Dec 15, 2019

This week, we revisit the interest rate cap topic following the Presidential assent of the Finance Bill, 2019 into law, which repealed Section 33B of the Banking Act that provided for the capping of bank interest rates. We, therefore, revisit the issue of the interest rate cap, focusing on:

- Background of the Interest Rate Cap Legislation - What Led to its Enactment?

- A Recap on our Analysis on the Subject,

- A Review of the Effects It Has Had So Far in Kenya,

- Recent Developments,

- Our Expectations Going Forward, and Conclusion.

Section I: Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

The enactment of the Banking (Amendment) Act 2015 in September 2016, that capped lending rates at 4.0% above the Central Bank Rate (CBR), and deposit rates at 70.0% of the CBR, came against a backdrop of low trust in the Kenyan banking sector due to reasons such as:

- The total cost of credit was high, at approximately 17.7% per annum in August 2016. However, there was a notable decline to 16.6% per annum on average in FY’2016, after the rate cap was introduced, yet on the other hand, the interest earned on deposits placed in banks was still low, at approximately 7.1% per annum,

- Calls for capping interest rates were based on the high profitability in the banking sector because of high spreads between lending rates and deposits rates, which in 2016 was at a high of 9.5% according to the World Bank. As a result, in 2016, the Return on Equity of Kenyan banks stood at 24.5% above the 5-year Sub Saharan Africa (SSA) average of 15.4%. The Return on Assets, on the other hand, stood at 3.1%, above the 5-year SSA average of 1.5%, according to the IMF, and,

- The period was marred with several failures of banks such as Chase Bank Limited, Imperial Bank Limited and Dubai Bank, due to failures in corporate governance. The failure of these banks rendered depositors helpless and unable to access their deposits in these banks, leading to negative public sentiment that necessitated regulatory action in the banking sector.

Section II. A Recap on Our Analysis on the Subject

Our view has always been that the interest rate cap regime would have an adverse effect on the economy and by extension to Kenyans, and as popular as the regulation was, it needed to be repealed as highlighted in our previous reports as highlighted below:

- Interest Rate Cap is Kenya's Brexit- Popular But Unwise, dated 21st August 2016, highlighted our view that the interest rate cap would have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, emphasized by the lack of compelling evidence of an economy where interest rate capping was successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing alternative products and channels. Below is a schedule of examples in Africa and what became of the rate caps:

|

Status of Interest Rate Caps in Sub Saharan Africa |

||

|

Country |

Year Implemented |

Status |

|

1. West Africa Economic & Monetary Union (WEAMU) |

1997 |

Still in effect with maximum interest rates chargeable by banks & MFIs |

|

2. Ethiopia |

1998 |

Still in effect for minimum deposit rates |

|

3. South Africa |

2007 |

Still in effect for different loan sub-categories with their own interest rates |

|

4. Zambia |

2012 |

Abolished capping in 2015 |

|

5. Monetary Community of Central Africa (CEMAC) |

2012 |

Still in effect with maximum interest rates chargeable by MFIs |

|

6. Kenya |

2016 |

Abolished capping in November 2019 |

|

7. Nigeria |

2017 |

Maximum cap on bank mortgages removed in September 2019 |

- Our second topical, Impact of the Interest Rate Cap, dated 28th August 2016, four days after the interest rate cap bill was signed into law, highlighted the immediate effects of the interest rate cap, as banking stocks lost 15.6% in 2-days. Having wrongly predicted that the President would never sign the rate cap Act into law , we re-iterated our stance on the negative effects of the interest rate cap, while identifying the winners and losers of the Banking (Amendment) Act 2015,

- The State of Interest Rate Cap, dated 14th May 2017, 9-months after the interest rate cap was signed into law, we assessed the interest rate cap and its effects on private sector credit growth, the banking sector, and the economy in general, following concerns raised by the IMF. We noted that the law had the effect of (i) inhibiting access to credit by SMEs and other “small borrowers” whom banks cited as being “risky”, and were unable to be fitted within the 4.0% margin imposed by the Law, and (ii) contributing to subdued private sector credit growth, which was recorded at 4.0% by March 2017. We suggested that policymakers ought to review the legislation, highlighting that there existed opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow, and consequently improve private sector credit growth,

