Cytonn Monthly - May 2019

By Cytonn Research Team, Jun 2, 2019

Executive Summary

Fixed Income

During the month of May, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 82.6%, a decline from 157.0% recorded in the month of April 2019, attributable to tightened liquidity in the market, evidenced by the rise in the average interbank rate to 5.5% in May, from 3.4% in April. The subscription rates for the 91-day, 182-day and 364-day papers came in at 77.9%, 27.6% and 139.4%, lower than the 137.5%, 88.2% and 233.6% registered in the previous month, respectively. The yields on the 91-day and 182-day papers declined by 0.2% points and 0.3% points, respectively, to 7.1% and 7.7%, while the yield on the 364-day paper remained unchanged at 9.3%. The Monetary Policy Committee (MPC) met on 27th May 2019 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the prevailing monetary policy stance leaving the Central Bank Rate (CBR) unchanged at 9.0%, which was in line with our expectations. The Y/Y inflation rate for the month of May declined to 5.5%, from 6.6% recorded in April, lower than our expectations of a decline to 5.8% - 6.2%, with the variance being as a result of a 0.4% m/m decline in the food and non-alcoholic beverages index against our expectations of a 0.2% decline;

Equities

During the month of May, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 4.7%, 4.3% and 7.5%, respectively, taking their YTD performance to gains / (losses) of 6.7%, (5.5%) and 1.8%, respectively. During the month, listed banks in Kenya released their Q1’2019 financial results, recording a core earnings per share increase of 10.6%, down from 14.4% in Q1’2018;

Private Equity

During the month of May, there was private equity activity in the financial services sector, with Mauritius based Bank One, in which Kenyan banking group I&M Holdings has a 50.0% stake, set to receive a USD 37.5 mn (Kshs 3.8 bn) loan from the International Finance Corporation (IFC). In fundraising, (i) Generation Investment Management, a Pan-African focused sustainable investment firm, announced the closing of a USD 1.0 bn (Kshs 101.3 bn) growth equity fund, Generation Sustainable Solutions Fund III, (ii) Kasada Capital Management, a Sub-Saharan hospitality investment platform, reached a close on its first fund, Kasada Hospitality Fund LP, having secured equity commitments of over USD 500.0 mn (Kshs 50.6 bn), (iii) Leapfrog Investments, an emerging markets-focused private equity firm, announced the close of its third Impact Fund (Fund III) at USD 700.0 mn (Kshs 70.0 bn), surpassing its USD 600.0 mn (Kshs 60.0 bn) target by 16.7%, and (iv) the International Finance Corporation (IFC) announced plans to invest USD 50.0 mn (Kshs 5.1 bn) in private equity firm, Helios Investment Partners, through Helios’s fourth fund, Helios Investors IV L.P;

Real Estate

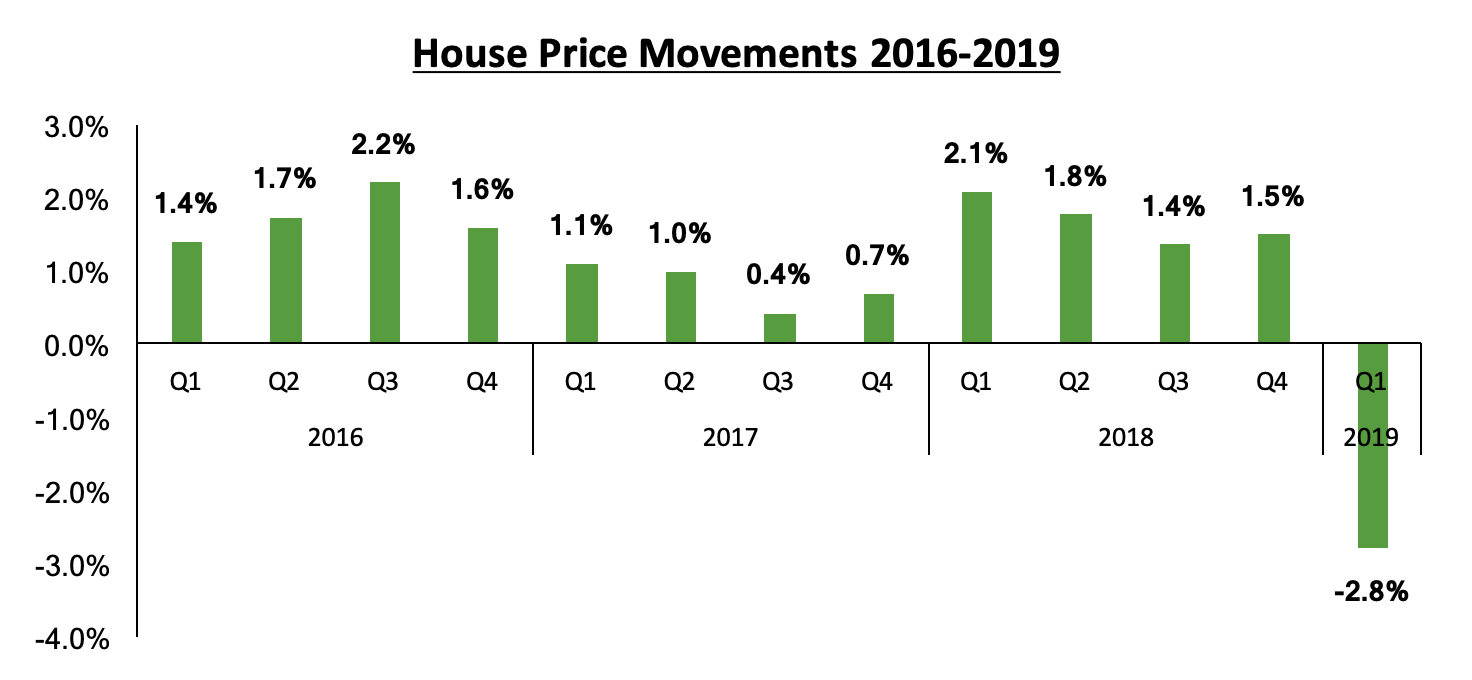

During the month of May, two real estate sector reports were released, namely the KBA-Housing Price Index, and Hotel Chain Development Pipelines in Africa 2019, by Kenya Bankers’ Association and W Hospitality Group, respectively. The residential sector recorded notable activity during the month, which included i) the launch of the Kenya Mortgage Refinancing Company (KMRC), after its successful mobilization of funds from the World Bank, African Development Bank (AfDB) and various local financial institutions, and ii) launch of various residential projects such as Habitat Heights in Mavoko to be undertaken by Singapura developers, a Singapore based firm; and King’s Serenity in Rongai by Kings Developers Limited. In the commercial office sector, Toshiba, a Japanese multinational firm, set up its first shop in East and Central Africa in Nairobi, while in the hospitality sector, Marriott’s Autograph Collection Hotels made its first debut in Kenya, taking over Nairobi’s Sankara Hotel located in Westlands as a franchise.

- In line with increasing the product offering to our clients, we are happy to announce that Cytonn Asset Managers has received two more licenses to offer personal retirement benefit scheme with a monthly payment platform from the Retirement Benefits Authority (RBA). The licenses allow Cytonn Asset Managers to; manage segregated funds, personal pension funds and the income drawdown fund. https://bit.ly/2K6xs6u. For more information on the pension products, email us at pensions@cytonn.com;

- Interested in learning about real estate investments in a relaxing environment next weekend? Be sure to stop by our stand at The Hub, on the 8th and 9th June 2019 from 9:00 am - 6:00 pm and start your investments journey;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

T-Bills & T-Bonds Primary Auction:

During the month of May, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 82.6%, a decline from 157.0% recorded in the month of April 2019, attributable to tightened liquidity in the market, as evidenced by the rise in the average interbank rate to 5.5% in May, from 3.4% in April. The subscription rates for the 91-day, 182-day and 364-day papers came in at 77.9%, 27.6% and 139.4%, lower than the 137.5%, 88.2% and 233.6% registered in the previous month, respectively. The yields on the 91-day and 182-day papers declined by 0.2% points and 0.3% points, respectively, to 7.1% and 7.7%, while the yield on the 364-day paper remained unchanged at 9.3% from the previous month. T-bills acceptance rate came in at 89.8% during the month, compared to 77.4% recorded in April, with the government accepting a total of Kshs 71.1 bn of the Kshs 79.3 bn worth of bids received. The Central Bank of Kenya (CBK) remained disciplined in rejecting expensive bids in order to ensure stability of interest rates.

During the week, T-bills recorded an oversubscription, with the subscription rate coming in at 129.4%, down from 131.4% the previous week. The oversubscription rate is partly attributable to favorable liquidity in the money market during the week supported by government payments. The yield on the 91-day declined by 0.1% points to 7.0%, from 7.1%, recorded the previous week, while yields on the 182-day and 364-day papers remained unchanged at 7.7% and 9.3%, respectively. The acceptance rate declined to 91.1% from 91.9%, recorded the previous week, with the government accepting Kshs 28.3 bn of the Kshs 31.1 bn bids received.

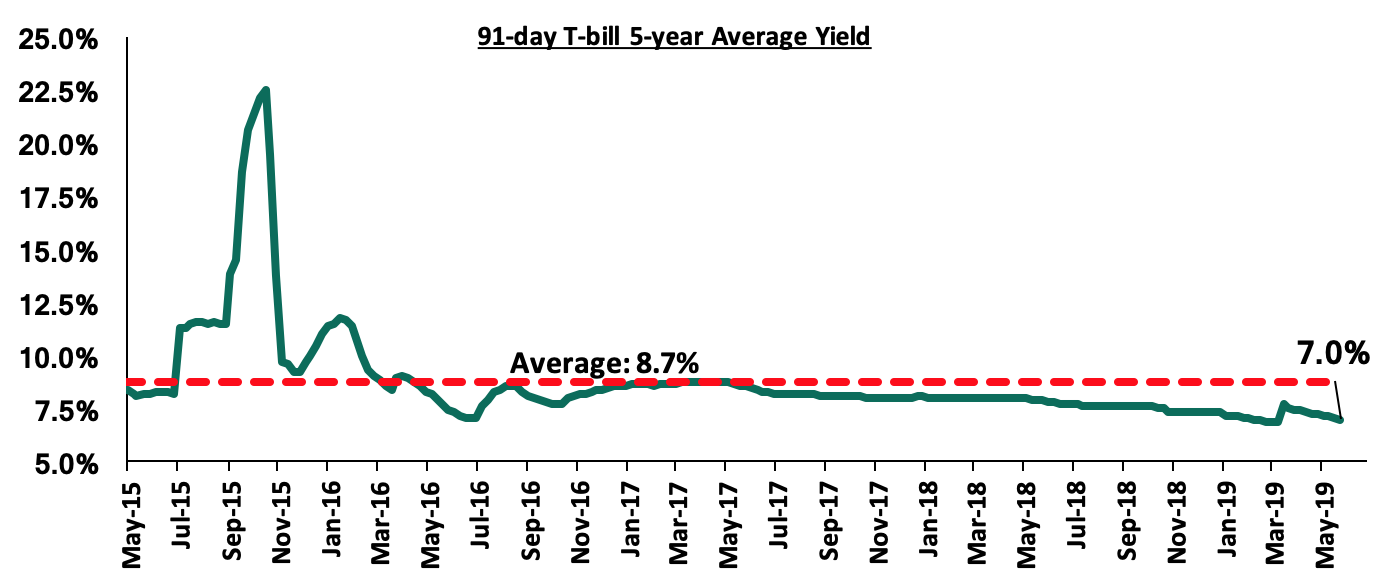

The 91-day T-bill is currently trading at a yield of 7.0%, which is below its 5-year average of 8.7%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment that has persisted since the passing of the law capping interest rates. We expect this to continue in the short-term, given:

- The discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and,

- The maintaining of the Central Bank Rate at 9.0% by the Monetary Policy Committee in their May 2019 meeting.

