Cytonn Q3’2019 Markets Review

By Cytonn Investments, Oct 6, 2019

Executive Summary

Global Markets Review

According to the World Bank, the global economy has continued to slow down, with 2019 growth expected at 2.6%, a 0.4% point decline from the 3.0% recorded in 2018. This is as a result of (i) an escalation in the trade dispute between the US and China, (ii) country-specific uncertainty such as Britain’s exit from the European Union (“Brexit”), (iii) heightened geopolitical tension between the US and Iran that has disrupted the mid-stream and down-stream oil supply channels, and (iv) overall slowing global trade, which, according to World Bank, contracted by 1.4% in June 2019;

Sub-Saharan Africa Region Review

Majority of the currencies in the Sub Saharan Africa Region have depreciated against the US Dollar on an YTD basis with the Ugandan Shilling and the Nigerian Naira being the only gainers. The Ghanaian Cedi was the worst performer, depreciating by 12.4% against the dollar YTD owing to perceptions about the country’s inability to manage its finances properly after a four-year bailout by the International Monetary Fund that ended in April 2019. Yields on African Eurobonds generally declined in Q3’2019. This was partly attributed to the adoption of a looser monetary policy regime by the Eurozone and the United States that led to a decline in yields in advanced economies and hence increased investor interest in Africa’s debt market. Majority of the SSA stock markets recorded negative returns during Q3’2019, attributed to expectations of slower global economic growth, and uncertainties from the escalated trade dispute between the United States and China;

Kenya Macroeconomic Review

The macroeconomic environment in Kenya has remained relatively stable in the third quarter of 2019, supported by (i) a stable interest rate environment, evidenced by the declining yields in government securities in the primary market, which has enabled the Kenyan Government to continue accessing cheap domestic debt, and (ii) improved business confidence and strong private consumption as evidenced by the Stanbic Bank Monthly Purchasing Manager’s Index (PMI), which averaged 53.7 in Q3’2019 and rose to 54.1 in September, indicating expansion. Kenya’s economy expanded by 5.6% in Q2’2019, similar to the 5.6% recorded in Q1’2019, but lower than the 6.4% recorded in Q2’2018. The average inflation rate increased to an average of 5.1% in Q3’2019, compared to 4.4% in Q3’2018;

Fixed Income

T-bill’s remained oversubscribed in Q3’2019, with the average subscription rate coming in at 106.8%, a decline compared to 125.5% in Q2’2019. Average subscription rates for the 91-day, 182-day, and 364-day papers in Q3’2019 came in at 121.9%, 44.4% and 163.0%, respectively, from 100.6%, 49.6% and 248.1% in Q2’2019;

Equities

In Q3’2019, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 3.0%, 7.6%, and 3.1%, respectively, taking their YTD performance as at the end of September to gains and (losses) of 3.6%, (14.2%) and (2.2%) for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the quarter was shaped by declines in large caps such as Bamburi, Equity Group, and Safaricom, which declined by 17.9%, 3.9%, and 2.1%, respectively. During the week, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 gaining by 1.8%, 1.6%, and 1.5%, respectively, taking their YTD performance to gains and (losses) of 4.8%, (13.9%) and (1.3%), respectively. The performance in NASI during the week was driven by gains in Safaricom, BAT, Co-operative Bank of Kenya, and Standard Chartered Bank, which gained by 3.5%, 2.9%, 2.1% and 1.9%, respectively;

Private Equity

During Q3’2019, we witnessed high levels of private equity activity across the sectors we cover, including financial services, FinTech, and Education, evidenced by increased deal activity by global investors, among them Helios and Actis. The financial services and FinTech sectors witnessed the most activity, with some of the notable transactions being the capital raises by Branch and Tala, and the acquisition of a stake in Credit Bank by Oiko Credit, among others;

Real Estate

The real estate sector has recorded subdued performance in Q3’2019, with the residential, commercial office and retail sectors recording average yields of 4.7%, 7.7% and 8.0% in Q3’2019, from 4.9%, 7.8% and 8.2%, respectively, in H1’2019. The decline in performance was driven by (i) delay in the processing of construction permits by some county governments, (ii) oversupply in the commercial office and retail sectors with a surplus of 5.2 mn SQFT and 2.0 mn SQFT, respectively, as at 2018, and (iii) slow private sector credit growth.

- Cytonn Investments filed an application with the Capital Markets Authority (CMA), on 3rd October 2019, to register a Development Real Estate Investment Trust, (D-REIT), seeking to raise Kshs 2.0 bn of capital. The D-REIT, which is innovatively structured to pay a coupon over the life of the development, will be deployed for the first phases of two of our real estate projects, The Ridge in Ridgeways, and RiverRun Estates in Ruiru. For a copy of the press release, please see here.

- The Ridge is a comprehensive aspirational lifestyle development on 10 acres in Ridgeways where stage one of the development is complete – including land acquisition, concept development and foundation works. The funds raised will go towards the second stage, entailing the superstructure construction.

- RiverRun is a master planned mixed-use community on 100 acres in Ruiru, with a dedicated affordable housing component;

- David Gitau, Investments Analyst, was on K24 to discuss Cytonn’s Listed Banks H1’2019 Report. Watch David here;

- Caleb Mugendi, Assistant Manager – Public Markets, was on NTV to discuss alternative investments. Watch Caleb here;

- Beatrice Mwangi, Research and Deal Orientation Analyst was on Inooro TV to discuss the performance of Kenyan markets. Watch Beatrice here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. Phase 2 now open for sale. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- Cytonn Money Market Fund closed the week at an average yield of 10.4% p.a. To subscribe, just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Introduction

According to the World Bank, the global economy has continued to slowdown, with 2019 growth expected at 2.6%, a 0.4% point decline from 3.0% recorded the in 2018. This is as a result of;

- An escalation in the trade dispute between the US and China,

- Country-specific uncertainty such as Britain’s exit from the European Union (“Brexit”),

- Heightened geopolitical tension between the US and Iran, disrupting the mid-stream and down-stream oil supply channel,

- Overall slowing global trade, which, according to World Bank, contracted by 1.4% in June 2019, and,

- Reduced consumption expenditure in major global economic regions such as Asia, as it has resulted in the reduction in global demand for goods and services, and hence contributed to the slowing global trade.

United States

The US economy grew by 2.0% in Q2’2019, a 2.2% point decline from the 4.2% recorded in Q2’2018. The decline is attributed to a decline in the manufacturing sector with industrial production growing by 0.4% in August 2019, the slowest pace since August 2017. The US economy is expected to grow by 2.5% in 2019, slower than the 2.9% growth recorded in 2018, weighed down by reduced exports to major traditional partners such as China and the Eurozone, owing to uncertainty regarding the trade dispute between the US and China, and the fragile growth in the Eurozone.

The Federal Open Monetary Committee (FOMC) held 2 meetings during Q3’2019, and reduced the Federal Funds Rate by 25 bps at each meeting, to a range of 1.75% - 2.00%, from 2.25%-2.50% previously, citing:

- Weakened business investment and exports amid falling manufacturing as a result of slower global growth and trade policy tensions, and,

- Muted inflationary pressure with the current inflation rate of 1.7%, being below the government’s target of 2.0%

The stock market has been on an upward trend, with the S&P 500 gaining by 1.2% in the quarter and 18.7% YTD. The gain was largely supported by improved corporate earnings performance by a majority of counters in the financial services, oil and gas, consumer goods and technology sectors, and the easing stance adopted by the Federal Reserve. US valuations are still higher than their long-term historical average with the Shiller Cyclically Adjusted P/E (CAPE) multiple currently at 29.6x, which is 77.2% above the historical average of 16.7x.

Eurozone

The Eurozone economy grew by 0.2% in Q2’2019, a 0.1% point decline from the 0.3% recorded in Q2’2018. The slow growth is attributed to dampened sentiments in major economies such as Germany, which contracted by 0.3% during the quarter as a result of falling exports, and could be on path for a recession this year. The slow growth is also attributed to a fall of 1.8% in industrial production as a result of collapsing production of motor vehicles and capital goods. In addition, uncertainty over Britain’s exit from the European Union (“Brexit”) has also led to increased uncertainty in the Eurozone regarding its impact, and the type of exit deal to be adopted by the UK.

The European Central Bank (ECB) maintained the base lending rate at 0.0%, and the rates on the marginal lending facility at 0.25%, while it reduced its deposit rates by 10 bps to (0.5%) from (0.4%), and introduced a fresh stimulus package by restarting its bond purchases of EUR 20.0 bn a month from November. The stimulus packages were in a bid to revive growth amid the fragile economic growth in the Eurozone, and the muted inflationary pressures, as the inflation rate for the region came in at 1.0% in September, lower than the ECB target of 2.0%.

The Stoxx 600 index rose by 2.2% in Q3’2019 and by 16.4% YTD. The P/E ratio currently at 16.0x, is 17.9% below the historical average of 19.5x, indicating markets are currently trading at relatively cheaper valuations.

China

The Chinese economy grew by 6.2% in Q2’2019, a 0.5% point decline from the 6.7% recorded in Q2’2018. The decline is attributed to trade flows remaining weak amid softening global demand and higher tariffs on bilateral trade with the U.S, coupled with a decline in manufacturing activity. The government is however providing additional fiscal support through fixed investments that grew by 5.5% in August 2019. During the quarter, the Manufacturing PMI closed at 49.8 in September 2019, marking the fifth consecutive month the manufacturing sector contracted during the year since the last recorded expansion in April at 50.1.

The Chinese government has adopted a more accommodative stance, with the aim of attaining the target GDP growth of “around 6.5%” by injecting liquidity in the economy by reducing the reserve requirements for banks, and resuming public investment, which should result in increased liquidity and consequently higher domestic consumption.

The Shanghai Composite index declined by 2.5% in Q3’2019, for a gain of 16.4% YTD. The year to date gain is supported by expectations of a positive outcome following resumption of trade talks with the United States, coupled with increased capital injection by the government, which improved investor confidence. The P/E ratio currently at 11.8x, is 18.6% below the historical average of 14.5x, indicating markets are currently trading at relatively cheaper valuations.

