleum products taxed at 8.0%, and,

- Introduction of a voluntary tax disclosure program that will last for 3 years and will be effective from 1st January 2021. People who declare their tax liability in the first year of the program will get a 100.0% interest and penalty waiver while those who declare their liability between the second and third year will get 50% and 25% waiver, respectively. Those who declare their liability within this period will be free from prosecution provided they were not already under audit or do not have an ongoing court case in respect of the tax liability. This program will assist the Kenya Revenue Authority (KRA) to collect the much needed outstanding arrears and will help include more individuals/ businesses into their database.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 18.5% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 285.2 bn against a prorated target of Kshs 350.0 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 recording gains of 0.8%, 3.9% and 1.8%, respectively, taking their YTD performance to losses of 15.3%, 23.3% and 18.2%, for NASI, NSE 20 and NSE 25, respectively. The performance of the NASI was driven by gains recorded by large-cap stocks such as NCBA, Bamburi, KCB, Equity Group, ABSA and Co-operative Bank of 11.2%, 5.8%, 5.5%, 4.0%, 3.8% and 3.6%, respectively. However, the gain was weighed down by declines recorded by large-cap stocks such as SCBK, BAT, EABL and Safaricom of (1.7%), (1.6%), (1.3%) and (0.5%), respectively.

Equities turnover increased by 204.7% during the week to USD 45.6 mn, from USD 15.0 mn recorded the previous week, taking the YTD turnover to USD 602.7 mn. Foreign investors remained net sellers during the week, with the net selling position declining by 44.4% to USD 3.3 mn, from a net selling position of USD 5.9 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing of riskier assets in favour of safe havens.

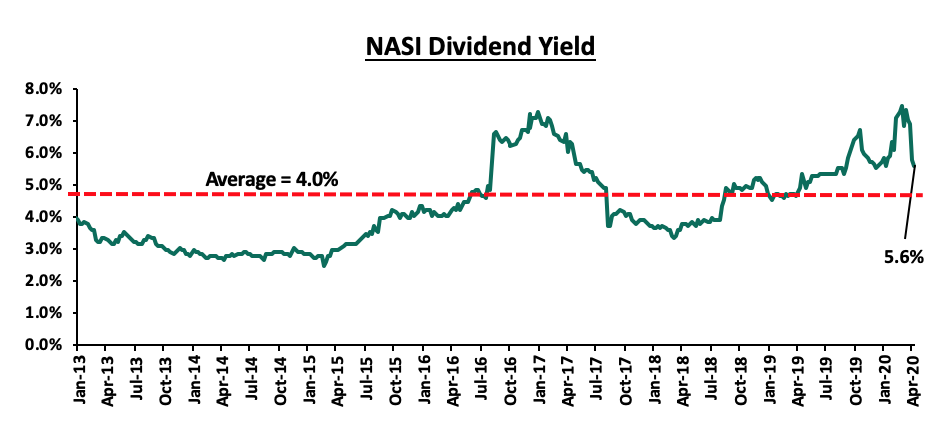

The market is currently trading at a price to earnings ratio (P/E) of 9.0x, 31.7% below the historical average of 13.2x, and a dividend yield of 5.6%, 1.6% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 9.0x is 7.0% above the most recent trough valuation of 8.4x experienced in the last week of March 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Central Bank of Kenya (CBK) in their presentation to the Senate Ad Hoc Committee on the COVID-19 situation, disclosed that Kenya’s seven largest banks had restructured loans amounting to Kshs 176.0 bn in April, equivalent to 6.4% of the industry’s total gross loan book of Kshs 2.8 tn as at January 2020, as the economic fallout from the pandemic continues to impact borrowers’ ability to repay and service their loans. During the week, Standard Chartered Bank Kenya (SCBK) was the latest lender to disclose it had restructured loans amounting to Kshs 8.0 bn, equivalent to 6.2% of its net loans, which stood at Kshs 128.7 bn in FY’2019. Previously, the lender had also announced repayment breaks of up to 3 months on all loans as part of its efforts to cushion its customers from the ongoing pandemic. SCBK becomes the second lender, after ABSA, to disclose the number of loans it has restructured, with ABSA having restructured loans amounting to Kshs 8.3 bn, equivalent to 4.3% of its net loans, which stood at Kshs 194.9 bn in FY’2019 as highlighted in our Cytonn Weekly #16/2020. The loans restructured by SCBK and ABSA account for 9.3% of the loans restructured in April and signals the banking sector has started to feel the adverse impact of the pandemic as a result of a slowdown in most economic sectors. In our view, the high Non-Performing Loans (NPLs), which stood at 10.5% as at the end of FY’2019, compared to the 5-year average of 8.2%, for the listed banking sector, continues to be an area of concern and is expected to increase in FY’2020 as businesses continue to be impacted by the pandemic. Bank earnings are also expected to take a hit as a result of reduced interest income and increased provisioning for bad debt. However, to cushion the impact to the banking sector, the CBK announced it would be flexible concerning loan classification and provisioning for loans that were performing on 2nd March 2020 and whose repayment period was extended or restructured due to the pandemic.

