Kenya Listed Banks H1'2019 Report, & Cytonn Weekly #39/2019

By Research Team, Sep 29, 2019

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate falling to 98.4%, from 103.7% recorded the previous week. The undersubscription is partly attributable to tightened liquidity in the money market during the week. The yields on the 91-day paper declined by 0.1% points to 6.3%, from 6.4% recorded the previous week, while the yields on the 182-day paper remained unchanged at 7.2%. The 364-day paper rose by 0.1% point to 9.8%, from 9.7% recorded the previous week. The Monetary Policy Committee (MPC) met on 23rd September 2019 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). In line with our expectations, the MPC retained the prevailing monetary policy stance leaving the Central Bank Rate unchanged at 9.0%;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 25 and NSE 20 declining by 0.3%, 0.3% and 0.5%, respectively, taking their YTD performance to gains/ (declines) of 2.9%, (14.0%) and (2.7%), for NASI, NSE 20 and NSE 25, respectively. During the week, the Central Bank of Kenya (CBK) issued its final regulatory approval for the merger between NIC Group and CBA Group, which will see the combined entity NCBA Group Plc begin operations on 1st October 2019;

Private Equity

Emerging Markets Private Equity Association (EMPEA), a global industry association for private capital in emerging markets, released their Mid-Year 2019 Statistics Report, which gives a snapshot of the global private equity space, particularly on the fundraising space, highlighting a significant drop in funds raised towards private equity, to USD 165.0 bn (Kshs 17.1 tn) in H1’2019, less than 33.0% of the USD 505.6 bn (Kshs 52.4 tn) raised in FY’2018. Emerging markets raised USD 33.1 bn (Kshs 3.3 tn), of which USD 1.6 bn (Kshs 166.1 bn) was raised by African PE funds. Development Partners International, a London-based Africa-focused private equity firm, in collaboration with Convergence Partners, a South-African impact investment company, have announced an investment of USD 54.0 mn (Kshs 5.6 bn) in Channel VAS, a FinTech company with operations in Africa, Asia and the Middle East that advances micro-credit to individuals through mobile money transfer, for an undisclosed stake;

Real Estate

During the week, Barclays Bank of Kenya signed an agreement with the Centum Real Estate, an affiliate of Centum Investment Company, to finance buyers of Centum’s properties being developed in Kilifi and Nairobi at discounted interest rates. In the hospitality sector, Radisson Group announced plans to begin operation of its third hotel, Radisson Blu Hotel and Residence, located at Nairobi Arboretum, next week;

Focus of the Week

Following the release of H1’2019 results by Kenyan banks, this week we analyze the performance of the 11 listed banks in the country, identify the key factors that influenced their performance, and give our outlook for the banking sector going forward;

- Cytonn Asset Managers Ltd, our subsidiary regulated by CMA and RBA, will host a training for Pensions Trustees on October 3rd and 4th 2019 at Sarova Whitesands in Mombasa. The training is about “Maximizing Pension Returns Through Alternative Investments” and it is geared towards improving scheme returns based on strategic asset allocation to achieve a 13.5% return. The training is at no cost, to attend just email pensions@cytonn.com

- Cytonn Money Market Fund closed the week at an average yield of 10.9% p.a. You can now invest and withdraw digitally by dialing *809#;

- Cytonn Real Estate was named the Best Real Estate Developer in Kenya, 2019 by the International Business Magazine. We are proud to receive this prestigious award. It is a testament to our commitment to providing excellent and aspirational real estate products.

- Caleb Mugendi, Assistant Manager – Public Markets, was on CNBC to discuss the halting of the trading of Mumias Sugar LTD’s shares at the Nairobi Securities Exchange. Watch Caleb here.

- Following the licensing of our regulated affiliate, Cytonn Asset Managers Limited, we are transitioning to an agency model and are looking for agents for our regional markets – Kisumu, Nakuru, Mt. Kenya, and Mombasa. If you have an existing financial services sales business and interested in being an agent in any of these regions, please email us at IFA@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved over 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.comto reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate falling to 98.4%, from 103.7% recorded the previous week. The undersubscription is partly attributable to tightened liquidity in the money market during the week attributable to a disruption in the budget cycle with delays in cash disbursements by the government. The yields on the 91-day paper declined by 0.1% points to 6.3%, from 6.4% recorded the previous week, while the yields on the 182-day paper remained unchanged at 7.2%. The 364-day paper rose by 0.1% point to 9.8%m from 9.7% recorded the previous week. The acceptance rate also fell to 64.9%, from 85.4% recorded the previous week, with the government accepting Kshs 15.3 bn out of the Kshs 23.6 bn worth of bids received.

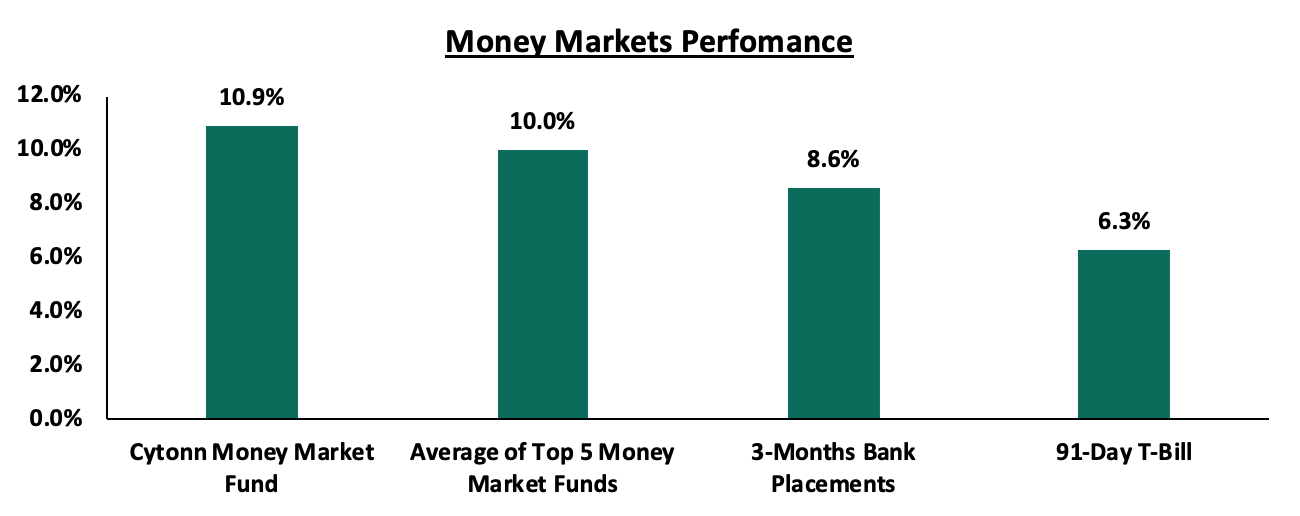

In the money markets, 3-month bank placements ended the week at 8.6% (based on what we have been offered), the 91-day T-bill came in at 6.3%, while the average of Top 5 Money Market Funds by yield came in at 10.0%, unchanged from the previous week, with the Cytonn Money Market Fund closing the week at 10.9%, from 11.0% recorded the previous week.

Liquidity:

During the week, liquidity tightened with the average interbank rate increasing to 7.3%, from 6.6% recorded the previous week. This is attributable to a glitch in the budget cycle with delays in cash disbursements by the government. This saw commercial banks’ excess reserves increase to come in at Kshs 14.4 bn in relation to the 5.25% cash reserves requirement (CRR), from Kshs 11.4 bn the previous week. The average volumes traded in the interbank market increased by 40.6% to Kshs 8.4 bn, from Kshs 6.0 bn the previous week.