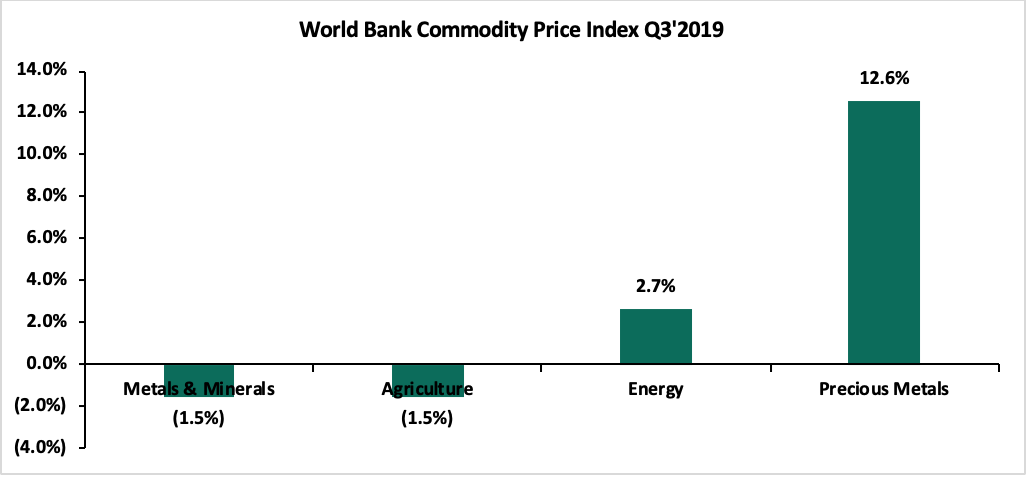

Commodity Prices

According to the World Bank Commodity Prices Index, energy, metals, precious metals and agriculture segments gained/(declined) by 2.7%, (1.5%), 12.5% and (1.5%), respectively, in Q3’2019. Below is a chart showing the performance of select commodity groups for Q3’2019;

As per the chart above:

- The increase in precious metals was largely influenced by the rise in gold prices, which has benefitted as a store of value following the expansionary monetary policy adopted in advanced economies leading to lower interest rates, and

- The decline in agriculture was largely driven by the declines in oils & meals and food, which both recorded declines of 1.0% points.

Currency Performance

Majority of the currencies in the Sub Saharan Africa Region have depreciated against the US Dollar on an YTD basis with the Ugandan Shilling and the Nigerian Naira being the only gainers. The Ghanaian Cedi was the worst performer, depreciating by 12.4% against the US Dollar YTD owing to perceptions about the country’s inability to manage its finances properly after a four-year bailout by the International Monetary Fund that ended in April 2019. The Kenya Shilling’s depreciation against the US Dollar YTD has mainly been attributable to high dollar demand from merchandise importers and the energy sector. Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Sep-18 |

Dec-18 |

Sep-19 |

Last 12 Months Change (%) |

YTD Change (%) |

|

Ugandan Shilling |

3,820.0 |

3,699.3 |

3,675.0 |

3.8% |

0.7% |

|

Nigerian Naira |

306.4 |

307.0 |

306.0 |

0.1% |

0.3% |

|

Tanzanian Shilling |

2,257.2 |

2,298.7 |

2,315.5 |

(2.6%) |

(0.7%) |

|

Malawian Kwacha |

718.4 |

719.8 |

727.6 |

(1.3%) |

(1.1%) |

|

Kenyan Shilling |

100.7 |

101.8 |

103.8 |

(3.0%) |

(1.9%) |

|

Botswana Pula |

10.6 |

10.7 |

11.0 |

(4.2%) |

(3.1%) |

|

South African Rand |

14.1 |

14.3 |

15.1 |

(7.1%) |

(5.5%) |

|

Mauritius Rupee |

34.2 |

34.2 |

36.1 |

(5.5%) |

(5.7%) |

|

Ghanaian Cedi |

4.8 |

4.8 |

5.4 |

(13.5%) |

(12.4%) |

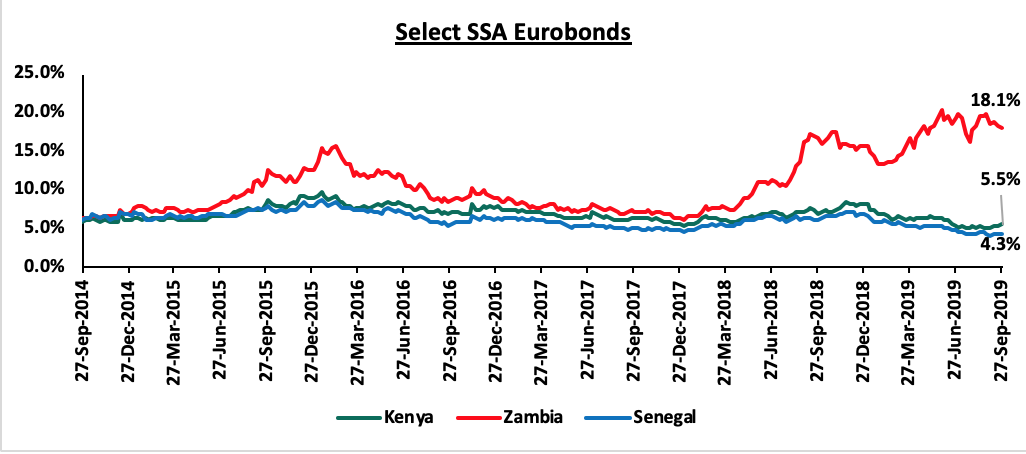

African Eurobonds

Yields on African Eurobonds generally declined in Q3’2019. This was partly attributed to the adoption of a looser monetary policy regime in the Eurozone and the United States that led to a decline in yields in advanced economies. As a result, there was increased investor interest in Africa’s debt market.

Below is a graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by their respective countries:

Analysis of trends observed in the chart above is as follows:

- Yields on the Zambia Eurobond continued to increase in Q3’2019, attributable to the exodus of foreign investors amid fears of the country’s debt sustainability, with most believing it to be close to default as the country is struggling with high debt levels. Zambia’s external debt has risen to USD 10.1 bn at the end of 2018, compared with USD 8.7 bn in 2017, with the debt to GDP ratio estimated at 74.4% further, raising fears of a debt crisis in the country. This has seen the downgrading of the Government of Zambia's long-term issuer ratings to Caa2 from Caa1 and changed the outlook to negative from stable.

- Yields on Kenyan and Senegalese Eurobonds both declined in Q3’2019, signalling that the demand for the instruments had risen during the period, mostly attributed to macroeconomic stability in both countries.

Equities Market Performance

Majority of the SSA stock markets recorded negative returns during Q3’2019, attributed to expectations of slower global economic growth, coupled with uncertainties from the escalated trade dispute between the United States and China, which saw widespread sell-offs across emerging markets by investors. In the near term, we expect the markets to remain subdued due to the exit of offshore investors. Below is a summary of the performance of key bourses in SSA:

|

Equities Market Performance (Dollarized*) |

|||||

|

Country |

Sep-18 |

Dec-18 |

Sep-19 |

Last 12 Months Change (%) |

YTD Change (%) |

|

Kenya |

1.5 |

1.4 |

1.4 |

(6.0%) |

1.4% |

|

Rwanda |

0.1 |

0.1 |

0.1 |

(1.3%) |

0.0% |

|

South Africa |

3,939.8 |

3,675.7 |

3,622.9 |

(8.0%) |

(1.4%) |

|

Uganda |

0.5 |

0.5 |

0.4 |

(12.5%) |

(6.7%) |

|

Nigeria |

107.0 |

102.4 |

90.3 |

(15.6%) |

(11.8%) |

|

Tanzania |

1.0 |

1.0 |

0.8 |

(11.8%) |

(19.2%) |

|

Ghana |

604.0 |

519.0 |

408.0 |

(32.5%) |

(21.4%) |

|

Zambia |

448.0 |

440.7 |

336.2 |

(25.0%) |

(23.7%) |

|

*The index values are dollarized for ease of comparison |

|||||

We are of the view that relative political stability, higher oil production (in oil exporting countries), strong agricultural production and strengthening economic reforms will improve SSA’s economic outlook. However, political uncertainty, widening fiscal and current account deficits, and rising public debt levels could continue to weigh on the economic outlook for the region.

According to the Kenya National Bureau of Statistics (KNBS), Kenya’s economy expanded by 5.6% in Q2’2019, similar to the 5.6% recorded in Q1’2019, but lower than 6.4% recorded in Q2’2018. The economic growth was driven by:

- Recovery in the financial and insurance sector, which recorded a growth of 6.7% compared to the growth of 3.9% seen in Q2’2018,

- Increased output in the education, transport and storage and construction sectors, which grew by 6.0%, 7.2% and 7.2%, respectively,

- Information and Communication sector which recorded the highest growth of 11.6%, compared to 11.7% recorded in Q2’2018, and,

- The agricultural sector which recorded a slower growth of 4.1%, compared to 6.5% seen in Q2’2018.

With the implementation of the Big 4 agenda, various sectors stand to grow significantly with the increased activity such as the manufacturing sector, which will also benefit from the major infrastructural developments taking place. For a more comprehensive analysis, see our Q2’2019 Quarterly GDP Review and Outlook Note.

During Q3’2019, we tracked Kenya 2019 GDP growth projections released by 13 organizations, that comprised of research houses, global agencies, and government organizations. The average GDP growth, including Cytonn’s 2019 growth estimate of 5.9%, came in at 5.9%, unchanged from average projections released in Q2’2019. The common view is that GDP growth will slow in 2019 from a growth of 6.3% in 2018, the fastest economic growth since the 8.4% recorded in 2010.

Below is a table showing average projected GDP growth for Kenya in 2019; noteworthy being that the highest projection is by the Central Bank of Kenya at 6.3%. We shall be updating this table should projections change and shall highlight who had the most accurate projection at the end of the year.

|

Kenya 2019 Annual GDP Growth Outlook |

||||

|

No. |

Organization |

Q1'2019 |

Q2'2019 |

Q3’2019 |

|

1. |

Central Bank of Kenya |

6.3% |

6.3% |

6.3% |

|

2. |

Citigroup Global Markets |

6.1% |

6.1% |

6.1% |

|

3. |

African Development Bank (AfDB) |

6.0% |

6.0% |

6.0% |

|

4. |

PNB Paribas |

6.0% |

6.0% |

6.1% |

|

5. |

UK HSBC |

6.0% |

6.0% |

6.0% |

|

6. |

Euromonitor International |

5.9% |

5.9% |

6.3% |

|

7. |

International Monetary Fund (IMF) |

6.1% |

5.8% |

5.9% |

|

8. |

Cytonn Investments Management Plc |

5.8% |

5.8% |

5.8% |

|

9. |

Focus Economics |

5.8% |

5.8% |

5.6% |

|

10. |

World Bank |

5.8% |

5.7% |

5.7% |

|

11. |

JPMorgan |

5.7% |

5.7% |

5.6% |

|

12. |

Euler Hermes |

5.7% |

5.7% |

5.7% |

|

13. |

Oxford Economics |

5.6% |

5.6% |

5.6% |

|

|

Average |

5.9% |

5.9% |

5.9% |

Inflation

The average inflation rate rose to 5.1% as compared to 4.4% in a similar period in 2018. September’s inflation rate declined significantly to 3.8% from 5.0% in August 2019, with the m/m inflation decreasing marginally by 0.1%. The decline in the month-on-month inflation in September was mainly due to:

- A 0.4% decline in the food and non-alcoholic beverage index, owing to a decrease in prices of some foodstuffs in September 2019 outweighing increases recorded in others, with carrots, cabbages and tomato prices having decreased by 9.8%, 6.3% and 4.1%, respectively.