The CBK also disclosed that as at the end of April 2020, 11 commercial banks and one microfinance bank had been granted approval to access Kshs 17.6 bn which was made available following the reduction in Cash Reserve Ration (CRR) by 1.0% points to 4.25% from 5.25% in the March 2020 Monetary Policy Committee (MPC) Sitting as highlighted in our Cytonn Weekly #13/2020, which in effect freed a total of Kshs 35.2 bn. There is an increased demand for funding from the banking sector as depicted by the spending of 50.0% (Kshs 17.6 bn) of the amount made available (Kshs 35.2 bn) by the 1.0% point reduction in CRR in just one month. The table below shows the funding allocation by sector in the month of April:

|

Economic Sector |

Total Amount (Kshs'000) |

Percent |

|

Tourism, Restaurant and Hotels |

8,018,521.0 |

45.6% |

|

Agriculture |

2,937,148.0 |

16.7% |

|

Real Estate |

2,100,568.0 |

11.9% |

|

Trade |

1,825,080.0 |

10.4% |

|

Manufacturing |

1,295,077.0 |

7.4% |

|

Transport and Communication |

688,418.0 |

3.9% |

|

Personal/Household |

593,786.0 |

3.4% |

|

Building and Construction |

97,084.0 |

0.6% |

|

Energy and Water |

17,142.0 |

0.1% |

|

Mining and Quarrying |

16,206.0 |

0.1% |

|

Financial Services |

2,878.0 |

0.0% |

|

Total |

17,591,908.0 |

100.0% |

Source: Central Bank of Kenya

Key Take Outs:

- The main sectors funded were tourism, accounting for the largest portion, 45.6%, of funds provided by banks and is considered the worst hit sector of the economy by the ongoing pandemic, followed by agriculture accounting for 16.7%, with the sector being impacted by both COVID-19 and the locust invasion and Real Estate accounted for 11.9% of the funds provided, and,

- Personal and household funding accounted for 3.4% of the funding as most individuals’ incomes are affected by salary cuts and/or retrenchment by most businesses adversely affected by the global pandemic, especially Micro, Small and Medium Enterprises (MSMEs), with the CBK expecting an increase in extension and restructuring of personal loans in the coming months.

In our view, private sector credit growth is expected to be severely hit in the coming months despite the government’s effort to cushion the economy and the willingness of banks to restructure loans, as more businesses continue to demand working capital to help them mitigate the tough operating environment resulting from the global pandemic. In the April 2020 sitting, the MPC noted that private sector credit grew by 8.9% in the 12 months to March 2020, with growth mainly observed in the manufacturing sector, which accounted for 17.4%, building and construction 9.5%, trade 7.8%, transport and communication 7.1% and consumer durables accounted for 24.1%. The growth in private sector credit was supported by the repeal of the interest rate cap and the lowering of the Central Bank Rate, which lowered lending rates by commercial banks, coupled with the lowering of the CRR, which improved liquidity and credit market conditions. However, the high NPLs in the banking sector, coupled with a tough operating economic environment as indicated by the Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI) which came in at 34.8 in April, a 30-month low and down from the 37.5 seen in March 2020, pointing towards a severe decline in business conditions since a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook, we expect banks to shy away from lending to the riskier private sector.