- In the Update of Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated 23rd July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, we analyzed the macroeconomic performance, on the back of the rate cap, the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was still higher than the legislated 14.0%, as banks loaded excessive additional charges, while noting that the large banks, which control a substantial amount of the banking sector loan portfolio, were the most expensive. We suggested (i) A repeal or modification of the interest rate cap, (ii) Increased transparency on credit pricing, (iii) Improved and more accommodating regulation, (iv) Consumer education, (v) Diversification of funding sources into alternatives, and (vi) Enhanced consumer protection,

- In our note titled The Total Cost of Credit Post Rate Cap, dated 14th January 2018, we analyzed the true cost of credit, the initiatives put in place to make credit cheaper and more accessible, the impact of the interest rate cap on private sector credit growth, and we gave our view on what more can be done to remedy the effects of the interest rate cap, which included to implement strong consumer protection agencies and frameworks, and to diversify funding sources to include alternative products and channels,

- In Rate Cap Review Should Focus More on Stimulating Capital Markets, dated 13th May 2018, we revisited the interest rate cap following an announcement by the Treasury that they were in the process of completing a draft proposal that will address credit management in the economy, where we gave our views on how promoting competing sources of financing would lead to a self-pricing regulatory structure, which would effectively reduce credit prices, as opposed to relying on bank funding,

- In our note on the Status of the Rate Cap Review in Finance Bill 2018, 26th August 2018, we revisited the interest rate cap topic following the proposed amendments to the Finance Bill, 2018, tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its second reading. In this focus, we highlighted that legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation,

- In our focus note Review of the Interest Rate Cap, dated 23rd June 2019, we revisited the interest rate cap topic following the proposal by the then, National Treasury Cabinet Secretary, Mr. Henry Rotich, in the Budget reading for the 2019/20 fiscal year, to repeal Section 33B of the Banking Act, which was included in the Finance Bill, 2019. In this focus, we discussed policy measures that can protect borrowers from excessive interest rates, including consumer education and protection measures, as well as promoting capital markets infrastructure to spur competition in the credit market through non-bank funding,

- In End of Interest Rate Caps?, dated 20th October 2019, we revisited the interest rate cap following the recommendation by President Uhuru Kenyatta to repeal the Interest Rate Cap, in a memorandum to Parliament in which he declined to assent the Finance Bill, 2019 into law, where we gave our views on how the economy would be impacted by the repeal of the cap. We highlighted that we expect to see a growth in private sector credit, higher GDP growth and increased monetary policy effectiveness.

Section III: A Review of the Effects It Has Had So Far in Kenya

The interest rate cap has had the following five key effects to Kenya’s Economy since its enactment, most of them clearly negative, save for spurring alternative financial services channels, which we believe will have long-term positive effects:

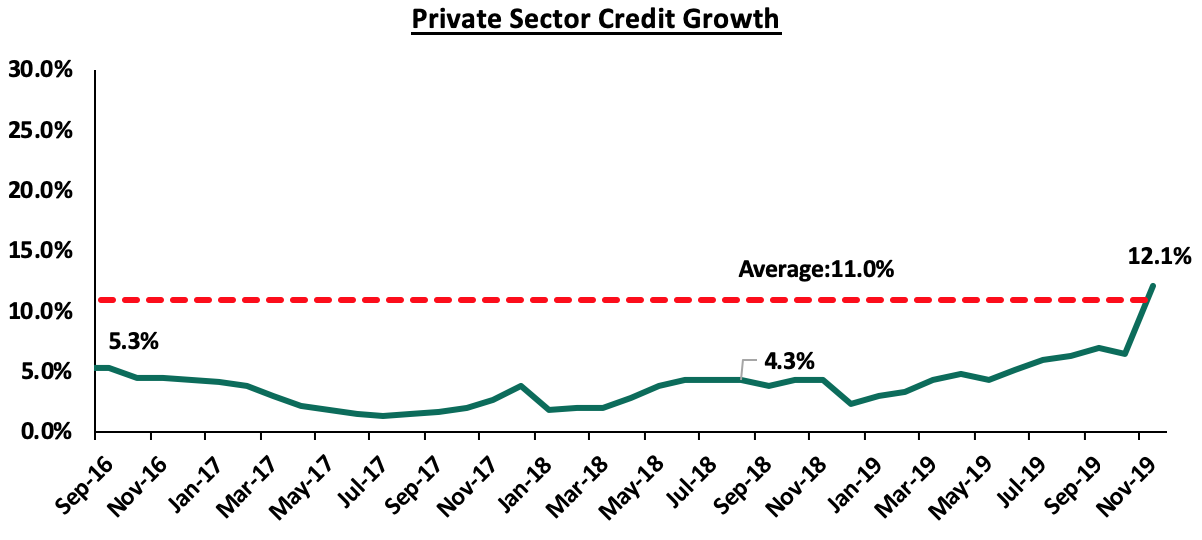

- Private Sector Credit Crunch

Private sector credit growth in Kenya has been declining, and the enactment of the Banking (Amendment) Act 2015, had the adverse effect of further subduing credit growth. The lending to MSMEs by banks declined to a low of 15.8% of the total banking sector loan portfolio in 2018, from a high of 23.4% in 2013 on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Banks thus invested in asset classes with higher returns on a risk-adjusted basis, such as government securities. Investment in government securities increased by 19.0% to Kshs 1,188.4 bn, from Kshs 998.4 bn recorded in 2017. Private sector credit growth touched a high of 25.8% in June 2014, and averaged 11.0% over the last five-years, but dropped to below 5.0% after the implementation of interest rates controls, rising slightly to 6.6% in October 2019. However, after the repeal of the rate cap, private sector credit growth improved to 12.1% of November 2019. The chart below highlights the trend in private sector credit growth.

- Loan Accessibility Reduced

Following the enactment of the Banking (Amendment) Act, 2015, banks recorded a rise in demand for loans, as did the number of loan applications, which increased by 20.0% in Q4’2016, according to the CBK Credit Officer Survey of October-December 2016. This was on account of borrowers attempting to access cheaper credit. However, the supply of loans by banks did not meet this rise in demand as evidenced by:

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth declined by 7.7% since the implementation of the interest rate cap law to Kshs 2,013.6 bn, from Kshs 2,182.6 bn recorded in December 2016,

- The Decline in the Number of Loan Accounts: The number of loan accounts in large banks (Tier I) declined by 27.8%, the largest among the three tiers, followed by Tier II banks with a decline of 11.1% between October 2016 and June 2017,

- Increase in Average Loan Size: Despite a 26.1% decline in the industry’s number of loan accounts between October 2016 and June 2017, the average loan size increased by 36.3% to Kshs 548,000, from Kshs 402,000 between October 2016 and June 2017. This points to lower credit access by smaller borrowers, while also demonstrating that credit was extended to larger and more “secure” borrowers, and,

- Decrease in Average Loan Tenures: The average loan tenure declined by 50.0% to 18-24 months compared to 36-48 months prior to the introduction of the interest rate cap. This is due to bank’s increasing their sensitivity to risk, thereby opting to extend only short-term and secured lending facilities to borrowers, rather than longer-term loans to be used for investments, according to the latest survey by the Kenya Bankers Association (KBA) on the effects of the Banking (Amendment) Act, 2015.