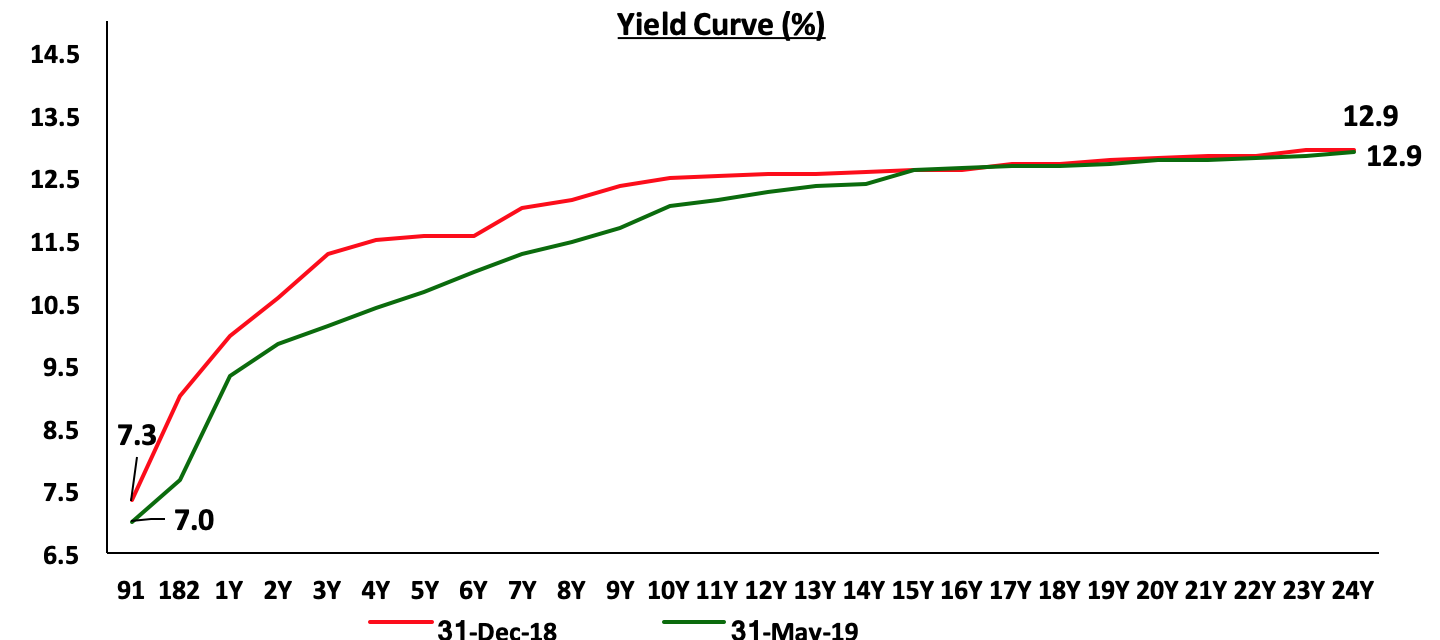

During the month of May, the government issued two bonds with issue numbers (FXD 2/2019/5) and (FXD 2/2019/15) with 5-year and 15-year tenors. The issue was oversubscribed, with the performance rate coming in at 141.7%. The market maintained a bias towards the 5-year bond that generated total bids of Kshs 39.2 bn as investors continue to avoid the longer-tenor bond driven by the perception that risks may not be adequately priced on the longer end of the yield curve, which is relatively flat due to saturation of long-term bonds, coupled with the duration risk associated with longer-term papers. The accepted yields for the 5-year and 15-year bonds came in at 10.9% and 12.7% in line with our expectations of 10.8% - 11.0% and 12.5% - 12.7% for the 5-year and 15-year bonds, respectively.

Secondary Bond Market:

The yields on government securities in the secondary market remained relatively stable during the month of May as the Central Bank of Kenya continued to reject expensive bids in the primary market.

Liquidity:

The average interbank rate rose to 5.5% during the month of May from 3.4% in April, pointing to tightening liquidity conditions in the money market. During the week, the average interbank rate declined to 4.7%, from 5.4% the previous week. The decline in the interbank rate points to improved liquidity conditions in the money market, which the Central Bank of Kenya (CBK) attributed to support from government payments, which partly offset tax remittances.

Kenya Eurobonds:

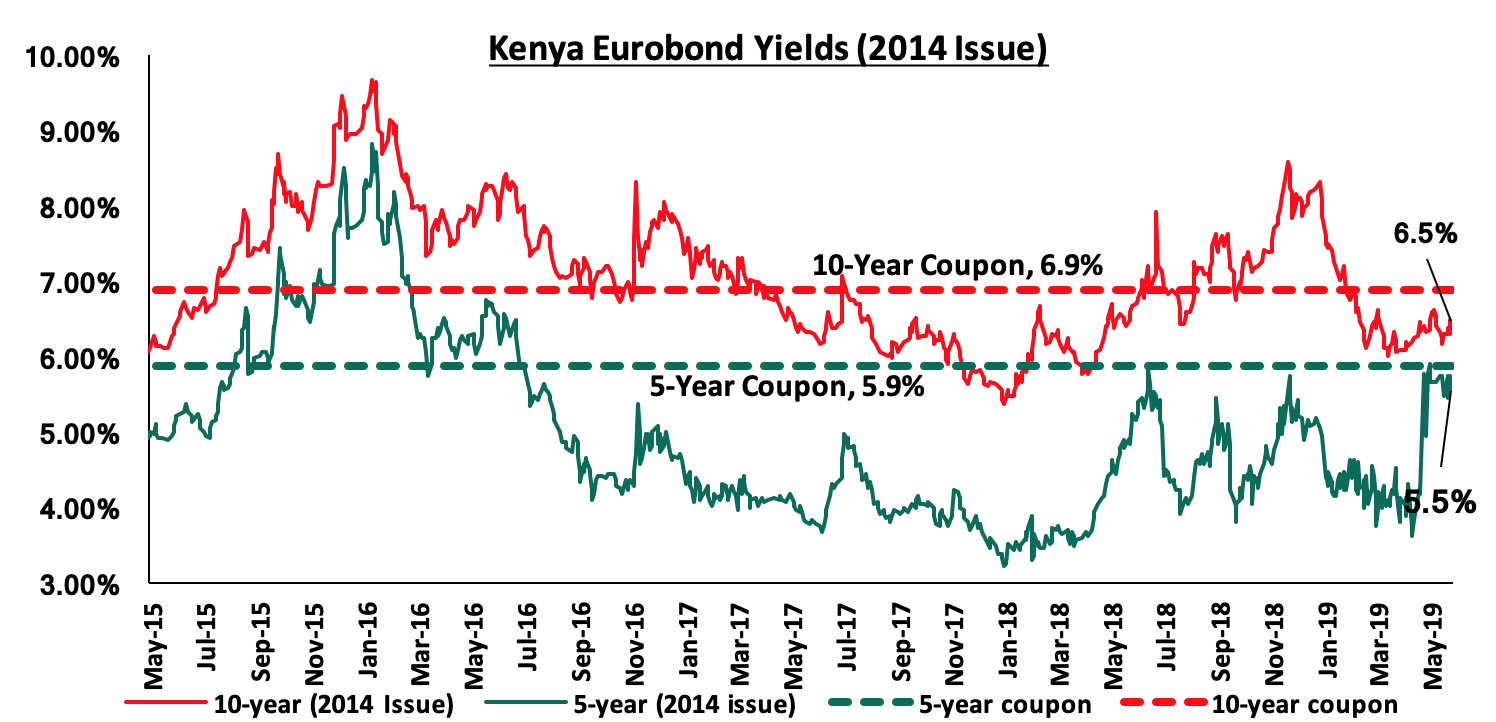

According to Reuters, the yield on the 5-year Eurobond issued in June 2014 declined by 0.3% points to 5.5% in May, from 5.8% in April 2019, while those of the 10-year Eurobonds issued in the same year rose by 0.1% points to 6.5% in May, from 6.4% in April 2019. During the week, the yield on the 5-year Eurobond issued in 2014 rose by 0.1% points to 5.5%, from 5.4% the previous week, while that of the 10-year Eurobond issued in the same year rose by 0.2% points to 6.5%, from 6.3% the previous week.

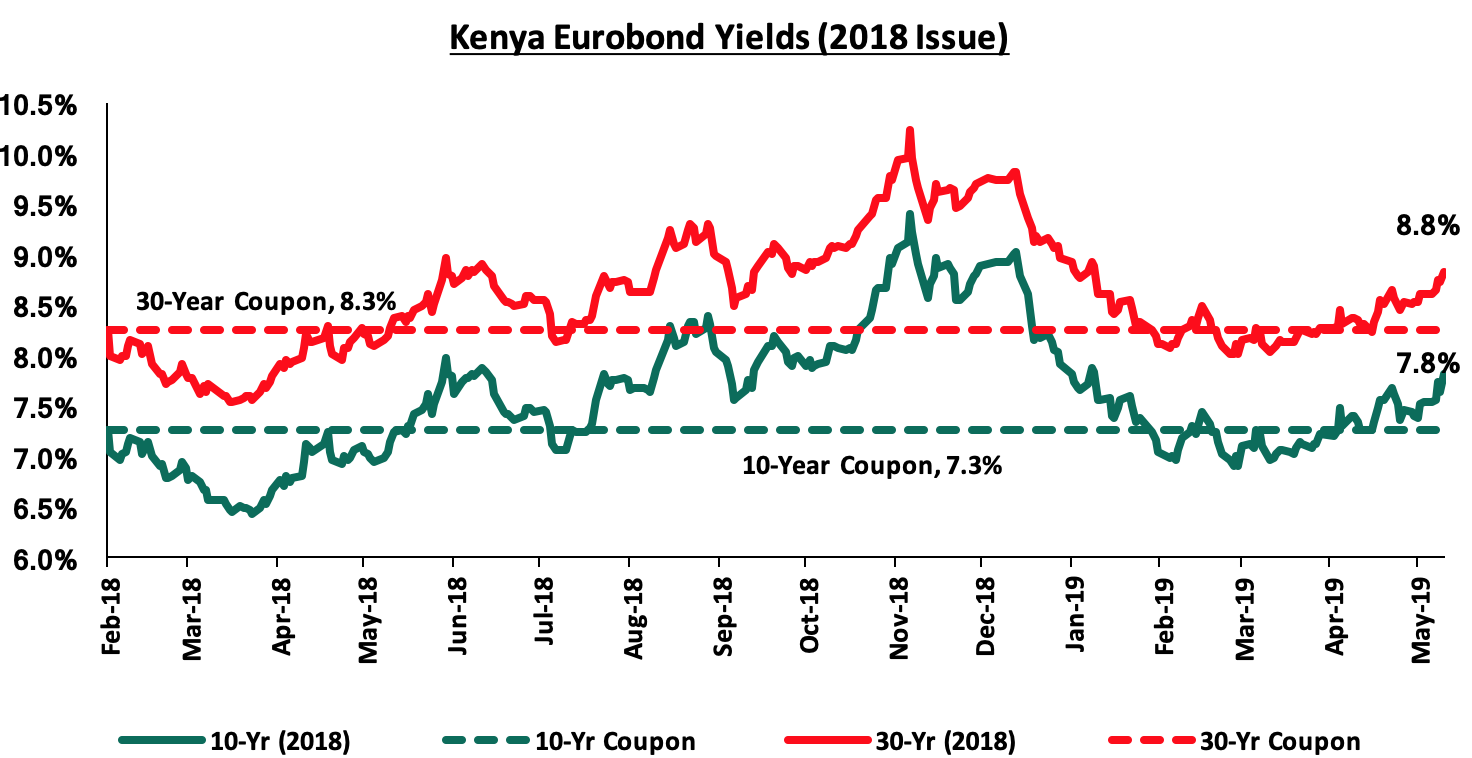

During the month, the yields on the 10-year and 30-year Eurobond issued in February 2018 rose by 0.4% points for both issuances to close at 7.8% and 8.8%, from 7.4% and 8.4% in April 2019, respectively, attributable to increased risk perception due to the downgrading of Kenya’s 2019 growth prospects following delayed onset of the long rains this year. During the week, the yield on the 10-year Eurobond rose by 0.3% points to 7.8% from 7.5% recorded the previous week while those of the 30-year Eurobond rose by 0.2% points to 8.8%, from 8.6% the previous week.