However, continued upward pressure in prices are coming from:

- A 0.5% increase in transport cost driven by a raise in pump prices for petrol and diesel, and

- A 0.1% increase in Housing, Water, Electricity, Gas and Other Fuels Index stimulated by an increase in house rent and cooking fuel prices.

|

Major Inflation Changes - September 2019 |

|||

|

Broad Commodity Group |

Price change m/m (Sep-19/Aug-19) |

Price change y/y (Sep-19/Sep-18) |

Reason |

|

Food & Non-Alcoholic Beverages |

(0.4%) |

6.3% |

The m/m decline was due to a decrease in prices of some foodstuffs for instance carrots, cabbages and tomatoes |

|

Transport Cost |

0.5% |

1.9% |

The m/m rise was mainly on account of increase in pump prices of petrol and diesel. |

|

Housing, Water, Electricity, Gas and other Fuels |

0.1% |

1.0% |

The m/m rise was as a result of increase in house rent and cooking fuels |

|

Overall Inflation |

(0.1%) |

3.8% |

The m/m decline was due to a 0.4% decline in the food index which has a CPI weight of 36.0% |

The Kenya Shilling

The Kenya Shilling depreciated against the US Dollar by 1.6% in Q3’2019, to close at Kshs 103.9, from Kshs 102.3 at the end of Q2’2019. During the week, the Kenya Shilling remained stable against the dollar to close at 103.8, unchanged from the previous week. In our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to (6.2%) of GDP, from (7.6%) recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit by 1.7% and a rise in secondary income (transfers) balance by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 8.9% in the 12-months to August 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.0 bn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Monetary Policy

The Monetary Policy Committee (MPC) met twice in Q3’2019, retaining the Central Bank Rate (CBR) at 9.0% on both occasions. In the July 24th meeting, the committee noted that inflation expectations were well anchored within the target range of 2.5% - 7.5%, and that economic growth prospects were improving, in line with our expectations. This was evidenced by;

- A stable foreign exchange market, with the current account deficit narrowing to 4.2% in the 12 months to June 2019 from 5.4% in May 2018, and;

- A stable and resilient banking sector, with average liquidity and capital adequacy ratios at 50.6% and 18.2%, respectively in June 2018. The committee also noted that the economy was performing stronger than expected supported by agricultural production, strong growth of MSMEs and the service sector, foreign direct investment, and a stable macroeconomic environment.

For more information, see our note on Monetary Policy Committee Meeting for July 2019.

In the September 23rd meeting, the MPC cited that inflation expectations remained well anchored within the target range largely due to lower food prices following improved weather conditions and that there was sustained optimism for stronger economic growth in 2019 as per the private sector market perception survey. This was mainly attributed to implementation of the Big 4 agenda projects, ongoing public infrastructure investments, improved weather conditions, and a stable macroeconomic environment. The MPC noted that there was; however, need to remain vigilant on the possible effects of the increased uncertainties in the external environment. For more information see our note on Monetary Policy Committee Meeting for September 2019. Going forward we expect the MPC to retain the CBR at 9%, similar to their previous meetings with due to the current uncertainty in the market around the Finance Bill 2019, which contained a proposal to remove the interest rate cap.

Q3’2019 Highlights

- The National Treasury in the Finance Bill 2019 proposed to repeal the current interest rate cap. This proposal was rejected on grounds that it will subject Kenyans to expensive loans from commercial banks. Members of Parliament also cited that banks have continued to be profitable in the interest rate cap regime, and there is no guarantee from banks that a repeal would lead to increased lending to Micro, Small and Medium Enterprises (MSMEs), who have been the most affected by the rate cap. We do expect a review of the Banking (Amendment) Act 2015, given a Member of Parliament proposed a revision of the law to include a ceiling of 6.0% above the limit set by the Banking (Amendment) Act, 2015 for the high-risk borrowers. For more information see Cytonn Weekly #38/2019,

- The National Treasury released the budgetary review for the 2018/2019 financial year indicating that revenues collected had increased by 9.2% to Kshs 1.7 tn from Kshs 1.5 tn collected during the 2017/2018 financial year. The revenue collected was 93.1% of the budgetary target for the year as compared to the previous period where revenue collected was 91.7% of the budgetary target. Total expenditure amounted to Kshs 2.4 tn, a 12.1% increase from Kshs 2.1 tn recorded during the same period last year. This was 94.7% of the Kshs 2.5 tn target, with 62.2% of the expenditure being on recurrent expenditure, while development expenditure only accounted for 22.5%. Total expenditure was, however, 6.3% lower than the targeted expenditure as per the budget. The key concern, however, remains the widening of the fiscal deficit where the expenditure side has continued to grow faster recording a 12.1% growth, compared to the 9.2% growth in revenue collection. For more information see our Cytonn Weekly #34/2019,

- According to KNBS, Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to (6.2%) of GDP, from (7.6%) recorded in Q2’2018. This was mainly driven by; (i) A 1.7% narrowing of the merchandise trade deficit from Kshs 277.7 bn in Q2’2018 to Kshs 272.9 billion in Q2’2019, (ii) A marginal decline in net inflows of international trade in services by 0.1% points to Kshs 38.27 bn, from Kshs 38.29 bn recorded in Q2’2018, and (iii) A 5.1% rise in the secondary income (transfers) balance, to a surplus of Kshs 149.2 bn, from a surplus of Kshs 142.0 bn in Q2’2018. For a more comprehensive analysis, see our Q2’2019 Quarterly Balance of Payments Review and Outlook Note

- According to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), released earlier during the week, a sharper upturn in new business stimulated a stronger improvement in operating conditions during the month of September. The seasonally adjusted PMI came in at 54.1 in September, an improvement from 52.9 in August. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. The sharper increase in new business saw several firms report higher client numbers since August. Export demand rose at a quicker pace, however, it was still the second lowest in nearly two years. The growth was attributed to greater trade with customers in Tanzania, Burundi and Congo, as well as international markets such as the US and Europe. Nonetheless, output levels rose only modestly as many companies continued to struggle with cash flow problems. This led to an increase in outstanding business as well as further build-up of input stocks. Job numbers grew solidly at its quickest pace since December 2016 as businesses reportedly built up their workforces for future activity. This was as a result of high sentiments towards the 12-month outlook. Price pressures faced by Kenyan firms eased in September, due to the slowed rate of overall input cost inflation, which reached a near two-year low. Firms that saw input prices rise related this to higher taxation and fuel costs, as well as a marginal mark-up of salaries. However, a greater supply of agricultural goods meant that many commodities dropped in price. Consequently, output charges increased only moderately, with the pace of inflation falling to a four-month low. Some attributed the rise in prices of export goods from August to a deterioration in the shilling exchange rate.

|

Macro-Economic & Business Environment Outlook |

|||

|

Macro-Economic Indicators |

YTD 2019 Experience and Outlook Going Forward |

Outlook at the Beginning of the Year |

Current outlook |

|

Government Borrowing |

· We still maintain our expectations of KRA not achieving their revenue targets having been raised by 14.2% in the FY’2019/2020 budget to Kshs 2.1 tn from the Kshs 1.9 tn. In the National Treasury’s budgetary review for the 2018/2019 financial year, revenues collected had increased by 9.2% to Kshs 1.7 tn from Kshs 1.5 tn collected during the 2017/2018 financial year. The revenue collected was 93.1% of the budgetary target for the year. It is doubtful that the KRA will meet its target. This is expected to result in further borrowing from the domestic market to plug in the deficit, which coupled with heavy maturities might lead to pressure on domestic borrowing, · We also remain negative due to the ballooning public debt, as well as the maturity profile of the newly acquired foreign debt as it is relatively short, which raises maturity concentration risk as the country will be in a continuous state of maturing obligations between 2024 and 2028 |

Negative |

Negative |

|

Exchange Rate |

· The Kenya Shilling is expected to remain stable against the US Dollar in the range Kshs 101.0-Kshs 104.0 against the USD in 2019, with continued support from the CBK in the short term through its sufficient reserves currently at USD 9.0 bn (equivalent to 5.6-months of import cover) |

Neutral |

Neutral |

|

Interest Rates |

· The interest rate environment has remained stable in 2019, with the CBR having been retained at 9.0% in the 2 MPC meetings held in Q3’2019. We expect slight upward pressure on interest rates going forward, as the government tries to meet its domestic borrowing targets for the 2019/2020 fiscal year |

Neutral |

Neutral |

|

Inflation |

· Inflation is expected to remain within the government target range of 2.5% - 7.5%. Risks are however abound in the near-term, arising from the late onset of the traditionally long rains season which has disrupted food supply leading to a flare in food inflation, coupled with the continued rise in global fuel prices |

Positive |

Positive |

|

GDP |

· The country's Gross Domestic Product (GDP), adjusted for inflation, rebounded in 2018 having expanded by 6.3% in 2018 from 4.9% recorded in 2017. This was the fastest economic growth since the 8.4% recorded in 2010, and above the 5-year average GDP growth rate of 5.4% |

Positive |

Positive |

|

· GDP growth is projected to range between 5.7%-5.9% in 2019, lower than the 6.3% growth in 2018, but higher than the 5-year historical average of 5.4%. |

|||

|

Investor Sentiment |

· Eurobond yields have been on a declining trend YTD. An improvement was also recorded in foreign inflows in the capital market to a net buying position of USD 1.2 mn Q3’2019 from a net selling position of USD 93.4 mn in Q4’2018, an indication of improved investor sentiments |

Neutral |

Neutral |

|

· We expect improved foreign inflows from the negative position in 2018, mainly supported by long term investors who enter the market looking to take advantage of the current cheap valuations in select sections of the market |

|||

|

Security |

· The political climate in the country has eased. Despite the terror attack experienced during the first half of 2019, Kenya was spared from travel advisories, evidence of the international community’s confidence in the country’s security position |

Positive |

Positive |

Of the 7 indicators we track, 3 are positive, 3 are neutral and 1 is negative. The outlook of the 7 indicators has remained unchanged from the beginning of the year. From this, we maintain our positive outlook on the 2019 macroeconomic environment supported by expectations for strong economic growth at between 5.7%-5.9%, a stable currency, inflation rates within the government’s target, and stable interest rates in 2019.