Universe of Coverage

|

Banks |

Price at 30/04/2020 |

Price at 08/05/2020 |

w/w Change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

83.0 |

83.0 |

0.0% |

(23.9%) |

109.0 |

179.7 |

3.3% |

119.8% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.4 |

(3.6%) |

(19.8%) |

3.0 |

4.8 |

4.5% |

102.1% |

0.2x |

Buy |

|

Jubilee Holdings |

263.0 |

268.0 |

1.9% |

(23.6%) |

351.0 |

453.4 |

3.4% |

72.5% |

0.9x |

Buy |

|

KCB Group*** |

37.0 |

39.1 |

5.5% |

(27.7%) |

54.0 |

55.8 |

9.0% |

51.9% |

0.9x |

Buy |

|

I&M Holdings*** |

51.3 |

51.0 |

(0.5%) |

(5.6%) |

54.0 |

73.6 |

5.0% |

49.3% |

0.7x |

Buy |

|

Equity Group*** |

37.7 |

39.2 |

4.0% |

(26.8%) |

53.5 |

55.3 |

6.4% |

47.6% |

1.2x |

Buy |

|

Co-op Bank*** |

12.6 |

13.1 |

3.6% |

(20.2%) |

16.4 |

18.2 |

7.7% |

47.1% |

1.0x |

Buy |

|

Sanlam |

15.0 |

16.0 |

6.7% |

(7.0%) |

17.2 |

21.7 |

0.0% |

35.6% |

1.3x |

Buy |

|

Stanbic Holdings |

92.5 |

88.0 |

(4.9%) |

(19.5%) |

109.3 |

109.8 |

8.0% |

32.8% |

1.0x |

Buy |

|

Standard Chartered |

187.5 |

184.3 |

(1.7%) |

(9.0%) |

202.5 |

223.6 |

10.9% |

32.2% |

1.4x |

Buy |

|

NCBA |

28.5 |

31.7 |

11.2% |

(14.0%) |

36.9 |

39.4 |

0.8% |

25.1% |

0.7x |

Buy |

|

ABSA Bank*** |

10.6 |

11.0 |

3.8% |

(17.6%) |

13.4 |

12.6 |

10.0% |

24.5% |

1.2x |

Buy |

|

Liberty Holdings |

8.3 |

8.2 |

(2.2%) |

(21.2%) |

10.4 |

10.1 |

0.0% |

23.3% |

0.7x |

Buy |

|

CIC Group |

2.3 |

2.3 |

2.2% |

(13.8%) |

2.7 |

2.6 |

0.0% |

14.2% |

0.8x |

Accumulate |

|

HF Group |

3.9 |

4.0 |

3.1% |

(37.9%) |

6.5 |

4.3 |

0.0% |

7.2% |

0.2x |

Hold |

|

Britam |

6.8 |

6.9 |

0.6% |

(23.6%) |

9.0 |

6.8 |

3.6% |

1.8% |

0.7x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average and as such, we believe that investors should take advantage of the current attractive valuations in the market.

- Industrial Reports

During the week, Hass consult released their Hass Property Index Q1’2020 report, which indicated that the Nairobi Metropolitan Area residential market recorded a slight decline in performance, recording a 0.02% drop in annual price as at Q1’2020, compared to a 3.3% increase recorded in Q1’2019; while q/q prices appreciated by 0.9%, compared to a drop of 2.6% in Q1’2019. Other key take-outs from the report were as follows:

- Detached units and apartments recorded an average y/y price depreciation of 1.6% and 2.0%, on average, and a q/q appreciation of 1.3% for detached units and a 0.4% depreciation for apartments,

- Semi-detached units registered a q/q and y/y price appreciation of 0.9% and 5.8%, respectively,

- Ridgeways recorded the highest annual price appreciation at 9.4%, while Loresho recorded the highest quarterly growth at 3.6%. Tigoni recorded the lowest negative quarterly growth averaging 4.7% while Juja posted the lowest negative annual growth averaging 9.3%,

- Among Satellite Towns, Limuru and Kiambu were the best performers with annual price appreciation of 5.0% and 4.2%, respectively. Ongata Rongai and Kiserian posted the highest q/q price appreciation at 2.6% and 1.8%, respectively,

- In terms of rental yields, the market recorded a 0.8% increase to 7.2% in Q1’2020 from 6.8% in Q1’2019, attributable to a rise in apartment rents. Apartments recorded the strongest growth over the quarter with asking rents growing at 2.1% with parklands recording the highest q/q rise at 0.7% and the highest drop recorded by Lang’ata at 3.2%. Annually, the highest rise was recorded by Lang’ata at 6.4% while the highest drop was by Lavington at 3.1%.

Hass Consult also released the Land Price Index Q1’2020 Report, which indicated that Land price indices for the first quarter of 2020 recorded a marginal decline for both suburbs and satellite towns over the period, at 0.9% and 0.2%, respectively. The report attributes the subdued sector performance to temporary closure of Land Registries as a COVID-19 preventive measure thus slowing down land transactions (they have since been partially opened by the Lands Ministry) and a general slowdown in economic activity due to the ongoing pandemic.