The newly issued dual-tranche Eurobond with 7-years and 12-years tenor, priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor, respectively, started trading on 17th May 2019. The yield on the 7-year bond and 12-year bonds have risen by 0.3% points and 0.4% points to 7.3% and 8.3%, from 7.0% and 7.9%, respectively, as at the close of 17th May 2019.

The Kenya Shilling:

The Kenya Shilling remained stable against the US Dollar during the month of May, closing at Kshs 101.4, unchanged from the previous month with inflows from diaspora remittances and offshore investors offsetting end month dollar demand from oil and merchandise importers. During the week, the Kenya Shilling depreciated by 0.1% against the US Dollar to close at Kshs 101.4, from Kshs 101.2 in the previous week, driven by increased dollar demand from merchandise and oil importers buying dollars to meet their end-month obligations. On an YTD basis, the shilling has appreciated by 0.5% against the US Dollar in addition to 1.3% in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit with data on balance of payments indicating continued narrowing to 4.5% of GDP in the 12-months to April 2019, from 5.5% recorded in April 2018. The decline has been attributed to resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food,

- Improving diaspora remittances, which have increased cumulatively by 3.8% in the Q1’2019 to USD 665.6 mn, from USD 641.5 mn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

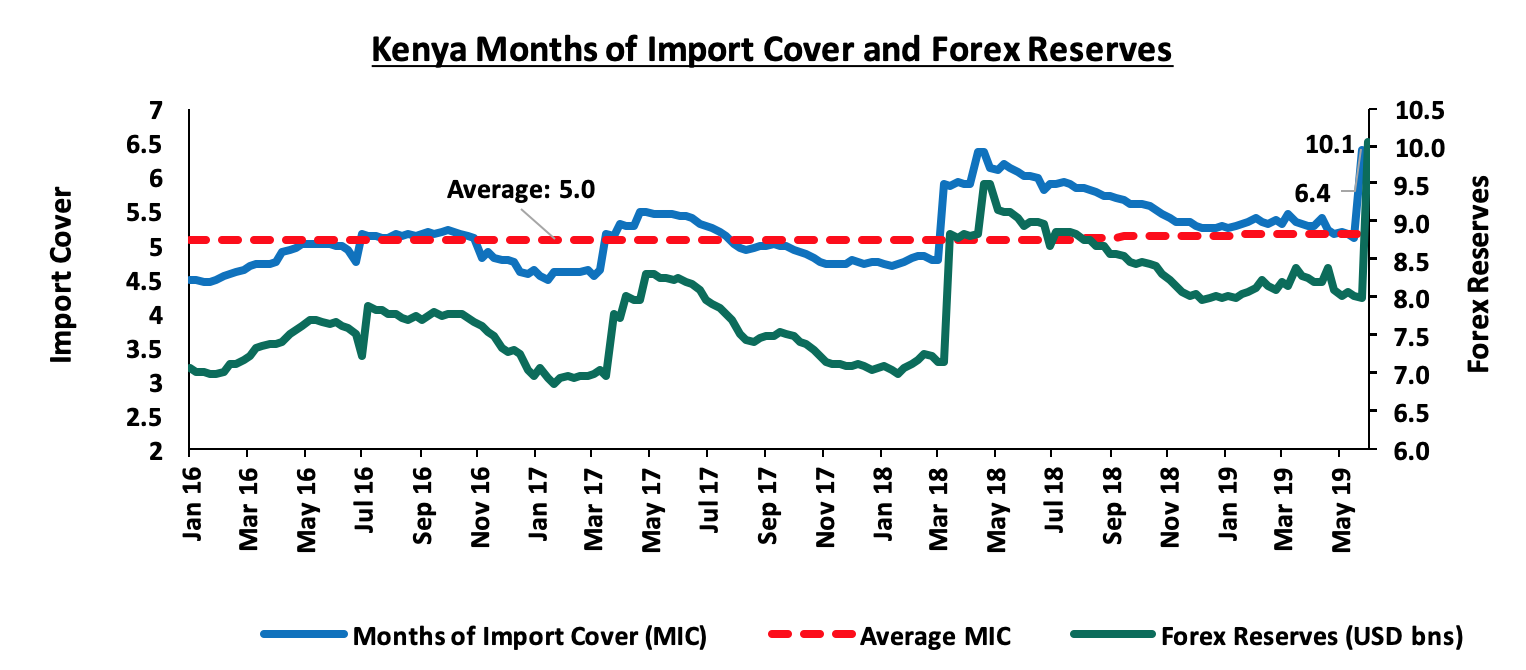

- High levels of forex reserves, currently at an all-time high of USD 10.1 bn (equivalent to 6.4-months of import cover), above the statutory requirement of maintaining at least 4-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Inflation:

The Y/Y inflation rate for the month of May declined to 5.5%, from 6.6% recorded in April, lower than our expectations of a decline to 5.8% - 6.2%, with the variance being as a result of a 0.4% m/m decline in the food and non-alcoholic beverages index against our expectations of a 0.2% decline. Month-on-month 0.1% deflation was attributed to;

- A 0.4% decline in the food and non-alcoholic drinks’ Index, due to favorable weather conditions, which led to lower prices for some commodities with the prices of spinach, sukuma wiki (kale) and tomatoes recording declines of 10.7%, 9.4%, and 6.8%.

A 0.3% rise was however recorded in the Transport index due to a rise in the pump prices of petrol and diesel, and a 0.6% rise in the housing, water, electricity, gas and other fuels’ index due to higher cost of house rents and some cooking fuels. Partly contributing to this, were prices of domestic consumption of electricity that increased by 7.8% for consumption of 50 KWh increasing from Kshs 778.7 in April 2019 to Kshs 839.8 in May 2019 due to increase in fuel adjustment costs. Below is a summary of key changes in the Consumer Price Index (CPI) in May;

|

Major Inflation Changes in the Month of May 2019 |

|||

|

Broad Commodity Group |

Price change m/m (May-19/April-19) |

Price change y/y (May-19/May-18) |

Reason |

|

Food & Non-Alcoholic Beverages |

(0.4%) |

6.3% |

The m/m decline was due to favourable weather conditions which led to lower prices for some commodities |

|

Transport |

0.3% |

11.1% |

The m/m rise was mainly on account of increase in pump prices of petrol and diesel |

|

Housing, Water, Electricity, Gas and other Fuels |

0.6% |

4.6% |

The m/m rise was as a result of higher costs of house rents, electricity and cooking fuels |

|

Overall Inflation |

(0.1%) |

5.5% |

The m/m decline was due to a 0.4% decline in the food index which has a CPI weight of 36.0% |

Monetary Policy:

The Monetary Policy Committee (MPC) met on 27th May 2019 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the prevailing monetary policy stance leaving the Central Bank Rate (CBR) unchanged at 9.0%, which was in line with our expectations citing that inflation expectations remained well anchored within the target range and that the economy was operating close to its potential as evidenced by:

- Month on month inflation remained within the 2.5% - 7.5%, target range despite rising to 6.6% in April, from 4.4% in March, largely driven by a rise in in food prices attributable to depressed supply of vegetables and other fast-growing food crops following the delayed onset of the long rains,

- Stability in the foreign exchange market supported by the narrowing of the current account deficit to 4.5% of GDP in the 12-months to April, from 5.5% in April 2018, driven by resilient performance of exports particularly horticulture, and higher diaspora remittances, and receipts from tourism and transport services, and,

- Improving private sector credit growth despite being below historical averages coming in at 4.9% in the 12-months to April, compared to 4.3% in the 12-months to March with strong growth being observed in the manufacturing sector (7.9%); trade (8.4%); finance and insurance (13.3%); and consumer durables (16.4%).

As such, the MPC concluded that the current policy stance was still appropriate, but noted that there was a need to remain vigilant on possible spill overs of recent food and fuel price increases. We expect monetary policy to remain relatively stable in 2019, as the CBK monitors Kenya’s inflation rate and the currency.

Monthly Highlights:

During the month, Kenya issued its 3rd Eurobond, raising USD 2.1bn (Kshs 210.0 bn) through a dual-tranche Eurobond of 7-year and 12-year tenors, value dated 15th May 2019. A longer-term issuance would have been more preferable, though it comes at a trade-off on the yields as investors would demand a higher risk premium to compensate for the risk in tandem with the repayment period of the loan. The Eurobond will be listed on the London Stock Exchange (LSE). The issue was 4.5x oversubscribed attracting orders worth USD 9.5 bn. The Eurobond was priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor with the proceeds expected to go towards:

- Refinancing the obligations outstanding from the USD 750.0 mn Eurobond issued in 2014, which is due on 24th June, 2019, and,

- Financing development infrastructure projects as well as the general budgetary expenditure.

The additional funds obtained from the Eurobond will add to the public debt burden, which stood at Kshs 5.4 tn as at March 2019, according to the latest data released by the CBK. As at the end of 2018, the debt to GDP ratio stood at 57.5%. We expect the new issue to drive the debt to GDP ratio to “around” 60.0%, which continues to raise concern mainly driven by the inability of KRA to meet the set revenue collection targets. As at the end of March, ordinary revenue hit Kshs 1.1 tn against a target of Kshs 1.4 tn. The performance of the issue was commendable considering the current market conditions, with the International Monetary Fund (IMF) having withdrawn their stand-by credit facility in 2018, coupled with the downgrading of Kenya’s growth prospects by both the IMF and the World Bank. Key to note is that, unlike the previous issues, with expected bullet payments on the maturity date, both the 7-year and the 12-year tenors are sinkable, which means that the repayment of the principal will be amortized equally, at USD 300 mn and USD 400 mn, respectively, per year in the last three-years to maturity, as opposed to a full repayment of the principal on redemption. For more information, see our Cytonn Weekly #20/2019.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids as they are currently 17.1% ahead of its domestic borrowing target for the current financial year, having borrowed Kshs 310.1 bn against a pro-rated target of Kshs 292.2 bn. A budget deficit is likely to result from depressed revenue collection, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

During the month of May, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 4.7%, 4.3% and 7.5%, respectively, taking their YTD performance to gains/ (losses) of 6.7%, (5.5%) and 1.8%, respectively. The decline recorded in NASI was driven by declines in large cap stocks such as Barclays Bank Kenya, EABL, Equity Group, and KCB Group, which recorded declines of 14.6%, 11.0%, 9.3% and 7.1%, respectively. For this week, markets recorded a positive performance, with NASI, NSE 20 and NSE 25 gaining by 2.8%, 1.4% and 2.1%, respectively. The gain in the NASI was largely due to gains recorded in large cap counters such as Co-operative Bank, Equity Group, Standard Chartered Bank Kenya (SCBK) and Safaricom, which recorded gains of 8.3%, 6.6%, 3.5% and 3.4%, respectively.

Equities turnover rose by 26.3% during the month to USD 123.3 mn, from USD 97.6 mn in April 2019. Foreign investors remained net buyers for the month, with a net buying position of USD 21.5 mn, a 430.1% increase from April’s net buying position of USD 4.1 mn.

For this week, equities turnover increased by 51.3% to USD 37.6 mn, from USD 24.9 mn the previous week, bringing the year to date (YTD) turnover to USD 667.1 mn. Foreign investors remained net buyers for the week, with a net buying position of USD 11.2 mn, a 116.7% increase from last week’s net buying position of USD 5.2 mn.

