Jan 18, 2026

- Economic Growth:

According to the Kenya National Bureau of Statistics (KNBS) Q3’2025 Gross Domestic Product Report, the Kenyan economy recorded a 4.9% growth in Q3’2025, higher than the 4.2% growth recorded in Q3’2024. The improved performance was largely driven by accelerated growth in key sectors, with Mining and Quarrying rebounding to 16.6% in Q3’2025 from a 12.2% contraction in Q3’2024, Construction expanding by 6.7% in Q3’2025 from a 2.6% contraction in Q3’2024, and Electricity and Water Supply growing by 3.6% in Q3’2025 from 0.9% in Q3’2024. Consequently, the economy recorded an average growth of 4.9% in the first three quarters of 2025, an improvement from the 4.5% average growth recorded in a similar period in 2024. The average GDP growth rate for 2024 is expected to come in at an average of 5.0%, an improvement from the 4.7% expansion witnessed in 2024.

In 2026, we expect the economy to continue its recovery trajectory with the projected GDP growth to come in at a range of 5.2% - 5.5%.

The key factors that shall support growth include:

- Continued growth in Services and Agricultural sectors: The steady performance in the agricultural sector witnessed in 2025 is expected to continue into 2026 following continued support by the government through fertilizer subsidy program. In the FY’2025/2026 budget, the government allocated Kshs 8.0 bn for the fertilizer subsidy program aimed at lowering the cost of farm inputs and enhancing food supply in the country, despite a reduction from Kshs 10.0 bn in FY’2024/2025. Additionally, the favorable weather conditions and sufficient rainfall experienced in the country is set to continue supporting the sector. The service sector is expected to register robust performance driven by growth in information and technology as internet connectivity increases, as well as accommodation and food services as a result of increased tourism,