Other key take-outs from the report were as follows:

- Annually, prices in Nairobi's suburbs marginally increased by 0.28% while for the satellite towns prices increased by 6.51%,

- Gigiri and riverside recorded the sharpest drop y/y at 7.2% each, whereas Spring Valley and Muthaiga recorded the highest rise with 8.9% and 6.3% respectively,

- Muthaiga posted the best q/q performance with average price appreciation of 2.4%, whereas Gigiri recorded the largest q/q decline recording a 2.8% drop in price,

- Among Satellite Towns, Kitengela and Ruiru recorded the highest y/y increase at 12.7% and 11.1% respectively with Thika recording the least increase at 0.7%. On quarterly performance, Kitengela also recorded the highest q/q price appreciation at 2.0% while Kiserian recorded the lowest quarterly negative growth at 2.3%.

The indices are in tandem with the Cytonn Q1’2020 Markets Review, according to which, property prices recorded an annual decline of 0.1% in Q1’2020 with returns to investors being boosted by growth in rental yields which came in at 5.2%, compared to 4.4% in Q1’2019; as land prices recorded an annual capital appreciation of 1.0%, 1.0% lower than 2.0% recorded in Q4’2019. However, the market performance is tipped to come under pressure, albeit slightly compared to other asset classes, from the Covid-19 pandemic. As disposable incomes contract due to the economic downturn, rental rates and prices are set to drop as landlords continue to offer waivers and discounts until the economic situation returns to normalcy.

- Hospitality Sector

During the week, Hotel chain Sarova Hotels announced that it would stop managing Sarova Taita Hills Game Lodge and Sarova Salt Lick Game Lodge after 13 years of the management deal. In March this year, the hotel chain also suspended operations in four of its local hotels and lodges indefinitely. The four; Sarova Woodlands in Nakuru, Sarova Lion Hill at the Lake Nakuru National Park, Sarova Mara Game Camp and Sarova Taita Hills Game Lodge were closed as a result of reduced demand for hotel accommodation due to the COVID-19 pandemic. Kenya’s hospitality sector is largely dependent on business and leisure tourism, both of which have been stemmed by the global lockdown. According to global hotel research firm, STR, hotel occupancy rates in the USA declined by 68.5% to 21.6% in April, a trend that is expected to continue globally until the pandemic is contained. As such, we expect to see hotel facilities reducing their operations in a bid to cut down on operating costs in the wake of strained cash flows due to the weak demand currently experienced. However, we expect the sector’s recovery to commence in the near term on the back of government policies aimed at cushioning the sector such as the government’s directive to re-open hotels and restaurants in major towns and the Ministry of Tourism’s post-corona recovery strategy fund of Kshs 500.0 mn.

- Industrial Sector

During the week, Africa Logistics Properties (ALP) announced plans to continue investing in modern grade-A warehousing across the country with the planned completion of their 50-acre warehousing complex at Tilisi Industrial Park, Limuru, by December this year. According to the firm, which also owns the 50,000-SQM ALP North warehouse, in Tatu City Industrial Park located in Ruiru, plans have been put in place to protect construction workers at its ongoing projects against Coronavirus in a bid to ensure that the construction goes on even as many construction projects cease due to various factors such as cash flow constraints, reduced labor force and supply chain constraints resulting from the COVID-19 pandemic. We expect to see an increase in demand of modern industrial park space fueled by; (i) Increased online shopping trends and the resultant growth of ecommerce businesses, (ii) government focus on the Big 4 Agenda on manufacturing which is expected to influence demand for warehouses used to manufacture products, (iii) improvement of infrastructure, for instance, the construction of SGR phase two which will increase thorough output of Special Economic Zones, and, (iv) a shift in activities from the existing Industrial Area due to challenges such as poor infrastructure and high land costs, to satellite towns such as Ruiru and Limuru supported by increased demand for centralized warehouses by retailers.

- Statutory Review

During the week, National Treasury Cabinet Secretary, Ukur Yatani published draft regulations aimed at guiding the new amendment to Section 38 of the Retirement Benefits Act which was amended in the Tax Act 2020 to allow pensioners to use a portion of their pension savings to purchase a residential home. As per the proposed regulations, pensioners will be allowed to use the lower of 40.0% of their pension savings or a maximum of Kshs 7.0 mn towards a home purchase. This is in addition to the old provision which allows members to use 60.0% of their accumulated pension savings as mortgage collateral. Other key highlights from the draft include;