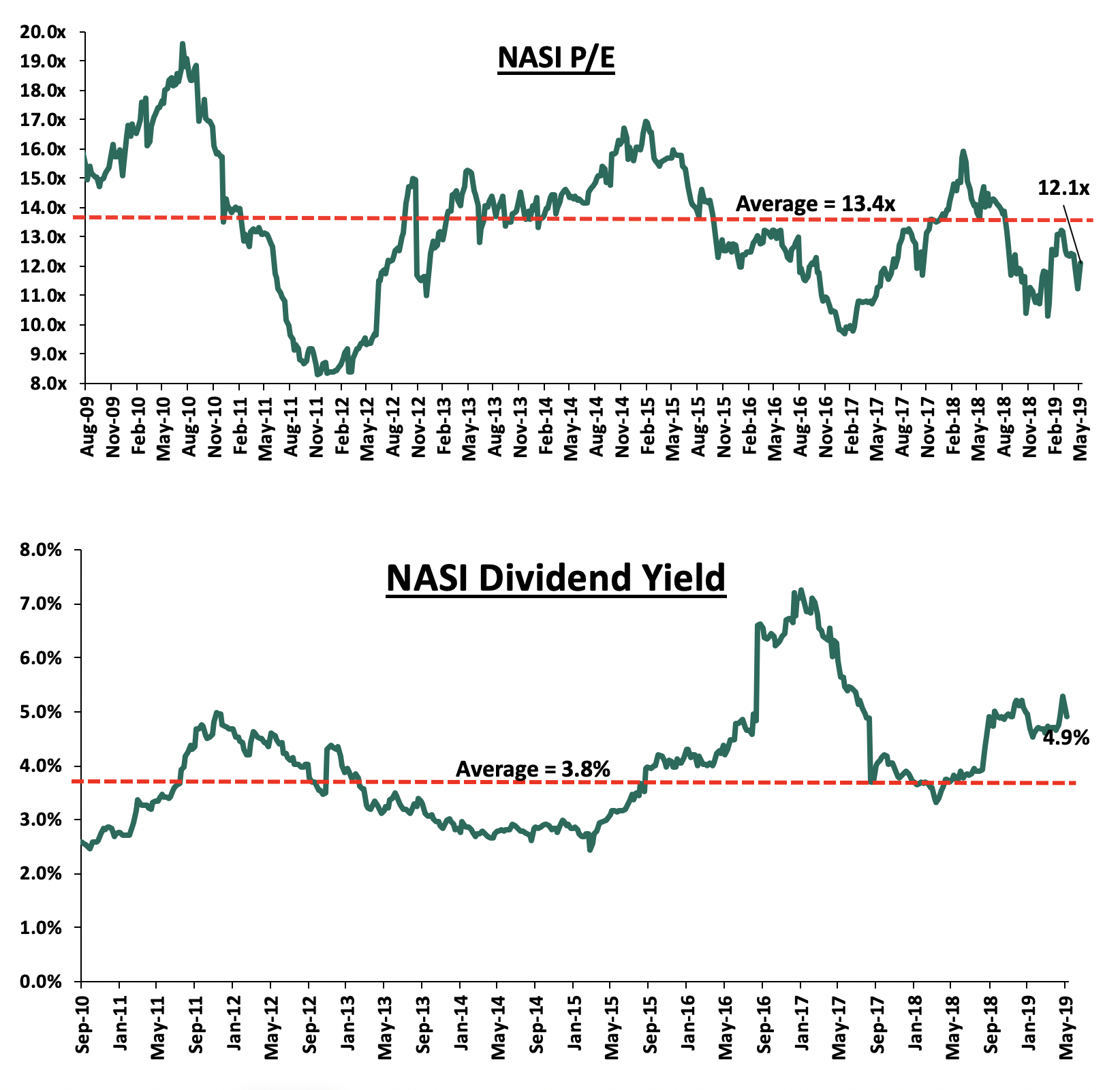

The market is currently trading at a price to earnings ratio (P/E) of 12.1x, 9.4% below the historical average of 13.4x, and a dividend yield of 4.9%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.1x is 23.5% above the most recent trough valuation of 9.8x experienced in the first week of April 2017, and 45.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Earnings Releases

I&M Holdings released their Q1’2019 financial results:

During the week, I&M Holdings released their financial results with core earnings per share increasing by 30.5% to Kshs 5.7, from Kshs 4.4 in Q1’2018, higher than our projections of a 28.2% increase to Kshs 5.6. The performance was driven by a 4.9% increase in total operating income, coupled with a 10.9% decline in total operating expenses. The variance in core earnings per share growth against our expectations was largely due to the 10.9% decline in total operating expenses to Kshs 2.4 bn, from Kshs 2.7 bn in Q1’2018, against our expectations of a 5.2% rise. However, after adjusting for the bonus issue of 1:1 that was issued during the quarter, core earnings per share came in at to Kshs 2.9. Highlights of the performance from Q1’2018 to Q1’2019 include:

- Total operating income increased by 4.9% to Kshs 5.4 bn, from Kshs 5.2 bn in Q1’2018. This was driven by a 9.7% increase in Non-Funded Income (NFI) to Kshs 2.1 bn, from Kshs 1.9 bn, coupled with a 2.1% increase in Net Interest Income (NII) to Kshs 3.34 bn, from Kshs 3.27 bn in Q1’2018,

- Interest income increased by 8.9% to Kshs 6.1 bn, from Kshs 5.6 bn in Q1’2018. This was driven by a 16.8% growth in interest income from loans and advances to Kshs 5.0 bn, from Kshs 4.2 bn in Q1’2018. Interest income on government securities recorded a 23.7% decline to Kshs 1.0 bn, from Kshs 1.4 bn in Q1’2018. The yield on interest-earning assets however declined to 11.2%, from 11.8% in Q1’2018, following a faster 19.6% rise in interest earning assets that outpaced the 8.9% rise in interest income. Moreover, a decline in yields on government securities as well as a decline in lending rates due to the two Central Bank Rate (CBR) cuts in 2018 contributed to the decline in the yield. Consequently, the Net Interest Margin (NIM) declined to 6.1%, from 7.4% in Q1’2018,

- Interest expense increased by 18.2% to Kshs 2.8 bn, from Kshs 2.3 bn in Q1’2018, following a 19.6% increase in the interest expense on customer deposits to Kshs 2.4 bn, from Kshs 2.0 bn in Q1’2018. Consequently, the cost of funds rose to 5.0%, from 4.8% in Q1’2018,

- Non-Funded Income rose by 9.7% to Kshs 2.1 bn, from Kshs 1.9 bn in Q1’2018. The increase was mainly due to a 15.6% rise in fees and commissions on loans to Kshs 388.9 mn, from Kshs 336.4 mn in Q1’2018. In addition, FX trading income increased by 8.7% to Kshs 645.3 mn, from Kshs 593.7 mn in Q1’2018. The revenue mix shifted to 62:38 funded to non-funded income, from 63:37, owing to the high growth in NFI that outpaced growth in NII,

- Total operating expenses declined by 10.9% to Kshs 2.4 bn, from Kshs 2.7 bn in Q1’2018, largely driven by a 65.5% decline in Loan Loss provisions (LLP) to Kshs 199.4 mn, from Kshs 578.4 mn in Q1’2018. Staff costs however recorded a 13.4% rise to Kshs 1.1 bn, from Kshs 992.3 mn in Q1’2018,

- The Cost to Income Ratio (CIR) improved to 44.9%, from 52.8% in Q1’2018. Without LLP, the cost to income ratio improved as well, to 41.2% from 41.6% in Q1’2018,

- Profit before tax increased by 27.8% to Kshs 3.3 bn, up from Kshs 2.6 bn in Q1’2018. Profit after tax grew by 30.5% to Kshs 2.4 bn in Q1’2019, from Kshs 1.8 bn in Q1’2018, with the effective tax rate declining to 27.5%, from 29.0% in Q1’2018,

- The balance sheet recorded an expansion as total assets increased by 21.6% to Kshs 299.6 bn, from Kshs 246.3 bn in Q1’2018. Growth was supported by a 36.4% growth in property and equipment to Kshs 7.8 bn, from Kshs 5.7 bn in Q1’2018, coupled with a 10.6% growth in net loans to Kshs 168.9 bn, from Kshs 152.7 bn in Q1’2018, and an 8.2% increase in government securities to Kshs 55.5 bn, from Kshs 51.3 bn in Q1’2018,

- Total liabilities rose by 24.1% to Kshs 246.5 bn, from Kshs 198.6 bn in Q1’2018, driven by a 28.8% increase in customer deposits to Kshs 221.2 bn, from Kshs 171.7 bn in Q1’2018. Deposits per branch increased by 32.0% to Kshs 5.4 bn from Kshs 4.1 bn in Q1’2018, as the number of branches declined by 1 to 41 branches, from 42 in Q1’2018,

- The faster growth in deposits compared to the growth in loans led to a decline in the loan to deposit ratio to 76.4%, from 88.9% in Q1’2018,

- Gross Non-Performing Loans (NPLs) increased by 6.1% to Kshs 23.7 bn, from Kshs 22.4 bn in Q1’2018. The NPL ratio however improved to 13.0% from 13.8% in Q1’2018 due to the faster growth in gross loans that outpaced the growth in Gross Performing Loans (NPLs). General Loan Loss Provisions increased by 32.7% to Kshs 7.1 bn from Kshs 5.3 bn in Q1’2018. Thus, the NPL coverage improved to 57.4% in Q1’2019 from 39.5% in Q1’2018,

- Shareholders’ funds increased by 11.7% to Kshs 50.1 bn in Q1’2018, from Kshs 44.9 bn in Q1’2018, supported by a 20.5% increase in retained earnings to Kshs 29.3 bn, from Kshs 24.3 bn,

- I&M Holdings remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 16.3%, 5.8% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 18.7%, exceeding the statutory requirement by 4.2% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 16.5%, while total capital to risk-weighted assets came in at 18.9%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.0%, and a Return on Average Equity (ROaE) of 17.8%.

Key Take-Outs:

- The bank maintained its continual rise in NFI recording a 9.7% rise to Kshs 2.1 bn from Kshs 1.9 bn in Q1’2018. This resulted in the revenue contribution mix shifting to 67:33 funded to non-funded income, from 73:27, owing to the high growth in NFI that outpaced growth in NII,

- The bank’s asset quality improved, with the NPL ratio declining to 13.0% from 13.8% in Q1’2018. NPL coverage also improved to 57.4% up from 39.5% in Q1’2018, as the 32.7% rise in provisions to Kshs 7.1 bn from Kshs 5.3 bn in Q1’2018 outpaced the 6.1% growth in gross NPL to Kshs 23.7 bn in Q1’2019, from Kshs 22.4 bn in Q1’2018.

For more information, please see our I&M Holdings Q1’2019 Earnings Note

Diamond Trust Bank released their Q1’2019 financial results:

During the week, Diamond Trust Bank Kenya released their Q1’2019 financial results with core earnings per share increasing by 9.3% to Kshs 7.0, from Kshs 6.4 in Q1’2018, in line with our expectation of a 9.7% increase to Kshs 7.1. The performance was driven by the 9.7% decline in total operating expenses to Kshs 3.2 bn from Kshs 3.5 bn in Q1’2018. Highlights of the performance from Q1’2018 to Q1’2019 include:

- Total operating income declined by 1.9% to Kshs 6.1 bn, from Kshs 6.2 bn in Q1’2018. This was due to the 6.6% decline in Net Interest Income (NII) to Kshs 4.5 bn, from Kshs 4.9 bn in Q1’2018, which outweighed the 15.3% increase in Non-Funded Income (NFI) to Kshs 1.5 bn, from Kshs 1.3 bn in Q1’2018,

- Interest income declined by 5.1% to Kshs 8.2 bn, from Kshs 8.6 bn in Q1’2018. This was caused by the 10.1% decline in interest income from loans to Kshs 4.9 bn, from Kshs 5.5 bn in Q1’2018, which outweighed the 2.4% increase in interest income from government securities to Kshs 3.14 bn, from Kshs 3.07 bn in Q1’2018. The yield on interest-earning assets thus declined to 10.7%, from 11.3% in Q1’2018,

- Interest expenses declined by 3.0% to Kshs 3.6 bn, from Kshs 3.7 bn in Q1’2018, following an 8.9% decline in the interest expense on customer deposits to Kshs 3.0 bn, from Kshs 3.3 bn in Q1’2018, which outweighed the 14.1% rise in interest expense on placement liabilities to Kshs 225.0 mn, from Kshs 197.7 mn in Q1’2018, and the 78.0% increase in other interest expenses to Kshs 353.5 mn, from Kshs 198.6 mn in Q1’2018. The cost of funds thus declined to 5.0%, from 5.1% in Q1’2018. The Net Interest Margin (NIM) declined to 6.0%, from 6.4% in Q1’2018,