- Banks’ Changed their Operating Models to Mitigate the Effects of the Rate Cap Legislation

The enactment of the Banking (Amendment) Act, 2015, saw banks changing their business and operating models to compensate for reduced interest income (their major source of income) as a result of the capped interest rates. This saw banks adapt to the tough operating environment by adopting new operating models through:

- Increased Focus on Non-Funded Income (NFI): This is evidenced by the fact that the proportion of non-interest income to total income stood at 28.4% in September 2016, and has risen to the current average of 38.0%, for listed commercial banks as at Q3’2019,

- Increased Lending to the Government Rather than the Private Sector: This is evidenced by the growth in allocations to government securities by 15.1% in the year after implementing the interest rate cap, compared to the 7.7% decline in loans, as government securities rose to 24.9% of total banking sector assets in FY’2017, from 23.4% prior to the caps. Q3’2019 saw a slower growth in government securities to come in at 3.3%, outpaced by the 11.6% loan growth,

- Cost Rationalization: Banks also stepped up their cost rationalization efforts by increasing the use of alternative channels by mainly leveraging on technology such as mobile money and digital banking to improve efficiency and consequently reduce costs associated with the traditional brick and mortar approach. This led to the closure of branches and staff layoffs in a bid to retain the profit margins in the tough operating environment, due to depressed interest income, which saw the cost to income ratio excluding loan loss provisions for the listed commercial banks in Q3’2019 come in at 49.4%, down from 59.4% recorded in 2015, and,

- Focus on Niche Segments: The implementation of the law saw the larger banks venture into the small banks’ niche markets, and consequently, most of the Tier II and Tier III banks have struggled to operate. The smaller banks have witnessed declining top-line revenue, leading to increased operational inefficiency, and operating losses; this has led to depleted capital, spurring an increase in the consolidation activity in the banking sector, which has seen smaller banks struggling to operate being acquired, merging or forming strategic relationships with larger banks in order to leverage on the synergies created.

- The Proliferation of Alternative Credit Markets

As a result of the private sector credit crunch, there was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels, up from 71.4% in 2016. According to Global Digital, in 2018 there were about 6.1 mn digital borrowers in the country coupled with 28.3 mn unique mobile users (which represents one installation of a mobile application). Players in this segment charge exorbitant interest rates, e.g. M-Shwari charges a facilitation fee of 7.5% on amounts borrowed, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a monthly rate of 15.0%, with the annualized rates varying between 132.0% and 152.0%. While the immediate effects of these alternative channels has been predatory, we believe that the investments and progress made in developing the alternative channels will have positive long-term impact as an alternative financials services channel once the sector becomes regulated.

- Reduced Effectiveness of the Monetary Policy

Through its assessment of the impact of the interest rate cap in the rate cap era, the Monetary Policy Committee had noted that the implementation of the interest rate cap had weakened the transmission of monetary policy and thus had made it difficult for the CBK to adjust the monetary policy rates in response to economic developments. Before the interest rates were capped, the CBK was able to adjust the Central Bank Rate (CBR) in relation to changes in inflation and GDP growth. This is mainly because any alteration to the CBR would directly affect credit conditions. Expansionary monetary policy thereafter was difficult to implement since lowering the CBR had the effect of lowering the lending rates and as a consequence, banks found it even more difficult to price for risk at the lower interest rates, leading to pricing out of more risky borrowers, and hence further reducing access to credit. On the other hand, if the CBK was to employ a contractionary monetary policy, so as to reduce inflation and credit growth for example, then raising the CBR would have the reverse effect of increasing the supply of credit in the economy since banks would be able to admit riskier borrowers.

Section IV: Recent Developments

Presidential assent of the Finance Bill, 2019

The Finance Bill, 2019 was signed into law on 7th November, 2019, repealing section 33B of the Banking Act which provided for the capping of interest rates at 4.0% above the Central Bank Rate, pursuant to the failure of the National Assembly to raise a two-thirds majority to overturn President Uhuru Kenyatta’s memorandum to repeal the interest rate cap. The President’s decision to repeal the interest rate cap was on the back of the following reasons:

- Reduction of Credit to the Private Sector, Particularly the Micro, Small and Medium Enterprises (MSMEs). In the first year following the introduction of the interest rate cap, the stock of credit to MSMEs declined sharply by 10% y/y on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Most commercial banks adjusted their lending towards large corporates and the public sector.