Kenya Eurobonds:

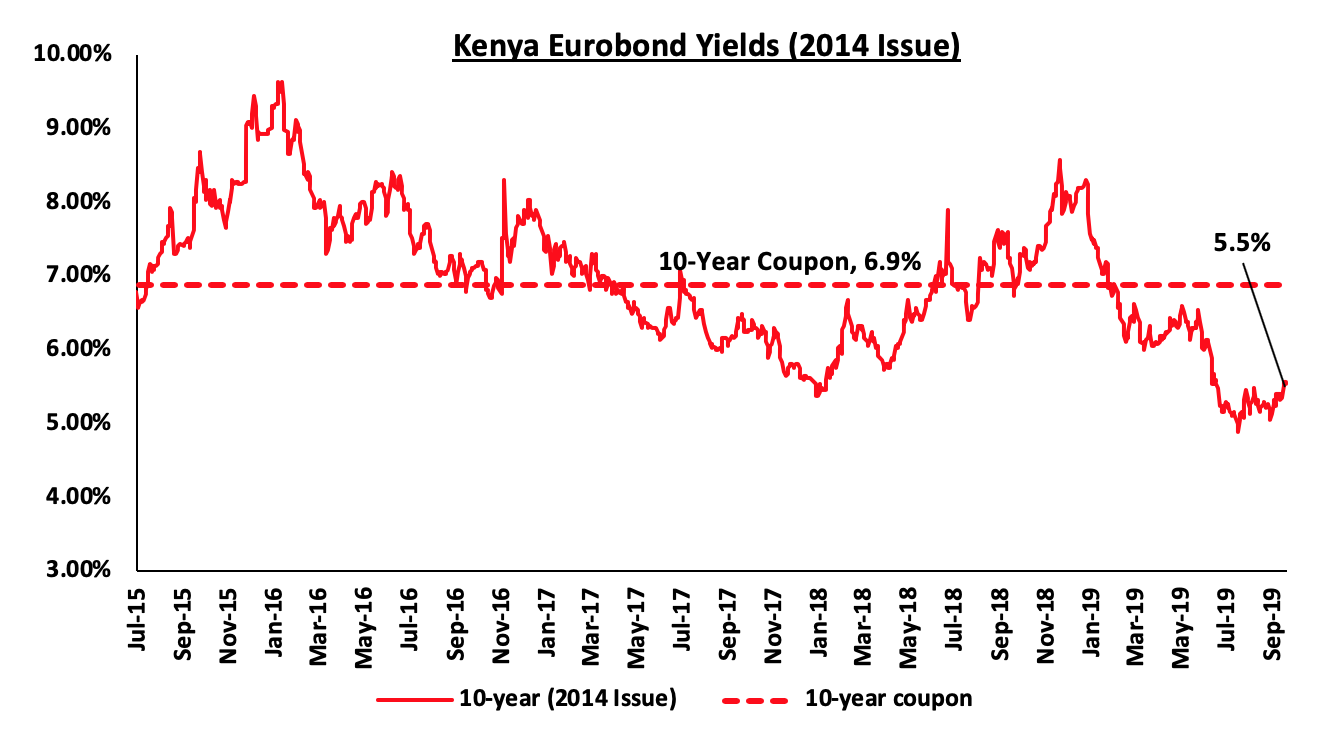

According to Reuters, the yield on the 10-year Eurobond issued in 2014 increased by 0.1% points to 5.5% during the week, from 5.4% the previous week. The rise in Eurobond yields in the past three weeks has been attributable to news that global rating firm Moody’s could further lower Kenya’s creditworthiness currently at ‘B2 stable’ following the completion of their periodic review on Kenya, where they raised concern over the country's very low fiscal strength, ballooning debt and rampant corruption.

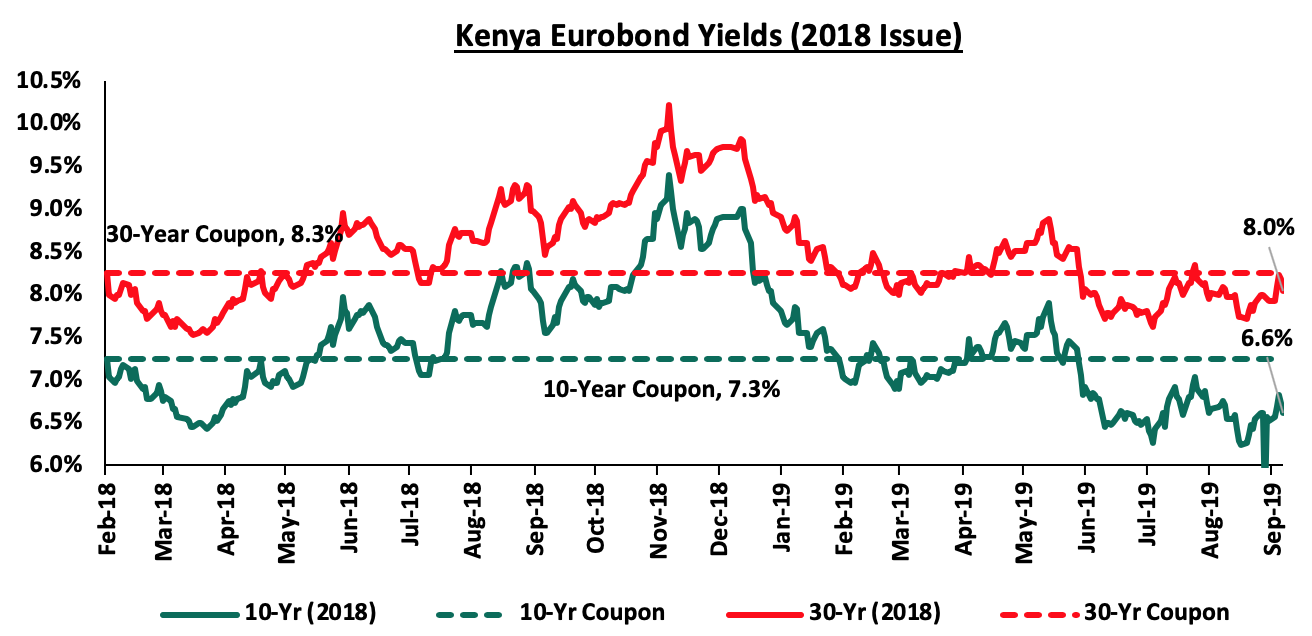

During the week, the yields on the 2018, 10-year and 30-year Eurobond issues both increased by 0.1% points to 6.6% and 8.0%, from 6.5% and 7.9% recorded the previous week, respectively.

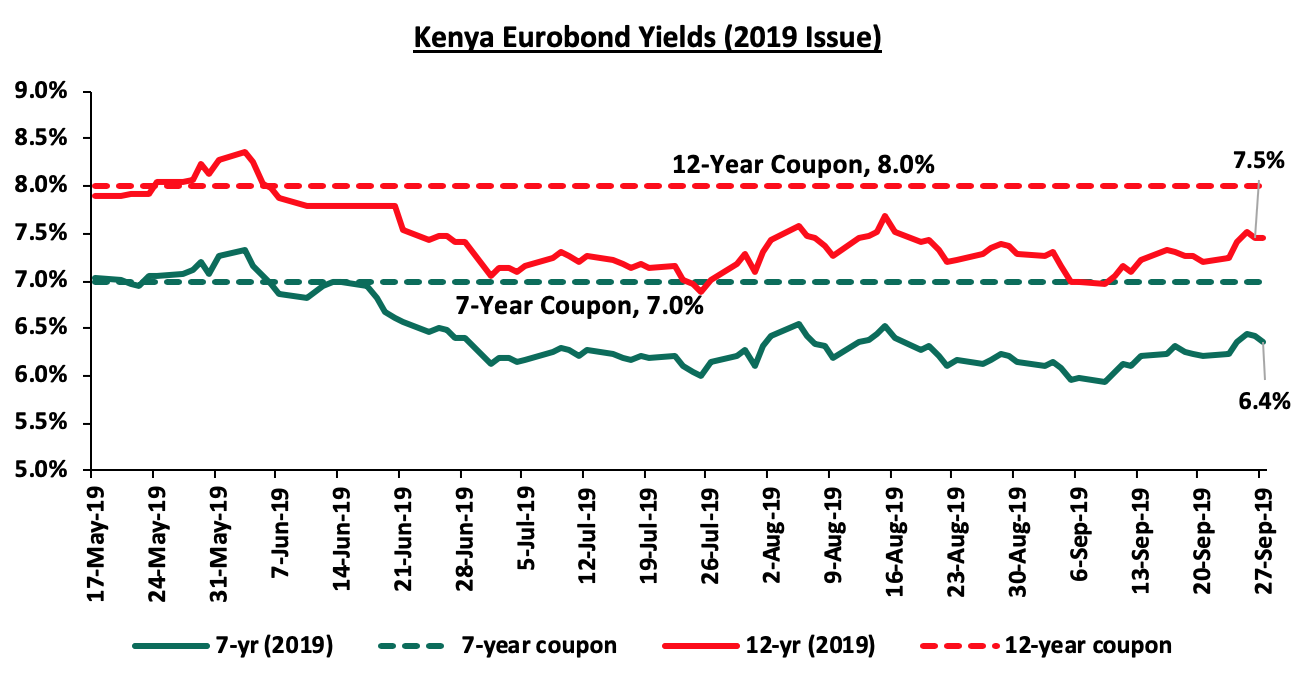

During the week, the yield on the 7-year Eurobond issued in 2019 rose by 0.2% points to 6.4%, from 6.2% recorded the previous week, while the yield on the 12-year Eurobond rose by 0.3% points to come in at 7.5%, from 7.2% recorded the previous week.