- Non-Funded Income (NFI) increased by 15.3% to Kshs 1.5 bn, from Kshs 1.3 bn in Q1’2018. The increase was mainly driven by a 75.8% rise in forex trading income to Kshs 0.6 bn, from Kshs 0.4 bn in Q1’2018 coupled with the 6.2% growth in other fee and commission income to Kshs 0.54 bn, from Kshs 0.51 bn in Q1’2018. The growth was however weighed down by the 26.1% decline in fees and commissions on loans to Kshs 0.3 bn, from Kshs 0.4 bn in Q1’2018. As a result of the performance, the revenue mix shifted to 75:25 from 79:21, due to the faster growth in NFI coupled with the decline in NII,

- Total operating expenses declined by 9.7% to Kshs 3.2 bn, from Kshs 3.5 bn, largely driven by the 61.5% decline in Loan Loss Provisions (LLP) to Kshs 0.3 bn in Q1’2019, from Kshs 0.7 bn in Q1’2018, which outweighed the 5.4% rise in staff costs to Kshs 1.1 bn in Q1’2019, from Kshs 1.0 bn in Q1’2018, and the 2.0% rise in other operating expenses to Kshs 1.80 bn, from Kshs 1.76 bn in Q1’2018,

- Due to the faster decline of total operating expenses compared to the total operating income, the Cost to Income Ratio (CIR) improved to 51.8%, from 56.3% in Q1’2018. However, without LLP, the cost to income ratio deteriorated to 47.4%, from 45.0% in Q1’2018, highlighting the decline in cost of risk to 4.4%, from 11.2% in Q1’2018,

- Profit before tax increased by 7.8% to Kshs 2.9 bn, up from Kshs 2.7 bn in Q1’2018. Profit after tax grew by 9.3% to Kshs 2.0 bn in Q1’2019, from Kshs 1.8 bn in Q1’2018 as the effective tax rate decreased to 33.1% from 33.7% in Q1’2018,

- The balance sheet recorded an expansion, albeit marginal, as total assets increased by 0.7% to Kshs 370.1 bn, from Kshs 367.7 bn in Q1’2018. This growth was largely driven by a 5.3% increase in investments in government and other securities to Kshs 125.7 bn, from Kshs 119.4 bn in Q1’2018, coupled with a 48.8% increase in other assets to Kshs 12.9 bn, from Kshs 8.7 bn in Q1’2018, which outweighed the 2.9% decline in the loan book to Ksh 188.6 bn, from Kshs 194.1 bn in Q1’2018,

- Total liabilities declined by 1.1% to Kshs 309.3 bn, from Kshs 312.8 bn in Q1’2018, caused by a 31.6% decrease in borrowings to Kshs 12.5 bn, from Kshs 18.3 bn in Q1’2018, coupled with a 32.9% decline in placement liabilities to Kshs 12.8 bn, from Kshs 19.1 bn in Q1’2018, which outweighed the 1.3% increase in deposits to Kshs 275.3 bn, from Kshs 271.9 bn in Q1’2018. Deposits per branch increased by 3.5% to Kshs 2.0 bn, from Kshs 1.9 bn in Q1’2018, with the number of branches having reduced to 137 from 140 in Q1’2018,

- The decline in loans coupled with the increase in deposits led to a decline in the loan to deposit ratio to 68.5%, from 71.4% in Q1’2018,

- Gross Non-Performing Loans (NPLs) declined by 6.7% to Kshs 14.4 bn in Q1’2019 from Kshs 15.4 bn in Q1’2018. The NPL ratio thus improved to 7.3%, from 7.5% in Q1’2018. General Loan Loss Provisions declined by 36.5% to Kshs 5.3 bn, from Kshs 8.3 bn in Q1’2018, and consequently the NPL coverage declined to 50.7%, from 68.3% in Q1’2018,

- Shareholders’ funds increased by 11.6% to Kshs 55.4 bn in Q1’2019, from Kshs 49.7 bn in Q1’2018, as retained earnings grew by 16.6% y/y to Kshs 43.9 bn, from Kshs 37.6 bn in Q1’2018,

- Diamond Trust Bank Kenya is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 18.5%, 8.0% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 20.7%, exceeding the statutory requirement by 6.2% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 19.3%, while total capital to risk-weighted assets came in at 21.5%, and,

- The bank currently has a Return on Average Assets (ROaA) of 1.9%, and a Return on Average Equity (ROaE) of 13.0%.

Key Take-Outs:

- The bank recorded a relatively weaker earnings performance with total operating income declining by 1.9%. This was largely due to the depressed performance of funded income, with the bank seemingly earning lower interest income owing to lower yields, presumably due to the 100 bps decline in the Central Bank Rate (CBR), and, the decline in yields on government securities, as the 5.3% growth in government securities investments resulted in a tepid 2.4% rise in interest income from the government securities investments. The expansion from the bottom line was largely due to a faster decline in total operating expenses, which was largely derived from the steep 61.5% decline in Loan Loss Provisions (LLP), and,

- The bank recorded an improved performance on the NFI income segment, which recorded a 15.3%, growth y/y, largely supported by the 75.8% growth in forex trading income, and the 6.2% growth in other fee and commission income. Consequently, NFI contribution to total income rose to 25.3% from 21.5%. This however remains below the current industry average of 36.0%.

For more information, please see our Diamond Trust Bank Kenya Q1’2019 Earnings Note

Barclays Bank Kenya released their Q1’2019 financial results

During the week, Barclays Bank Kenya released their financial results with core earnings per share increasing by 13.8% to Kshs 0.39 from Kshs 0.35 in Q1’2018, slower than our expectation of a 19.0% increase to Kshs 0.41. The performance was driven by the 3.1% growth in total operating income to Kshs 8.0 bn, from Kshs 7.7 bn in Q1’2018, coupled with the 1.5% decline in total operating expenses to Kshs 4.9 bn, from Kshs 5.0 bn in Q1’2018. However, the growth in core EPS was after stripping the exceptional items expense of Kshs 0.2 bn. The variance in core EPS growth against our expectation was due to the slower than expected growth in total operating income. We had anticipated an 11.3% growth in total operating income to Kshs 8.6 bn. Highlights of the performance from Q1’2018 to Q1’2019 include:

- Total operating income rose by 3.1% to Kshs 8.0 bn, from Kshs 7.7 bn in Q1’2018, driven by the 14.0% growth in Non-Funded Income (NFI) to Kshs 2.6 bn, from Kshs 2.3 bn in Q1’2018, which outpaced the 1.3% decline in Net Interest Income (NII) to Kshs 5.4 bn, from Kshs 5.5 bn in Q1’2018,

- Interest income rose by 7.1% to Kshs 7.4 bn, from Kshs 6.9 bn in Q1’2018, driven by the 15.9% increase in interest income from government securities to Kshs 1.9 bn, from Kshs 1.7 bn in Q1’2018, the 3.6% increase in interest income from loans to Kshs 5.4 bn, from Kshs 5.2 bn in Q1’2018, and the 250.1% increase in interest income from placement assets to Kshs 63.6 mn, from Kshs 18.2 mn in Q1’2018. The yield on interest-earning assets however declined to 11.8%, from 12.1% in Q1’2018, due to the 100 bps decline in the Central Bank Rate (CBR) which consequently reduced the yields on loans,

- Interest expenses rose by 38.8% to Kshs 2.0 bn, from Kshs 1.5 bn in Q1’2018, following a 38.2% increase in the interest expense on customer deposits to Kshs 1.8 bn, from Kshs 1.3 bn in Q1’2018, coupled with the 43.0% rise in interest expense on placement liabilities to Kshs 0.3 bn, from Kshs 0.2 bn in Q1’2018. The cost of funds thus rose to 3.6% from 2.9% in Q1’2018. The Net Interest Margin (NIM) declined to 8.7%, from 9.7% in Q1’2018,

- Non-Funded Income (NFI) increased by 14.0% to Kshs 2.6 bn, from Kshs 2.3 bn in Q1’2018. The increase was mainly driven by an 11.6% rise in total fees and commission income to Kshs 1.5 bn, from Kshs 1.4 bn in Q1’2018 coupled with the 107.9% growth in other income to Kshs 0.3 bn, from Kshs 0.1 bn in Q1’2018, and the 2.1% rise in forex trading income to Kshs 0.78, from Kshs 0.76 in Q1’2018. As a result of the performance, the revenue mix shifted to 68:32 from 71:27, due to the fast growth in NFI coupled with the decline in NII,

- Total operating expenses declined by 1.5% to Kshs 4.9 bn, from Kshs 5.0 bn, largely driven by the 15.2% decline in staff costs to Kshs 2.3 bn in Q1’2019, from Kshs 2.8 bn in Q1’2018, which outweighed the 10.6% rise in Loan Loss Provisions (LLP) to Kshs 0.64 bn, from Kshs 0.58 bn in Q1’2018, and the 16.9% rise in other operating expenses to Kshs 2.0 bn, from Kshs 1.7 bn in Q1’2018,

- Due to the decline of total operating expenses coupled with the increase in total operating income, the Cost to Income Ratio (CIR) improved to 61.9%, from 64.8% in Q1’2018. Without LLP, the cost to income ratio improved to 53.9%, from 57.4% in Q1’2018,

- Profit before tax increased by 2.7% to Kshs 2.8 bn, up from Kshs 2.7 bn in Q1’2018. Profit after tax grew by 0.9% to Kshs 1.90 bn in Q1’2019, from Kshs 1.88 bn in Q1’2018 as the effective tax rate increased to 31.8% from 30.6% in Q1’2018,

- The balance sheet recorded an expansion as total assets increased by 18.8% to Kshs 345.4 bn, from Kshs 290.7 bn in Q1’2018. This growth was largely driven by a 24.0% increase in investments in securities to Kshs 83.2 bn, from Kshs 67.0 bn in Q1’2018, coupled with a 41.8% increase in other assets to Kshs 54.0 bn, from Kshs 38.1 bn in Q1’2018,

- The loan book rose by 9.0% to Kshs 180.5 bn, from Kshs 165.5 bn in Q1’2018, attributed to an increase in the corporate loan book segment, increased SME lending, and increased lending via the bank’s timiza mobile lending platform,

- Total liabilities rose by 21.5% to Kshs 299.4 bn, from Kshs 246.4 bn in Q1’2018, driven by a 15.9% increase in deposits to Kshs 224.0 bn, from Kshs 193.3 bn in Q1’2018, coupled with a 36.3% increase in placement liabilities to Kshs 7.2 bn, from Kshs 5.3 bn in Q1’2018. Deposits per branch increased by 17.2% to Kshs 2.6 bn, from Kshs 2.2 bn in Q1’2018, with the number of branches having reduced to 88 from 89 in Q1’2018,

- The faster growth in deposits compared to loans led to a decline in the loan to deposit ratio to 80.6%, from 85.6% in Q1’2018,

- Gross Non-Performing Loans (NPLs) rose by 22.1% to Kshs 15.4 bn in Q1’2019, from Kshs 12.6 bn in Q1’2018. The NPL ratio thus deteriorated to 8.1%, from 7.2% in Q1’2018. General Loan Loss Provisions rose by 30.4% to Kshs 7.5 bn, from Kshs 5.7 bn in Q1’2018. However, the NPL coverage declined to 67.8%, from 71.7% in Q1’2018, as interest in suspense declined by 10.1% to Kshs 3.0 bn, from Kshs 3.3 bn in Q1’2018,

- Shareholders’ funds increased by 4.1% to Kshs 46.1 bn in Q1’2019, from Kshs 44.2 bn in Q1’2018, as retained earnings grew by 2.3% y/y to Kshs 194.0 mn, from Kshs 175.9 mn in Q1’2018, and other reserves rose by 10.3% to Kshs 194.0 mn, from Kshs 175.9 mn in Q1’2018,

- Barclays Bank Kenya is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 14.6%, 4.1% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 16.5%, exceeding the statutory requirement by 2.0% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 14.8%, while total capital to risk-weighted assets came in at 16.7%, and,

- The bank currently has a Return on Average Assets (ROaA) of 2.5%, and a Return on Average Equity (ROaE) of 16.5%.