- A Decline in Economic Growth. The crowding out of the private sector, especially the MSMEs is estimated to have lowered Kenya’s economic growth by 0.4% points in 2017, and 0.2% points in 2018, as Kenya’s GDP growth came in at 4.9% and 6.3% in 2017 and 2018, respectively.

- Weakening Effectiveness of Monetary Policy Transmission. A recent analysis by the CBK on the impact of interest rate capping showed a slowdown in the monetary policy transmission to growth and inflation. Monetary policy transmission takes 3-12 months to impact growth and 12-20 months to affect inflation, which is 3-5 months longer compared to the period before the introduction of interest rate capping. In addition, the analysis showed evidence of perverse outcomes following a monetary policy action, particularly a reduction in loan advances by some banks after a lowering of the Central Bank Rate (CBR), which is contrary to the expected outcome of an increase in credit extension after the adoption of expansionary monetary policy.

- Reduction in Loan Accessibility. Loan accessibility reduced following the introduction of the interest rate cap. According to the CBK’s Annual Banking Sector Supervision Report for 2017, loans and advances stood at Kshs 2.0 tn in FY’2017, a 7.7% decline from the Kshs 2.2 tn in loans at end of 2016. In addition, banks moved to increase the average loan size and decrease the average loan tenure, thus further lowering credit access to small borrowers. Furthermore, banks decreased the diversity of their loan products and withdrew lending to specific segments of the market.

- The Emergence of Shylocks and Other Unregulated Lenders. There was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels up from 71.4% in 2016. These unregulated lenders have taken advantage of the situation under the capped interest rates to lend to borrowers at exorbitant interest rates e.g. M-Shwari charges a facilitation fee of 7.5%, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a rate of 15.0%, which are very expensive when annualized.

Section V: Our Expectations Going Forward

With the repeal of the interest rate cap law, we expect to see the following benefits accrue to the economy:

- Private Sector Credit Growth: As of November 2019, the private sector credit growth rate improved to 12.1%, from 11.4% recorded in September according to the MPC market perception survey. With the repeal of the rate cap law, there is an anticipation of improved market liquidity, coupled with improved macroeconomic environment, which is expected to support higher credit growth. We expect that access to credit by Micro, Small and Medium Enterprises (MSMEs) will continue increasing as banks will have sufficient margin to compensate for risks, further supported by the removal of the floor on deposits in 2018 that reduced the cost of funding for banks. Private sector credit growth will also be supported by government efforts, including use of the loan facility ‘Stawi’, that enables businesses to access unsecured loans ranging from Kshs 30,000 to Kshs 250,000 from five commercial banks (NIC Group, KCB Group, Diamond Trust Bank Kenya (DTBK), Co-operative Bank Kenya and Commercial Bank of Africa (CBA), with a repayment period of between 1 – 12 months. Priced at 9.0% p.a, the credit product will help address MSMEs challenges such as access to formal credit because of the informal nature of their businesses and lack of collateral. Equity Bank lined up Kshs 150.0 bn for lending to small businesses despite the interest rate cap environment and the continued efforts to finance the SMEs saw the lender awarded as the best bank in SME banking. According to Equity Bank’s CEO, 72.0% of Equity Bank’s lending is dedicated to SMEs. We expect that banks will emulate this and increase their lending to MSMEs now that the policy has shifted in their favor,

- Increased Loan Accessibility: With the rate cap in place, banks recorded a rise in demand for loans on account of borrowers trying to access cheaper credit. However, banks did not meet the demand evidenced by reduced loan growth and a decline in the number of loan accounts by 27.8% for Tier I banks and 11.1% for Tier II banks between October 2016 and June 2017. With the repeal of the interest rate cap, we expect to see an increase in the number of loan accounts as banks are expected to increase credit access to smaller borrowers. The repeal has seen commercial banks increase aggressiveness in marketing retail loans to customers and we expect more banks to continue with this trend. We also expect an increase in the average loan tenures since banks will reduce their sensitivity to risk given that they will be able to price risk according to each borrower’s risk profile,