Kenya Shilling:

During the week, the Kenya Shilling remained stable against the US Dollar to close at Kshs 103.8, unchanged from the previous week, due to subsiding dollar demand from the energy sector and tightening liquidity in the money market. On a YTD basis, the shilling has depreciated by 1.9% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that the current account deficit narrowed to 4.2% of GDP in the 12-months to July 2019, from 5.5% recorded in July 2018. The decline has been attributed to the resilient performance of exports, particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food and SGR- related equipment,

- Improving diaspora remittances, which have increased cumulatively by 8.9% in the 12-months to August 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.0 bn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

The Monetary Policy Committee (MPC) met on 23rd September 2019 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the prevailing monetary policy stance leaving the Central Bank Rate (CBR) unchanged at 9.0%, in line with our expectations, citing that inflation expectations remained well anchored within the target range and that the economy was operating close to its potential, as evidenced by:

- Month on month inflation remained within the 2.5% - 7.5% target range, falling to 5.0% in August, from 6.3% in July, largely driven by a decline in food inflation to 6.7% in August from 7.9% in July, attributed to decreases in the prices of both vegetable and non-vegetable food crops, due to improved supply,

- Stability in the foreign exchange market supported by the narrowing of the current account deficit to 4.2% of GDP in the 12-months to July 2019, from 5.5% in July 2018, driven by resilient performance of exports particularly horticulture and manufactured goods, strong diaspora remittances and higher receipts from tourism and transport services, coupled with lower imports of food and SGR-related equipment. The foreign exchange market has also been supported by adequate forex reserves currently at USD 9.1 bn (equivalent to 5.7-months of import cover), that continue to provide adequate cover and a buffer against short-term shocks in the foreign exchange market, and,

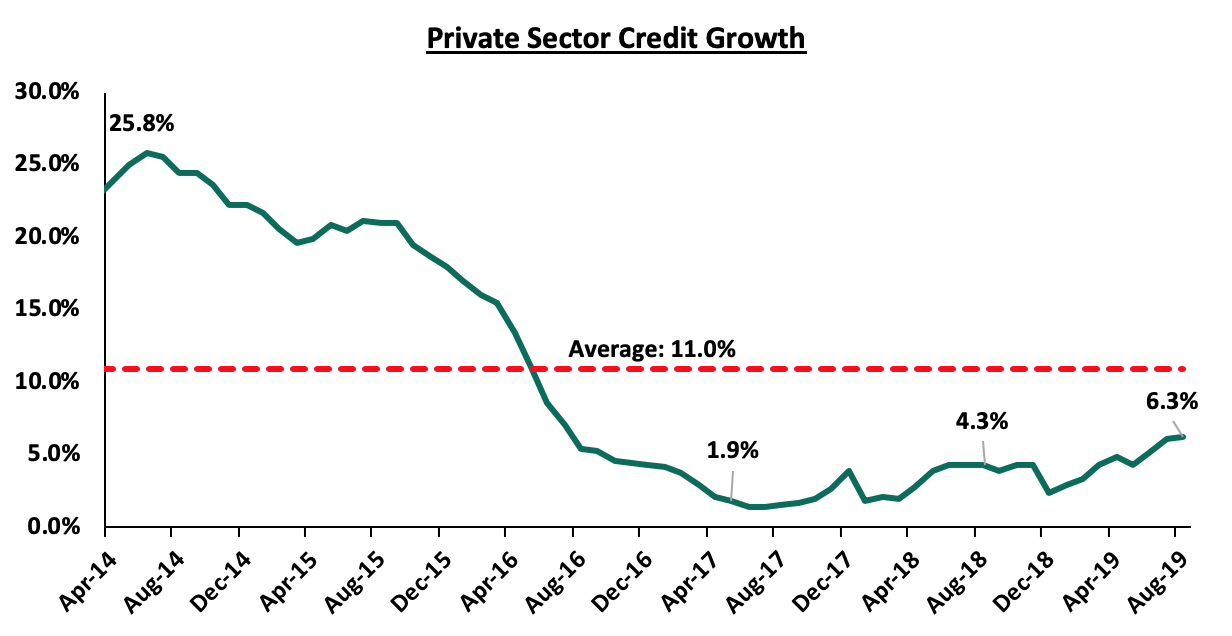

- Improving private sector credit growth, despite being below historical averages, coming in at 6.3% in the 12-months to August, compared to 6.1% in July. Strong growth in credit to the private sector was being observed in the consumer durables (23.0%), private households (8.6%) and trade (8.4%).

As such, the MPC concluded that the current policy stance was still appropriate and that the economy was operating close to its potential, noting the prospective tightening of the fiscal policy which would provide scope for accommodative monetary policy in the near term. The committee also pointed out that there was a need to remain vigilant on possible effects of the increased uncertainties in the external environment. In the short and medium-term, we expect the Central Bank Rate to remain stable, however, if the government will be able to sustain efforts to cut the budget deficit to 5.9% in the FY 2019/20, from the actual deficit of 7.6% in FY 2018/19 by taming expenditure, then we might see the MPC committee loosen the monetary policy, in order to spur economic growth.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance:

During the week, the equities market was on a downward trend with NASI, NSE 25 and NSE 20 declining by 0.3%, 0.3% and 0.5%, respectively, taking their YTD performance to gains/(declines) of 2.9%, (14.0%) and (2.7%), for NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by declines in Bamburi, NIC Group, Co-operative Bank of Kenya, EABL and Safaricom, which declined by 7.3%, 3.2%, 2.5%, 1.5% and 1.5%, respectively.

Equities turnover declined by 7.5% during the week to USD 25.2 mn, from USD 27.3 mn the previous week, taking the YTD turnover to USD 1.1 bn. Foreign investors remained net buyers for the week, with a net buying position of USD 2.6 mn, a 53.7% decline from a net buying position of USD 5.5 mn the previous week.