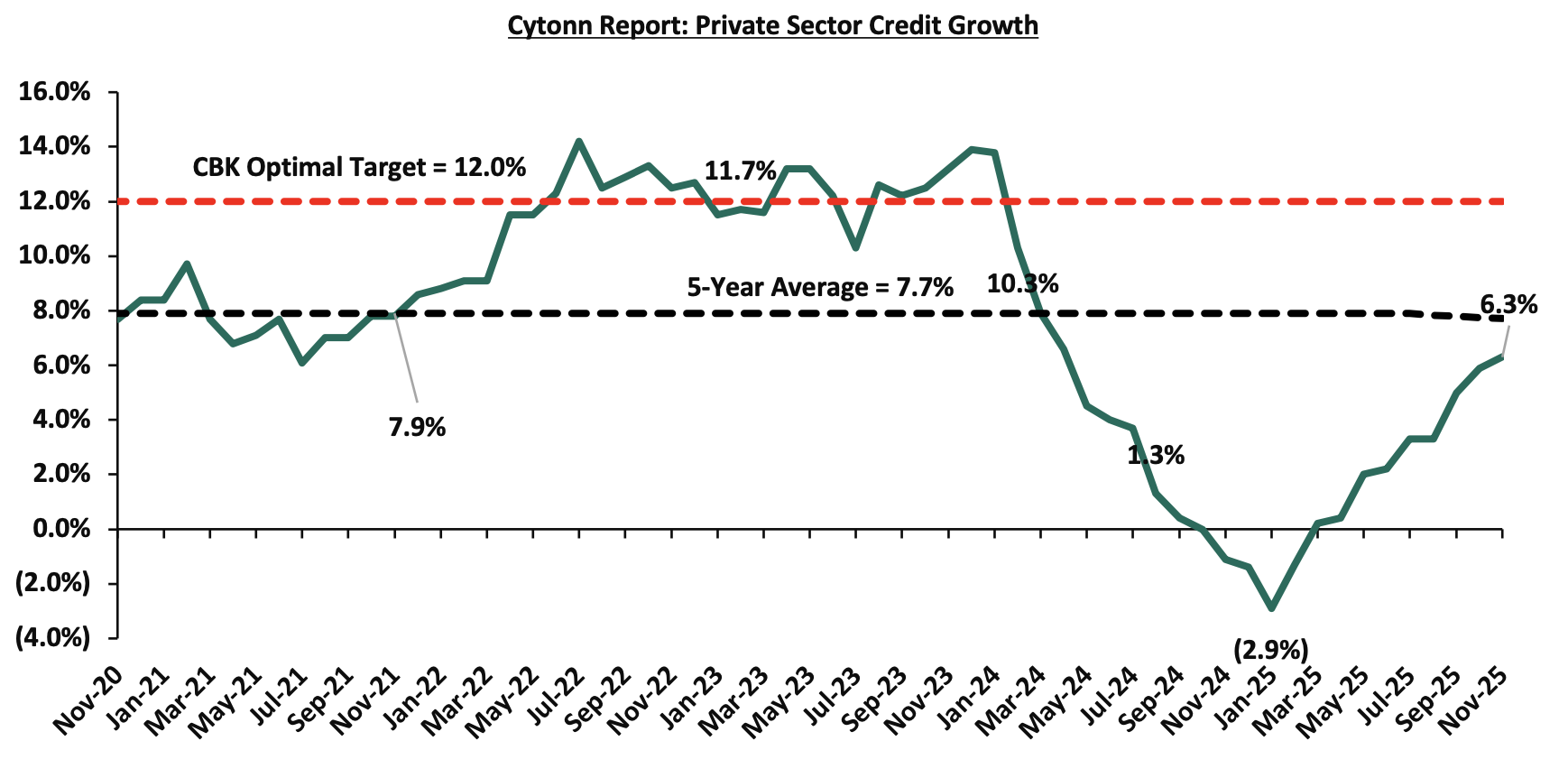

- Eased monetary policy – In 2025, the Monetary Policy Committee (MPC) lowered the Central Bank Rate (CBR) by a total of 175.0 bps from 10.75% in February to 9.00% in December in a bid to support the economy, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary pressures. We expect the MPC to continue lowering the rates gradually in the short to medium term therefore lowering borrowing costs, leading to increased spending and an uptick in the business environment. Further, this is expected to support private sector credit growth, which, despite recent improvements, has remained in single digits, at 6.3% in November 2025, after recording negative growth rates from November 2024 to February 2025. The low CBR is also expected to support overall economic growth, and,

- Gradual increase in access to credit: During the first 11 months of 2025, private sector credit growth rate averaged 2.2%, significantly lower than the 4.7% average growth rate recorded over the same period in 2024. This decline occurred despite the CBK's aggressive monetary easing, with the CBR cut to 9.0% from 13.0% through nine consecutive reductions since August 2024. The weak credit growth reflects the lagged transmission of monetary policy to actual lending rates, with commercial banks slow to reduce their lending rates in line with CBR cuts, as well as lingering caution from the higher interest rate environment that prevailed through much of 2024. Despite this decline, we anticipate an expansion of credit to the private sector driven by, the expansionary monetary policy stance by the Central Bank of Kenya, policy initiatives such as the MSMEs Credit Guarantee Scheme and the ongoing economic revival. Additionally, we expect the renewed focus on Public-private Partnerships (PPP) to finance commercially viable projects to spur growth in the private sector. Furthermore, with the expected reduction in credit risk and a decline in yields in the short-term government papers, we expect the banking sector to increase its lending to the private sector in search of better yields following the adoption of risk-based lending. The chart below shows 5-year private sector credit growth:

Source: CBK

However, key risks threaten economic growth including:

- High Risk of Debt Distress: According to International Monetary Fund and the World Bank, Kenya is currently at risk of high debt distress with the country’s debt to GDP ratio coming in at 67.7% as at June 2025, 17.7% points above the recommended IMF threshold of 50.0% for developing countries. Additionally, Kenya’s debt stood at Kshs 12.3 tn as of November 2025, 12.8% higher than the Kshs 10.9 tn debt recorded over a similar period in 2024. Consequently, the government will face significant pressure to service the existing debt with the debt service to revenue ratio standing at 75.3% as of December 2025, 45.3% points above the 30.0% threshold recommended by the IMF. Economic growth potential diminishes when debt levels are high because a significant part of the revenue is allocated towards servicing the existing debt, leaving less for developmental spending, and,

- Rising Inflationary Pressures – The country’s inflation rate averaged 4.1% in 2025, remaining within and falling below the mid-point of the CBK’s target range of 2.5%-7.5%. Despite the improvement recorded in 2025, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2026, weighing down the business environment.

- Currency:

The Kenya Shilling appreciated by 0.2% against the US Dollar to close at Kshs 129.0 in 2025, compared to Kshs 129.3 at the end of 2024 a significant moderation from the 17.4% appreciation recorded in 2024. This stability has been achieved despite significant global shocks including US trade tariffs and Middle East conflicts, underscoring the strength of Kenya's foreign exchange management framework.

Going forward, we expect the shilling to trade against the US dollar within a range of Kshs 129.0 and Kshs 132.0 by the end of 2026.