- Higher GDP Growth: Credit and economic growth are positively correlated and we expect that with increased access to credit by MSMEs, the economy is bound to expand as MSMEs make a significant contribution to the economy. According to data from the KNBS, MSMEs account for approximately 28.4% of Kenya’s GDP. The real GDP contracted by 0.2% points in 2016 on account of the slowdown in credit to the economy, owing to the interest rate cap, and according to the CBK, a 10.0% change in sectoral credit results in between 0.1%-0.2% changes in sectoral growth in the respective sectors. Therefore an increase in credit to the various sectors including the SMEs will increase the overall economic growth,

- Banks Will Change Operating Models to Accommodate Effects of the Rate Cap Repeal: The repeal of the cap law will see banks recording higher interest income levels, as banks increase access to credit. We also expect banks to keep leveraging on technology such as mobile banking to improve efficiency and consequently save on costs associated with the traditional approach despite the easing operating environment. According to the CBK, the average savings interest rates fell to a 36-month low of 4.6% in the 12 months to September, from 6.3% in the same month last year when Parliament made changes to the banking law to remove the floor on deposit interest rates at 70.0% of the CBR. Since the removal of the floor, lenders have been riding on cheap deposits to grow profits. With the interest rate cap repeal, banks are expected to ride on higher interest rates on loans in addition to the lower deposit interest rates to drive growth and increase profitability,

- Continued Growth of Alternative Credit Markets: In addition to the private sector credit growth, we expect to see continued growth in the alternative credit markets. While the immediate effects of the alternative channels have been deemed predatory, we believe that the investments and progress made in developing the alternative channels will have positive long-term impact as an alternative financial services channel once the sector becomes regulated. Even with the rate cap repeal, we still expect alternative credit markets to keep growing, supported by their ease of accessibility compared to regular bank loans. The Government in its need to regulate the sector in 2018, sponsored a Bill proposing the licensing and regulation of digital lenders in a bid to regulate entities that neither fall under the Banking Act nor Microfinance Act but the Bill is still pending in Parliament. Mobile lenders bridge the gap for Kenyans who do not have formal accounts or whose incomes do not allow them to borrow from other formal financial institutions so even if the bill is passed, we expect access to loans through these platforms to continue increasing,

- Increased Monetary Policy Effectiveness: With the repeal of the rate cap law, the Central Bank of Kenya is free to adjust the monetary policy rate in response to economic developments such as inflation and growth. This is evidenced by the decision of the MPC to lower the Central Bank Rate by 50 bps to 8.5%, from 9.0% at their last meeting in response to the new law. The CBK will be able to exercise its constitutional mandate of formulating and implementing expansionary or contractionary monetary policy, without affecting the ability of banks to price risk or admitting riskier borrowers, thereby controlling money supply in the economy,