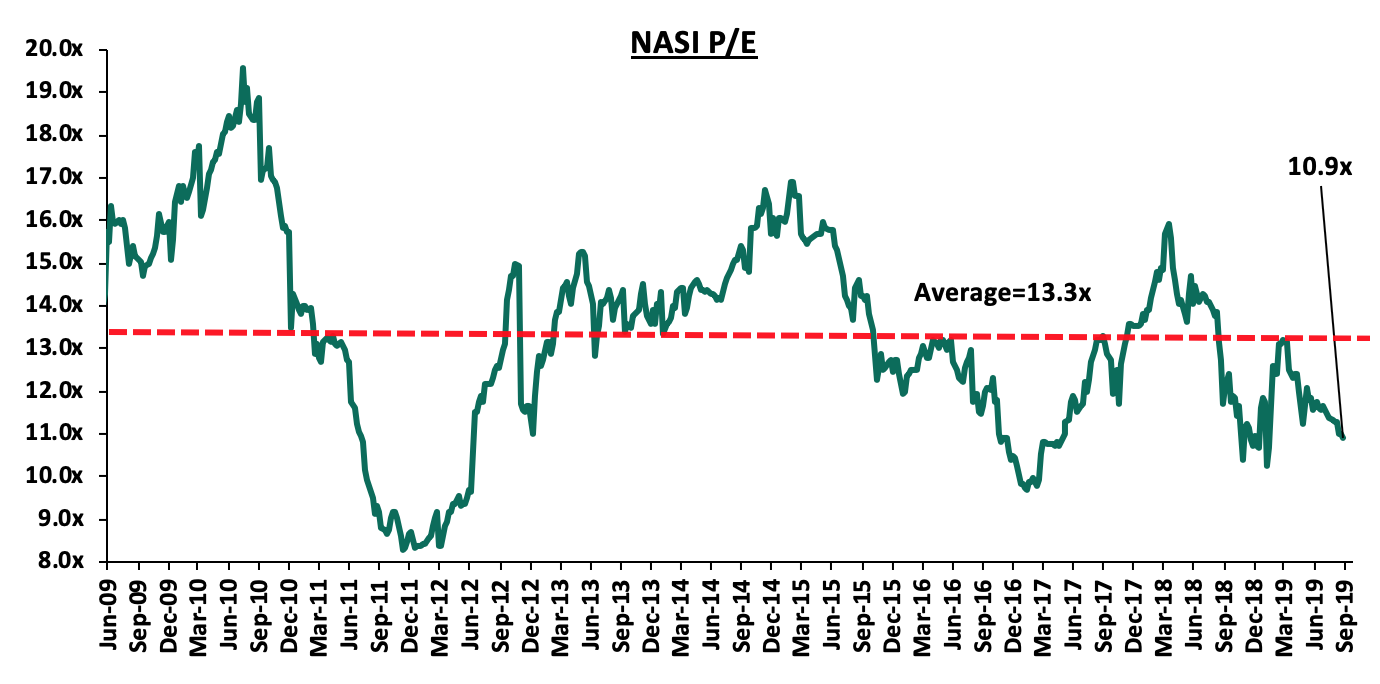

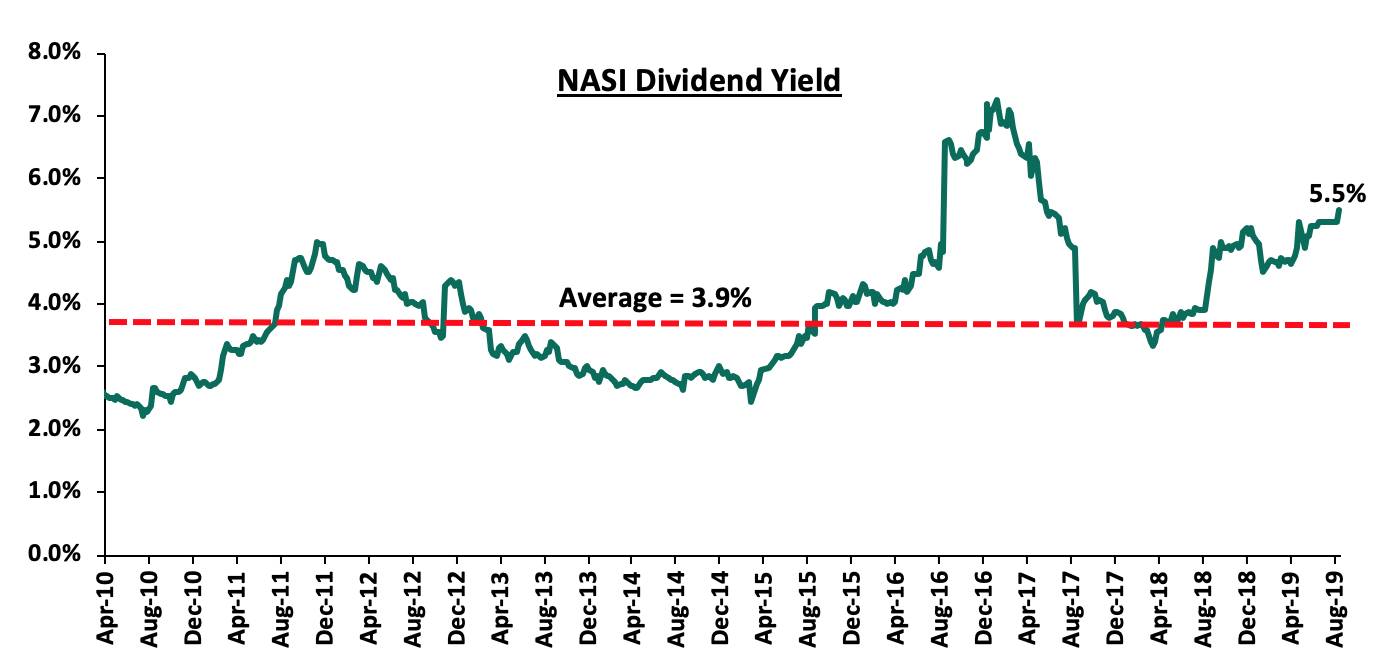

The market is currently trading at a price to earnings ratio (P/E) of 10.9x, 17.9% below the historical average of 13.3x, and a dividend yield of 5.5%, above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 10.9x is 12.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 31.6% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, the Central Bank of Kenya (CBK) announced the issuance of the final regulatory approval for the merger between Commercial Bank of Africa (CBA) and NIC Group. The final approval of the transaction comes after the approval by The Cabinet Secretary of the National Treasury on 20th September 2019, under Section 9 of the Banking Act, which guides on amalgamations and transfer of assets and liabilities for banking institutions. Key things to note is that:

- The combined entity is supposed to commence operations on 1st October 2019, with both NIC Group and CBA Group set to operate under a non-operating holding company NCBA Group Plc,

- The banking businesses in Kenya of both banks will operate under the Kenyan banking subsidiary NCBA Bank Kenya PLC, and,

- The management details of the combined entity have already been fleshed out, with Mr. John Gachora, the current Managing Director (MD) of NIC Group set to be the Group Chief Executive Officer (CEO) of the combined entity (NCBA Group Plc). Mr. Isaac Awuondo, the current Group MD of CBA Group will become the Chairman of NCBA Bank Kenya Plc, and maintain oversight on the digital banking subsidiary.

In terms of operations, we expect a relatively smooth transition, with the integration of the two bank’s core banking systems already done, as well as staff alignment of the two banks. There however may be minimal internal operation disruptions as staff are physically relocated. Furthermore, with the bank having set up a merger integration and operations center in June 2019, we expect the banks to have finalized their own internal integration operations, which should see a smooth transition to a combined entity. We expect NCBA Group Plc to focus on branding and increased consumer awareness campaigns in the near term, as they endeavor to minimize service disruptions to clientele as well as highlight the synergies and benefits expected to be reaped from the merger. We maintain our view as highlighted in our merger note, that the deal will be accretive to shareholders in the long term, as the scale achieved at the group level will lead to an enhanced balance sheet, which should see a shift towards improved deposit mix and alignment towards cost effective deposit mobilization, coupled with improved capital markets access, which will position the combined entity for growth and expansion into other regional markets. The new-found scale as shown in the table below, should also see the bank increase its branch network, as the bank increases is customer service points, adopting a relatively similar strategy to its new peer group of KCB Group, Equity Group and Co-operative Bank of Kenya, in addition to establishing presence in areas it doesn’t have. However, there may be branch closures in areas where there are overlapping branches. As shown in the table below, NCBA Group PLC will become the third largest bank in Kenya, by both deposits and asset base.

|

Bank |

KCB Group |

Equity Group |

NCBA Group |

Co-operative Bank |

|

Customer Deposits |

654.6 |

458.6 |

358.0 |

323.6 |

|

Total Assets |

861.1 |

638.7 |

476.1 |

429.6 |

Values in Kshs bn

CIC Group announced the redemption of its 5-year corporate bond issued in October 2014 of Kshs 5.0 bn, with a coupon rate of 13.0%, which will be redeemed in October 2019. The bond that was issued to fund CIC’s regional expansion into Uganda and Malawi, as well as bolstering the capital requirements of the insurer's subsidiaries, and supporting investments in their medical and real estate projects, will be redeemed at par, which should see CIC Group save Kshs 650.0 mn per annum in interest expense, which the firm has been paying in coupon payments to bondholders since the issuance of the bond. CIC Group recorded a 96.1% decline in profit after tax in H1’2019 to Kshs 20.9 mn, from Kshs 0.5 bn in H1’2018. The performance was largely due to the flat growth in the total income, which grew by 0.1% to Kshs 8.74 bn, from Kshs 8.72 bn in H1’2018, which was weighed down by the 6.3% rise in operating expenses, to Kshs 8.6 bn, from Kshs 8.1 bn in H1’2018. With the cost base rising faster compared to the flat revenue, the company saw its combined ratio rise to 120.8% in H1’2019, from 114.1% in H1’2018, highlighting that the core insurance business remains unprofitable. We are thus of the view that the repayment will free CIC Group’s bottom line owing to the Kshs 650.0 mn headroom created after the repayment. The repayment is likely being funded by the sale of non-core assets such as the 712 acres of land in Kajiado and Kiambu counties.

Sanlam Plc announced the launch of a voluntary early retirement program, aimed at reducing the operating expenses by approximately Kshs 200.0 mn. The program is targeted at individuals aged 50-years and above in its insurance subsidiary. Participants who take up the retirement option will be given a sendoff package equivalent to a month’s salary for every three years of service, write off of a third of outstanding in-house loans, and will be retained on medical cover for the remainder of the year. They will also be paid for accrued leave days and pension dues in line with prevailing regulations and laws. Sanlam Plc recorded an improved performance in H1’2019, as the profits rose to Kshs 0.6 bn, from a loss of Kshs 1.5 bn in H1’2018, aided by an 84.6% rise in total revenue to Kshs 4.7 bn, from Kshs 2.5 bn in H1’2018, and a 5.7% reduction in total operating expenses. As a consequence, the combined ratio improved to 135.8%, from 172.6% in H1’2018. This however indicates that the core insurance business remains unprofitable, and largely relied on investment income. If completed, we are of the view that the program should see the insurance company reduce its cost base, and aid the insurer in improving its expense ratio even further, which improved to 63.5% in H1’2019, from 74.5% in H1’2018, and likely enable the firm improve on its underwriting business performance.