- Revision of the word "institution" to include institution or projects approved by the housing CS or licensed under the Sacco Societies Act, Insurance Act or a scheme with residential houses for sale. Previously, members could only benefit from the mortgage guarantee from a bank, mortgage or financial institution licensed under the Banking Act, a building society licensed under the Building Societies Act, a microfinance institution established under the Microfinance Act, or the National Housing Corporation,

- A member of a scheme shall only be allowed a one-off utilization of their benefits to purchase a residential house,

- A member earning a pension from the scheme and/or has attained normal retirement age shall not be eligible to apply,

- Trustees of the various retirement schemes will ensure the houses are priced at market value and their ownership will only be transferred under special circumstances such as retirement, death, illness or if the member is emigrating from Kenya to another country without the intention of returning to reside in Kenya, and,

- Funds applied towards the purchase of a residential house under these Regulations shall first be deemed to have been drawn from the member’s own contributions together with earned investment income and any balance shall be applied from the employer’s contribution and the investment income.

In our view, successful implementation of the draft regulations will lead to diversification of sources of funds to be used in purchasing residential houses as Kenyans will now afford to buy homes or take mortgages for houses which will, in turn, improve homeownership in the country. However, while this is a step in the right direction towards alleviating Kenya’s housing deficit, only 1 in 10 Kenyans belongs to an individual pension scheme other than the National Social Security Fund (NSSF) which is compulsory, with NSSF members contributing Kshs 400 per month, 40.0% of this may not be enough to purchase a house especially with the current undersupply of low-middle income housing in the country. As such, we are of the view that the government should raise the proportion allowed for home purchase to either 60.0%, as is the case for mortgage collateral, or more (as seen in countries like Singapore where members can withdraw up to 120.0% of their home value). See our FOTW below for more on our view.

Despite the effects of the COVID-19 pandemic taking a toll on the Kenyan economy, we continue to retain a neutral outlook towards the performance of the real estate sector, supported by the continued investor confidence in addition to measures such as the reopening of the land registry by the Ministry of Lands which may see some activity in the land sector thus stimulating the sector.

On April 25th 2020, President Uhuru Kenyatta assented the amendments to the Tax Act 2020, one of which was to the Retirement Benefits Act allowing pensioners to use their savings to purchase a residential house and withdrawal taxation rate; this is in line with the Big 4 agenda to promote housing. Following this amendment, the Retirement Benefits Authority drafted regulations aimed at governing the new provision. As such, this week, we seek to enlighten the market on the changes made in the Retirement Benefits Authority (RBA) Regulations, what the changes mean for retirement schemes and the pensions industry going forward and our take on the adequacy and effectiveness of the proposed regulations.

But before we continue, we must commend RBA for their responsiveness: the President assented to the Tax Act on April 25th 2020 and in less than a month, we already have the draft regulations for discussion on how they impact the President’s Big 4 housing agenda. This responsiveness is in stack contrast to the Finance Act 2019, which the President assented to on November 2019, and, inter alia, provided that “Deposits in a registered home ownership savings plan shall be invested in accordance with… regulations issued by the Capital Markets Authority;” The home ownership amendment was to expand homeownership savings instruments to include capital markets instruments, in addition to bank savings, so that Kenyans saving for homes can earn higher capital markets returns on their savings for home ownership. If you save through a bank, the return is about 5%, compared to saving through a capital markets instrument where the return is about 10%. However, it has been 7 months since the presidential assent and the Capital Markets Authority, CMA, is yet to issue draft regulations. Prospective homeowners and affordable housing developers are left awaiting the draft regulations from CMA to operationalize the capital markets homeownership savings plan that the President assented to on November 7th 2019.

Back to the RBA proposed regulations, we review the topic in five sections as follows:

- Introduction: Role of the RBA and Reasons for the Recent Amendments to RBA Regulations,

- Changes in the RBA Regulations,

- Our Take on the Proposed Regulations,

- Case Study – Singapore’s Central Provident Fund, and,

Section 1: Introduction: Role of the RBA and Reasons for the Recent Amendments to RBA Regulations