The Kenyan shilling will be supported by:

- Improving diaspora remittances standing at a cumulative USD 5,036.7 mn in the 12 months to December 2025, 1.9% higher than the USD 4,945.2 mn recorded over the same period in 2024. In the December 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.3% in the period. In 2026, diaspora remittances are set to improve further, mainly driven by the recovery of the global economy, increasing Kenyan population in the diaspora, and advancing technology that has facilitated easier transfer of money,

- Improving forex reserves currently at USD 12.5 bn (equivalent to 5.4-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover. Forex reserves improved by a significant 32.3% to USD 12.5 bn (equivalent to 5.4 months of import cover) in January 2026, from USD 9.2 bn (equivalent to 4.0 months of import cover) in a similar period in 2024. The rise is largely attributed to the Eurobond buyback program of the USD 900.0 mn tranche maturing in 2027 in February 2025, which alleviated the country’s credit risk and increased dollar supply in the market. This was further supported by reduced debt service obligations, aided by the stability of the Kenyan shilling, and,

- The Central Bank has demonstrated exceptional capability in managing liquidity conditions to support exchange rate stability. In 2025, the CBK mopped up a cumulative Kshs 9.2 tn in liquidity from the banking sector through repurchase agreements (repos) and term auction deposits (TADs). This strategic liquidity management came at a time when the CBK was actively purchasing dollars from the market to build reserves, with the liquidity mop-up preventing excess shilling supply that could have weakened the currency. The CBK's sophisticated use of open market operations, including repos, reverse repos, and TADs, demonstrates its ability to maintain optimal liquidity conditions that support currency stability.

The Kenyan shilling will however face the following challenges:

- An ever-present current account deficit which came in at 2.2% of GDP in the twelve months to October 2025, a deterioration from the 1.5% deficit recorded in a similar period in 2024. The persistent current account deficit reflects the country’s reliance on imports which has resulted in increased demand for foreign currency which continues to put more strain on the local currency,

- The low interest rates, with the Monetary Policy Committee reducing the CBR to 9.00% in its last sitting, extending its expansionary monetary policy stance, noting that its previous measures had successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5% and stabilized the exchange rate. The lower rates pose a challenge to the Kenyan Shilling, increasing pressure on the currency’s stability due to reduced attractiveness for foreign investors, especially in the face of sustained external borrowing needs and global market fluctuations,

- Elevated risk of increase in global crude oil prices as a result of supply chain constraints following the rising geopolitical tension in South America. Consequently, the possible rise in global oil prices is set to increase demand for the US Dollar by oil and energy importers, as well as manufacturers against a low supply of US Dollar currency, and,

- The high debt servicing costs which continue to put pressure on forex reserves. Notably, the debt service to revenue ratio stood at 75.3% as of December 2025, 60.3% points above the 30.0% threshold recommended by the IMF, and 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025.

- Ever since the Covid-19 pandemic, Kenya had benefited from near-continuous financing from the IMF and World Bank, supporting fiscal stability and reforms. However, in 2025, both lenders froze funding, USD 750.0 mn in World Bank DPO financing was suspended, and the IMF terminated its multi-year programme, due to Kenya’s failure to meet key prior actions, including amendments to the Competition Act, Treasury Single Account, e-procurement, and other policy reforms. Despite this, the outlook for 2026 is more positive, as Kenya is actively engaging with both institutions to unlock funding, progress has been made on reforms, and record-high forex reserves of USD 12.5 bn provide a strong buffer against liquidity pressures, improving the likelihood of IMF and World Bank support compared to 2025.

We expect the shilling to remain within a range of Kshs 129.0 and Kshs 132.0 against the USD by the end of 2026 with a bias towards a 2.3% depreciation by the end of the year.

- Inflation:

In 2025, the average inflation rate in the country was 4.1%, marking 0.4% points decrease from the average inflation rate of 4.5% witnessed in 2024. Notably, the y/y inflation rate remained unchanged in December 2025 at the 4.5% recorded in November 2025. Key to note, the overall inflation rates throughout 2025, remained within the Central Bank’s target range of 2.5% and 7.5%, hitting its lowest in January 2025 at 3.3%. Despite the improvement recorded in 2025, we expect the inflation rate to remain relatively stable in the short term, but face upward pressure in the medium to long term during 2026, given that the current fiscal measures do not address the cost-driven inflation, in addition to a ripple effect of the current expansionary monetary stance.

We expect inflation to average 5.0% in 2026, within the government target range of 2.5% - 7.5%. Key risks driving inflationary pressure are the high electricity prices, fuel costs, and exchange rate fluctuations on the Kenyan shilling.