Universe of Coverage

|

Company |

Price at 20/9/2019 |

Price at 27/9/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

40.1 |

42.0 |

4.9% |

12.1% |

61.3 |

8.3% |

68.7% |

1.2x |

Buy |

|

Sanlam |

17.9 |

18.8 |

4.7% |

(14.8%) |

29.0 |

0.0% |

62.0% |

0.7x |

Buy |

|

I&M Holdings |

45.0 |

45.0 |

0.0% |

5.9% |

79.8 |

7.8% |

52.8% |

1.2x |

Buy |

|

Diamond Trust Bank |

112 |

113.5 |

1.3% |

(27.5%) |

175.6 |

2.3% |

51.4% |

0.8x |

Buy |

|

Equity Group*** |

37.9 |

37.5 |

(1.2%) |

7.5% |

53.0 |

5.3% |

41.4% |

1.8x |

Buy |

|

Kenya Reinsurance |

2.9 |

2.9 |

0.3% |

(16.6%) |

3.8 |

5.2% |

34.5% |

0.3x |

Buy |

|

Co-operative Bank*** |

12.1 |

11.8 |

(2.5%) |

(17.5%) |

15.0 |

8.5% |

33.4% |

1.1x |

Buy |

|

Barclays Bank*** |

10.9 |

11.0 |

0.5% |

0.0% |

12.6 |

10.0% |

31.0% |

1.5x |

Buy |

|

Britam |

7.0 |

7.0 |

0.6% |

(30.6%) |

8.8 |

5.0% |

30.7% |

0.8x |

Buy |

|

NIC Group |

29.9 |

29.0 |

(3.2%) |

4.1% |

37.9 |

3.5% |

27.3% |

0.7x |

Buy |

|

Jubilee holdings |

350.0 |

350.0 |

0.0% |

(13.5%) |

418.5 |

2.6% |

22.1% |

1.1x |

Buy |

|

CIC Group |

3.3 |

3.3 |

1.5% |

(14.5%) |

3.8 |

3.9% |

20.9% |

1.2x |

Buy |

|

Liberty Holdings |

10.5 |

8.8 |

(15.8%) |

(31.5%) |

11.3 |

5.7% |

13.3% |

0.8x |

Accumulate |

|

Standard Chartered |

193.0 |

194.3 |

0.6% |

(0.1%) |

202.9 |

6.4% |

10.8% |

1.4x |

Accumulate |

|

Stanbic Holdings |

96.0 |

96.0 |

0.0% |

5.8% |

100.5 |

6.1% |

7.6% |

0.8x |

Hold |

|

HF Group |

5.8 |

7.3 |

25.5% |

31.4% |

2.8 |

0.0% |

(52.3%) |

0.3x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

During the week, Emerging Markets Private Equity Association (EMPEA), a global industry association for private capital in emerging markets, released their Mid-Year 2019 Statistics Report, which gives a snapshot of the global private equity space, particularly on the fundraising space, highlighting a significant drop in funds raised towards private equity, to USD 165.0 bn (Kshs 17.1 tn) in H1’2019, less than 33.0% of the USD 505.6 bn (Kshs 52.4 tn) raised in FY’2018. This slowdown in funds channelled towards private equity can be attributed to the general uncertainty in the global market, driven by factors such as the trade wars between the US and China, Brexit, and a slowdown in the economies of European Union countries.

From a geographical aspect, the US saw the largest level of capital raised, at USD 94.8 bn (Kshs 9.8 tn), compared to Western Europe and all other developed markets collectively, which raised USD 35.8 bn (Kshs 3.7 tn) and USD 2.5 bn (Kshs 259.5 bn), respectively. Emerging markets raised USD 33.1 bn (Kshs 3.3 tn), of which USD 1.6 bn (Kshs 166.1 bn) was raised by African PE funds. This was an improvement compared to H1’2018, where African PE funds raised USD 990.5 mn (Kshs 102.8 bn). However, there was a spike in H2’2018 where USD 2.1 bn (Kshs 217.9 bn) was raised.

Of the funds raised by African PE firms, buyout and growth continues to be the most favoured strategy by investors, raking in USD 783.0 mn (Kshs 81.3 bn), followed by infrastructure and real assets, at USD 567.0 mn (Kshs 58.8 bn).

|

Top 5 Funds Closed by Value in Africa (H1’2019) |

|||

|

Fund Manager(s) |

Fund Name |

Fund Type |

Capital Raised (USD mn) |

|

Meridiam |

Meridiam Infrastructure Africa Fund |

Infrastructure |

613 |

|

Amethis |

Amethis Fund II |

Growth |

425 |

|

Partech Partners |

Partech Africa Fund |

Venture Capital |

148 |

|

EXEO Capital |

Agri-Vie Fund II |

Growth |

146 |

|

Ethos |

Ethos Mezzanine Partners Fund III |

Mezzanine |

120 |

|

Total |

|

|

1,452 |

Source: EMPEA

Venture capital still continues to struggle with growth, with only 2 out of the top 10 funds closed in Africa focused on venture capital, i.e. Partech Africa Fund and KawiSafi Ventures. It remains to be seen whether a similar spike will be witnessed in H2’2019, albeit this will be unlikely, given that there has so far not been increased fundraising activity in Q3’2019.

Development Partners International, a London-based Africa-focused private equity firm, in collaboration with Convergence Partners, a South-African impact investment company, have announced an investment of USD 54.0 mn (Kshs 5.6 bn) in Channel VAS, a FinTech company with operations in Africa, Asia and the Middle East that advances micro-credit to individuals through mobile money transfer, for an undisclosed stake. Channel VAS has grown from its inception in 2012 to its current scale of 30 countries, serving over 650 mn individuals in these jurisdictions, and advancing over USD 5.0 mn (Kshs 518.7 mn) daily. Apart from cash, the company also advances loans in form of airtime, data and mobile handsets. The funds raised are expected to be utilised in Channel VAS’ target of providing over USD 1.5 bn (Kshs 155.6 bn) of credit to hundreds of millions of people globally through its partnerships with mobile network operators and financial institutions.

This investment came less than ten months since South African private equity firm, Ethos, announced a USD 49.0 mn (Kshs 5.0 bn) investment into Channel VAS for an undisclosed stake, with the funds intended to be advanced towards expansion of Channel VAS' footprint globally.

FinTech lending and microfinance institutions in general have been a major attraction for investors in Kenya and Sub-Saharan Africa. Lack of access to finance is a major issue for entrepreneurs and Micro, Small and Medium Enterprises (MSMEs) across Africa. According to the IMF, there are 44.2 mn MSMEs in Sub-Saharan Africa with a potential demand for USD 404.0 bn in financing. The current volume of financing in Sub-Saharan Africa is estimated at USD 70.0 bn signifying a huge financing gap of USD 334.0 bn. Microfinance institutions aim to bridge this gap by offering convenient access to credit.

Private equity investments in Africa remain robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

- Residential Sector

During the week, Barclays Bank of Kenya signed an agreement with the Centum Real Estate, an affiliate of Centum Investment Company, to finance buyers of Centum’s properties being developed in Kilifi (Centum’s development in Vipingo) and Nairobi at discounted interest rates. The housing loans will be priced between 11.5% p.a. and 11.9% p.a., approximately 1.5% points below the current maximum lending rate of 13.0% p.a. by commercial banks. The bank will fund 100% of the value for houses sold below Kshs. 10 million, and provide 90.0% financing for units priced above that level. The agreement currently covers both completed and off-plan units within the 1,255-unit Palm Ridge Estate and Awali Estate in Kilifi County, the 168-unit Riverbank Apartments and 400-unit Cascadia Apartments in Nairobi.

The above move is an indication of continued efforts by private sector players to compliment government efforts in enhancing home ownership in Kenya through increased availability of real estate financing. Currently, the inaccessibility and unaffordability of financing continues to be a key challenge facing potential home buyers in Kenya. The high effective cost of credit, at approximately 18.0%, inclusive of administration fees, has resulted in low home ownership with only approximately 26.1% of Kenyans in urban areas owning the homes they live in, according to 2015/16 Kenya Integrated Household Budget Survey (KIHBS). This is also evidenced by the underdeveloped mortgage market with only 26,187 mortgages in Kenya as at December 2017 out of a total adult population of approximately 23 mn persons, with the mortgage to GDP ratio at 2.7% as at 2017, compared to countries such as South Africa and USA, which have a ratio of above 30.0% and 70.0%, respectively. Thus, to enable homeownership, the government for the past three decades has continued to introduce a number of policies and fiscal reforms to enhance ownership. For further details on these initiatives, see Cytonn Weekly#37/2019.

In our view, increased private sector participation in provision of affordable financing will complement the government’s efforts on enhancing home ownership, at a relatively affordable cost. This will also expand the mortgage market, with more homebuyers taking up mortgages at affordable rates, hence increased uptake of housing units.

- Hospitality Sector

Radisson Group announced plans to begin operation of its third hotel, Radisson Blu Hotel and Residence in Nairobi next week. The hotel will be located at the Nairobi Arboretum area, and brings to the hospitality market 122-keys, in addition to amenities such as a spa, sauna, steam rooms, swimming pool and fitness center. This is part of an expansion plan by the international group, which is also planning to open an additional three new brands in Kenya, namely Red Radisson, Radisson and Radisson Collection (further details are yet to be disclosed). Currently, the Radisson group has two hotels in Nairobi, namely Radisson Blu in Upperhill and Park Inn by Radisson in Westlands. Other international brands that have continued to enter and expand their foothold in Kenya include Marriot, an American multinational hotel chain, which during the month signed a franchise agreement with Aleph Hospitality, a Dubai-based hotel management company to add Bluewater Hotels located in Kisumu to its portfolio.