Money Markets, T-Bills & T-Bonds Primary Auction:

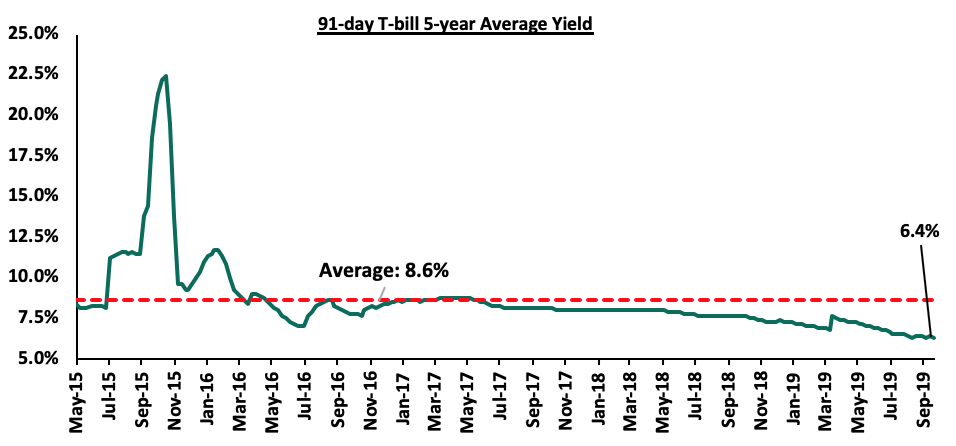

T-bills remained oversubscribed in Q3’2019, with the average subscription rate coming in at 106.8%, a decline compared to 125.5% in Q2’2019. Average subscription rates for the 91-day, 182-day, and 364-day papers in Q3’2019 came in at 121.9%, 44.4% and 163.0%, respectively, from 100.6%, 49.6% and 248.1% in Q2’2019. Yields on the 91-day and 182-day T-bills decreased by 0.4% points and 0.3% points, while that of the 364-day T-bill gained by 1.0% points in Q3’2019, closing at 6.3%, 7.2%, and 9.8%, from 6.7%, 7.5%, and 8.8% for the 91, 182, and 364-day papers, respectively, mainly due to the Central Bank of Kenya’s (CBK’s) efforts to keep rates low by rejecting expensive bids in the auction market.

During the week, T-bills were undersubscribed at a subscription rate of 86.4%, down from 98.4% recorded the previous week attributable to tight liquidity in the market owing to CBK’s actions of mopping up of liquidity through offering attractive rates of about 8.9% on repurchase agreements (repos). The yields on the 182-day and 364-day papers remained unchanged at 7.2% and 9.8%, respectively, while the yield on the 91-day paper increased marginally to 6.4% from 6.3%, the previous week. The acceptance rate declined to 55.2% from 64.9% recorded the previous week, with the government accepting Kshs 15.3 bn of the Kshs 23.6 bn worth of bids received.

The yield on the 91-day T-bill is currently at 6.4%, below its 5-year average of 8.6%. The lower yield on the 91- day paper is mainly attributed to the low interest rate environment we have been experiencing, and we expect this to continue in the short-term because:

- The rate cap is still in place, which will make it easier for the government to borrow from the domestic market, as institutions will continue channeling funds more actively towards government securities deemed less risky, since the pricing of loans to the private sector is based on the Central Bank Rate as opposed to their risk profiles, and,

- The government domestic borrowing requirement for the 2019/20 financial year has been reduced by 4.8%, to Kshs 305.7 bn from Kshs 321.0 bn, with revenues expected to increase by 14.2% from the previous fiscal year, to Kshs 2.1 tn from Kshs 1.9 tn.

During Q3’2019, the Kenyan Government issued 5 Treasury Bonds, with details in the table below:

|

No. |

Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount to be Raised (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

1 |

29/07/2019 |

FXD3/2019/15 |

15.0 |

12.3% |

40.0 |

50.6 |

12.3% |

216.7% |

58.4% |

|

2 |

19/08/2019 |

FXD3/2019/10 |

10.0 |

11.5% |

50.0 |

45.0 |

11.5% |

105.5% |

85.3% |

|

3 |

19/08/2019 |

FXD1/2019/20 |

20.0 |

12.9% |

14.7 |

12.7% |

29.3% |

100.0% |

|

|

4 |

23/09/2019 |

FXD1/2018/15 (Re-open) |

15.0 |

12.7% |

50.0 |

15.3 |

12.6% |

30.5% |

100.0% |

|

5 |

23/09/2019 |

FXD2/2019/15 |

15.0 |

12.7% |

17.4 |

12.7% |

34.7% |

100.0% |

|

|

|

Average |

|

|

|

|

|

|

83.3% |

88.7% |

Performance in the Primary T-bond auctions in Q3’2019 was varied between the various issues, with the subscription rate averaging 83.4%. The average acceptance rate for Q3’2019 came in at 88.7%, as the CBK continued to reject bids deemed expensive in order to maintain the rates at low levels.

During the week, the CBK re-opened two T-bonds; FXD1/2018/15 and FXD2/2019/15 through a tap sale. The bonds were undersubscribed at an overall subscription rate of 31.2%. The yield came in at 12.6% for FXD1/2018/15 and 12.7% for FXD2/2019/15. The acceptance rate came in at 100.0%, meaning the government accepted all the bids received, which were worth Kshs 9.3 bn, against Kshs 30.0 bn on offer.

Green Bond

During the week, Acorn Group announced that the country’s first ever green bond issued by the company, in partnership with PE Fund Helios, had attracted an 85.0% subscription rate, raising Kshs 4.3 bn of the targeted amount of Kshs 5.0 bn. The notes have been certified as ‘Green Bonds’ based on Acorn’s compliance with Climate Bonds Standards through the Climate Bonds Standard Board, who approved the Pre-issuance Certificate of the bond. The criteria to meet the Climate Bonds Standard principles include water, energy and materials efficiency. Under water efficiency, an independent verifier will look at the use of low flow showerheads and faucets for kitchen sinks and wash basins. In terms of energy efficiency, the verifier will look at natural ventilation, smart meters and sensor lighting. For material efficiency, they will focus on materials used for floor slabs, roof slabs and aluminium window frames.

The bond was priced at a rate of 12.3%, and will be used to finance sustainable and climate-resilient student accommodation with a combined capacity of 40,000 beds. According to the company’s CEO, Edward Kirathe, the first tranche of the medium-term note targeted to raise Kshs 2.0 bn given that the local bond market has not witnessed any corporate bond issue since 2017, attributable to defaults witnessed over the past five-years by issuers such as ARM Cement, Nakumatt and Imperial Bank. Contrary to expectations, the market has been receptive and the company attributes this to having GuarantCo as its guarantor, which sparked investor confidence. According to the company, the investor mix comprised mainly of pension funds, commercial banks, and development finance institutions accounting for 30.0% each, while insurance firms took up 10.0%. The lead arrangers of the issue, Stanbic Investment Bank, recommended that prospective issuers of bonds will have to enhance their credit risk profiles to be able to be successful, citing that it was important to outline the benefits, risk and engage early on a non-deal roadshow in order to spark interest.

According to report done by the IFC, a green bond is a fixed-income instrument whose distinguishing feature is that proceeds are earmarked exclusively for projects with environmental benefits. These include: renewable energy, adaptation to climate change, waste management, pollution prevention, water management and green buildings, just to name a few. The green bond market was launched in Kenya in February 2019, through the Green Bonds Programme Kenya, which is a joint initiative between the Central Bank of Kenya, Nairobi Securities Exchange, Climate Bonds Initiative and Kenya Bankers Association with several other organizations endorsing the program. Similar to infrastructure bonds, the instruments will be tax-free following changes in the proposed Finance Bill 2019 which is still going through the legislative process in parliament. In our view, the introduction of the green bond is a pro-active and good initiative by the Capital Markets Authority, which will benefit both investors and the stakeholders in the long-run considering its focus on environmental issues and a more sustainable economy.

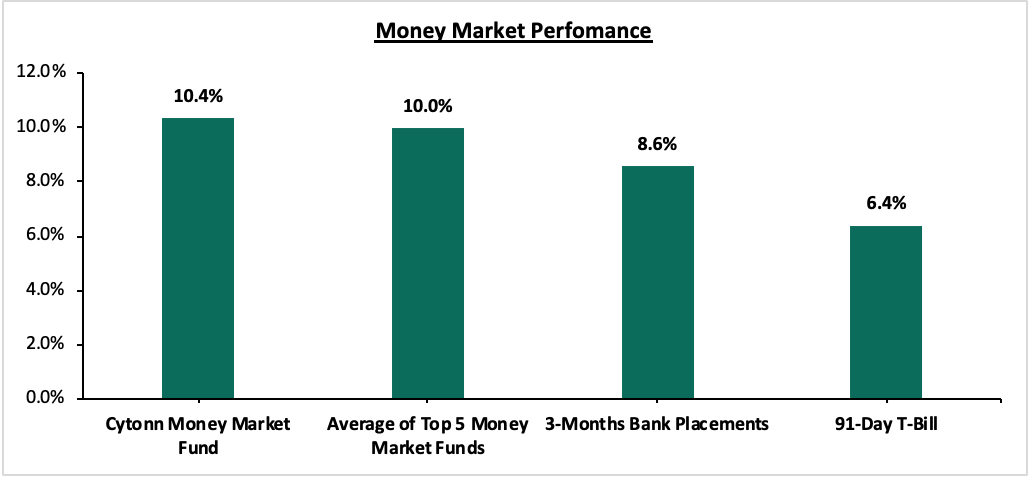

Money Market Funds

In the money markets, 3-month bank placements ended the week at 8.6% (based on what we have been offered), the 91-day T-bill came in at 6.4%, while the average of Top 5 Money Market Funds by yield came in at 10.0%, unchanged from the previous week, with the Cytonn Money Market Fund closing the week at 10.4%.

Liquidity

Liquidity tightened during Q3’2019 as indicated by an increase in the average interbank rate to 4.1%, from 3.7% recorded in H1’2019. During the week, liquidity tightened with the average interbank rate increasing to 7.5%, from 7.3% recorded the previous week, attributable to CBK’s actions of mopping up of liquidity through offering attractive rates of about 8.9% on repurchase agreements (repos) which is posing stiff competition for smaller banks. This saw commercial banks’ excess reserves increase to come in at Kshs 13.0 bn in relation to the 5.25% cash reserves requirement (CRR), from Kshs 14.4 bn the previous week. The average volumes traded in the interbank market decreased by 14.9% to Kshs 6.2 bn, from Kshs 7.3 bn the previous week.