- Interest Rates:

The Central Bank of Kenya (CBK) is expected to continue with the expansionary monetary policy stance in the short-to-medium term attributable to a stronger and stable currency and the eased inflation currently below the mid-point of the CBK’s preferred target of a range of 2.5% - 7.5%. The 9.00% Central Bank Rate (CBR) set in December 2025 marks the lowest level since January 2023. In the short term, we anticipate the Central Bank of Kenya (CBK) will adopt a more cautious approach to rate adjustments as it evaluates the performance of the local currency and inflation trends. However, in the medium term, there is potential for further reductions in the CBR to stimulate private sector credit growth, which, despite recent improvements, has remained in single digits, at 6.3% in November 2025, after recording negative growth rates from November 2024 to February 2025.

Despite the projected marginal increase in borrowing by 1.6% to Kshs 901.0 bn in FY’2025/2026 from Kshs 887.2 bn in FY’2024/25, Kenya still has an ever-present fiscal deficit, projected at 4.8% of GDP in FY’2025/26. As such, we expect the government to continue borrowing aggressively from both the domestic and foreign markets, given that the government is already ahead of its total net domestic borrowing target of Kshs 634.8 bn in FY’2025/26. The escalating debt service due to further borrowing will persistently burden the government, compelling it to borrow more to cover the maturing debts. However, the interest rate environment is expected to stabilize in the medium term as the government receives a boost from concessional loans from the IMF and the World Bank, improving the country’s credit outlook.

The table below summarizes the various macroeconomic factors and their possible impact on the business environment in 2026. With two indicators assessed as negative, two as neutral, and three as positive, the general outlook for the macroeconomic environment in 2026 is NEUTRAL.

|

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

|

|

|

Macro-Economic Indicators |

2026 Outlook |

2026 Outlook |

Previous Outlook (2025)

|

|

Government Borrowing |

· On the domestic front, we expect the government to borrow aggressively from the domestic market as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 923.3 bn in the FY’2025/26 budget, 4.8% of the GDP. The government intends to plug this fiscal deficit through Kshs 287.7 bn in external financing and Kshs 635.5 bn in domestic borrowing. Borrowing domestically is less costly for the government than acquiring debt denominated in foreign currencies, which not only carry higher interest rates but also come with the added risk of currency fluctuations. · In our view, the level of foreign borrowing is likely to remain elevated in 2026 due to several key factors: (i) the continued need to service and refinance external obligations, including upcoming maturities such as the USD 1.0 bn Eurobond due in February 2028, even after partial buybacks of 2027 and 2028 bonds in 2025 that helped ease near‑term refinancing pressures and extend maturities; (ii) ongoing negotiations and prospects for additional financing from the International Monetary Fund (IMF), as Kenya has requested a new IMF support programme following the expiration of its previous ECF/EFF arrangements, which could provide much‑needed concessional funds to support macroeconomic stability and external obligations; and (iii) planned disbursements and new commitments from multilateral lenders, including the World Bank Development Policy Operations and commercial financing arrangements, as well as innovative instruments such as sustainability‑linked bonds and debt‑for‑food‑security swaps that are expected to be executed by early 2026 to diversify external funding sources and support development priorities. · On revenue collection, we expect continued improvement in 2026 due to the raft of measures the new administration has put in place to boost tax collection such implementation of the Finance Act 2025 which is geared towards expanding the tax base and increasing revenues through sealing revenue leakages to meet the government’s budget for the fiscal year 2025/2026 of Kshs 4.2 tn, as well as reduce the budget deficit and borrowing. · In 2026, the government’s revenue outlook is expected to remain constrained, reflecting limited scope for further tax hikes amid political pressures ahead of the August 2027 General Election and the lingering impact of youth-led protests. The National Treasury has revised down its tax revenue target, acknowledging subdued tax performance driven by compliance gaps, administrative challenges, and revenue-reducing measures under the Finance Act, 2025. Consequently, revenue mobilisation efforts are likely to lean more heavily on non-tax measures, enhanced tax administration, and asset disposals, even as easing the tax burden to placate the electorate risks widening the fiscal deficit and weighing on overall revenue growth. |