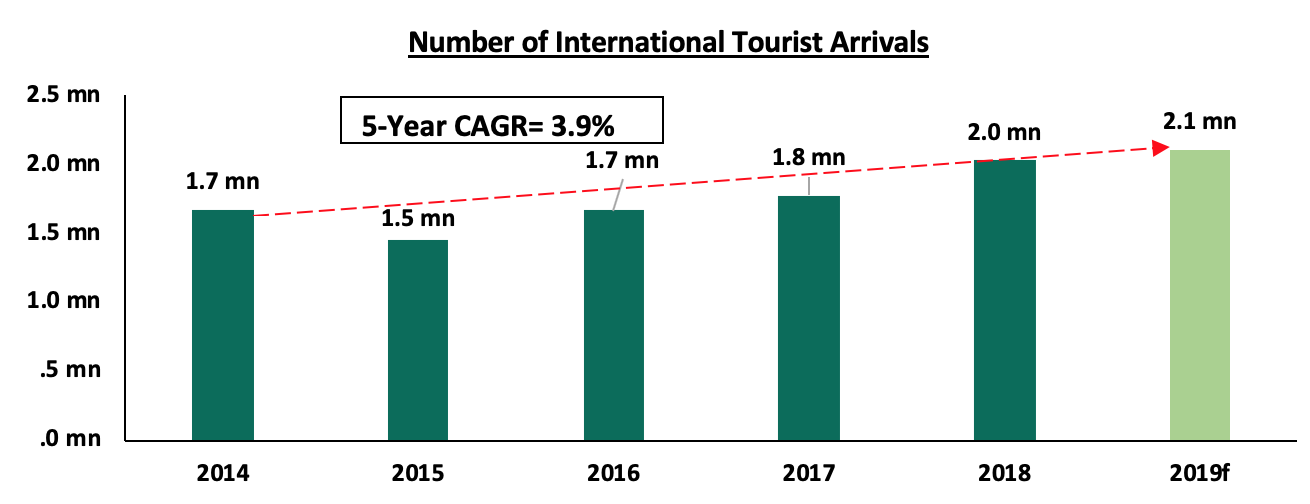

The hospitality sector is on an upward trend and continues to attract international hotel chains as a result of increased demand for hospitality services from both leisure and business travelers. According to the Kenya National Bureau of Statistics- Economic Survey 2019, the number of international tourist arrivals increased by 14.0% to 2.0 mn in 2018 from 1.8 mn in 2017, and is expected to come in at 2.1 mn in 2019, thus enhancing continued demand for hospitality services and facilities.

Source: Kenya National Bureau of Statistics 2019

We expect the hospitality sector to continue recording increased activities supported by;

- Improved hotel standards with the entry of global hotel brands,

- The continued marketing of Kenya as an experience destination, and

- Improved security, which continue to boost tourists’ confidence in the country and thus making it a preferred travel destination for both business and holiday travelers.

We expect the real estate sector to continue recording activities fueled by the continued entry and expansion of international brands in the hospitality sector, and the continued efforts by the private sector players to enhance home ownership.

Following the release of H1’2019 results by Kenyan banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that drove the performance of the sector. In this report, we assess the key factors that influenced the performance of the banking sector in the first half of 2019, the key trends in the sector, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As a result, we shall address the following:

- Key Themes that Shaped the Banking Sector in H1’2019;

- Performance of the Banking Sector in H1’2019; and,

- Outlook and Focus Areas of the Banking Sector Players Going Forward.

Section I: Key Themes that Shaped the Banking Sector in H1’2019:

The first half of 2019 has been characterized by consolidation activity in the banking sector involving some of the major players in the industry, among them KCB Group which acquired National Bank, NIC Group which merged with CBA Group and Equity Group which is set to acquire a controlling equity stake in Commercial Bank of Congo (BCDC) with the aim of merging the business with its existing subsidiary in DRC and is currently rumoured to be looking at acquiring HF Group. We also saw banks continue to diversify their revenue sources through venturing into fee businesses like bancassurance, brokerage, and fleet management, coupled with increased transactional income as customers adopt alternative channels of transactions. Thus, our report is themed “Consolidation and Revenue Diversification to Drive Growth in the Kenyan Banking Sector”.

Below, we highlight the key themes that shaped the banking sector in H1’2019, which include consolidation, regulation, asset quality, demonetization and revenue diversification:

- Consolidation – Consolidation activity remained one of the key highlights witnessed in Kenya’s banking sector, as players in the sector are either acquired or merge leading to formation of relatively larger, well capitalized and possibly more stable entities. Ongoing consolidation transactions include:

-

- KCB Group finalized the take-over of 100.0% of all the ordinary shares of National Bank of Kenya (NBK) on 6th September 2019 after the Capital Markets Authority approved the acquisition. The transaction will enable KCB to increase its customer base and product offerings, which should result in a steady growth in profitability, after addressing the current challenges facing NBK of inadequate capitalization and high levels of Non-Performing Loans. For more information on the transaction, kindly see our Kenya Listed Banks Q1’2019 Report,

- On 27th September 2019, the Central Bank of Kenya announced the merger of Commercial Bank of Africa Limited and NIC Group PLC, effective 30th September 2019, following attainment of all regulatory approvals. The merged company is set to remain listed on the Nairobi Securities Exchange (NSE). Mr. John Gachora, who is currently the Group Managing Director of NIC Group will become the Group Managing Director and Chief Executive Officer of the combined entity, while Mr. Isaac Awuondo who is currently the Group Managing Director of CBA will become Chairman of the Kenyan banking subsidiary, and will maintain direct oversight over the Digital Business. The appointments are in line with our expectations, which we highlighted in our Cytonn January 2019 Monthly Report. With digital banking being a core aspect in the merger, a separate digital banking unit will be created, and it will be overseen by its own distinct board. In terms of preparation, both entities are ready to integrate their spaces, core systems, branding and even staff having received the final go ahead from the CBK. For more information on the merger, kindly see our Kenya Listed Banks Q1’2019 Report,

- Kenyan banks continued to pursue their inorganic growth strategies beyond Kenya, with a key example being Equity Group Holdings, who entered into a binding term sheet with Atlas Mara Limited to acquire certain banking assets in 4 countries in exchange for shares in Equity Group. These include:

-

-

- 62.0% of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd.;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz); and,

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

-

More information on the details of the transaction are highlighted in our Kenya Listed Banks Q1’2019 Report. Aside from the Atlas Mara Limited transaction, Equity have entered into a binding Term Sheet with the shareholders of Banque Commerciale du Congo (BCDC), for the purchase of a controlling stake in the Congo-based lender, as discussed in our Cytonn Weekly #37/2019. Successful completion of the above transactions will likely see Equity expand its regional footprint, aiding the bank’s performance, which has in the recent past been constrained by thin margins due to the existent caps on loans. By expanding into markets where credit pricing is unrestricted, Equity would be able to leverage on its strong retail banking expertise as well as its strong digital banking capability via its subsidiary Finserve. This would enable Equity to expand both its funded and Non-Funded Income (NFI) revenue streams.

As noted in our focus note titled Consolidation in Kenya’s Banking Sector to Continue, we expect more consolidation in the banking sector, as the relatively weaker banks that probably do not serve a niche become acquired by the larger counterparts who have expertise in deposit mobilization, or serve a niche in the market. Consolidation will also likely happen, as entities form strategic partnerships, as they navigate the relatively tougher operating environment that is exacerbated by the stiff competition among the various players in the banking sector.

The table below summarizes the deals that have either happened or announced and expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

||

|

Oiko Credit |

Credit Bank |

3 |

22.8% |

1 |

1.5x |

Aug 2019 |

||

|

KCB Group |

National Bank of Kenya |

7 |

100.0% |

6.6 |

0.9x |

Apr 2019* |

||

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan 2019* |

||

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan 2019 |

||

|

CBA Group |

NIC Group |

33.5 |

53:47*** |

23.0 |

0.7x |

Jan 2019* |

||

|

KCB Group |

Imperial Bank** |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec 2018 |

||

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug 2018 |

||

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar 2017 |

||

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov 2016 |

||

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun 2016 |

||

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

Jun 2016 |

||

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar 2015 |

||

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul 2014 |

||

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov 2013 |

||

|

Average |

|

|

73.7% |

|

1.4x |

|

||

|

* Announcement date ** Refers to certain Assets & Liabilities of Imperial Bank, which is under receivership *** Shareholder swap ratio between CBA and NIC, respectively |

||||||||

- Regulation - Regulation remained a key aspect that affected the banking sector in H1’2019, with the regulatory environment evolving and becoming increasingly stringent. Key changes in the regulatory environment in H1’2019 include:

-

- Banking Sector Charter: The Central Bank of Kenya proposed to introduce a Banking Sector Charter in 2018, which will guide service provision in the sector. The Charter, which came into effect in March 2019, aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. It is expected to facilitate a market-driven transformation of the Kenyan banking sector, thereby considerably improving the quality of service provided, as well as increase the access to affordable financial services for the unbanked and under-served population. The implementation of the charter will likely hasten the implementation of risk-based credit scoring, which requires banks to extend credit on the basis of their credit scores, as determined by licensed credit reference bureaus. The charter is largely centered on consumer protection, by requiring banks to make full disclosure on the terms of the issuance of credit. In a bid to improve credit extension to Micro, Small and Medium Enterprises (MSMEs), the Banking Sector Charter prescribes that banks should have at least 20.0% of the loans extended to MSMEs. The CBK requires strict compliance with the charter, as banks may be imposed with administrative sanctions should they fail to comply with the charter,

- Banking (Amendment) Act 2015: During the first half of the year, the High Court suspended the Banking (Amendment) Act 2015 for 1-year, terming it as unconstitutional. The court found the provisions of sections 33 b (1) and (2) of the Banking Act, which capped interest at 4.0% above the Central Bank Rate (CBR) to be vague, imprecise and ambiguous. To address this, the proposed Banking (Amendment) Bill 2019 was introduced in Parliament as it aims to seal the loopholes highlighted by the High Court in March 2019. Included in the Finance Bill 2019, there is the proposition by the Cabinet Secretary of the National Treasury to repeal the Act, citing that since its enactment, the law has failed to meet its objective of improved credit access, especially to MSMEs. During the week, discussions of the repeal propositions were concluded, with lawmakers voting to reject the propositions and retain the rate caps. With banks cognisant of Parliament’s relentlessness regarding the law, the push has since shifted towards increasing the 4.0% margin set. The same was proposed earlier in January 2019 by a member of parliament, proposing to increase the margin from 4.0% above the CBR, to 6.0% above the current ceiling, implying that the new cap would be at 19%, under the current CBR of 9%. With private sector credit growth remaining below the 5-year average as shown in the graph below, we retain our view as highlighted in our focus note, Review of the Interest Rate Cap that a repeal stands as the best course of action. We note that the CBK has been proactive in implementing policies aimed at consumer protection and increased credit access, with the policies yielding minimal results, as shown by the improvement in the private sector credit growth to 6.3% in August, compared to 4.3% in a similar period in 2018. We thus maintain our view that a repeal of the law remains the best course of action to spur credit extension to MSMEs, which should consequently spur economic growth.

-

- Demonetization: In an effort to track illicit financial flows, the Central Bank of Kenya, on 31st May 2019, announced the introduction of new generation notes of denominations Kshs 1,000, Kshs 500, Kshs 200, Kshs 100 and Kshs 50. Further to this, they highlighted that the old Kshs 1,000 notes will cease to be a legal tender and will be withdrawn from the market by 1st October 2019. In some cases, this exercise has brought cash shortages in the market that prompts people to seek alternatives on digital platforms. Aside from tracking illegal financial flows, demonetization is expected to enhance financial inclusion of the informal sector, in addition to helping the country transition to a more cash-less economy. For more information on demonetization, kindly see our topical on the Effects of the Issuance of the New Generation Banknotes.

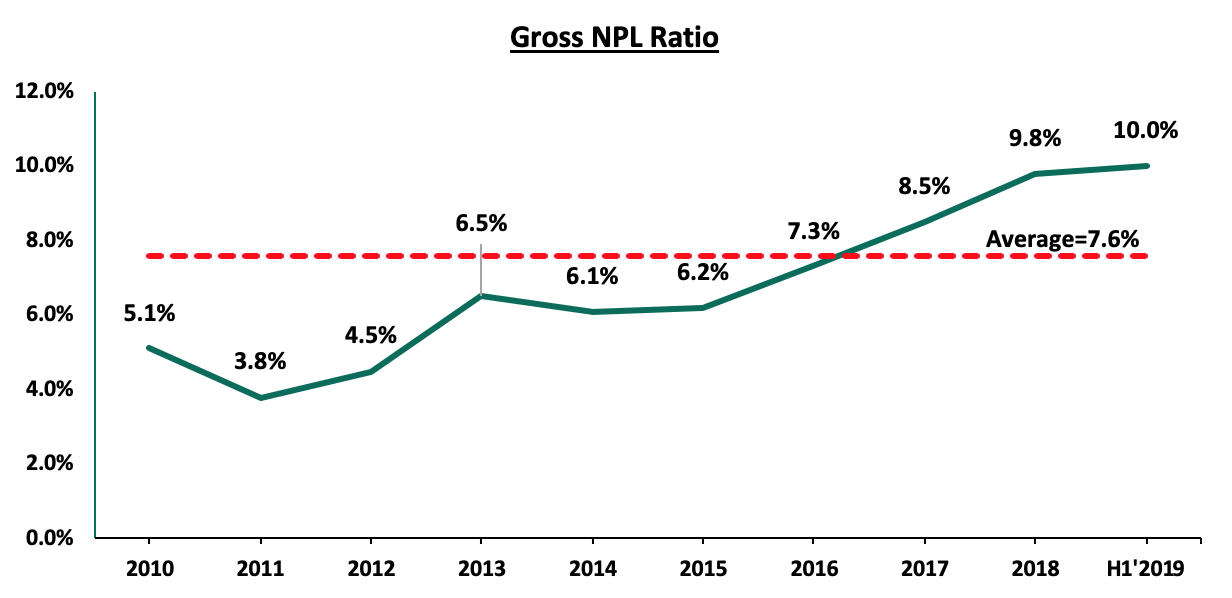

- Asset Quality – The listed banking sector continued to record a deterioration in its asset quality in H1’2019, as indicated by the rise in the Gross Non-Performing Loans (NPLs) ratio to 10.0%, from 9.8% in H1’2018, much higher than the 5-year average of 7.6%. The chart below highlights the asset quality trend:

Economic recovery from the harsh operating environment experienced in 2017 and the first quarter of 2018 has been slower than anticipated, which resulted in an increase in the number and value of bad loans. In addition, the denominator effect has been at play as the slow growth in loans has contributed to the increasing Gross NPL ratio in the sector. The major sectors touted by banks as leading in asset quality deterioration include trade, retail, manufacturing and real estate. Delayed payments by the government was also identified as a contributing factor, which affected various sectors, with small to mid-sized companies affected the most. Owing to the deteriorating asset quality, banks continued to implement their stringent lending policies in a bid to curb the rising NPLs, and consequently the associated impairment charges. Furthermore, banks have been investing heavily in adopting the use of advanced credit scoring method to identify delinquencies before they occur. In addition, several banks have set up remediation teams that help distressed clients to restructure, and consequently regain their debt-servicing capability. We however expect the industry’s asset quality to deteriorate in the near-term as businesses continue to cite a relatively tougher environment. Banks will thus continue to focus largely on (i) lending to relatively larger corporate entities, (ii) secured lending, and (iii) working capital financing to financially sound businesses.

- Revenue Diversification: Listed banks continued their revenue diversification drive by growing the Non-Funded Income (NFI) segment, with various banks launching several initiatives as highlighted below:

-

- Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. The Property Hub intends to serve the clients who have property to sell and connect them to the Co-operative Bank clients who want to buy property. The bank will also offer mortgages to the buyers of the property as it expects to leverage on its contacts with key institutions and the cooperative movements that largely own the bank to boost the property sales for its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019,

- Co-operative Bank also highlighted its plan of growing the business of its leasing-focused subsidiary Co-op Bank Fleet, which intends to leverage on the synergies created by Co-operative Bank’s client base to grow its business, with the main business case of the subsidiary being the easing of the cash flow constraints of acquisitions of fleets, repair and maintenance, thus allowing businesses to focus on their core business. For more information, please see our our report here,

- Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, in order to provide real time cross border payments to its clients. DTBK will be the first East African Bank to go live on the SWIFT global payment innovation service, a service that is carrying out over USD 30.0 bn worth of transactions a day, in over 148 currencies. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019,

- Standard Chartered Bank Kenya (SCBK) launched an innovation hub lab in Nairobi dubbed Xcelerator in a bid to boost its revenue streams and diversify by riding on financial technology. SCBK plans to allocate Kshs 10.0 bn into supporting Financial Technology (FinTech) startups to scale up and generate innovative solutions to problems in the banking sector. StanChart views FinTech firms as partners amid their growing disruption of the local financial sector, a move likely to aid the bank in generating additional revenue. For additional information, please see our Cytonn Weekly #15/2019, and,

- Housing Finance recently launched a WhatsApp banking solution that offers clients customized mobile services, making it the second company in the continent after First Bank of Nigeria, who launched the service in October 2018. To subscribe, one only needs to save the bank’s WhatsApp phone number and get access to services such as account opening, funds transfer bill payments and loans. This move by Housing Finance is mainly driven by the increased use of mobile phones and the internet.