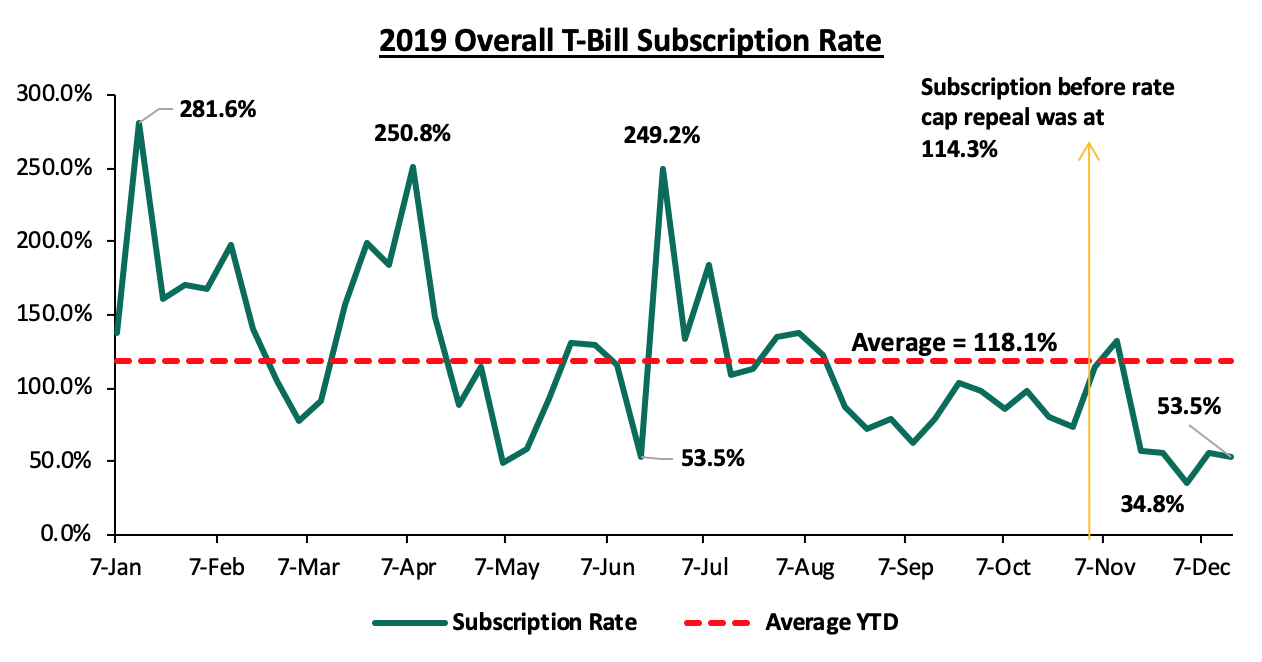

- Reduced Accessibility of Government Debt Locally: With the rate cap in place, banks preferred to lend to less risky borrowers including the government through the purchase of government securities, which saw high subscription rates on government securities. However with the rate cap repeal, we expect banks to increase their credit accessibility and admit riskier borrowers including SMEs and individuals, which will see a reduction in subscription rates for government securities. The subscription rate for government papers, has declined to 53.5%, from 123.2% recorded in 2018. The undersubscription is partly attributable to reduced participation by banks following the interest rate cap repeal, as banks are now looking to lend to the private sector. Below is a chart highlighting the performance through the year:

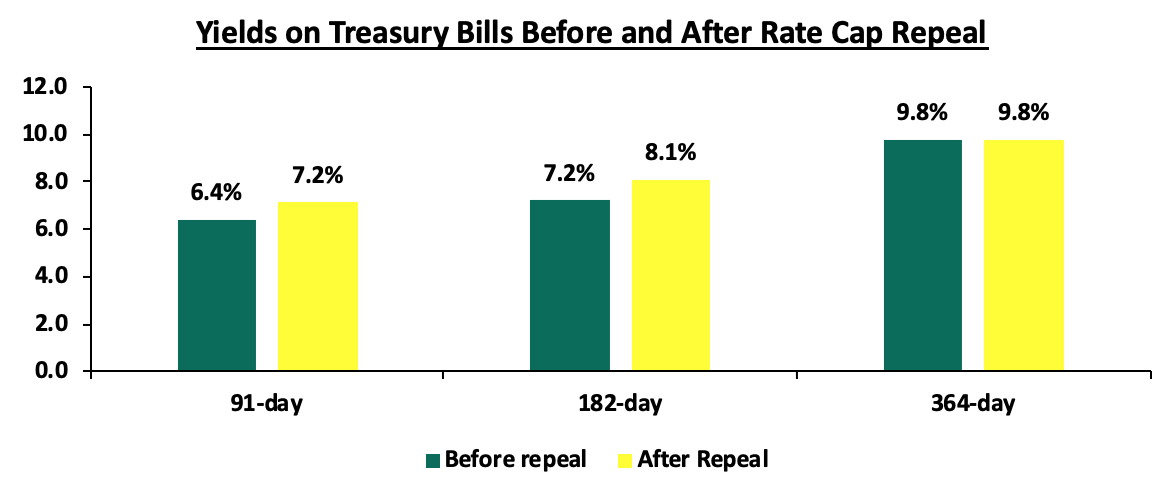

Yields on government securities has also been on the rise as the Government reprices its debt to make it attractive to lenders. Yields on government papers have increased between the period before the repeal, with the yield on the 91-day paper coming in at 7.2%, from 6.4%, yield on the 182-day paper increasing to 8.2% from 7.2% as well as the yields on the other long tenure bonds increasing to accommodate the impact of the removal of the ceiling on interest rates. If yields remain at lower levels, there will be reduced accessibility to government debt locally. Following the projected budget deficit of Kshs 689.3 bn in this financial year, equivalent to 6.4% of GDP, we expect increased pressure on the government debt front as it tries to meet its domestic debt target. This on the other hand is expected to put upward pressure on yields on government securities so as to incentivize investors to participate in the primary market. The chart below shows the yields for 91, 182 and 364-day papers immediately before rate cap repeal and post repeal:

- Increased Accessibility to Mortgages: The introduction of the interest rate cap in 2016 saw an increased demand for mortgage loans due to perceived affordability by borrowers. However, commercial banks introduced tighter credit standards so the actual mortgage disbursements were lower than the increased demand. Commercial banks also preferred investments in government securities under the cap legislation as compared to financing of mortgages. The value of mortgage loan assets outstanding increased by 0.8% to Kshs 224.9 bn in 2018, from Kshs 223.2% recorded the previous year. With the implementation of the affordable housing program by the government as part of its big 4 agenda, we expect to see a continued increase in the value of mortgage loan assets outstanding, due to increased appetite for home ownership. Although the rates charged for mortgages may be slightly higher, the increased accessibility to mortgage loans is expected to be supported by the Kenya Mortgage Refinance Company (KMRC), which is an initiative by the National Treasury to support the affordable housing agenda by providing secure long-term funding to the mortgage lenders, thereby providing liquidity and increasing affordability to borrowers. For more information on the mandate of the Kenya Mortgage Refinancing Company, see our Kenya Mortgage Refinancing Company Update.

Conclusion

The decision to repeal the rate cap law will be a boost to the economy because a free market, where interest rates are set by the forces of demand and supply coupled with increased competition from non-bank financial institutions for funding, will see a competitive environment with increased access to credit by borrowers and higher economic growth prospects, given that monetary policy tools will be more effective in response to the changing conditions.

Going forward, we do not expect banks to reprice loans taken during the rate cap era. According to the Kenyan Bankers Association, most banks will not readjust their new pricing on commercial loans since banks have accepted their risk profile as an industry, with the cost of credit being at 13.0%, offered before the law was overhauled. This comes as a relief to borrowers, who were concerned that there would be massive repricing on loans after the repeal of the interest rate cap. KCB Group also stated that commercial banks would behave responsibly and only raise rates for risky borrowers by only 2.0% or 3.0%. Commercial banks are still yet to validate their total cost of credit in response to the interest rate cap repeal.

However, we still recommend that we deal with two key outstanding issues of;

- Consumer Protection against Abuse by Banks, since the removal of the cap may set stage for the return of expensive loans that had risen to more than 25.0% before the rate cap. The Banking Sector Charter, a commitment from banks to practice responsible and disciplined banking cognizant of customer needs, is expected to aid in consumer protection in the easing operating environment for banks, and,

- Promoting Competing Alternative Funding Channels, which will further increase access to credit for borrowers who are unable to access formal loans from banks, due to the expected increase in banks’ loan books at the detriment of other loan providers post the rate cap era.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.