Kenya Eurobonds:

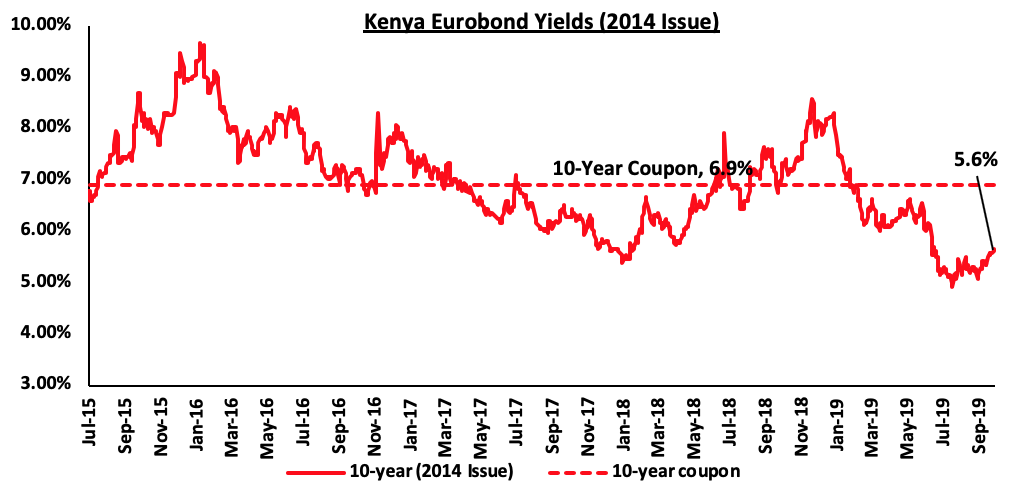

The yields on the 10-Year Eurobond issued in 2014 have increased marginally by 0.1% points to 5.6%, from 5.5% seen in Q2’2019. The rise in Eurobond yields in the past four weeks has been attributable to news that global rating firm Moody’s could further lower Kenya’s creditworthiness currently at ‘B2 stable’ following the completion of their periodic review on Kenya, where they raised concern over the country's very low fiscal strength, ballooning debt and rampant corruption.

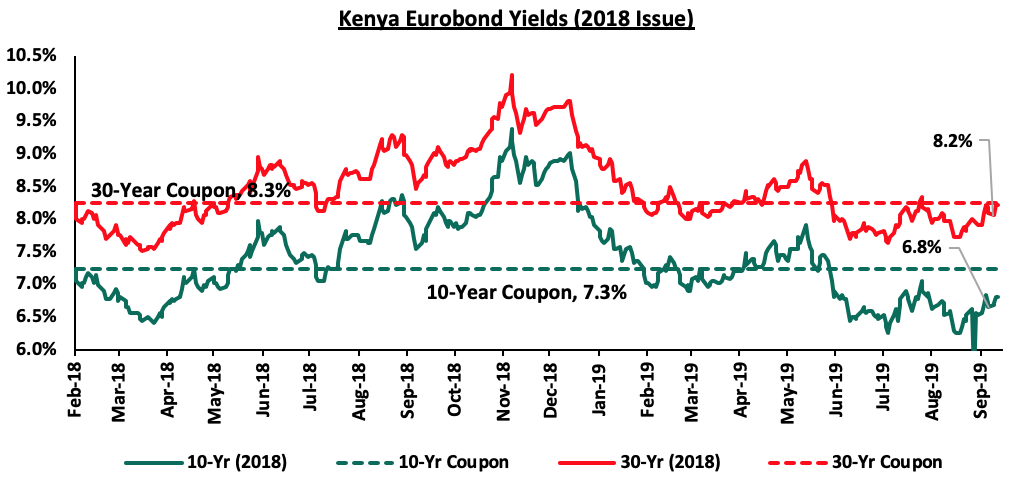

For the February 2018 Eurobond issue, since the issue date, yields on the 10-year Eurobond have decreased by 0.4% points to close Q3’2019 at 6.7% while the 30-year Eurobond has decreased by 0.2% points to close the quarter at 8.1%. During the week, the yields on the 10-year and 30-year Eurobond both increased by 0.1% points to 6.8% and 8.2%, from 6.7% and 8.1% recorded the previous week.

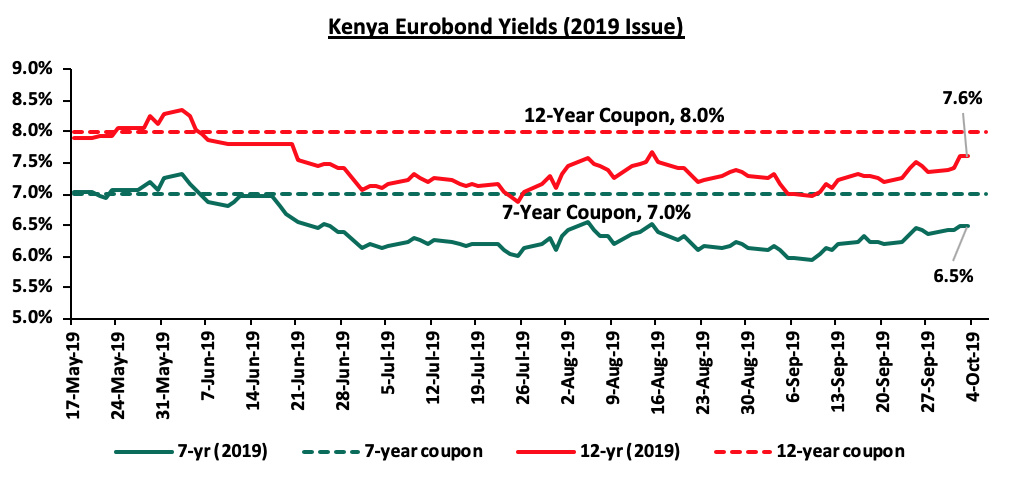

For the latest issued dual-tranche Eurobond during Q3’2019, with 7-years and 12-years tenor, priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor, respectively; the yield on the 7-year bond gained by 0.1% points to 6.5% from 6.4% recorded in the previous week, while the 12-year bond gained by 0.2% points to 7.6% from 7.4% recorded in the previous week.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The Government failed to meet its FY’2018/2019 domestic target narrowly by 1.3%, having borrowed Kshs 317.0 bn against a target of Kshs 321.0 bn. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance

During Q3’2019, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 3.0%, 8.3%, and 4.3%, respectively, taking their YTD performance as at the end of September to gains and losses of 3.6%, (14.2%) and (2.9%) for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the quarter was shaped by declines in large caps such as Bamburi, Equity Group, and Safaricom, which declined by 17.9%, 3.9%, and 2.1%, respectively. During the week, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 gaining by 1.8%, 1.6%, and 1.5%, respectively, taking their YTD performance to gains and losses of 4.8%, (13.9%) and (1.3%), respectively. The performance in NASI during the week was driven by gains in Safaricom, BAT, Co-operative Bank of Kenya, and Standard Chartered Bank, which gained by 3.5%, 2.9%, 2.1% and 1.9%, respectively.

Equities turnover declined by 7.5% during the quarter to USD 289.6 mn, from USD 313.1 mn recorded in Q2’2019, taking the YTD turnover to USD 1.1 bn. During the week, equities turnover increased by 1.5% to USD 25.6 mn, from USD 25.2 mn the previous week. In the quarter under review, foreign investors were net buyers, with a net buying position of USD 0.8 mn, a 9.4% decline from the net buying position of USD 14.9 mn recorded in Q2’2019. During the week, foreign investors remained net buyers for the week, with a net buying position of USD 2.2 mn, a 13.6% decline from a net buying position of USD 2.6 mn the previous week.