Key Take-Outs:

- The bank’s improved performance was weighed down by the separation costs, as the bank transitions its systems to that of ABSA. The bank’s management highlighted that the spending should continue to affect the bank’s earnings, with expenditure expected to be focused on advertising, rebranding ATMs, cards and branches to Absa brand, the purchase of new IT hardware, and software upgrades,

- Asset quality continued to experience a deterioration, as highlighted by the rise in the NPL ratio to 8.1% from 7.2% in Q1’2018. Main sectors experiencing challenges were trade, manufacturing and retail. The additional provisioning expenses weighed down on the improved efficiency,

- Barclays Bank benefited from the restructuring exercise it conducted in 2017, and it is the only bank to record a decline in staff costs y/y, which reduced by 15.2% y/y, and,

- The bank recorded a relatively strong balance sheet growth, as the deposit base grew by 15.9% to Kshs 224.0 bn. Consequently, the bank utilized the additional funding by investing in government securities which recorded a growth of 24.0% increase to Kshs 83.2 bn, and growing its loan book which grew 9.0% to Kshs 180.5 bn. This aided the bank in growing its interest income, which was however weighed down by the decline in yields. However, the fast deposit growth came at a cost, as highlighted by the rise in the cost of funding to 3.6% from 2.9% in Q1’2018. This consequently weighed down the performance of funded income, as NII declined by 1.3% y/y.

For more information, please see our Barclays Bank of Kenya Q1’2019 Earnings Note

National Bank of Kenya released their Q1’2019 financial results

During the week, National Bank of Kenya released their financial results with core earnings per share increasing to Kshs 0.31, from a loss per share of Kshs 0.33 in Q1’2018, in line with our projections of an increase to Kshs 0.33. The performance was driven by a 25.8% increase in total operating income, which outpaced the 22.2% increase in total operating expenses. Highlights of the performance from Q1’2018 to Q1’2019 include:

- Total operating income increased by 25.8% to Kshs 2.2 bn, from Kshs 1.8 bn in Q1’2018. This was driven by a 41.7% increase in Net Interest Income (NII) to Kshs 1.7 bn, from Kshs 1.2 bn in Q1’2018, despite a 9.2% decline in Non-Funded Income (NFI) to Kshs 0.5 bn, from Kshs 0.6 bn in Q1’2018,

- Interest income increased by 18.7% to Kshs 2.4 bn, from Kshs 2.0 bn in Q1’2018. This was driven by a 24.8% growth in interest income from government securities to Kshs 1.2 bn, from Kshs 1.0 bn in Q1’2018, coupled with a 14.5% increase in interest income from loans to Kshs 1.2 bn, from Kshs 1.0 bn in Q1’2018, which more than offset the 59.7% decline in interest income from placement assets to Kshs 8.3 mn, from Kshs 20.5 mn in Q1’2018. The yield on interest-earning assets thus rose to 11.8%, from 10.5% in Q1’2018,

- Interest expense declined by 17.8% to Kshs 0.6 bn, from Kshs 0.8 bn in Q1’2018, largely due to the 11.0% decline in the interest expense on customer deposits to Kshs 0.6 bn from Kshs 0.7 bn in Q1’2018, coupled with the 69.9% decrease in interest expense on placements to Kshs 28.2 mn, from Kshs 93.4 mn in Q1’2018. The cost of funds remained flat at 3.3%. Consequently, the Net Interest Margin (NIM) rose to 8.2%, from 7.1% in Q1’2018,

- Non-Funded Income declined by 9.2% to Kshs 0.5 bn from Kshs 0.6 bn in Q1’2018. The decline was mainly driven by the 10.8% decline in total fee and commission income to Kshs 0.29 bn, from Kshs 0.32 bn in Q1’2018, coupled with the 15.5% decline in forex trading income to Kshs 0.15 bn, from Kshs 0.17 bn in Q1’2019. The decline in NFI was however mitigated by the 19.1% growth in other income to Kshs 66.6 mn, from Kshs 55.9 mn in Q1’2018,

- Total operating expenses rose by 22.2% to Kshs 2.1 bn, from Kshs 1.7 bn in Q1’2018, largely driven by an increase in Loan Loss Provisions (LLP) to Kshs 0.4 bn, from a write back of Kshs 70.8 mn in Q1’2018, coupled with a 5.3% increase in staff costs to Kshs 1.0 bn, from Kshs 0.9 bn in Q1’2018. The rise in expenses was however mitigated by the 12.1% decline in other operating expenses to Kshs 0.7 bn, from Kshs 0.8 bn in Q1’2018,

- The Cost to Income Ratio (CIR) improved to 92.9%, from 95.7% in Q1’2018. Without LLP, the cost to income ratio improved to 78.7%, from 85.0% in Q1’2018,

- Profit before tax increased to Kshs 0.2 bn, up from a loss before tax of Kshs 0.5 bn in Q1’2018. Profit after tax grew to Kshs 0.1 bn in Q1’2019, from a loss after tax of Kshs 0.1 bn in Q1’2018, as the effective tax rate rose to 14.1% from 3.2% in Q1’2018,

- The balance sheet contracted as total assets declined by 0.5% to Kshs 104.7 bn, from Kshs 105.2 bn in Q1’2018. The contraction was largely due to the 10.2% decline in the loan book to Kshs 45.9 bn, from Kshs 51.1 bn. The decline in assets was however mitigated by the 15.1% increase in government securities to Kshs 39.1 bn, from Kshs 33.9 bn in Q1’2018,

- Total liabilities declined by 1.3% to Kshs 97.5 bn, from Kshs 98.8 bn in Q1’2018, caused by the 55.8% decline in other liabilities to Kshs 2.9 bn, from Kshs 6.6 bn in Q1’2018, which outpaced the 2.6% increase in deposits to Kshs 89.1 bn, from Kshs 86.9 bn in Q1’2018, and the 3.8% increase in placement liabilities to Kshs 5.5 bn, from Kshs 5.3 bn in Q1’2018. Deposits per branch increased by 11.5% to Kshs 1.3 bn, from Kshs 1.2 bn in Q1’2018, as the number of branches declined to 69, from 75 in Q1’2018,

- The decline in loans coupled with the growth in deposits led to a decline in the loan to deposit ratio to 51.5%, from 58.9% in Q1’2018,

- Gross Non-Performing Loans (NPLs) increased by 8.8% to Kshs 31.5 bn in Q1’2019, from Kshs 28.9 bn in Q1’2018. The NPL ratio thus deteriorated to 48.5% in Q1’2019, from 42.9% in Q1’2018. General Loan Loss provisions rose by 16.3% to Kshs 14.5 bn, from Kshs 12.4 bn in Q1’2019, and consequently, the NPL coverage rose to 60.3%, from 56.5% in Q1’2018,

- Shareholders’ funds increased by 11.8% to Kshs 7.2 bn in Q1’2019, from Kshs 6.5 bn in Q1’2018, supported by a 21.5% increase in statutory loan loss reserves to Kshs 3.6 bn, from Kshs 3.0 bn, which outpaced the 14.3% increase in accumulated losses to Kshs 5.0 bn, from Kshs 4.4 bn in Q1’2018,

- National Bank remains undercapitalized with a core capital to risk-weighted assets ratio of 2.4%, 8.1% points below the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 3.8%, 10.7% points below the statutory requirement of 14.5%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 3.1%, while total capital to risk-weighted assets came in at 4.7%, and,

- The bank currently has a Return on Average Assets (ROaA) of 0.7%, and a Return on Average Equity (ROaE) of 11.3%.

Key Take-Out:

- The bank reversed the loss-making trend recorded in 2018, as it seized to incur the restructuring expense, with management highlighting that the benefits of the exercise would be felt in H1’2018. Top line interest revenue recorded an improved performance as increased allocations to government securities bore fruit. NII expansion was further supported by the decline in cost of funding.

For more information please see our National Bank of Kenya Q1’2019 Earnings Note

Housing Finance Group released their Q1’2019 financial results

HF Group release their Q1’2019 financial results, recording a loss per share of Kshs 0.4 in Q1’2019, from a core earnings per share of Kshs 0.1 recorded in Q1’2018. The performance was driven by a 21.6% decline in total operating income, coupled with only a marginal 0.1% decline in total operating expenses. Highlights of the performance from Q1’2018 to Q1’2019 include:

- Total operating income declined by 21.6% to Kshs 769.5 mn, from Kshs 1.0 bn in Q1’2018. This was driven by a 26.7% decline in Net Interest Income (NII) to Kshs 510.8 mn, from Kshs 697.2 mn in Q1’2018 coupled with an 8.8% decline in Non-Funded Income (NFI) to Kshs 258.7 mn from Kshs 283.8 mn in Q1’2018,

- Interest income declined by 16.2% to Kshs 1.4 bn, from Kshs 1.6 bn in Q1’2018. This was driven by a 19.1% decline in interest income from loans and advances to Kshs 1.3 bn, from Kshs 1.5 bn in Q1’2018. Interest income on government securities however recorded an 81.7% rise to Kshs 91.2 mn, from Kshs 50.2 mn in Q1’2018. The yield on interest-earning assets declined to 11.4%, from 12.1% in Q1’2018, due to the faster 16.2% decline in interest income which more than offset the 0.8% decline in interest earning assets, coupled with a decline in yields on government securities as well as a decline in lending rates due to the two Central Bank Rate (CBR) cuts in 2018. Consequently, the Net Interest Margin (NIM) declined to 4.1%, from 5.0% in Q1’2018,

- Interest expense declined by 8.3% to Kshs 839.9 mn, from Kshs 915.5 mn in Q1’2018, following a 15.0% decline in interest on customer deposits to Kshs 460.9 mn, from Kshs 542.3 mn in Q1’2018, which outweighed the 5.0% rise in other interest expenses to Kshs 359.3 mn, from Kshs 342.1 mn in Q1’2018. Despite the decline, cost of funds rose to 7.4% from 7.2% in Q1’2018, owing to only a Kshs 75.6 mn decline in interest expense despite the Kshs 658.3 mn decline in in interest bearing liabilities,

- Non-Funded Income declined by 8.8% to Kshs 258.7 mn, from Kshs 283.8 mn in Q1’2018. The decline was mainly due to a 35.2% decline in other income to Kshs 127.4 mn, from Kshs 196.6 mn, coupled with a 64.2% decline in FX trading income to Kshs 6.3 mn from Kshs 17.6 mn in Q1’2018. Fees and commissions on loans however rose by 140.2% to Kshs 16.4 mn from Kshs 6.8 mn. The revenue mix shifted to 66:34 funded to non-funded income, from 71:29, owing to the high decline in NII that outpaced the decline in NFI,

- Total operating expenses declined marginally by 0.1% to Kshs 927.1 mn from Kshs 928.0 mn in Q1’2018, largely driven by a 17.5% decline in other income to Kshs 492.4 mn from Kshs 596.6 mn in Q1’2018 that was offset by the 59.5% and 16.6% rise in Loan Loss Provisions (LLP) and staff costs to Kshs 179.7 mn and Kshs 255.0 mn, in Q1’2019 respectively,

- The Cost to Income Ratio (CIR) deteriorated to 120.5%, from 94.6% in Q1’2018. Without LLP, the cost to income ratio also deteriorated, to 97.1% from 83.1% in Q1’2018,

- HF Group recorded a loss before tax of Kshs 157.7 mn from a profit before tax of Kshs 52.9 mn in Q1’2018. HF Group also recorded a loss after tax of Kshs 158.3 mn from a profit after tax of Kshs 37.1 mn in Q1’2018,

- The balance sheet recorded a contraction as total assets declined by 11.6% to Kshs 59.1 bn, from Kshs 66.8 bn in Q1’2018. The contraction was mainly driven by a 13.9% decline in the loan book to Kshs 42.0 bn from Kshs 48.8 bn in Q1’2018, coupled with an 55.6% decline in placements to Kshs 1.3 bn, from Kshs 3.0 bn in Q1’2018,

- Government securities however recorded a 45.1% rise to Kshs 3.6 bn, from Kshs 2.5 bn in Q1’2018,

- Total liabilities declined by 12.1% to Kshs 50.2 bn, from Kshs 48.8 bn in Q1’2018, driven by a 22.9% decline in borrowings to Kshs 13.0 bn, from Kshs 16.9 bn in Q1’2018, coupled with a 5.3% decline in customer deposits to Kshs 34.0 bn, from Kshs 35.9 bn in Q1’2018. Deposits per branch declined by 5.3% to Kshs 1.5 bn from, Kshs 1.6 bn in Q1’2018, as deposits declined yet the number of branches remained unchanged at 22,

- The faster decline in loans as compared to deposits led to a decline in the loan to deposit ratio to 123.5% from 135.8% in Q1’2018. Loans to loanable funds as well declined to 90.6%, from 92.2% in Q1’2018,

- Gross Non-Performing Loans (NPLs) increased by 67.5% to Kshs 14.2 bn in Q1’2019, from Kshs 8.5 bn in Q1’2018. The NPL ratio thus deteriorated to 30.1%, from 16.3% in Q1’2018. General Loan Loss Provisions increased by 28.5% to Kshs 2.5 bn, from Kshs 1.9 bn in Q1’2018. Despite this, the NPL coverage declined to 36.4%, from 39.2% in Q1’2018, due to the faster growth in gross non-performing loans that outpaced the rise in provisions,

- Shareholders’ funds declined by 9.2% to Kshs 10.3 bn in Q1’2019, from Kshs 11.3 bn in Q1’2018, due a 76.5% decline in retained earnings to Kshs 825.9 mn, from Kshs 3.5 bn in Q1’2018,

- HF Group remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 13.7%, 3.2% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 14.9%, exceeding the statutory requirement by 0.4% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 14.5%, while total capital to risk-weighted assets came in at 15.9%, and,

- The bank currently has a Return on Average Assets (ROaA) of (1.3%), and a Return on Average Equity (ROaE) of (7.4%).