Negative |

Negative |

|

Exchange Rate |

• We expect the Kenyan shilling to trade within a range of KSh 129.0 to KSh 132.0 against the USD by the end of 2026, reflecting a moderate depreciation bias amid ongoing external and domestic pressures. The currency is likely to remain under pressure due to several factors. (i), a persistent current account deficit continues to generate strong demand for foreign currency, placing sustained strain on the shilling. (ii) external debt obligations, including upcoming Eurobond maturities in 2027 and 2028, even after the partial buybacks conducted in 2025, continue to weigh on foreign exchange reserves, requiring careful management of inflows and outflows. (iii) Kenya remains vulnerable to global commodity price shocks, particularly crude oil, as geopolitical tensions in key oil-producing regions could lead to sudden price spikes that increase import costs and strain reserves. (iv) while U.S. interest rates are easing, the dollar’s continued strength against emerging market currencies has sustained pressure on the shilling • On the positive side, strong diaspora remittances remain a key stabilizing factor, providing a steady source of foreign currency inflows that support domestic liquidity. These inflows are likely to moderate depreciation pressures and help maintain relative stability in the currency. While short-term volatility may persist due to external shocks and market sentiment, the overall outlook for the shilling in 2026 remains cautiously stable, reflecting a balance between persistent external pressures and supportive inflows from remittances and external financing. |

Neutral |

Neutral |

|

Interest Rates |

• Given the expansionary monetary policy stance maintained in 2025, we expect the Monetary Policy Committee (MPC) to continue accommodative measures in 2026, aimed at supporting economic growth and stimulating private sector activity while carefully monitoring inflation and the shilling’s performance. The yield curve is expected to remain relatively stable, as lower policy rates reduce short-term borrowing costs, encouraging investment and consumption without triggering excessive inflationary pressures • On the macroeconomic front, expansionary monetary policy is likely to bolster domestic demand, particularly in the manufacturing and services sectors, while providing liquidity to credit-constrained businesses. However, external vulnerabilities, including currency pressures from persistent current account deficits and potential commodity price shocks (notably crude oil), may continue to pose risks to inflation and reserves. The combination of accommodative monetary policy, prudent debt management, and supportive external financing is therefore expected to maintain a balanced environment, encouraging growth and investment while containing external and inflationary pressures. Overall, the outlook suggests a predictable interest rate environment, improved credit conditions, and continued resilience in Kenya’s macroeconomic framework throughout 2026. |

Positive |

Positive |

|

Inflation |

• We expect inflation to average 5.0% in 2026, remaining comfortably within the government’s target range of 2.5%–7.5%. The primary drivers of inflation are high electricity tariffs and elevated fuel costs, which increase production and transport expenses across the economy. In addition, the Central Bank of Kenya’s (CBK) accommodative monetary policy stance is contributing to inflationary pressures by sustaining domestic demand and increasing liquidity in the financial system. Overall, the combination of persistent cost-push factors and a demand-supportive monetary environment is expected to keep inflation moderately elevated, though still within the target range, allowing policymakers to balance growth objectives with price stability throughout 2026. |

Neutral |

Neutral |

|

GDP |

• We anticipate the economic growth to continue on its recovery trajectory in 2026, with the GDP growth rate ranging between 5.2% - 5.5%. We expect the GDP growth to be supported by the continued recovery of the agricultural sector and a robust performance in the services sector driven by growth in information and technology as well as accommodation and food services as a result of increased tourism. However, there are several risks could potentially hinder this growth such as the high risk of debt distress, elevated inflationary pressures and currency depreciation. |

Positive |

Neutral |

|

Investor Sentiment |

• We expect the high positive investor sentiments witnessed in 2025 to persist through the short to medium term of 2026, mainly due to; i) Anchored inflationary pressures driven by reduced fuel costs, ii) Stability of the Kenyan currency as a result of decreased dollar demand from importers, especially for oil and energy sectors, and iii) Recovery of the private sector as the low interest rate environment reduces borrowing costs leading to an uptick in the business environment. |

Positive |

Positive |

|

Security |

• We expect 2026 to be characterized by heightened political activity and tensions as the country enters the pre-election period ahead of the August 2027 general elections. Political positioning, coalition building, early campaign activities, and intensified competition among political actors are expected to create significant uncertainty and potential disruptions to the business environment |

Negative |

Negative |

The change from last year’s outlook is:

- GDP outlook revised to Positive from Neutral, supported by stronger-than-expected economic performance in 2025, easing monetary conditions following cumulative policy rate cuts, and improving macroeconomic stability marked by anchored inflation and a stable Kenyan shilling. These factors are expected to enhance private sector credit uptake and sustain the recovery momentum into 2026.

Out of the seven metrics that we track, two have a neutral outlook, two have a negative outlook, and three have a positive outlook, compared with last year when three were neutral, two were negative, and two were positive. While the number of positive metrics has increased, our general outlook for the macroeconomic environment remains NEUTRAL for 2026, unchanged from 2025. The composition of the outlook remains balanced, with improvements in currency stability and interest rate normalization being offset by persistent challenges, including elevated debt levels, constrained multilateral financing, and heightened political uncertainty as the country enters the pre-election period ahead of the August 2027 general elections