We expect more forays by banks into the NFI segment, as players seek to alleviate the effects of the compressed funded income regime. We note that the average NFI for H1’2019 has grown by 16.5% compared to 6.9% seen in H1’2018 showing the shifted focus towards the segment has borne fruit for the sector.

Section II: Performance of the Banking Sector in H1’2019:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Barclays Bank Kenya |

18.0% |

7.4% |

30.8% |

0.6% |

8.4% |

12.6% |

32.4% |

11.1% |

5.9% |

15.4% |

81.3% |

6.0% |

18.1% |

|

I&M Bank |

17.0% |

8.8% |

18.3% |

2.2% |

6.0% |

21.9% |

39.3% |

6.0% |

12.5% |

28.5% |

72.6% |

5.7% |

17.7% |

|

Stanbic Holdings |

14.4% |

10.5% |

5.2% |

19.5% |

5.1% |

10.1% |

47.8% |

53.2% |

10.3% |

8.1% |

74.4% |

15.0% |

15.3% |

|

Diamond Trust Bank |

11.0% |

(6.6%) |

(5.5%) |

(7.5%) |

6.0% |

8.5% |

24.5% |

(15.6%) |

0.5% |

14.4% |

67.4% |

(3.8%) |

13.9% |

|

Equity Group |

9.1% |

9.2% |

14.3% |

7.6% |

8.5% |

25.6% |

44.0% |

16.1% |

16.5% |

13.0% |

70.0% |

16.7% |

22.1% |

|

NIC Group |

8.6% |

0.9% |

(7.0%) |

7.7% |

6.0% |

23.9% |

32.5% |

29.3% |

3.5% |

8.1% |

77.8% |

3.1% |

12.0% |

|

SCBK |

5.4% |

(7.3%) |

(26.0%) |

0.0% |

7.6% |

(2.2%) |

32.4% |

(12.8%) |

(1.0%) |

(15.2%) |

52.5% |

7.4% |

18.2% |

|

KCB Group |

5.0% |

4.3% |

1.6% |

5.2% |

8.2% |

14.7% |

34.1% |

3.5% |

7.3% |

20.3% |

85.0% |

13.6% |

22.7% |

|

Co-operative Bank |

4.6% |

(1.7%) |

3.5% |

(3.8%) |

8.4% |

25.1% |

38.0% |

38.1% |

9.0% |

14.2% |

79.6% |

2.6% |

18.8% |

|

National Bank of Kenya |

(40.1%) |

7.3% |

(14.4%) |

20.0% |

8.2% |

(28.7%) |

19.4% |

(4.6%) |

(4.9%) |

(17.5%) |

51.8% |

(1.0%) |

6.7% |

|

HF Group |

N/A |

(15.6%) |

(9.8%) |

(23.5%) |

4.0% |

55.8% |

47.1% |

44.4% |

(6.6%) |

5.4% |

91.0% |

(14.8%) |

(6.5%) |

|

H1'2019 Mkt Weighted Average* |

9.0% |

3.7% |

5.3% |

3.8% |

7.7% |

16.5% |

37.2% |

12.7% |

8.6% |

12.1% |

73.8% |

9.8% |

19.3% |

|

H1'2018 Mkt Weighted Average** |

19.0% |

7.9% |

12.0% |

6.4% |

8.1% |

6.9% |

34.3% |

4.6% |

10.0% |

14.9% |

73.8% |

3.8% |

19.5% |

|

*Market cap weighted as at 6/09/2019 **Market cap weighted as at 31/08/2018 |

|||||||||||||

Key takeaways from the table above include:

- Kenya Listed Banks recorded a 9.0% average increase in core Earnings per Share (EPS), compared to a growth of 19.0% in H1’2018. As a result, the Return on Average Equity decreased marginally to 19.3% compared to 19.5% recorded a similar period in 2018,

- Deposit growth came in at 8.6%, slower than the 10.0% growth recorded in H1’2018. On the other hand, interest expense increased at a slower pace of 5.3%, compared to 12.0% in H1’2018, indicating that banks have been able to mobilize relatively cheaper deposits. In addition, the removal of the 70.0% minimum deposit payable on deposits in the Finance Act 2018 reduced the cost of deposit funding,

- Average loan growth came in at 9.8%, which was faster than the 3.8% recorded in H1’2018, indicating that there was an improvement in credit extension to the economy. Government Securities on the other hand recorded growth of 12.1%, which was a slower growth rate compared to the 14.9% in H1’2018. This shows that banks have begun to adjust their business models, focusing more on private sector lending as opposed to investing in government securities, whose yields declined during the year. Interest income increased by 3.7%, slower than the 7.9% recorded in H1’2018. Consequently, the Net Interest Income grew by 3.8%, slower than the 6.4% recorded in H1’2018,

- The average Net Interest Margin in the sector came in at 7.7%, lower than the 8.1% in H1’2018. The decline was mainly due to a decline in yields recorded in government securities, coupled with the decline in yields on loans due to the 100-bps decline in the Central Bank Rate, and,

- Non-Funded Income grew by 16.5% y/y, faster than the 6.9% recorded in H1’2018. The growth in NFI was boosted by the total fee and commission income which improved by 12.7%, compared to the 4.6% growth recorded in H1’2018, owing to the faster loan growth.

Section III: Outlook and Focus Areas of the Banking Sector Going Forward:

The banking sector had a slower growth compared to the performance recorded in a similar period last year, largely due to the slower expansion of funded income segment, as NII grew by 3.8% in H1’2019, slower than 6.4% in H1’2018. Funded income continues to record relatively slower growth, affected by the declining yields in both loans and government securities. We maintain our view that the interest rate cap has not achieved its intended objectives of easing the access to credit and reducing the cost of credit, and thus needs to be repealed, so as to spur economic growth, as MSMEs have continued to struggle in accessing the much-needed credit. It would be helpful for the MSMEs to form a lobby group to engage directly with policy makers and legislators. We also continue to be proponents of promoting competing sources of financing, which should reduce the overreliance on bank funding in the economy, currently 90.0% to 95.0% of all funding. By having various competing sources of financing, this would trigger a self- regulated pricing structure, in the event of a repeal of the law.

Thus, we expect the following:

- A review of the Banking (Amendment) Act 2015, given the proposition to repeal the law that was included in the Finance Bill 2019 was voted down by lawmakers. Given that a Member of Parliament proposed a revision of the law to include a ceiling of 6.0% above the limit set by the Banking (Amendment) Act, 2015 for the high risk borrowers, we expect parliament to maintain their stance of a no repeal of the interest rate cap, and instead opt for an amendment of the margins, as pressure from various institutions such as the National Treasury and the CBK increases. The National Assembly approved the Finance Bill 2019 earlier this week and the same is at the Presidential accent stage where it should be signed into law, and,

- The demonetization exercise will likely result in a possibly stronger deposit growth for banks especially in H2’2019, as money flows into banks, especially in the run up to the 1st October deadline. So far, approximately 100.0 mn out of the 217.0 mn one-thousand notes have been converted, and within the first month of the June announcement, deposits in banks grew by Kshs 22.3 bn, while currency outside banks fell by Kshs 25.1 bn. Furthermore, during the current transition period, we expect an increase in the number and value of transactions, as demand for digital transactions rises, with a majority of people prioritizing digital transactions to avoid handling the old currency as well as fake currency. This should presumably lead to a relatively better performance of the Non-Funded Income (NFI) segment.

We expect banks to continue focusing on the following:

- Asset Quality Management: Banks will look to manage the industry-wide deteriorating asset quality, which can be seen in the current Gross NPL Ratio that came in a 10.0%, higher than the 5-year average of 7.6%. This may involve further tightening of credit standards as banks cherry pick low risk credit consumers and increase focus on secured, collateral-based lending,

- Revenue Diversification: In the current regime of compressed interest margins, focus on Non-Funded Income (NFI) is likely to continue, as banks aim to grow transactional income via alternative channels such as agency banking, internet and mobile technologies. The average growth in NFI for H1’2019 came in at 16.5%, compared to 6.9% recorded in H1’2018,

- Operational Efficiency: Cost containment is likely to continue being a focus area as can be seen in the H1’2019 figures, where the average cost-to-income ratio was 55.1%, lower than the 5 year average of 58.0%. Banks such as National Bank of Kenya, Standard Chartered and Stanbic Bank have had to lay off staff in H1’2019 in an effort to cut costs. We expect continued restructuring, possibly leading to staff layoffs, as staff headcount demands reduce, on increased usage of mobile and internet channels,

- Downside Regulatory Compliance Risk Management: With increased emphasis on anti-money laundering and fraudulent transactions, we expect banks to be keener on streamlining their operational processes and procedures in line with global standards and regulatory requirements, and

- Consolidation: Banks will continue to form strategic partnerships in an effort to increase market share for the strong players in the market and struggling banks that don’t have a niche market will get acquired. We expect well capitalized players to take advantage of this, which should see several deals completed.

For more information, see our Cytonn H1’2019 Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.