Key Take-Outs:

- The bank experienced a deterioration in asset quality, with gross non-performing loans (NPLs) rising by 67.5%, to Kshs 14.2 bn in Q1’2019, from Kshs 8.5 bn in Q1’2019. This warranted increased provisioning by 28.5% to Kshs 2.5 bn from Kshs 1.9 bn in Q1’2018. The deteriorating asset quality, coupled with the tough operating environment occasioned by the interest rate cap, has continued to hamper the bank’s lending activities, leading to a decline in its interest income,

- The bank deteriorated on its operational efficiency as the Cost to income ratio increased to 118.2%, from 92.3% in FY’2017. Without LLP, the cost to income ratio also deteriorated to 120.5%, from 94.6% in Q1’2018. This was largely driven by a 16.6% rise in staff costs to Kshs 255.0 mn from Kshs 218.7 mn in Q1’2018, and, Decline in balance sheet - The balance sheet assets declined by 11.6% to Kshs 59.1 bn from Kshs 66.8 bn in Q1’2018. The contraction was driven by a 13.9% decline in the loan book to Kshs 42.0 bn from Kshs 48.8 bn in Q1’2018. Customer deposits also recorded a 5.3% decline to Kshs 34.0 bn from Kshs 35.9 bn in Q1’2018. The bank also faces issues of asset-liability mismatch - with high cost of funds and low earning long term assets.

For more information, see our HF Group Q1’2019 Earnings Note

During the month, Equity Group released its Q1’2019 financial results:

Equity Group released its financial results with core earnings per share increasing by 4.9% to Kshs 1.64, from Kshs 1.56 in Q1’2018, faster than our projections of a 0.7% increase to Kshs 1.58. The performance was driven by a 6.6% increase in total operating income, despite a faster 7.0% increase in total operating expenses. The variance in core earnings per share growth against our expectations was largely due to a slower 7.0% rise in total operating expenses to Kshs 8.8 bn, from Kshs 8.2 bn in Q1’2018, which was not in line with our expectation of a 13.2% increase to Kshs 9.3 bn. For more information, see our Equity Group Q1'2019 Earnings note

During the month, Stanbic Bank released its Q1’2019 financial results

Stanbic Bank released its Q1’2019 financial results with profit after tax increasing by 19.3% to Kshs 2.3 bn in Q1’2019, from Kshs 1.9 bn in Q1’2018. The performance was largely driven by an 18.5% increase in total operating income despite the 24.4% increase in the total operating expenses. For more information, see our Stanbic Bank Kenya Earnings note Q1'2019.

During the month, NIC Group released their Q1’2019 financial results:

NIC Group released their financial results with core earnings per share declining by 4.3% to Kshs 1.3, from Kshs 1.4 in Q1’2018, contrary to our projections of a 1.2% increase to Kshs 1.4. The performance was driven by an 8.8% increase in total operating income to Kshs 3.8 bn, from Kshs 3.5 bn in Q1’2018, which was outpaced by the 16.8% increase in total operating expenses to Kshs 2.5 bn, from Kshs 2.1 bn in Q1’2018. The variance in core earnings per share growth against our expectations was largely due to the faster 16.8% rise in total operating expenses to Kshs 2.5 bn, from Kshs 2.1 bn in Q1’2018, which was not in line with our expectation of a 11.2% increase to Kshs 2.4 bn. For more information, see our NIC Group Q1’2019 Earnings Note

During the month, Co-operative Bank Kenya released their Q1’2019 financial results

Co-operative Bank released their financial results with core earnings per share increasing by 4.4% to Kshs 0.61, from Kshs 0.59 in Q1’2018, in line with our projections. The performance was driven by a 1.7% increase in total operating income, coupled with a 1.2% decline in total operating expenses. Total operating income increased by 1.7% to Kshs 11.1 bn, from Kshs 10.9 bn in Q1’2018. This was driven by a 19.1% increase in Non-Funded Income (NFI) to Kshs 4.2 bn, from Kshs 3.5 bn in Q1’2018, which outpaced the 6.5% decline in Net Interest Income (NII) to Kshs 6.9 bn, from Kshs 7.4 bn in Q1’2018. For more information, see our Co-operative Bank Q1’2019 Earnings Note.

During the month, KCB Group released the Q1’2019 financial results

KCB group released their financial results with core earnings per share increasing by 11.4% to Kshs 1.9, from Kshs 1.7 in Q1’2018, in line with our expectations. The performance was driven by a 10.6% increase in total operating income to Kshs 18.8 bn, from Kshs 17.0 bn in Q1’2018, which outpaced the 8.2% increase in total operating expenses to Kshs 10.3 bn, from Kshs 9.5 bn in Q1’2018. For more information, see our KCB Group Q1’2019 Earnings Note.

During the month, Standard Chartered Bank Kenya released their Q1’2019 financial results

Standard Chartered Bank of Kenya released their financial results with core earnings per share increasing by 31.0% to Kshs 7.0 from Kshs 5.3 in Q1’2018, which was in line with our expectation of a 30.0% increase to Kshs 6.9. The performance was driven by a 3.7% increase in total operating income, coupled with an 11.8% decline in total operating expenses. For more information, see our Standard Chartered Bank of Kenya Q1’2019 Earnings Note.

A summary of the performance is highlighted in the table below:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-funded income Growth |

NFI to Total Operating Income |

Growth in Total Fee and Commissions |

Deposit Growth |

Growth in Govt Securities |

Cost to Income |

Loan to Deposit ratio |

Loan Growth |

Cost of Funds |

Return on average equity |

|

Stanbic |

N/A |

12.9% |

2.2% |

19.3% |

4.9% |

17.7% |

49.0% |

61.5% |

29.0% |

(8.8%) |

53.0% |

75.9% |

12.6% |

3.2% |

14.3% |

|

NBK |

N/A |

18.7% |

(17.8%) |

41.7% |

8.2% |

(9.2%) |

22.5% |

(10.8%) |

2.6% |

15.1% |

92.9% |

51.5% |

(10.2%) |

3.3% |

11.3% |

|

SCBK |

31.2% |

(6.4%) |

(28.8%) |

2.8% |

7.8% |

5.6% |

32.4% |

(10.0%) |

0.3% |

13.9% |

51.9% |

50.5% |

3.3% |

3.4% |

18.2% |

|

I&M |

30.5% |

8.9% |

18.2% |

2.1% |

6.1% |

9.7% |

38.2% |

(4.0%) |

28.8% |

8.2% |

44.9% |

76.4% |

10.6% |

5.0% |

17.8% |

|

Barclays |

13.8% |

7.1% |

38.8% |

(1.3%) |

8.7% |

14.0% |

32.2% |

11.6% |

15.9% |

24.0% |

61.9% |

80.6% |

9.0% |

3.6% |

16.5% |

|

KCB |

11.4% |

7.1% |

(4.1%) |

11.2% |

8.5% |

9.2% |

32.3% |

11.6% |

11.2% |

18.9% |

54.7% |

84.1% |

10.9% |

3.1% |

22.4% |

|

DTBK |

9.3% |

(5.1%) |

(3.0%) |

(6.6%) |

6.0% |

15.3% |

25.3% |

(7.4%) |

1.3% |

5.3% |

51.8% |

68.5% |

(2.9%) |

5.0% |

13.0% |

|

Equity |

4.9% |

6.5% |

7.4% |

6.3% |

8.6% |

6.9% |

40.8% |

3.2% |

12.1% |

13.0% |

49.8% |

71.3% |

12.7% |

2.6% |

22.8% |

|

Co-op |

4.4% |

(2.9%) |

6.2% |

(6.5%) |

8.7% |

19.1% |

37.7% |

33.6% |

7.4% |

33.1% |

54.2% |

79.2% |

(0.5%) |

3.7% |

18.3% |

|

NIC |

(4.3%) |

1.3% |

(7.9%) |

9.4% |

5.9% |

7.2% |

29.1% |

6.2% |

5.0% |

10.3% |

65.2% |

78.3% |

2.1% |

5.1% |

12.2% |

|

HF |

N/A |

(16.2%) |

(8.3%) |

(26.7%) |

4.1% |

(8.8%) |

33.6% |

79.7% |

(5.3%) |

45.1% |

120.5% |

89.1% |

(13.9%) |

7.4% |

(7.4%) |

|

Q1'2019 Mkt cap Weighted Average |

10.6% |

3.6% |

2.5% |

4.5% |

8.0% |

10.7% |

35.9% |

11.2% |

11.0% |

16.1% |

53.8% |

74.0% |

7.7% |

3.4% |

19.2% |

|

Q1'2018 Mkt cap Weighted Average |

14.4% |

9.3% |

11.4% |

8.1% |

8.1% |

9.5% |

37.1% |

12.2% |

9.4% |

25.0% |

56.6% |

76.8% |

6.1% |

3.6% |

18.4% |

Key takeaways from the table above include:

- All banks have released their Q1’2019 financial results, recording a 10.6% average increase in core Earnings Per Share (EPS), compared to a growth of 14.4% in Q1’2018,

- Deposit growth came in at 11.0%, faster than the 9.4% growth recorded in Q1’2018. Despite the relatively fast deposit growth, interest expenses rose by 2.5% compared to 11.4% in Q1’2018 indicating that banks have been mobilizing relatively cheaper deposits. Furthermore, in September 2018, an implementation of the Finance Act 2018 saw the removal of the minimum interest rate payable on deposits, which stood at 70.0% of the Central Bank Rate (CBR). This helped mitigate high increments in interest expense, despite the relatively fast deposit growth,

- Average loan growth came in at 7.7%, which was faster than the 6.1% recorded in Q1’2018, indicating that there was an improvement in credit extension, with banks targeting select segments such as corporate entities and Small and Medium Enterprises (SMEs). Government securities on the other hand recorded a growth of 15.8% y/y, which was faster compared to the loans, albeit slower than 25.0% recorded in Q1’2018. This highlights banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns. Interest income increased by 3.8%, compared to a growth of 9.3% recorded in Q1’2018. The slower growth in interest income despite the increased allocations to both loans and government securities may be attributable to the decline in yields on loans owing to the 100-bps decline in the CBR, and the decline in yields on government securities, and consequently, the Net Interest Margin (NIM) declined to 8.0% from 8.1% in Q1’2018, and,

- Non-Funded Income grew by 10.7% y/y, faster than 9.5% recorded in Q1’2018. The growth in NFI was supported by the 11.2% average increase in total fee and commission income, albeit slower than the 12.2% growth recorded in Q1’2018. The fee and commission income were however subdued by the implementation of the Effective Interest Rate (EIR) model under IFRS 9 in 2018, which requires banks to amortize the fees and commissions on loans, over the tenor of the loan.