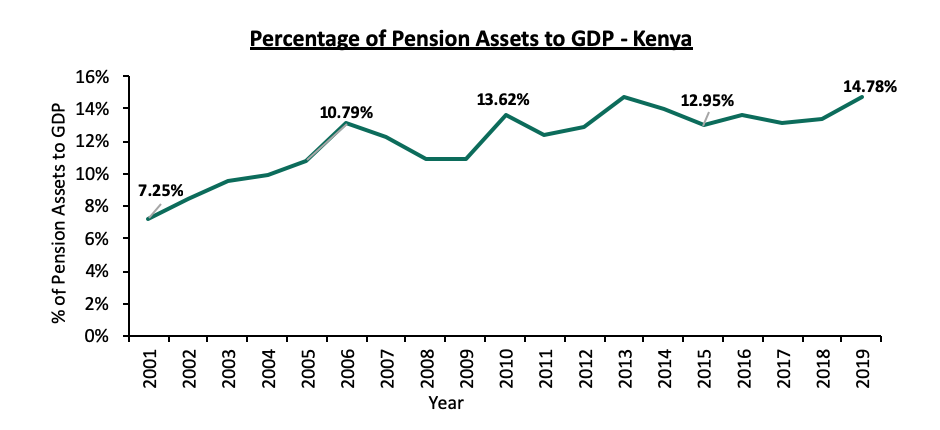

The Retirement Benefits Authority is the government body established under the terms of the Retirement Benefits Act 1997 tasked with the regulation, supervision and promotion of retirement benefits schemes in Kenya. The Authority is also in charge of protecting the interests of members and sponsors of the retirement benefits sector. The Retirement Benefits Authority Regulations serve as subsidiary legislations to the Act and contain guidelines for the treatment of members’ benefits, investments, withdrawals, reports and restriction on the use of scheme funds. The retirement industry plays a big role in the economy of Kenya with assets worth Kshs 1.32 tn as at December 2019 and averaged 13.55% of the country’s GDP over the last 10-years.

The industry has witnessed significant growth increasing by a 9-year CAGR of 17.6%, from 0.7 mn registered members in 2010 to 3.01 mn members as of December 2019, according to the Kenya National Bureau of Statistics (KNBS) FinAccess Report 2019. Despite the growth, many Kenyans still suffer from low pension adequacy upon retirement; this is due to poor savings culture whereby many employees withdraw their allowable portion of their retirement savings when moving from one employer to another.

Through the Tax Act 2020, the government introduced various economic measures aimed at alleviating the housing deficit in Kenya as well as easing the effects of the Corona disease on household incomes. This was achieved through an amendment to Section 38 of the Retirement Benefits Act to allow the use of retirement savings to purchase a residential house in a bid to improve home ownership in Kenya. The government has made it possible for citizens in registered retirement benefits schemes to use a portion of their retirement benefits to purchase a residential house. This is in addition to the previously existing law that allowed retirement schemes’ members to allocate up to 60% of their benefits towards securing a mortgage loan.However, the mortgage was never really used because banks preferred to have the actual house as security rather than the pension savings.

Section 2: Changes in the RBA Regulations

The law providing for reduction of the tax rates upon withdrawal and the addition of use of retirement savings to purchase a house were assented to by the President on April 25th 2020. The regulations however to govern the purchase of house are proposals by the Cabinet Secretary and are yet to be gazetted. Below we list the proposed changes relating to purchase of housing:

- The proportion available for the purchase of a residential house at the time of the application shall be the lower of 40% of the member’s accumulated benefit subject to a maximum of Kshs 7.0 million or the purchase price of the house. This means that a worker who wishes to buy a residential house can do so directly from their pension utilizing up to 40% of their accumulated benefits; the maximum however they can use is Kshs 7 million and the amount they use should not exceed the buying price of the house. Accumulated benefit here refers to the total pension contribution over the years plus interest earned,

- Addition of paragraph (c) to the definition of institution to read:

- a bank, mortgage or financial institution licensed under the Banking Act (Cap. 488), a building society licensed under the Building Societies Act (Cap. 489), a microfinance institution established under the Microfinance Act, 2006 (No. 19 of 2006) the National Housing Corporation; or

- any other institution, including an issuer of a tenant purchase arrangement that is specifically approved by the Authority for the purpose of providing a facility; or

- an institution or projects approved by the ministry in charge of matters relating to housing or licensed under the SACCO Societies Act, Insurance Act or a scheme with residential houses for sale;

This means that on top of the already existing institutions qualified by (a) and (b), scheme members may purchase a house from SACCOs, Insurance companies, and retirement schemes that have built or own residential houses for sale. Members can also buy a house from the Ministry of Transport, Infrastructure, Housing & Urban Development-approved institutions and projects. An example of this is the Boma Yangu Affordable Housing Programme.

