Jul 8, 2020

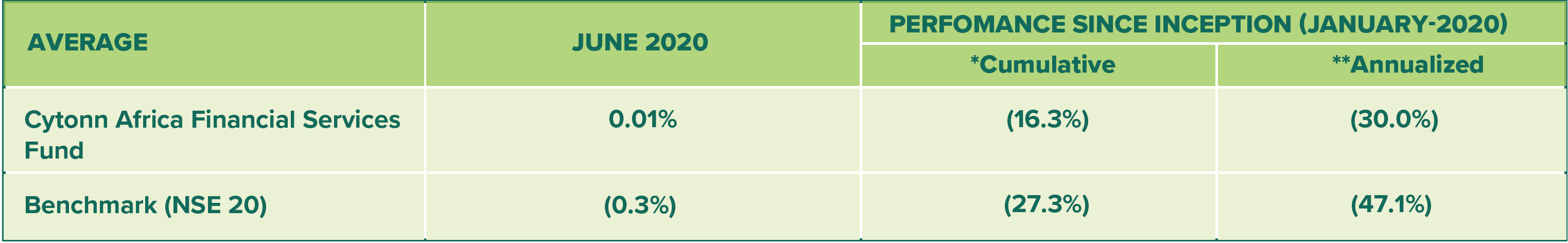

1. FUND PERFOMANCE

*Aggregate percent amount that your investment would have gained since the fund started (16-Jan-2020)

**Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns.

2. FUND MANAGER’S REPORT AND OUTLOOK

Fund Objective

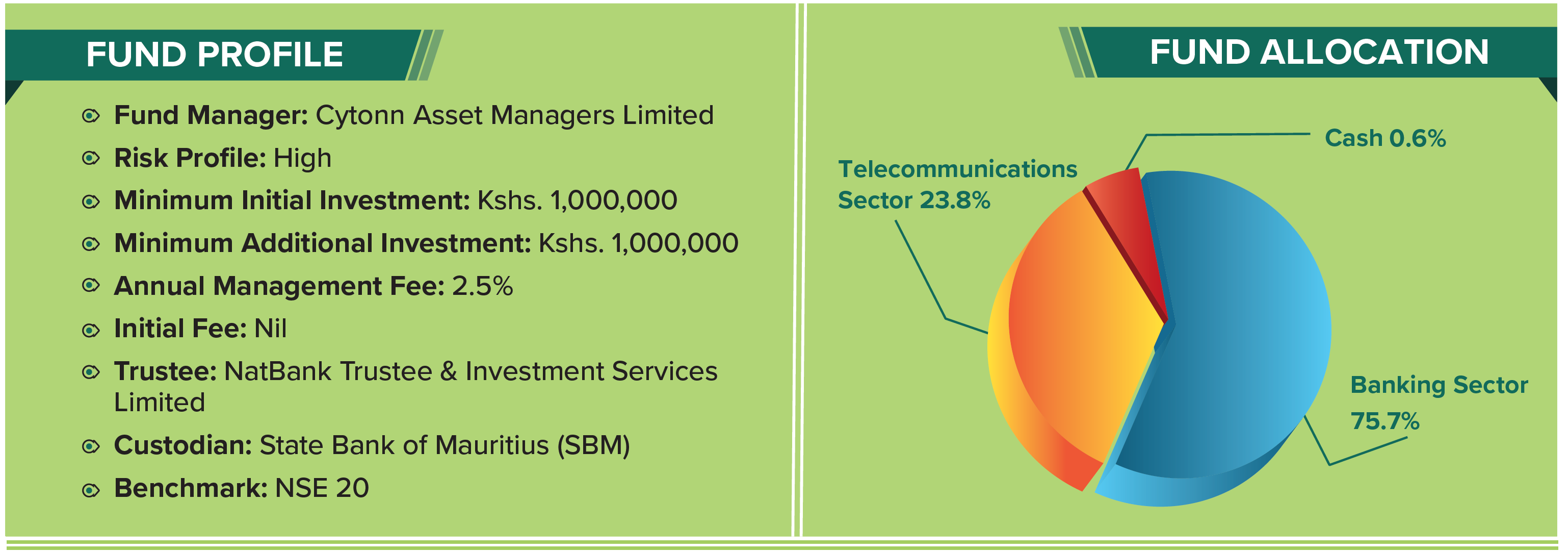

CAFF is a high-risk fund that aims to achieve the highest possible return for the investor through investing infinancial services stocks in Sub Saharan Africa. The investment risk is reduced through holding a diversified portfolio of Securities.

Portfolio Strategy

The fund seeks to invest in the financial services sector stocks of Sub Saharan Africa countries that possess a high potential return, in the form of capital appreciation and dividend yield. The fund seeks to outperform the benchmark, NSE 20, by maintaining a diversified portfolio.

Portfolio Performance

The Cytonn African Financial Services Fund recorded marginal gains of 0.01% in the month of June 2020. The gains in the fund's performance was mainly driven by gains recorded in Safaricom shares of 0.4%. The fund was however weighed down by the losses recorded by both Co-operative Bank and Equity Group’s shares held in the Fund's portfolio of 1.6%. The equities market recorded mixed performance in the month of June, with both NASI and NSE 25 gaining by 0.4%, while NSE 20 declined by 0.3%. The NASI performance was driven by gains recorded by large cap stocks such as KCB, Standard Chartered Bank, Safaricom and EABL of 2.5%, 2.3%, 0.4% and 0.3%, respectively.

Economic report and outlook

Economic performance in most sectors slowed in the first quarter of 2020 compared to the corresponding quarter of 2019. Real GDP grew by 4.9% during the review period compared to 5.5% growth in the first quarter of 2019. Though Kenya was somewhat spared the brunt of the COVID-19 pandemic in the first quarter of 2020, the economy was a ected by the resultant uncertainty that was already slowing economic activity in some of the country’s major trading partners. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with June’s inflation coming in at 4.6% a decline from 5.3% in May, driven by a 1.3% decline in the food and non-alcoholic drinks’ Index, coupled with a 0.8% decline in the housing, water, electricity, gas and other fuels’ index. Slight pressure has been recorded on the Kenyan Shilling on the back of increased dollar demand from merchandise importers as the easing of coronavirus restrictions jumpstart economic activities, thus boosting demand for hard currency but we do not foresee further declines as the Central Bank remains active in the market to cushion the shilling.

The Nairobi securities markets recorded a 0.3% decline in the month of June as measured by the Nairobi All Share Index. With the market trading at valuations below the historical average, the valuations are now significantly attractive with the current market price to earnings ratio (P/E) at 8.2x, which is 37.2% below the historical average of 13.1x, and the dividend yield is at 5.1%, 1.1% points above the historical average of 4.0%.

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.