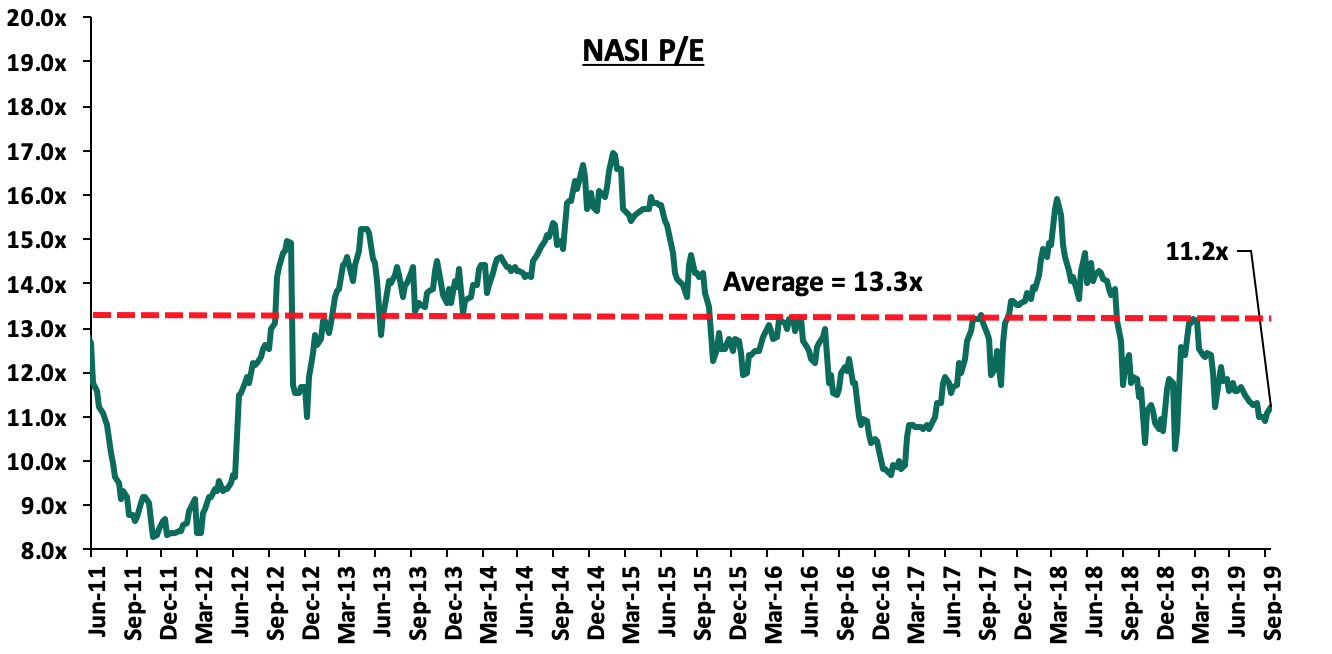

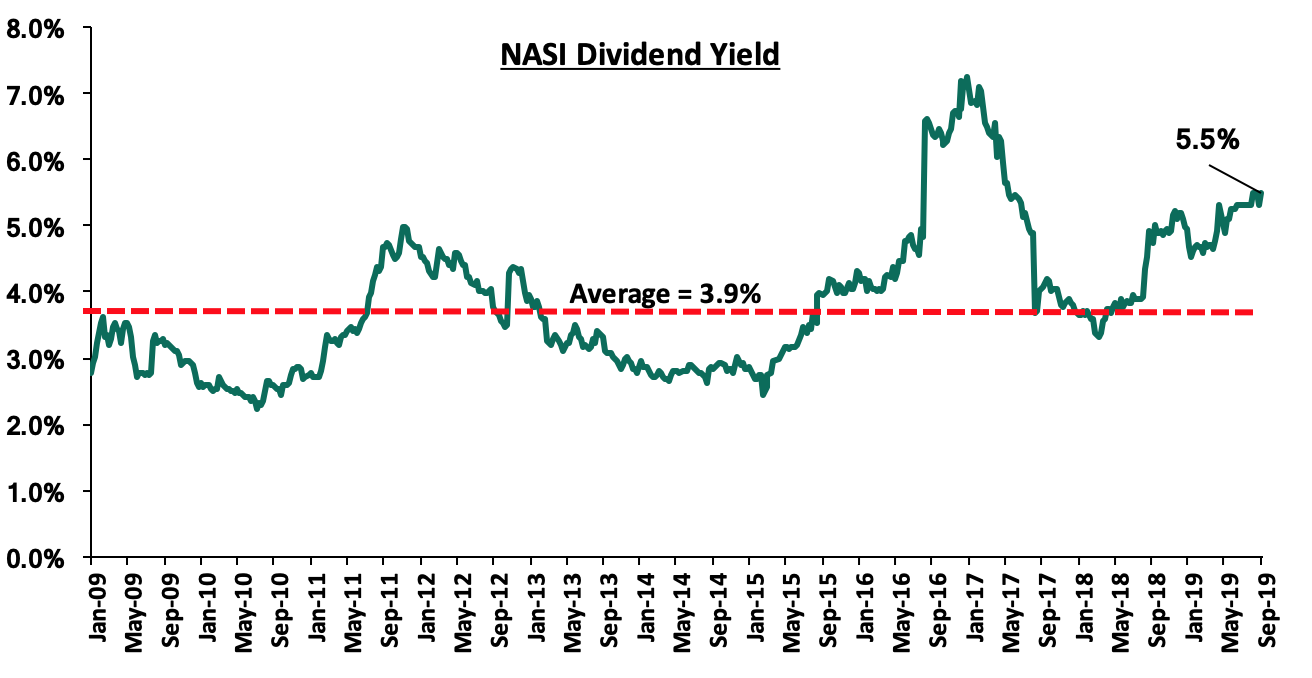

The market is currently trading at a price to earnings ratio (P/E) of 11.2x, 15.5% below the historical average of 13.3x, and a dividend yield of 5.5%, above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.2x is 15.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 35.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Listed Banks H1’2019 Results:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance. For more details, see our H1’2019 Banking Report here.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Barclays Bank Kenya |

18.0% |

7.4% |

30.8% |

0.6% |

8.4% |

12.6% |

32.4% |

11.1% |

5.9% |

15.4% |

81.3% |

6.0% |

18.1% |

|

I&M Bank |

17.0% |

8.8% |

18.3% |

2.2% |

6.0% |

21.9% |

39.3% |

6.0% |

12.5% |

28.5% |

72.6% |

5.7% |

17.7% |

|

Stanbic Holdings |

14.4% |

10.5% |

5.2% |

19.5% |

5.1% |

10.1% |

47.8% |

53.2% |

10.3% |

8.1% |

74.4% |

15.0% |

15.3% |

|

Diamond Trust Bank |

11.0% |

(6.6%) |

(5.5%) |

(7.5%) |

6.0% |

8.5% |

24.5% |

(15.6%) |

0.5% |

14.4% |

67.4% |

(3.8%) |

13.9% |

|

Equity Group |

9.1% |

9.2% |

14.3% |

7.6% |

8.5% |

25.6% |

44.0% |

16.1% |

16.5% |

13.0% |

70.0% |

16.7% |

22.1% |

|

NIC Group |

8.6% |

0.9% |

(7.0%) |

7.7% |

6.0% |

23.9% |

32.5% |

29.3% |

3.5% |

8.1% |

77.8% |

3.1% |

12.0% |

|

SCBK |

5.4% |

(7.3%) |

(26.0%) |

0.0% |

7.6% |

(2.2%) |

32.4% |

(12.8%) |

(1.0%) |

(15.2%) |

52.5% |

7.4% |

18.2% |

|

KCB Group |

5.0% |

4.3% |

1.6% |

5.2% |

8.2% |

14.7% |

34.1% |

3.5% |

7.3% |

20.3% |

85.0% |

13.6% |

22.7% |

|

Co-operative Bank |

4.6% |

(1.7%) |

3.5% |

(3.8%) |

8.4% |

25.1% |

38.0% |

38.1% |

9.0% |

14.2% |

79.6% |

2.6% |

18.8% |

|

National Bank of Kenya |

(40.1%) |

7.3% |

(14.4%) |

20.0% |

8.2% |

(28.7%) |

19.4% |

(4.6%) |

(4.9%) |

(17.5%) |

51.8% |

(1.0%) |

6.7% |

|

HF Group |

N/A |

(15.6%) |

(9.8%) |

(23.5%) |

4.0% |

55.8% |

47.1% |

44.4% |

(6.6%) |

5.4% |

91.0% |

(14.8%) |

(6.5%) |

|

H1'2019 Mkt Weighted Average* |

9.0% |

3.7% |

5.3% |

3.8% |

7.7% |

16.5% |

37.2% |

12.7% |

8.6% |

12.1% |

73.8% |

9.8% |

19.3% |

|

H1'2018 Mkt Weighted Average** |

19.0% |

7.9% |

12.0% |

6.4% |

8.1% |

6.9% |

34.3% |

4.6% |

10.0% |

14.9% |

73.8% |

3.8% |

19.5% |

|

*Market cap weighted as at 6/09/2019 **Market cap weighted as at 31/08/2018 |

|||||||||||||

Key takeaways from the table above include:

- Kenya Listed Banks recorded a 9.0% average increase in core Earnings per Share (EPS), compared to a growth of 19.0% in H1’2018. As a result, the Return on Average Equity decreased marginally to 19.3% compared to 19.5% recorded a similar period in 2018,

- Deposit growth came in at 8.6%, slower than the 10.0% growth recorded in H1’2018. On the other hand, interest expense increased at a slower pace of 5.3%, compared to 12.0% in H1’2018, indicating that banks have been able to mobilize relatively cheaper deposits. In addition, the removal of the 70.0% minimum deposit payable on deposits in the Finance Act 2018 reduced the cost of deposit funding,

- Average loan growth came in at 9.8%, which was faster than the 3.8% recorded in H1’2018, indicating that there was an improvement in credit extension to the economy. Government Securities on the other hand recorded growth of 12.1%, which was a slower growth rate compared to the 14.9% in H1’2018. This shows that banks have begun to adjust their business models, focusing more on private sector lending as opposed to investing in government securities, whose yields declined during the year. Interest income increased by 3.7%, slower than the 7.9% recorded in H1’2018. Consequently, the Net Interest Income grew by 3.8%, slower than the 6.4% recorded in H1’2018,

- The average Net Interest Margin in the sector came in at 7.7%, lower than the 8.1% in H1’2018. The decline was mainly due to a decline in yields recorded in government securities, coupled with the decline in yields on loans due to the 100-bps decline in the Central Bank Rate, and,

- Non-Funded Income grew by 16.5% y/y, faster than the 6.9% recorded in H1’2018. The growth in NFI was boosted by the total fee and commission income which improved by 12.7%, compared to the 4.6% growth recorded in H1’2018, owing to the faster loan growth.

Quarterly Highlights

During the quarter;

- The Central Bank of Kenya (CBK) announced the issuance of the final regulatory approval for the merger between Commercial Bank of Africa (CBA) and NIC Group. The final approval of the transaction comes after the approval by the Cabinet Secretary of the National Treasury on 20th September 2019, under Section 9 of the Banking Act, which guides on amalgamations and transfer of assets and liabilities for banking institutions, as highlighted in our Cytonn Weekly #39/2019,

- KCB Group revised its final offer to take over 7.5% of the deposits and loans held by Imperial Bank Limited Under Receivership (IBLR) as at the end of July 2019, after the bank conducted extensive due diligence on IBLR. With approximately Kshs 53.0 bn outstanding deposits, this translates to a final payout of approximately Kshs 3.975 bn, bringing the final recovery rate to approximately 38.0%. The transaction has seen 92.0% depositors who held deposits in IBLR gain access to their deposits. We thus continue to maintain our view that a resolution of the matter would mark the second instance a bank is successfully brought out of receivership, thereby providing more confidence in the Kenyan financial services space regulation, which provides an avenue for remediation of collapsed entities as well as providing protection for depositors’ funds. For more information, see here,

- The Banking Amendment Bill was tabled in the National Assembly. The Bill seeks to seal the loopholes in the wordings of the Banking (Amendment) Act 2015. In March 2019, the High Court suspended the Banking (Amendment) Act 2015 in a ruling that declared Section 33B (1) and (2) of the Banking Act unconstitutional, and gave the National Assembly one year to amend the anomalies, failure to which will mean a reversion to a free-floating interest rates regime. For more details, please see our Cytonn Weekly #30/2019,

- CIC Group announced the redemption of its 5-year corporate bond issued in October 2014 of Kshs 5.0 bn, with a coupon rate of 13.0%, which will be redeemed in October 2019. The bond was issued to fund CIC’s regional expansion into Uganda and Malawi, as well as bolstering the capital requirements of the insurer's subsidiaries, and supporting investments in their medical and real estate projects. For more details, please see our Cytonn Weekly #39/2019, and,

- Barclays Bank of Kenya announced that three of its branches namely, Bamburi, Maragua and Supplies, were up for sale, valued at Kshs 65.0 mn. This is in line with the lender’s strategy of deepening digital channels to accommodate the changing pattern of customer preferences towards alternate channels. Previously, in FY’2017, the lender closed 13 branches as part of its consolidation strategy and drive to achieve operational efficiencies. For a more detailed analysis, please see our Cytonn Weekly #27/2019.