- Amendment of the definition of the word “house” to be a residential house,

- A member can utilize either of the option to be issued with a guarantee to secure a mortgage loan or to utilize their benefits to purchase a house but not both,

- A member of a scheme can only be allowed to utilize their funds to purchase a house once,

- A member who has attained the normal retirement age or is already receiving a pension from the scheme is not eligible to apply for the purchase of a house from their benefits

- The application of a member to use part of his retirement savings to purchase a house shall not take more than 60-days in consideration before a decision is made, and,

- Every scheme shall provide the minimum requirements to be met by members, for an application submitted under these Regulations.

Section 3: Our Take on the Proposed Regulations

The new law to allow members to purchase homes through their pension savings is welcome as it provides an incentive for workers to save in retirement benefits schemes as well as boost one of the Government’s Big Four Agenda, which aims to improve homeownership rates by enhancing the diversification of sources of funds to be used in the purchasing of residential homes by Kenyans.

We, however, find that there is a need for further six clarifications as follows:

- For the regulation to be appropriately descriptive, we suggest it is called the “The Retirement Benefits (Mortgage Loans and Residential Purchases) Regulations”, so that it is clear the regulations are equally about both getting mortgages and purchasing residential units. Leaving the name of the regulation to be about mortgages only makes it look like it is about mortgages, yet it is equally about mortgages as it is about residential purchases,

- Definition of “institution” should be clear in terms of the purpose of the institution because we have two different institutions:

- Institutions to issue mortgage loans and facilities secured by retirement benefits; for example banks, mortgage companies, and,

- Institutions to avail residential units for purchases, such as real estate developers and vendors.

These two are totally different institutions and should be separated in the definitions. We should have lending institutions and real estate vendors/institutions. To say that the residential units being purchased have to be from an institution and then describe an institution as a bank seems bizarre since they typically don’t sell real estate, and this kind of confused definition could easily attract litigation from the industry since statutes and regulations ought to be clear,

- Arising from (ii) above, the way the regulations are written, they are discriminative as to what type of a residential unit a member can buy. They are very punitive to real estate developers because the funds cannot be used to purchase a residential unit unless the unit is being sold by a SACCO, an insurance company, pension fund or a project approved by the ministry of housing. This excludes the entire real estate developer world - large, small and individual developers. The restriction also exposes members to the risk of schemes undertaking development, which is not their forte, as can be demonstrated by schemes that have recently gone into the development and ended up with loss-making projects for the scheme. Members should be able to purchase suitable real estate from vendors of their choice,

- Just like in the case of a mortgage to buy a house is allowed at 60% of member benefits, the amount to buy a house should also be 60% of member benefits, the limitation to 40% for the sake of buying a residential unit, as opposed to 60% when borrowing seems skewed towards favoring borrowing rather than buying,

- The limitation to an absolute figure of seven million also seems discriminatory; once the percentage of accessible benefits has been determined, whether 40% or 60%, then we should let the percentage determine the absolute figure, similar to the way Regulation 11 currently limits assignment of benefits to 60%, but has no absolute limit. This limitation again appears to be favoring mortgages as opposed to housing purchases and could be deemed discriminatory,

- Proposed Regulation 15 (5), we propose to add section (e) an ability for the authority to waive the encumbrance to allow for future flexibility for unforeseen circumstances. Just keeping the occurrences to (a) through (d) is restrictive. For example, it is possible that the market may over time develop reverse mortgage, where a retiree begins to get monthly income against their residential property upon retirement and then upon death they would transfer the property to the reverse mortgage provider. There is a need to leave a window open for product development with the approval of the Authority.

As currently put forward by the Cabinet Secretary, Regulation 15 (5) states that “Trustees of the scheme shall ensure and/or cause the title to the residential house to be encumbered to restrict transfer to any person. The restriction shall stand until there is an occurrence of any of the following events;

- A member has retired from service on early retirement grounds, or has attained age sixty or the normal retirement age of the scheme whichever is earlier;

- Death of a member;

- Member becomes incapacitated due to ill health or permanent disability to the extent that it would occasion his retirement;

- f the member is emigrating from Kenya to another country without the intention of returning to reside in Kenya and approval has been granted by the Authority; “

In summary, from the title of the regulation to the allowable percentages, the regulation seems more inclined to members taking mortgages rather than outrightly purchasing residential units, it is not clear what is the policy intention of this inclination, if anything it just saddles members with debt rather than allow them outright purchases of residences.

Section 4: Case Study – Singapore’s Central Provident Fund

In this section, we take a look at a country that allows retirement savings to be used to purchase residential houses. We focus on the pension system in Singapore, a country which has a high integration between housing and pension policies. The Central Provident Fund (CPF) – the statutory scheme – has been integrated as one of the three key pillars of housing policy in the country; the other two are Lands Acquisition Act and the Housing Development Board.