Monthly Highlights

The Central Bank of Kenya (CBK), in conjunction with five commercial banks (NIC Group, KCB Group, Diamond Trust Bank Kenya (DTBK), Co-operative Bank Kenya and Commercial Bank of Africa (CBA)), came up with a mobile loan facility targeting Micro Small and Medium Enterprises (MSMEs). The facility dubbed “Stawi” targets small business owners who don’t have access to formal credit because of the informal nature of their businesses and lack of collateral. For more information, please see our National Housing Development Fund (NHDF), & Cytonn Weekly #21/2019 report.

NIC Group and Commercial Bank of Africa (CBA) announced the leadership of the combined entity, upon the completion of the proposed merger between the two banks. Mr. John Gachora, who is currently the Group Managing Director of NIC Group will become the Group Managing Director and Chief Executive Officer of the combined entity, while Isaac Awuondo who is currently the Group Managing Director of CBA will become Chairman of the Kenyan banking subsidiary, and will maintain direct oversight over the Digital Business. The appointments are in line with our expectations, which we highlighted in our Cytonn January 2019 Monthly Report. For more information, please see our Investing in Unit Trust Funds, & Cytonn Weekly #20/2019 report.

KCB Group released a circular to its shareholders detailing the merger guidelines and expected timelines. The transaction details were as we had highlighted in our Kenya Listed Banks FY’2018 Report & Cytonn Weekly #16/2019. If successful, the transaction will see KCB Group significantly increase its balance sheet, with management highlighting that they expected to reach the Kshs 1.0 tn mark by the end of 2022. For more information, please see our Investing in Unit Trust Funds, & Cytonn Weekly #20/2019 report.

Equity Group highlighted its plan to roll out lending focused especially on Micro, Small and Medium Enterprises (MSMEs), which operate in the agricultural, manufacturing and health sectors. The bank highlighted the plan to lend approximately Kshs 150.0 bn, with a majority of the funds expected to be sourced from the maturing investments in government securities. For more information, please see our Understanding Retirement Benefits Schemes in Kenya & Cytonn Weekly #19/2019 report.

Universe of Coverage

Below is our universe of coverage table:

|

Banks |

Price as at 24/05/2019 |

Price as at 31/05/2019 |

w/w Change |

m/m Change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

122.0 |

120.0 |

(1.6%) |

(1.6%) |

(23.3%) |

241.5 |

2.2% |

103.4% |

0.6x |

Buy |

|

UBA Bank |

5.8 |

6.3 |

8.7% |

(8.1%) |

(18.8%) |

10.7 |

13.6% |

84.8% |

0.4x |

Buy |

|

Zenith Bank |

19.0 |

20.1 |

5.8% |

(5.6%) |

(12.8%) |

33.3 |

13.4% |

79.2% |

0.9x |

Buy |

|

CRDB |

120.0 |

120.0 |

0.0% |

(7.7%) |

(20.0%) |

207.7 |

0.0% |

73.1% |

0.4x |

Buy |

|

CAL Bank |

0.8 |

0.8 |

0.0% |

(8.9%) |

(16.3%) |

1.4 |

0.0% |

70.7% |

0.7x |

Buy |

|

NIC Group |

30.0 |

30.5 |

1.7% |

(3.2%) |

9.7% |

48.8 |

3.3% |

63.3% |

0.8x |

Buy |

|

Access Bank |

5.8 |

6.1 |

5.2% |

(12.2%) |

(10.3%) |

9.5 |

6.6% |

62.3% |

0.4x |

Buy |

|

KCB Group*** |

39.0 |

39.5 |

1.3% |

(6.8%) |

5.5% |

60.0 |

8.9% |

60.8% |

1.0x |

Buy |

|

GCB Bank |

5.0 |

5.0 |

0.4% |

25.7% |

9.6% |

7.7 |

7.5% |

60.7% |

1.2x |

Buy |

|

Co-operative Bank |

11.5 |

12.5 |

8.3% |

(1.2%) |

(12.9%) |

18.5 |

8.0% |

56.6% |

1.1x |

Buy |

|

Equity Group |

36.5 |

38.9 |

6.6% |

(5.0%) |

11.5% |

58.1 |

5.1% |

54.7% |

1.7x |

Buy |

|

I&M Holdings |

60.0 |

57.0 |

(5.0%) |

(1.9%) |

34.1% |

83.9 |

6.1% |

53.2% |

1.1x |

Buy |

|

Barclays Bank |

10.4 |

10.2 |

(1.9%) |

(15.0%) |

(6.8%) |

13.1 |

10.8% |

39.2% |

1.4x |

Buy |

|

Ecobank |

7.2 |

8.0 |

11.1% |

2.6% |

6.7% |

10.7 |

0.0% |

34.1% |

1.8x |

Buy |

|

Union Bank Plc |

7.0 |

6.3 |

(10.7%) |

(10.7%) |

11.6% |

8.2 |

0.0% |

30.4% |

0.7x |

Buy |

|

National Bank |

4.0 |

4.1 |

2.5% |

(17.3%) |

(22.9%) |

5.2 |

0.0% |

26.8% |

0.3x |

Buy |

|

Guaranty Trust Bank |

31.1 |

31.6 |

1.6% |

(4.2%) |

(8.3%) |

37.1 |

7.6% |

25.0% |

2.0x |

Buy |

|

Stanbic Bank Uganda |

30.0 |

30.0 |

0.0% |

3.4% |

(3.3%) |

36.3 |

3.9% |

24.8% |

2.1x |

Buy |

|

Stanbic Holdings |

100.0 |

98.0 |

(2.0%) |

(1.8%) |

8.0% |

115.6 |

6.0% |

23.9% |

0.9x |

Buy |

|

Bank of Kigali |

276.0 |

265.0 |

(4.0%) |

(3.3%) |

(11.7%) |

299.9 |

5.2% |

18.4% |

1.5x |

Accumulate |

|

SBM Holdings |

6.0 |

5.9 |

(1.7%) |

(1.0%) |

(1.7%) |

6.6 |

5.1% |

17.1% |

0.8x |

Accumulate |

|

Standard Chartered |

186.5 |

186.5 |

0.0% |

(6.4%) |

(4.1%) |

203.8 |

6.7% |

16.0% |

1.4x |

Accumulate |

|

Bank of Baroda |

130.0 |

129.0 |

(0.8%) |

0.0% |

(7.9%) |

130.6 |

1.9% |

3.2% |

1.1x |

Lighten |

|

FBN Holdings |

7.1 |

7.1 |

0.0% |

(3.4%) |

(11.3%) |

6.6 |

3.5% |

(2.4%) |

0.4x |

Sell |

|

Standard Chartered |

21.8 |

21.7 |

(0.5%) |

14.2% |

3.3% |

19.5 |

0.0% |

(10.3%) |

2.7x |

Sell |

|

Stanbic IBTC Holdings |

42.1 |

42.0 |

(0.1%) |

(3.2%) |

(12.4%) |

37.0 |

1.4% |

(10.5%) |

2.2x |

Sell |

|

Ecobank Transnational |

10.1 |

11.2 |

10.9% |

6.7% |

(34.4%) |

9.3 |

0.0% |

(16.8%) |

0.4x |

Sell |

|

HF Group |

4.2 |

4.4 |

4.8% |

9.7% |

(20.6%) |

2.9 |

8.0% |

(26.1%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates |

||||||||||

|

** Upside/ (Downside) is adjusted for Dividend Yield |

||||||||||

|

***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

|

****Stock prices indicated in respective country currencies |

||||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

During the month of May, there was private equity activity in the financial services sector. We also saw significant fundraising activity and a private equity report released:

Financial Services Sector

- Mauritius based Bank One, in which Kenyan banking group I&M Holdings has a 50.0% stake, is set to receive a USD 37.5 mn (Kshs 3.8 bn) loan from the International Finance Corporation (IFC), with an undisclosed tenor. The loan will be classified as senior debt, therefore ranking higher than other Bank One’s obligations. The bank intends to use this loan to strengthen its long-term funding position and to expand its lending operations to SMEs in Mauritius that fit their lending criteria; that is, SMEs with 10 to 300 employees and annual sales of Kshs 10.0 mn to Kshs 1.5 bn. For more information, see our Cytonn Weekly #20/2019.

Fundraising

- Generation Investment Management, a Pan-African focused sustainable investment firm, based in San Francisco, USA, announced the closing of a USD 1.0 bn (Kshs 101.3 bn) growth equity fund, Generation Sustainable Solutions Fund III. The fund will be the third raised by the firm, after Generation Climate Solutions Fund II, which raised USD 683.0 mn (Kshs 69.1 bn) in 2014 and Global Equity Strategy Fund, which raised USD 2.2 bn (Kshs 222.7 bn) in 2008, and seeks to target start-up companies with a focus on financial inclusion, healthcare and environmental solutions. The fund, even before closure, made 2 investments, one in Andela, a Nigeria-based software development service provider, where it invested an undisclosed amount into the firm’s Series D funding, whose target was to raise USD 100.0 mn (Kshs 10.1 bn), as well Sophia Genetics, a healthcare technology company based in Washington, USA, where it invested an undisclosed amount. The fund will make investments of between USD 50.0 mn (Kshs 5.1 bn) and USD 150.0 mn (Kshs 15.2 bn). For more information, see our Cytonn Weekly #21/2019.

- Kasada Capital Management, a Sub-Saharan hospitality investment platform, reached a close on its first fund, Kasada Hospitality Fund LP, having secured equity commitments of over USD 500.0 mn (Kshs 50.6 bn), with the commitments being raised from Katara Hospitality, a hotel developer based in Qatar, and Accor Group, a French-based hospitality operator, who invested USD 350.0 mn (Kshs 35.4 bn) and USD 150.0 mn (Kshs 15.2 bn), respectively. The funds will be targeting brownfield and greenfield projects within Sub-Saharan Africa, and is aimed at allowing international investors to tap into the high-growth hospitality sector in the region. Kasada is looking to partner with local partners, with the aim of supporting the entire value chain, from contractors and developers to suppliers in the industry, in order to expand local businesses and create jobs. For more information, see our Cytonn Weekly #21/2019.

- Leapfrog Investments, an emerging markets-focused private equity firm, announced the close of its third Impact Fund (Fund III) at USD 700.0 mn (Kshs 70.0 bn), surpassing its USD 600.0 mn (Kshs 60.0 bn) target by 16.7%, with the funds being used to invest in healthcare and financial services companies in Asia and Africa. This close brings the total capital raised by the investment firm so far to USD 1.6 bn (Kshs 160.0 bn), with its first fund having closed at USD 135 mn (Kshs 13.5 bn) in 2010 and the second fund closing at USD 400 mn (Kshs 40.0 bn) in 2014. Fund III was led by US-based Prudential Financial and other institutional investors in participation including, pensions and asset managers, development financiers, foundations and family offices. For more information, see our Cytonn Weekly #20/2019.

- International Finance Corporation (IFC) announced plans to invest USD 50.0 mn (Kshs 5.1 bn) in private equity firm, Helios Investment Partners, through Helios’s fourth fund, Helios Investors IV L.P., which is set to close in September 2019. The funds are to be directed towards Helios’s investments across Africa. Each transaction is estimated to have a ticket size ranging between USD 30.0 mn (Kshs 3.0 bn) and USD 200.0 mn (Kshs 20.2 bn). This investment by IFC forms part of the USD 1.25 bn (Kshs 126.3 bn) that Helios is looking to raise in its fourth fund. For more information, see our Cytonn Weekly #19/2019.

Report

I&M Burbidge, the Corporate finance advisory of I&M Bank Limited, in their report, East Africa Financial Review, highlighted the deal activity in the East African region, for Q1’2019. According to the report, there were a total of 22 deals in this period, with 10 of these being private equity investments, 3 private equity exits, 2 joint ventures and 7 mergers and acquisitions. This was an improvement from a similar period in 2018, where there were only 16 deals reported. The major increase came on the private equity side, where there was a total of 13 reported deals in Q1’2019, compared to the 7 witnessed in Q1’2018. Of the reported private equity deals in Q1’2019, ICT led in terms of sector, with 4 deals in total, followed by financial services sector with 3 reported deals. The energy and retail sectors trailed, with 2 and 1 deals, respectively. For more information, see our Cytonn Weekly #19/2019.