Universe of Coverage

|

Banks |

Price at 4/10/2019 |

w/w change |

q/q change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Holdings |

45.1 |

7.4% |

(18.2%) |

5.9% |

79.8 |

7.8% |

84.7% |

0.8x |

Buy |

|

Sanlam |

17.4 |

(7.2%) |

(8.5%) |

(14.8%) |

29.0 |

0.0% |

66.7% |

0.8x |

Buy |

|

KCB Group*** |

41.9 |

(7.0%) |

9.8% |

12.1% |

61.4 |

8.3% |

54.9% |

1.1x |

Buy |

|

Diamond Trust Bank |

115 |

1.3% |

(3.2%) |

(27.2%) |

175.6 |

2.3% |

55.0% |

0.6x |

Buy |

|

Equity Group*** |

37.9 |

1.2% |

(3.9%) |

7.5% |

53.0 |

5.3% |

45.2% |

1.6x |

Buy |

|

Co-operative Bank*** |

12.1 |

2.1% |

(0.8%) |

(16.8%) |

15.0 |

8.4% |

32.8% |

1.0x |

Buy |

|

NIC Group |

29.5 |

3.3% |

(2.1%) |

7.7% |

37.9 |

3.3% |

32.0% |

0.6x |

Buy |

|

Kenya Reinsurance |

3.0 |

2.7% |

(23.1%) |

(17.2%) |

3.8 |

5.2% |

30.6% |

0.1x |

Buy |

|

Britam |

7.0 |

(0.3%) |

(13.7%) |

(30.2%) |

8.8 |

4.9% |

30.3% |

0.7x |

Buy |

|

Barclays Bank*** |

11.2 |

1.8% |

4.8% |

0.0% |

12.6 |

10.0% |

22.3% |

1.4x |

Buy |

|

CIC Group |

3.1 |

(0.7%) |

(13.5%) |

(20.5%) |

3.8 |

4.2% |

28.8% |

1.2x |

Buy |

|

Liberty Holdings |

9.7 |

0.2% |

(7.0%) |

(24.7%) |

11.3 |

5.1% |

21.2% |

0.7x |

Buy |

|

Jubilee holdings |

346.0 |

(1.1%) |

(12.4%) |

(13.5%) |

418.5 |

2.6% |

23.5% |

1.0x |

Accumulate |

|

Standard Chartered |

198.0 |

1.9% |

2.7% |

2.7% |

208.0 |

6.3% |

11.3% |

1.5x |

Accumulate |

|

Stanbic Holdings |

96.3 |

0.3% |

0.0% |

5.8% |

100.5 |

6.1% |

10.5% |

1.1x |

Accumulate |

|

HF Group |

6.9 |

(4.7%) |

75.6% |

27.1% |

2.8 |

0.0% |

(60.2%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance

Financial Services

Deals in the financial services sector in the quarter include;

- Interswitch, a Nigeria-based payments firm that is owned 60.0% by Helios Investment Partners, announced that it has hired advisors, including JPMorgan Chase & Co., Citigroup Inc. and Standard Bank Group Ltd to revive plans for a stock-market listing in London and Lagos later this year. According to Reuters, the value of the financial technology company is speculated to be between USD 1.3 bn to USD 1.5 bn. For more information, see our Cytonn Weekly #30.

- Actis, a UK based private equity investor, took over the management rights of the Abraaj Private Equity Fund IV (APEF IV), a global buyout fund, and Abraaj Africa Fund III (AAF III), a Sub-Saharan investment fund. APEF IV has made investments worth USD 1.6 bn (Kshs 165.2 bn) in the Middle East and Africa while AAF III has a portfolio of investments in Africa. This transaction follows the collapse of Abraaj group, a global private equity firm based in the United Arab Emirates (UAE), following the liquidation case the firm currently faces. For more information, see our Cytonn Weekly #29.

- Sterling Capital, a Kenyan-based investment bank, acquired a 20.0% stake in Afvest, a Nairobi-based emerging markets private equity firm for an undisclosed value. Afvest focuses on early-stage businesses in the financial services, energy, agro-processing and technology sectors. This acquisition is in line with the two firms’ strategy of investing in early-stage businesses and entrepreneurs with the potential to generate high returns. For more information, see our Cytonn Weekly #28.

- TLG Capital, a frontier markets Investment Company based in England, announced a USD 10.0 mn investment in Tanzania based Platcorp Holdings Limited, the holding company of Platinum Credit - a Kenyan micro-finance company, through its Credit Opportunities Fund (COF). Platcorp Holdings Limited focuses on investments in its microfinance and non-banking subsidiaries. For more information, see our Cytonn Weekly #27.

- Oiko Credit, a Netherland’s based private equity firm, acquired a 22.8% stake in Credit Bank. The stake acquired was through a capital injection of Kshs 1.0 bn. For more information, see our Cytonn Monthly - August 2019.

Fundraising

- Investment firm Centum, through its real estate arm Centum Real Estate, signed a refinancing deal with Nedbank Corporate and Investment Bank (CIB), which is Nedbank’s property finance division. They managed to raise Kshs 6.5 bn from the South Africa-based firm. These funds will allow the firm to consolidate the debt facilities for the Two Rivers development, which is the firm’s biggest project. The development is currently in its second phase, which will utilize the 102 acres the company owns on Limuru Road in Nairobi, near the affluent neighborhoods of Runda, Nyari, Gigiri and Muthaiga. For more information, see our Cytonn Weekly #30.

- OPay, a Nigerian based mobile payment platform, raised USD 50.0 mn (Kshs 5.1 bn) in its first round of funding. The startup, founded by Norwegian browser company Opera in 2018, aims to use the capital for expansion to other African Markets including Tanzania, Ghana and South Africa where Opera reaches 120 mn customers across the region and to support Opera’s commercial network in Nigeria which includes ORide, a motorcycle ride-hailing app and OFood, a food delivery service application. For more information, see our Cytonn Weekly #28.

- Lulalend, a South African digital lender, raised USD 6.5 mn in its Series A round funding, which was co-led by the International Finance Corporation (IFC) and Quona Capital. The startup, based in Cape Town, provides short-term loans to small and medium-sized businesses (SMEs) that are often unable to obtain working capital. The funds raised will be used to build its staff capacity and strengthen its balance sheet, in order to provide financing to more SMEs in South Africa by expanding its loan book to USD 100.0 mn. For more information, see our Cytonn Weekly #27.

- Tala, a California-based FinTech company with operations in Kenya, raised Kshs 11.4 bn (USD 110.0 mn) in a Series D financing round (the fourth round of capital injection from external investors) led by RPS Ventures, a California-based venture capital firm. Other investors in the round include GGV Capital, and previous investors IVP (Institutional Venture Partners), Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures. The new investment builds on PayPal Ventures’ strategic investment in Tala, announced in November 2018. This funding round brings the total amounts raised by Tala to over Kshs 22.6 bn (USD 219.4 mn). For more information, please see our Cytonn Weekly #34/2019.

- Accion, through its seed-stage investment arm, Accion Venture Lab, raised USD 23.0 mn (Kshs 2.4 bn), for a new FinTech start-up fund. The capital for the new fund was raised through contributions from various participants including Ford Foundation, Prudential Financial, Blue Haven Initiative, Visa Inc. and Proparco (the development finance institution of the French Government). The firm intends to allocate approximately 25% - 30% of the funds to Africa where their focus will be on start-ups that leverage technology to increase the reach, quality and affordability of financial services for the under-served. For more information, please see our Cytonn Weekly #37/2019.

Education

- Investisseurs & Partenaires (I&P), a Sub-Saharan impact investing firm based in Paris, France, announced plans to invest EUR 70.0 mn (Kshs 8.1 bn) in Africa’s education sector with the aim of addressing the challenges of access, equity, quality and adequacy of education in Africa. For more information, see our Cytonn Weekly #29.

- The Danish SDG (Sustainable Development Goals) Investment Fund invested Danish Krone (DKK)0 mn (Kshs 692.5 mn) in Africa Education Holding, which offers affordable high-quality programmes in labour market relevant studies of medicine, business, IT, law and social sciences, for an undisclosed stake. This was done in collaboration with Proparco, the French development agency, who invested USD 7.0 mn (Kshs 726.9 mn) as well as Finnfund, the Finnish development agency which invested an undisclosed amount. For more information, please see our Cytonn Weekly #38/2019.

Hospitality

- Amethis, an Africa-focused investment fund manager, acquired a stake in Veranda Leisure & Hospitality (VLH), a subsidiary of Rogers Group, a listed company on the Stock Exchange of Mauritius, with the funds intended to be directed towards projects under VLH through new leisure activities and accommodation offerings. For more information, please see our Cytonn Weekly #37/2019.

FinTech

- Mobile lender, Branch International, through Barium Capital, announced the issuance of its fourth commercial paper and full repayment of its previous issue worth Kshs 500.0 mn. To date, the firm has been able to raise Kshs 16.5 bn from the private capital market. For more information, see our Cytonn Monthly - July 2019.

- Juhudi Kilimo, a Kenyan based microfinance institution, raised EUR 2.2 mn (Kshs 252.2 mn) in equity capital from Incofin CVSO, a fund managed by Belgian based Incofin Investment Management, for an undisclosed stake. This will be Incofin’s first equity investment in the country, adding to its expansive portfolio, which includes over 325 investments in 65 countries, with a combined value of over USD 1.0 bn, focused on growing the financial services industry in developing countries. For more information, please see our Cytonn Weekly #33/2019.

- TechAdvance, a Nigerian based payment application development company, raised USD 1.0 mn (Kshs 103.5) mn in equity funding from Lamar Holding, an energy investment company based in Bahrain. TechAdvance will use this funding to support its expansion strategy, aimed at widening its coverage in Africa as well as reaching out to other markets globally, having gotten approval from the Central Bank of Bahrain to operate a payment solutions service business, in addition to a similar license from the Central Bank of Nigeria, indicating that the firm intends to leverage the partnership with Lamar Holdings to cross into the Middle Eastern market. For more information, please see our Cytonn Weekly #33/2019.

- In the FinTech sector, FairMoney, a Paris-based FinTech startup focused on Nigeria, closed a Series A round of investment, raising USD 10.0 mn (Kshs 1.0 bn), led by Flourish, a venture of The Omidyar Group, a family-founded impact investment firm with operations in Asia, North America and Africa. The funding round was also boosted by existing seed investors; DST Global, a Hong Kong-based investment company that funds late-stage ventures in the global internet industry, Newfund, and Le Studio VC, French venture capital firms, and Speedinvest, an Austrian venture capital firm. For more information, please see our Cytonn Weekly #38/2019.

- Development Partners International, a London-based Africa-focused private equity firm, in collaboration with Convergence Partners, a South-African impact investment company, announced an investment of USD 54.0 mn (Kshs 5.6 bn) in Channel VAS, a FinTech company with operations in Africa, Asia and the Middle East that advances micro-credit to individuals through mobile money transfer, for an undisclosed stake. For more information, please see our Cytonn Weekly #39/2019.

Reports

During the quarter, the following private equity reports were released;

- KPMG East Africa and East Africa Venture Capital Association (EAVCA) released a joint report, Private Equity Sector Survey of East Africa, which looks into the private equity market over the period spanning 2017 and 2018, with a keen focus on the shift in trends in the private equity space since 2016. The report highlighted an improvement in deal activity in 2017 and 2018, with 33 and 51 deals disclosed, respectively, as well as the number of PE funds investing in East Africa increased to 97 up from 72 recorded in a similar study conducted between 2015 and 2016. For more information, please see our Cytonn Weekly #32/2019.

- During the quarter, Emerging Markets Private Equity Association (EMPEA), a global industry association for private capital in emerging markets, released their Mid-Year 2019 Statistics Report, which gives a snapshot of the global private equity space, particularly on the fundraising space, highlighting a significant drop in funds raised towards private equity, to USD 165.0 bn (Kshs 17.1 tn) in H1’2019, less than 33.0% of the USD 505.6 bn (Kshs 52.4 tn) raised in FY’2018. For more information, please see our Cytonn Weekly #39/2019.

We maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

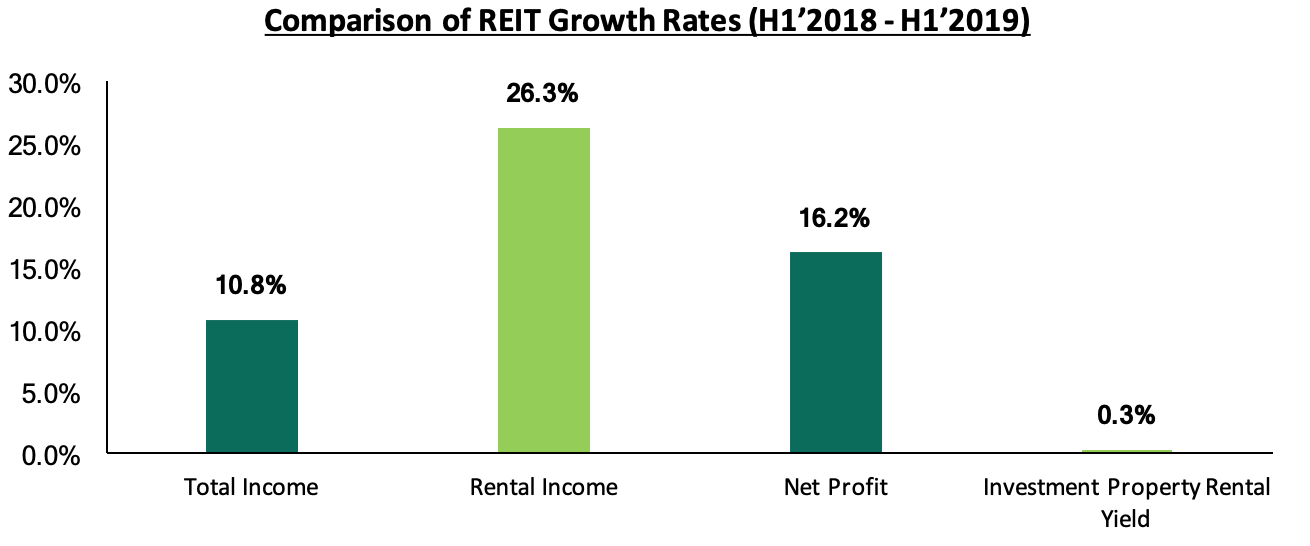

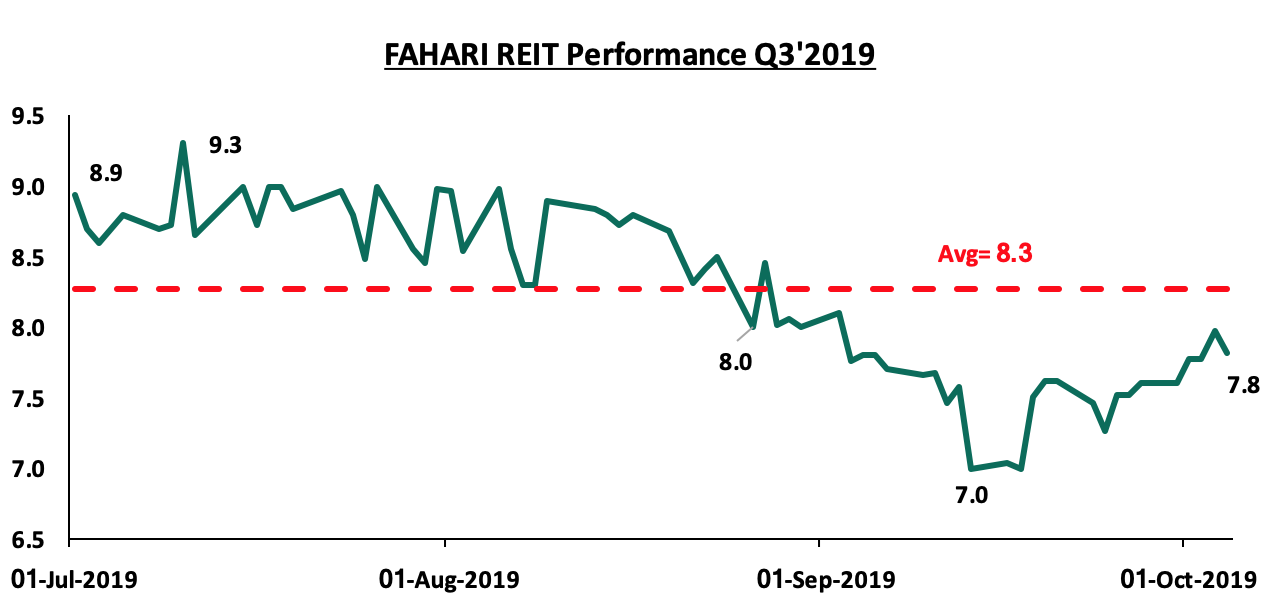

In Q3’2019, the real estate sector recorded an array of activities across the various themes supported by the Kenyan Government’s focus on the affordable housing initiative and continued infrastructural improvement. As per the Kenya National Bureau of Statistics (KNBS) Quarterly Gross Domestic Product Report Q2'2019, the real estate sector improved with the sector’s growth rate coming in at 5.4% in Q2’2019, 0.8% points higher than 4.6% recorded in Q2’2018. The construction sector’s growth rate increased to 7.2% in Q2’2019, from 5.4% in Q2’2018, attributable to ongoing public infrastructure projects especially the construction of roads and Phase Two of the Standard Gauge Railway.

During the quarter, the key challenge was the delay in the processing of construction permits by some county governments such as Nairobi and Kiambu, which continues to affect developers by prolonging project implementation timelines. The delays have mainly been as a result of the e-permit system downtime, inadequate staffing, and suspension of planning committees of the Nairobi, Kisumu, Kiambu, and Mombasa County Governments. Currently, construction permits in Kenya can take as long as two years and this has greatly affected Kenya’s rank in the global Ease of Doing Business Index by World Bank. As of 2018, Kenya’s rank dropped four ranks to #128 from #124 in 2017 in terms of ease of obtaining construction permits, owing to lack of improvements on the system, and the situation has only worsened in 2019, and thus, we expect Kenya’s rank in 2019 to drop further. Industry players such as the Architectural Association of Kenya (AAK) and the Kenya Private Developers Association (KPDA) have decried over the matter calling for an immediate resolution of the matter. This is especially critical as the government attempts to deliver the affordable housing initiative through public-private partnerships. Delays in the approval system ultimately leads to unnecessarily high development costs for private developers.

Other challenges facing the sector include; (i) access to financing with private sector credit growth coming in at 5.2% in June 2019, compared to a 5-year (2013-2018) average of 14.0%, and (ii) oversupply in select sectors such as the commercial office and retail sectors with a surplus of 5.2mn SQFT and 2.0mn SQFT, respectively, as at 2018.

- Residential Sector

During Q3’2018, construction activity in the residential sector picked up. Key developments included:

- The County Government of Nairobi commenced works on the Pangani Regeneration Project, one of the 7 flagship projects earmarked for Nairobi County as part of the Kenyan Government’s Affordable Housing Initiative. For more, see Cytonn Weekly #29/2019,

- Cytonn Real Estate, the development affiliate of Cytonn Investments, handed over the first phase of its Ruaka project, The Alma, after full uptake of the 16 one-bedrooms, 70 two-bedroom and 27 three-bedroom units selling at Kshs 6.3 mn, Kshs 9.9 mn and Kshs 12.9 mn, respectively. For more, see Cytonn Weekly #29/2019,

- Centum Real Estate broke ground on its Riverbank Apartments Project, consisting of 160-units, within the Two Rivers development complex, along Limuru Road. For more, see Cytonn Weekly #32/2019,

- Chinese developers Erdemann Properties launched Phase III of their Greatwall Gardens Project in Athi River. For more see Cytonn Weekly #32/2019,

- Safaricom Investment Co-operative (SIC) unveiled its gated community development, dubbed “The Zaria Village”, located in Kiambu County off the Ruiru-Kiambu Bypass. For more, see Cytonn Weekly #37/2019, and

- The government’s aim of improving the mortgage market also took shape as the Central Bank of Kenya finally gazetted the Mortgage Refinancing Companies regulations, which are especially critical for the commencement of operations of the Kenya Mortgage Refinancing Company. For analysis, see Cytonn Weekly #34/2019.

Market Performance

In Q3’2019, apartments registered higher average returns to investors at 4.9% in comparison to detached markets with 4.5%. In comparison to H1’2019, rental yields notably improved across the residential market with apartments recording average rental yields of 5.2%, in comparison to 4.9% in H1’2019, whereas detached markets recorded an average of 4.6%, in comparison to 3.9% in H1’2019, largely attributable to increase in occupancy rates as homebuyers capitalize on the pricing discounts.

- Detached Performance

Detached units posted average total returns of 4.5%, 0.8% points lower than the 5.3% recorded in Q3’2018. This was evidenced by a drop in price per SQM from Kshs 138,049 as at Q3’2018 to Kshs 137,421 as developers cut their prices in order to attract clientele amidst a tough financial environment.

In the high-end markets, rental yields averaged at 4.3% in Q3’2019 in comparison to 3.7% in H1’2019, owing to an increase in rental rates from Kshs 741 per SQM in Q3’2018 to Kshs 796 per SQM in Q3’2019, especially in Runda, which is in close proximity to international organizations such as the United Nations and foreign embassies, thus attracting wealthy tenants willing to pay premium rent for an exclusive neighbourhood close to the organizations.

The upper mid-end markets remained largely flat with prices appreciating annually by 0.1%. Average total returns to investors came in at 4.3%, 0.2% points lower than 4.5% recorded in H1’2019. This was on account of a drop in occupancy rates from 89.1% to 88.7% in Q3’2019, which led to a 0.1% point drop in rental yields from 4.3% in H1’2019 to 4.2% in Q3’2019. This is as appetite for lower mid-end units increased due to their affordability evidenced by a relatively low rent per SQM of Kshs 380 in comparison to upper mid-end and high-end markets at Kshs 650 and Kshs 796, respectively. Consequently, the lower mid-end markets recorded the highest returns to investors in the detached market, averaging at 5.2%. However, these areas also recorded an overall price depreciation of 0.1% owing to increased price offers from developers in a bid to lure clientele.

(All Values in Kshs Unless Stated Otherwise)

|

Detached Units Performance Q3’2019 |

|||||||

|

Location |

Price per SQM Q3'2019 |

Rent Per SQM Q3'2019 |

Annual Uptake Q3'2019 |

Occupancy Q3'2019 |

Rental Yield Q3'2019 |

Annual Price Appreciation Q3'2019 |

Total Returns Q3'2019 |

|

A: Top 5 High-End |

|||||||

|

Runda |

229,183 |

1,033 |

11.9% |

93.3% |

5.1% |

0.7% |

5.8% |

|

Rosslyn |

164,377 |

848 |