The Central Provident Fund Board is the statutory authority that administers the country’s mandatory and comprehensive pension scheme, Central Provident Fund. This is similar to NSSF here in Kenya. The contribution rates to CPF are from the employee 20% of their income and from the employer, 17% of the employee’s income (these contribution rates may vary with age). Mandatory CPF contributions are tax-exempt for both the employer and employee. The same applies to pre-retirement and retirement withdrawals from the three accounts discussed below. Both the employer and employee may make additional voluntary contributions to the CPF, but these contributions are not subject to tax breaks.

The contributions are distributed to 3 accounts:

- Ordinary Account – Funds in this account can be used for housing insurance, education and other approved usages,

- Special Account – The funds here are purely for old-age and investing in retirement-related products

- MediSave Account – Funds accumulating in this account are for approved hospitalization and medical insurance expenses.

There is an additional account automatically created when one reaches the age of 55 years.

- Retirement Account – This is automatically created upon attaining the age of 55 years old which is the lowest age that one can access their pension savings. Upon reaching 55 years old, the Ordinary and Special Account merge to form the Retirement Account and the money will be used as retirement income.

Once contributions are remitted, the funds are divided into the three accounts as follows: (The amounts here refer to the percentage of your pay)

|

Age |

CPF allocation for Ordinary Account |

CPF allocation for Special Account |

CPF allocation for MediSave Account |

|

Up to 35 years old |

23.0% |

6.0% |

8.0% |

|

35 to 45 years old |

21.0% |

7.0% |

9.0% |

|

45 to 50 years old |

19.0% |

8.0% |

10.0% |

|

50 to 55 years old |

15.0% |

11.5% |

10.5% |

|

55 to 60 years old |

12.0% |

3.5% |

10.5% |

|

60 to 65 years old |

3.5% |

2.5% |

10.5% |

|

Above 65 years old |

1.0% |

1.0% |

10.5% |

The funds allocated in the Ordinary Account may be used to cater for property expenses in any of the following ways:

- Pay the purchase price of a new house

- Repay a housing loan fully or partially for an already existing loan

- Repay the construction loan instruments or loan instruments take to buy land for construction

- Pay stamp duty, legal costs, survey fees and any other costs incurred in the purchase of private property

CPF savings can only be used if you are buying a House Development house or private property with a remaining lease of at least 30 years, provided one’s age plus the remaining lease is at least 80 years. All properties in Singapore have a renewable lease of 99 years old. The total CPF usage by the household is capped at a percentage of the property purchase price or the value of the property at the time of purchase, whichever is lower.

Also, there are no limits to withdraw CPF savings to buy a new flat from the Housing Development Board (HDB) which is a Singapore's public housing authority that plans and develops housing estates.

The scheme has proven successful, with Singapore registering one of the highest home ownership rates globally at 90.3% with 80% of this being public housing. The CPF aims to make members have enough retirement savings to meet their basic expenses in retirement, have a property that is fully paid up when they retire and have adequate savings to cover their medical expenses in old age.

Kenya can borrow a few lessons from the above case study:

- Increase limits of funds available to purchase a house: CPF allows 23% out of the 37% total contribution to be utilized for purchase a house; this translates to 62% of a member’s total contribution. Additionally, there is no upper limit as we have in the proposed amendment of Kshs 7 million.

If the logic is to increase house ownership in Kenya then the Ministry should consider not inhibiting too much the allowable portion for their agenda as that would be shooting their foot,

- Lessening restrictions on qualified real estate providers: Kenya could borrow from the limit restrictions Singapore applies. For CPF, there is no limit for usage of the retirement savings to purchase a house developed by their Housing Development Board – you can use 100% of your pension to purchase a government developed house. The limit of 62% of your pension applies to all the other real estate developers. Kenya could apply the same by putting no restrictions on purchases of Government-built houses while the limit restriction applies to the rest of the market with no inhibitions (in terms of banks or SACCOs),

Section 5: Conclusion

The current regulations, as proposed, need to be reviewed in three key respects;

- First, proposed regulations effectively exclude purchasing units from real estate developers,

- Second, the definition of institutions whose units qualify to be purchased using pension funds is confusing, since the regulations do not differentiate between financing institutions and developer institutions,

- Finally, the percentage allowed for either mortgage access or outright purchase access need to be the same,

If the above three key issues are not addressed, the proposed regulations will effectively be a cosmetic regulatory piece that cunningly defeats what was decisive legislation to promote housing purchase.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.